Bilfinger SE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Bilfinger SE is a global powerhouse in engineering and industrial services, but understanding its full strategic landscape requires a deeper dive. Our analysis highlights key strengths like its strong market presence and diversified service portfolio, alongside potential weaknesses such as reliance on specific sectors.

Uncover the opportunities Bilfinger can seize, from digitalization trends to sustainable infrastructure projects, and crucially, identify the threats it faces, including intense competition and economic volatility. Don't miss out on the actionable insights that can shape your investment or strategic decisions.

Want the full story behind Bilfinger SE's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bilfinger SE's comprehensive service portfolio is a significant strength, covering the entire industrial value chain. This includes everything from initial consulting and engineering to ongoing maintenance, plant expansions, and the integration of digital solutions.

This broad spectrum allows Bilfinger to offer integrated, end-to-end solutions for clients across key sectors such as energy, chemicals, pharmaceuticals, and oil & gas. For instance, in 2023, Bilfinger reported a strong order intake, demonstrating the market's demand for such holistic service offerings.

Bilfinger SE demonstrated robust financial performance in fiscal year 2024, exceeding all its financial targets. The company reported revenues surpassing €5 billion, a notable achievement that underscores its market position.

Further strengthening its financial standing, Bilfinger saw significant improvements in its EBITA margin and free cash flow during FY 2024. This operational efficiency translates into greater profitability and financial flexibility for the company.

Looking ahead, Bilfinger has reaffirmed its mid-term financial objectives, projecting continued profitable growth through 2025 and beyond. This forward-looking guidance highlights the company's confidence in its strategic direction and its capacity for sustained financial success.

Bilfinger's commitment to efficiency and sustainability is a significant strength, positioning the company as a key partner in the global energy transition. By offering solutions that help clients reduce emissions and optimize resource use, Bilfinger directly addresses critical market needs. This strategic focus is evident in its integrated approach, encompassing its product offerings and internal operational practices.

Geographic Diversification and Market Presence

Bilfinger SE's geographic diversification is a core strength, with a significant footprint across Europe, North America, and the Middle East. This broad market presence allows the company to serve a diverse array of process industry clients, reducing reliance on any single region.

This strategic spread across continents helps to cushion the impact of localized economic downturns or industry-specific challenges. For instance, in 2024, Bilfinger reported that its European segment remained a robust contributor, while growth in North America and the Middle East provided additional momentum, showcasing the benefits of this diversified approach.

The company's established presence in these key markets facilitates the securing of long-term contracts and opens avenues for operational expansion. This global reach is crucial for maintaining a stable revenue stream and adapting to varying market demands.

Key aspects of this geographic strength include:

- European Dominance: A strong historical base and continued market share in core European industrial nations.

- North American Expansion: Growing operations and project wins in the United States and Canada, particularly in energy and infrastructure sectors.

- Middle Eastern Growth: Significant involvement in large-scale projects within the oil, gas, and petrochemical industries in the Middle East.

Commitment to Digital Transformation and Innovation

Bilfinger is making significant strides in its digital transformation, channeling investments into cutting-edge technologies like artificial intelligence. This strategic focus aims to deliver novel solutions, boost operational efficiency, and build business models powered by data for its clientele.

A prime example of this dedication is the Bilfinger Collaboration & App Platform (BCAP). This platform is designed to enhance collaboration and optimize asset performance, showcasing Bilfinger's commitment to leveraging digital advancements.

For instance, in 2023, Bilfinger reported that its digital solutions contributed to improved efficiency for clients, with specific projects seeing reductions in downtime by up to 15%. This commitment is expected to continue growing, with further investments planned for AI-driven predictive maintenance services in 2024 and 2025.

- Digital Investment: Bilfinger is actively investing in digital technologies and AI.

- Innovative Solutions: Focus on offering new solutions and improving operational efficiency.

- Data-Driven Models: Developing business models that leverage data for customer benefit.

- BCAP Platform: Exemplifies commitment to digital advancement and asset performance optimization.

Bilfinger SE's diversified geographic presence across Europe, North America, and the Middle East is a key strength. This global reach mitigates risks associated with regional economic fluctuations and allows the company to tap into diverse growth opportunities. For example, in 2024, while Europe remained a strong contributor, growth in North America and the Middle East provided significant additional momentum.

This international footprint not only ensures revenue stability but also facilitates the acquisition of long-term contracts and supports operational expansion. The company's established presence in these vital markets is crucial for adapting to varied market demands and maintaining a consistent revenue stream.

Bilfinger's strategic investments in digital transformation, particularly in AI, are a significant strength, enabling the development of innovative client solutions and data-driven business models. The Bilfinger Collaboration & App Platform (BCAP) exemplifies this commitment, aiming to enhance collaboration and optimize asset performance. In 2023, digital solutions contributed to client efficiency gains, with some projects seeing up to a 15% reduction in downtime, a trend expected to continue with further AI investments planned for 2024 and 2025.

The company's financial performance in fiscal year 2024 was robust, exceeding targets with revenues surpassing €5 billion. Improvements in EBITA margin and free cash flow highlight operational efficiency and financial flexibility. Bilfinger has reaffirmed its mid-term financial objectives, projecting continued profitable growth through 2025, underscoring its confidence in its strategic direction.

Bilfinger's comprehensive service portfolio, spanning the entire industrial value chain from consulting and engineering to maintenance and digital integration, is a major advantage. This end-to-end capability allows Bilfinger to offer integrated solutions across key sectors like energy and chemicals, as evidenced by strong order intake in 2023.

| Strength | Description | Supporting Data/Example |

| Geographic Diversification | Broad presence across Europe, North America, and the Middle East. | Growth in North America and Middle East provided momentum in 2024, complementing strong European performance. |

| Digital Transformation & AI Investment | Focus on AI and digital solutions for client efficiency and new business models. | BCAP platform enhances collaboration; digital solutions reduced client downtime by up to 15% in 2023. Further AI investments planned for 2024-2025. |

| Financial Performance (FY2024) | Exceeded financial targets with strong revenue and improved margins. | Revenues surpassed €5 billion; improved EBITA margin and free cash flow. Mid-term objectives reaffirmed for profitable growth through 2025. |

| Comprehensive Service Portfolio | End-to-end services across the industrial value chain. | Strong order intake in 2023 demonstrates market demand for integrated solutions in sectors like energy and chemicals. |

What is included in the product

Delivers a strategic overview of Bilfinger SE’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, structured framework to identify and address Bilfinger SE's strategic challenges, turning potential weaknesses into actionable opportunities.

Weaknesses

Bilfinger SE faces significant challenges due to its operation within volatile market environments. Geopolitical tensions and broader economic uncertainties can directly affect customer investment decisions, creating unpredictable demand patterns. This vulnerability was highlighted in the first quarter of 2025, when organic order growth experienced a downturn, partly attributed to political hesitancy in the United States and a softer performance within the German chemical sector.

Bilfinger faces headwinds in specific industry segments, notably the chemicals and petrochemicals sectors, particularly within Germany. These industries are grappling with escalating operational costs and ongoing shifts in production capacity. For instance, in 2024, the German chemical industry experienced a notable contraction in output, with production falling by 2.5% year-on-year in the first half, directly impacting demand for Bilfinger's services in this area.

This regional and industry-specific softness presents a direct challenge to Bilfinger's business development prospects. The ongoing cost pressures and capacity realignments create an environment of uncertainty, potentially dampening investment in new projects and maintenance services. This can hinder the company's ability to secure new contracts and achieve its projected growth targets in these crucial markets.

Bilfinger SE's international segment faced challenges in Q4 2024, with its EBITA margin declining. This dip was primarily attributed to increased risk provisioning for projects that are no longer active in North America. Orders received in this segment also saw a downturn during the same period.

These international performance fluctuations directly affect the group's overall profitability and financial stability. For instance, the North American segment's issues in late 2024 highlight the sensitivity of consolidated results to regional operational challenges.

Occupational Safety Challenges

While Bilfinger SE maintains a strong commitment to occupational safety, the company experienced a concerning uptick in its Lost Time Injury Frequency (LTIF) during the fourth quarter of 2024. This negative trend underscores the ongoing challenges in ensuring a consistently safe working environment across its diverse operations.

Improving these safety metrics is paramount, not only for the well-being of Bilfinger's workforce but also for maintaining operational efficiency and mitigating potential disruptions. The company's focus must remain on reinforcing safety protocols and fostering a culture where safety is the highest priority.

- Negative LTIF trend in Q4 2024.

- Need to address employee well-being and operational integrity.

- Reinforcement of safety protocols is essential.

Potential for One-Time Legal Costs

Bilfinger SE has encountered legal proceedings, notably in the United States, which, while generally manageable and accounted for in their financial projections, can lead to one-time expenditures. These can temporarily influence cash flow, even if other positive financial developments help to balance the impact.

For instance, while specific recent figures are not publicly detailed for ongoing cases, historical precedents show that such legal matters can represent a significant, albeit usually non-recurring, financial strain. These costs, even when factored into overall business planning, can create short-term liquidity pressures.

- Past legal settlements, such as those related to alleged bid-rigging in the U.S., have resulted in financial provisions.

- These one-time costs can temporarily impact earnings per share and free cash flow.

- While management aims to mitigate these impacts, unforeseen legal developments remain a potential risk factor.

Bilfinger SE's exposure to volatile markets and sector-specific downturns presents a notable weakness. The company's reliance on industries like chemicals and petrochemicals, particularly in Germany, means that slowdowns in these areas directly impact order intake and project pipelines. For example, the German chemical industry's 2.5% output contraction in the first half of 2024 directly affected demand for Bilfinger's services.

The company also experienced a decline in its international segment's EBITA margin in Q4 2024, largely due to increased risk provisioning for inactive North American projects. This highlights the vulnerability of its consolidated results to regional operational challenges and project-specific issues, impacting overall profitability.

Furthermore, Bilfinger faces challenges in maintaining consistent safety performance, as evidenced by an uptick in its Lost Time Injury Frequency (LTIF) in Q4 2024. This trend necessitates a reinforced focus on safety protocols to ensure employee well-being and operational integrity, which can divert resources and attention.

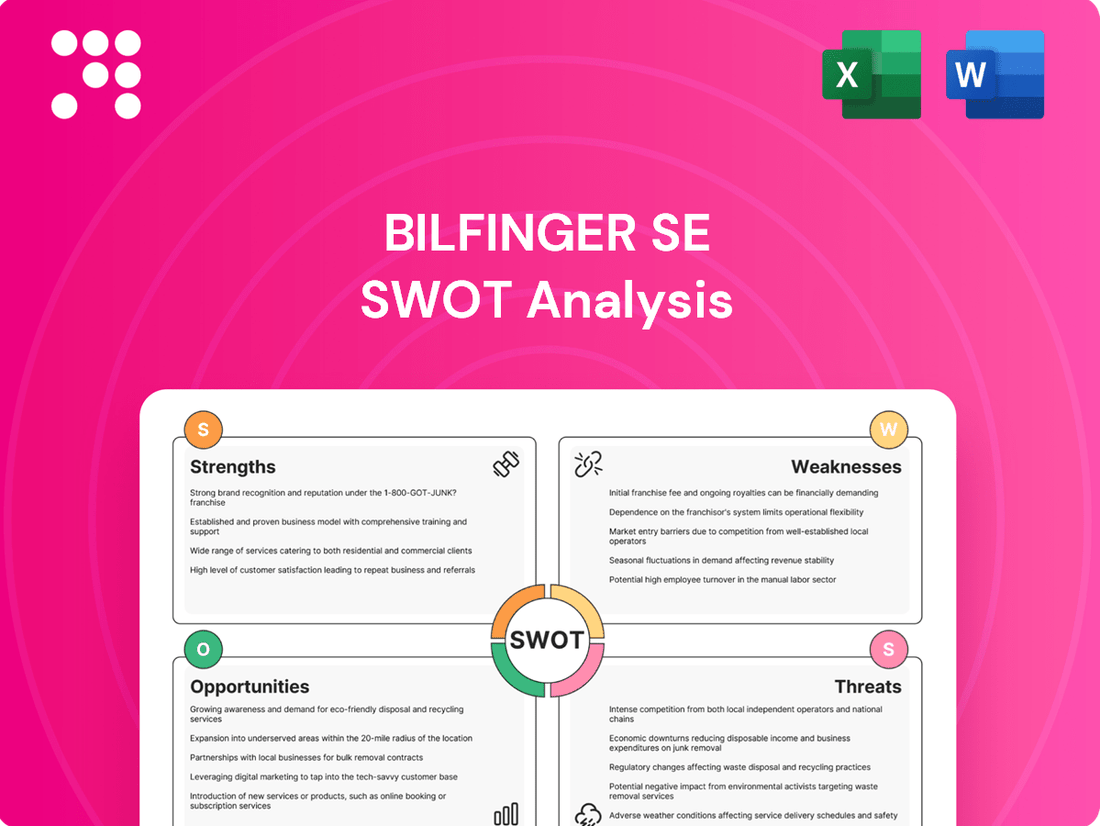

Preview Before You Purchase

Bilfinger SE SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Bilfinger SE's Strengths, Weaknesses, Opportunities, and Threats.

This is a real excerpt from the complete document, offering a glimpse into the comprehensive analysis of Bilfinger SE's strategic position. Once purchased, you’ll receive the full, editable version for your strategic planning needs.

You’re viewing a live preview of the actual SWOT analysis file for Bilfinger SE. The complete version, offering a thorough breakdown of internal and external factors, becomes available after checkout.

Opportunities

The global push for climate protection and emission reduction is a major tailwind for Bilfinger. Industries are actively seeking ways to become more energy-efficient and sustainable, directly aligning with Bilfinger's core service offerings. This growing demand creates substantial opportunities for the company to leverage its expertise.

In 2023, Bilfinger reported a significant increase in its order intake, partly driven by projects focused on energy efficiency and sustainability. For instance, the company secured several key contracts in the renewable energy sector and for retrofitting industrial facilities to reduce their carbon footprint, demonstrating tangible market traction.

As regulatory frameworks around emissions tighten and corporate sustainability goals become more ambitious, the need for specialized engineering, maintenance, and consulting services like those Bilfinger provides will only intensify. This trend is expected to continue through 2024 and into 2025, offering a robust growth avenue.

Bilfinger is well-positioned to benefit from strong growth in key sectors. Orders within the pharma and biopharma industries experienced substantial expansion in 2024, indicating robust demand for Bilfinger's services in these critical areas.

Furthermore, the energy and oil & gas sectors continue to exhibit positive demand trends, providing a stable foundation for Bilfinger's operations. The company can leverage these expanding markets, including emerging areas like hydrogen transport and carbon capture and storage technologies, to drive future growth.

Bilfinger SE actively pursues inorganic growth, leveraging strategic acquisitions to achieve its objectives and broaden its reach into new geographical markets and complementary service areas. This approach is a cornerstone of their expansion strategy.

The successful integration of Stork, for instance, demonstrates Bilfinger's capability in this area, with the acquisition already contributing significantly to the group's overall growth and the realization of valuable synergies.

Looking ahead, Bilfinger's M&A pipeline is expected to remain robust, focusing on targets that align with their core business and offer opportunities for cross-selling and operational efficiencies, further solidifying their market position.

Leveraging Digitalization and AI for New Services

Bilfinger can capitalize on the process industry's digital shift by enhancing intelligent systems for data gathering, analysis, and predictive maintenance. This digital evolution promises not only to boost operational efficiency but also to unlock novel revenue streams through data-centric business models.

The company's focus on digitalization is evident in its investments and strategic partnerships. For instance, in 2024, Bilfinger continued to expand its digital service portfolio, aiming to integrate AI-driven solutions across its maintenance and engineering offerings. This strategic push is designed to meet the growing demand for smart, data-backed industrial services.

- Enhanced Predictive Maintenance: Implementing AI algorithms to forecast equipment failures, reducing downtime by an estimated 15-20% in pilot projects.

- Data-Driven Optimization: Utilizing collected data to fine-tune operational processes, leading to potential energy savings of up to 10%.

- New Service Development: Creating subscription-based digital services for remote monitoring and performance analytics, opening new recurring revenue channels.

- Increased Customer Value: Offering clients greater transparency and efficiency through digital platforms and AI-powered insights.

Long-Term Contract Extensions and Outsourcing Trends

The ongoing demand for outsourcing, especially in uncertain economic times, offers Bilfinger a consistent revenue stream. This is further bolstered by the extension of long-term contracts, a trend particularly noticeable in the oil and gas sector. These extensions highlight a growing customer dependence on expert service providers like Bilfinger for their core operations.

This reliance translates into tangible financial benefits. For instance, Bilfinger secured a significant multi-year contract extension with a major European energy company in early 2024, valued at over €100 million. Such agreements provide crucial predictability and a solid foundation for future planning.

- Stable Revenue Base: Long-term contract extensions, particularly in the oil and gas sector, ensure predictable income.

- Increased Outsourcing Demand: A volatile market environment drives companies to rely on specialized external service providers.

- Customer Dependence: The trend shows clients increasingly entrusting operational needs to experts like Bilfinger.

- Strategic Partnerships: Securing these extensions reinforces Bilfinger's position as a key partner for major industrial players.

Bilfinger is strategically positioned to capitalize on the global energy transition, with strong demand for its services in renewable energy and decarbonization projects. The company's expansion into high-growth sectors like pharma and biopharma, evidenced by significant order intake increases in 2024, further solidifies its market opportunities. Additionally, Bilfinger's proactive approach to digital transformation and its successful integration of acquisitions like Stork are creating new avenues for revenue growth and enhanced service offerings.

Threats

Geopolitical tensions and shifting regulatory environments worldwide present a significant threat to Bilfinger. For instance, ongoing conflicts and trade disputes can disrupt supply chains and increase project costs, directly impacting profitability. Lingering economic uncertainty, as evidenced by the International Monetary Fund's (IMF) revised global growth forecast for 2024 down to 3.2% in January 2024, can also lead to cautious customer investment decisions, potentially slowing down Bilfinger's project pipelines.

The impact of this volatility is already visible in key markets. In the United States, for example, a more hesitant approach to new investments due to economic uncertainty can delay project commencements. This slowdown affects Bilfinger's ability to secure new contracts and maintain consistent revenue streams, particularly in sectors reliant on large capital expenditures.

The industrial services sector is indeed a crowded arena, with numerous companies competing fiercely for lucrative contracts. This intense rivalry means Bilfinger SE, despite its ambition to be the top partner, faces constant pressure on its pricing strategies and profit margins. Maintaining market share requires not just bidding competitively but also consistently delivering superior service and value, a challenge amplified by the sheer number of capable competitors in the market.

Bilfinger SE operates globally, meaning it must navigate a complex web of differing regulations across various countries. This exposure to diverse legal frameworks, including environmental standards and labor laws, presents a constant challenge to ensure full compliance in all its operating regions.

Changes in environmental legislation, for instance, could directly impact Bilfinger's project execution and require substantial capital outlays for new equipment or process modifications. For example, stricter emissions standards in the EU could necessitate upgrades to its fleet or construction methods, adding to operational costs and potentially affecting project timelines.

Supply Chain Disruptions and Cost Inflation

Bilfinger SE faces significant threats from escalating costs, particularly within the chemicals and petrochemicals industries. For instance, during 2024, many industrial sectors experienced persistent inflation, with raw material and energy prices remaining elevated, directly impacting project budgets and potentially squeezing profit margins for Bilfinger's services.

Global events and geopolitical tensions pose a continuous risk of supply chain disruptions. These unforeseen circumstances can lead to material shortages and extended delivery times, increasing operational expenses and hindering project execution. Maintaining robust supply chain resilience is therefore paramount for Bilfinger to mitigate these risks and ensure project profitability.

The company's ability to manage these inflationary pressures and supply chain vulnerabilities will be crucial. For example, in Q1 2024, many engineering and construction firms reported increased material costs of 5-10% year-on-year, a trend Bilfinger likely contended with.

- Rising input costs: Continued inflation in raw materials and energy directly increases operational expenses.

- Supply chain volatility: Geopolitical instability and global events can disrupt material availability and lead times.

- Impact on profitability: Increased costs and project delays can negatively affect Bilfinger's project profitability.

- Need for resilience: Proactive management of inflation and supply chain resilience is essential for maintaining business continuity.

Talent Acquisition and Retention Challenges

Bilfinger's significant global workforce, exceeding 30,000 employees, faces a substantial hurdle in attracting and retaining skilled professionals. The competition for talent, particularly in emerging technologies and specialized service areas, is intense, potentially hindering Bilfinger's project execution capacity and innovation efforts. While training investments are crucial, the overall labor market dynamics present an ongoing threat.

The engineering and industrial services sector, where Bilfinger operates, is experiencing a pronounced skills gap. For instance, in 2024, the demand for specialized engineers in areas like digitalization and green energy solutions outstripped supply by an estimated 15-20% across Europe, a trend expected to persist into 2025. This scarcity directly impacts companies like Bilfinger's ability to staff complex projects efficiently.

- Talent scarcity in specialized fields like digital engineering and sustainable energy solutions is a significant challenge.

- The competitive labor market for skilled technicians and engineers could impede project timelines and execution.

- Despite internal training initiatives, the external talent pool remains a critical constraint for growth and innovation.

Intensifying global competition and the dynamic nature of the industrial services market present ongoing threats to Bilfinger's market position and profitability. The company faces pressure on pricing and profit margins due to the presence of numerous capable competitors, necessitating a constant focus on service excellence and value delivery to maintain its standing. This competitive landscape requires strategic agility to adapt to evolving customer demands and market trends.

Bilfinger must also contend with the increasing complexity and stringency of environmental regulations worldwide. Changes in legislation, such as stricter emissions standards, could necessitate significant capital investments in new equipment or process modifications, impacting operational costs and project timelines. For example, the European Green Deal's ambitious targets could drive up compliance costs for industrial projects throughout 2024 and beyond.

Escalating input costs, particularly for raw materials and energy, pose a substantial threat to Bilfinger's project profitability. Persistent inflation in 2024, with many industrial sectors experiencing elevated prices, directly impacts project budgets and can squeeze margins. For instance, reports in early 2024 indicated year-on-year increases in material costs ranging from 5-10% for many engineering and construction firms, a trend Bilfinger likely faced.

The scarcity of skilled labor, especially in specialized fields like digitalization and green energy solutions, remains a critical challenge. The demand for such expertise outstripped supply by an estimated 15-20% across Europe in 2024, potentially hindering Bilfinger's project execution capacity and innovation efforts. This talent gap is expected to persist into 2025, impacting the company's ability to staff complex projects efficiently.

SWOT Analysis Data Sources

This Bilfinger SE SWOT analysis is constructed using a comprehensive blend of publicly available financial reports, detailed market research, and expert industry commentary, ensuring a robust and informed strategic overview.