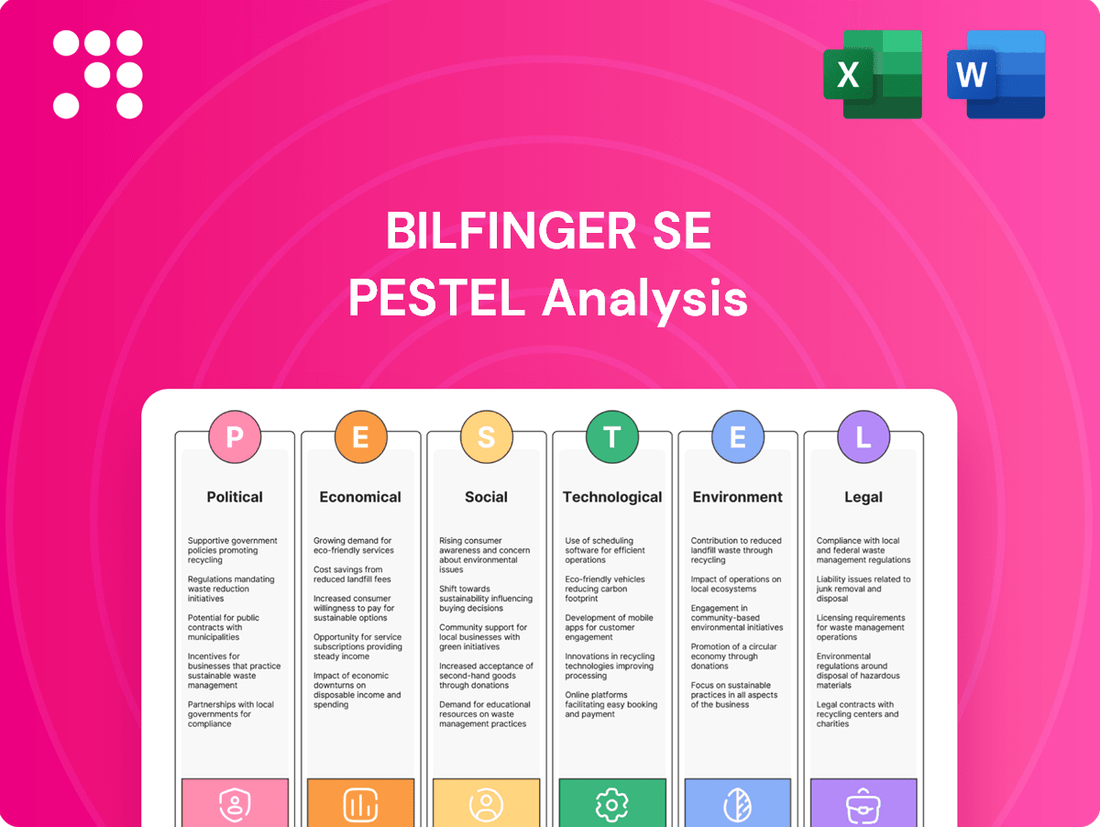

Bilfinger SE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bilfinger SE Bundle

Navigate the complex external landscape impacting Bilfinger SE with our expert PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the company's operational environment. Gain a crucial competitive advantage by leveraging these insights for your strategic planning. Download the full version now to unlock actionable intelligence and make informed decisions.

Political factors

Government infrastructure spending is a significant driver for Bilfinger SE, particularly in the industrial and energy sectors. National and regional investment plans, such as Germany's €19.4 billion stimulus package announced in 2020 to boost the economy and infrastructure, directly translate into demand for Bilfinger's engineering, construction, and maintenance services.

The company benefits from public-private partnerships and government stimulus packages aimed at modernizing critical infrastructure, like the European Union's NextGenerationEU recovery fund which allocates substantial amounts to green and digital transitions, creating opportunities for Bilfinger's sustainable solutions.

The stability and predictability of these political commitments are crucial for Bilfinger's long-term project pipeline. For instance, ongoing commitments to renewable energy expansion and grid modernization in countries like Germany and Norway provide a consistent demand base for Bilfinger's expertise in these areas.

Bilfinger SE operates within a complex web of governmental regulations and industrial standards across its global operations. Environmental regulations, such as emissions controls and waste management mandates, directly impact its project execution and require significant investment in compliance technologies. For instance, the increasing focus on decarbonization in the European Union, a key market for Bilfinger, necessitates adherence to stringent CO2 reduction targets for industrial facilities.

Safety standards are paramount in Bilfinger's sectors, particularly in construction and industrial services, with compliance often exceeding minimum legal requirements to mitigate risks and maintain a strong safety record. Labor laws, varying by country, also influence operational costs and workforce management. Changes in these regulations, such as stricter workplace safety laws or new environmental reporting requirements, can lead to increased compliance costs but also create opportunities for Bilfinger to offer specialized services in areas like environmental remediation or safety consulting.

Bilfinger SE's global operations are significantly influenced by international trade policies and tariffs. Changes in these policies can directly impact the cost of materials and components sourced from different countries, affecting project profitability. For instance, the imposition of new tariffs on steel or specialized equipment could increase Bilfinger's procurement expenses, potentially leading to higher project bids or reduced margins.

Trade disputes and the formation of new trade blocs can disrupt supply chains and alter the flow of goods and services, impacting Bilfinger's ability to deliver projects efficiently across borders. The company's procurement strategies must remain agile to navigate these shifts, ensuring access to necessary resources while mitigating risks associated with protectionist measures. This also shapes the competitive landscape, as varying trade regulations can create advantages or disadvantages for Bilfinger relative to its international rivals.

Political Stability and Geopolitical Risks

Bilfinger SE operates globally, making political stability in its key markets crucial. Geopolitical risks, such as ongoing conflicts or trade disputes, can directly impact project timelines and profitability, especially in regions like Eastern Europe where Bilfinger has significant industrial service operations. For instance, the ongoing geopolitical tensions in Eastern Europe could affect supply chains and the cost of materials for projects in that region.

The company actively manages these risks through diversification of its project portfolio across different geographical areas and by implementing robust risk assessment frameworks. This strategy helps to mitigate the impact of localized political instability or disruptions. Bilfinger's focus on regions with stable political environments and strong industrial bases provides a degree of resilience against broader geopolitical shifts.

- Diversified Geographic Footprint: Bilfinger's presence in markets across Europe, North America, and Asia helps spread risk, reducing reliance on any single politically volatile region.

- Contractual Safeguards: Projects often include clauses to address political risks, such as force majeure provisions, to protect against unforeseen disruptions.

- Local Partnerships: Collaborating with local entities in various countries can provide valuable insights into the political landscape and aid in navigating local regulations and potential challenges.

Energy Policy and Transition

Government energy policies, especially those pushing for a transition to cleaner energy sources and setting decarbonization targets, significantly shape Bilfinger SE's operations. These policies directly influence demand for services related to renewable energy installations, the conversion of existing industrial plants, and the ongoing maintenance of traditional energy infrastructure. For instance, Germany's commitment to phasing out nuclear power by 2023 and its ambitious renewable energy goals create a sustained need for Bilfinger's expertise in plant engineering and construction.

The increasing global focus on sustainability and net-zero emissions is a major driver for Bilfinger's business segments. This transition creates substantial opportunities in areas like hydrogen technology, carbon capture, utilization, and storage (CCUS), and the development of various sustainable energy solutions. Bilfinger's involvement in projects like the construction of electrolysis plants for green hydrogen production exemplifies how these policy shifts translate into tangible business growth.

- Renewable Energy Growth: Global investment in renewable energy is projected to reach trillions of dollars by 2030, creating a robust market for Bilfinger's EPC (Engineering, Procurement, and Construction) services in wind, solar, and other green technologies.

- Decarbonization Mandates: Many countries, including those in the EU, have set legally binding decarbonization targets, compelling industries to invest in energy efficiency and emissions reduction technologies, which are core offerings for Bilfinger.

- Hydrogen Economy Development: The burgeoning hydrogen economy is a key growth area, with significant government support and investment in infrastructure, positioning Bilfinger to capitalize on its expertise in building hydrogen production and distribution facilities.

Government policies, especially those promoting infrastructure development and energy transition, are crucial for Bilfinger SE. For example, Germany's €19.4 billion stimulus package in 2020 and the EU's NextGenerationEU fund, with its focus on green and digital transitions, directly translate into demand for Bilfinger's services. These initiatives create consistent demand for modernization and sustainable solutions.

Regulatory frameworks, including environmental standards and safety regulations, significantly influence Bilfinger's operations and costs. The EU's stringent CO2 reduction targets, for instance, necessitate compliance investments and offer opportunities for specialized services like environmental remediation. Labor laws also impact operational expenses and workforce management.

International trade policies and geopolitical stability are key political factors affecting Bilfinger's global business. Trade disputes can disrupt supply chains and increase procurement costs, impacting project profitability. Bilfinger mitigates these risks through geographic diversification and robust risk assessment, maintaining operations in politically stable regions.

Government energy policies, particularly those driving decarbonization and renewable energy adoption, are vital. Germany's commitment to phasing out nuclear power and its renewable energy goals create sustained demand for Bilfinger's expertise in plant engineering and construction. The global push for net-zero emissions fuels growth in areas like hydrogen technology and CCUS.

| Policy Area | Impact on Bilfinger SE | Example/Data Point |

|---|---|---|

| Infrastructure Spending | Increased demand for engineering, construction, and maintenance services. | Germany's €19.4 billion stimulus package (2020) |

| Environmental Regulations | Higher compliance costs, opportunities for specialized services. | EU CO2 reduction targets for industrial facilities |

| Energy Transition Policies | Growth in renewable energy, hydrogen, and CCUS sectors. | Germany's renewable energy goals, growth in green hydrogen production facilities |

| Trade Policies | Impacts on material costs and supply chain stability. | Potential tariffs on steel and specialized equipment |

What is included in the product

This PESTLE analysis of Bilfinger SE examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic direction.

It provides a comprehensive understanding of the external macro-environment, highlighting key trends and potential impacts for Bilfinger SE.

A clear, actionable PESTLE analysis for Bilfinger SE that highlights key external factors, enabling proactive strategy development and mitigating potential risks.

Economic factors

Global economic growth directly fuels demand for Bilfinger SE's services, particularly in its core sectors like energy, chemicals, and real estate. For instance, a projected global GDP growth of 2.7% for 2024, as estimated by the IMF, typically translates to increased capital expenditure and maintenance spending by industrial clients. Higher industrial production indices, such as the 0.4% rise in the Eurozone's industrial production in January 2024, signal greater activity and a corresponding need for Bilfinger's engineering and maintenance solutions.

Economic downturns, however, present significant challenges. A slowdown in global growth or a contraction in industrial output can lead to clients postponing or canceling investment projects and maintenance schedules. This was evident in 2023, where inflationary pressures and geopolitical uncertainties tempered industrial investment in some regions, impacting contract volumes for service providers like Bilfinger.

Inflation significantly impacts Bilfinger SE's operational expenses, especially concerning raw materials, energy, and labor. For instance, rising energy prices in 2024 directly increase the cost of operating machinery and facilities.

If Bilfinger cannot effectively manage these rising costs through contract renegotiations or hedging, profit margins could shrink. The company's capacity to pass on increased expenses to clients is crucial, particularly in labor-intensive projects where wage inflation, which saw average wage growth around 4-5% in key European markets during 2024, directly affects project profitability.

Prevailing interest rates directly impact Bilfinger SE's financing costs for both ongoing projects and its corporate debt. Higher rates mean more expensive borrowing, which can squeeze profit margins on projects with fixed financing arrangements. For instance, if Bilfinger secured a significant loan in late 2023 or early 2024 when interest rates were elevated, the ongoing cost of servicing that debt will be higher throughout 2024 and into 2025.

Client investment decisions are also heavily influenced by interest rates. When borrowing costs rise, clients, particularly in capital-intensive industries like manufacturing or energy, may postpone or scale back new projects. This reduction in client spending directly affects Bilfinger's pipeline of potential work and revenue streams. For example, a 1% increase in interest rates can significantly alter the economic viability of a multi-billion euro industrial plant construction.

The availability and cost of capital for large industrial projects are critical. Central bank monetary policy, such as adjustments to benchmark rates by the European Central Bank (ECB) or the US Federal Reserve, directly shapes this landscape. If monetary policy tightens, leading to higher interest rates, the cost of capital for Bilfinger and its clients escalates, potentially limiting the scale and number of new large-scale investments undertaken in 2024 and 2025.

Exchange Rate Fluctuations

Exchange rate fluctuations significantly impact Bilfinger SE's global operations. For instance, a stronger Euro can reduce the value of revenues earned in weaker currencies, affecting profitability. Conversely, a weaker Euro might make imported equipment more expensive, increasing operational costs.

These currency movements also influence the competitiveness of Bilfinger's bids in international markets. If the Euro strengthens against a client's local currency, Bilfinger's services become relatively more expensive, potentially leading to lost contracts. In 2024, the Euro experienced moderate volatility against currencies like the US Dollar and British Pound, necessitating careful financial management.

Bilfinger employs various hedging strategies to mitigate these risks, including forward contracts and options to lock in exchange rates for future transactions. These financial instruments help stabilize earnings and manage the cost of goods and services procured internationally, providing a degree of certainty in an unpredictable global economic landscape.

- Impact on Revenue: A stronger Euro in 2024 reduced the translated value of non-Euro revenues for Bilfinger.

- Cost of Imports: Fluctuations in the Euro impacted the cost of machinery and materials sourced from countries with different currency valuations.

- Bid Competitiveness: Exchange rate shifts affected the pricing of Bilfinger's project bids in markets like North America and the UK.

- Hedging Effectiveness: Bilfinger's use of financial derivatives in 2024 aimed to neutralize a portion of the adverse currency effects on its financial results.

Client Investment Cycles and Industry Trends

Bilfinger SE operates in sectors like oil & gas, chemicals, and power generation, which are inherently cyclical. Client investment in these areas often fluctuates based on global commodity prices and energy demand. For instance, a downturn in oil prices can lead to reduced capital expenditure by energy companies, impacting Bilfinger's order intake.

Long-term trends like decarbonization and digitalization are reshaping client investment. Companies are increasingly prioritizing projects related to renewable energy infrastructure and the modernization of existing plants through digital solutions. This shift influences demand for Bilfinger's specialized engineering and maintenance services, requiring adaptability in their offerings.

Bilfinger's ability to align its service portfolio with these evolving client needs and investment cycles is crucial. The company's focus on energy transition projects and digital services demonstrates an effort to capitalize on these trends. For example, in 2023, Bilfinger secured significant orders in the renewable energy sector, reflecting this strategic adaptation.

- Cyclicality: Investment in oil & gas and power sectors can swing significantly with commodity prices and regulatory changes.

- Decarbonization Drive: Clients are investing heavily in green technologies and emissions reduction, creating new service opportunities.

- Digitalization Impact: Demand for smart plant solutions and data analytics is growing, influencing maintenance and upgrade strategies.

- Adaptation: Bilfinger's success hinges on its capacity to pivot its service offerings to meet these dynamic client investment priorities.

Global economic growth directly fuels demand for Bilfinger SE's services, with a projected global GDP growth of 2.7% for 2024 by the IMF indicating increased client capital expenditure. Conversely, economic downturns can lead to project postponements, as seen in 2023 due to inflationary pressures tempering industrial investment.

Inflation significantly impacts Bilfinger's operational costs, particularly for materials and labor, with average wage growth around 4-5% in key European markets during 2024 affecting project profitability. Prevailing interest rates also influence financing costs and client investment decisions; for example, a 1% increase in rates can alter the economic viability of large industrial projects.

Exchange rate fluctuations, such as those seen with the Euro in 2024, affect the translated value of non-Euro revenues and the cost of imports, necessitating hedging strategies. Bilfinger's success also depends on adapting to cyclical industry trends and long-term shifts like decarbonization and digitalization, with the company securing significant orders in renewable energy in 2023.

Same Document Delivered

Bilfinger SE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Bilfinger SE PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this professionally structured analysis upon completing your purchase.

Sociological factors

Bilfinger SE, like many industrial service providers, faces significant challenges from evolving workforce demographics. An aging workforce in key European markets, particularly Germany, means a substantial portion of experienced engineers and skilled tradespeople are nearing retirement. This trend, coupled with declining birth rates in these regions, directly impacts labor availability and the pipeline of new talent.

Attracting and retaining specialized technical talent remains a critical hurdle. The demand for engineers, project managers, and skilled technicians in sectors like energy transition and digitalization is high, creating a competitive landscape. Bilfinger needs to actively address this by offering attractive career paths and competitive compensation packages to secure essential expertise.

To counter potential skill gaps, Bilfinger is focusing on robust talent development and knowledge transfer initiatives. This includes expanding apprenticeship programs and vocational training to cultivate future specialists, alongside upskilling existing employees for new technological demands. For instance, in 2023, the company continued its investment in digital learning platforms to enhance employee skills in areas crucial for future growth.

Societal expectations for health, safety, and wellbeing are increasingly paramount, especially for companies like Bilfinger SE operating in demanding industrial sectors. There's a growing societal demand for rigorous safety protocols and comprehensive employee welfare programs. This emphasis directly impacts how Bilfinger SE manages its operations, invests in training, and cultivates its public image.

Stringent safety regulations and a heightened awareness of employee wellbeing are shaping Bilfinger SE's operational framework. For instance, in 2023, the industrial services sector saw a continued focus on reducing workplace incidents, with many European countries enforcing stricter adherence to occupational safety directives, often tied to performance metrics and public accountability.

A robust safety culture is no longer just a compliance issue; it's a critical differentiator for Bilfinger SE. It plays a significant role in attracting skilled talent, as professionals actively seek employers with proven track records in safety. Furthermore, a strong safety reputation is often a prerequisite for securing contracts with major clients who prioritize risk mitigation and responsible operations.

Societal expectations for corporate social responsibility are increasingly shaping Bilfinger SE's operations and public perception. The company's commitment to ethical conduct, active community involvement, and clear reporting on its social footprint are vital for sustaining stakeholder confidence. For instance, in 2023, Bilfinger reported a significant increase in its sustainability performance, with a 15% reduction in its Scope 1 and 2 greenhouse gas emissions compared to 2022, demonstrating tangible progress in environmental stewardship.

Proactive CSR initiatives, going beyond basic regulatory adherence, are crucial for bolstering Bilfinger's brand reputation. These efforts not only resonate with environmentally and socially conscious consumers but also attract investors prioritizing sustainability. In 2024, Bilfinger was recognized on several sustainability indices, further enhancing its appeal to a growing segment of socially responsible investors, and its employee engagement surveys show a 10% increase in staff pride related to the company's CSR activities.

Public Perception of Industrial Activities

Public attitudes toward industrial activities, particularly concerning environmental impact and energy production, significantly shape Bilfinger SE's operational landscape. Growing public concern over climate change and pollution can lead to stricter regulations and increased opposition to projects involving fossil fuels or traditional heavy industry, potentially delaying or canceling approvals. For instance, in 2024, public discourse around energy transition intensified, with a notable increase in protests against new fossil fuel infrastructure in several European countries.

Bilfinger's ability to secure project approvals and maintain its license to operate is directly influenced by public perception. Projects in sectors like nuclear energy or large-scale industrial development face heightened scrutiny if public opinion leans towards caution or outright opposition. This can translate into more rigorous environmental impact assessments and community engagement requirements, adding complexity and cost to project execution. For example, a 2025 survey indicated that over 60% of respondents in key European markets expressed concern about the environmental footprint of industrial construction projects.

To navigate this, Bilfinger actively employs communication strategies aimed at managing public perception and highlighting its commitment to sustainability. The company emphasizes its role in developing and maintaining infrastructure that supports the energy transition, such as renewable energy facilities and modernizing existing industrial plants for greater efficiency. Bilfinger’s 2024 sustainability report detailed a 15% reduction in its own operational carbon emissions, a figure often communicated to stakeholders to demonstrate tangible progress.

- Public Concern: Growing awareness of climate change impacts leads to increased scrutiny of industrial projects, affecting Bilfinger's project approvals.

- Sector Sensitivity: Projects involving fossil fuels or nuclear energy are particularly vulnerable to negative public sentiment.

- Regulatory Impact: Negative public perception can result in more stringent environmental regulations and longer approval processes.

- Company Response: Bilfinger focuses on communication strategies that highlight sustainable practices and contributions to the energy transition, aiming to build public trust.

Changing Work Culture and Employee Expectations

Bilfinger SE, like many global companies, faces evolving employee expectations centered on work-life balance and flexible work arrangements. In 2024, a significant portion of the workforce, particularly younger generations, prioritize roles that offer autonomy and integration with personal life. This shift directly influences Bilfinger's talent acquisition and retention strategies, pushing for more hybrid and remote work options where feasible within its operational framework.

The company's approach to diversity, equity, and inclusion (DEI) is also paramount in attracting and retaining top talent. By fostering an inclusive environment, Bilfinger aims to reflect the diverse global talent pool. For instance, in 2023, the company reported increased engagement in employee resource groups, indicating a growing employee focus on these cultural aspects.

Adapting to these demands is crucial for Bilfinger to remain competitive in the global talent market. This includes leveraging digital tools to facilitate seamless collaboration and communication, regardless of employee location. The successful implementation of advanced project management software and virtual meeting platforms in 2024 has been key to maintaining productivity and employee satisfaction amidst changing work dynamics.

Key considerations for Bilfinger SE include:

- Enhanced flexible work policies: Implementing and communicating clear guidelines for hybrid and remote work to meet employee demand for better work-life integration.

- Strengthened DEI initiatives: Continuing to build a culture where all employees feel valued and have equal opportunities for growth and development.

- Investment in digital collaboration tools: Ensuring employees have access to the technology needed to work effectively in distributed teams.

- Regular employee feedback mechanisms: Actively seeking and responding to employee input on workplace culture and expectations to drive continuous improvement.

Societal shifts towards valuing employee wellbeing and safety are profoundly influencing Bilfinger SE's operational standards. The company actively invests in comprehensive safety training programs, aiming to minimize workplace incidents and foster a secure environment, a trend reinforced by stricter regulations in 2023 across European markets. This commitment to safety is not merely a compliance measure but a critical factor in attracting and retaining skilled professionals who increasingly prioritize employers with robust safety cultures.

Bilfinger's dedication to corporate social responsibility (CSR) is also a key sociological driver, impacting its brand reputation and stakeholder relations. In 2024, the company reported a 10% increase in employee pride related to its CSR activities, underscoring the importance of ethical conduct and community engagement. This focus on sustainability and social impact is vital for building trust and appealing to a growing segment of socially conscious investors and employees.

Public perception of industrial activities, particularly concerning environmental impact, directly affects Bilfinger's project approvals and operational license. With public concern over climate change intensifying in 2024, projects in sensitive sectors like energy face greater scrutiny, necessitating proactive communication strategies. Bilfinger highlights its role in the energy transition, showcasing a 15% reduction in its own operational carbon emissions in 2024 to demonstrate tangible progress and build public confidence.

Technological factors

Bilfinger SE is significantly leveraging digitalization and Industry 4.0 to reshape its service delivery. Technologies like the Industrial Internet of Things (IIoT) are central to this transformation, enabling real-time data collection and analysis across client operations. This allows for more proactive and efficient service provision.

The integration of digital tools, such as predictive maintenance and digital twins, is enhancing operational efficiency for Bilfinger. Predictive maintenance, for instance, uses data analytics to anticipate equipment failures, thereby minimizing costly downtime for clients. This proactive approach not only boosts productivity but also extends asset lifecycles.

These technological advancements are creating new value propositions for Bilfinger's customers. By offering data-driven insights and optimized maintenance strategies, Bilfinger is moving beyond traditional service models to become a strategic partner in operational excellence. For example, in 2023, Bilfinger reported a significant increase in digital service offerings, contributing to a stronger service revenue stream.

Innovations in advanced materials like composites and smart materials are significantly reshaping Bilfinger SE's engineering and construction projects. These materials offer enhanced durability and performance, crucial for industrial facilities operating in demanding environments. For instance, the use of advanced composites can lead to lighter yet stronger structural components, reducing installation time and material costs.

Additive manufacturing, or 3D printing, is another key technological factor, enabling the creation of complex, customized parts on-site or near-site. This reduces lead times and transportation expenses, as demonstrated by projects where 3D printed components have replaced traditional, more labor-intensive fabrication methods. Bilfinger's adoption of these techniques directly contributes to more cost-effective and efficient project execution.

Modular construction, a manufacturing technique that involves prefabricating sections of a project off-site, is also gaining traction. This approach, which Bilfinger actively integrates, allows for parallel processing of site preparation and module construction, accelerating project timelines. The company's commitment to these advancements, including a reported focus on digital twins and advanced analytics in project management, positions them to deliver more sustainable and economically viable solutions for clients.

Automation and robotics are increasingly vital in industrial services, especially for tasks like inspection, maintenance, and hazardous operations, directly impacting Bilfinger SE's operational efficiency and safety protocols. These advancements promise enhanced safety by removing human workers from dangerous environments and can significantly boost precision in complex maintenance procedures.

The integration of automated systems allows for optimized labor utilization, meaning fewer personnel might be needed for certain repetitive or high-risk tasks, freeing up skilled workers for more complex problem-solving. Bilfinger SE, like many in the sector, is navigating the crucial balance between leveraging the cost-saving and efficiency gains of automation and retaining the invaluable human expertise and adaptability of its workforce.

Cybersecurity and Data Protection

Bilfinger SE operates in an environment where robust cybersecurity and data protection are paramount, especially given its deep integration of digital systems, management of sensitive client data, and reliance on operational technology (OT) networks for industrial services. The increasing sophistication of cyber threats poses significant risks, potentially disrupting industrial control systems and compromising confidential information, which could lead to operational downtime and reputational damage.

The company's commitment to safeguarding its assets and those of its clients is reflected in its ongoing investments in advanced cybersecurity measures. Compliance with stringent data protection regulations, such as the General Data Protection Regulation (GDPR), is a critical aspect of Bilfinger's strategy to mitigate risks and maintain trust. For instance, in 2023, Bilfinger reported increased expenditure on IT security and digital transformation initiatives, underscoring the growing importance of these areas. The company actively works to enhance its defenses against evolving cyber threats, ensuring the integrity and confidentiality of its operations and client data.

- Increased cyber threat landscape impacting industrial sectors.

- Bilfinger's investment in cybersecurity to protect OT and client data.

- Compliance with GDPR and other data protection regulations is essential.

- Potential financial and operational impact of data breaches.

Environmental Technologies and Solutions

Advancements in environmental technologies like carbon capture, waste-to-energy, and sophisticated water treatment present significant growth avenues for Bilfinger SE. These innovations enable clients to meet increasingly stringent environmental regulations and reduce their ecological impact, creating demand for Bilfinger's expertise.

Bilfinger actively develops and deploys these cutting-edge solutions, positioning itself as a key partner for industries striving for sustainability. Their involvement spans from initial concept to full-scale implementation, ensuring clients achieve their environmental objectives.

The company's commitment is underscored by its investment in research and development focused on sustainable industrial processes. For instance, in 2023, Bilfinger reported a notable increase in its focus on green technologies and energy efficiency solutions as part of its strategic growth initiatives.

- Carbon Capture Technologies: Bilfinger's involvement in projects utilizing carbon capture, utilization, and storage (CCUS) technologies is expanding as industries seek to decarbonize operations.

- Waste-to-Energy Solutions: The company is actively engaged in designing and constructing waste-to-energy plants, transforming waste into valuable energy resources.

- Advanced Water Treatment: Bilfinger offers advanced water and wastewater treatment solutions, crucial for industries facing water scarcity and stricter discharge standards.

- R&D Investment: Bilfinger continues to invest in R&D for sustainable industrial processes, aiming to innovate and enhance its offerings in the environmental technology sector.

The increasing sophistication of Artificial Intelligence (AI) and Machine Learning (ML) is transforming how Bilfinger SE delivers its services, particularly in predictive analytics and process optimization. These technologies enable more accurate forecasting of equipment failures and enhance the efficiency of complex industrial processes.

Bilfinger's adoption of AI/ML is geared towards creating smarter, more autonomous operations for its clients. This includes leveraging AI for intelligent automation in maintenance scheduling and for generating actionable insights from vast datasets collected by IIoT devices. For example, in 2023, Bilfinger highlighted the growing contribution of data analytics and AI-driven solutions to its service portfolio, indicating a strategic shift towards intelligent service delivery.

The integration of AI and ML also supports the development of digital twins, allowing for real-time simulation and performance monitoring of assets. This capability is crucial for optimizing asset performance and extending their operational lifespan, a key value proposition for Bilfinger's clients in the industrial sector. The company's continued investment in these areas reflects a commitment to staying at the forefront of technological innovation.

Legal factors

Bilfinger SE operates within a complex web of contract law, particularly for its large-scale industrial projects. These contracts often involve intricate clauses regarding scope, timelines, performance standards, and crucially, liability. Effective negotiation is paramount to clearly define responsibilities and allocate risks, thereby minimizing potential financial and reputational damage. For instance, a significant portion of Bilfinger's project portfolio involves long-term service agreements, where contract terms directly influence revenue recognition and potential penalties for underperformance.

The company's global footprint means it must navigate diverse international contract laws, which can vary significantly in their approach to dispute resolution and enforcement. This necessitates a robust understanding of legal frameworks in each operating region to ensure compliance and protect its interests. In 2024, Bilfinger continued to emphasize standardized contract management processes across its divisions to address these cross-border complexities and streamline dispute resolution, a key factor in managing project profitability.

Bilfinger SE operates under a complex web of Health, Safety, and Environmental (HSE) regulations that vary significantly across its global operating regions. These laws mandate strict adherence to worker safety protocols, environmental protection measures, and controls on industrial emissions, directly impacting the company's operational procedures and compliance costs.

Non-compliance with these stringent HSE regulations can lead to severe consequences, including substantial fines, costly legal battles, and significant reputational damage. For instance, in 2023, the European Union continued to emphasize stricter emissions standards, with potential penalties for industrial polluters reaching millions of Euros, a factor Bilfinger must actively manage.

Bilfinger SE is committed to upholding these global and local standards, investing in robust HSE management systems and continuous training programs. The company's 2024 sustainability reports highlight ongoing initiatives to minimize environmental impact and ensure a safe working environment, reflecting a proactive approach to regulatory adherence.

Bilfinger SE navigates a complex web of labor laws and employment regulations across its global operations. These vary significantly, impacting everything from minimum wages and working hours to collective bargaining rights and dismissal procedures. For instance, strict works council regulations in Germany require extensive consultation on workforce changes, while other regions might have more flexible employment-at-will doctrines.

Compliance with these diverse legal frameworks directly influences Bilfinger's human resource strategy and operational costs. Ensuring adherence to varying national labor standards, such as those related to pay equity or mandated employee benefits, can add complexity to workforce planning and potentially increase overhead. In 2023, Bilfinger employed approximately 30,000 individuals globally, each subject to the specific labor laws of their respective countries.

Competition Law and Antitrust Regulations

Competition law and antitrust regulations are crucial for Bilfinger SE, influencing its market interactions. These laws govern mergers and acquisitions, ensuring they don't stifle competition. For instance, the European Commission's scrutiny of major industrial deals in 2024 and 2025 highlights the strict oversight on market concentration. Bilfinger must navigate these regulations to participate in competitive bidding processes without engaging in practices like price-fixing or abusing dominant market positions.

Compliance with antitrust laws is paramount to avoid significant penalties and legal challenges. The potential for hefty fines, as seen in various sectors where antitrust violations have led to multi-million Euro penalties, underscores the financial risks. Maintaining fair market access and a level playing field is essential for Bilfinger's sustained growth and reputation.

- Merger Control: Bilfinger must ensure any acquisitions comply with thresholds set by competition authorities, such as the European Union's merger regulation, which reviews transactions exceeding certain turnover limits.

- Anti-Competitive Practices: Regulations prohibit agreements between companies that restrict competition, such as price-fixing cartels or market-sharing arrangements.

- Abuse of Dominance: Companies with a significant market share are restricted from exploiting their position to the detriment of competitors or consumers.

- Compliance Costs: Adhering to these complex legal frameworks requires ongoing investment in legal counsel and internal compliance programs.

Intellectual Property Rights and Data Privacy

Bilfinger SE's proprietary technologies, engineering designs, and digital solutions are protected by intellectual property rights (IPR). Safeguarding these innovations is crucial to maintaining a competitive edge and preventing unauthorized use. The company must also navigate complex legal landscapes to avoid infringing on the intellectual property of others, a common challenge in the engineering and construction sectors.

Data privacy is another significant legal consideration for Bilfinger SE. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict requirements for handling client, employee, and operational data. Non-compliance can lead to substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates robust data management practices and ongoing legal compliance efforts.

- Intellectual Property Protection: Bilfinger actively patents its innovations in areas like energy-efficient building technologies and advanced industrial process optimization to secure its market position.

- IP Infringement Risk: The company must continuously monitor for potential infringements of its patents and trademarks, while also ensuring its own operations do not violate existing third-party IP.

- Data Privacy Compliance: Adherence to GDPR and similar regulations is paramount, especially given the sensitive client and project data Bilfinger manages, with potential fines for breaches being a significant deterrent.

- Digital Solutions and Data Security: As Bilfinger expands its digital offerings, ensuring the secure and compliant handling of data generated by these solutions becomes increasingly critical.

Bilfinger SE operates under stringent regulatory frameworks governing its industrial operations and project execution. Compliance with these laws, including those related to environmental protection and worker safety, is paramount to avoid penalties and maintain operational continuity. For example, the company's commitment to sustainability in 2024 involved significant investments in reducing its environmental footprint, aligning with evolving EU Green Deal initiatives and national regulations.

The company's global presence necessitates adherence to a patchwork of international and national laws, particularly concerning contract enforcement and dispute resolution. Bilfinger's proactive approach to standardizing contract management in 2024 aimed to mitigate risks associated with varying legal interpretations across its diverse project locations.

Labor laws and competition regulations significantly shape Bilfinger's human resource management and market participation. In 2023, Bilfinger's workforce of approximately 30,000 employees across various countries meant navigating a complex landscape of employment standards, from German works council requirements to more flexible labor laws elsewhere.

Environmental factors

Global concerns about climate change are significantly reshaping Bilfinger SE's operational landscape, driving a heightened demand for services focused on decarbonization. Clients across various industries are increasingly seeking solutions to reduce their greenhouse gas emissions and improve energy efficiency, directly impacting Bilfinger's service portfolio.

This transition towards cleaner energy sources presents substantial opportunities for Bilfinger. For instance, the company's involvement in projects related to renewable energy infrastructure, such as offshore wind farms, is a direct response to this trend. In 2024, Bilfinger reported a strong order intake in its Energy segment, reflecting the growing market for sustainable solutions.

Increasing resource scarcity, particularly for critical raw materials and water, directly impacts industrial operations by driving up costs and creating supply chain vulnerabilities. For example, the European Union has identified 34 critical raw materials essential for its economy, with many facing significant supply risks. This trend fuels the push towards a circular economy, demanding more efficient resource utilization and waste reduction.

Bilfinger SE can support clients by offering expertise in optimizing resource consumption and minimizing waste across their facilities. This includes implementing advanced process technologies to reduce water usage, which is crucial given that global water demand is projected to exceed supply by 40% by 2030. Bilfinger's services can help clients adopt circular principles, turning waste streams into valuable resources.

Opportunities abound in waste management and recycling technologies, areas where Bilfinger can provide innovative solutions. The global waste management market is expected to reach over $600 billion by 2027. By developing and implementing sustainable asset management strategies, Bilfinger enables clients to extend asset lifecycles, reduce the need for new material extraction, and enhance overall operational sustainability.

Stricter pollution control and emission standards are increasingly shaping the demand for Bilfinger SE's services. As regulations tighten across air, water, and soil, clients require more sophisticated solutions for compliance. This drives demand for Bilfinger's expertise in areas like advanced filtration systems, comprehensive wastewater treatment, and precise environmental monitoring technologies.

Bilfinger plays a crucial role in helping its clients navigate these evolving environmental mandates. By offering specialized engineering and maintenance services, the company assists businesses in reducing their environmental footprint and adhering to stringent national and international emission targets. For instance, Bilfinger's involvement in projects aimed at decarbonization and emission reduction directly supports clients in meeting goals set by frameworks like the EU Green Deal, which targets a significant reduction in industrial emissions by 2030.

Biodiversity Loss and Ecosystem Services

Growing global concern over biodiversity loss is significantly impacting how industrial projects, including those Bilfinger SE undertakes, are planned and executed. The recognition of the economic value of ecosystem services, such as clean water and pollination, is pushing for more stringent environmental considerations.

Conducting thorough environmental impact assessments (EIAs) is crucial for identifying and mitigating potential harm to sensitive ecosystems near industrial sites. Bilfinger SE's commitment to sustainability means integrating measures to protect these valuable natural resources.

Designing projects to minimize ecological disruption is a key focus. This includes strategies for habitat restoration and promoting biodiversity conservation around operational areas. For instance, in 2023, the EU Biodiversity Strategy aimed to protect 30% of land and sea areas, influencing project approvals.

- Increased regulatory scrutiny on biodiversity impact for new projects.

- Demand for nature-based solutions in infrastructure development.

- Potential for reputational damage and project delays due to environmental non-compliance.

- Opportunities in ecological restoration and biodiversity management services.

Waste Management and Hazardous Materials

Environmental regulations concerning waste management, especially for hazardous materials from industrial sites, are increasingly stringent. Societal expectations also demand greater corporate responsibility in this area. Bilfinger SE plays a crucial role by offering compliant solutions for treating, disposing of, and remediating waste. For instance, in 2023, the company continued to implement advanced waste-to-energy technologies, contributing to a circular economy model for its industrial clients.

The company's expertise in handling complex waste streams, including chemical and industrial byproducts, positions it as a key player in environmental services. Bilfinger's commitment to safety and compliance is paramount, ensuring that clients meet regulatory requirements and minimize environmental impact. This focus is reflected in their ongoing projects, such as the remediation of contaminated industrial sites, which are critical for environmental protection.

There are significant opportunities for Bilfinger SE in developing and implementing sustainable waste management strategies and technologies. This includes investing in innovative recycling processes and digital solutions for waste tracking and optimization. By offering these advanced services, Bilfinger helps clients reduce their environmental footprint and achieve their sustainability goals. The growing demand for green solutions in the industrial sector presents a strong growth avenue for Bilfinger's environmental division.

- Regulatory Landscape: Bilfinger operates within a framework of evolving environmental laws, such as the EU's Waste Framework Directive, which sets targets for waste reduction and recycling.

- Hazardous Waste Management: The company provides specialized services for the safe treatment and disposal of hazardous materials, a critical need for sectors like manufacturing and energy.

- Sustainable Solutions: Bilfinger is actively involved in developing and deploying technologies that promote waste valorization and circular economy principles, aligning with global sustainability trends.

- Market Demand: The global waste management market is projected to grow, with a significant portion driven by industrial waste, indicating a robust demand for Bilfinger's services.

The increasing focus on decarbonization and energy efficiency is a significant driver for Bilfinger SE, with clients actively seeking services to reduce their environmental impact. For instance, Bilfinger's order intake in its Energy segment saw robust growth in 2024, directly reflecting this market shift towards sustainable solutions and renewable energy infrastructure.

Resource scarcity, particularly concerning critical raw materials and water, is escalating operational costs and creating supply chain risks for industries. This trend is accelerating the adoption of circular economy principles, emphasizing efficient resource use and waste minimization, with global water demand projected to outstrip supply by 40% by 2030.

Stricter pollution control and emission standards are compelling clients to seek advanced solutions for compliance, boosting demand for Bilfinger's expertise in areas like advanced filtration and wastewater treatment. Bilfinger's services directly support clients in meeting emission reduction targets, such as those outlined in the EU Green Deal, aiming for significant industrial emission cuts by 2030.

Growing concerns over biodiversity loss are influencing industrial project planning, necessitating thorough environmental impact assessments and habitat restoration strategies. The EU Biodiversity Strategy's 2023 aim to protect 30% of land and sea areas highlights the increasing importance of ecological considerations in project approvals.

| Environmental Factor | Impact on Bilfinger SE | Key Data/Trend |

| Decarbonization & Energy Efficiency | Increased demand for green services, renewable energy projects | Strong order intake in Energy segment (2024) |

| Resource Scarcity | Higher operational costs, supply chain vulnerabilities, push for circular economy | Global water demand to exceed supply by 40% by 2030 |

| Pollution Control & Emissions | Demand for advanced compliance solutions, environmental monitoring | Support for EU Green Deal emission reduction targets by 2030 |

| Biodiversity Loss | Need for EIAs, habitat restoration, ecological impact mitigation | EU Biodiversity Strategy aims to protect 30% of land/sea by 2030 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bilfinger SE is meticulously crafted using data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.