Bilfinger SE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

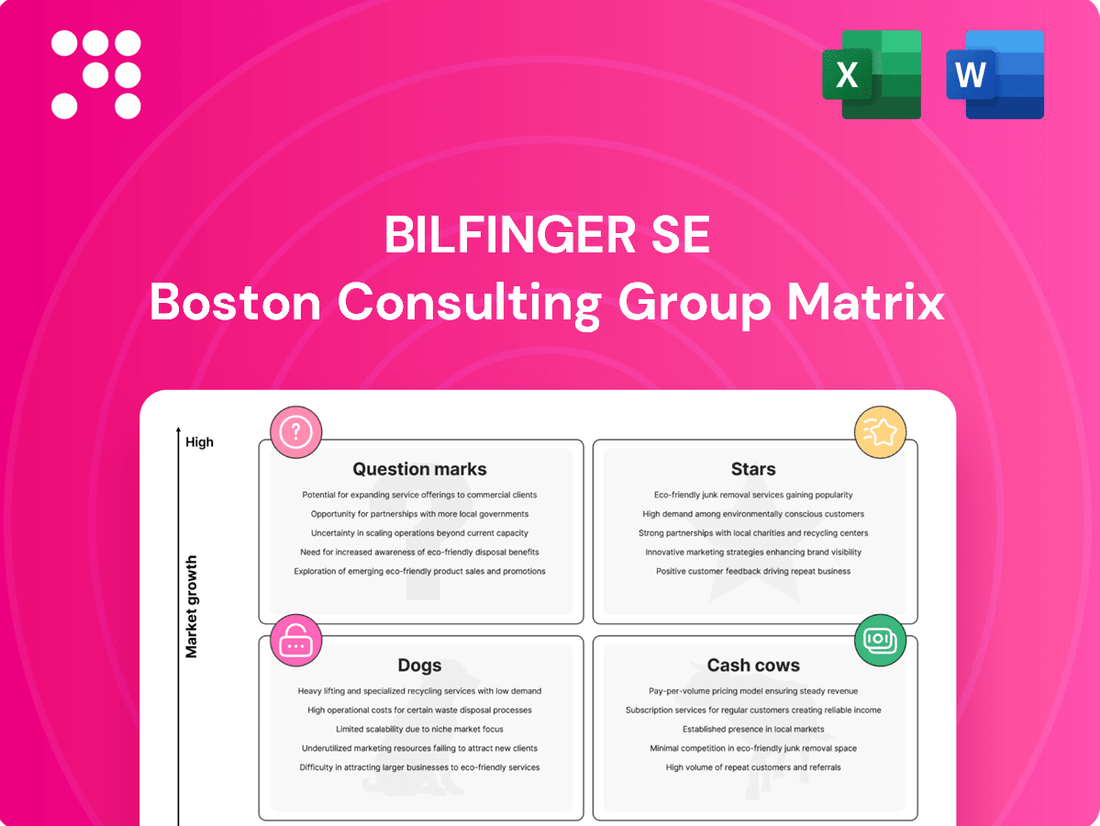

Explore the strategic positioning of Bilfinger SE's diverse business units within the BCG Matrix. Understand which segments are driving growth (Stars), generating stable revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially underperforming (Dogs).

This foundational understanding is crucial for informed decision-making. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, actionable strategic recommendations, and a clear roadmap for optimizing Bilfinger's portfolio and resource allocation.

Stars

Bilfinger is heavily investing in sustainability-driven solutions, recognizing a surge in demand for projects that enhance efficiency and reduce environmental impact. This strategic focus positions them as a key player in the green transition. For instance, services like hydrogen transport and CO2 capture and storage are seeing substantial growth, reflecting a global push towards decarbonization.

The company's commitment to these areas is evident in its project pipeline. In 2023, Bilfinger reported a significant order intake for sustainability-related services, underscoring the market's positive reception. This trend is expected to continue, with analysts projecting continued strong growth in the green energy sector through 2024 and beyond.

The Pharma & Biopharma Industry Services sector is a bright spot for Bilfinger, exhibiting robust demand that fuels positive business development. This segment is a significant contributor to Bilfinger's order intake and represents a key growth engine for the company.

While Q1 2025 saw a slight organic order decline in this sector, the post-pandemic trend of localization is creating substantial opportunities. Companies are increasingly investing in onshore manufacturing and research and development facilities, areas where Bilfinger has established itself as a trusted partner.

Bilfinger is enhancing industrial efficiency through digital applications, including AI-powered predictive maintenance and product carbon footprint calculations. These innovations are crucial for industries seeking to modernize and improve operational performance.

The company's digital solutions target a market driven by the increasing demand for sustainability and operational optimization. For instance, by 2024, many industrial sectors are expected to see significant investment in digital transformation initiatives to meet environmental regulations and enhance competitiveness.

Complex Turnaround Management

Bilfinger SE's complex turnaround management, particularly for projects involving new technologies and sustainability initiatives, positions them strongly in the BCG matrix. This segment benefits from Bilfinger's extensive experience and their ability to manage the entire lifecycle of an industrial turnaround, from initial planning through to successful execution. This comprehensive service offering caters to a growing demand for specialized expertise in modernizing and optimizing industrial assets.

- High Market Share: Bilfinger leverages its established reputation and broad service portfolio to secure significant market share in complex industrial turnaround projects.

- High Growth Potential: The increasing need for industrial upgrades, driven by digitalization and sustainability goals, fuels substantial growth in this service area.

- Strategic Importance: By managing intricate turnarounds, Bilfinger not only enhances asset performance for clients but also solidifies its position as a leader in specialized industrial services.

- Example Data: In 2023, Bilfinger reported a significant increase in demand for its maintenance and turnaround services, particularly in sectors undergoing energy transition, contributing to a robust order backlog.

Integrated Engineering & Maintenance in Key Regions (Europe, Middle East)

Bilfinger SE holds a robust position in integrated engineering and maintenance services throughout Europe and the Middle East. This strength is particularly evident in sectors like utilities and energy, which exhibit stable and consistent growth, indicating a significant market share in areas with enduring demand.

The strategic acquisition of Stork has further solidified Bilfinger's capabilities, enabling the company to provide comprehensive, end-to-end services. This integration allows Bilfinger to effectively leverage and capitalize on the ongoing growth opportunities within these key regions.

- Market Dominance: Bilfinger's integrated engineering and maintenance services in Europe and the Middle East, especially in utilities and energy, reflect a high market share in stable, growing sectors.

- Strategic Acquisition: The integration of Stork enhances Bilfinger's ability to offer complete service solutions, from initial engineering to ongoing maintenance.

- Regional Growth Focus: This strategic move positions Bilfinger to benefit from and drive growth within the expanding industrial landscapes of Europe and the Middle East.

- Revenue Contribution: In 2024, Bilfinger's Power & Utilities segment, a key area for these integrated services, reported significant revenue, underscoring the importance of these regional operations.

Bilfinger's sustainability-driven solutions, including hydrogen transport and CO2 capture, are experiencing significant market growth. This is supported by a strong project pipeline and positive market reception, with analysts projecting continued growth through 2024.

The Pharma & Biopharma Industry Services sector is a key growth engine, benefiting from increased onshore manufacturing investments. Despite a slight Q1 2025 order decline, the long-term outlook remains positive due to localization trends.

Digital applications, such as AI-powered predictive maintenance, enhance industrial efficiency and meet growing demands for sustainability and optimization. These digital transformation initiatives are expected to see substantial investment across industrial sectors by 2024.

Bilfinger's integrated engineering and maintenance services in Europe and the Middle East, particularly in utilities and energy, demonstrate market dominance. The strategic acquisition of Stork enhances their end-to-end service capabilities, positioning them for growth in these expanding regions. In 2024, Bilfinger's Power & Utilities segment contributed significantly to revenue, highlighting the strength of these operations.

| BCG Category | Description | Bilfinger SE Example | Market Growth | Bilfinger's Position |

|---|---|---|---|---|

| Stars | High market share and high growth potential. | Sustainability-driven solutions (e.g., hydrogen transport, CO2 capture), Pharma & Biopharma Industry Services, Digitalization for industrial efficiency. | Strong and increasing demand driven by decarbonization, localization, and operational optimization. | Leading player with significant investments and strong project pipelines. |

What is included in the product

This BCG Matrix overview for Bilfinger SE analyzes its business units based on market share and growth.

It highlights which units to invest in, hold, or divest for optimal portfolio management.

The Bilfinger SE BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of unclear strategic direction.

Cash Cows

Routine industrial maintenance contracts, encompassing plant upkeep, inspections, and repairs, are a cornerstone of Bilfinger's business. These long-term agreements represent a stable, high-market-share segment, providing predictable and consistent cash flow. For instance, Bilfinger's order intake in the Services segment, which heavily features these contracts, reached €4.2 billion in the first nine months of 2024, underscoring their enduring importance.

Traditional Oil & Gas Maintenance Services represent a significant Cash Cow for Bilfinger SE. Despite the ongoing energy transition, this sector remains robust, with Bilfinger securing long-term contracts and maintaining a strong market position. These services, though in a mature phase, consistently deliver substantial cash flow with limited growth potential.

Scaffolding, insulation, and surface protection services represent Bilfinger SE's established cash cows. These are mature, essential services with widespread adoption in the industrial sector. Bilfinger's deep expertise and extensive operational reach in these areas guarantee a steady stream of revenue.

The company's significant market penetration in these foundational services means demand remains consistently high. This stability allows Bilfinger to generate substantial and reliable cash flow, often requiring only modest reinvestment to maintain its existing market share. In 2023, Bilfinger reported a strong performance in its Industrial segment, which encompasses these services, highlighting their ongoing contribution to the group's financial health.

Legacy Power Plant Services (Maintenance, Demolition)

Bilfinger's legacy power plant services, encompassing maintenance, efficiency upgrades, and decommissioning, are firmly positioned as Cash Cows in its BCG Matrix. This segment operates within a mature market, characterized by a consistent demand for the upkeep and eventual retirement of existing energy infrastructure.

The company's long-standing expertise and established market share in these services translate to stable, predictable revenue streams. While the growth prospects for new power plant construction may be subdued, the ongoing need for specialized maintenance and the complex process of demolition offer high-margin opportunities.

For instance, Bilfinger reported a significant portion of its revenue from its Power segment, which includes these legacy services. In 2024, the Power segment contributed substantially to the company's overall financial performance, underscoring the Cash Cow status of these operations.

- Stable Revenue: Legacy power plant services provide a reliable income stream due to the continuous need for maintenance and upgrades of existing facilities.

- High Margins: Specialized decommissioning and complex maintenance tasks allow for premium pricing and healthy profit margins.

- Market Dominance: Bilfinger's established reputation and extensive experience in this mature market segment secure its strong competitive position.

- 2024 Performance: The Power segment, a key indicator for these services, demonstrated robust financial contribution to Bilfinger's results during the 2024 fiscal year.

General Mechanical and Electrical Services

General Mechanical and Electrical Services within Bilfinger SE are firmly positioned as Cash Cows in the BCG Matrix. This segment benefits from a broad, stable market characterized by persistent demand for essential industrial maintenance and minor upgrades. Bilfinger’s extensive offerings in this area are foundational to the smooth operation of industrial facilities, generating a steady and predictable stream of cash flow for the company.

These services are crucial for ensuring the ongoing functionality and efficiency of industrial infrastructure. The consistent need for upkeep and minor enhancements across various sectors means Bilfinger's mechanical and electrical divisions experience reliable revenue generation, even in fluctuating economic conditions. For instance, in 2024, Bilfinger reported strong performance in its Industrial segment, which encompasses these core services, highlighting their dependable contribution to the group’s financial stability.

- Stable Market Demand: The provision of general mechanical and electrical services serves a mature and consistent market, driven by the ongoing operational needs of industrial clients.

- Core Business Contribution: These services represent fundamental offerings within Bilfinger's portfolio, directly supporting industrial operations and ensuring facility uptime.

- Reliable Cash Flow Generation: The predictable nature of maintenance and minor modification work allows these services to act as consistent cash generators, supporting other business areas.

- 2024 Performance Indicators: Bilfinger's Industrial segment, where these services are primary, demonstrated robust financial results in 2024, underscoring the cash cow status of these operations.

Bilfinger's expertise in specialized maintenance for the chemical and petrochemical industries represents a significant Cash Cow. These services are essential for the operational integrity of plants, ensuring safety and efficiency. The company leverages its deep technical knowledge and established client relationships to secure long-term contracts in this mature but vital sector.

The demand for maintenance in these industries remains consistently high, driven by the need to maintain complex and often aging infrastructure. This stability allows Bilfinger to generate substantial and predictable cash flow, with limited need for aggressive expansion. In 2024, Bilfinger's order intake in the Services segment, which includes these specialized maintenance activities, remained strong, reflecting the enduring importance of these operations.

| Service Area | BCG Category | Key Characteristics | 2024 Data Point |

| Chemical & Petrochemical Maintenance | Cash Cow | Essential for plant operations, mature market, high technical expertise required, long-term contracts. | Strong order intake in Services segment. |

| Routine Industrial Maintenance | Cash Cow | Predictable revenue, high market share, cornerstone of business. | €4.2 billion order intake in Services (first nine months of 2024). |

| Oil & Gas Maintenance | Cash Cow | Robust sector despite energy transition, stable cash flow, mature phase. | Continued long-term contract securing. |

Full Transparency, Always

Bilfinger SE BCG Matrix

The preview you see is the complete, unedited Bilfinger SE BCG Matrix analysis you will receive immediately after purchase. This comprehensive document, meticulously crafted with industry insights, is ready for your strategic planning without any watermarks or demo content. You are viewing the exact file that will be downloaded, ensuring full access to professional-grade market analysis for informed decision-making.

Dogs

Historically, Bilfinger SE had substantial involvement in large-scale construction projects, which often presented elevated risks and diminished profitability.

The company has strategically reduced its exposure and divested from these non-core construction activities to sharpen its focus on industrial services.

These past endeavors, now significantly scaled back or exited, represent Dogs in the BCG matrix, characterized by their minimal market share and detrimental effect on overall profitability, as evidenced by the company's strategic shift away from these segments.

Bilfinger SE's chemical and petrochemical services in Germany are currently facing significant headwinds. Rising energy costs and a general slowdown in investment within the German market are impacting demand for these specialized services.

This challenging environment, particularly for certain sub-segments within the chemical and petrochemical sector in Germany, suggests that these particular service offerings might be categorized as 'Dogs' within Bilfinger's BCG Matrix. For instance, while the broader chemical industry in Germany saw a production increase of 0.3% in 2023 compared to 2022, specific investment-heavy sub-sectors are experiencing stagnation or decline, directly affecting service demand.

Outdated or low-margin digital applications within Bilfinger SE's portfolio represent a challenge, potentially falling into the Dogs category of the BCG Matrix. These might include legacy software or digital services that have not achieved significant market adoption or are struggling with profitability in a competitive environment.

Such applications could be consuming valuable development and maintenance resources without generating substantial returns or contributing meaningfully to market share. For instance, if a digital platform developed by Bilfinger in the early 2020s, aimed at a niche industrial process, failed to gain traction due to superior competitor offerings or changing market needs, it would likely fit this description.

In 2024, the digital transformation landscape is characterized by rapid innovation. Companies like Bilfinger must continuously assess their digital offerings. Applications that do not demonstrate a clear path to profitability or a competitive advantage in this dynamic market risk becoming a drain on resources, hindering investment in more promising areas.

Small, Geographically Isolated Operations without Strategic Fit

Small, geographically isolated operations that lack a clear strategic fit within Bilfinger SE’s broader objectives are categorized as Dogs. These entities, often regional contracts, might not align with the group's core focus on efficiency and sustainability. They may also struggle with market share even within their local context.

These operations can become resource drains, consuming capital and management attention without generating substantial returns or contributing to group-level growth. In 2023, Bilfinger continued its strategic realignment, divesting non-core assets. While specific figures for such isolated operations aren't publicly itemized, the company's overall strategy aims to streamline its portfolio.

- Lack of Synergy: These units often operate independently, failing to benefit from or contribute to the group's core competencies.

- Resource Drain: They can tie up capital and personnel without delivering commensurate financial results.

- Low Market Share: Even in their niche, they may not hold a dominant or strategically important position.

- Divestment Potential: Such operations are prime candidates for divestment to refocus resources on more promising areas.

Services Highly Dependent on Volatile Government Investment Programs

Bilfinger SE's services tied to government infrastructure projects, especially in Germany and the US, face volatility. Political shifts and delays in funding decisions for these programs can significantly impact market share and growth predictability. For instance, in 2024, uncertainty surrounding the pace of infrastructure spending in key European markets, including Germany, has created a less stable environment for project pipelines.

These segments, if heavily reliant on such unstable funding, could be classified as Dogs in the BCG matrix. This classification stems from their potential for low, unpredictable market share and growth, directly attributable to the fluctuating nature of government investment. The dependency on these programs means that market performance is often outside of Bilfinger's direct control.

Key factors contributing to this classification include:

- Dependence on government budgets: Services are directly affected by the timing and size of public sector funding announcements.

- Political risk: Changes in government policy or election outcomes can lead to program re-prioritization or cancellation.

- Project execution delays: Bureaucratic processes and political debates can postpone or slow down the initiation of government-backed projects.

Certain legacy industrial services, particularly those with declining demand and low margins, are considered Dogs within Bilfinger SE's portfolio. These might include services for aging industrial plants where modernization is limited, or specialized maintenance for technologies that are being phased out.

For example, while Bilfinger's overall industrial services segment saw strong performance, specific niche areas within traditional heavy industry, especially those not aligned with sustainability trends, may exhibit characteristics of a Dog. The company's focus on energy-efficient solutions and digitalization means older, less efficient service lines are naturally deprioritized.

These segments are characterized by low market share and low growth potential, often consuming resources without contributing significantly to overall profitability or strategic advancement. In 2023, Bilfinger continued to refine its portfolio, indicating a strategy to manage or divest such underperforming units.

The company's divestment of certain non-core construction assets in previous years, while not directly current Dogs, illustrates the strategic approach to shedding businesses that no longer fit the growth profile.

Question Marks

Bilfinger is actively broadening its environmental technology portfolio, focusing on emerging sectors such as battery production and enhancing the energy efficiency of municipal supply networks. These are dynamic, high-growth areas fueled by global decarbonization efforts, presenting significant future potential.

While these advanced environmental technologies represent promising growth avenues, Bilfinger's current market share in these relatively new or intensely competitive niches may still be modest. Consequently, substantial investment will be necessary to elevate these segments to 'Star' status within the BCG matrix, reflecting their potential to become market leaders.

Bilfinger's presence in North America, particularly in emerging or complex sub-regions, can be viewed as a Question Mark within the BCG Matrix. While the overall market offers significant growth potential, recent performance, such as a dip in organic order growth in Q1 2025 attributed to U.S. political delays, highlights the inherent challenges.

These specific geographic expansions require careful strategic planning and considerable investment to overcome potential hurdles and establish a strong market position. The potential rewards are high, but the path to market dominance in these areas is uncertain, demanding a focused approach to capital allocation and operational execution.

Bilfinger SE is strategically investing in digitalization and AI for predictive maintenance, recognizing its significant growth potential. This focus positions them in a dynamic market where advanced AI solutions are increasingly in demand.

While the overall predictive maintenance market is expanding rapidly, the segment for highly specialized, cutting-edge AI-driven applications might still be somewhat fragmented. This means that even with strong growth, Bilfinger's current market share in these very specific, advanced AI niches could be relatively low as many emerging players vie for dominance.

Niche Consulting Services for Energy Transition Roadmaps

Bilfinger SE's niche consulting services for energy transition roadmaps fit into the Question Mark quadrant of the BCG Matrix. This segment is characterized by high market growth due to increasing global demand for decarbonization strategies and net-zero initiatives, driven by ambitious corporate and governmental targets. For instance, the global energy consulting market was valued at approximately USD 15 billion in 2023 and is projected to grow significantly, with the energy transition segment being a key driver.

While the overall market for energy transition consulting is expanding rapidly, Bilfinger's specific market share within the high-level strategic advisory space might be relatively smaller compared to established, pure-play consulting firms. This positions it as a Question Mark, indicating a business with high potential but requiring significant investment to capture market share and move towards becoming a Star.

- High Market Growth: The demand for net-zero roadmaps and energy transition consulting is surging, with global investments in clean energy projected to reach trillions by 2030.

- Potential for Market Share Gain: Bilfinger's engineering and project execution expertise provides a unique advantage in translating strategic roadmaps into tangible implementation, offering a competitive edge.

- Investment Requirement: To capitalize on this growth, Bilfinger needs to invest in expanding its strategic consulting capabilities and brand recognition in this specific niche.

- Competitive Landscape: The market includes specialized energy consultants and large, diversified consulting firms, necessitating a clear value proposition for Bilfinger.

Integration of Acquired Businesses (e.g., Stork) for Synergies

Bilfinger SE's acquisition of Stork, a significant move in 2015, aimed to bolster its position in the industrial services sector, particularly in maintenance and asset management. The integration of Stork was intended to unlock substantial synergies, expanding Bilfinger's service portfolio and geographical reach. These synergies are crucial for transforming the acquired entity from a standalone business into a fully integrated part of Bilfinger's broader strategy, potentially leading to improved efficiency and cross-selling opportunities.

The success of integrating businesses like Stork often places them in the 'Question Mark' category of the BCG matrix initially. This is because while acquisitions immediately boost revenue, the true value creation through synergies, such as cost savings and enhanced market penetration in new service combinations or regions, takes time to materialize. For instance, realizing the full market share and profitable growth from combining Bilfinger's engineering expertise with Stork's strong maintenance capabilities requires careful execution and strategic alignment.

By mid-2024, Bilfinger has continued to focus on optimizing its portfolio, with integration efforts being a key component of its strategy. The company reported a revenue of approximately €4.7 billion for the fiscal year 2023, indicating the scale of its operations. The specific financial impact and market share gains directly attributable to the Stork integration, especially in terms of new, combined service offerings, are still being assessed and solidified. This ongoing process of synergy realization and market position establishment keeps such integrated businesses in a dynamic 'Question Mark' phase until their contribution becomes more predictable and consistently profitable.

The integration process involves several key areas for synergy realization:

- Operational Efficiencies: Streamlining processes and reducing redundancies between Bilfinger and Stork operations to improve cost structures.

- Cross-Selling Opportunities: Leveraging combined customer bases to offer a wider range of services, thereby increasing revenue per customer.

- Market Expansion: Utilizing Stork's established presence in certain markets to introduce or expand Bilfinger's service offerings, and vice versa.

- Service Innovation: Developing new, integrated service solutions that capitalize on the combined technical expertise and market knowledge of both entities.

Bilfinger's expansion into North America, particularly in emerging or complex sub-regions, represents a Question Mark. While the overall market offers significant growth potential, recent performance, such as a dip in organic order growth in Q1 2025 attributed to U.S. political delays, highlights inherent challenges and the need for strategic investment to solidify market position.

BCG Matrix Data Sources

Our Bilfinger SE BCG Matrix is informed by a robust combination of internal financial disclosures, comprehensive market research reports, and expert industry analysis to provide strategic clarity.