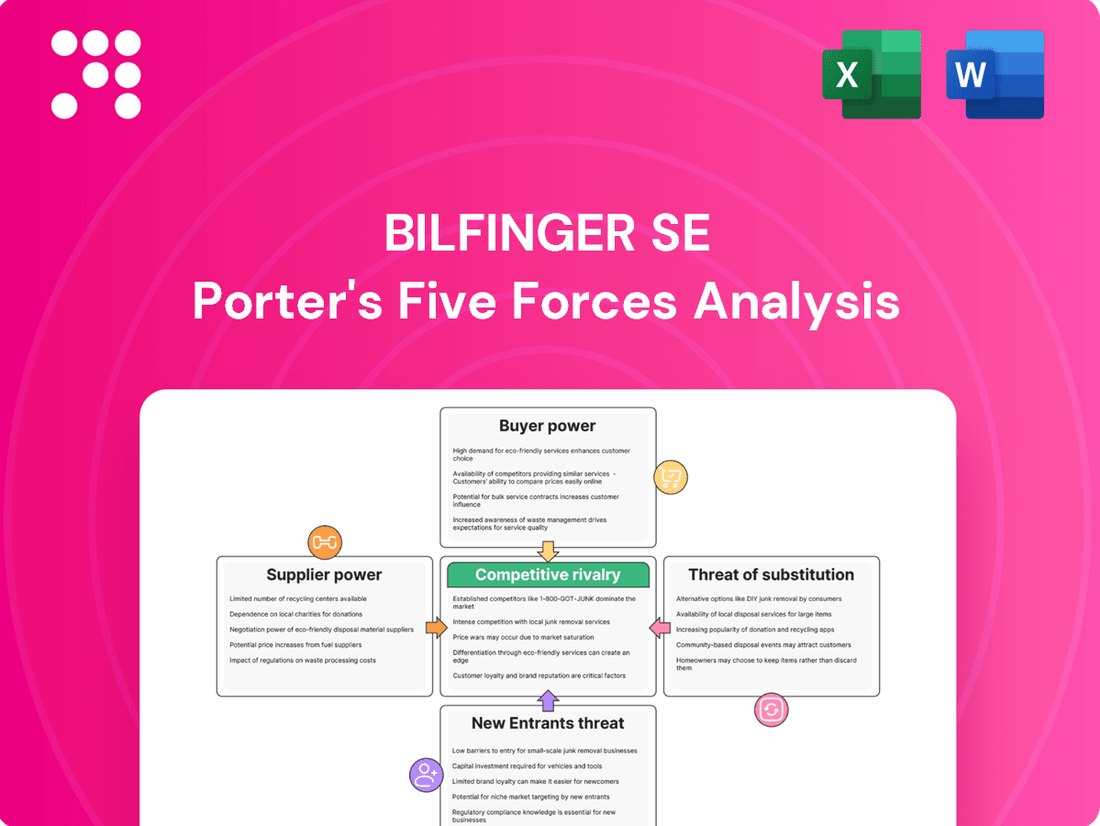

Bilfinger SE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Bilfinger SE operates in a complex industrial services landscape where buyer power can significantly impact pricing and contract terms. The threat of substitutes, while present, is often mitigated by the specialized nature of their offerings, but understanding the nuances of this force is crucial.

The complete report reveals the real forces shaping Bilfinger SE’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bilfinger SE's reliance on a concentrated supplier base for specialized industrial equipment and highly skilled labor significantly influences supplier bargaining power. For instance, in the complex field of industrial services, a limited number of manufacturers produce critical, high-specification components, giving these suppliers considerable leverage. This concentration means Bilfinger has fewer viable alternatives when sourcing these essential inputs, potentially leading to higher costs or supply chain disruptions.

Switching suppliers for Bilfinger involves significant costs, impacting its bargaining power. These expenses can include the need to retool manufacturing equipment to accommodate new specifications, retrain personnel on different operational procedures, and the lengthy process of requalifying new suppliers to ensure quality and reliability. For instance, if Bilfinger relies on specialized components for its industrial services, a change in supplier could necessitate substantial investment in new machinery or extensive testing protocols for the alternative parts.

The financial implications of these switching costs can be considerable. Breaking existing long-term contracts might also incur penalties, further locking Bilfinger into its current supplier relationships. This dependency strengthens the suppliers' position, as Bilfinger faces a tangible economic disincentive to seek alternative providers, thereby reducing Bilfinger's leverage in negotiations. For example, in 2024, many industrial firms reported increased capital expenditure on supply chain diversification, highlighting the very real costs associated with supplier transitions.

The bargaining power of suppliers for Bilfinger SE is significantly influenced by the uniqueness of their inputs. If suppliers provide highly specialized components, proprietary technologies, or critical expertise that are difficult to substitute, their leverage increases.

For instance, in the engineering and construction sectors where Bilfinger operates, suppliers of specialized heavy machinery, advanced digital twin software, or unique safety equipment can command greater power. The reliance on these specific inputs for project execution and quality assurance means Bilfinger has less room to negotiate on price or terms.

Conversely, if Bilfinger sources more standardized materials or services, such as basic construction supplies or general labor, the bargaining power of those suppliers is considerably lower due to the availability of multiple alternatives.

Threat of Forward Integration by Suppliers

The threat of forward integration by Bilfinger's suppliers poses a significant challenge. If suppliers, particularly those providing specialized components or raw materials, possess the technical expertise and financial resources, they could potentially move into offering industrial services themselves. This would turn them from partners into direct competitors, directly impacting Bilfinger's market share and pricing power.

Consider a scenario where a key supplier of advanced welding equipment also begins offering welding services to Bilfinger's clients. This capability would allow them to capture a larger portion of the value chain, leveraging their existing customer relationships and technical knowledge. Such a move would significantly increase the bargaining power of that supplier, as Bilfinger might lose business or face pressure on its service margins.

- Potential for Suppliers to Offer Direct Industrial Services: Suppliers with specialized knowledge and capabilities in areas like engineering, maintenance, or project management could integrate forward.

- Increased Supplier Leverage: If suppliers can deliver services directly, they can bypass Bilfinger, forcing Bilfinger to compete with its own supply chain.

- Impact on Bilfinger's Margins: Direct competition from suppliers can lead to price erosion and reduced profitability for Bilfinger's service offerings.

- Strategic Implications: Bilfinger must monitor supplier capabilities and consider strategies to mitigate this threat, such as long-term contracts or diversification of its supplier base.

Importance of Bilfinger to Suppliers

The bargaining power of suppliers to Bilfinger SE is influenced by how crucial Bilfinger is to their overall business. If Bilfinger accounts for a substantial percentage of a supplier's revenue, that supplier is likely more amenable to favorable pricing and terms. Conversely, if Bilfinger is a minor client for a supplier, its leverage to dictate terms is considerably weaker.

For instance, consider a specialized engineering component manufacturer. If Bilfinger represents 40% of its annual sales, this supplier will be highly motivated to maintain that relationship, potentially offering competitive pricing. However, if Bilfinger only makes up 2% of a large, diversified materials provider's income, the latter has less incentive to concede on price or terms.

- Supplier Dependence: Bilfinger's significance as a customer directly impacts a supplier's willingness to negotiate.

- Revenue Concentration: Suppliers heavily reliant on Bilfinger's business are more susceptible to Bilfinger's demands.

- Market Position of Supplier: Niche or specialized suppliers might hold more power if Bilfinger has limited alternatives.

- Availability of Alternatives: If many suppliers can provide the needed goods or services, Bilfinger's bargaining power increases.

Bilfinger SE faces significant supplier bargaining power due to the specialized nature of many industrial components and the high cost associated with switching providers. This concentration of specialized suppliers, coupled with substantial switching costs like retooling and retraining, grants them considerable leverage. For example, in 2024, many industrial firms reported increased capital expenditure on supply chain diversification, underscoring the financial burden of supplier transitions.

The threat of forward integration by suppliers also looms large; if suppliers can offer direct industrial services, they become competitors, potentially eroding Bilfinger's margins. Furthermore, a supplier's dependence on Bilfinger's business is a key factor; if Bilfinger represents a large portion of a supplier's revenue, the supplier is more likely to offer favorable terms.

| Factor | Impact on Bilfinger SE | Example Scenario |

|---|---|---|

| Supplier Concentration | High | Limited manufacturers for critical, high-specification industrial equipment. |

| Switching Costs | High | Retooling, retraining, and requalification processes for new suppliers. |

| Uniqueness of Inputs | High | Proprietary technologies or specialized safety equipment difficult to substitute. |

| Threat of Forward Integration | Moderate to High | Supplier of advanced welding equipment starting to offer welding services. |

| Supplier Dependence on Bilfinger | Variable | Supplier representing 40% of revenue is more amenable to negotiation than one representing 2%. |

What is included in the product

This analysis of Bilfinger SE's competitive landscape reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Bilfinger SE's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Bilfinger's customer base exhibits a degree of concentration, particularly within its key industrial segments. If a significant portion of revenue is derived from a limited number of large clients in sectors like energy or manufacturing, these customers can exert considerable bargaining power. For instance, in 2023, Bilfinger's revenue from its largest customer represented a notable percentage, though specific figures vary by segment and are often subject to confidentiality agreements.

Switching from Bilfinger SE to another industrial services provider can involve significant costs and complexities for customers. These can include the expense and time required for re-contracting, the potential disruption to ongoing operations during a transition, and the effort needed to integrate a new service provider's systems and personnel into their existing industrial facilities. For large-scale, complex industrial operations, these switching costs are often substantial, thereby limiting the bargaining power of customers.

Bilfinger SE faces a moderate level of bargaining power from its customers, partly due to the availability of substitute services. Customers can sometimes opt for in-house maintenance teams, especially for simpler tasks, or engage with smaller, specialized local service providers who might offer lower prices. In 2023, the industrial services sector saw continued investment in digital solutions, which can also reduce reliance on traditional external maintenance providers for certain functions.

Customer Price Sensitivity

Bilfinger's customers exhibit varying degrees of price sensitivity. For essential services critical to maintaining plant operations or ensuring safety, price sensitivity tends to be lower. However, for less critical or more commoditized services, customers are more likely to shop around and demand competitive pricing. In 2023, Bilfinger reported that its Energy division, which often deals with essential maintenance and upgrades for power plants, likely experienced less price pressure than its Industrial division, which might offer more standardized services.

Several factors influence this sensitivity. The financial health of the customer is paramount; companies facing economic downturns or margin pressures will naturally be more focused on cost. Furthermore, if the cost of Bilfinger's services represents a significant portion of a customer's overall operational expenditure, they will be more inclined to seek lower prices. For instance, a large industrial conglomerate might have more leverage and a greater focus on cost optimization for routine maintenance contracts compared to a smaller, specialized manufacturer relying on Bilfinger for a critical, unique process.

- Customer Price Sensitivity: Varies based on service criticality and customer financial health.

- Impact on Pricing: Higher sensitivity leads to greater demand for lower prices and competitive bidding.

- 2023 Data Context: Energy sector services likely less price sensitive than some Industrial sector offerings.

- Key Influences: Operational reliance, customer profitability, and the proportion of service cost to total expenditure.

Threat of Backward Integration by Customers

The threat of backward integration by Bilfinger's customers is a significant factor in their bargaining power. Large industrial clients, particularly those in sectors like energy, chemicals, or manufacturing, often possess substantial financial resources and technical expertise.

If these clients can develop in-house capabilities for core industrial services such as engineering, maintenance, or project management, they reduce their reliance on external providers like Bilfinger. This capability directly strengthens their negotiating position, potentially leading to lower service prices or demands for more favorable contract terms.

For instance, a major oil and gas producer might decide to build its own specialized maintenance division rather than outsourcing to companies like Bilfinger, especially if they perceive cost savings or greater control over quality. In 2024, many large industrial conglomerates continued to explore vertical integration strategies to enhance efficiency and reduce operational costs, directly impacting the demand for outsourced services.

- Customer Expertise: Major clients often possess in-house engineering and operational knowledge, enabling them to assess and potentially replicate Bilfinger's service offerings.

- Resource Availability: Financially robust customers have the capital to invest in developing their own service divisions, acquiring necessary equipment and talent.

- Cost Control: By bringing services in-house, large customers aim to achieve greater cost efficiencies and predictability compared to outsourcing.

- Strategic Importance: For some clients, certain industrial services are so critical to their operations that developing internal expertise becomes a strategic imperative.

Bilfinger's customers possess significant bargaining power, particularly large clients in concentrated industrial segments. This power is amplified by the substantial switching costs associated with changing service providers, which include re-contracting, operational disruption, and system integration challenges. In 2024, many industrial firms continued to evaluate insourcing strategies, increasing the pressure on service providers like Bilfinger to offer competitive pricing and demonstrate clear value.

| Factor | Impact on Bilfinger | 2023/2024 Context |

| Customer Concentration | High for key clients; enables stronger negotiation | Revenue from top clients remains a critical metric, though specific percentages are often confidential. |

| Switching Costs | Moderate to High; deters customers from switching | Complex industrial operations necessitate lengthy transition periods and significant investment for new providers. |

| Substitute Services | Moderate threat from in-house teams or smaller specialists | Digitalization in 2023 offered some alternatives for less critical maintenance tasks. |

| Backward Integration | Significant threat; clients can develop own capabilities | In 2024, vertical integration remained a trend for large industrial players seeking cost control and operational autonomy. |

Preview the Actual Deliverable

Bilfinger SE Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Bilfinger SE, offering a detailed examination of industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It provides actionable insights into Bilfinger SE's competitive landscape, enabling strategic decision-making.

Rivalry Among Competitors

The industrial services market where Bilfinger SE operates is characterized by a significant number of competitors, including major players like Oceaneering International, Stantec, Worley, Fluor, Parsons, ABB, Schneider Electric, Leadec, and Siemens Global. Many of these companies are of comparable or even larger size than Bilfinger, contributing to a highly competitive landscape.

This intense rivalry means that companies are constantly vying for market share, often through competitive pricing and service innovation. For instance, in 2024, the global industrial services market is projected to reach hundreds of billions of dollars, with many of these firms securing substantial contracts across various sectors.

The industrial services market is experiencing robust growth, projected to expand significantly in the coming years. This upward trend suggests that companies like Bilfinger SE can increase their revenue by capturing new business rather than solely by intensifying competition for existing market share. For instance, the global industrial services market was valued at approximately $1.2 trillion in 2023 and is anticipated to reach over $1.7 trillion by 2028, demonstrating a compound annual growth rate (CAGR) of around 7.5%.

Bilfinger's services exhibit a moderate degree of differentiation, primarily through its focus on integrated solutions and digital offerings. While core maintenance and engineering services can be somewhat commoditized, Bilfinger's emphasis on enhancing efficiency and sustainability for clients sets it apart. For instance, their digital solutions for asset management and predictive maintenance offer a unique value proposition compared to purely traditional service providers.

The company's commitment to being a leader in sustainability and efficiency is a key differentiator, allowing them to move beyond pure price competition. By offering comprehensive portfolios that address complex client needs, such as decarbonization projects and energy efficiency improvements, Bilfinger can command a premium. This strategic positioning helps to mitigate the intensity of price-based rivalry in the market.

Exit Barriers

Bilfinger SE operates within an industrial services market characterized by substantial exit barriers. These barriers can trap companies, including Bilfinger, in the market even when profitability wanes, leading to sustained competitive pressure.

The significant investment in fixed assets, such as specialized machinery and large-scale facilities, represents a major hurdle for competitors looking to leave the sector. Similarly, Bilfinger's extensive and specialized workforce, often requiring unique training and certifications, makes it difficult and costly to redeploy or dismiss personnel. Long-term contracts, a common feature in industrial services, further bind companies to ongoing commitments, making a swift exit impractical.

These high exit barriers mean that even in periods of low profitability, companies like Bilfinger are compelled to remain operational. This can result in prolonged and intense competition as firms struggle to maintain market share and profitability, potentially leading to price wars or reduced investment in innovation.

- High Fixed Asset Investment: Bilfinger's substantial infrastructure and equipment represent significant sunk costs that are difficult to recover upon exit.

- Specialized Labor Force: The need for highly skilled and specialized technicians and engineers creates a human capital barrier, making it costly to downsize or reassign employees.

- Long-Term Contracts: Commitments to clients through multi-year service agreements necessitate continued operation, limiting flexibility for exiting the market.

- Industry Specificity: The specialized nature of industrial services means assets and expertise are not easily transferable to other industries, increasing the cost of exit.

Strategic Objectives of Competitors

Bilfinger's competitors often pursue a mix of strategic objectives. Some, like Valmet, are heavily invested in innovation and technological advancement within the energy and process industries, aiming to lead in sustainable solutions. Others might prioritize expanding their global footprint, seeking to establish a stronger presence in emerging markets to capture new revenue streams.

The competitive landscape is shaped by these differing goals. For instance, a competitor focused solely on aggressive market share acquisition might engage in price wars, directly impacting industry profitability. Conversely, rivals prioritizing long-term profitability may invest more in operational efficiency and customer retention, creating a different dynamic.

Bilfinger's own strategic objective of becoming the number one partner for efficiency and sustainability means it's likely to face intensified rivalry from companies that share similar ambitions. This shared focus on sustainability, in particular, is driving significant investment in green technologies and services across the sector.

- Market Share Focus: Some competitors aim to grow their slice of the pie, potentially through competitive pricing or aggressive sales tactics.

- Profitability Drive: Others concentrate on maximizing earnings, often through cost control and high-margin service offerings.

- Innovation Leadership: A key objective for many is to be at the forefront of technological advancements, especially in areas like digitalization and sustainability.

- Global Expansion: Entering and succeeding in new geographical markets is a common strategy to diversify revenue and increase overall scale.

The competitive rivalry within the industrial services sector is intense, driven by a large number of significant players like Oceaneering International, Stantec, and Worley, many of whom rival Bilfinger SE in size. This crowded market forces companies to constantly compete on price and service innovation to gain market share. For example, the global industrial services market was valued at approximately $1.2 trillion in 2023 and is expected to grow to over $1.7 trillion by 2028.

Bilfinger differentiates itself through integrated solutions and digital offerings, moving beyond simple price competition by focusing on client efficiency and sustainability. This strategy is crucial as the market is projected to grow substantially, offering opportunities for revenue expansion through new business rather than solely through aggressive competition for existing contracts.

The rivalry is further fueled by companies pursuing diverse strategic goals, such as market share expansion, technological leadership in sustainability, or global market penetration. Bilfinger's own ambition to lead in efficiency and sustainability positions it directly against competitors with similar objectives, intensifying competition in these growth areas.

SSubstitutes Threaten

The threat of substitutes for Bilfinger's industrial services is significant, especially when considering the price-performance trade-off. Alternative solutions, such as advanced predictive maintenance software and in-house automation technologies, can increasingly meet the same operational needs at a comparable or even lower cost. For instance, the industrial services market is experiencing substantial growth, projected to reach over $1.5 trillion globally by 2024, driven by these very technological advancements.

Customer propensity to substitute for Bilfinger SE's services is generally low, particularly within the process industry where outsourcing for efficiency and sustainability remains a strong trend. Customers are often locked into complex, long-term relationships due to the specialized nature of Bilfinger's engineering and maintenance offerings. For instance, the high switching costs associated with re-tooling or re-training internal staff for complex industrial processes make a sudden shift to an alternative provider unlikely. This reliance on specialized expertise and established operational integration creates a significant barrier to substitution.

Emerging technologies pose a significant threat of substitution for traditional industrial services. Advanced robotics and AI-driven autonomous systems are increasingly capable of performing tasks previously requiring human intervention, such as inspection, repair, and routine maintenance. For instance, companies are investing heavily in digital twin technology, which creates virtual replicas of physical assets. This allows for predictive maintenance and remote troubleshooting, potentially reducing the need for on-site service calls. In 2024, the global industrial automation market was valued at over $200 billion, reflecting the strong adoption of these technologies.

Switching Costs to Substitutes

The threat of substitutes for Bilfinger SE's services is generally moderate, largely due to the significant switching costs customers face. These costs can be substantial, encompassing not only financial outlays but also operational disruptions.

Customers considering a switch from Bilfinger's specialized engineering and industrial services to an in-house solution or a different provider often face considerable investment. This includes the potential need to acquire new, specialized equipment, which can represent a significant capital expenditure. For instance, if a client decides to manage their own plant maintenance rather than outsourcing to Bilfinger, they might need to purchase advanced diagnostic tools or heavy machinery, potentially costing millions of euros depending on the scale of operations.

Beyond capital investment, retraining existing staff or hiring new personnel with the requisite technical expertise poses another hurdle. This investment in human capital can be time-consuming and costly. Furthermore, adopting unproven or less established technologies as a substitute carries inherent risks, including potential performance issues, integration challenges, and the possibility of project delays, all of which translate into indirect costs for the customer.

- Capital Investment: Customers might need to invest in new machinery and technology to replicate Bilfinger's capabilities, a significant financial commitment.

- Training and Skill Development: Retraining existing staff or hiring new, specialized personnel requires time and financial resources.

- Operational Disruption: The process of switching providers or bringing services in-house can lead to temporary disruptions in operations, impacting productivity and revenue.

- Risk of Unproven Technologies: Adopting substitute solutions that are not as established carries risks of performance issues and integration problems, leading to unforeseen costs.

Quality and Performance of Substitutes

The quality and performance of substitute solutions are critical considerations. While Bilfinger SE is known for its high standards of safety and quality across its diverse service portfolio, potential substitutes might offer comparable or even superior performance in specific niches. For instance, specialized engineering firms or digital-first maintenance providers could present more agile or cost-effective alternatives for certain tasks.

The threat of substitutes is amplified if these alternatives provide greater flexibility or more integrated solutions. Companies might opt for modular service packages or digital platforms that allow for greater customization and real-time performance monitoring, potentially surpassing the comprehensiveness of traditional, broader service contracts. This is particularly relevant in areas like predictive maintenance where advanced analytics can offer significant advantages.

- Substitute Performance: While Bilfinger emphasizes high safety and quality, specialized competitors may offer superior performance in niche areas.

- Flexibility and Integration: Substitutes offering greater flexibility and integrated digital solutions can pose a significant threat.

- Cost-Effectiveness: The overall cost-benefit analysis of substitute solutions, including their long-term reliability, is a key factor for customers.

- Technological Advancements: Emerging technologies in areas like AI-driven diagnostics and robotics could redefine service delivery, creating new substitute threats.

The threat of substitutes for Bilfinger's industrial services is moderate, primarily due to high customer switching costs. While digital solutions and in-house capabilities are emerging, the specialized nature of Bilfinger's offerings and the significant investment required to replicate them create a barrier. For example, the global industrial automation market, a key area for potential substitution, was valued at over $200 billion in 2024, indicating substantial investment in alternative technologies.

Customers face substantial capital expenditures and operational risks when considering substitutes. Acquiring specialized equipment and retraining staff can cost millions, and the potential for performance issues with unproven technologies adds another layer of concern. This makes a complete shift away from established providers like Bilfinger a complex and often unappealing proposition.

The performance and flexibility of substitutes are key differentiators. While Bilfinger maintains high quality, niche providers or digital platforms might offer more agile or cost-effective solutions in specific areas, such as predictive maintenance. This is evidenced by the increasing adoption of AI-driven diagnostics, which are transforming service delivery models.

| Substitute Area | Potential Impact on Bilfinger | Key Considerations for Customers | 2024 Market Data/Trend |

|---|---|---|---|

| In-house Automation & Robotics | Reduced demand for routine maintenance services | High initial investment, need for specialized skills | Global industrial automation market exceeding $200 billion |

| Predictive Maintenance Software | Shift from reactive to proactive service models | Integration complexity, data security concerns | Significant growth driven by AI and IoT integration |

| Specialized Niche Service Providers | Competition in specific service segments | May offer better cost-performance in narrow areas | Growing market share for specialized engineering firms |

Entrants Threaten

Entering the industrial services sector, especially for companies aiming for a comprehensive value chain offering like Bilfinger SE, demands significant upfront capital. This includes substantial investments in specialized machinery, advanced technologies, and robust infrastructure to compete effectively.

For instance, Bilfinger SE reported revenues of approximately €4.4 billion in 2023, underscoring the scale of operations and the financial muscle required to maintain such a market position. Acquiring and maintaining the necessary assets, from heavy construction equipment to sophisticated digital platforms, presents a formidable financial hurdle for potential new entrants.

Bilfinger SE, a global industrial services provider, benefits significantly from economies of scale and scope. Its extensive operational footprint and broad service portfolio, spanning from maintenance and plant engineering to construction and digitalization, allow it to spread fixed costs over a larger revenue base. This naturally leads to lower per-unit costs compared to smaller, more specialized competitors.

New entrants face a substantial hurdle in replicating Bilfinger's cost efficiencies. Achieving comparable economies of scale would require massive upfront investment to build a similar volume of operations and client base. Furthermore, developing the breadth of services Bilfinger offers, covering the entire value chain, demands considerable expertise, infrastructure, and market access, making it difficult for newcomers to compete on cost.

In 2023, Bilfinger reported revenues of approximately €4.7 billion, underscoring its significant scale. This scale allows for optimized procurement, efficient resource allocation across projects, and the ability to absorb fluctuations in demand more effectively than smaller firms, thereby presenting a considerable barrier to entry.

Bilfinger SE operates in a sector where established brand loyalty and deep-seated customer relationships act as significant barriers to new entrants. The company's focus on being the premier partner for efficiency and sustainability across diverse process industries means it has cultivated trust and reliability over many years. Building comparable levels of confidence and long-term partnerships would require new competitors to invest heavily in time and resources, making market entry challenging.

Access to Distribution Channels and Supply Chains

New companies entering the industrial services sector, like Bilfinger SE operates within, face significant hurdles in securing reliable supply chains and establishing effective distribution networks. Existing, established players often have long-standing relationships with material suppliers and component manufacturers, making it difficult for newcomers to negotiate favorable terms or even gain access to essential resources. This can create a substantial barrier to entry, as consistent access to quality materials and specialized components is crucial for delivering services.

Furthermore, the labor market presents a considerable challenge, particularly for skilled workers. The demand for experienced engineers, technicians, and project managers in industrial services often outstrips supply. Bilfinger, for instance, relies on a highly specialized workforce. New entrants must compete fiercely for this limited talent pool, which can drive up labor costs and delay project execution, further hindering their ability to establish a competitive foothold. In 2023, the global shortage of skilled labor in manufacturing and engineering sectors was a widely reported issue, impacting project timelines and cost estimations across the industry.

- Supply Chain Dependencies: New entrants struggle to secure consistent access to specialized components and raw materials due to established relationships held by incumbents.

- Distribution Network Challenges: Building an effective network to reach industrial clients requires significant investment and time, often leveraging existing infrastructure.

- Skilled Labor Scarcity: The industrial services sector faces a persistent shortage of skilled engineers and technicians, making talent acquisition a major obstacle for new companies.

- Capital Investment: Overcoming these access barriers necessitates substantial upfront capital for infrastructure, supplier relationships, and workforce development.

Regulatory and Legal Barriers

New entrants in the industrial and energy sectors face significant regulatory and legal hurdles. Bilfinger operates within highly regulated environments such as energy generation, chemical processing, and pharmaceuticals, where compliance with stringent standards is paramount. These include complex licensing requirements, demanding environmental protection laws, and evolving safety regulations that necessitate substantial investment and expertise to navigate successfully.

The industrial services landscape, particularly for companies like Bilfinger SE, is characterized by extensive legal frameworks that act as a substantial barrier to entry. For instance, in the energy sector, new entrants must adhere to national and international regulations concerning emissions, waste disposal, and operational safety, often requiring specific certifications and permits. In 2024, the ongoing focus on decarbonization and stricter environmental compliance across Europe means that any new player would need to demonstrate immediate adherence to these evolving standards, a costly and time-consuming undertaking.

- Licensing and Permits: Obtaining necessary operational licenses and permits for industrial sites, especially in the energy and chemical sectors, can take years and involve rigorous inspections.

- Environmental Standards: Compliance with strict environmental regulations, such as those related to emissions (e.g., EU ETS) and waste management, requires significant capital investment in technology and processes.

- Safety Regulations: Adherence to comprehensive health and safety protocols, particularly in hazardous environments common in industrial operations, is non-negotiable and subject to frequent audits.

- Industry-Specific Certifications: Many clients in sectors like pharmaceuticals and heavy industry require suppliers to hold specific quality and safety certifications, which are costly and time-intensive to acquire.

The threat of new entrants for Bilfinger SE is generally considered moderate due to high capital requirements and established customer relationships. However, specific niches within the industrial services market might present lower barriers.

Significant upfront investment in specialized equipment, technology, and skilled labor is essential, deterring many potential new players. Bilfinger's 2023 revenue of approximately €4.7 billion highlights the scale of operations and the financial commitment needed to compete effectively.

New entrants also face challenges in replicating Bilfinger's economies of scale and scope, which provide cost advantages. Building comparable operational breadth and market reach requires substantial time and capital, making it difficult to match incumbent cost efficiencies.

Established brand loyalty and deep customer relationships, cultivated over years of reliable service, further impede market entry. New companies must invest heavily in building trust and demonstrating long-term value to gain traction against established providers like Bilfinger.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bilfinger SE is built upon a robust foundation of publicly available information, including Bilfinger's annual reports, investor presentations, and official press releases. We supplement this with insights from reputable industry analysis firms and financial news outlets to capture a comprehensive view of the competitive landscape.