Caledonia Mining SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Caledonia Mining's SWOT analysis reveals a company with significant operational strengths, particularly its efficient Blanket Mine, but also faces external threats from commodity price volatility and regulatory shifts. Understanding these dynamics is crucial for any investor looking to capitalize on its potential.

Want the full story behind Caledonia Mining's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Caledonia Mining has demonstrated a strong track record of consistent gold production, often meeting or exceeding its own targets. In 2024, the Blanket Mine achieved an impressive 76,656 ounces, hitting the higher end of its projected range.

This operational success has led the company to revise its production outlook upwards. For 2025, Caledonia Mining has increased its guidance for Blanket Mine to between 75,500 and 79,500 ounces, a positive signal driven by robust performance in the early part of the year.

Caledonia Mining demonstrated a remarkable financial turnaround in 2024, achieving a net attributable profit of $17.9 million, a stark contrast to the net loss reported in the prior year. This upward trajectory continued into the first quarter of 2025, where the company saw its gross profit nearly double.

Further solidifying its financial strength, Caledonia Mining reported a significant increase in net profit attributable to shareholders in Q1 2025. This growth was primarily fueled by favorable gold prices and the company's success in implementing effective cost management strategies, underscoring its robust operational and financial health.

Caledonia Mining is demonstrating a strong commitment to its future through strategic investments, with a significant capital expenditure budget of $41.8 million earmarked for 2025. This funding is primarily directed towards modernizing its flagship Blanket Mine and driving forward crucial exploration initiatives at projects such as Bilboes and Motapa.

These investments are designed to achieve several key objectives: boosting operational efficiency, elevating safety standards across its sites, and importantly, extending the productive lifespan of its mining assets. Such forward-thinking capital allocation is foundational for sustaining long-term profitability and fostering continued growth for the company.

Commitment to ESG and Community Development

Caledonia Mining's dedication to ESG and community development is a significant strength. Their 2024 ESG report, adhering to Global Reporting Initiative standards, highlights tangible progress. This commitment translates into concrete actions that benefit both the environment and local populations.

Key achievements underscore this commitment. For instance, the company met 20% of its power requirements through solar energy, demonstrating environmental responsibility. Furthermore, their water recycling efforts reached 25%, showcasing efficient resource management. These initiatives are complemented by substantial investments in community infrastructure.

- Solar Power Generation: 20% of power needs met by solar energy in 2024.

- Water Recycling: Achieved 25% water recycling rate.

- Community Investment: Significant funding allocated to schools and clinics.

Potential for Multi-Asset Growth in Zimbabwe

Caledonia Mining is actively evolving from a single-mine operation to a diversified gold producer in Zimbabwe. This strategic shift is fueled by key acquisitions, including Bilboes, Motapa, and Maligreen, signaling a commitment to broader resource development. The company anticipates a significant boost in its overall gold output as these projects mature.

The Bilboes project stands out as a cornerstone of this multi-asset growth strategy. Its potential to substantially increase Caledonia's gold production is substantial. With a feasibility study slated for finalization, the project is on track to unlock significant future expansion opportunities for the company.

- Strategic Diversification: Caledonia is moving beyond its flagship Blanket mine to incorporate new gold assets.

- Acquisition Integration: Projects like Bilboes, Motapa, and Maligreen are being integrated into Caledonia's operational framework.

- Production Upside: Bilboes alone has the capacity to significantly elevate Caledonia's total gold output.

- Future Expansion: The completion of the Bilboes feasibility study is a critical step towards realizing this expansion potential.

Caledonia Mining's operational performance is a clear strength, consistently delivering on or exceeding production targets. In 2024, the Blanket Mine produced 76,656 ounces, hitting the upper end of its forecast. This robust performance led to an upward revision of 2025 guidance for Blanket Mine to 75,500-79,500 ounces.

Financially, the company has shown remarkable resilience and growth. 2024 saw a significant turnaround with a net attributable profit of $17.9 million, a stark contrast to the previous year's loss. This positive momentum continued into Q1 2025, with gross profit nearly doubling, driven by favorable gold prices and effective cost management.

The company is strategically investing in its future, with a $41.8 million capital expenditure budget for 2025. These funds are allocated to modernizing Blanket Mine and advancing exploration at Bilboes and Motapa, aiming to enhance efficiency, safety, and asset longevity.

Caledonia Mining is also actively diversifying its asset base, moving beyond the Blanket Mine. Acquisitions like Bilboes, Motapa, and Maligreen are key to this strategy, with Bilboes alone poised to significantly increase overall gold output upon project maturation and feasibility study completion.

| Metric | 2024 Performance | 2025 Guidance (Blanket Mine) | Key Projects for Growth |

|---|---|---|---|

| Gold Production (Ounces) | 76,656 (Blanket Mine) | 75,500 - 79,500 | Bilboes, Motapa, Maligreen |

| Net Attributable Profit | $17.9 million | N/A (Ongoing reporting) | N/A |

| Capital Expenditure | N/A (Focus on 2025) | $41.8 million | Blanket Mine modernization, Bilboes, Motapa exploration |

What is included in the product

Delivers a strategic overview of Caledonia Mining’s internal and external business factors, highlighting its operational strengths, market opportunities, and potential threats.

Offers a clear view of Caledonia Mining's competitive landscape, helping to identify and mitigate potential risks proactively.

Weaknesses

Caledonia Mining's primary reliance on the Blanket Mine in Zimbabwe represents a significant weakness. This singular operational asset means the company's fortunes are closely tied to the mine's output and the operating environment within Zimbabwe. For instance, in the first quarter of 2024, Blanket Mine produced 19,999 ounces of gold, highlighting the direct correlation between its performance and Caledonia's overall financial results.

Caledonia Mining anticipates a rise in its on-mine costs per ounce and all-in sustaining costs for 2025. This projected increase is driven by higher expenses in labor, human resources, and IT, alongside elevated sustaining capital expenditures.

These escalating costs could potentially squeeze profit margins for Caledonia Mining. The impact would be more pronounced if gold prices were to experience a downturn or remain stagnant, making it harder to absorb the increased operational expenses.

Caledonia Mining's operations are heavily concentrated in Zimbabwe, making it susceptible to the nation's inherent political and economic instability. This exposure includes the risk of abrupt shifts in mining legislation, significant currency devaluations, and unpredictable foreign currency retention mandates. For instance, Zimbabwe's inflation rate has historically been a major concern, impacting the real value of repatriated earnings.

Short-Term Cost Pressures from Investments

Caledonia Mining's ambitious capital investment plans for 2025, aimed at enhancing its operations and long-term output, are poised to create significant short-term cost pressures. These outlays for modernization and expansion, while strategically vital, will likely strain immediate profitability and cash flow as expenses are recognized before the full benefits of these investments materialize.

The company has earmarked substantial funds for projects such as the Blanket Mine solar plant expansion and the development of the Bilboes project. For instance, capital expenditure was projected to be between $35 million and $40 million for 2024, with a significant portion carrying over into 2025 for ongoing development. This heavy investment phase inherently means higher operating costs in the near term.

- Increased operational expenses due to new equipment and infrastructure.

- Potential impact on dividend payouts as cash is reinvested.

- Higher depreciation charges from newly acquired assets.

Reliance on External Funding for Major Projects

Caledonia Mining's ambition for significant growth, particularly with projects like Bilboes, hinges on securing substantial external funding. While the company prioritizes using its own cash flow, the sheer scale of these undertakings means development finance institutions are expected to cover a large portion of the investment. This reliance creates a dependency, exposing Caledonia to the risks associated with securing and managing external capital, including potential changes in financing terms or availability.

The financial health and strategic execution of Caledonia Mining are therefore closely tied to its ability to attract and manage external funding. For instance, the substantial capital required for the Bilboes gold project, estimated in the hundreds of millions of dollars, necessitates a strong pipeline of development finance. This dependency introduces a layer of financial risk, as the company must navigate the complexities and potential volatility of the international financing landscape to realize its expansion plans.

- Projected Funding Mix: A significant portion of the estimated $300 million to $400 million required for Bilboes is anticipated to come from development finance institutions, according to company statements in early 2024.

- Financial Risk Exposure: Reliance on external funding for major projects introduces risks related to interest rate fluctuations, currency exchange rates, and the overall availability of capital in the global market.

- Strategic Dependency: The successful execution of Caledonia's growth strategy, particularly the development of Bilboes, is directly linked to its capacity to secure favorable financing terms from external partners.

Caledonia Mining's significant reliance on the Blanket Mine in Zimbabwe makes it vulnerable to operational disruptions and the country's economic climate. For example, in Q1 2024, Blanket Mine produced 19,999 ounces of gold, directly impacting Caledonia's revenue. Furthermore, the company anticipates rising on-mine costs per ounce and all-in sustaining costs for 2025 due to increased expenses in labor, HR, IT, and higher sustaining capital expenditures.

The company's concentration in Zimbabwe exposes it to political and economic instability, including potential changes in mining legislation and currency devaluations. Caledonia's ambitious 2025 capital investment plans, such as the Blanket Mine solar plant expansion and Bilboes project development, will also create short-term cost pressures, with 2024 capital expenditure projected between $35 million and $40 million, much of which extends into 2025.

Growth ambitions, particularly for the Bilboes project requiring an estimated $300 million to $400 million, necessitate substantial external funding, primarily from development finance institutions. This dependency introduces financial risks related to interest rates, currency exchange, and capital availability, directly impacting the strategic execution of Caledonia's expansion plans.

Same Document Delivered

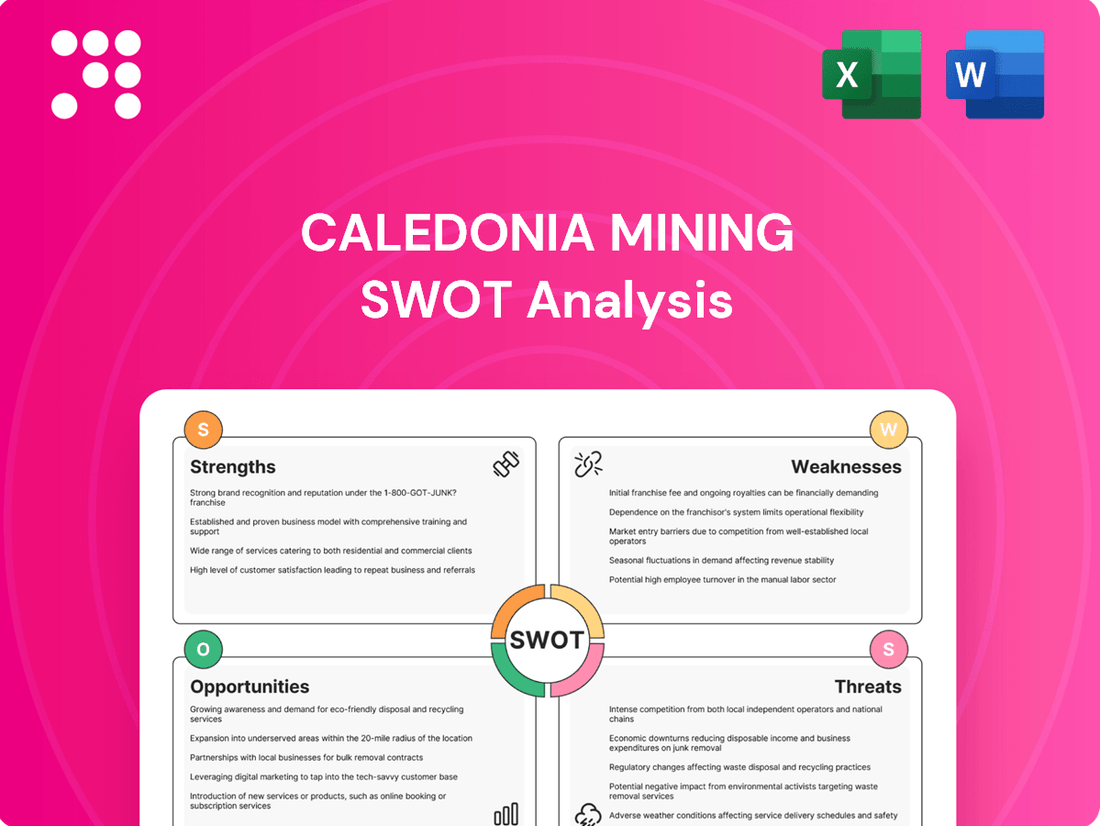

Caledonia Mining SWOT Analysis

This is the actual Caledonia Mining SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Caledonia Mining's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete Caledonia Mining SWOT analysis. Once purchased, you’ll receive the full, editable version ready for strategic planning.

Opportunities

A strong gold price environment has been a significant tailwind for Caledonia Mining, directly impacting its bottom line. For instance, the company reported a substantial increase in gross profit in 2024, largely attributed to the elevated gold prices. This favorable market has also bolstered operating cash flows, providing the company with greater financial flexibility for reinvestment and strategic initiatives in early 2025.

Caledonia Mining's strategic pivot to becoming a multi-asset gold producer in Zimbabwe presents a substantial growth avenue. The company is actively pursuing the development of its Bilboes, Motapa, and Maligreen projects, each holding the potential to significantly expand its operational footprint and gold output.

The successful development of the Bilboes project, in particular, stands to be a game-changer. Estimates suggest that Bilboes alone could nearly triple Caledonia's current gold production, marking a dramatic increase in scale and transforming the company into a major player within the Zimbabwean mining landscape.

Caledonia Mining's exploration efforts are paying off, significantly boosting its mineral resource base. Recent successes at the Blanket Mine have extended its projected mine life to 2034, based on current reserves, demonstrating a robust operational future.

The company's exploration at Motapa, with initial promising results reported in November 2024, indicates substantial additional resource potential. This ongoing exploration is crucial for enhancing long-term sustainability and providing further opportunities for growth.

Technological Advancements and Efficiency Improvements

Caledonia Mining is strategically investing in modernizing its Blanket Mine operations. These upgrades, focusing on energy efficiency and IT systems, are designed to boost productivity and cut operational expenses. For instance, the company has been implementing new technologies aimed at reducing its energy footprint, a key area for cost savings in mining.

The company's commitment to operational excellence is further underscored by its integrated safety, health, environment, and community management system, which was fully implemented in July 2025. This system is crucial for enhancing operational control and ensuring sustainable practices. Such a comprehensive approach not only mitigates risks but also positions Caledonia for long-term resilience in a dynamic market.

These technological advancements and efficiency improvements present significant opportunities for Caledonia Mining. By embracing modern solutions, the company can expect to see:

- Reduced operating costs through energy-saving initiatives and optimized processes.

- Enhanced operational efficiency leading to higher output and improved resource utilization.

- Strengthened operational resilience by integrating robust safety and environmental management systems.

- Improved financial performance driven by cost reductions and increased productivity.

Government Incentives for Gold Deliveries

The Zimbabwean government is actively working to boost gold production, with initiatives like reducing the incentive threshold for gold deliveries to Fidelity Gold Refinery. This move aims to bring more gold into the formal sector, potentially increasing overall output. For instance, in early 2024, the government announced plans to allow artisanal and small-scale miners to retain 70% of their export earnings in foreign currency, a significant incentive compared to previous arrangements.

While these incentives primarily target artisanal miners, a healthier and more formalized gold sector can indirectly benefit larger producers like Caledonia Mining. A more structured environment can lead to greater market stability and potentially improved supply chain efficiencies. For example, increased formalization could reduce illicit gold trading, leading to a more predictable market for all participants.

These government efforts could foster a more robust mining ecosystem in Zimbabwe.

- Lowered Incentive Threshold: Government initiatives to reduce the required gold delivery amounts for incentives encourage formalization.

- Increased Foreign Currency Retention: Policies allowing miners to retain a higher percentage of export earnings in foreign currency act as a strong motivator.

- Formalization of Gold Sector: These measures aim to bring more gold production into official channels, enhancing transparency and control.

- Indirect Benefits for Major Producers: A stronger, more formalized gold market can lead to greater stability and potential efficiencies for companies like Caledonia Mining.

Caledonia Mining is well-positioned to capitalize on favorable gold prices, which significantly boosted its gross profit in 2024. The company's strategic expansion into multiple gold assets in Zimbabwe, including the promising Bilboes project, offers substantial growth potential, with Bilboes alone capable of tripling current production. Ongoing exploration success, such as the extended mine life at Blanket Mine and new discoveries at Motapa, further strengthens its resource base and future outlook.

The company's commitment to modernizing operations, evidenced by investments in energy efficiency and IT systems at Blanket Mine, is set to reduce costs and enhance productivity. Furthermore, government initiatives in Zimbabwe aimed at formalizing the gold sector, such as revised foreign currency retention policies for miners, could indirectly benefit Caledonia by fostering a more stable and efficient market environment.

| Opportunity | Description | Potential Impact | Data Point/Example |

|---|---|---|---|

| Strong Gold Price Environment | Sustained elevated gold prices. | Increased revenue and profitability. | Gross profit increased substantially in 2024 due to higher gold prices. |

| Multi-Asset Growth Strategy | Development of Bilboes, Motapa, and Maligreen projects. | Significant expansion of production capacity. | Bilboes project could triple Caledonia's current gold production. |

| Exploration Success | Expansion of mineral resource base. | Extended mine life and new resource potential. | Blanket Mine mine life extended to 2034; promising initial results at Motapa in November 2024. |

| Operational Modernization | Investment in energy efficiency and IT upgrades. | Reduced operating costs and improved productivity. | Focus on energy-saving initiatives to cut operational expenses. |

| Government Support for Gold Sector | Incentives for formalizing gold production. | Increased market stability and potential efficiencies. | Policies allowing higher foreign currency retention for miners enacted in early 2024. |

Threats

Zimbabwe's political and economic landscape presents a persistent threat to Caledonia Mining. Fluctuations in government policy, particularly concerning currency stability and foreign exchange retention, can directly impact profitability. For instance, the Zimbabwean dollar's volatility in 2023 and early 2024 has created uncertainty for businesses operating in the country, affecting import costs and the repatriation of earnings.

Unforeseen regulatory changes or broader economic downturns pose a significant risk to Caledonia's operational efficiency and financial health. These shifts can disrupt supply chains, increase operational costs, and negatively impact the company's ability to realize its full revenue potential, as seen in past instances of economic instability in the region.

While gold prices have shown strength, a significant downturn would directly impact Caledonia Mining's revenue and profitability, given its status as a pure-play gold producer. For instance, if gold prices were to fall by 10% from their current levels, it could substantially reduce the company's earnings per share.

The inherent volatility of commodity markets presents an ongoing risk to financial projections and the potential returns on investment for Caledonia. This means that future revenue and profit forecasts are subject to considerable uncertainty due to these price swings.

Despite ongoing modernization, Blanket Mine faces inherent operational risks common in underground mining. Geological unpredictability, potential equipment malfunctions, and the ever-present danger of safety incidents like rockfalls can significantly disrupt operations. For instance, in 2023, Caledonia Mining reported a minor incident that temporarily halted production, highlighting the sensitivity of their operations to such events.

Infrastructure and Energy Supply Challenges

Caledonia Mining's operations in Zimbabwe are significantly exposed to the country's infrastructure, particularly its energy supply. Power disruptions remain a primary risk, directly impacting production continuity at Blanket Mine. For instance, in 2023, the company continued its efforts to mitigate these risks, including the ongoing development of its solar power plant, which aims to reduce reliance on the national grid.

While the solar project is a crucial step, the potential for disruptions to both power and water, especially during periods of drought, continues to pose a threat to output. Such events could lead to temporary shutdowns or reduced operational efficiency, affecting the company's ability to meet production targets.

- Dependence on Zimbabwe's national grid for electricity supply.

- Risk of production disruptions due to power outages.

- Vulnerability to water supply interruptions, particularly during droughts.

- Potential impact on operational efficiency and output targets.

Competition and Regulatory Changes in the Mining Sector

Caledonia Mining faces significant threats from both intensifying competition and potentially unfavorable regulatory shifts within Zimbabwe's mining landscape. The sector is dynamic, with numerous local and international entities vying for resources and market share, putting pressure on operational efficiency and profitability.

Government policy changes represent a critical risk. For instance, the discontinuation of tax relief, as seen in some periods, directly impacts operational costs. Furthermore, alterations to royalty structures or the introduction of new beneficiation requirements could further strain Caledonia's financial performance and diminish its competitive edge against peers operating under different fiscal regimes.

- Intensifying Competition: Increased activity from both established and emerging mining companies in Zimbabwe.

- Evolving Regulatory Framework: Potential for new or revised mining laws, tax policies, and environmental regulations.

- Impact of Policy Changes: Discontinuation of tax incentives or changes in royalty rates could directly increase operating expenses.

- Beneficiation Requirements: New mandates for processing minerals within Zimbabwe could necessitate significant capital investment and operational adjustments.

Caledonia Mining faces substantial threats from Zimbabwe's volatile political and economic climate, impacting currency stability and foreign exchange repatriation. Economic downturns and regulatory shifts can disrupt operations and profitability, as evidenced by the Zimbabwean dollar's fluctuations in 2023-2024, which affected import costs and earnings. Intense competition in the mining sector and potential changes in government policies, such as altered royalty structures or new beneficiation requirements, could also increase operating expenses and reduce Caledonia's competitive advantage.

Operational risks, including geological unpredictability and equipment malfunctions at Blanket Mine, pose ongoing threats to production continuity. Furthermore, reliance on Zimbabwe's national power grid remains a significant vulnerability, with power outages directly impacting output, although the development of a solar power plant aims to mitigate this. Water supply interruptions, especially during droughts, also present a risk to operational efficiency.

| Threat Category | Specific Threat | Potential Impact | 2023/2024 Data/Context |

| Political & Economic Instability | Currency Volatility & FX Repatriation | Reduced profitability, increased import costs | Zimbabwe dollar depreciated significantly in late 2023/early 2024. |

| Regulatory Environment | Policy Changes (Tax, Royalties) | Increased operating costs, reduced competitiveness | Past instances of tax relief discontinuation highlight this risk. |

| Operational Risks | Power Outages | Production disruptions, reduced efficiency | Ongoing mitigation through solar plant development; grid reliance persists. |

| Commodity Market | Gold Price Decline | Reduced revenue and profitability | A 10% drop in gold prices could significantly impact EPS. |

SWOT Analysis Data Sources

This Caledonia Mining SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary. These sources provide a robust and data-driven perspective for strategic evaluation.