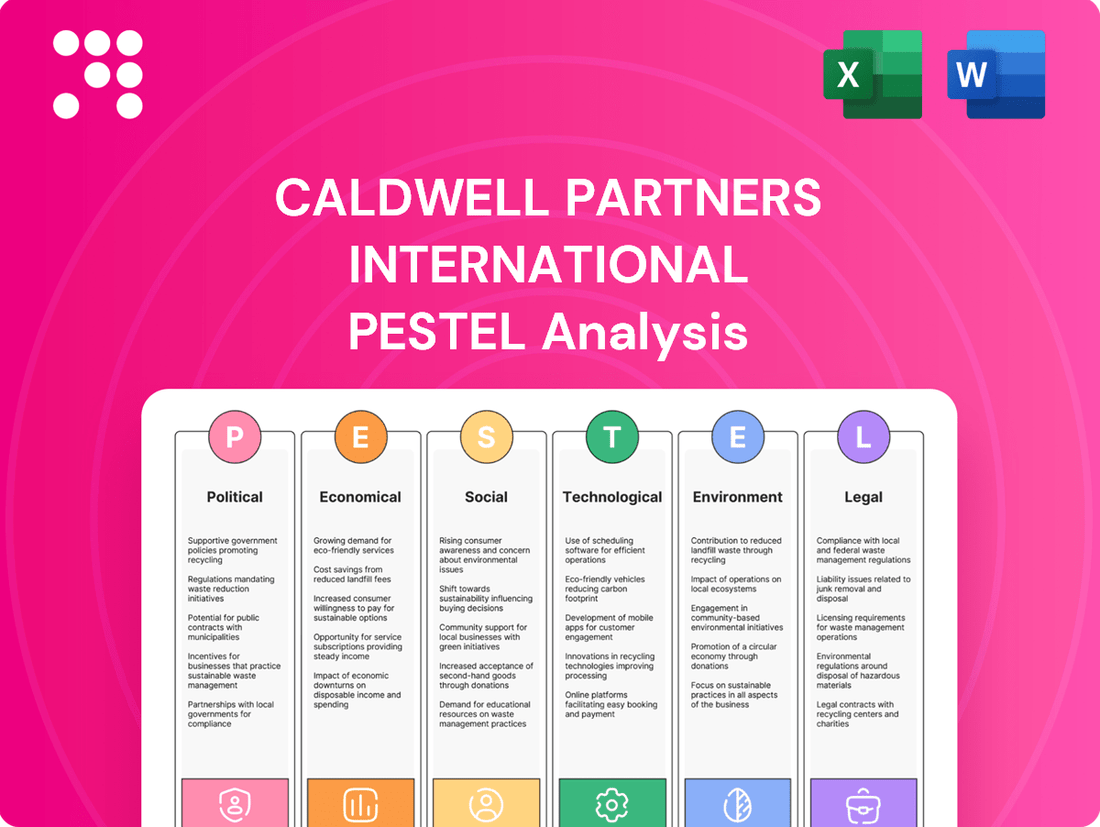

Caldwell Partners International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caldwell Partners International Bundle

Unlock the hidden forces shaping Caldwell Partners International's trajectory with our comprehensive PESTLE analysis. Understand the intricate interplay of political stability, economic fluctuations, and evolving social trends that directly impact their operations. Equip yourself with actionable intelligence to anticipate market shifts and refine your strategic approach. Download the full PESTLE analysis now for a critical competitive advantage.

Political factors

Political stability in Caldwell Partners' key markets, such as North America and Europe, directly impacts business confidence and the willingness of companies to invest in growth, which in turn affects demand for executive search services. For instance, a stable political environment in Canada, where Caldwell Partners has a significant presence, fosters a predictable business climate, encouraging companies to seek top talent. Conversely, political uncertainty, like potential shifts in trade agreements or regulatory frameworks, can dampen investment and slow down hiring decisions.

Changes in government policies, whether related to labor laws, taxation, or foreign direct investment, can significantly alter the landscape for executive placements. For example, if a government implements policies that encourage international business expansion, this could create new opportunities for Caldwell Partners to place executives in emerging markets. In 2024, many governments are focusing on economic resilience and digital transformation, which may lead to increased demand for leaders with expertise in these areas.

Caldwell Partners must actively monitor these political developments to provide strategic advice to its clients. Understanding how policy changes might affect industries or specific regions allows the firm to proactively identify leadership needs and market shifts. For example, anticipating a government's focus on green energy initiatives could prompt Caldwell to prepare for increased demand for executives in renewable energy sectors.

Evolving regulations around corporate governance, board diversity, and executive pay directly shape the executive search landscape for Caldwell Partners. For instance, the SEC's proposed rules in late 2023 regarding board diversity and independence, building on existing Nasdaq listing requirements, highlight a growing demand for candidates with specific skill sets and backgrounds. This increased scrutiny means Caldwell must actively source and vet talent that meets these heightened standards, impacting the types of roles they fill and the expertise they offer clients.

Legislative shifts are fueling a demand for specialized executive search services focused on board composition and independence. In 2024, many companies are proactively enhancing their governance structures to align with anticipated regulatory changes, creating a need for firms like Caldwell to identify directors with robust independence credentials and diverse experiences. This trend is evident as institutional investors, such as Vanguard and BlackRock, continue to emphasize ESG (Environmental, Social, and Governance) factors in their proxy voting, further pressuring boards to demonstrate strong governance practices.

Caldwell Partners must remain highly attuned to these dynamic legal frameworks. Staying current with legislation, such as the Corporate Sustainability Reporting Directive (CSRD) in Europe, which impacts governance reporting, is crucial for providing accurate counsel. This ensures they can effectively advise clients on sourcing C-suite and board talent that not only possesses the necessary leadership skills but also understands and can navigate complex compliance requirements, a critical factor in today's business environment.

Geopolitical tensions, such as the ongoing conflicts in Eastern Europe and the Middle East, significantly impact global talent mobility. For Caldwell Partners, this translates to increased difficulty in facilitating cross-border executive placements, as many nations tighten immigration policies and impose sanctions. For instance, in 2024, the World Bank reported a slowdown in international migration flows compared to pre-pandemic levels, partly due to these geopolitical uncertainties.

Visa restrictions and political instability in key markets directly affect Caldwell Partners' operational capacity. Navigating complex and often changing immigration laws requires specialized expertise and can prolong recruitment timelines. The firm’s ability to source and deploy talent internationally is therefore contingent on a nuanced understanding of localized regulatory environments and the availability of talent within those specific, often challenging, regions.

Government Spending and Industry Support

Government spending plays a crucial role in shaping demand for executive talent. For instance, the US government's commitment to infrastructure development, with significant investments planned through initiatives like the Infrastructure Investment and Jobs Act, is expected to boost demand for leadership in construction, engineering, and related sectors through 2025. Conversely, shifts towards fiscal conservatism or budget cuts in areas like public health could dampen executive recruitment in those fields.

Caldwell Partners should monitor these trends closely. For example, increased federal funding for semiconductor manufacturing, aiming to bolster domestic supply chains, directly translates into a higher need for experienced executives in technology and advanced manufacturing. Understanding these governmental priorities allows for proactive identification of sectors poised for growth and strategic targeting of executive search efforts.

- Infrastructure Investment: The US Infrastructure Investment and Jobs Act allocates over $1 trillion, driving demand for leadership in construction and engineering.

- Technology Sector Support: Government initiatives like the CHIPS Act are injecting billions into domestic semiconductor production, creating executive opportunities.

- Healthcare Spending: Fluctuations in healthcare budgets, influenced by policy changes, directly impact executive hiring needs in the medical and pharmaceutical industries.

- Defense Spending: Projected increases in defense budgets for 2024-2025 will likely elevate the need for executives in aerospace and defense manufacturing.

Political Influence on Economic Policy

Government policies, such as tax reforms and fiscal stimulus packages, directly impact economic conditions and, consequently, corporate hiring needs. For instance, in early 2024, the US government's focus on infrastructure spending, partly driven by the Infrastructure Investment and Jobs Act, created demand for executive talent in construction and engineering sectors.

Political decisions to support or regulate specific industries significantly alter the strategic talent requirements for businesses. For example, government incentives for renewable energy development in 2024 have boosted demand for leaders with expertise in green technologies and sustainable business practices.

Caldwell Partners must analyze these political-economic connections to forecast shifts in the executive job market. Understanding how legislative agendas translate into economic realities allows for proactive talent acquisition strategies. The ongoing geopolitical landscape, including trade relations and international agreements, also plays a crucial role in shaping global economic policies and talent demands.

- Tax Policy: Changes in corporate tax rates, such as potential adjustments in the US in 2025, can influence profitability and investment, thereby affecting hiring.

- Fiscal Stimulus: Government spending on initiatives like infrastructure or technology can directly create job opportunities and demand for specialized leadership.

- Industry Regulation: New regulations or deregulation in sectors like finance or healthcare can reshape the need for compliance and strategic leadership roles.

- Trade Agreements: International trade policies and agreements impact global supply chains and market access, influencing the demand for executives with international experience.

Political stability across Caldwell Partners' core markets, particularly North America and Europe, directly influences business confidence and investment appetite, impacting the demand for executive search services. For instance, a stable political climate in Canada, a key market for Caldwell, promotes a predictable business environment, encouraging companies to actively seek top leadership talent.

Government policies, ranging from labor laws and taxation to foreign investment frameworks, significantly reshape the executive placement landscape. In 2024, many governments are prioritizing economic resilience and digital transformation, which is expected to increase the need for executives with expertise in these critical areas.

Legislative changes concerning corporate governance, board diversity, and executive compensation directly influence the executive search market. For example, evolving regulations and investor demands for ESG compliance are driving a greater need for board members with specific independence credentials and diverse experiences.

Geopolitical tensions and evolving international relations can affect global talent mobility, creating challenges for cross-border executive placements due to tightened immigration policies and sanctions. In 2024, the World Bank noted a slowdown in international migration, partly attributed to these geopolitical uncertainties.

What is included in the product

This PESTLE analysis for Caldwell Partners International examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

It offers a comprehensive overview of external forces, providing actionable insights for strategic decision-making and risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Caldwell Partners International.

Economic factors

Global economic growth is a key driver for Caldwell Partners. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a slight slowdown from 2023, indicating a resilient but moderating economic landscape. This directly influences corporate confidence and investment in leadership talent, impacting Caldwell's placement volumes.

Recessionary pressures remain a concern, with some regions experiencing slower growth or contraction. For instance, while major economies like the US showed resilience in early 2024, geopolitical tensions and inflation could still trigger downturns. Such conditions typically lead to hiring freezes and reduced demand for executive search services, directly affecting Caldwell's revenue streams.

Caldwell Partners' performance is intrinsically linked to these economic cycles. Periods of robust global expansion, characterized by increased corporate M&A activity and new venture funding, typically boost demand for executive roles. Conversely, economic uncertainty or recessionary environments necessitate a more cautious approach from clients, potentially leading to a decrease in new mandates for Caldwell.

High inflation, reaching 3.4% year-over-year in the US as of April 2024, directly impacts Caldwell Partners by increasing operational costs and potentially shrinking client budgets for executive recruitment. This economic pressure can also lead to more conservative spending on strategic hires, affecting the demand for their services.

Rising interest rates, with the Federal Reserve holding the target range at 5.25%-5.50% through mid-2024, dampen mergers and acquisitions (M&A) activity. This slowdown is critical for Caldwell Partners as M&A often drives executive transitions and creates demand for their specialized search services.

These fluctuating economic conditions necessitate that Caldwell Partners strategically adjust its pricing models and service offerings. Understanding how corporate investment decisions and the willingness to undertake high-level searches are influenced by inflation and interest rates is paramount for maintaining competitiveness and profitability.

While broad unemployment figures are less critical for executive search, the specific supply and demand for C-suite talent significantly impacts Caldwell Partners. A tight market for specialized leadership, where demand outstrips supply, elevates the value of executive search firms. For instance, the U.S. unemployment rate hovered around 3.9% in early 2024, but the availability of highly specialized executives, particularly in tech and finance, remained constrained, driving demand for recruitment services.

When the market for top-tier executives is tight, companies face greater challenges in identifying and securing qualified candidates internally. This scarcity directly benefits Caldwell Partners, as businesses are more inclined to engage external expertise to fill critical leadership gaps. This dynamic was evident in sectors experiencing rapid growth or technological disruption throughout 2024, where the need for experienced executives was acute.

Conversely, an oversupply of executive talent could theoretically lessen the perceived urgency for external recruitment. However, specialized firms like Caldwell Partners continue to provide access to passive candidates – those not actively seeking new roles – who are often the most desirable hires. This ongoing value proposition ensures relevance even in periods of broader labor market ease.

Mergers, Acquisitions, and Corporate Restructuring Activity

Mergers and acquisitions (M&A) are crucial for executive search firms like Caldwell Partners. When companies combine or restructure, there's a significant need to build or adjust leadership teams. This often means new C-suite roles are created, or existing ones are re-evaluated, directly impacting demand for executive placements.

The M&A landscape in 2024 and early 2025 is dynamic. For instance, global M&A deal value saw a notable uptick in the first half of 2024 compared to the same period in 2023, with a projected continuation of this trend throughout the year. This robust activity translates into increased opportunities for Caldwell Partners to engage with companies undergoing these transformations.

- Increased M&A Activity: Global M&A deal volume in Q1 2024 reached approximately $800 billion, a significant increase from Q1 2023, indicating a strong market for corporate consolidation.

- Restructuring Demand: Corporate restructuring, often a consequence of M&A or economic shifts, frequently leads to executive departures and new appointments, creating a steady pipeline of search mandates.

- Strategic Leadership Needs: Newly formed entities post-merger require unified and experienced leadership, driving demand for Caldwell Partners' expertise in identifying top-tier executives.

- Market Trend Monitoring: Tracking M&A trends, such as sector-specific consolidation or cross-border deals, allows Caldwell Partners to proactively anticipate and capitalize on future business demand.

Industry-Specific Economic Trends

Different industries navigate distinct economic cycles and growth paths, directly impacting their need for executive leadership. For instance, sectors like technology and renewable energy are experiencing robust expansion, driving a higher demand for specialized executive talent. In contrast, some traditional industries might exhibit more moderate growth, leading to a potentially slower pace of executive recruitment.

Caldwell Partners International needs to meticulously track these industry-specific economic trends to strategically deploy its resources. By focusing on sectors demonstrating strong demand for executive talent, such as the rapidly evolving AI and sustainable energy markets, the firm can optimize its service allocation and capitalize on emerging opportunities. For example, the global renewable energy market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow significantly, indicating a strong need for experienced leaders in this field.

- Technology Sector Growth: The global IT services market is expected to reach $1.5 trillion by 2024, signaling continued demand for tech executives.

- Renewable Energy Expansion: Investments in clean energy are projected to exceed $2 trillion globally by 2030, creating a need for leadership in this sector.

- Healthcare Innovation: The life sciences sector continues to see innovation, with biotech and pharma companies actively seeking experienced executives to drive R&D and market entry.

Economic factors significantly shape Caldwell Partners' operating environment. Global economic growth, projected at 3.2% for 2024 by the IMF, indicates a moderating but resilient landscape, influencing corporate confidence and talent investment. However, recessionary pressures and high inflation, at 3.4% year-over-year in the US as of April 2024, increase operational costs and can shrink client budgets for executive recruitment. Rising interest rates, with the Federal Reserve maintaining its target range at 5.25%-5.50% through mid-2024, dampen M&A activity, a key driver for executive transitions and Caldwell's business.

| Economic Indicator | Value/Projection (2024/Early 2025) | Impact on Caldwell Partners |

|---|---|---|

| Global GDP Growth | 3.2% (IMF Projection) | Influences corporate confidence and demand for executive roles. |

| US Inflation Rate (YoY) | 3.4% (April 2024) | Increases operational costs and can reduce client spending on recruitment. |

| Federal Funds Rate Target | 5.25%-5.50% (Mid-2024) | Dampens M&A activity, a key demand driver for executive search. |

| Global M&A Deal Volume (Q1 2024) | Approx. $800 billion | Indicates increased opportunities for executive placements due to corporate consolidation. |

Preview Before You Purchase

Caldwell Partners International PESTLE Analysis

The preview you see here is the exact Caldwell Partners International PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Caldwell Partners International, providing valuable strategic insights.

Sociological factors

The global workforce is experiencing significant generational shifts, with the aging executive population necessitating robust succession planning. For instance, in 2024, a substantial portion of C-suite executives in North America were over 55, highlighting a critical need for identifying and developing future leaders. Caldwell Partners must navigate this by understanding the unique expectations and skillsets of emerging generations, like Gen Z, who are increasingly entering leadership roles with a focus on digital fluency and social responsibility.

The increasing societal and corporate emphasis on Diversity, Equity, and Inclusion (DEI) is a significant factor influencing executive search. Clients are actively seeking diverse candidate slates for leadership and board positions. For instance, a 2024 survey by Deloitte found that 70% of organizations consider DEI a top priority for their talent acquisition strategies.

Caldwell Partners International needs to showcase its proficiency in identifying and evaluating diverse candidates. This involves ensuring their recruitment methodologies are inherently inclusive and fair. Firms adept at navigating broader talent pools are better positioned to meet this growing demand.

This trend directly benefits specialized executive search firms like Caldwell, as companies increasingly outsource their DEI-focused recruitment needs. The ability to access and vet a wider range of candidates is becoming a critical differentiator in the market.

Executives today, much like their teams, are placing greater emphasis on elements beyond just salary. Work-life balance, a sense of purpose in their work, and leaders who demonstrate strong ethical principles are becoming increasingly important. For instance, a 2024 survey by Robert Half found that 58% of professionals would consider leaving a job for one that offered better work-life balance.

Caldwell Partners needs to grasp these shifting priorities to not only attract premier talent to their own firm but also to guide their clients in designing leadership positions that genuinely appeal to today's executives. This means understanding how a company's culture and core values resonate with the aspirations of senior leaders.

Talent Scarcity in Specialized and Digital Roles

The accelerating pace of technological advancement, especially in areas like artificial intelligence and cybersecurity, has led to a significant shortage of executives possessing highly specialized skills. This talent scarcity directly elevates the importance of Caldwell Partners' expertise in pinpointing and recruiting niche executive talent, as organizations increasingly struggle to fill these critical roles.

This dynamic environment necessitates that Caldwell Partners consistently refine its executive search strategies. The firm must evolve its methods to effectively locate leaders capable of navigating the complexities and constant shifts within modern business landscapes, ensuring clients secure individuals with forward-thinking capabilities.

- Talent Gap: By 2025, the World Economic Forum projects that 50% of all employees will need reskilling, with digital skills being paramount.

- Demand for AI/Cybersecurity Leaders: Global spending on cybersecurity is expected to reach $231.4 billion in 2025, driving demand for specialized leadership.

- Executive Search Value: The average time to fill executive positions in specialized tech roles can exceed 90 days, highlighting the value of efficient recruitment.

Executive Compensation and Performance Expectations

Societal views on executive pay are increasingly focused on fairness and performance linkage. In 2024, for instance, proxy advisory firms continued to push for greater alignment between executive compensation and long-term shareholder value, with a significant number of companies facing shareholder votes on executive pay packages. Caldwell Partners must guide clients in structuring compensation that not only attracts elite talent but also withstands this heightened scrutiny, reflecting a societal demand for accountability.

The evolving landscape of performance expectations for C-suite executives is a critical sociological factor. Beyond traditional financial metrics, there's a growing emphasis on Environmental, Social, and Governance (ESG) performance, diversity and inclusion, and stakeholder management. For example, a 2025 report indicated that over 70% of S&P 500 companies now include some form of ESG metric in their executive compensation plans, a trend Caldwell Partners needs to expertly navigate for its clients.

- Societal Demand for Fairness: Public perception and shareholder activism increasingly scrutinize executive pay ratios and the justification for high compensation.

- Performance Metric Evolution: ESG and stakeholder-related goals are becoming as important as financial results in executive performance evaluations and pay.

- Attracting Top Talent: Caldwell Partners must advise on compensation structures that remain competitive while adhering to evolving societal expectations.

- Accountability and Transparency: A strong emphasis is placed on clear communication and justification of executive compensation decisions to all stakeholders.

Societal expectations for executive conduct and corporate responsibility are increasingly stringent. In 2024, public and media scrutiny of executive behavior, particularly concerning ethical lapses and social impact, intensified. Caldwell Partners must therefore prioritize candidates with demonstrable integrity and a commitment to positive societal contributions, aligning with a growing demand for accountable leadership.

Technological factors

The recruitment landscape is rapidly evolving with AI and machine learning. By 2024, it's estimated that AI will handle over 70% of initial candidate screening, a significant jump from previous years. This technological shift offers Caldwell Partners a chance to boost efficiency in sourcing and preliminary assessments.

However, the core of executive search, especially for C-suite positions, remains deeply human. Caldwell Partners' strength lies in its ability to gauge nuanced aspects like cultural fit, leadership intangibles, and strategic alignment, areas where AI currently falls short. The firm needs to strategically integrate AI to optimize processes while preserving its high-touch, expert-driven approach.

Advanced data analytics are revolutionizing how Caldwell Partners assesses talent and understands market dynamics. By leveraging sophisticated tools, the firm can delve deeper into candidate profiles, identifying subtle indicators of success and potential cultural fit, thereby improving search precision. This analytical prowess allows them to pinpoint emerging market trends and predict future talent requirements with greater accuracy.

The strategic application of data analytics by Caldwell Partners enables them to identify patterns associated with effective leadership within specific industries. This insight is crucial for advising clients on the qualities to seek in new hires and for predicting future talent needs. For instance, by analyzing compensation benchmarks derived from vast datasets, they can ensure clients offer competitive packages, a critical factor in attracting top-tier talent in the competitive 2024-2025 market.

Caldwell Partners' capacity to interpret and act upon these data-driven insights provides a significant competitive advantage in strategic talent advisory. Their ability to translate complex data into actionable recommendations allows them to offer clients a more precise and effective approach to executive search and talent management, particularly in a rapidly evolving economic landscape.

The surge in virtual collaboration tools, like Zoom and Microsoft Teams, has fundamentally reshaped executive search. Caldwell Partners can now tap into a global talent pool, conducting interviews and assessments seamlessly across borders. This trend saw a significant uptick in 2024, with many companies reporting increased efficiency in remote hiring processes.

This shift also presents a strategic opportunity for Caldwell Partners to advise clients on building and managing effective remote leadership teams. As of early 2025, a substantial percentage of companies are operating with hybrid models, demanding new leadership competencies focused on virtual engagement and distributed team management.

Cybersecurity Risks and Data Privacy in Executive Search

Cybersecurity risks are a major technological concern for Caldwell Partners, as the firm handles highly sensitive personal data of executive candidates and confidential client information. Protecting this data from breaches is not just a technical challenge but a fundamental requirement for maintaining trust. In 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial and reputational stakes involved.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is critical. Caldwell Partners must ensure its systems and processes meet these stringent requirements to avoid significant penalties and legal repercussions. Failure to do so can severely damage client confidence and the firm's standing in the industry.

- Data Breach Costs: The average cost of a data breach globally was $4.45 million in 2024.

- Regulatory Compliance: Adherence to GDPR and CCPA is essential for data privacy.

- Reputational Impact: Secure data handling directly influences client trust and firm reputation.

Digital Transformation and its Impact on Executive Roles

The relentless pace of digital transformation is fundamentally reshaping executive responsibilities. Leaders now need not just strategic vision, but also deep digital fluency, a knack for fostering innovation, and the ability to expertly navigate organizational change. Caldwell Partners must pinpoint candidates who possess these critical skills to steer companies through the disruptive currents of technological advancement.

This necessitates a rigorous evaluation of a candidate's adaptability and their capacity to anticipate future digital trends. For instance, a 2024 report by McKinsey indicated that 70% of CEOs believe digital transformation is their top priority, highlighting the urgent need for digitally adept leadership.

- Digital Literacy: Executives must understand emerging technologies like AI, cloud computing, and data analytics.

- Innovation Mindset: The ability to foster a culture of experimentation and embrace new digital solutions is paramount.

- Change Management: Leading teams through digital adoption and overcoming resistance is a key differentiator.

- Adaptability: Candidates must demonstrate a proven track record of learning and evolving alongside technological shifts.

Technological advancements, particularly in AI and data analytics, are transforming executive search. Caldwell Partners can leverage these tools to enhance efficiency in candidate screening and talent assessment, as AI is projected to handle over 70% of initial screenings by 2024. The firm's ability to interpret complex data allows for more precise identification of leadership qualities and market talent needs, a critical advantage in the 2024-2025 landscape.

Virtual collaboration tools have expanded Caldwell Partners' reach to a global talent pool, facilitating seamless cross-border recruitment. This trend, which saw significant growth in 2024, also positions the firm to advise clients on managing effective remote leadership teams, a growing necessity as many companies adopt hybrid models in early 2025.

Cybersecurity and data privacy are paramount concerns, given the sensitive information handled. The global average cost of a data breach in 2024 was $4.45 million, highlighting the financial and reputational risks. Strict adherence to regulations like GDPR and CCPA is essential for maintaining client trust and avoiding penalties.

The evolving digital landscape demands executives with strong digital fluency and adaptability. With 70% of CEOs prioritizing digital transformation in 2024, Caldwell Partners must identify leaders capable of navigating technological change and fostering innovation.

| Technological Factor | Impact on Caldwell Partners | Key Data/Trends (2024-2025) |

| AI in Recruitment | Automates initial screening, increases efficiency | AI to handle >70% of initial candidate screening by 2024 |

| Data Analytics | Improves talent assessment, predicts future needs | Enhanced precision in identifying leadership skills and market trends |

| Virtual Collaboration | Expands global talent access, enables remote hiring | Increased efficiency in remote hiring processes reported in 2024 |

| Cybersecurity & Data Privacy | Manages sensitive data, ensures regulatory compliance | Average data breach cost: $4.45M (2024); GDPR/CCPA compliance critical |

| Digital Transformation | Requires digitally fluent and adaptable leaders | 70% of CEOs prioritize digital transformation (2024) |

Legal factors

Caldwell Partners, operating globally, navigates a complex tapestry of employment laws. This includes complying with diverse hiring practices, non-discrimination statutes, and compensation regulations across multiple jurisdictions. For instance, in 2024, the European Union continued to strengthen its General Data Protection Regulation (GDPR) implications for employee data management, impacting how Caldwell handles sensitive information across its European offices.

Adherence to these varied labor regulations is paramount for avoiding costly legal disputes and upholding the firm's reputation. Failure to comply can lead to significant fines; for example, the US Department of Labor reported over $1 billion in back wages recovered for workers due to wage and hour violations in fiscal year 2023 alone.

The firm must remain vigilant regarding evolving employment legislation in each market it serves. Staying abreast of these changes, such as potential shifts in minimum wage laws or new parental leave mandates observed in several North American and Asian markets during 2024, is crucial for maintaining operational integrity and employee trust.

Caldwell Partners International must navigate a complex web of data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA). These laws mandate stringent handling of sensitive personal data belonging to executives and clients, requiring secure storage, processing, and transfer mechanisms.

Failure to comply with these evolving data protection laws can result in substantial financial penalties; for instance, GDPR violations can incur fines of up to 4% of global annual turnover or €20 million, whichever is higher. This underscores the critical need for Caldwell Partners to implement robust data governance frameworks to safeguard against legal repercussions and protect its reputation.

Anti-discrimination laws, such as the Age Discrimination in Employment Act (ADEA) and Title VII of the Civil Rights Act, are foundational for Caldwell Partners. These statutes mandate that hiring and promotion decisions must be free from bias related to age, sex, race, religion, or disability. In 2024, a renewed focus on equitable representation in leadership means adherence to these laws is critical for maintaining a strong reputation and avoiding costly litigation.

Caldwell Partners must actively ensure its search processes, from candidate sourcing to final recommendations, are demonstrably fair and promote equal opportunity. This includes reviewing job descriptions for biased language and training recruiters on unconscious bias mitigation. Companies that prioritize diversity, equity, and inclusion (DEI) are increasingly sought after by top talent, with studies in 2024 showing a significant percentage of job seekers considering a company's DEI commitment when evaluating opportunities.

Corporate Governance and Board Composition Regulations

Legal frameworks governing corporate governance, such as those mandating board independence and defining director duties, directly shape the criteria for executive searches. Caldwell Partners must stay abreast of these regulations to guide clients in building compliant and effective leadership teams.

For instance, in 2024, many jurisdictions continue to refine rules around ESG (Environmental, Social, and Governance) reporting, which increasingly influences the demand for board members with specific expertise in these areas. These evolving legal landscapes can create new opportunities and requirements for specialized board and C-suite talent.

- Director Independence: Many stock exchanges, like the NYSE and Nasdaq, require a majority of independent directors on listed companies' boards.

- Executive Accountability: Regulations like Sarbanes-Oxley (SOX) in the US impose strict accountability on CEOs and CFOs for financial reporting.

- ESG Mandates: Emerging regulations globally are pushing for greater transparency and accountability in corporate ESG performance, impacting board composition.

- Diversity Quotas: Some countries, like France and Norway, have implemented quotas for gender diversity on corporate boards, influencing search mandates.

Contract Law and Professional Services Agreements

Caldwell Partners International, like any professional services firm, relies heavily on robust contract law to govern its executive search and advisory engagements. Understanding the nuances of terms of engagement, fee structures, and crucial confidentiality clauses is paramount. For instance, in 2024, the global legal services market was valued at approximately $750 billion, highlighting the extensive legal framework businesses operate within.

The firm's engagement agreements must be meticulously drafted to clearly define scope, deliverables, and payment terms, ensuring legal enforceability. Liability provisions are also critical, protecting both Caldwell Partners and its clients from unforeseen issues. In 2025, regulatory scrutiny on service agreements, particularly concerning data privacy and intellectual property, is expected to intensify, making compliance a key focus.

- Contractual Clarity: Ensuring all terms of engagement, from search scope to fee structures, are clearly defined and legally binding.

- Confidentiality Obligations: Upholding strict confidentiality clauses to protect sensitive client and candidate information, a critical aspect of executive search.

- Liability Management: Implementing well-defined liability provisions within agreements to mitigate potential risks and disputes.

- Regulatory Compliance: Adapting contracts to meet evolving legal standards, including those related to data protection and employment law, which saw significant updates in late 2024.

Caldwell Partners must navigate a complex landscape of employment laws across its global operations, ensuring compliance with hiring practices, non-discrimination statutes, and compensation regulations. For instance, in 2024, the EU's continued strengthening of GDPR impacted how the firm manages employee data across Europe, with potential fines for violations reaching up to 4% of global annual turnover.

Adherence to anti-discrimination laws, such as the ADEA and Title VII, is critical for fair hiring and promotion, especially with a renewed 2024 focus on equitable representation in leadership. Companies prioritizing DEI are increasingly attractive to top talent, as indicated by 2024 surveys showing a significant percentage of job seekers considering a company's DEI commitment.

Corporate governance regulations, including those mandating board independence and defining director duties, directly influence executive search criteria. Evolving rules around ESG reporting in 2024 are also shaping demand for board members with specific expertise in these areas, creating new opportunities for specialized talent.

Robust contract law governs Caldwell Partners' engagements, requiring clear terms, fee structures, and confidentiality clauses. As regulatory scrutiny on service agreements, particularly concerning data privacy, intensifies into 2025, meticulous contract drafting and compliance remain paramount for mitigating risks.

Environmental factors

The growing emphasis on Environmental, Social, and Governance (ESG) principles is reshaping executive search, with clients actively seeking leaders adept at sustainability and ethical practices. Caldwell Partners is seeing a significant rise in demand for executives who can champion ESG integration, reflecting a broader corporate shift towards responsible business operations.

This strategic imperative means identifying leaders capable of navigating intricate environmental regulations and social impact considerations, ensuring long-term value creation. For instance, a 2024 report indicated that over 70% of investors consider ESG factors when making investment decisions, underscoring the need for executives with proven ESG leadership.

Companies are increasingly embedding sustainability into their core strategies, a trend that directly influences leadership recruitment. For instance, a 2024 survey by Gartner found that 60% of CEOs believe ESG (Environmental, Social, and Governance) factors are critical to their company's long-term value creation.

This means Caldwell Partners must identify leaders who not only possess traditional business acumen but also demonstrate a genuine commitment to environmental stewardship, such as driving carbon reduction targets or championing circular economy models. Executives are now evaluated on their ability to integrate these responsibilities into business operations.

The demand for such leaders is growing; a 2025 report by the World Economic Forum highlights that companies with strong ESG performance are projected to outperform their peers by 10-15% in market capitalization.

Climate change is fundamentally reshaping industries, from energy production to agriculture, presenting both significant risks and novel opportunities. This necessitates leadership with specialized skills to navigate these evolving landscapes. For instance, the global renewable energy sector, a direct response to climate concerns, saw investment reach an estimated $600 billion in 2023, highlighting a major shift.

Caldwell Partners must actively consider how climate-related risks and the development of adaptation strategies are influencing the demand for executive talent across various sectors. Identifying leaders adept at driving innovation and steering organizations through climate-induced transitions is paramount.

Sectors heavily impacted by climate change, such as insurance and real estate, are increasingly seeking executives with expertise in risk management and sustainable practices. The financial services industry alone is projected to see a significant rise in demand for climate risk analysts and sustainability officers in the coming years, with some reports suggesting a 30% increase by 2025.

Remote Work's Environmental Impact and Office Footprint

The increasing adoption of remote and hybrid work models, partly driven by environmental concerns like reducing commuting emissions, directly affects Caldwell Partners' operational footprint. For instance, a 2024 report indicated that the average employee in a hybrid model commutes 30% less than a fully in-office worker, translating to significant carbon reduction. This shift allows Caldwell Partners to leverage virtual tools for talent searches, potentially cutting down on travel-related emissions and associated costs. The firm can also advise clients on structuring leadership teams for distributed workforces, promoting a more sustainable operational model.

This environmental trend also reshapes corporate real estate strategies. As companies re-evaluate their office space needs in light of hybrid work, the demand for large, centralized offices may decrease, leading to a potential reduction in the embodied carbon associated with new construction and the energy consumption of large facilities. Caldwell Partners, as a talent acquisition firm, is positioned to guide clients through these evolving real estate decisions, helping them find leadership that can effectively manage a more flexible and potentially environmentally conscious workspace.

- Reduced Commuting Emissions: Hybrid work models can lead to substantial cuts in greenhouse gas emissions from employee travel.

- Virtual Recruitment Tools: Caldwell Partners can minimize its own travel footprint by utilizing advanced virtual collaboration platforms for candidate sourcing and interviews.

- Optimizing Distributed Workforces: The firm can assist clients in identifying leaders skilled in managing remote and hybrid teams, fostering operational efficiency and sustainability.

- Evolving Real Estate Needs: The environmental impact of office spaces is becoming a key consideration for businesses, influencing decisions on physical footprints and energy consumption.

Regulatory Pressure for Environmental Compliance

Governments globally are tightening environmental rules, pushing companies to meet new benchmarks for pollution, waste handling, and resource use. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will directly impact industries by taxing carbon emissions on imported goods, requiring businesses to demonstrate robust environmental compliance strategies.

This regulatory shift necessitates leaders with deep understanding of environmental laws and the ability to embed sustainable practices into core operations. Caldwell Partners, therefore, needs to identify and place executives skilled in navigating these complex compliance landscapes and championing environmental responsibility within client organizations.

The increasing focus on Environmental, Social, and Governance (ESG) factors means that businesses failing to adapt face not only penalties but also reputational damage and investor scrutiny. In 2024, over 90% of S&P 500 companies reported on ESG metrics, highlighting the growing importance of environmental stewardship in corporate strategy.

- Increased fines for non-compliance: Environmental violations can lead to significant financial penalties, impacting profitability.

- Demand for ESG expertise: Companies are actively seeking leaders who can integrate sustainability into their business models.

- Global regulatory convergence: International agreements are driving more consistent environmental standards across industries.

- Investor pressure: Asset managers are increasingly prioritizing companies with strong environmental track records.

The increasing global focus on sustainability and climate action is a significant environmental factor influencing executive search. Caldwell Partners is observing a heightened demand for leaders who can integrate environmental, social, and governance (ESG) principles into their strategies, with over 70% of investors in 2024 considering ESG factors in their decisions. This trend is driving the need for executives adept at navigating complex environmental regulations and championing sustainable business practices, as evidenced by Gartner's 2024 finding that 60% of CEOs view ESG as critical for long-term value.

Climate change itself is a major driver, creating both risks and opportunities across sectors like energy and agriculture, with renewable energy investments reaching an estimated $600 billion in 2023. Caldwell Partners must identify leaders capable of managing climate-related risks and driving innovation in adaptation strategies, especially in industries like insurance and real estate where demand for climate risk expertise is projected to rise by 30% by 2025.

The rise of remote and hybrid work models, partly due to environmental concerns like reduced commuting emissions, is also reshaping operational footprints. A 2024 report indicated a 30% reduction in commuting for hybrid workers, a trend Caldwell Partners can leverage through virtual tools, thereby minimizing travel-related emissions. This shift also impacts corporate real estate strategies, pushing companies to re-evaluate their physical footprints and energy consumption, creating a need for leaders who can manage more flexible and environmentally conscious workspaces.

Stricter environmental regulations worldwide, such as the EU's 2026 Carbon Border Adjustment Mechanism, are compelling businesses to enhance their environmental compliance. Caldwell Partners is therefore tasked with finding executives who possess a deep understanding of environmental laws and can embed sustainable practices, as failing to adapt can lead to penalties and reputational damage, with over 90% of S&P 500 companies reporting on ESG metrics in 2024.

| Environmental Factor | Impact on Caldwell Partners | Relevant Data (2024-2025) |

|---|---|---|

| ESG Integration | Increased demand for leaders with sustainability expertise. | 70% of investors consider ESG; 60% of CEOs see ESG as critical for value (Gartner, 2024). |

| Climate Change | Need for leaders skilled in risk management and adaptation. | $600 billion invested in renewables (2023); 30% projected increase in climate risk roles by 2025. |

| Hybrid Work Models | Opportunities for reduced operational footprint and advising clients on distributed teams. | 30% less commuting in hybrid models (2024 report); focus on sustainable real estate strategies. |

| Environmental Regulations | Requirement for executives with strong compliance and sustainability knowledge. | EU CBAM implementation (2026); 90%+ S&P 500 companies reporting ESG (2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from leading international organizations, government publications, and reputable industry research firms. We integrate economic indicators, regulatory updates, technological advancements, and socio-cultural trends from these trusted sources to provide a comprehensive overview.