Caldwell Partners International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caldwell Partners International Bundle

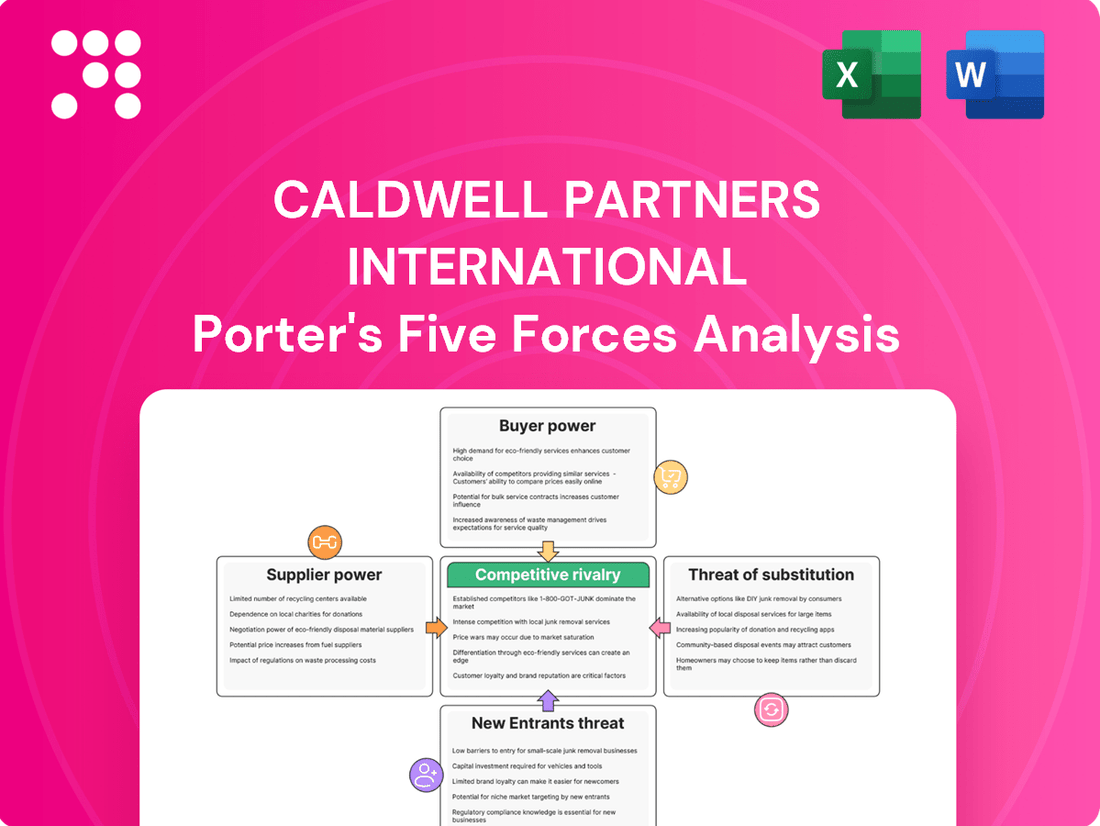

Caldwell Partners International navigates a competitive landscape shaped by moderate buyer power and significant rivalry within the executive search industry. Understanding these dynamics is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Caldwell Partners International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The primary suppliers for Caldwell Partners are the highly specialized C-suite and board-level executives they aim to place. These individuals hold unique skills and extensive experience, making their availability and willingness to participate a crucial element in Caldwell's operations. The bargaining power of these executive candidates is considerable, particularly for niche or highly sought-after positions. They are often passive candidates, not actively looking for new roles, and therefore require a very specific and persuasive approach from recruiters.

Caldwell Partners International relies on data and technology providers for essential recruitment tools. For instance, the global AI market, which includes recruitment AI, was projected to reach over $150 billion in 2024, highlighting the growing importance of these suppliers.

Suppliers offering advanced AI-powered sourcing, candidate assessment platforms, and sophisticated market intelligence software possess significant bargaining power. These technologies are crucial for Caldwell to maintain its competitive edge and operational efficiency in the executive search landscape.

Should Caldwell become heavily dependent on a limited number of specialized technology vendors, these suppliers' ability to dictate terms and pricing will increase. This dependence is a key factor in assessing their leverage within the industry.

The consultants and partners at Caldwell Partners are essentially the firm's key suppliers of expertise, industry knowledge, and crucial networks. Their deep connections and specialized insights form the very foundation of Caldwell's value proposition to clients.

Caldwell's success hinges on its capacity to attract and retain highly skilled search consultants. In 2023, Caldwell Partners reported revenue of $112.5 million, a slight decrease from $118.2 million in 2022, underscoring the competitive landscape for top talent in executive search.

Research and Support Staff

While not as potent as the leverage held by top-tier executive talent or seasoned senior consultants, the bargaining power of specialized research and support staff remains a factor for executive search firms like Caldwell Partners International. These individuals are crucial for tasks such as market mapping, identifying potential candidates, and managing administrative functions that ensure smooth operations.

The availability and cost of skilled support staff can directly impact a firm's overall efficiency and its capacity to handle a greater volume of search assignments. For instance, in 2024, the demand for specialized administrative and research support in professional services sectors remained robust, with some regions experiencing salary increases of 5-8% for these roles due to a tight labor market.

- Impact on Efficiency: Skilled support staff accelerate market intelligence gathering and candidate screening, directly affecting project timelines and client satisfaction.

- Cost Influence: Rising wages for specialized administrative and research roles in 2024 put upward pressure on operational costs for search firms.

- Capacity Management: A readily available pool of competent support personnel allows firms to scale operations more effectively during peak demand periods.

- Talent Scarcity: In specific niches, the scarcity of highly qualified research assistants or administrative professionals can grant them significant negotiation leverage.

Recruitment Process Outsourcing (RPO) Partnerships

The bargaining power of suppliers for recruitment process outsourcing (RPO) and specialized research firms can be moderate to high. This is particularly true when these providers offer highly specialized skills or proprietary technology that Caldwell Partners International needs for specific talent acquisition projects. For instance, if an RPO partner possesses a unique database or an advanced AI sourcing tool, their leverage increases.

Caldwell Partners' own IQTalent segment, which offers on-demand talent acquisition augmentation, suggests an internal capability to manage parts of the outsourcing process. This internal capacity could serve as a counter-balance to external suppliers. However, the effectiveness of this internal solution in fully replacing specialized external RPO or research support will influence supplier power. In 2023, the global RPO market was valued at approximately $12.5 billion, indicating a substantial industry with diverse providers.

- Supplier Dependence: Caldwell Partners' reliance on external RPO or research firms for niche skill sets or high-volume searches dictates supplier power.

- Uniqueness of Services: The more unique or difficult-to-replicate the services offered by these external providers, the greater their bargaining power.

- Integration Level: The degree to which these external services are integrated into Caldwell's core talent acquisition workflows impacts how easily they can be substituted.

- Internal Capabilities: Caldwell's IQTalent segment provides an alternative, potentially reducing the bargaining power of external RPO providers.

The primary suppliers for Caldwell Partners are the highly specialized executive candidates themselves, whose unique skills and passive job-seeking status grant them significant bargaining power, especially for niche roles.

Technology providers offering AI recruitment tools and market intelligence software also wield considerable influence, as these are critical for Caldwell's competitive edge, with the global AI market projected to exceed $150 billion in 2024.

Furthermore, Caldwell's own consultants and partners are key suppliers of expertise, and the firm's ability to attract and retain them is vital, especially given the competitive landscape where Caldwell reported $112.5 million in revenue for 2023.

The bargaining power of suppliers for recruitment process outsourcing (RPO) and specialized research firms can be moderate to high, particularly if they offer unique technologies or databases, impacting Caldwell's operational costs and efficiency.

| Supplier Type | Key Leverage Factors | 2023/2024 Data Point |

|---|---|---|

| Executive Talent | Niche skills, passive status | Crucial for filling C-suite/board roles |

| Technology Providers | AI capabilities, proprietary data | Global AI market > $150 billion (2024 projection) |

| Internal Consultants | Expertise, networks | Caldwell revenue: $112.5 million (2023) |

| RPO/Research Firms | Specialized services, unique tech | Global RPO market: ~$12.5 billion (2023) |

What is included in the product

Analyzes the competitive intensity within the executive search industry, focusing on Caldwell Partners International's unique market position and strategic advantages.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of each force.

Customers Bargaining Power

Caldwell Partners International's clients are primarily large corporations, often engaging at the C-suite and board levels for crucial leadership placements. These high-value clients are the backbone of Caldwell's revenue, frequently presenting intricate and high-stakes recruitment challenges.

The substantial revenue these clients generate, coupled with their demand for specialized expertise and demonstrable outcomes, significantly amplifies their bargaining power. For instance, in 2024, executive search firms like Caldwell often faced pressure from major corporations to reduce fees or demonstrate a clearer return on investment for critical hires, especially in a competitive talent market.

If a few major clients account for a substantial portion of Caldwell Partners' revenue, their ability to negotiate better terms, such as reduced fees or enhanced services, significantly increases. This concentration of clients presents a notable risk to the company's pricing power and overall financial stability.

Clients in the executive search market are acutely aware of the fees associated with placements and place significant importance on the quality and swiftness of the candidates presented. This sensitivity directly impacts their bargaining power.

The substantial investment and the critical nature of executive appointments mean clients demand tangible value and successful hires. For instance, in 2024, the average fee for a retained executive search in North America often ranged from 25% to 35% of the placed executive's first-year guaranteed compensation, with placements typically taking between 60 to 120 days.

Consequently, clients possess considerable leverage. If a search firm fails to meet these expectations regarding cost-effectiveness or delivery speed and quality, clients are readily inclined to shift their business to competing firms that can better satisfy their requirements.

Availability of Alternatives (Internal and External)

The bargaining power of customers in the executive recruitment sector, specifically for a firm like Caldwell Partners International, is significantly influenced by the availability of alternatives. Clients, or customers, have a wide array of options when seeking to fill executive positions. These range from developing and utilizing their own internal talent acquisition teams, which can be a cost-effective solution for some, to engaging with a multitude of external executive search firms.

The competitive landscape includes both large, global search firms with extensive networks and resources, as well as smaller, specialized boutique firms that focus on niche industries or specific executive levels. Furthermore, the increasing sophistication of professional networking platforms and the emergence of AI-driven recruitment solutions offer clients even more avenues to identify and engage potential candidates directly, bypassing traditional search methods altogether. This ease of access to diverse recruitment channels directly empowers clients, giving them considerable leverage in negotiations and service selection.

Consider these key factors impacting customer bargaining power:

- Diverse Recruitment Channels: Clients can choose between internal HR departments, global executive search firms, boutique search specialists, and direct professional network engagement.

- Cost-Benefit Analysis: The perceived cost-effectiveness of internal recruitment or DIY networking versus external search firm fees directly influences client negotiation strength.

- Technological Advancements: The rise of AI-powered recruitment tools provides clients with alternative, potentially faster and more data-driven, methods for candidate sourcing.

- Market Saturation: A high number of available search firms means clients can easily switch providers if dissatisfied or if better terms are offered elsewhere.

Economic Climate and Hiring Confidence

The economic climate directly impacts Caldwell Partners International's client demand. In 2024, with ongoing global economic uncertainties, many companies adopted a more cautious approach to executive hiring, which inherently amplifies customer bargaining power. This means clients have more leverage when negotiating fees for search services as Caldwell Partners competes for a potentially smaller pool of available mandates.

Conversely, a robust economic expansion typically reduces customer bargaining power. When businesses are confident and expanding, the demand for executive talent surges, making clients more willing to engage search firms and less inclined to push for lower fees. For instance, during periods of low unemployment, such as the sub-4% unemployment rates seen in parts of the US in early 2024, companies are more eager to fill critical leadership roles, diminishing their negotiating leverage.

- Economic Uncertainty Amplifies Customer Power: In 2024, economic headwinds meant companies were more selective with hiring, giving them greater sway in fee negotiations with executive search firms like Caldwell Partners.

- Demand Fluctuations Drive Bargaining Power Shifts: A strong economy leads to increased demand for talent, reducing client leverage, while economic slowdowns empower customers by creating competition for fewer hiring mandates.

- Talent Market Dynamics Matter: In tight labor markets, where executive talent is scarce, companies are often more willing to pay premium fees, thereby reducing their bargaining power.

Caldwell Partners' clients, often large corporations, wield significant bargaining power due to the high stakes and substantial fees involved in executive placements. The availability of numerous alternative recruitment channels, from internal teams to specialized boutiques and AI tools, further empowers clients. For example, in 2024, the competitive executive search market, with fees often 25-35% of first-year compensation, meant clients could easily switch providers if expectations on cost or delivery weren't met. This leverage is amplified during economic downturns when companies become more cautious with hiring, as observed in the sub-4% unemployment rates of early 2024, which paradoxically gave companies more negotiating sway with search firms.

| Factor | Impact on Caldwell Partners | 2024 Context |

|---|---|---|

| Client Size & Revenue Contribution | High dependence on key clients increases their leverage. | Major corporations often demand fee reductions or clearer ROI. |

| Availability of Alternatives | Numerous recruitment options dilute Caldwell's unique selling proposition. | Internal HR, boutique firms, and AI recruitment tools offer competitive alternatives. |

| Cost Sensitivity | Clients are highly aware of placement fees and seek value. | Executive search fees in 2024 often ranged from 25-35% of first-year compensation. |

| Economic Climate | Economic uncertainty strengthens client bargaining power. | Cautious hiring in 2024 gave clients more leverage in negotiations. |

What You See Is What You Get

Caldwell Partners International Porter's Five Forces Analysis

This preview showcases the complete Caldwell Partners International Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the executive search industry. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any alterations or missing sections.

Rivalry Among Competitors

The executive search landscape is highly competitive, featuring global giants like Korn Ferry and Heidrick & Struggles alongside numerous specialized boutique firms and internal recruitment departments. Caldwell Partners navigates this crowded market, facing rivals with diverse specializations, geographic footprints, and service portfolios, all of which intensify the rivalry.

The executive search industry is a dynamic arena characterized by both significant consolidation and a growing trend towards specialization. While larger, global firms often command substantial market share, there's a parallel rise of boutique firms that carve out niches by focusing on specific industries, functional areas, or even particular levels of seniority.

Caldwell Partners International strategically navigates this landscape by emphasizing its specialization in C-suite and board-level executive placements, complemented by robust leadership advisory services. This focus allows them to differentiate themselves from broader recruitment agencies and even other specialized firms.

For instance, the executive search market, valued globally at over $10 billion annually, sees intense competition. Within this, firms like Caldwell that hone in on high-level placements and offer value-added advisory services are better positioned to command premium fees and build strong client relationships.

Competitive rivalry in the executive search industry is intense, with firms vying for market share through distinct service offerings. Caldwell Partners International competes by highlighting its reputation, extensive network, deep industry expertise, and innovative methodologies, including data-driven approaches and AI integration. This focus on quality leadership advisory services is crucial in attracting top-tier clients.

Caldwell Partners strategically differentiates itself by integrating traditional executive search with advanced technology-powered talent acquisition. This dual approach, executed through its distinct brands, Caldwell and IQTalent, allows the firm to offer a broader spectrum of talent solutions. For instance, IQTalent, launched in 2017, specifically targets the need for tech-enabled recruitment, a growing segment of the market.

Market Growth and Demand

The global executive search market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 8.5% from 2023 to 2028, reaching an estimated $23.6 billion by 2028. This expansion is fueled by a persistent demand for visionary leadership capable of navigating rapid technological advancements and increasing globalization. The need for executives skilled in areas like artificial intelligence, data analytics, and sustainable practices is particularly high.

However, this expanding market also intensifies competitive rivalry. As more firms enter and existing ones seek to capture greater market share, the pressure to differentiate and deliver exceptional value increases. Clients are increasingly seeking specialized expertise, leading to a surge in demand for search professionals adept at filling critical roles in finance, operations, and technology sectors. This dynamic environment forces firms to innovate their service offerings and client engagement strategies to remain competitive.

- Projected Global Executive Search Market Growth: Expected to reach $23.6 billion by 2028, with an 8.5% CAGR from 2023-2028.

- Key Demand Drivers: Need for visionary leadership in technology, globalization, AI, data analytics, and sustainability.

- Intensified Competition: Growth attracts new entrants and fuels market share battles among existing firms.

- Evolving Client Needs: Increased demand for specialized roles in finance, operations, and technology.

Innovation in Recruitment Technology

The competitive rivalry in executive search is intensifying due to rapid technological advancements, particularly in AI and data analytics. Firms that integrate these tools for candidate sourcing, screening, and assessment are establishing a significant edge. For instance, by mid-2024, a substantial portion of leading executive search firms reported increased investment in AI-driven recruitment platforms, aiming to improve efficiency and candidate quality.

This technological arms race compels competitors to invest in similar capabilities to avoid falling behind. Companies failing to adopt AI and data analytics risk losing market share to more agile and data-savvy rivals. By the end of 2024, industry surveys indicated that over 70% of executive search firms were actively exploring or implementing AI solutions to enhance their service offerings.

- AI Adoption: Executive search firms are increasingly leveraging AI for candidate sourcing, reducing time-to-fill by an estimated 20-30% in early 2024 implementations.

- Data Analytics: The use of data analytics allows for more precise candidate matching and predictive insights into hiring success, a trend gaining traction throughout 2024.

- Competitive Advantage: Firms demonstrating strong technological integration are attracting more high-profile clients and top-tier candidates.

- Industry Investment: Significant capital is being channeled into developing proprietary AI recruitment tools and acquiring tech-forward competitors.

Competitive rivalry in the executive search sector is fierce, with firms like Caldwell Partners facing global powerhouses and specialized boutiques. The market, projected to reach $23.6 billion by 2028, sees companies differentiating through specialized expertise and technological integration, such as AI-driven recruitment, which by mid-2024 saw significant investment from leading firms.

Firms are increasingly adopting AI and data analytics to gain an edge, with over 70% of executive search firms exploring AI solutions by the end of 2024. This focus on technology enhances efficiency and candidate quality, enabling firms to attract more high-profile clients and candidates, thereby intensifying the competition for market share.

Caldwell Partners leverages its specialization in C-suite placements and leadership advisory, alongside its tech-focused brand IQTalent, to stand out. This dual approach addresses the growing demand for specialized talent in areas like AI and data analytics, crucial for navigating today's complex business environment.

The need for executives skilled in AI, data analytics, and sustainability is driving demand, intensifying competition as firms vie for these in-demand placements. Those that effectively integrate advanced technologies and offer deep industry insights are best positioned to thrive in this dynamic and growing market.

| Key Competitor Strategies | Differentiation Focus | Technological Integration | Market Share Driver |

| Global Reach and Scale | Broad Service Portfolio | Emerging; Varies by Firm | Brand Recognition, Existing Client Base |

| Niche Specialization | Deep Industry/Functional Expertise | Targeted Adoption | Reputation in Specific Sectors |

| Technology-Enabled Talent Acquisition | AI & Data Analytics Integration | High Investment in AI Platforms | Efficiency, Candidate Quality, Predictive Analytics |

SSubstitutes Threaten

Organizations increasingly invest in building robust in-house talent acquisition capabilities, particularly for senior leadership roles. This trend is fueled by the desire for greater control over the hiring process and a deeper understanding of organizational culture. For instance, many large corporations are expanding their internal executive search functions, reducing reliance on external firms.

The growing sophistication of internal HR departments, often augmented by advanced recruitment technology and data analytics, presents a significant substitute for external executive search firms. These internal teams can leverage proprietary networks and a more intimate knowledge of company needs, potentially offering cost efficiencies and faster time-to-hire for specialized positions.

Professional networking platforms, most notably LinkedIn, present a significant threat of substitutes for executive search firms. In 2024, LinkedIn's user base exceeded 1 billion professionals globally, offering companies direct access to a vast pool of potential candidates, including senior executives. This direct sourcing capability can reduce the reliance on external search firms for filling certain roles, thereby lowering the perceived value of traditional executive search services.

The rise of AI-driven recruitment platforms presents a significant threat of substitutes for traditional executive search firms like Caldwell Partners. These platforms automate candidate sourcing, screening, and initial engagement, offering a more cost-effective and faster alternative for filling certain roles. For instance, by mid-2024, many companies were leveraging AI tools that could analyze millions of resumes and online profiles, identifying suitable candidates in a fraction of the time it would take a human recruiter.

This automation directly substitutes for the labor-intensive aspects of executive search, such as initial candidate outreach and resume review. While AI may not replicate the nuanced strategic advice and deep market intelligence provided by experienced search consultants, it can certainly fulfill the more transactional elements of talent acquisition. The increasing sophistication of AI in predictive analytics for candidate success further strengthens its position as a viable substitute.

Contingent or Fractional Leadership

The rise of contingent or fractional leadership presents a significant threat of substitutes for traditional executive search firms. Companies are increasingly turning to interim executives and fractional leaders for specialized, project-based, or part-time senior roles, especially during economic downturns. This trend allows businesses to access high-level expertise without the long-term commitment of permanent hires, directly impacting the demand for traditional, full-time executive placements.

This shift is driven by a need for agility and cost-effectiveness. For instance, a 2024 survey indicated that over 60% of companies are considering or actively using interim executives for critical roles, up from 40% in 2022. This flexible talent acquisition model offers a viable alternative to permanent recruitment, potentially fragmenting the market for executive search services.

The implications for executive search firms are substantial:

- Substitution Risk: Fractional and interim leadership directly substitutes for permanent executive roles, reducing the need for traditional headhunting.

- Market Fragmentation: Specialized interim management firms and platforms are emerging, creating new competitive landscapes.

- Demand Shift: Demand for agile, project-specific leadership solutions is growing, requiring search firms to adapt their service offerings.

- Economic Sensitivity: This trend is amplified during economic uncertainty, as companies prioritize flexibility and cost control in leadership appointments.

Consulting Firms Expanding into Talent Services

Large consulting firms are increasingly offering talent advisory and executive placement, directly competing with specialized executive search firms like Caldwell Partners. These consulting giants can leverage their established client networks and deep industry knowledge to attract business.

This expansion blurs the lines between traditional consulting and talent acquisition, presenting a significant substitute for Caldwell's core services. For instance, in 2024, major consulting players reported substantial growth in their human capital and organizational consulting divisions, indicating a strategic push into talent-related offerings.

- Consulting firms' broader service portfolios

- Leveraging existing client relationships for talent acquisition

- Increased competitive pressure on specialized search firms

- Potential for integrated talent solutions as a substitute offering

The threat of substitutes for executive search firms like Caldwell Partners is significant, driven by evolving talent acquisition strategies and technological advancements. Companies are increasingly building internal capabilities and leveraging digital platforms, which directly impacts the demand for external search services.

In 2024, the global professional networking platform LinkedIn boasted over 1 billion users, offering companies direct access to a vast talent pool, thereby reducing reliance on external recruiters for many roles. Similarly, AI-driven recruitment tools are automating candidate sourcing and screening, providing a faster and more cost-effective alternative for initial talent identification. For example, by mid-2024, AI platforms could analyze millions of profiles, significantly cutting down the time for candidate discovery.

Furthermore, the rise of fractional and interim leadership models offers a flexible substitute for permanent executive hires, particularly in dynamic economic conditions. A 2024 survey revealed that over 60% of companies were considering or utilizing interim executives, up from 40% in 2022, highlighting a shift towards agile talent solutions.

Major consulting firms are also expanding their talent advisory and executive placement services, leveraging existing client relationships and broad expertise to compete. This expansion creates a more crowded market, where integrated talent solutions can serve as a substitute for specialized search functions.

| Substitute Category | Key Drivers | 2024 Impact/Data Point |

|---|---|---|

| Internal HR/Talent Acquisition | Control, cultural fit, cost efficiency | Expansion of internal executive search functions in large corporations |

| Professional Networking Platforms (e.g., LinkedIn) | Direct access to talent, broad reach | Over 1 billion global users, enabling direct sourcing |

| AI-Driven Recruitment Platforms | Automation, speed, cost-effectiveness | AI tools analyzing millions of profiles by mid-2024 |

| Fractional/Interim Leadership | Agility, cost savings, specialized expertise | 60%+ companies considering/using interim executives (2024) |

| Large Consulting Firms | Integrated services, existing client networks | Growth in human capital/organizational consulting divisions |

Entrants Threaten

The executive search industry, especially for C-suite and board positions, thrives on deep-seated reputation and trust. Newcomers find it incredibly difficult to quickly build the kind of extensive, high-level professional networks that established firms like Caldwell Partners International possess. This established credibility and access to talent pools are significant deterrents for potential new entrants.

Launching a significant executive search firm demands considerable capital for seasoned consultants, market intelligence platforms, and a solid operational foundation. For instance, a top-tier firm might invest millions annually in proprietary databases and research capabilities.

A key hurdle for new entrants is gaining access to a deep pool of highly specialized talent and possessing the nuanced expertise to accurately assess and place these individuals. This often means building extensive networks and developing sophisticated evaluation methodologies, a process that takes years and significant resources.

The executive search industry, including firms like Caldwell Partners International, thrives on deep, long-standing relationships with corporate clients. These partnerships are built over years, cemented by a consistent history of successful executive placements and a reputation for strategic insight. For instance, a significant portion of revenue for established firms often comes from repeat business, highlighting the stickiness of these client connections.

New entrants find it incredibly difficult to penetrate these entrenched client relationships. They lack the established trust and proven track record that incumbent firms possess. Breaking into a market where client loyalty is high requires substantial investment in business development and a compelling value proposition to even get a foot in the door.

Technological Investment

The threat of new entrants in the executive search industry, particularly concerning technological investment, is elevated. While technology can democratize access to candidate data, the substantial investment required for advanced AI, sophisticated data analytics platforms, and proprietary search methodologies creates a significant barrier. New firms must commit considerable capital to acquire and implement these tools to effectively compete with established players already benefiting from these technological advantages.

For instance, a new entrant might need to invest upwards of $500,000 to $1 million annually for robust data analytics software and AI-driven talent sourcing tools. Established firms, like Caldwell Partners International, have already made these investments, giving them a competitive edge in identifying and engaging top-tier talent more efficiently. This technological gap means newcomers face a steeper climb to match the capabilities and reach of incumbents.

- High upfront costs for advanced AI and data analytics platforms.

- Need for proprietary methodologies to differentiate from tech-enabled competitors.

- Established firms possess existing technological infrastructure and expertise.

- Significant ongoing investment required to maintain technological parity.

Regulatory and Ethical Compliance

The executive search industry is heavily regulated, demanding strict adherence to privacy laws like GDPR and CCPA. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, creating a significant barrier for new firms. Navigating these complex compliance requirements and establishing ethical recruitment practices, including mitigating unconscious bias, represents a substantial upfront investment and ongoing operational cost for any new entrant.

New entrants must invest in robust compliance frameworks and training to manage sensitive candidate data and uphold ethical standards. Failure to do so can result in severe penalties and reputational damage, making it a critical consideration. The ongoing need for legal counsel and compliance officers adds to the operational expenses, potentially limiting the profitability of new firms in their initial stages.

- Regulatory Hurdles: Compliance with data privacy laws (e.g., GDPR, CCPA) imposes significant legal and operational burdens.

- Ethical Standards: Establishing and enforcing ethical recruitment practices, including bias mitigation, requires dedicated resources and training.

- Compliance Costs: Investment in legal expertise, compliance software, and ongoing training represents a substantial cost for new entrants.

- Reputational Risk: Non-compliance can lead to hefty fines (e.g., up to 4% of global annual turnover under GDPR) and severe damage to a firm's reputation.

The threat of new entrants in the executive search sector is generally low, primarily due to the significant barriers to entry. Building the necessary reputation, extensive networks, and capital investment for advanced technology and compliance presents a formidable challenge for newcomers. Established firms like Caldwell Partners International benefit from years of relationship-building and a proven track record.

New firms require substantial capital, often exceeding $500,000 annually, for essential technology like AI-driven talent sourcing and robust data analytics. Furthermore, navigating complex regulations such as GDPR, which can impose fines up to 4% of global annual turnover, adds considerable cost and risk for any new player attempting to enter the market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Caldwell Partners International is built upon a foundation of industry-specific market research reports, proprietary client data, and publicly available financial statements. We also leverage insights from executive interviews and competitor intelligence gathered from industry conferences and trade publications.