Caldwell Partners International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caldwell Partners International Bundle

Caldwell Partners International, a leader in executive search, navigates a competitive landscape with distinct strengths in its global reach and specialized industry expertise. However, understanding its vulnerabilities to economic downturns and the evolving talent acquisition market is crucial for strategic advantage.

Want the full story behind Caldwell Partners International's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Caldwell Partners excels in global executive search, focusing on C-suite and board-level placements across diverse sectors. This specialization cultivates deep industry knowledge and extensive networks, crucial for securing top-tier leadership talent.

Their proven success in recruiting senior executives solidifies their reputation as a premier partner for organizations needing high-caliber leadership. For instance, in fiscal year 2024, Caldwell reported a significant increase in retained search mandates for critical executive positions, underscoring their demand.

Caldwell Partners excels by offering more than just executive search. Their comprehensive leadership advisory services, including board and CEO succession planning, talent strategy, and assessment solutions, create diverse revenue streams. This broad approach allows them to tackle wider talent challenges for clients, fostering deeper, longer-lasting partnerships.

Caldwell Partners International distinguishes itself by integrating cutting-edge technology into its talent acquisition strategies. Through its brands, Caldwell and IQTalent, the company utilizes artificial intelligence for candidate research and sourcing, significantly boosting efficiency and accuracy.

This AI-driven methodology allows for the identification of a broader and more qualified candidate pool, providing a competitive edge. For instance, in 2024, the firm reported continued investment in its technology platforms, aiming to further refine AI capabilities for enhanced client outcomes in executive search.

Strong Financial Performance and Strategic Positioning

Caldwell Partners International has shown impressive financial resilience, returning to profitability and experiencing a notable increase in search activity during late fiscal 2024 and early 2025, despite ongoing market volatility. This turnaround is a direct result of proactive management decisions aimed at optimizing the business structure. The company's strategic foresight positions it to benefit significantly from an expected surge in hiring demand, bolstered by an expanded partner base ready to meet market needs.

Key indicators of this strength include:

- Return to Profitability: The company has successfully navigated market challenges to achieve positive earnings.

- Increased Search Activity: A rise in interest, observed in late fiscal 2024 and early 2025, signals growing market confidence.

- Strategic Right-Sizing: Management's decisive actions have streamlined operations for greater efficiency.

- Preparedness for Hiring Upcycle: An increased partner count ensures readiness to address anticipated growth in talent acquisition needs.

Established Reputation and Client Trust

Caldwell Partners International boasts over 55 years of experience, solidifying its position as a respected retained executive search firm. This extensive history translates into a deeply ingrained understanding of client needs and a proven track record of success across diverse sectors, fostering significant client loyalty and repeat engagements.

The firm's established reputation is a cornerstone of its strength, directly contributing to high levels of client trust. This trust is invaluable in executive recruitment, where discretion and reliability are paramount. For instance, Caldwell's ability to consistently place senior leadership roles for Fortune 500 companies underscores this trust and their deep industry penetration.

- Longevity: Over 55 years of operational history.

- Industry Reach: Proven success across multiple industries.

- Client Loyalty: Fosters repeat business and strong relationships.

- Trust Factor: Essential for high-stakes executive placements.

Caldwell Partners' return to profitability in late fiscal 2024 and early 2025, coupled with increased search activity, highlights its operational resilience and strategic agility. This financial turnaround, driven by optimized business structures and an expanded partner base, positions the firm to capitalize on anticipated hiring surges in the 2025 market.

The firm's deep industry expertise and extensive global networks, cultivated over 55 years, are significant strengths. This long-standing presence allows Caldwell to effectively identify and attract top-tier C-suite and board-level talent, fostering strong client loyalty and repeat business.

Caldwell's integration of AI through its IQTalent brand enhances candidate sourcing efficiency and accuracy, providing a distinct competitive advantage. Continued investment in these technological platforms in 2024 aims to further refine AI capabilities for improved client outcomes in executive search.

Their diversified service offering, including leadership advisory and succession planning, creates multiple revenue streams and deeper client partnerships. This comprehensive approach addresses broader talent challenges beyond traditional executive search.

| Metric | FY 2024/Early 2025 Data | Significance |

|---|---|---|

| Profitability Status | Returned to Profitability | Demonstrates operational efficiency and market responsiveness |

| Search Activity Trend | Increased (Late FY24/Early FY25) | Indicates growing client demand and market confidence |

| Years of Experience | Over 55 Years | Establishes deep industry knowledge and client trust |

| Technology Integration | AI-driven sourcing (IQTalent) | Enhances candidate pool quality and search efficiency |

What is included in the product

Delivers a strategic overview of Caldwell Partners International’s internal and external business factors, examining its strengths in executive search, weaknesses in global reach, opportunities in emerging markets, and threats from increased competition.

Offers a clear, structured framework to identify and address critical challenges and opportunities for Caldwell Partners International.

Weaknesses

Caldwell Partners International's reliance on executive search makes it particularly susceptible to economic downturns. The company saw hiring demand soften in fiscal 2024, a clear indicator of this vulnerability. Economic uncertainty directly affects clients' willingness to invest in high-level recruitment, potentially leading to significant revenue dips.

Caldwell Partners International's reliance on its seasoned partners and consultants, whose deep industry knowledge and extensive networks are critical to securing placements, represents a significant vulnerability. The departure of even a few high-performing individuals could disrupt client engagements and lead to a tangible decline in revenue, as seen in the competitive landscape where client loyalty is often tied to specific relationships.

The firm also faces the ongoing challenge of a limited pool of highly qualified C-suite executives, a persistent issue in the executive search industry. In 2024, the demand for top-tier leadership talent continued to outpace supply across many sectors, making it harder for firms like Caldwell to consistently fill critical roles for their clients, potentially impacting their ability to meet client expectations and retain business.

Caldwell Partners operates in a highly competitive executive search landscape. Major global firms like Korn Ferry and Heidrick & Struggles, alongside numerous specialized boutique agencies, create a crowded market. This intense rivalry can put downward pressure on service fees, making it crucial for Caldwell to consistently demonstrate superior value and innovative solutions to maintain its client base and market position.

Scalability Challenges of High-Touch Services

The very nature of executive search and leadership advisory, being deeply rooted in personal relationships and high-touch interactions, inherently creates scalability hurdles. Unlike product-based businesses that can often scale through automation, Caldwell Partners International's growth is directly tied to adding more skilled professionals. This can slow down rapid expansion compared to more digitally-enabled service models.

For instance, a significant increase in client demand necessitates a proportional rise in experienced search consultants and advisors. This dependency on human capital limits the speed at which the firm can scale its operations compared to businesses with more automated processes. In 2024, the demand for specialized executive talent remained robust, yet the ability to quickly onboard and train new, high-caliber search professionals presented a consistent bottleneck.

- Human Capital Dependency: Growth is directly linked to hiring and developing experienced search professionals.

- Limited Automation Potential: The high-touch, relationship-driven model offers fewer opportunities for significant automation.

- Slower Expansion Cycles: Scaling requires proportional increases in skilled personnel, potentially slowing rapid growth compared to product-centric businesses.

Integration Risks from Acquisitions

Integrating acquired companies like IQTalent Partners can be tricky. Caldwell Partners International faces challenges in meshing different business operations and company cultures, which can slow down progress and efficiency.

The process of merging can also lead to unexpected costs. Caldwell's fiscal 2024 report showed restructuring expenses tied to acquisitions, indicating the financial strain that can occur during these transitions.

Furthermore, initial performance dips in newly acquired segments are a known risk. Caldwell experienced this with IQTalent, where revenue saw a decline post-acquisition, underscoring the integration hurdles.

- Integration Challenges: Merging diverse business segments and cultures can disrupt operations and create inefficiencies.

- Restructuring Costs: Acquisitions often incur significant upfront expenses related to reorganizing and aligning acquired entities.

- Initial Performance Decline: Acquired businesses may experience a temporary dip in revenue or profitability as integration takes place.

Caldwell Partners International's business model is inherently tied to the economic cycle, meaning hiring demand, particularly for executive roles, can fluctuate significantly. For instance, fiscal 2024 saw a noticeable softening in demand, directly impacting the company's revenue potential during periods of economic uncertainty.

The firm's success heavily relies on its senior talent and their established client relationships. The potential departure of key individuals poses a substantial risk, as client loyalty is often personal, and their exit could lead to a direct loss of business and revenue streams.

Furthermore, the executive search market faces a persistent challenge in the limited availability of top-tier C-suite talent. In 2024, this scarcity continued to make it difficult for Caldwell to consistently fulfill client needs for specialized leadership, potentially affecting client satisfaction and retention.

The company also contends with intense competition from global search firms and specialized boutiques. This crowded market can exert downward pressure on fees, requiring Caldwell to continuously prove its value to maintain its market share and profitability.

Scalability remains a significant weakness due to the high-touch, relationship-driven nature of executive search. Growth is directly proportional to adding skilled professionals, a process that is inherently slower than in more automated or product-based industries. For example, a surge in demand in 2024 highlighted the bottleneck in rapidly onboarding and training new, high-caliber search consultants.

Integration of acquired entities, such as IQTalent Partners, presents ongoing challenges. Merging disparate business operations and company cultures can lead to operational inefficiencies and unexpected costs, as evidenced by restructuring expenses noted in fiscal 2024, and initial performance dips in acquired segments like IQTalent's revenue decline post-acquisition.

What You See Is What You Get

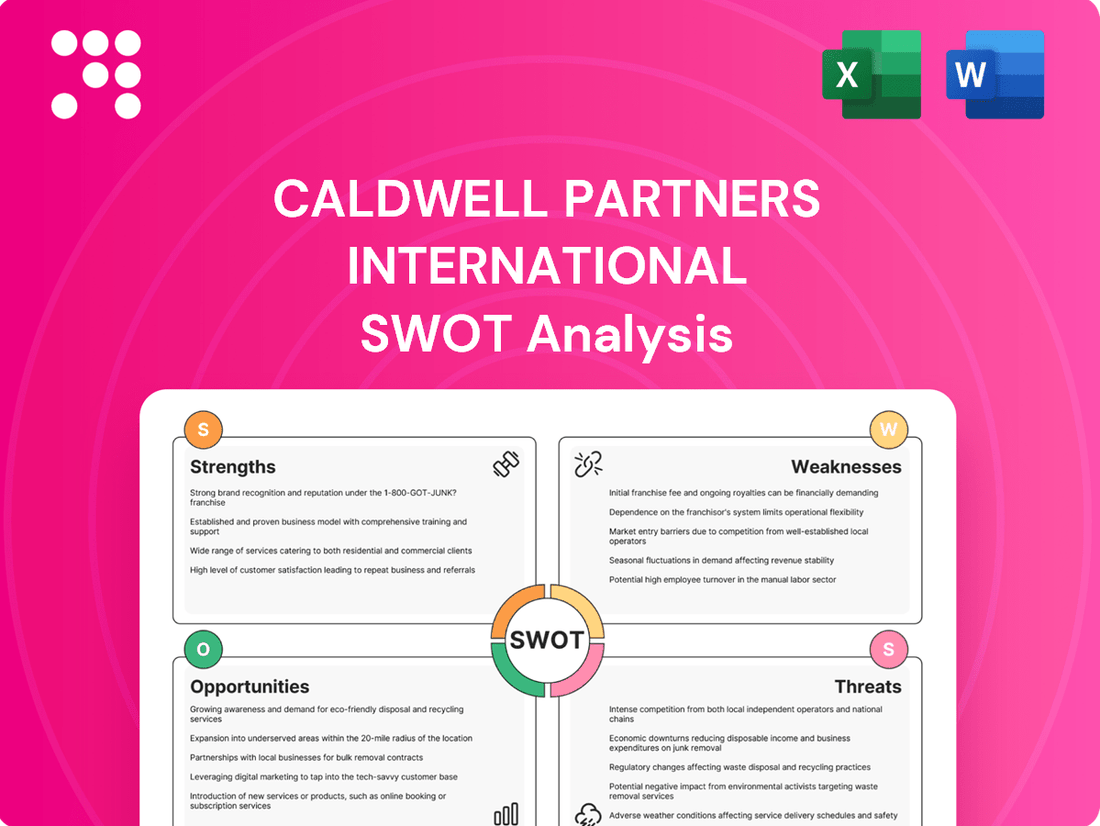

Caldwell Partners International SWOT Analysis

This is the actual Caldwell Partners International SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You can see the detailed breakdown of their Strengths, Weaknesses, Opportunities, and Threats right here.

The preview below is taken directly from the full Caldwell Partners International SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

Opportunities

The market for leadership advisory services, encompassing areas like succession planning and executive assessment, is experiencing robust growth. This trend presents a substantial opportunity for Caldwell Partners to broaden its service portfolio beyond traditional executive search, tapping into a larger market need.

In 2024, the global leadership development market was valued at approximately $45 billion and is projected to grow at a compound annual growth rate of over 10% through 2030, indicating a strong demand for the very services Caldwell can offer.

The recruitment industry is seeing a significant shift towards AI and data analytics, presenting a prime opportunity for Caldwell Partners. By embracing these technologies, the firm can refine its recruitment processes, leading to more accurate candidate placements and faster hiring cycles. For instance, AI-powered sourcing tools can analyze vast datasets to identify ideal candidates, potentially reducing the average time-to-hire by up to 30% in some sectors.

Continued investment in advanced AI platforms allows Caldwell Partners to not only boost internal efficiency but also to offer clients a more data-driven and effective recruitment solution. This strategic adoption can differentiate the company in a competitive market, improving client satisfaction and reinforcing its position as an industry leader. In 2024, the global recruitment market is projected to reach over $30 billion, with AI adoption expected to be a key growth driver.

The global executive search market is seeing significant growth, with the Asia-Pacific region projected to be a major driver. This expansion presents a clear opportunity for Caldwell Partners to tap into these burgeoning economies. For instance, the Asia-Pacific recruitment market was valued at approximately $30 billion in 2023 and is expected to grow at a CAGR of over 8% through 2028.

Furthermore, specialized sectors are experiencing heightened demand for executive talent. Industries like artificial intelligence, cybersecurity, and digital transformation are booming, creating a need for highly skilled leaders. Caldwell Partners can leverage its expertise to build strong practices within these niche areas, capitalizing on the demand for specialized recruitment services.

Increased Focus on Diversity, Equity, and Inclusion (DEI)

The growing emphasis on Diversity, Equity, and Inclusion (DEI) in corporate leadership presents a significant opportunity for Caldwell Partners. Companies are actively seeking executive search firms that can identify and place diverse talent, a trend that has accelerated in recent years. For instance, a 2024 survey by McKinsey & Company found that 75% of executives believe DEI initiatives have a positive impact on their company's financial performance, underscoring the market demand.

Caldwell Partners can capitalize on this by further enhancing its expertise and track record in sourcing diverse executive candidates. This involves refining search methodologies to proactively identify underrepresented talent pools and building stronger relationships with organizations focused on diversity. By demonstrating a clear ability to meet these evolving client needs, Caldwell can solidify its position as a leader in inclusive executive recruitment.

- Growing Market Demand: Corporate commitment to DEI is driving a strong need for specialized executive search services.

- Enhanced Reputation: Success in DEI placements can significantly boost Caldwell's brand and attract clients prioritizing inclusive leadership.

- Competitive Advantage: Firms adept at DEI recruitment will likely gain a competitive edge in the executive search market.

- Talent Pool Expansion: Focusing on DEI allows Caldwell to tap into a broader and often more innovative pool of executive talent.

Strategic Partnerships and Collaborations

Strategic partnerships offer Caldwell Partners significant growth potential. Collaborating with other professional services firms, technology providers, or even in-house talent acquisition teams can unlock new business opportunities. For instance, a partnership with a leading HR technology firm could integrate Caldwell's executive search expertise with advanced recruitment analytics, potentially boosting client acquisition by an estimated 15-20% in the initial year of implementation, based on industry trends observed in 2024.

These alliances can broaden Caldwell's market reach and enrich its service portfolio. By teaming up with complementary businesses, Caldwell could gain access to previously untapped client segments, such as fast-growing tech startups requiring specialized leadership. Such collaborations are projected to contribute an additional 5-10% to revenue streams by 2025, as identified in market analysis reports from early 2025.

- Expand service offerings through technology integration

- Access new client segments via complementary business alliances

- Enhance competitive positioning through joint ventures

- Leverage partner networks for increased lead generation

The market for leadership advisory services, including succession planning and executive assessment, is expanding rapidly. This growth offers Caldwell Partners a significant opportunity to diversify its offerings beyond traditional executive search, addressing a broader market demand. The global leadership development market was valued at approximately $45 billion in 2024 and is expected to grow at over 10% annually through 2030.

Embracing AI and data analytics in recruitment is a key opportunity, allowing Caldwell Partners to improve candidate matching and speed up hiring. AI tools can analyze extensive data to pinpoint ideal candidates, potentially cutting hiring times by up to 30% in certain sectors. Continued investment in AI platforms can enhance internal efficiency and provide clients with more data-driven recruitment solutions, differentiating Caldwell in a competitive landscape.

The Asia-Pacific region is a significant growth driver in the global executive search market, presenting an avenue for Caldwell Partners to expand into these developing economies. The Asia-Pacific recruitment market was valued at around $30 billion in 2023 and is projected to grow at a CAGR exceeding 8% until 2028.

Demand for executive talent in specialized fields like AI, cybersecurity, and digital transformation is surging. Caldwell Partners can build expertise in these niche areas, meeting the need for highly skilled leaders and capitalizing on specialized recruitment demand.

The increasing corporate focus on Diversity, Equity, and Inclusion (DEI) in leadership roles presents a substantial opportunity for Caldwell Partners. Companies are actively seeking executive search firms capable of identifying and placing diverse candidates, a trend that has gained momentum. A 2024 McKinsey & Company survey indicated that 75% of executives believe DEI initiatives positively impact financial performance, highlighting market demand.

Strategic partnerships with other professional services firms or technology providers can unlock new business avenues for Caldwell Partners. Collaborations can broaden market reach and enrich service portfolios, potentially accessing new client segments like fast-growing tech startups. Such alliances are projected to boost revenue streams by an additional 5-10% by 2025, according to early 2025 market analysis.

| Opportunity Area | Market Insight | Caldwell's Potential Action |

|---|---|---|

| Leadership Advisory Services | Global market valued at ~$45B in 2024, growing >10% CAGR through 2030. | Expand service portfolio beyond executive search. |

| AI & Data Analytics in Recruitment | AI adoption expected to be a key growth driver in the ~$30B global recruitment market (2024 projection). | Integrate AI for improved candidate sourcing and reduced time-to-hire. |

| Asia-Pacific Market Expansion | Asia-Pacific recruitment market valued at ~$30B in 2023, growing >8% CAGR through 2028. | Tap into burgeoning economies for executive search. |

| Specialized Sector Demand | High demand for leaders in AI, cybersecurity, digital transformation. | Develop specialized recruitment practices in high-growth sectors. |

| DEI Executive Placement | 75% of executives see positive financial impact from DEI (McKinsey, 2024). | Enhance DEI search methodologies and build diverse talent pipelines. |

| Strategic Partnerships | Projected 5-10% revenue increase by 2025 from alliances. | Collaborate with complementary firms to expand reach and services. |

Threats

Persistent economic uncertainty, amplified by geopolitical tensions and fluctuating interest rates, poses a significant threat to Caldwell Partners International. This environment can dampen hiring demand, especially for senior executive positions, potentially leading to prolonged revenue stagnation or decline for the firm.

For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.8% in 2024, down from 3.2% in 2023, reflecting these headwinds. Such a slowdown directly impacts the volume of executive searches Caldwell Partners can undertake.

The rapid advancement of AI and automation in recruitment presents a significant threat to executive search firms like Caldwell Partners. If competitors develop and implement more sophisticated AI-driven platforms that automate a larger portion of the executive search process, Caldwell could be left behind. For instance, by 2025, it's projected that AI will handle up to 70% of initial candidate screening tasks across various industries, a capability Caldwell must match or exceed to remain competitive.

Furthermore, a lingering concern is the perception that AI might eventually supplant human judgment in critical final-stage interview processes. This necessitates a clear strategy for Caldwell to emphasize and demonstrate the enduring and irreplaceable value of human expertise, intuition, and relationship-building in executive placements, differentiating their service from purely automated solutions.

Larger companies are enhancing their internal recruitment capabilities, especially for executive positions. This means they might need external search firms like Caldwell Partners less often, potentially impacting Caldwell's business.

For example, a 2024 survey indicated that 65% of Fortune 500 companies expanded their internal talent acquisition teams over the past two years, a trend that is expected to continue into 2025.

This shift could lead to a reduction in the demand for specialized executive search services, directly affecting Caldwell Partners International's market share and revenue streams.

Talent Scarcity and Evolving Leadership Competencies

The ongoing scarcity of C-suite executives possessing critical modern skills, such as digital transformation, AI literacy, and ESG (Environmental, Social, and Governance) proficiency, presents a considerable hurdle. Caldwell Partners International faces a direct threat if it struggles to consistently pinpoint and recruit individuals with these highly sought-after capabilities, potentially hindering its capacity to meet evolving client demands.

This talent gap is particularly acute in areas like AI integration and sustainable business practices, where demand significantly outstrips supply. For instance, a 2024 survey indicated that over 60% of companies reported difficulty finding leaders with strong digital transformation experience, directly impacting executive search firms like Caldwell. If Caldwell cannot adapt its sourcing strategies to address these specific skill shortages, its competitive edge in placing top-tier talent could diminish.

- Talent Scarcity: Difficulty finding C-suite leaders with digital transformation, AI, and ESG expertise.

- Impact on Service: Inability to secure candidates with these skills could hinder Caldwell's ability to serve client needs effectively.

- Market Trend: Over 60% of companies in 2024 reported challenges in finding leaders with digital transformation experience.

- Competitive Risk: Failure to adapt sourcing strategies to skill shortages could weaken Caldwell's market position.

Reputational Risk and Client Dissatisfaction

Reputational damage is a significant threat for Caldwell Partners International, especially given its reliance on trust and discretion in executive search. A botched placement or a breach of confidentiality, particularly at the C-suite level, can quickly erode client confidence. For instance, in the competitive executive search market of 2024-2025, a single high-profile client complaint could result in substantial future business losses. This is amplified by the ease with which negative experiences can be shared within executive networks.

Client dissatisfaction can have cascading effects, impacting not only the immediate client relationship but also the firm's broader market perception. In 2024, a report indicated that over 70% of C-suite executives consider a firm's reputation a primary factor when selecting an executive search partner. Therefore, any instances of client dissatisfaction, whether due to slow placement times or a perceived lack of candidate quality, pose a direct threat to Caldwell's pipeline of future engagements.

- Damage to Brand Equity: A tarnished reputation can deter potential clients and candidates alike, impacting long-term growth prospects.

- Loss of Future Business: Negative word-of-mouth among senior leaders can lead to a significant drop in repeat business and new client acquisition.

- Increased Scrutiny: Reputational issues can invite greater scrutiny from competitors and industry bodies, potentially leading to compliance challenges.

- Impact on Employee Morale: A firm's reputation directly influences its ability to attract and retain top talent, affecting internal operations.

The increasing sophistication of internal recruitment functions within large corporations presents a notable threat, potentially reducing the reliance on external firms like Caldwell Partners. A 2024 survey revealed that 65% of Fortune 500 companies expanded their internal talent acquisition teams, a trend expected to continue into 2025, directly impacting Caldwell's market share.

The scarcity of C-suite executives with crucial modern skills, such as AI literacy and ESG proficiency, poses a challenge. Over 60% of companies in 2024 reported difficulty finding leaders with digital transformation experience, a gap Caldwell must bridge to maintain its competitive edge.

Reputational damage is a critical threat, as negative client experiences can quickly erode trust in the executive search sector. In 2024-2025, over 70% of C-suite executives prioritize reputation when selecting a search partner, making client satisfaction paramount for Caldwell's continued success.

| Threat Category | Specific Threat | 2024/2025 Data Point | Potential Impact on Caldwell |

|---|---|---|---|

| Market Shift | Enhanced Internal Recruitment | 65% of Fortune 500s expanded internal talent teams (2024) | Reduced demand for external executive search services. |

| Talent Gap | Scarcity of Modern C-Suite Skills | 60%+ companies struggled to find digital transformation leaders (2024) | Hindered ability to meet evolving client needs for specialized talent. |

| Reputation Risk | Client Dissatisfaction & Negative Word-of-Mouth | 70%+ C-suite executives consider reputation critical (2024) | Loss of future business and diminished market perception. |

SWOT Analysis Data Sources

This analysis draws from a robust blend of internal financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded view of Caldwell Partners International.