Caledonia Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

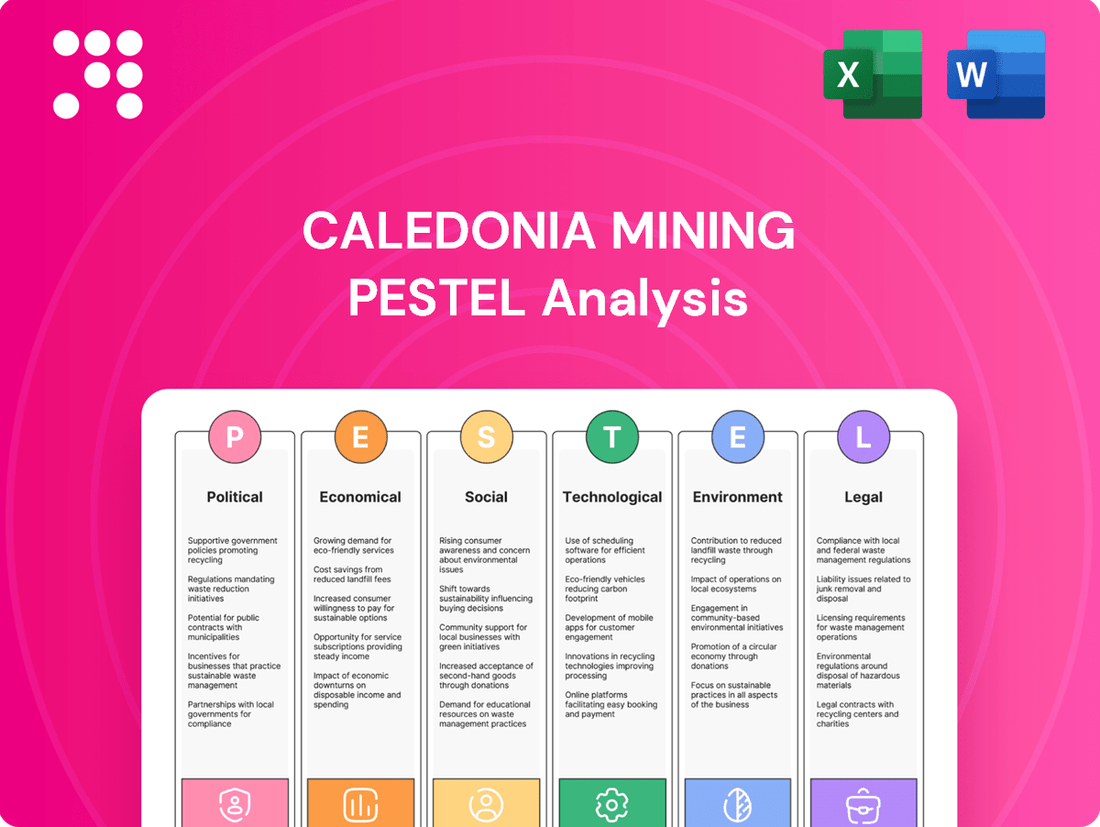

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Caledonia Mining's trajectory. Our PESTLE analysis provides a comprehensive understanding of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Download the full report now to gain actionable intelligence and refine your strategic approach.

Political factors

Caledonia Mining's operations in Zimbabwe are heavily influenced by government stability and policy consistency. The country's political landscape directly impacts investor confidence and the predictability of the operating environment. For instance, the gazetting of the Mines and Minerals Bill 2025 signifies an effort to update mining legislation, aiming for greater transparency and modernization.

The success of these legislative changes hinges on their consistent implementation and enforcement. Investors closely watch how these new regulations are applied to gauge the government's commitment to a stable mining sector. This consistency is vital for Caledonia Mining to plan its long-term capital investments and operational strategies effectively.

The new Mines and Minerals Bill, gazetted in June 2025, introduces significant reforms. These include stricter 'use it or lose it' principles for mining titles and requirements for social responsibility certificates for large-scale miners. This legislation aims to tackle speculative claim hoarding and boost environmental and community engagement.

Compliance with these evolving regulations is crucial for Caledonia Mining's ongoing operations and future expansion strategies. The bill's focus on active resource utilization and community benefit could impact operational efficiency and the cost of doing business.

Zimbabwe is actively pursuing foreign direct investment to bolster its mining sector, with a clear objective to establish it as a cornerstone of economic growth. The government's stance is to attract capital and expertise to unlock the nation's mineral wealth.

A new Bill permits 100% foreign ownership in mining ventures. However, it also includes clauses for strategic minerals that might necessitate state joint ventures, a detail Caledonia Mining will need to monitor closely.

Caledonia Mining has a proven track record of adhering to indigenization requirements, which has fostered strong community relationships and ensured local economic participation, a strategy that aligns well with the evolving regulatory landscape.

Fiscal Policy and Royalties

The Zimbabwean government's fiscal policies, particularly its approach to taxes and royalties, have a direct bearing on Caledonia Mining's profitability. For instance, the 2025 National Budget introduced measures such as increased taxes and penalties, which could lead to higher operational costs for mining companies like Caledonia.

These fiscal adjustments are part of a broader strategy by the government to influence the mining sector. The stated aims include boosting gold deliveries and enhancing transparency within the industry. Furthermore, there's a discernible focus on supporting small-scale miners, signaling an evolving fiscal landscape that mining entities must navigate.

- Taxation Impact: Increased taxes and penalties in the 2025 National Budget directly affect Caledonia's cost structure.

- Revenue Focus: Government policy aims to increase gold deliveries, potentially influencing Caledonia's output targets.

- Transparency Measures: Enhanced transparency requirements could necessitate new compliance procedures for Caledonia.

- Sector Support: Government support for small-scale miners may alter the competitive dynamics within the gold mining industry.

Geopolitical Tensions and Global Relations

Global geopolitical tensions, particularly in regions impacting supply chains or investor sentiment, can significantly influence gold prices. For Caledonia Mining, operating in Zimbabwe, these tensions can create volatility in the price of gold, their primary revenue driver. When global economic uncertainty rises, gold often acts as a safe-haven asset, potentially increasing demand and prices, which would be beneficial for Caledonia's earnings. For instance, during periods of heightened international conflict in 2024, gold prices saw notable upward movements.

Zimbabwe's international relations are also a critical factor. Stronger diplomatic ties and a more stable geopolitical standing can attract foreign investment, which is crucial for capital-intensive mining operations like Caledonia's. Conversely, strained international relations could limit access to global markets, hinder the repatriation of profits, or even lead to sanctions, impacting the company's financial health and expansion plans. As of mid-2025, Zimbabwe continues to navigate its relationships with key global economic partners, influencing the overall investment climate.

- Geopolitical Instability: Heightened global tensions in 2024 saw gold prices reach record highs, demonstrating its safe-haven appeal.

- Foreign Investment Climate: Zimbabwe's efforts to improve its international standing in 2024-2025 aim to attract crucial foreign direct investment into sectors like mining.

- Market Access: Stable international relations are vital for Caledonia Mining to ensure smooth export of its gold and access to international financing.

Political stability in Zimbabwe is paramount for Caledonia Mining's operations and investment decisions. The government's commitment to consistent policy implementation, as seen with the Mines and Minerals Bill 2025, directly shapes the operating environment and investor confidence. The bill's focus on active resource utilization and social responsibility certificates, gazetted in June 2025, signals a move towards modernization and increased accountability.

Zimbabwe's drive to attract foreign investment, permitting 100% foreign ownership in most mining ventures, presents opportunities. However, clauses for strategic minerals requiring state joint ventures, as detailed in the 2025 legislation, necessitate careful monitoring by Caledonia Mining. The company's established practice of adhering to indigenization requirements positions it favorably within this evolving regulatory framework.

Fiscal policies, including tax and royalty adjustments outlined in the 2025 National Budget, directly impact Caledonia Mining's profitability. Measures like increased taxes and penalties are part of a strategy to boost gold deliveries and enhance industry transparency. The government's support for small-scale miners also indicates a shifting fiscal landscape that mining entities must navigate.

Global geopolitical events in 2024, such as international conflicts, positively influenced gold prices due to its safe-haven status, benefiting Caledonia Mining. Zimbabwe's international relations are equally critical, impacting foreign investment and market access. As of mid-2025, the country's diplomatic efforts aim to foster a more favorable investment climate for sectors like mining.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Caledonia Mining, detailing their impact across political, economic, social, technological, environmental, and legal dimensions.

It offers forward-looking insights and actionable strategies to navigate industry challenges and capitalize on emerging opportunities.

The Caledonia Mining PESTLE analysis offers a pain point reliever by providing a clean, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring all stakeholders grasp key external factors impacting the company.

Economic factors

Caledonia Mining's financial health is directly tied to the global price of gold. The company saw a significant boost in revenue and profit during the first quarter of 2025, largely due to a strong and consistent gold price. This trend is anticipated to continue, with favorable gold prices expected to push profitability well beyond current market forecasts for the year 2025.

Rising operational costs, including labor, power, and consumables, have directly impacted Caledonia Mining's Blanket Mine, pushing the on-mine cost per ounce higher in Q1 2025. This inflationary environment in Zimbabwe, coupled with unreliable power and foreign exchange challenges, presents significant headwinds for the mining sector.

Caledonia is actively implementing cost control measures to navigate these economic pressures, aiming to mitigate the impact of increased expenses on profitability.

Caledonia Mining's expansion plans are underpinned by a robust capital investment budget of $41.0 million for 2025, primarily directed towards the Blanket Mine and promising new ventures such as Bilboes and Motapa.

The company intends to finance these significant capital outlays through its existing cash flow and reserves, bolstered by the anticipated sale of its solar plant in April 2025, which is expected to enhance its net cash position.

This strategic financial management provides Caledonia with the necessary flexibility to pursue its ambitious goal of evolving into a diversified, multi-asset gold producer.

Foreign Exchange Availability and Controls

Foreign exchange availability in Zimbabwe presents a significant hurdle for Caledonia Mining. The company requires access to foreign currency, primarily US dollars, to import essential mining equipment and spare parts. Shortages can lead to operational delays and increased costs. For instance, in early 2024, reports indicated persistent forex scarcity, impacting various sectors including mining, as businesses struggled to secure sufficient foreign currency for imports.

Repatriating profits is another key concern tied to foreign exchange. While the Zimbabwean government has expressed a desire to boost mineral revenue, the practical ability for companies like Caledonia Mining to convert local currency earnings into foreign currency for distribution to shareholders or reinvestment abroad remains a critical determinant of investor confidence. The efficiency and predictability of these processes directly influence the company's financial health and its attractiveness to international capital.

The export proceeds surrender requirement, where a portion of export earnings must be surrendered to the central bank, can also affect Caledonia Mining's profitability. While the exact percentage can fluctuate, a high surrender requirement directly reduces the amount of foreign currency the company retains, impacting its ability to manage its own foreign currency needs and potentially its overall financial returns. As of late 2023 and early 2024, discussions around optimizing these surrender thresholds were ongoing, aiming to balance government revenue with the operational needs of exporters.

- Foreign Currency Scarcity: Zimbabwe's ongoing foreign exchange shortages in 2024 directly impact Caledonia Mining's ability to import critical mining equipment and spare parts, potentially causing operational disruptions.

- Profit Repatriation Challenges: The ease and efficiency with which Caledonia Mining can convert earnings into foreign currency for shareholder returns or international reinvestment is a key factor for investor confidence, directly linked to forex availability.

- Export Proceeds Surrender Impact: The requirement for mining companies to surrender a portion of their export earnings to the central bank can reduce retained foreign currency and affect Caledonia Mining's profitability, with ongoing policy discussions around these percentages.

Zimbabwe's Economic Growth Outlook

Zimbabwe's economic trajectory in 2025 appears robust, with the mining sector anticipated to expand by around 7%. This growth is primarily fueled by strong performance in gold and coal production, supported by significant ongoing expansion initiatives and fresh capital injections into the industry.

The broader Zimbabwean economy is also set for a positive year, with GDP growth projected at 6% for 2025. This uplift is directly linked to the substantial investments flowing into the mining sector, alongside a more predictable and stable macroeconomic landscape.

- Mining Sector Growth: Projected at approximately 7% in 2025.

- Key Drivers: Gold and coal production are leading the expansion.

- Underpinning Factors: Ongoing expansion projects and new investments.

- Overall GDP Forecast: Expected to reach 6% growth in 2025.

The economic outlook for Zimbabwe in 2025 is positive, with an anticipated 7% growth in the mining sector, driven by strong gold and coal performance. This expansion is supported by significant capital investments and ongoing development projects within the industry. Overall GDP growth for Zimbabwe is projected at a healthy 6% for 2025, reflecting the positive impact of these mining sector developments and a more stable economic environment.

| Economic Factor | 2025 Projection | Impact on Caledonia Mining |

| Mining Sector Growth | ~7% | Positive, indicating increased demand and potential for expansion. |

| Overall GDP Growth | ~6% | Suggests a stable and supportive macroeconomic environment for operations. |

| Gold Price | Favorable (Q1 2025 trend) | Directly boosts revenue and profitability. |

| Inflation/Operational Costs | Rising (e.g., labor, power) | Increases on-mine costs, necessitating cost control measures. |

| Foreign Exchange Availability | Challenging | Hinders imports of equipment/spares and profit repatriation. |

Preview the Actual Deliverable

Caledonia Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Caledonia Mining delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Understand the critical external forces shaping Caledonia Mining's future, from government regulations and economic stability in Zimbabwe to social community relations and technological advancements in mining. This comprehensive analysis provides actionable insights for stakeholders.

Sociological factors

Strong community relationships are crucial for Caledonia Mining's operational stability and its social license to operate. In 2024, the company demonstrated this commitment by investing $1.3 million in community development initiatives.

These investments primarily targeted essential infrastructure, including school upgrades and the construction of health shelters, directly benefiting local populations.

Proactive and positive community engagement is a key strategy for Caledonia Mining, helping to mitigate operational risks and foster a foundation for long-term sustainability and mutual benefit.

Caledonia Mining's commitment to employing 100% Zimbabwean nationals at its Blanket Mine significantly impacts local employment. This strategy directly addresses the scarcity of meaningful job opportunities in the region.

The company actively invests in upskilling its workforce, providing career progression pathways. This not only builds a more skilled labor pool but also strengthens community relations by offering tangible development prospects.

By prioritizing local hiring and knowledge transfer, Caledonia ensures that specialized skills remain within Zimbabwe. This focus is crucial for sustainable economic development and self-sufficiency in the mining sector.

Caledonia Mining prioritizes the well-being of its workforce, a crucial social consideration, particularly as operations at the Blanket Mine extend to greater depths. The company is allocating substantial capital for safety and ventilation upgrades in 2025, aiming to mitigate risks associated with increasing underground temperatures and improve overall worker conditions.

A comprehensive safety, health, environment, and community management system is scheduled for implementation in July 2025, underscoring Caledonia's commitment to a holistic approach to social responsibility and operational integrity.

Corporate Social Responsibility (CSR) Initiatives

Caledonia Mining's dedication to Corporate Social Responsibility is evident in its 2024 ESG report, which details alignment with Global Reporting Initiative standards and an ongoing IFRS Sustainability Standards readiness assessment. This commitment underscores a strategic approach to integrating sustainability into its core operations, aiming for transparency and accountability in its environmental, social, and governance performance.

The company's CSR efforts actively contribute to societal development beyond its direct mining activities. For instance, Caledonia prioritizes supporting local businesses through its procurement processes, thereby fostering economic growth within the communities where it operates. Furthermore, its provision of access to water for local communities, particularly during drought periods, highlights a direct and impactful response to critical social needs.

- ESG Reporting: Caledonia's 2024 report signifies a strong focus on ESG, aligning with GRI standards and preparing for IFRS Sustainability Standards.

- Local Economic Support: The company actively supports local businesses through its procurement policies, contributing to regional economic vitality.

- Community Water Access: Caledonia provides essential water resources to communities, especially during times of drought, addressing a fundamental social requirement.

Impact on Local Livelihoods and Land Use

Mining activities can significantly alter local livelihoods, especially impacting farmers and those occupying communal land. Caledonia Mining's operations are situated in areas where these dynamics are crucial to manage. The company's commitment to community engagement is therefore vital for sustainable operations and social license to operate.

New legislation, like the proposed Mines and Minerals Bill 2025, is set to reshape land use and compensation. This bill intends to prevent mining within 450 meters of residential areas or cultivated plots, aiming to mitigate direct impacts on local agriculture and housing. It also mandates compensation for landholders negatively affected by mining, a key aspect for ensuring fairness.

Caledonia Mining actively implements community projects designed to address local needs and foster positive impacts. These initiatives are part of the company's strategy to build strong relationships and contribute to the well-being of the communities where it operates, aligning with the evolving regulatory landscape and social expectations.

- Land Use Restrictions: The Mines and Minerals Bill 2025 proposes a 450-meter buffer zone around homes and cultivated land, directly affecting mining proximity.

- Compensation Framework: The bill aims to establish clear compensation mechanisms for landholders impacted by mining operations.

- Community Investment: Caledonia Mining's community projects focus on supporting local livelihoods and addressing specific needs identified within the operating areas.

- Social License: Effective management of these sociological factors is critical for Caledonia Mining to maintain its social license to operate and ensure long-term viability.

Caledonia Mining's deep integration with local communities is a cornerstone of its operational strategy, especially with the Blanket Mine. The company's commitment to employing 100% Zimbabwean nationals, as of 2024, directly addresses local employment needs and fosters skill development within the region. Furthermore, significant investments in community development, totaling $1.3 million in 2024, underscore a dedication to enhancing local infrastructure and well-being.

The company's proactive approach to social responsibility includes a comprehensive safety, health, environment, and community management system slated for implementation in July 2025. This system aims to enhance worker well-being, particularly as operations delve deeper, and to solidify positive community relations. Caledonia's ESG reporting, aligned with GRI standards and preparing for IFRS Sustainability Standards, demonstrates a transparent commitment to societal impact.

Anticipated legislation, such as the proposed Mines and Minerals Bill 2025, will introduce buffer zones and compensation frameworks, directly influencing land use and community relations. Caledonia's ongoing community projects, focused on local needs and economic support, position the company to navigate these evolving sociological and regulatory landscapes effectively, ensuring its social license to operate remains robust.

| Sociological Factor | Caledonia Mining's Response/Data (2024-2025) | Impact/Significance |

|---|---|---|

| Local Employment | 100% Zimbabwean nationals employed at Blanket Mine (2024) | Addresses regional unemployment, builds local expertise |

| Community Investment | $1.3 million invested in community development initiatives (2024) | Improves infrastructure (schools, health shelters), enhances local well-being |

| Workforce Development | Active investment in upskilling and career progression | Creates skilled labor, strengthens community ties |

| Safety & Well-being | Capital allocation for safety/ventilation upgrades (2025) | Mitigates operational risks, improves worker conditions |

| ESG & Reporting | Alignment with GRI standards, readiness for IFRS Sustainability Standards | Ensures transparency, accountability, and sustainable practices |

| Local Economic Support | Prioritizes local businesses in procurement | Fosters regional economic growth |

| Legislative Impact | Anticipated Mines and Minerals Bill 2025 (buffer zones, compensation) | Requires adaptation in land use and community compensation strategies |

Technological factors

Technological advancements are paramount for boosting efficiency and minimizing the environmental footprint in gold mining. Caledonia Mining is actively modernizing its Blanket Mine operations, incorporating IT upgrades to streamline processes and enhance overall productivity.

The mining sector is increasingly embracing automation, with technologies like remotely operated vehicles and robotic drilling becoming more common. This shift not only reduces the need for human presence in hazardous underground conditions but also significantly improves operational precision, as seen in the industry's drive towards safer and more controlled extraction methods.

Technological advancements are significantly reshaping how gold deposits are identified and assessed. Techniques like AI-driven exploration, sophisticated satellite imaging, and detailed geological mapping are proving invaluable. These tools allow for more precise detection and evaluation of potential gold resources, which is crucial for long-term operational success.

Caledonia Mining is leveraging these technologies in its exploration efforts. The company is actively engaged in exploration at its Blanket and Motapa sites. Initial programs have yielded promising results, and further work is planned for 2025. The goal is to extend the mine's life and broaden its production capabilities, directly benefiting from these technological integrations.

Energy costs and the unreliability of power supplies present persistent hurdles for mining ventures in Zimbabwe. Caledonia Mining has proactively addressed this by integrating solar energy into its operations, currently sourcing 20% of its power from this renewable source. The company finalized the sale of its solar plant in April 2025, highlighting a strategic shift in its energy management approach.

Sustained investment in energy-saving measures and the exploration of alternative energy solutions remain critical for Caledonia's operational stability and its ability to manage costs effectively. This focus on energy resilience is paramount in navigating the power challenges inherent in the Zimbabwean mining landscape.

Data Management and Digital Transformation

Caledonia Mining is actively enhancing its data management capabilities, with a new integrated system for safety, health, environment, and community management scheduled for launch in July 2025. This move reflects a broader trend in the mining industry toward digital transformation.

The mining sector's digital evolution is characterized by the adoption of cutting-edge technologies. For instance, satellite imagery is increasingly used for exploration and monitoring, while advanced analytics are being deployed to optimize operational efficiency and predict equipment failures. Connected devices, often referred to as the Internet of Things (IoT) in mining, enable real-time data collection from various points across operations, leading to better resource allocation and improved safety protocols.

- Integrated Management System: Caledonia's new system, live July 2025, aims to streamline safety, health, environment, and community data.

- Industry Digitalization: The mining sector is embracing digital transformation, with significant investment in new technologies.

- Real-time Monitoring: Technologies like satellite systems and IoT devices are crucial for continuous operational oversight.

- Data-Driven Decisions: Advanced analytics are becoming central to improving resource management and operational outcomes in mining.

Tailings Management Technology

Caledonia Mining is prioritizing safety and sustainability in its tailings management, aligning with the Global Industry Standard for Tailings Management (GISTM). This commitment is crucial for responsible mining operations.

The company is making significant strides in water conservation, having successfully recycled 25% of its water from its new tailings storage facility. This is particularly important given increasing water scarcity concerns in many mining regions.

Further investment in completing this tailings storage facility is a key component of Caledonia's 2025 capital expenditure plans. This demonstrates a forward-looking approach to managing operational byproducts effectively and safely.

Key technological and strategic points for Caledonia's tailings management include:

- Adherence to GISTM: Demonstrates a commitment to the highest international safety standards for tailings facilities.

- Water Recycling: Achieving 25% water recycling from the new facility highlights a focus on resource efficiency and environmental stewardship.

- 2025 Capital Expenditure: Allocation of funds to complete the tailings storage facility underscores its strategic importance for ongoing operations and future expansion.

Technological advancements are critical for Caledonia Mining's efficiency and environmental stewardship. The company is integrating IT upgrades at its Blanket Mine and leveraging AI-driven exploration, satellite imaging, and detailed geological mapping for resource assessment. These tools are crucial for identifying and evaluating gold deposits, supporting the company's exploration efforts at its Blanket and Motapa sites, with promising initial results and further work planned for 2025 to extend mine life.

Caledonia Mining is enhancing operational resilience through technology, particularly in energy management and data systems. The company is sourcing 20% of its power from solar energy, a strategic move to mitigate power supply unreliability in Zimbabwe, finalizing the sale of its solar plant in April 2025. Furthermore, a new integrated system for safety, health, environment, and community management is set to launch in July 2025, reflecting the mining sector's broader digital transformation trend.

The company's commitment to responsible mining is evident in its adoption of advanced technologies for tailings management. Caledonia Mining is adhering to the Global Industry Standard for Tailings Management (GISTM) and has achieved 25% water recycling from its new tailings storage facility, a key component of its 2025 capital expenditure plans. This focus on resource efficiency and safety underscores a forward-looking approach to managing operational byproducts.

| Technological Area | Caledonia Mining's Application | Impact/Goal | Key Dates/Data |

| Operational Efficiency | IT upgrades at Blanket Mine | Streamline processes, enhance productivity | Ongoing |

| Exploration & Assessment | AI-driven exploration, satellite imaging, geological mapping | Precise detection and evaluation of gold resources | Exploration at Blanket & Motapa sites; further work planned for 2025 |

| Energy Management | Solar energy integration | Mitigate power unreliability, reduce costs | 20% of power sourced from solar; solar plant sale finalized April 2025 |

| Data Management & Safety | Integrated SHEC management system | Streamline safety, health, environment, community data | Launch scheduled for July 2025 |

| Tailings Management | Adherence to GISTM, water recycling | Ensure safety, resource efficiency, environmental stewardship | 25% water recycled; completion of facility part of 2025 CAPEX |

Legal factors

Zimbabwe's proposed Mines and Minerals Bill 2025 is a crucial legal development, aiming to replace the 1961 Act with a framework designed for modern mining practices. This legislation is poised to enhance transparency and streamline mining title administration, directly impacting Caledonia's operational framework and compliance strategies.

The new bill introduces updated provisions for environmental stewardship and community benefit-sharing, requiring Caledonia to adapt its practices to align with these evolving legal expectations. For instance, the bill emphasizes local beneficiation, potentially influencing Caledonia's supply chain and investment decisions in Zimbabwe.

The new Mines and Minerals Bill in Zimbabwe mandates Environmental Impact Assessments (EIAs) for significant mining projects, with substantial civil penalties for those who don't comply. This underscores a heightened focus on environmental stewardship within the sector.

Minister of Mines Soda Zhemu has made it clear that mining licenses will be revoked for companies failing to meet their EIA obligations. This strong stance, particularly relevant in 2024, signals a zero-tolerance policy towards environmental negligence, impacting operational continuity for companies like Caledonia Mining.

Caledonia Mining Corporation, a major employer in Zimbabwe, navigates a complex landscape of labor laws. Adherence to local employment regulations, covering everything from minimum wage requirements to worker safety standards, is paramount for smooth operations. For instance, recent reports indicate that Zimbabwe's minimum wage for the mining sector has seen adjustments, directly affecting Caledonia's labor costs.

Changes in employment legislation, particularly concerning collective bargaining agreements and dispute resolution mechanisms, can significantly influence Caledonia's workforce management strategies. The company's commitment to local hiring means it is directly exposed to shifts in these regulations, which could impact operational expenses and the overall cost of labor. Understanding and adapting to these evolving legal frameworks is crucial for maintaining a stable and productive workforce at its Blanket Mine.

Corporate Governance and Reporting Standards

Caledonia Mining is focused on strong corporate governance and transparent reporting. The company's commitment to Environmental, Social, and Governance (ESG) principles is demonstrated by its 2024 ESG Report, prepared in accordance with Global Reporting Initiative (GRI) standards. This proactive approach to sustainability reporting is vital for building trust with investors, especially as reporting frameworks continue to evolve.

The company is also preparing for the adoption of International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards. This readiness assessment is key to ensuring compliance and maintaining investor confidence on major exchanges like the NYSE American and AIM. Adherence to these increasingly stringent reporting requirements is fundamental for long-term value creation and market access.

- GRI Standards Adoption: Caledonia's 2024 ESG Report aligns with GRI standards, a widely recognized framework for sustainability reporting.

- IFRS Readiness: The company is undertaking an IFRS Sustainability Standards readiness assessment, anticipating future regulatory requirements.

- Exchange Listings: Compliance with robust reporting standards is essential for maintaining listings on the NYSE American and AIM.

- Investor Confidence: High ESG and financial reporting standards directly contribute to enhanced investor confidence and market reputation.

Land Use and Surface Rights Legislation

The proposed Mines and Minerals Bill 2025 is set to significantly alter land use dynamics for mining operations. It aims to resolve historical disputes between mining entities and surface rights holders by clearly defining land-use rights and establishing formal dispute resolution processes. This legislation is crucial for companies like Caledonia Mining, as it directly impacts their operational planning and community relations.

Key provisions within the bill empower farmers to continue cultivating the surface of mining sites, provided these activities align with approved operational schemes. This ensures agricultural productivity is not entirely halted by mineral extraction. Furthermore, the bill mandates that mining companies must provide formal notification to landholders and secure their consent before commencing operations that could affect sensitive land areas, fostering a more collaborative approach.

- Landowner Consent: The bill requires explicit consent from landowners for operations impacting sensitive areas, a significant shift towards greater landowner control.

- Surface Rights Codification: It codifies the rights of surface landowners, including agricultural use, ensuring a balance between resource extraction and land productivity.

- Dispute Resolution: New mechanisms for resolving conflicts between miners and landholders are introduced, aiming for more efficient and equitable outcomes.

Zimbabwe's proposed Mines and Minerals Bill 2025 introduces stricter environmental compliance, with mandatory Environmental Impact Assessments (EIAs) and significant penalties for non-compliance. Minister Soda Zhemu has emphasized that mining licenses will be revoked for companies failing to meet EIA obligations, a policy actively enforced in 2024, signaling a firm stance against environmental negligence for entities like Caledonia Mining.

The bill also addresses land use, requiring mining companies to obtain landowner consent for operations impacting sensitive areas and codifying the rights of surface landowners, including agricultural use. This aims to balance resource extraction with land productivity and establishes new dispute resolution mechanisms between miners and landholders.

Caledonia Mining's commitment to robust corporate governance is underscored by its 2024 ESG Report, prepared in accordance with GRI standards, and its ongoing readiness assessment for IFRS Sustainability Disclosure Standards. These efforts are crucial for maintaining investor confidence and compliance with listing requirements on major exchanges like the NYSE American and AIM.

Environmental factors

Water stress and scarcity, particularly in regions like Zimbabwe experiencing droughts, present a considerable environmental hurdle for Caledonia Mining. This scarcity directly impacts operational continuity and resource availability.

Caledonia is actively addressing this by implementing water recycling from its new tailings storage facility. Notably, a quarter of its total water consumption is now met through recycling, significantly reducing reliance on scarce local water sources and demonstrating a commitment to sustainable water use.

These effective water management strategies are not just environmentally responsible but are also crucial for ensuring the long-term sustainability and operational resilience of Caledonia's mining activities in a water-constrained environment.

Caledonia Mining is prioritizing environmental stewardship by aligning its tailings management with the Global Industry Standard for Tailings Management (GISTM). This commitment underscores a proactive approach to mining waste, aiming for enhanced safety and regulatory compliance.

A significant capital investment is earmarked for 2025 to complete the tailings storage facility. This development is crucial for ensuring the long-term environmental integrity of operations and meeting increasingly stringent global standards.

Caledonia Mining has proactively assessed climate change risks, including extreme weather and water scarcity, to safeguard its operations. This forward-thinking approach ensures the company is better prepared for environmental challenges.

The company's strategic investment in solar power, now supplying 20% of its electricity, significantly lowers its carbon emissions and strengthens energy security. This move towards renewable energy is a key step in its sustainability strategy.

Land Rehabilitation and Biodiversity Impact

Mining activities, by their nature, inevitably alter landscapes and can affect local wildlife. Caledonia Mining, like many in the sector, faces the challenge of managing these environmental footprints. While detailed specifics of their rehabilitation programs weren't readily available, the broader regulatory environment is shifting.

Zimbabwe's new Mines and Minerals Bill, enacted in 2023, places a stronger emphasis on environmental responsibility. This legislation includes provisions that criminalize the unauthorized felling of indigenous trees and introduces penalties for various environmental transgressions, underscoring a commitment to better land stewardship.

The effective management of land and the protection of biodiversity are becoming increasingly critical for the long-term viability and social license of mining operations. Companies are expected to demonstrate robust environmental, social, and governance (ESG) practices.

- Regulatory Shift: The 2023 Mines and Minerals Bill in Zimbabwe strengthens environmental protection, penalizing illegal deforestation and other violations.

- ESG Importance: Responsible land management and biodiversity conservation are key components of ESG frameworks, influencing investor confidence and operational sustainability.

- Industry Trend: A growing global expectation exists for mining companies to implement comprehensive land rehabilitation strategies to mitigate environmental impact.

Pollution Control and Waste Management

Caledonia Mining must navigate a shifting regulatory landscape concerning pollution control and waste management, particularly with the introduction of the new Mines and Minerals Bill. This legislation establishes a stringent environmental protection regime, complete with civil penalties and the possibility of revoking mining rights for non-compliance. This legislative emphasis highlights the critical need for Caledonia to implement robust pollution control and waste management strategies to prevent environmental degradation and maintain responsible operational standards.

The financial implications of failing to adhere to these new environmental regulations are significant. For instance, environmental penalties can directly impact a company's profitability and cash flow. In 2024, mining companies globally faced increased scrutiny and fines for environmental breaches, with some estimates suggesting that non-compliance costs could reach millions of dollars annually. Caledonia's commitment to best practices in waste management and emission control is therefore not just an ethical imperative but a crucial financial safeguard.

- Legislative Impact: The Mines and Minerals Bill mandates stricter pollution control, posing financial risks through penalties for violations.

- Operational Costs: Investing in advanced waste management technologies is essential to meet new environmental standards and avoid costly fines.

- Reputational Risk: Environmental non-compliance can damage Caledonia's reputation, affecting investor confidence and access to capital.

- Sustainability Focus: Proactive environmental stewardship aligns with growing investor demand for sustainable mining practices, potentially enhancing market valuation.

Water scarcity in Zimbabwe poses a significant operational challenge, yet Caledonia Mining is proactively mitigating this by recycling water, with 25% of its consumption now sourced internally. This strategy is vital for operational continuity and resource availability in a drought-prone region.

The company's commitment to environmental stewardship is further demonstrated by its alignment with the Global Industry Standard for Tailings Management (GISTM), backed by a substantial capital investment planned for 2025 to complete its tailings storage facility. This ensures long-term environmental integrity and compliance with global standards.

Caledonia Mining is strategically reducing its carbon footprint by powering 20% of its operations with solar energy, enhancing energy security and lowering emissions. This move reflects a broader industry trend towards sustainability and responsible resource management.

Zimbabwe's 2023 Mines and Minerals Bill introduces stricter environmental regulations, including penalties for deforestation and pollution, necessitating robust compliance measures from Caledonia Mining to avoid financial and reputational damage.

PESTLE Analysis Data Sources

Our Caledonia Mining PESTLE Analysis is built on a robust foundation of data from official government publications, international financial institutions like the IMF and World Bank, and reputable industry-specific reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.