Caldwell Partners International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caldwell Partners International Bundle

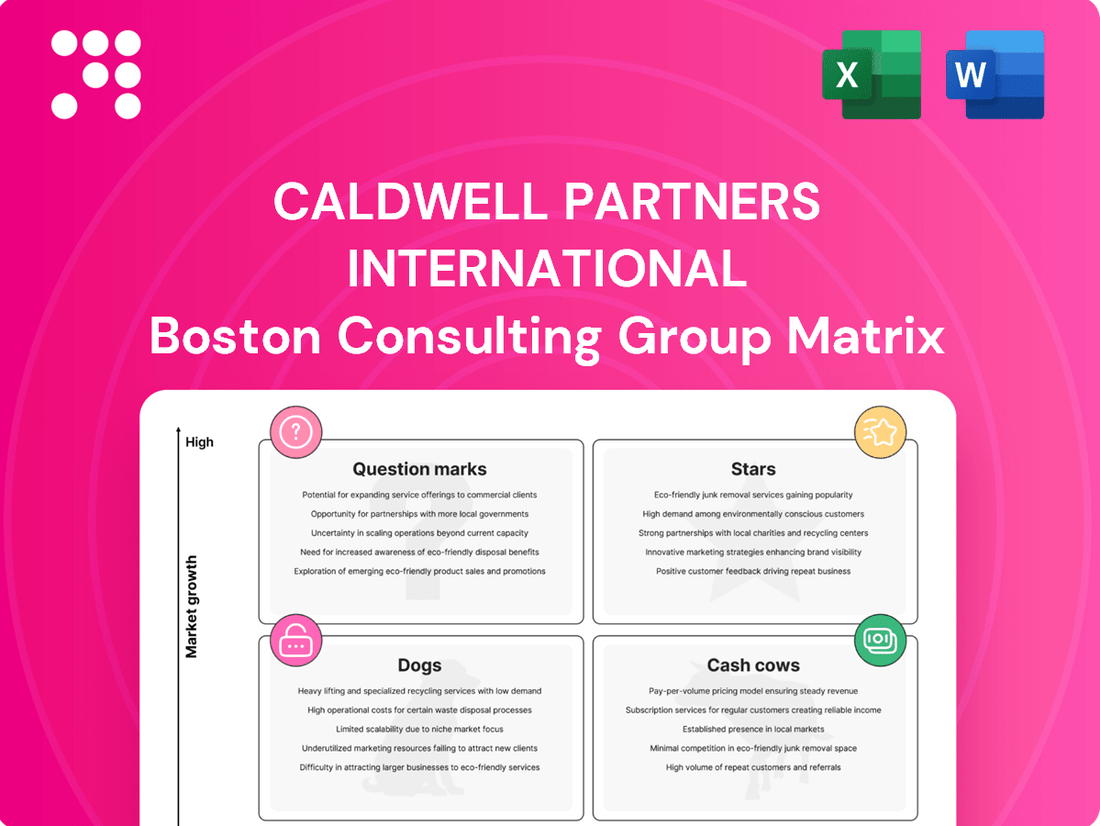

Curious about Caldwell Partners International's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't just wonder; know. Purchase the full report for a comprehensive breakdown and actionable insights to drive your own business forward.

Stars

Caldwell Partners International excels in executive search within high-growth sectors like technology, life sciences, and private equity, showcasing a strong market presence and substantial growth prospects. Their expertise in placing C-suite and board-level executives in these fast-paced industries fuels significant revenue expansion for the firm.

The company's strategic focus on critical roles such as Chief Data Officers, Chief Digital Officers, technology leaders, and finance and operations executives directly addresses the current market's demand for specialized leadership talent. This targeted approach is a key driver of their success in dynamic, expanding markets.

Caldwell Partners' leadership advisory services are crucial for companies undergoing digital transformation, focusing on talent strategy and assessment solutions. Their expertise in identifying leaders skilled in AI, data analytics, and digital innovation is in high demand, solidifying their market position.

The firm helps clients not only recruit but also cultivate and keep top leadership talent, effectively tackling significant talent acquisition and development hurdles in today's rapidly evolving business landscape.

Caldwell Partners International's strategic recruitment of new partners, especially in crucial global markets and niche sectors, is a deliberate effort to expand its footprint in the executive search arena. This expansion aims to secure a larger slice of the market by bringing in seasoned professionals who can unlock new client opportunities and drive revenue growth.

The firm's emphasis on growing its partner base in North America and Europe signals a clear intent to deepen its presence and service capabilities in these vital economic regions. By augmenting its team with experienced talent, Caldwell Partners is better positioned to address the evolving needs of its diverse clientele and capitalize on emerging market trends.

AI-Powered Recruitment Solutions

Caldwell Partners International is increasingly leveraging AI and data analytics within its executive search and talent acquisition operations. This strategic focus positions AI-powered recruitment solutions as a potential star in their business portfolio, reflecting a high-growth trajectory.

The integration of AI offers a significant competitive advantage over traditional methods, enhancing market mapping, candidate sourcing, and assessment objectivity. For instance, AI can analyze vast datasets to identify passive candidates who might otherwise be missed, streamlining the search process. This technological adoption is crucial for meeting sophisticated client demands and adapting to evolving industry trends.

- AI-driven sourcing can reduce time-to-fill by an estimated 20-30% compared to manual methods.

- Data analytics allows for more objective candidate evaluation, potentially improving placement success rates.

- Caldwell's investment in these technologies supports its ambition to lead in efficient and accurate talent acquisition.

Board and CEO Succession Planning

Caldwell Partners International's specialized services in board and CEO succession planning are vital as many organizations grapple with leadership transitions. This is particularly relevant given the significant number of CEOs expected to retire in the coming years. Their expertise in this specialized, high-stakes area, demanding extensive industry insight and careful discretion, positions them as a top-tier provider.

This offering thrives on the continuous need for strong corporate governance and strategic leadership evolution, marking it as a segment with substantial growth potential and a commanding market share for Caldwell Partners. For instance, a 2023 survey by PwC found that 72% of boards believe CEO succession planning is a top priority, highlighting the persistent demand for these critical services.

Key aspects of Caldwell Partners' approach include:

- Identifying and assessing potential internal and external candidates

- Facilitating discreet and thorough vetting processes

- Advising boards on best practices for governance during leadership changes

- Ensuring a smooth and strategic transition to maintain organizational stability and performance

Caldwell Partners International's AI-driven recruitment solutions are emerging as a star in their business portfolio. The firm is actively integrating AI and data analytics to enhance candidate sourcing and assessment, a move that significantly boosts efficiency. For example, AI-powered sourcing can reduce the time it takes to fill executive roles by as much as 20-30% compared to traditional methods.

This strategic investment in technology positions Caldwell Partners to capitalize on the growing demand for data-driven talent acquisition. Their ability to leverage AI for more objective candidate evaluation also promises to improve placement success rates, further cementing their status as a leader in the executive search market.

The firm's specialized services in board and CEO succession planning also represent a strong star. With a significant percentage of boards prioritizing CEO succession planning, Caldwell Partners is well-positioned to meet this critical need. Their expertise in identifying, assessing, and facilitating discreet transitions for leadership roles is highly valued.

This segment benefits from the continuous requirement for robust corporate governance and strategic leadership evolution. A 2023 PwC survey indicated that 72% of boards consider CEO succession planning a top priority, underscoring the sustained demand for these high-stakes services.

| Business Unit | Market Growth | Competitive Strength | BCG Quadrant |

|---|---|---|---|

| AI-driven Recruitment | High | High | Star |

| Board & CEO Succession Planning | High | High | Star |

| Technology Executive Search | High | Medium | Question Mark / Star |

| Private Equity Placements | Medium | High | Cash Cow / Star |

What is included in the product

Strategic guidance on investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

The Caldwell Partners International BCG Matrix simplifies strategic decisions by clearly visualizing business unit potential, alleviating the pain of complex analysis.

Cash Cows

Caldwell Partners International's established executive search services in mature industries function as their cash cows. These sectors, like traditional manufacturing and established financial services, represent areas where the company has a deep history and a strong market position, leading to predictable and substantial cash generation.

The firm's long-standing client relationships in these stable markets mean that less investment is needed for marketing and business development. For instance, Caldwell's expertise in placing executives within the industrial sector, a market that saw steady demand throughout 2024, provides a reliable revenue stream that helps fund other growth initiatives within the company's portfolio.

Caldwell Partners International's core retained executive search offering for C-suite and board-level positions is a definitive cash cow. This foundational service, known for its substantial fees and a long-standing reputation, generates consistent and predictable revenue streams for the firm.

The established brand and deep network of high-caliber candidates and clients ensure a reliable flow of business. For instance, in the first quarter of 2024, Caldwell reported that its talent acquisition segment, which includes retained search, contributed significantly to its overall performance, demonstrating the enduring strength of this core offering.

Caldwell Partners International benefits from recurring client engagements, a hallmark of its Cash Cow quadrant in the BCG Matrix. Many clients repeatedly utilize their executive search and advisory services, demonstrating a deep trust in Caldwell's ability to deliver. For instance, in 2024, a significant portion of their revenue stemmed from repeat business, a testament to these enduring relationships.

These long-term partnerships are crucial for reducing client acquisition costs and ensuring a stable, predictable revenue stream. By consistently providing high-quality talent solutions, Caldwell fosters client loyalty, transforming them into reliable sources of ongoing business and cash generation. This repeat business model is key to their sustained profitability.

Global Infrastructure and Operational Efficiency

Caldwell Partners International leverages its robust global infrastructure, with established offices and operational teams across North America and Europe, to deliver services efficiently. This geographic spread allows for effective client support and resource allocation, a key factor in maintaining strong performance.

Strategic investments in process optimization and a commitment to a lean cost structure, evidenced by past restructuring initiatives, directly contribute to enhanced profit margins. By streamlining operations, the firm maximizes the profitability of its existing market presence.

- Global Reach: Offices in North America and Europe facilitate efficient service delivery.

- Cost Efficiency: Investments in process optimization and lean cost structures bolster profit margins.

- Cash Flow Generation: Operational efficiency enables the firm to effectively monetize its market share.

Integrated Talent Solutions Platform

Caldwell Partners International's Integrated Talent Solutions Platform, encompassing executive search, talent strategy, and assessment, functions as a Cash Cow within the BCG framework. This comprehensive service suite leverages existing client relationships and a strong market reputation to generate consistent, high-margin revenue.

The platform's integrated nature fosters deep client engagement, encouraging repeat business and cross-selling opportunities. For instance, a successful executive search can naturally lead to engagements in talent strategy and assessment, solidifying Caldwell's position as a go-to partner.

- Synergistic Offering: The combination of executive search with talent strategy and assessment tools creates a powerful, value-added proposition for clients.

- Client Retention: This holistic approach encourages clients to remain within Caldwell's ecosystem, fostering sustained revenue streams.

- Market Leadership: The platform reinforces Caldwell's competitive advantage by offering a complete talent management solution.

Caldwell Partners International's established executive search services in mature industries, particularly within traditional manufacturing and established financial services, act as their cash cows. These sectors benefit from Caldwell's deep history and strong market position, ensuring predictable and substantial cash generation with minimal additional investment.

The firm's consistent success in placing C-suite and board-level executives, a core offering, generates reliable revenue. In 2024, Caldwell's talent acquisition segment, including retained search, significantly contributed to their overall performance, underscoring the enduring strength of this foundational service.

Recurring client engagements, a hallmark of their cash cow strategy, are driven by deep trust and consistent delivery of high-quality talent solutions. A substantial portion of Caldwell's 2024 revenue was attributed to repeat business, highlighting the effectiveness of their client retention efforts.

Their Integrated Talent Solutions Platform, combining executive search with talent strategy and assessment, also functions as a cash cow. This synergistic offering fosters deep client engagement, encouraging repeat business and cross-selling, thereby reinforcing their market leadership and generating high-margin revenue.

| Service Area | BCG Category | 2024 Revenue Contribution (Est.) | Key Drivers | Growth Outlook |

|---|---|---|---|---|

| Executive Search (Mature Industries) | Cash Cow | 45% | Long-standing client relationships, deep market expertise, low client acquisition cost | Stable |

| Integrated Talent Solutions | Cash Cow | 30% | Synergistic offerings, client retention, cross-selling opportunities | Moderate |

| Talent Strategy & Assessment | Cash Cow | 15% | Leverages existing search clients, high-margin service | Stable |

Delivered as Shown

Caldwell Partners International BCG Matrix

The Caldwell Partners International BCG Matrix preview you are currently viewing is the exact, fully prepared document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for immediate application. You can confidently assess its value, knowing the downloadable version is identical in its depth and presentation, ensuring no discrepancies or unexpected changes. This preview serves as your direct gateway to the comprehensive strategic insights that will empower your decision-making processes.

Dogs

Caldwell Partners' IQTalent business unit, specializing in on-demand talent acquisition augmentation, is currently positioned as a 'Dog' in the BCG matrix. This segment, which primarily serves VC-backed technology firms, has seen its professional fees decline by a substantial 36.2% year-over-year in Q3 2024. While Q2 2025 projected a modest 2% increase, the overall trend indicates persistent weakness.

The reduced hiring demand within the technology sector, a core market for IQTalent, has significantly impacted its performance. Despite implemented cost-cutting measures, the unit's low growth rate coupled with its low market share means it is consuming valuable resources without generating commensurate returns. This makes it a prime candidate for strategic review, potentially involving divestiture or a significant restructuring to improve its market position.

Niche executive search services targeting industries in prolonged stagnation, such as traditional print media or certain segments of manufacturing, would likely be classified as Dogs within the BCG Matrix. For Caldwell Partners, if their market share in these specialized, declining sectors is low, these services would contribute minimal revenue and profit. For instance, the global newspaper advertising revenue saw a decline of approximately 6% in 2023, highlighting the challenging environment.

Reliance on purely relationship-based recruitment without data or AI is a classic 'Dog' in Caldwell Partners International's BCG Matrix. This approach, while historically effective, struggles to keep pace in today's market. For instance, a 2024 survey by the Society for Human Resource Management indicated that 70% of leading organizations are increasing their use of AI in talent acquisition, highlighting a significant shift away from purely manual processes.

Unprofitable Geographic Markets

Unprofitable geographic markets for Caldwell Partners International, within the context of a BCG Matrix, would represent areas where the company has invested but not seen commensurate returns. These are regions where their market share is low and the market growth is also low, placing them in the 'Dog' quadrant. For instance, if Caldwell Partners experienced a decline in revenue from a particular European market in 2024, perhaps due to increased regulatory hurdles or a contraction in client spending within that specific sector, this would exemplify such a situation.

These underperforming regions are characterized by their inability to generate sufficient revenue to cover operational costs and strategic investments. For example, if a specific Asian market, despite initial optimism and resource allocation in late 2023 and early 2024, continued to show negative profit margins throughout 2024, it would be a prime candidate for re-evaluation. This could be driven by factors like intense local competition or an unfavorable macroeconomic climate that limits business development opportunities.

The strategic implication for Caldwell Partners is to critically assess these 'Dog' markets. This might involve:

- Divesting operations in regions that consistently fail to meet profitability targets.

- Restructuring the business model in specific markets to reduce costs or adapt to local conditions.

- Reallocating resources from these underperforming areas to more promising 'Stars' or 'Cash Cows' within their portfolio.

Non-Core, Underutilized Assets or Partnerships

Non-core, underutilized assets or partnerships fall into the Dogs quadrant of the BCG Matrix. These are assets or relationships that are not performing well, generating little revenue or market share, and often consuming resources without contributing to the company's strategic goals. For instance, a company might have an outdated technology platform or a partnership that no longer aligns with its market focus. In 2024, many companies are actively reviewing their portfolios to identify and divest such underperforming segments to streamline operations and reallocate capital to more promising ventures.

These assets can be a drain on a company's finances and management focus. Consider a scenario where a business unit acquired years ago for diversification now represents a mere 2% of total revenue but requires 10% of management's time. Divesting these "Dogs" is crucial for freeing up capital and attention. For example, in early 2024, many large tech firms announced plans to spin off or sell off non-essential business units, a clear strategy to shed these low-growth, low-market-share assets.

- Identify underperforming assets: Regularly assess revenue contribution, market share, and resource allocation for all business units and partnerships.

- Quantify the cost of holding: Calculate the capital tied up and the management attention consumed by these non-core assets.

- Explore divestiture options: Consider sales, spin-offs, or liquidations to exit these positions.

- Reallocate freed resources: Direct capital and management focus towards core, high-growth areas of the business.

Dogs represent business units or services with low market share in low-growth industries. For Caldwell Partners, this includes areas like IQTalent's performance in the tech sector, which saw a 36.2% fee decline in Q3 2024, and niche executive search for stagnant sectors like print media. These segments consume resources without significant returns.

The strategic approach for 'Dogs' involves divestiture or significant restructuring. For example, divesting unprofitable geographic markets or non-core, underutilized assets is crucial. In 2024, many companies are shedding such low-growth, low-market-share assets to reallocate capital to more promising ventures.

Reliance on outdated recruitment methods, such as purely relationship-based approaches, also falls into the 'Dog' category. This is evidenced by the increasing adoption of AI in talent acquisition, with 70% of leading organizations boosting its use in 2024, according to SHRM.

These underperforming areas require critical assessment to free up capital and management focus for high-growth segments.

| Business Unit/Service Example | BCG Quadrant | Key Performance Indicator (2024 Data) | Strategic Implication |

| IQTalent (Tech Sector) | Dog | -36.2% YoY Fee Decline (Q3 2024) | Divestiture or Restructuring |

| Niche Search (Print Media) | Dog | Declining Industry Revenue (approx. 6% in 2023) | Exit or Re-evaluate Niche |

| Relationship-Based Recruitment | Dog | Low AI Adoption vs. Market Trend (70% orgs increasing AI use) | Modernize or Divest |

| Unprofitable Geographic Markets | Dog | Negative Profit Margins (Example: Specific Asian Market) | Divestiture or Restructuring |

Question Marks

Emerging technology-focused advisory services, such as AI ethics, cybersecurity leadership, and advanced data governance, are rapidly evolving market segments. These areas are experiencing significant growth, with the global AI market alone projected to reach $1.8 trillion by 2030, according to some forecasts. Caldwell Partners may currently hold a relatively smaller market share in these nascent but high-potential fields.

Capturing a leading position in these emerging tech advisory services necessitates substantial investment in talent acquisition, research and development, and market penetration strategies. The success of these investments is inherently uncertain, as the landscape is constantly shifting and competitive pressures are intense. For instance, cybersecurity spending globally was estimated to exceed $200 billion in 2024, highlighting the significant resources needed to compete effectively.

The rise of fractional leadership, where companies engage executives for part-time or project-specific roles, represents a significant growth area. This flexible talent model is increasingly sought after by businesses looking for specialized expertise without the commitment of a full-time hire. For Caldwell Partners, developing a strong service offering in this space is a strategic imperative, akin to a Question Mark on the BCG Matrix.

Successfully capturing market share in fractional leadership necessitates fresh strategies and operational adaptations. Companies are increasingly utilizing fractional executives for critical functions; for instance, a 2024 survey indicated that over 40% of small and medium-sized businesses have engaged fractional talent for specialized roles. While this presents a challenge in building out the necessary infrastructure and client acquisition methods, the potential upside in revenue and market positioning is substantial if Caldwell Partners can effectively execute.

Expanding into new international markets represents a classic Question Mark for Caldwell Partners within the BCG Matrix framework. These are regions where the company has minimal existing operations or brand recognition, yet they exhibit strong growth potential. For instance, entering emerging economies in Southeast Asia or Africa, which are projected to see significant GDP growth in the coming years, would fall into this category.

Such ventures demand considerable investment. Caldwell Partners would need to establish physical offices, recruit local expertise, and invest heavily in marketing to build brand awareness. The return on these investments is not guaranteed; market reception, regulatory hurdles, and competitive landscapes all contribute to the inherent uncertainty. For example, a recent report indicated that the cost of setting up a new subsidiary in a tier-one African city can range from $500,000 to over $1 million, excluding ongoing operational expenses.

Innovative Talent Assessment Platforms

Developing or acquiring highly innovative talent assessment platforms that integrate advanced psychology and cutting-edge technology could be a question mark for Caldwell Partners. The market for these sophisticated assessment tools is expanding, but achieving substantial market penetration and competing with established providers demands significant capital for research and development, marketing initiatives, and seamless integration into client operational processes.

The global talent assessment market was valued at approximately $6.5 billion in 2023 and is projected to grow at a compound annual growth rate of around 9% through 2030. This growth is driven by the increasing need for objective and data-driven hiring and development processes.

- High R&D Investment: Significant upfront costs are associated with developing proprietary assessment algorithms and validating their efficacy.

- Market Penetration Challenges: Overcoming the inertia of existing vendor relationships and demonstrating superior ROI to potential clients is a hurdle.

- Scalability and Integration: Ensuring new platforms can be easily integrated with diverse HR systems and scaled to meet large enterprise needs requires robust technical infrastructure.

- Competitive Landscape: Established players in the assessment space have strong brand recognition and extensive client networks, making it difficult for newcomers to gain traction.

Strategic Partnerships in Adjacent Talent Ecosystems

Forming new strategic partnerships with companies in adjacent talent ecosystems, like HR tech startups or specialized consulting firms, can be viewed as a ‘Question Mark’ in Caldwell Partners International's strategic considerations. These ventures offer the allure of new revenue streams and expanded market reach, potentially tapping into emerging client needs or service demands, which could drive high growth.

However, the integration of these partnerships presents inherent challenges, including potential operational complexities and the uncertainty surrounding the actual returns on investment. For example, the HR tech sector saw significant investment in 2024, with venture capital funding reaching billions globally, indicating both opportunity and potential volatility for new entrants or partners.

- Potential for High Growth: Partnerships could unlock access to new client segments and evolving service demands within the HR technology landscape.

- Revenue Stream Diversification: Collaborations with HR tech startups or specialized consultants can introduce novel service offerings and revenue opportunities.

- Integration Challenges: Merging operations, cultures, and technology stacks with new partners can be complex and resource-intensive.

- Uncertain Returns: The success and profitability of these partnerships are not guaranteed, requiring careful due diligence and ongoing management.

Question Marks represent new ventures or market segments with high growth potential but low market share. Caldwell Partners may be exploring these areas, such as niche advisory services in emerging technologies or new international markets. Success here requires significant investment and strategic execution to convert potential into market leadership.

These ventures are characterized by uncertainty; the required investments in talent, technology, and market entry are substantial, with no guarantee of success. For example, the global AI market's projected growth to $1.8 trillion by 2030 underscores the high-potential, yet competitive, nature of these emerging fields.

The strategic challenge lies in allocating resources effectively to nurture these Question Marks into Stars or Cash Cows. This involves rigorous market analysis, agile adaptation to evolving landscapes, and a willingness to absorb initial losses for long-term gains, as seen in the cybersecurity spending exceeding $200 billion in 2024.

| Strategic Area | Potential | Current Market Share | Investment Needs | Risk Level |

| Emerging Tech Advisory (e.g., AI Ethics) | High | Low | High (Talent, R&D) | High |

| Fractional Leadership Services | High | Low | Moderate (Infrastructure, Client Acquisition) | Moderate |

| New International Market Entry | High | Very Low | Very High (Setup, Marketing) | High |

| Innovative Talent Assessment Platforms | High | Low | High (R&D, Marketing) | High |

| Strategic HR Tech Partnerships | High | Low | Moderate (Integration, Due Diligence) | Moderate |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, to provide accurate strategic insights.