Caledonia Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Caledonia Mining operates in a sector where supplier power can be significant due to specialized equipment and raw materials. Understanding the intensity of buyer bargaining and the threat of substitutes is crucial for navigating this landscape. The full Porter's Five Forces Analysis delves into these dynamics, offering a comprehensive view of Caledonia Mining's competitive environment.

Unlock the full Porter's Five Forces Analysis to explore Caledonia Mining’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of Caledonia Mining's suppliers is a significant factor, leaning towards moderate to high. This is primarily driven by the specialized nature of mining equipment and advanced technology required for efficient gold extraction. Major global players such as Caterpillar, Komatsu, and Sandvik hold substantial sway due to their market dominance and proprietary innovations.

Energy, particularly electricity and diesel, is a vital input for Caledonia Mining's operations. In 2024, Zimbabwe's power supply remained a significant factor, potentially bolstering the bargaining power of energy providers. Caledonia's strategic investment in solar power, as evidenced by their continued expansion of solar capacity, aims to mitigate this reliance and reduce vulnerability to energy price fluctuations.

Caledonia Mining relies on specialized chemicals like cyanide for gold extraction and explosives for mining operations. These are essential inputs, and their availability can significantly influence production efficiency and costs.

The supply of these critical materials is often concentrated among a limited number of global or regional producers. This concentration can grant suppliers considerable bargaining power, as Caledonia may have few alternatives if a primary supplier falters or raises prices.

For instance, in 2024, global cyanide prices saw fluctuations due to geopolitical events and increased demand from the mining sector, directly impacting operating expenses for companies like Caledonia. Similarly, disruptions in the explosives supply chain, perhaps due to manufacturing issues or transportation challenges, could lead to project delays and increased costs.

Supplier Power 4

The bargaining power of suppliers for Caledonia Mining is influenced by the availability of skilled labor. Experienced miners and technical staff hold significant sway, particularly in areas with limited expertise or high demand for these specialized roles. While Caledonia's Blanket Mine exclusively employs Zimbabwean staff, ongoing wage negotiations and labor relations are key considerations in managing this aspect of supplier power.

The scarcity of specialized mining skills can elevate the bargaining power of labor suppliers. This means that Caledonia must remain competitive in its compensation and working conditions to attract and retain essential personnel. As of early 2024, the global demand for skilled mining professionals remains robust, potentially increasing the leverage held by these workers.

- Skilled Labor Scarcity: High demand for experienced miners and technical staff.

- Wage Negotiations: Ongoing factor influencing operational costs.

- Local Employment: 100% Zimbabwean workforce at Blanket Mine.

- Global Demand: Robust demand for mining expertise globally in 2024.

Supplier Power 5

The bargaining power of suppliers for Caledonia Mining is moderate, influenced by the rising cost of essential inputs. In Q1 2025, Caledonia experienced a significant 12.9% increase in its on-mine cost per ounce. This rise was directly attributed to higher expenses for labor, power, and consumables, indicating that suppliers are effectively passing on their own increased costs.

This trend suggests suppliers have a degree of leverage, particularly for specialized consumables or power sources where alternatives might be limited or costly to switch. The ability of suppliers to command higher prices directly impacts Caledonia's profitability and operational efficiency.

- Rising Input Costs: Caledonia's Q1 2025 on-mine cost per ounce increased by 12.9%, driven by higher prices for labor, power, and consumables.

- Supplier Leverage: This cost escalation indicates suppliers possess some ability to pass on their own increased expenses to Caledonia.

- Impact on Profitability: Increased supplier costs can directly squeeze profit margins for Caledonia Mining.

Caledonia Mining's suppliers, particularly those providing specialized equipment and energy, wield moderate to high bargaining power. This is evident in the 12.9% rise in Caledonia's on-mine cost per ounce in Q1 2025, directly linked to increased labor, power, and consumable prices, demonstrating suppliers' ability to pass on their own rising expenses.

| Input Category | Supplier Power Level | Impact on Caledonia Mining | Relevant 2024/2025 Data Point |

|---|---|---|---|

| Specialized Mining Equipment | High | High capital expenditure, reliance on proprietary technology | Major suppliers like Caterpillar, Komatsu, Sandvik dominate |

| Energy (Electricity, Diesel) | Moderate to High | Operational cost volatility, strategic investment in solar to mitigate | Zimbabwe's power supply stability remains a factor in 2024 |

| Extraction Chemicals (Cyanide) | Moderate | Direct impact on production costs, price fluctuations | Global cyanide prices saw fluctuations in 2024 due to geopolitical events |

| Explosives | Moderate | Potential for supply chain disruptions, project delays | Manufacturing and transportation challenges can impact availability |

| Skilled Labor | High | Wage negotiations, retention challenges, competitive compensation | Robust global demand for skilled mining professionals in early 2024 |

What is included in the product

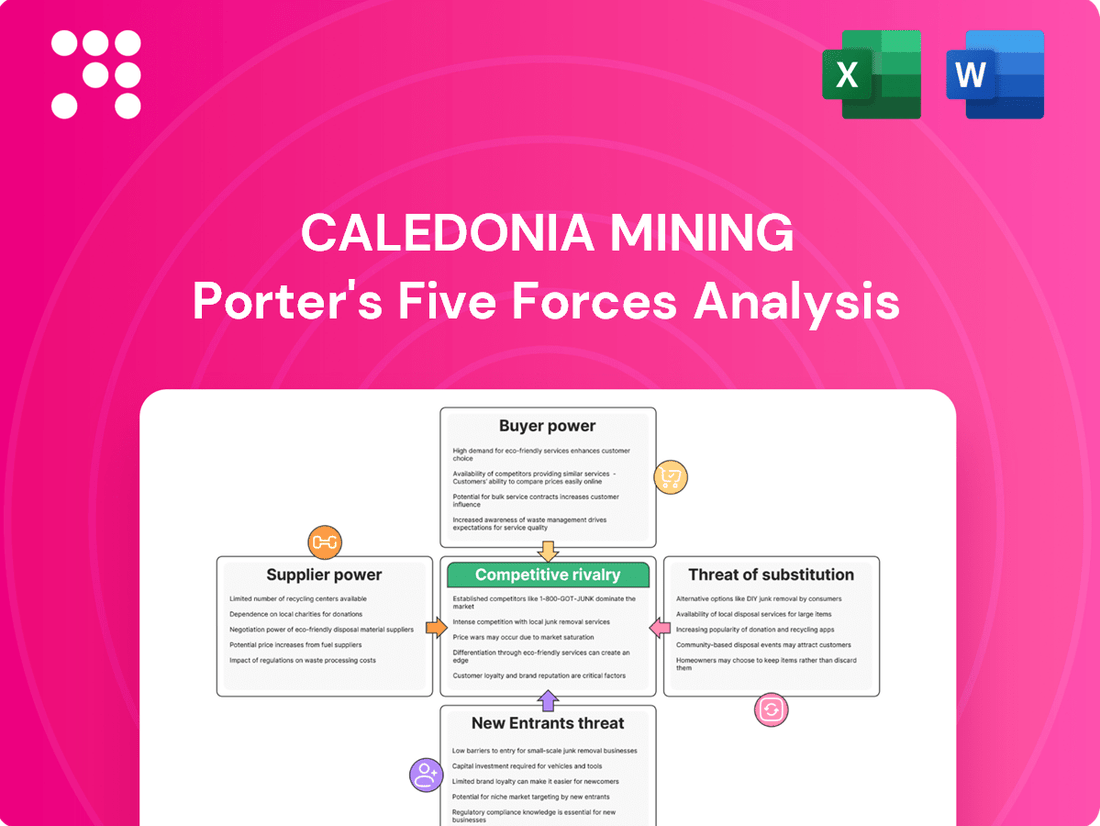

This Porter's Five Forces analysis for Caledonia Mining dissects the competitive intensity within the gold mining sector, focusing on the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Simplify complex competitive pressures with a visual Porter's Five Forces analysis, allowing Caledonia Mining to quickly identify and address key industry threats.

Customers Bargaining Power

Caledonia Mining's primary customers are gold refiners, bullion banks, and other market intermediaries. As gold is a global commodity, its price is largely dictated by broad market forces rather than the negotiation power of individual buyers. This significantly limits the bargaining power of any single customer.

Given gold's status as a globally traded commodity, individual mining companies like Caledonia Mining have minimal direct control over the selling price of their output. This positions them as price-takers in the international market, significantly diminishing customer bargaining power.

In 2024, the average price of gold fluctuated, but the overall trend reflects the market's influence rather than any single producer's pricing power. For instance, gold prices saw significant movement throughout the year, influenced by macroeconomic factors and central bank policies, not by the output of one company.

The demand for gold is remarkably diverse, encompassing investment vehicles like ETFs and central bank reserves, the ever-present jewelry market, and crucial industrial applications. This wide-ranging customer base means Caledonia Mining isn't overly dependent on any one sector, which naturally lessens the collective bargaining power of its buyers.

Buyer Power 4

Central bank demand for gold has been a significant factor, with net purchases by central banks reaching 1,037 tonnes in 2023, according to the World Gold Council. This robust and consistent buying from a powerful customer segment provides a strong floor for gold prices. Such substantial structural support benefits gold producers like Caledonia Mining by ensuring a baseline level of demand.

This persistent demand from central banks, a key buyer group, contributes to price stability and predictability for gold producers. For instance, in the first quarter of 2024, central banks continued their buying trend, adding 119 tonnes to their reserves. This ongoing purchasing activity directly impacts the bargaining power of customers in the gold market.

- High Central Bank Demand: Central banks were net purchasers of 1,037 tonnes of gold in 2023, indicating strong and consistent buying interest.

- Price Support: This significant demand provides structural support for gold prices, benefiting producers.

- Q1 2024 Trend: Central banks continued their buying in Q1 2024, adding 119 tonnes, reinforcing the trend.

- Impact on Producers: Strong buyer demand mitigates the bargaining power of individual customers for producers like Caledonia.

Buyer Power 5

Buyer power for Caledonia Mining is significantly limited by the robust gold market conditions anticipated through 2025. With gold prices showing a strong upward trend in 2024 and projections for continued increases, demand is clearly outstripping available supply. This scarcity translates directly into less negotiating power for customers, as they face a competitive environment to secure gold.

- Rising Gold Prices: Forecasts indicate gold prices could reach new highs in 2024 and 2025, driven by inflation hedging and geopolitical uncertainty.

- Demand Exceeds Supply: Central bank buying and investor demand are strong, creating a seller's market for precious metals.

- Reduced Buyer Leverage: In such a market, individual buyers have minimal ability to dictate terms or negotiate lower prices for gold.

- Caledonia's Advantage: The company benefits from this environment, allowing it to sell its gold at favorable market rates with little pushback from buyers.

Caledonia Mining's customers, primarily gold refiners and market intermediaries, possess limited bargaining power due to gold's status as a globally commoditized asset. The price is set by broad market forces, not individual buyer negotiations. This dynamic is reinforced by strong demand from central banks, which consistently purchase large quantities, as evidenced by their net additions of 119 tonnes in Q1 2024, following 1,037 tonnes in 2023.

The diverse demand for gold across investment, jewelry, and industrial sectors further dilutes any single customer segment's ability to exert significant influence. With gold prices trending upward in 2024 and projections suggesting continued strength through 2025, a seller's market is emerging, where demand outstrips supply, thereby reducing buyer leverage.

| Customer Segment | Bargaining Power Factor | Impact on Caledonia Mining |

|---|---|---|

| Gold Refiners & Intermediaries | Commoditized Nature of Gold | Low; Price is market-driven, not negotiable per buyer. |

| Central Banks | High Demand Volume | Mitigates buyer power; provides price support. (119 tonnes bought in Q1 2024) |

| Investors (ETFs, etc.) | Diversified Demand Base | Low collective power; company not reliant on a single investor group. |

| Jewelry & Industrial Sectors | Broad Market Reach | Limits individual buyer negotiation strength. |

Preview the Actual Deliverable

Caledonia Mining Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Caledonia Mining's competitive landscape through Porter's Five Forces, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the gold mining sector. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

Competitive rivalry in the gold mining sector is intense, featuring established giants, mid-tier players, and emerging junior miners. Caledonia Mining, as a mid-tier producer, faces competition primarily from other companies operating similar-sized assets, particularly those with comparable production costs and resource bases. For instance, in 2024, the global gold mining industry saw significant activity, with companies like Barrick Gold and Newmont Corporation continuing to dominate, while mid-tier producers such as Evolution Mining and Kinross Gold also maintained substantial operations.

Caledonia Mining operates in a fiercely competitive gold mining sector where companies constantly vie for operational efficiency and cost control. Achieving lower all-in sustaining costs (AISC) is paramount for profitability, especially when gold prices fluctuate. For instance, in 2024, many junior miners struggled with AISC exceeding $1,500 per ounce, making profitability a significant challenge.

Caledonia Mining's competitive rivalry is significantly shaped by its geographical focus on Zimbabwe. This means it primarily contends with other mining entities operating within or eyeing opportunities in that specific region. For instance, companies like Kuvimba Mining House are also active players in Zimbabwe's mining landscape, creating direct competition for resources and market share.

Recent legislative shifts in Zimbabwe are a crucial factor influencing this rivalry. New mining laws, implemented with the aim of boosting transparency and attracting foreign investment, are designed to level the playing field. This could intensify competition as more players are encouraged to enter the market, potentially increasing demand for skilled labor and equipment.

The operational environment in Zimbabwe presents unique challenges and opportunities that define the competitive dynamics. For example, in 2023, the mining sector contributed significantly to Zimbabwe's export earnings, highlighting the sector's economic importance and the stakes involved for companies like Caledonia.

Competitive Rivalry 4

Competitive rivalry in the gold mining sector, particularly for companies like Caledonia Mining, is intense and largely driven by exploration success and the ability to expand existing resource bases to extend mine life and boost production. This is a critical factor as companies vie for market share and investor attention.

Caledonia Mining has actively pursued this strategy, notably reporting substantial increases in its mineral resources at the Blanket Mine. For instance, as of the end of 2023, Caledonia announced a significant increase in its measured and indicated gold resources at Blanket, demonstrating the success of its ongoing exploration efforts. Beyond Blanket, Caledonia is strategically advancing new exploration projects, including Motapa and Bilboes, which represent potential future growth engines and are key battlegrounds for resource acquisition and development within the industry.

- Exploration Success: Caledonia's recent resource upgrades at Blanket underscore the importance of successful exploration in gaining a competitive edge.

- Resource Expansion: Extending mine life through new discoveries and resource definition is a primary focus for all players in the gold mining industry.

- New Project Development: Caledonia's advancement of Motapa and Bilboes highlights the strategic imperative to identify and develop new resource opportunities to counter depletion at existing mines and capture future growth.

- Production Profiles: The ability to increase production volumes, often a direct result of successful exploration and resource expansion, is a key differentiator among mining companies.

Competitive Rivalry 5

The profitability for gold miners, including Caledonia Mining, is directly tied to gold prices. As of early 2025, gold prices have remained robust, fostering higher potential margins for the industry. This environment intensifies competition, pushing companies to focus on efficient cost management and expanding production volumes to capture market share.

Caledonia Mining, operating primarily at its Blanket Mine in Zimbabwe, faces rivals who also aim to capitalize on favorable gold prices. The company's strategy involves optimizing its operations to maintain a competitive cost structure while pursuing increased output. This focus on operational efficiency is crucial for sustained profitability in a market where even high prices don't eliminate the need for cost discipline.

- Gold Price Influence: High gold prices in 2024 and projected strength into 2025 enable higher profit margins for gold miners, but do not eliminate the need for cost efficiency.

- Cost Control and Production Growth: Competition centers on reducing operational costs and increasing production volumes to maximize profitability in the current market.

- Industry Dynamics: Favorable gold prices create an environment where efficient operators can thrive, but also attract new entrants and encourage existing players to expand, thus intensifying rivalry.

Competitive rivalry for Caledonia Mining is intense, with a focus on operational efficiency and resource expansion. Companies like Barrick Gold and Newmont Corporation represent the dominant forces, while mid-tier producers such as Evolution Mining and Kinross Gold are direct competitors. Caledonia's strategy centers on optimizing its Blanket Mine in Zimbabwe and developing new projects like Motapa and Bilboes to secure future growth.

| Competitor Type | Example Companies (2024) | Caledonia's Position |

|---|---|---|

| Major Producers | Barrick Gold, Newmont Corporation | Mid-tier |

| Mid-tier Producers | Evolution Mining, Kinross Gold | Directly competing on operational efficiency and cost |

| Regional Players (Zimbabwe) | Kuvimba Mining House | Competing for resources and market share within Zimbabwe |

SSubstitutes Threaten

The threat of substitutes for gold, a key factor for Caledonia Mining, is quite low. Gold's unique combination of properties as a safe-haven asset, a store of value, and its use in jewelry, electronics, and dentistry makes it difficult for other materials to fully replace it. For instance, in 2024, gold continued to be a primary hedge against inflation and geopolitical uncertainty, demonstrating its enduring appeal.

While other precious metals like silver, platinum, and palladium exist, they do not fully substitute gold's unique combination of historical value, deep liquidity, and perceived stability, particularly during periods of economic uncertainty or geopolitical stress. Gold's long-standing role as a store of value, evidenced by its consistent demand even when prices fluctuate, sets it apart from its precious metal counterparts.

While digital currencies and other financial assets present alternative investment options, they lack the tangible and historical characteristics of gold. Gold's enduring appeal as a physical store of value and a hedge against inflation remains a significant differentiator.

In 2024, the global gold market continued to demonstrate resilience, with central banks actively increasing their gold reserves. For instance, the World Gold Council reported that central bank net purchases of gold reached 290 tonnes in the first half of 2024, underscoring gold's perceived stability compared to more volatile digital assets.

The threat of substitutes for gold, particularly from cryptocurrencies, is often overstated. Despite the growth of digital assets, gold's established role in portfolios and its long-standing reputation as a safe-haven asset are not easily replicated. The intrinsic value and historical precedent of gold provide a level of trust and security that newer, more volatile assets have yet to achieve.

Threat of Substitution 4

In industrial applications, while some materials might substitute for gold in specific niches, gold's superior conductivity and corrosion resistance often make it irreplaceable in high-performance or critical components. For example, in advanced electronics and aerospace, where reliability is paramount, the unique properties of gold are often favored despite higher costs. While copper can substitute for gold in some electrical applications, its lower conductivity and susceptibility to corrosion limit its use in demanding environments.

The threat of substitutes for gold is generally considered low, especially in its primary industrial uses. While silver and platinum group metals can sometimes serve as alternatives, they do not perfectly replicate gold's specific combination of conductivity, malleability, and resistance to tarnishing. For instance, in 2024, the price of gold averaged around $2,300 per ounce, significantly higher than industrial metals like copper, yet its unique properties justify its use in specialized sectors.

Key considerations regarding substitutes include:

- Industrial applications: Gold's high electrical conductivity and resistance to corrosion make it difficult to substitute in sectors like electronics, aerospace, and medical devices.

- Precious metal alternatives: While silver and platinum can offer some similar properties, they do not match gold's overall performance profile in critical applications.

- Jewelry and investment: In these sectors, substitutes are more prevalent, but the intrinsic value and cultural significance of gold limit the impact of alternatives.

- Technological advancements: Ongoing research may lead to new materials that could reduce reliance on gold in some niche areas, but widespread substitution remains unlikely in the near term.

Threat of Substitution 5

The threat of substitutes for gold, and by extension for gold mining companies like Caledonia Mining, is relatively low. Gold's unique properties as a store of value, a hedge against inflation and geopolitical uncertainty, and its historical role as a reserve asset make it difficult to replace. Central banks globally continue to accumulate gold, with net purchases by central banks reaching 290 tonnes in the first half of 2024, according to the World Gold Council. This consistent demand, driven by macro-economic factors and geopolitical risks, underscores gold's enduring role as a reserve asset that is not easily substituted by other financial instruments.

While other assets like cryptocurrencies or commodities might be considered by some investors as alternatives, they do not possess the same long-term track record or universal acceptance as gold. The intrinsic value and tangible nature of gold provide a level of security that digital or other commodity-based assets have yet to consistently demonstrate. For instance, the volatility experienced in digital asset markets contrasts sharply with gold's historical stability during periods of economic turmoil.

- Gold's Role as a Reserve Asset: Central banks continue to see gold as a crucial component of their reserves, with global official gold holdings remaining substantial.

- Inflation and Geopolitical Hedging: Gold's historical performance during periods of high inflation and geopolitical instability reinforces its appeal as a safe-haven asset.

- Lack of Direct Substitutes: No other asset offers the same combination of scarcity, durability, divisibility, and historical acceptance as a medium of exchange and store of value.

- Investor Sentiment: Despite the rise of alternative investments, a significant portion of investors, including institutional ones, maintain gold allocations in their portfolios.

The threat of substitutes for gold is low, as no other asset fully replicates its unique combination of properties. Gold serves as a crucial hedge against inflation and geopolitical uncertainty, a role that digital assets and other commodities struggle to fill. For example, central banks' continued accumulation of gold, with net purchases of 290 tonnes in the first half of 2024, highlights its perceived stability and store of value. While some industrial applications might find alternatives, gold's superior conductivity and resistance to corrosion often make it indispensable in high-performance sectors.

| Factor | Description | Impact on Caledonia Mining |

|---|---|---|

| Industrial Use | Gold's conductivity and corrosion resistance are hard to substitute in electronics and aerospace. | Maintains demand for industrial-grade gold. |

| Investment & Store of Value | Gold's safe-haven status is unmatched by digital assets or other commodities. | Supports gold prices and mining profitability. |

| Precious Metal Alternatives | Silver and platinum offer some similar properties but lack gold's overall profile. | Limited substitution in key gold markets. |

Entrants Threaten

The threat of new entrants into the gold mining sector, especially for underground operations like Caledonia Mining's Blanket Mine, is considerably low. This is primarily due to the immense capital investment needed for exploration, mine development, and construction, often running into hundreds of millions of dollars. For instance, establishing a new underground gold mine typically requires significant upfront expenditure for shafts, processing facilities, and infrastructure, creating a substantial barrier to entry.

The threat of new entrants in the gold mining sector, particularly for a company like Caledonia Mining, is significantly mitigated by the substantial geological risk and inherent uncertainty. Discovering economically viable gold deposits is a complex and expensive undertaking, often involving years of exploration with no assurance of a successful outcome. For instance, in 2024, the global average cost to discover a new gold deposit was estimated to be in the tens of millions of dollars, a considerable barrier to entry.

Furthermore, the capital-intensive nature of establishing and operating a mine presents another formidable hurdle. Developing a new mine requires massive upfront investment in infrastructure, equipment, and personnel, often running into hundreds of millions, if not billions, of dollars. This high capital requirement, coupled with the long lead times from discovery to production, effectively deters many potential new players from entering the market, thus protecting existing operators like Caledonia Mining.

The threat of new entrants in Zimbabwe's mining sector, particularly for gold operations like Caledonia Mining, is significantly mitigated by formidable regulatory and environmental barriers. Obtaining mining licenses and adhering to the country's environmental protection laws requires extensive capital, time, and specialized expertise, making it difficult for new players to establish a foothold. For instance, in 2024, the Zimbabwean government continued to emphasize strict compliance with environmental impact assessments for all new mining projects, adding layers of complexity and cost.

Threat of New Entrants 4

The threat of new entrants in the gold mining sector, particularly for operations like Caledonia Mining's Blanket Mine, is significantly mitigated by the substantial capital investment required for exploration, development, and operational setup. Establishing a new mine demands extensive geological surveys, permitting processes, and the construction of specialized infrastructure, including processing plants and tailings facilities. These upfront costs create a formidable barrier, effectively deterring many potential new players from entering the market.

Access to specialized infrastructure, skilled labor, and established supply chains also presents a challenge for new entrants. Existing players like Caledonia have developed these over years, creating a competitive advantage. For instance, Caledonia Mining's Blanket Mine in Zimbabwe benefits from decades of operational history, which has allowed it to cultivate deep relationships with local suppliers and develop a highly experienced workforce. In 2023, Caledonia reported total gold production of 77,370 ounces from Blanket Mine, demonstrating the established operational capacity that new entrants would struggle to replicate quickly.

Furthermore, the regulatory landscape for mining is often complex and time-consuming. New entrants must navigate stringent environmental regulations, obtain various mining licenses, and comply with local labor laws, all of which can prolong the entry process and increase costs. Caledonia Mining, having operated in Zimbabwe for many years, possesses a thorough understanding of these regulatory requirements, giving it an edge over any newcomer.

The established brand reputation and market access of existing gold producers also act as a deterrent. New entities face the challenge of building trust with buyers and securing favorable off-take agreements in a market where established players already have strong relationships. This can make it difficult for new entrants to secure competitive pricing for their output, further solidifying the position of incumbents.

- High Capital Requirements: The significant upfront investment for exploration, mine development, and processing infrastructure acts as a major barrier.

- Specialized Infrastructure & Expertise: New entrants need to build or acquire specialized processing plants and secure experienced mining personnel.

- Established Supply Chains & Relationships: Existing miners benefit from long-standing relationships with suppliers and off-takers, crucial for efficient operations and sales.

- Regulatory Hurdles: Navigating complex mining permits, environmental regulations, and local laws presents a substantial challenge for new market entrants.

Threat of New Entrants 5

The threat of new entrants for Caledonia Mining in Zimbabwe is moderately high, influenced by evolving mining legislation. Zimbabwe's enforcement of the 'use it or lose it' principle for mining titles aims to curb speculative land holding. This policy could theoretically open up opportunities for new players, but it also demands that entrants prove concrete development plans and possess adequate capital, acting as a barrier.

New entrants must navigate stringent requirements, including demonstrating financial capacity and technical expertise to develop mining claims. This regulatory environment, while intended to foster active mining, necessitates significant upfront investment and a clear operational strategy, thereby deterring casual or undercapitalized entrants.

- Regulatory Hurdles: Zimbabwe's mining laws require substantial proof of development plans and capital for new title acquisition.

- Capital Requirements: Significant financial commitment is necessary to meet the operational and developmental demands imposed by the 'use it or lose it' policy.

- Market Access: Established players like Caledonia Mining often benefit from existing infrastructure and operational experience, creating a competitive advantage.

- Government Policy: The government's drive to increase mining output and foreign investment can influence the ease of entry for new companies.

The threat of new entrants into the gold mining sector, particularly for underground operations like Caledonia Mining's Blanket Mine, remains low due to substantial barriers. The immense capital required for exploration, development, and infrastructure, often in the hundreds of millions of dollars, deters many. For instance, establishing a new underground gold mine in 2024 demanded significant upfront expenditure for shafts, processing facilities, and infrastructure, creating a formidable entry cost.

Geological risk and the cost of discovery also act as significant deterrents. In 2024, the average global cost to discover a new gold deposit was in the tens of millions of dollars, with no guarantee of success. Furthermore, navigating Zimbabwe's complex regulatory environment, including obtaining licenses and complying with environmental laws, requires substantial capital and expertise, adding further layers of difficulty for potential new entrants.

| Barrier Type | Description | Example Impact (2024) |

|---|---|---|

| Capital Investment | High upfront costs for exploration, development, and infrastructure. | Hundreds of millions of dollars for a new underground mine. |

| Geological Risk | Uncertainty and cost associated with discovering viable deposits. | Tens of millions of dollars in exploration costs with no guaranteed return. |

| Regulatory Compliance | Navigating licenses, environmental laws, and local regulations. | Increased costs and time delays for new entrants in Zimbabwe. |

| Infrastructure & Expertise | Need for specialized processing plants and skilled labor. | Existing operators like Caledonia benefit from established infrastructure and experienced workforce. |

Porter's Five Forces Analysis Data Sources

Our Caledonia Mining Porter's Five Forces analysis is built upon a foundation of comprehensive data, including official company filings (SEC, AIM), industry-specific market research reports, and reputable financial news outlets to capture the full competitive landscape.