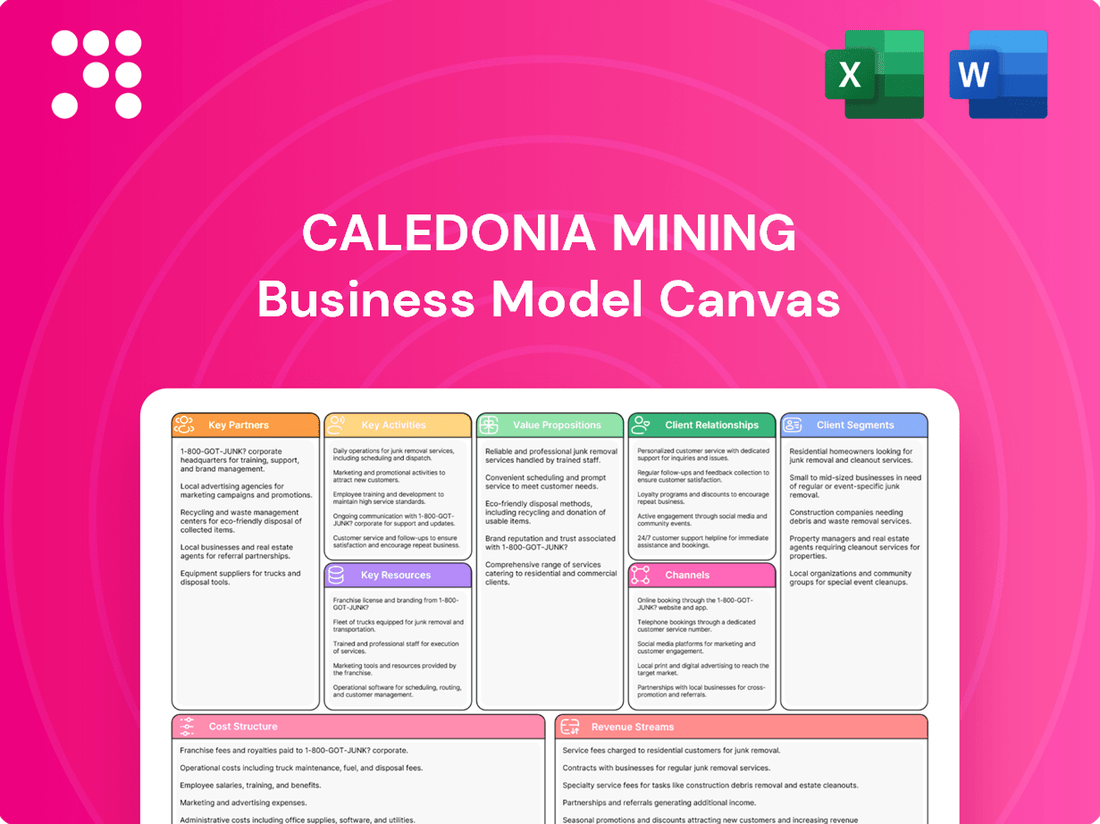

Caledonia Mining Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Unlock the core strategies behind Caledonia Mining's success with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver value to their target customers. This detailed analysis is your key to understanding their operational efficiency and revenue streams.

Partnerships

Caledonia Mining's relationship with the Zimbabwean government and its regulatory bodies is fundamental to its operations. These partnerships are vital for obtaining and retaining mining licenses, permits, and ensuring adherence to Zimbabwe's mining laws and environmental standards. For instance, the Zimbabwean government, through the Ministry of Mines and Mining Development, oversees the issuance of all mining concessions.

Maintaining strong ties with these entities guarantees operational stability and continuity. In 2023, Zimbabwe's mining sector contributed significantly to its GDP, highlighting the government's vested interest in supporting compliant and productive mining operations like Caledonia's Blanket Mine.

Caledonia Mining actively partners with local communities and traditional leaders to secure its social license to operate. This engagement is crucial for addressing community development needs and effectively managing environmental and social impacts. For instance, in 2024, the company continued its commitment to sustainable operations by supporting initiatives like solar energy infrastructure for local schools and clinics, demonstrating a tangible benefit to the region.

Caledonia Mining Corporation plc relies heavily on its suppliers for critical mining equipment, consumables, and specialized services to maintain efficient operations at its Blanket Mine in Zimbabwe. Establishing and nurturing strong relationships with these partners is paramount for ensuring a steady flow of necessary resources.

Prioritizing local procurement is a key strategy for Caledonia, aiming to bolster regional economic development and build resilience against potential disruptions in global supply chains. For instance, in 2023, Caledonia continued its efforts to source a significant portion of its operational needs locally, contributing to the Zimbabwean economy.

Financial Institutions and Investors

Caledonia Mining's ability to fund its ambitious growth plans hinges on strong relationships with financial institutions and investors. These partnerships are essential for securing the necessary capital for exploration, project development, and overall expansion. For instance, in 2024, the company continued to leverage its established banking relationships and access to capital markets to support its ongoing operations and strategic initiatives.

The company actively engages in capital raising activities, including share placements and debt financing, to fuel its expansion. Maintaining transparency through consistent and detailed financial reporting is paramount to fostering trust and attracting continued investment. This commitment to clear communication ensures that investors remain informed about Caledonia's progress and financial health.

Key aspects of these partnerships include:

- Securing Capital: Agreements with banks and investment funds provide access to crucial funding for exploration, development, and expansion projects.

- Capital Raising Activities: Ongoing engagement in share placements and debt financing to meet funding requirements.

- Investor Relations: Maintaining high standards of financial reporting and transparency to build and sustain investor confidence.

- Diverse Investor Base: Cultivating relationships with a broad spectrum of investors, from institutional funds to individual shareholders.

Technical and Engineering Consultants

Caledonia Mining Corporation plc leverages the expertise of technical and engineering consultants to refine its mine planning and geological assessments. These collaborations are crucial for optimizing existing operations and identifying promising new development opportunities.

For instance, in 2024, Caledonia continued to engage specialized consultants to enhance its understanding of the Blanket Mine's geological structure and to implement advanced mining techniques. This focus on expert input aims to boost operational efficiency and ensure the long-term viability of its assets.

- Specialized Expertise: Consultants provide deep knowledge in areas like geostatistics, rock mechanics, and processing technologies, which are vital for effective mine management.

- Operational Optimization: Their input directly contributes to improving extraction rates, reducing costs, and enhancing safety protocols.

- Project Evaluation: Caledonia utilizes these partnerships to conduct thorough feasibility studies and risk assessments for potential expansion projects, ensuring informed decision-making.

Caledonia Mining's key operational partners include suppliers of essential mining equipment and consumables, ensuring the continuous functioning of the Blanket Mine. Local procurement is emphasized, contributing to Zimbabwe's economic development and supply chain resilience, a strategy evident in their 2023 sourcing efforts.

Furthermore, strong relationships with financial institutions and investors are critical for funding growth initiatives, with capital raising activities in 2024 demonstrating ongoing reliance on these partnerships. Technical and engineering consultants also play a vital role, providing specialized expertise to optimize mine planning and geological assessments, as seen in their 2024 engagement for enhanced geological understanding.

| Partner Type | Key Contribution | Example/Focus Area | 2023/2024 Relevance |

|---|---|---|---|

| Government & Regulators | Licenses, Permits, Compliance | Ministry of Mines and Mining Development oversight | Zimbabwe's mining sector GDP contribution |

| Local Communities | Social License to Operate | Community development, environmental management | Solar infrastructure support for schools/clinics in 2024 |

| Suppliers | Equipment, Consumables, Services | Local procurement strategy | Continued local sourcing in 2023 |

| Financial Institutions & Investors | Capital for Growth | Banking relationships, capital markets access | Support for ongoing operations and strategic initiatives in 2024 |

| Technical Consultants | Expertise in Mining & Geology | Mine planning, geological assessments | Enhanced understanding of Blanket Mine geology in 2024 |

What is included in the product

This Caledonia Mining Business Model Canvas provides a detailed, narrative-driven breakdown of their gold mining operations, covering key partners, activities, resources, cost structure, and revenue streams.

It offers a strategic overview of their value proposition and customer relationships, designed for informed decision-making and investor discussions.

Caledonia Mining's Business Model Canvas offers a clear, one-page snapshot of their operations, simplifying complex mining strategies for stakeholders.

This model acts as a pain point reliever by condensing Caledonia Mining's intricate business strategy into a digestible format for quick review and understanding.

Activities

Caledonia Mining's primary focus is on identifying and evaluating new gold deposits, with a strategic emphasis on southern Africa. This proactive approach aims to bolster the company's production capacity and expand its overall resource holdings.

Ongoing exploration efforts are crucial, particularly at established sites like Blanket Mine, and emerging projects such as Motapa. These activities are designed to extend the operational life of existing mines and pinpoint new zones of high-grade gold mineralization, ensuring future output.

In 2024, Caledonia reported significant progress in its exploration programs, with drilling at Motapa yielding promising results, including intercepts of 4.5 meters at 4.47 grams per tonne of gold. This demonstrates the tangible outcomes of their resource delineation efforts.

Developing new mine shafts and constructing essential infrastructure are paramount to Caledonia Mining's operations. This includes projects like the ongoing expansion of the Central Shaft at their Blanket Mine, designed to unlock deeper gold reserves and enhance extraction efficiency.

Significant capital expenditure fuels these development activities, with the company consistently investing in modernizing its mining capabilities. For instance, in 2023, Caledonia Mining reported capital expenditure of $28.1 million, a substantial portion of which was directed towards these growth initiatives.

Expanding existing operations and improving mining efficiency through technological upgrades are also core activities. These efforts are crucial for Caledonia to maintain and increase its gold production levels, ensuring long-term viability and profitability.

Caledonia Mining Corporation's core activity revolves around operating the Blanket Mine, an underground gold mine. This involves the meticulous extraction, hoisting, and processing of gold-bearing ore. The primary focus is on maintaining consistent production levels, maximizing the efficiency of their milling operations, and achieving superior gold recovery rates to ensure profitability.

In 2024, Caledonia Mining reported a significant achievement by producing 78,158 ounces of gold. This figure highlights their operational success and commitment to output. The company's strategy emphasizes optimizing milling capacity, which in 2024 was reported to be running at approximately 50% of its potential, indicating substantial room for increased production and efficiency gains.

Environmental and Social Governance (ESG) Management

Caledonia Mining Corporation is dedicated to embedding strong Environmental, Social, and Governance (ESG) principles into its operational framework. This commitment extends to actively managing climate change risks, ensuring responsible water usage, and fostering positive relationships through community investment. For instance, in 2023, Caledonia reported significant progress in its water stewardship initiatives, with a focus on reducing its overall water footprint across its operations.

These ESG activities are fundamental to Caledonia's long-term sustainability and social license to operate. By proactively addressing environmental impacts and supporting local communities, the company aims to build trust and create shared value. This approach is increasingly vital for attracting investment and meeting the evolving expectations of stakeholders in the mining sector.

Key ESG management activities include:

- Climate Change Risk Assessment: Regularly evaluating and mitigating the physical and transitional risks associated with climate change, such as extreme weather events impacting operations.

- Water Management: Implementing efficient water use strategies and responsible discharge practices to minimize environmental impact and conserve local water resources.

- Community Investment: Directing resources towards community development projects, education, and healthcare initiatives to enhance local well-being and foster strong stakeholder relationships.

- Biodiversity Protection: Developing and executing plans to protect and, where possible, enhance biodiversity in areas surrounding its mining operations.

Financial Management and Investor Relations

Caledonia Mining Corporation PLC actively manages its financial performance, focusing on cost control at its Blanket Mine in Zimbabwe, optimizing capital allocation for exploration and infrastructure upgrades, and driving revenue generation through efficient gold production. In 2024, the company continued its efforts to enhance operational efficiency and manage its financial resources prudently.

Maintaining transparent and consistent communication with its investor base is a cornerstone of Caledonia's strategy. This involves the timely dissemination of financial reports, investor presentations detailing operational progress and strategic initiatives, and regular market updates to foster trust and confidence. For instance, Caledonia regularly publishes its quarterly and annual financial results, providing detailed insights into its financial health and operational achievements.

- Financial Performance Management: Focus on cost efficiency and capital deployment for growth initiatives.

- Investor Communication: Regular financial reporting and market updates to maintain transparency.

- Revenue Generation: Maximizing gold output and value from operations.

- Capital Allocation: Strategic investment in exploration and infrastructure to support future production.

Caledonia Mining's key activities center on the efficient operation of its Blanket Mine, focusing on gold extraction and processing. This includes optimizing milling capacity and maximizing gold recovery rates to drive profitability. The company also actively pursues exploration to identify and develop new gold deposits, particularly in southern Africa, aiming to expand its resource base and production capacity.

Development of new infrastructure, such as shaft expansions, is crucial for unlocking deeper gold reserves and enhancing extraction efficiency. Furthermore, Caledonia is committed to strong ESG principles, managing climate risks, water usage, and investing in local communities to ensure long-term sustainability and social license.

| Key Activity | Description | 2024 Data/Focus |

| Mine Operations | Extraction, hoisting, and processing of gold ore at Blanket Mine. | Produced 78,158 ounces of gold. Milling capacity operating at ~50% of potential. |

| Exploration & Development | Identifying and evaluating new gold deposits; developing new shafts and infrastructure. | Promising drilling results at Motapa (e.g., 4.5m at 4.47 g/t Au). Central Shaft expansion at Blanket Mine ongoing. |

| Financial Management & Investor Relations | Cost control, capital allocation, revenue generation, and transparent communication with investors. | Continued focus on operational efficiency. Regular financial reporting. |

| ESG Integration | Managing climate risks, water usage, community investment, and biodiversity. | Focus on water stewardship and community development initiatives. |

Preview Before You Purchase

Business Model Canvas

The Caledonia Mining Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited framework, meticulously detailing Caledonia Mining's strategic approach. Once your order is processed, you'll gain full access to this exact Business Model Canvas, ready for your immediate use and analysis.

Resources

Caledonia Mining's core key resource is its gold mineral reserves and resources, primarily located at the Blanket Mine. These substantial geological assets form the bedrock of the company's gold production capabilities and are crucial for its long-term valuation and operational sustainability.

The company's resource base has been significantly enhanced by recent acquisitions, notably the Bilboes and Motapa projects. As of the first quarter of 2024, Caledonia reported attributable gold mineral reserves of 1.47 million ounces and attributable gold mineral resources of 3.25 million ounces, demonstrating a robust and expanding foundation for future growth.

Caledonia Mining's core physical assets are centered around its Blanket Mine in Zimbabwe. This includes extensive underground mining infrastructure like shafts, haulage ways, and processing facilities essential for gold extraction and refinement. These are the backbone of their operations.

The company relies on a significant fleet of specialized mining equipment, ranging from drilling rigs and load-haul-dump machines to crushers and concentrators. These assets are vital for efficient and safe mineral extraction and processing, directly impacting production volumes and costs.

In 2023, Caledonia Mining reported that the Blanket Mine produced 79,949 ounces of gold. The ongoing investment in maintaining and upgrading this infrastructure and equipment is crucial for sustaining and potentially increasing this output in the coming years.

Caledonia's operations rely heavily on a highly skilled workforce. This includes experienced geologists, mining engineers, and skilled operators who ensure efficient and safe extraction processes. In 2023, Caledonia reported a strong safety record, a testament to the competence of its operational teams.

The company's management team is equally vital, providing strategic direction and overseeing project execution. Their expertise in navigating the complexities of the mining sector, including regulatory environments and market fluctuations, is a key resource. This leadership was instrumental in Caledonia's continued production growth throughout 2024.

Financial Capital

Access to sufficient financial capital is absolutely crucial for Caledonia Mining. This capital fuels everything from day-to-day operations to ambitious expansion plans. In 2024, the company’s ability to generate strong cash flow from its operations, particularly from the Blanket Mine, is a primary source of this vital financial resource.

Beyond operational cash flow, Caledonia Mining also leverages equity and debt financing to bolster its financial capital. This allows for significant investments in capital expenditures, such as upgrading equipment and exploring new mining areas. A healthy balance sheet, reflecting prudent financial management, underpins the company's capacity to secure this necessary funding.

The company's financial strength is evident in its performance metrics. For instance, Caledonia Mining reported significant revenue growth in early 2024, demonstrating its operational efficiency and the market's demand for its products. This financial performance directly translates into the capital available for reinvestment and growth initiatives.

- Operational Cash Flow: Generated from mining activities, providing the primary source of internal funding.

- Equity Financing: Raising capital through the issuance of shares to investors.

- Debt Financing: Utilizing loans or credit facilities to supplement capital needs.

- Capital Expenditures: Funds allocated for property, plant, and equipment upgrades and expansion projects.

Licenses, Permits, and Social License to Operate

Caledonia Mining's operations are underpinned by a crucial set of intangible resources: its licenses, permits, and social license to operate. These are not physical assets but are absolutely essential for the company's ability to mine legally and maintain its operational standing. The company holds various mining licenses and environmental permits, which are the legal gateways to its resource extraction activities. For instance, in 2024, Caledonia continued to focus on its Blanket Mine in Zimbabwe, where maintaining compliance with all regulatory requirements is paramount.

Beyond the legal framework, the social license to operate is equally vital. This refers to the ongoing acceptance and approval of its activities by local communities, stakeholders, and the broader public. Positive community relations are fostered through engagement, benefit-sharing initiatives, and responsible environmental stewardship. Caledonia's commitment to these aspects directly impacts its ability to operate smoothly and avoid disruptions. In 2023, the company reported continued positive engagement with local communities around its Blanket Mine, highlighting the importance of this intangible resource for sustained operations.

These intangible resources directly enable Caledonia Mining to conduct its business:

- Mining Licenses: Legal authorization to extract minerals, such as the 30-year mining lease for the Blanket Mine.

- Environmental Permits: Approvals for operational activities, ensuring compliance with environmental regulations and standards.

- Social License to Operate: Community acceptance and support, crucial for avoiding operational disruptions and maintaining a positive reputation.

- Regulatory Compliance: Adherence to all Zimbabwean mining and environmental laws, ensuring legal and ethical operations.

Intellectual property, including geological data, exploration expertise, and operational know-how, forms another critical intangible resource. This accumulated knowledge allows for efficient resource identification and extraction. Caledonia's ongoing exploration efforts, particularly at its newer projects, are building upon this intellectual capital.

The company's brand reputation and relationships with stakeholders, including suppliers, customers, and government bodies, are also key intangible assets. A strong reputation built on reliability and ethical practices facilitates smoother business operations and access to opportunities. Caledonia's consistent performance and transparent reporting contribute to this valuable asset.

| Key Resource Type | Description | 2024 Data/Relevance |

| Intellectual Property | Geological data, exploration expertise, operational know-how. | Ongoing exploration at Bilboes and Motapa projects builds on existing expertise. |

| Brand Reputation | Positive relationships with stakeholders, reliability, ethical practices. | Consistent production and transparent reporting in 2024 enhance brand value. |

| Geological Data | Detailed information on mineral deposits and their characteristics. | Crucial for mine planning and resource estimation, supporting future production targets. |

| Exploration Expertise | Skilled personnel and methodologies for identifying new mineral resources. | Enables the expansion of the company's resource base beyond current operations. |

Value Propositions

Caledonia Mining offers investors a steady stream of gold from its Blanket Mine, which in 2023 produced 147,077 ounces. This consistency is complemented by a robust growth strategy, targeting further expansion through significant projects such as Bilboes and Motapa, promising increased gold exposure for stakeholders.

Caledonia Mining offers investors direct access to the gold market, a commodity frequently sought during economic uncertainty due to its safe-haven status. This exposure allows investors to potentially benefit from rising gold prices. For instance, gold prices saw significant fluctuations throughout 2024, with analysts closely watching geopolitical events and inflation data as key drivers.

The company's core operation, Blanket Mine in Zimbabwe, is central to this value proposition. In 2024, Caledonia continued its focus on increasing production at Blanket, aiming to capitalize on the inherent value of the gold it extracts. This strategy directly appeals to those looking to gain from gold price appreciation.

Caledonia Mining champions responsible and sustainable mining, a core value proposition for ethically-minded investors. The company's commitment is underscored by its publicly available ESG reports, which transparently detail initiatives in environmental stewardship, community upliftment, and robust governance structures.

This dedication to sustainability resonates strongly with a growing segment of the investment community. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, highlighting the significant demand for companies like Caledonia that integrate environmental, social, and governance factors into their operations.

Operational Efficiency and Cost Management

Caledonia Mining Corporation actively pursues operational efficiency and rigorous cost management as core pillars of its business model. This focus is evident in their consistent efforts to lower on-mine costs per ounce and all-in sustaining costs (AISC), crucial metrics for profitability in the gold mining sector. For instance, in 2023, Caledonia reported an on-mine cost per ounce of $797 and an AISC of $1,097 per ounce, showcasing their dedication to cost control.

This commitment directly translates into enhanced profitability and aims to deliver superior shareholder returns. By meticulously managing expenses throughout the mining process, Caledonia seeks to maximize the value generated from each ounce of gold produced. Their strategic approach to operational optimization is designed to create a resilient and financially sound business.

- Focus on lowering on-mine cost per ounce and AISC.

- 2023 on-mine cost per ounce: $797.

- 2023 All-in Sustaining Costs (AISC): $1,097 per ounce.

- Directly contributes to increased profitability and shareholder value.

Long-Term Value Creation in Southern Africa

Caledonia's strategic vision centers on becoming a diversified gold producer within Zimbabwe, signaling a deep-seated commitment to long-term value creation in Southern Africa. This approach is underpinned by substantial capital expenditure aimed at extending the operational life of existing mines and actively pursuing new exploration prospects.

The company's focus on reinvesting profits into its Zimbabwean operations, such as the Blanket Mine, is a testament to its belief in the region's potential. For instance, Caledonia has been actively investing in projects designed to enhance production and reduce costs, with the goal of increasing shareholder returns over time.

- Strategic Focus: Caledonia aims to be a multi-asset gold producer in Zimbabwe, fostering long-term regional development.

- Capital Investment: Significant capital is allocated to extending mine life and exploring new gold deposits.

- Shareholder Value: The strategy is designed to deliver sustainable value creation for its investors.

- Operational Enhancements: Investments are directed towards improving production efficiency and cost management at its core assets.

Caledonia Mining offers investors a compelling blend of consistent gold production from its Blanket Mine, which produced 147,077 ounces in 2023, and significant growth potential through its expansion projects like Bilboes and Motapa. This dual approach provides both immediate returns and future upside, appealing to a broad range of investors seeking exposure to gold.

The company's commitment to operational efficiency, evidenced by its 2023 on-mine cost per ounce of $797 and AISC of $1,097 per ounce, directly translates into enhanced profitability. This focus on cost management is crucial for maximizing shareholder returns, especially in a volatile commodity market.

Furthermore, Caledonia's dedication to responsible and sustainable mining practices aligns with the growing demand for ESG-compliant investments. With the global sustainable investment market reaching an estimated $37.4 trillion in 2024, Caledonia's transparent ESG reporting offers a strong value proposition for ethically-minded investors.

Caledonia's strategic vision to become a diversified gold producer in Zimbabwe, backed by substantial capital investment in existing operations and new exploration, signals a long-term commitment to value creation. This focus on regional development and operational enhancements aims to deliver sustainable returns for stakeholders.

Customer Relationships

Caledonia Mining Corporation Plc prioritizes open and consistent dialogue with its investors. This is achieved through the timely release of detailed financial reports and presentations that clearly outline the company's operational performance and strategic direction.

In 2024, Caledonia continued its commitment to transparency by providing investors with comprehensive quarterly and annual results. These updates offer deep dives into production figures, cost management, and exploration progress, ensuring stakeholders are well-informed about the company's trajectory.

This proactive communication strategy, including investor calls and webcasts, builds significant trust and allows stakeholders to gain a thorough understanding of Caledonia's financial health and future prospects within the gold mining sector.

Caledonia Mining Corporation actively engages its shareholders through remote presentations and question-and-answer sessions held after each financial results announcement. This direct line of communication fosters transparency and allows investors to gain firsthand insights into the company's strategic direction and operational performance.

For instance, following its Q1 2024 results, Caledonia hosted a webinar where management addressed investor queries, reinforcing its commitment to open dialogue. This proactive approach is crucial for building investor confidence and ensuring alignment on the company's growth trajectory.

Caledonia fosters robust community ties through direct engagement and significant investments, such as its 2023 solar energy project at Blanket Mine, which significantly reduced reliance on grid power. This commitment extends to prioritizing local procurement, channeling approximately $15.6 million towards local suppliers in 2023, thereby stimulating regional economic growth and solidifying its social license to operate.

Regulatory Compliance and Government Liaison

Caledonia Mining Corporation PLC actively cultivates robust relationships with governmental and regulatory entities, a cornerstone of its operational strategy. By strictly adhering to all mining legislation, environmental standards, and securing requisite permits, the company demonstrates its commitment to responsible resource management. This proactive compliance fosters trust and ensures operational continuity.

This dedication to regulatory adherence is critical for maintaining Caledonia’s mining licenses and permits, thereby safeguarding its primary revenue-generating assets. For instance, in 2024, the company continued its focus on environmental stewardship, reporting on its ongoing efforts to manage water usage and waste disposal in line with Zimbabwean regulations.

- Regulatory Adherence: Caledonia Mining ensures full compliance with all Zimbabwean mining laws and environmental regulations, securing and maintaining necessary operating permits.

- Governmental Engagement: The company maintains proactive communication and a collaborative relationship with relevant government ministries and agencies to facilitate smooth operations.

- Operational Stability: This strong liaison helps prevent operational disruptions and ensures the long-term viability of its Blanket Mine operations.

Supplier and Partner Collaboration

Caledonia Mining actively cultivates strong partnerships with its suppliers and technical collaborators, emphasizing local procurement to bolster efficiency and reliability in its supply chain. This strategic approach is fundamental to maintaining operational continuity and advancing the company's sustainability objectives.

The company's commitment to local sourcing not only strengthens its operational backbone but also contributes to the economic development of the regions where it operates. For instance, in 2024, Caledonia continued its focus on building robust relationships with Zimbabwean suppliers, aiming to increase the percentage of local content in its procurement activities.

- Local Sourcing Focus: Caledonia prioritizes sourcing goods and services from local Zimbabwean businesses, fostering economic growth and ensuring supply chain resilience.

- Technical Partnerships: Collaboration with technical experts and equipment providers is crucial for maintaining high operational standards and driving innovation.

- Operational Continuity: Strong supplier relationships are key to preventing disruptions and ensuring the consistent flow of necessary materials and services to Caledonia's operations.

- Sustainability Integration: Partnering with suppliers who align with Caledonia's environmental and social governance (ESG) principles reinforces the company's commitment to responsible mining.

Caledonia Mining Corporation Plc maintains strong investor relations through transparent financial reporting and direct engagement, ensuring stakeholders are informed about operational performance and strategic growth. The company's commitment to clear communication, exemplified by its proactive investor calls and webinars, fosters trust and alignment with its financial objectives.

Channels

Caledonia Mining Corporation Plc's shares are traded on three distinct stock exchanges: the NYSE American under the ticker symbol CMCL, the AIM market of the London Stock Exchange also as CMCL, and the Victoria Falls Stock Exchange (VFEX) in Zimbabwe as VFEX:CMCL. These multiple listings enhance liquidity and provide investors with diverse avenues to participate in the company's growth, facilitating easier access for a global investor base. For instance, as of early 2024, the NYSE American offers significant trading volumes, while the AIM market provides access to European investors, and the VFEX connects with the growing Zimbabwean and regional African investment community.

Caledonia Mining Corporation Plc's official website and its dedicated investor relations portal are crucial communication channels. These platforms serve as the central repository for all essential investor information, including quarterly and annual financial reports, Environmental, Social, and Governance (ESG) disclosures, investor presentations, and timely news releases. This accessibility ensures stakeholders can readily obtain current data and insights into the company's performance and strategic direction.

For instance, as of the first quarter of 2024, Caledonia Mining reported a robust production of 35,875 ounces from its Blanket Mine in Zimbabwe. This operational data, along with detailed financial statements and operational updates, is consistently made available on their website, empowering investors with the necessary information for their decision-making processes.

Caledonia Mining Corporation PLC leverages financial news outlets and industry-specific publications to disseminate crucial information. This includes timely announcements of quarterly and annual results, operational updates, and significant strategic shifts, ensuring broad market awareness.

By engaging with platforms like Bloomberg, Reuters, and mining-focused journals, Caledonia effectively reaches a diverse audience. This strategic communication amplifies its visibility among potential investors, financial analysts, and industry stakeholders, fostering informed market perception.

For instance, Caledonia's 2024 interim results, released in August 2024, were widely covered, highlighting a 10% increase in gold production to 32,000 ounces for the first half of the year. This coverage is vital for attracting new investment and maintaining analyst coverage.

Investor Presentations and Webinars

Caledonia Mining Corporation actively engages investors and analysts through remote presentations and webinars. These sessions, typically held after significant financial updates, offer a direct channel for disseminating crucial information and answering queries. For instance, following their 2023 financial results, Caledonia hosted a webinar to elaborate on production figures and strategic outlook.

These interactive platforms are vital for transparent communication, allowing management to provide in-depth explanations of operational performance and future growth strategies. They facilitate a deeper understanding of the company's business model and its potential for value creation.

- Remote Presentations & Webinars: Caledonia conducts these for analysts and investors, particularly after financial announcements.

- Direct Engagement: These sessions allow for real-time Q&A and detailed discussion of results and strategic plans.

- Information Dissemination: They serve as a key channel for communicating operational performance and future outlook.

Brokerage Firms and Financial Advisors

Caledonia Mining Corporation Plc's (CMCL) shares are readily available to investors through a wide network of brokerage firms, both online and traditional. These firms act as crucial intermediaries, enabling individuals and institutions to buy and sell Caledonia's stock. In 2024, the accessibility through these channels remains a key component for retail and institutional participation.

Financial advisors play a significant role in guiding their clients towards potential investment opportunities like Caledonia Mining. They leverage their expertise to assess the company's fundamentals and market position, recommending CMCL to portfolios where it aligns with client objectives and risk tolerance. This advisory channel provides a layer of trusted guidance for many investors.

The presence of Caledonia Mining on major stock exchanges, such as the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE), further solidifies these channels. For instance, as of early 2024, CMCL's listing on the NYSE provides a broad base for U.S. investors to access the stock through their preferred brokerage services.

- Brokerage Firm Accessibility: Caledonia Mining shares are traded on exchanges like the NYSE and LSE, making them accessible through virtually any registered brokerage account.

- Financial Advisor Recommendations: Many financial advisors incorporate mining sector investments into diversified portfolios, often including companies like Caledonia based on their operational performance and growth prospects.

- Investment Facilitation: These channels streamline the investment process, allowing for efficient execution of buy and sell orders for CMCL stock, crucial for capturing market opportunities.

Caledonia Mining's communication strategy relies on multiple channels to reach its diverse investor base. These include its official website, investor relations portal, financial news outlets, and direct engagement through webinars.

The company's shares are listed on the NYSE American, AIM market of the London Stock Exchange, and the Victoria Falls Stock Exchange, ensuring broad accessibility for global investors. As of early 2024, the NYSE American demonstrated significant trading volumes, while the AIM market provided access to European investors.

Financial news outlets like Bloomberg and Reuters, along with mining-specific publications, are utilized to disseminate crucial information such as quarterly results and operational updates. For instance, Caledonia's 2024 interim results, released in August 2024, highlighted a 10% increase in gold production to 32,000 ounces for the first half of the year, which was widely covered.

Direct engagement through remote presentations and webinars allows management to provide in-depth explanations of operational performance and future growth strategies, fostering transparency and deeper understanding among stakeholders.

Customer Segments

Individual investors, whether just starting out or seasoned in the market, are drawn to Caledonia Mining for its potential for growth and its position within the gold sector. They closely monitor financial performance metrics and dividend distributions, aiming for long-term value appreciation.

For instance, in 2024, Caledonia Mining continued to focus on operational efficiency and resource expansion, aiming to deliver consistent returns to its shareholders. Investors are keenly observing the company's ability to maintain its production levels and manage costs effectively, which directly impacts its financial health and dividend capacity.

Financial professionals, including analysts, advisors, and portfolio managers, are key customers for Caledonia Mining. They seek in-depth financial data, including historical performance and future projections, to assess investment viability. For instance, understanding Caledonia's gold production figures, such as the 14,664 ounces produced in Q1 2024, is crucial for their valuation models.

These professionals rely on Caledonia's strategic frameworks and market analysis to inform their recommendations. They are particularly interested in detailed reports and presentations that outline the company's operational efficiency, cost management, and exploration strategies. Access to Caledonia's latest financial statements and analyst briefings is vital for their decision-making processes.

Business strategists, including entrepreneurs, consultants, and executives, are keen on dissecting Caledonia Mining's operational efficiency and growth trajectory. They utilize frameworks like the Business Model Canvas to understand how Caledonia leverages its assets, such as the Blanket Mine in Zimbabwe, to create value. For instance, Caledonia's focus on improving its gold recovery rates, which saw an increase in production in 2023, directly impacts its strategic positioning.

These professionals are also interested in Caledonia's expansion plans and how they align with broader market trends, often analyzed through PESTLE assessments. Understanding Caledonia's approach to navigating the Zimbabwean regulatory environment and its capital allocation strategies is crucial for their strategic decision-making. The company's commitment to increasing its dividend payouts, as seen in recent financial reports, signals a mature phase of its business model, appealing to strategists focused on shareholder returns.

Academic Stakeholders (Students, Researchers)

Academic stakeholders, including students and researchers, are crucial for Caledonia Mining. They utilize the company's financial data, sustainability reports, and strategic insights for in-depth analysis and case studies within the mining and business strategy domains. For instance, in 2024, Caledonia Mining continued to emphasize its ESG (Environmental, Social, and Governance) commitments, a key area of interest for academic research into responsible mining practices.

Caledonia Mining's performance data, such as its production figures and financial results, serves as valuable material for academic projects. In the first quarter of 2024, the company reported record gold production from Blanket Mine, a significant data point for students analyzing operational efficiency and growth strategies. This operational success directly fuels academic understanding of effective resource management in challenging environments.

Furthermore, Caledonia Mining's strategic decisions, including its expansion plans and community engagement initiatives, provide rich content for academic discourse. Researchers often examine how companies like Caledonia navigate complex regulatory landscapes and foster positive stakeholder relationships. The company's ongoing exploration efforts and potential new projects offer compelling case study material for understanding long-term value creation in the mining sector.

The accessibility of Caledonia Mining's disclosures supports academic endeavors by providing transparent information. This includes:

- Financial Reports: Detailed annual and quarterly financial statements for valuation and performance analysis.

- Sustainability Reports: Data on environmental impact, social responsibility, and governance practices.

- Operational Updates: Production figures, exploration results, and operational challenges.

- Strategic Communications: Investor presentations and management commentary on future plans.

Institutional Investors and Funds

Institutional investors and funds, such as pension funds and asset managers, represent a crucial customer segment for Caledonia Mining. These entities typically deploy substantial capital, seeking stable, long-term returns, often with a keen eye on dividend payouts and robust Environmental, Social, and Governance (ESG) performance. For instance, Caledonia Mining's focus on increasing its dividend payouts, as demonstrated by its consistent dividend policy, directly appeals to this segment's income-generating objectives.

Their investment decisions are driven by thorough due diligence, demanding detailed financial reports, comprehensive risk assessments, and transparency regarding sustainability initiatives. In 2024, Caledonia Mining continued to emphasize its operational efficiency and its commitment to responsible mining practices, which are key factors for these sophisticated investors. The company's ability to articulate its strategy for growth and its approach to managing operational and regulatory risks is paramount for attracting and retaining this capital.

- Capital Deployment: Large-scale investment from entities like pension funds and mutual funds.

- Investment Horizon: Focus on long-term growth, capital preservation, and dividend income.

- Key Information Needs: Detailed financial statements, risk management frameworks, and ESG reporting.

- Performance Drivers: Operational efficiency, resource expansion, and sustainable mining practices.

Caledonia Mining's customer segments are diverse, encompassing individual investors seeking growth, financial professionals requiring detailed data for valuation, and business strategists analyzing operational efficiency. Academic stakeholders utilize the company's disclosures for research, while institutional investors focus on long-term returns and ESG performance.

In 2024, Caledonia Mining's operational successes, such as the record gold production of 14,664 ounces in Q1 2024 from Blanket Mine, directly inform these diverse customer needs. The company's commitment to increasing dividends and its ESG initiatives further solidify its appeal across these segments.

| Customer Segment | Key Interests | 2024 Relevance |

|---|---|---|

| Individual Investors | Growth potential, dividends, financial performance | Monitoring operational efficiency and cost management for consistent returns. |

| Financial Professionals | In-depth financial data, valuation, risk assessment | Utilizing production figures (e.g., Q1 2024: 14,664 oz) for valuation models. |

| Business Strategists | Operational efficiency, growth trajectory, strategic frameworks | Analyzing expansion plans and navigating regulatory environments. |

| Academic Stakeholders | Financial data, ESG practices, case studies | Examining ESG commitments and operational efficiency improvements. |

| Institutional Investors | Long-term returns, ESG performance, capital deployment | Focusing on dividend policy and responsible mining practices. |

Cost Structure

Mining and production costs are the bedrock of Caledonia Mining's operational expenses, directly tied to the physical extraction and processing of gold. These include crucial elements like the wages for the workforce, the electricity needed to power the operations, essential consumables such as explosives and chemicals, and all on-mine costs calculated per ounce of gold produced. These expenditures are substantial and can shift due to how efficiently the mine is run and the changing prices of necessary inputs.

For Caledonia Mining, these costs are particularly impactful. In 2024, the company reported a significant decrease in its all-in-sustaining-costs (AISC) per ounce, a key metric for profitability. For instance, the AISC at Blanket Mine in Zimbabwe averaged $1,052 per ounce for the first half of 2024, a notable improvement from previous periods, demonstrating effective cost management despite the inherent volatility of input prices and operational demands.

Exploration and development costs are fundamental to Caledonia Mining's long-term strategy, encompassing the significant investments made in identifying and preparing new mineral resources. These expenditures are critical for future growth, as seen in the company's efforts at projects like Bilboes and Motapa.

In 2024, Caledonia Mining continued to allocate substantial capital towards these crucial areas. For instance, the development of the Motapa project, a key growth driver, involved considerable expenditure on infrastructure and resource definition, reflecting the upfront investment required to unlock future potential.

Caledonia Mining's capital expenditure is a cornerstone of its growth strategy, focusing on significant investments to modernize operations and expand its mining footprint. This includes upgrading existing facilities and developing new projects to boost efficiency and extend the lifespan of its mines.

For 2025, a notable portion of the capital budget is earmarked for the Blanket Mine, aiming to enhance its operational capabilities and prolong its productive life. These investments are crucial for maintaining a competitive edge and ensuring sustainable long-term production.

Administrative and Overhead Costs

Administrative and overhead costs encompass the essential, albeit indirect, expenses required to maintain Caledonia Mining's overall corporate infrastructure. These include vital functions such as general corporate administration, human resources management, and the upkeep of information technology systems. In 2024, these costs are a critical component of ensuring the company's smooth and compliant operation, even though they don't directly contribute to gold extraction.

These overheads are fundamental to the business's ability to function effectively and manage its operations. They represent the foundational support structure that enables production activities to take place. For Caledonia Mining, these costs are managed to ensure efficiency and support strategic objectives.

- General Corporate Expenses: Covering legal, accounting, and compliance activities.

- Human Resources: Costs associated with employee recruitment, training, and benefits.

- IT Expenses: Investment in and maintenance of technology infrastructure.

- Other Overheads: Including office rent, utilities, and insurance.

Environmental, Social, and Governance (ESG) Related Costs

Caledonia Mining incurs costs for environmental protection, such as water management and tailings dam maintenance. These efforts are crucial for maintaining their social license to operate and ensuring long-term sustainability.

Community development programs, including local employment initiatives and infrastructure support, represent another significant cost. In 2024, Caledonia continued its focus on these areas, recognizing their importance for stakeholder relations and operational stability.

Safety initiatives, encompassing training and equipment, are paramount. The company also bears costs related to comprehensive sustainability reporting, which is increasingly vital for investor confidence and regulatory compliance.

- Environmental Protection: Costs for water treatment, emissions control, and responsible tailings management.

- Community Engagement: Investment in local education, healthcare, and infrastructure projects.

- Safety Programs: Expenses for safety training, personal protective equipment, and robust safety protocols.

- Sustainability Reporting: Costs associated with data collection, analysis, and disclosure for ESG performance.

Caledonia Mining's cost structure is dominated by its mining and production expenses, which directly reflect the physical act of extracting and processing gold. These costs are heavily influenced by operational efficiency and input prices, with all-in-sustaining-costs (AISC) serving as a key profitability metric. For the first half of 2024, the AISC at Blanket Mine averaged $1,052 per ounce, showcasing effective cost management.

Exploration and development expenditures are also significant, representing investments in future growth like the Motapa project. Capital expenditure, particularly for Blanket Mine's modernization in 2025, underpins operational enhancement and longevity. Administrative and overhead costs, though indirect, are crucial for corporate functions, including IT and HR, ensuring smooth operations.

Furthermore, Caledonia incurs costs for environmental protection, community development, and safety initiatives, which are vital for its social license and sustainability. These include expenses for water management, local employment, and safety training, alongside costs for sustainability reporting.

| Cost Category | Key Components | 2024 Data/Focus |

| Mining & Production Costs | Wages, electricity, consumables, on-mine costs | H1 2024 AISC at Blanket Mine: $1,052/oz |

| Exploration & Development | New mineral resource identification and preparation | Continued investment in projects like Motapa |

| Capital Expenditure | Operational upgrades, new project development | Focus on Blanket Mine modernization for 2025 |

| Administrative & Overhead | General admin, HR, IT, legal, accounting | Ensuring smooth and compliant operations |

| Sustainability & Community | Environmental protection, community programs, safety | Water management, local employment, safety training |

Revenue Streams

Caledonia Mining Corporation's principal revenue generation comes from the sale of gold extracted at its Blanket Mine, located in Zimbabwe. This income is fundamentally tied to two key factors: the quantity of gold produced and the global market price per ounce.

In 2023, Caledonia Mining reported record gold production of 77,342 ounces from the Blanket Mine. This strong performance directly translated into robust revenue, with the company generating approximately $145 million in revenue from gold sales during that year, based on an average gold price of around $1,875 per ounce.

Future gold sales from Caledonia Mining's new projects, specifically Bilboes and Motapa, are poised to become a substantial revenue stream. These developments are strategically designed to significantly boost the company's overall gold production capacity.

The anticipated increase in output from Bilboes, for instance, is a key driver. By 2024, Caledonia Mining expects to have completed the initial phase of Bilboes, with production ramping up. This project alone has the potential to add considerable tonnage to their annual gold output, directly impacting future revenue projections.

Motapa also represents a significant future contributor. While still in the development phase, successful exploration and subsequent production at Motapa will further diversify and expand Caledonia's gold-generating assets, creating a more robust and resilient revenue base for years to come.

While Caledonia Mining Corporation primarily focuses on gold production at its Blanket Mine, the potential for by-product revenue exists. If the geological composition of the ore body yields other commercially valuable minerals, such as silver or base metals, their extraction and sale could supplement the company's income.

For instance, in 2023, Caledonia Mining reported that while gold is the main focus, they continuously monitor the ore for any economically viable secondary minerals. Although specific by-product revenue figures were not a significant disclosed component in their 2023 financial reports, the company’s exploration activities are designed to maximize resource recovery, which inherently includes assessing the potential of all minerals present.

Proceeds from Asset Sales (e.g., Solar Plant)

Caledonia Mining can generate occasional revenue through the sale of non-core assets. A prime example is the disposal of its solar plant in April 2025. This strategic move not only unlocked capital but also provided significant financial flexibility, enabling the company to pursue future growth opportunities and strengthen its balance sheet.

- Asset Sales: Proceeds from selling non-essential assets, like the solar plant in April 2025, offer a one-time cash injection.

- Financial Flexibility: Such sales enhance the company's ability to fund new projects or manage existing debt.

- Strategic Realignment: Divesting non-core assets allows management to focus resources on primary revenue-generating operations.

Potential Future Royalties or Joint Venture Income

Caledonia Mining could diversify its income by establishing joint ventures or royalty agreements on its exploration and development properties. This strategy offers a way to leverage its assets without bearing the full financial burden of development.

The recent acquisition of Bilboes is a prime example, incorporating a net smelter royalty. This suggests a precedent for structuring deals that generate ongoing revenue from its mining interests.

- Potential Joint Venture Income: Caledonia could partner with other mining companies on specific exploration projects, sharing costs and potential profits.

- Royalty Agreements: By granting rights to mine on its properties in exchange for a percentage of revenue or profits, Caledonia can secure passive income.

- Bilboes Acquisition Royalty: The net smelter royalty included in the Bilboes deal demonstrates a tangible example of this revenue stream in practice.

Caledonia Mining's primary revenue stems from gold sales, significantly boosted by record production of 77,342 ounces in 2023, generating approximately $145 million. Expansion projects like Bilboes and Motapa are set to dramatically increase future gold output and, consequently, revenue.

The initial phase of Bilboes is expected to be completed by 2024, significantly adding to annual gold production and revenue. Motapa, while in earlier development, represents another key future revenue driver through expanded gold-generating assets.

Occasional revenue can be generated through the sale of non-core assets, such as the solar plant divested in April 2025, which provided a capital injection and financial flexibility.

Diversification of income is also possible through joint ventures or royalty agreements on exploration properties, exemplified by the net smelter royalty incorporated into the Bilboes acquisition.

| Revenue Stream | Primary Source | 2023 Data/Notes | Future Potential |

| Gold Sales | Blanket Mine | 77,342 oz production, ~$145M revenue | Increased by Bilboes & Motapa |

| Asset Sales | Non-core assets | Solar plant sale (April 2025) | One-time capital injection |

| Joint Ventures/Royalties | Exploration properties | Net smelter royalty on Bilboes | Passive income from shared development |

Business Model Canvas Data Sources

The Caledonia Mining Business Model Canvas is informed by a blend of financial disclosures, operational reports, and market intelligence. These sources provide a robust foundation for understanding revenue streams, cost structures, and key activities.