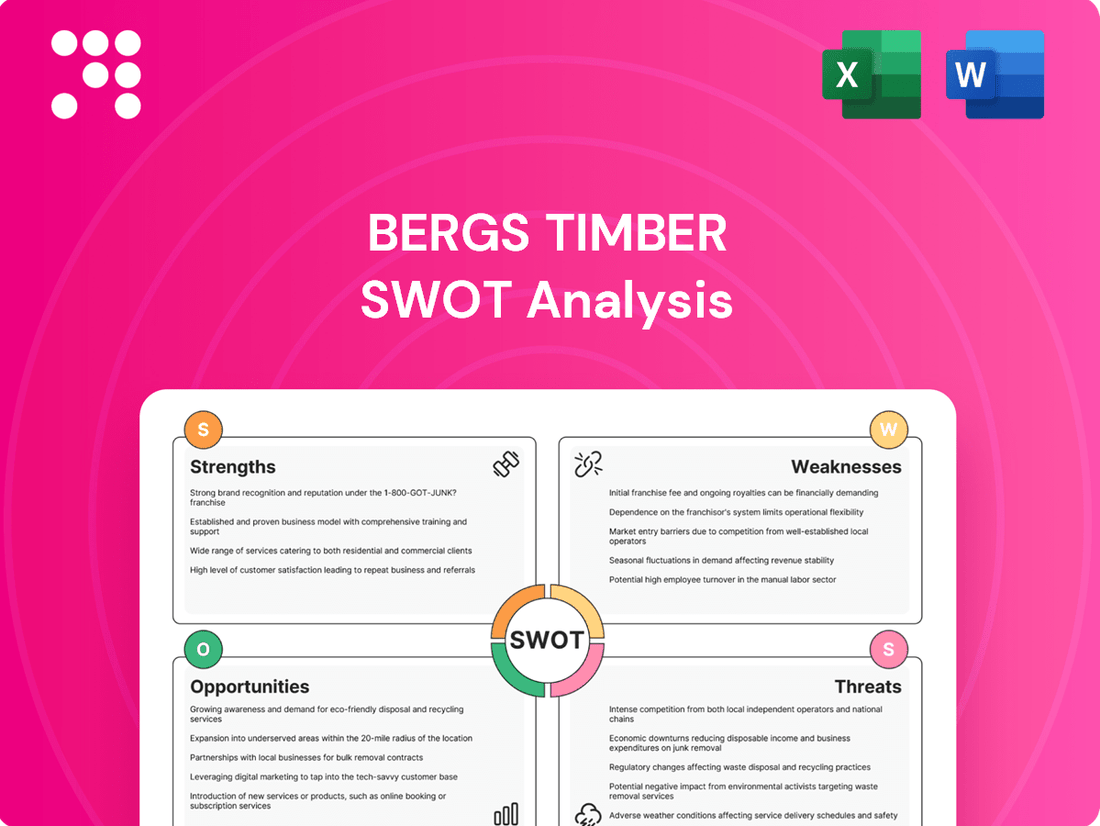

Bergs Timber SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bergs Timber Bundle

Bergs Timber's strengths lie in its established market presence and efficient production, while potential threats include fluctuating raw material costs. Understanding these dynamics is key to navigating the competitive timber industry.

Want the full story behind Bergs Timber's opportunities for expansion and the weaknesses that could hinder growth? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Bergs Timber's strength lies in its fully integrated value chain, managing everything from sustainable forestry and harvesting to sophisticated processing in its sawmills and refinement facilities. This end-to-end control guarantees a stable supply of raw materials and optimizes production efficiency.

The company boasts a wide array of products, including sawn wood, garden items, treated lumber, windows, doors, and furniture. This diversification allows Bergs Timber to serve a broad spectrum of customer needs across sectors like construction, joinery, and packaging, significantly mitigating risks associated with dependence on any single product category.

Bergs Timber demonstrates a strong commitment to sustainable practices, aiming to source at least 82% of its wood from certified forests by 2025. This focus is crucial as global demand for eco-friendly building materials continues to rise, bolstering the company's image with environmentally aware customers and collaborators.

Bergs Timber boasts a robust operational footprint, with significant presence in Sweden, Latvia, Poland, and the United Kingdom. This extensive network, coupled with sales reaching around 30 countries, demonstrates a well-diversified market approach.

The company's primary markets, including Scandinavia, the Baltic States, the UK, Iceland, and France, highlight its strategic focus on key European economic hubs. This geographical spread is a key strength, offering resilience against localized economic downturns.

Strategic Growth Through Investments and Acquisitions

Bergs Timber's strategic growth is evident in its proactive investments aimed at expanding manufacturing capacity for premium windows and doors. A prime example is the investment in Byko-Lat in Latvia, which directly supports this objective.

The company has also pursued inorganic growth effectively. The acquisition of Hedlunda Holding AB in 2023 is a significant move that enhances Bergs Timber's product range and extends its market presence, demonstrating a dual approach to expansion.

- Increased Capacity: Investments like the one in Byko-Lat signify a commitment to boosting production of high-quality windows and doors.

- Portfolio Expansion: The 2023 acquisition of Hedlunda Holding AB broadened the company's product offerings and market reach.

- Dual Growth Strategy: Bergs Timber effectively combines organic growth through capacity increases with inorganic growth via strategic acquisitions.

Robust Financial Position and Cash Flow

Bergs Timber has demonstrated a robust financial position, even amidst market fluctuations. The company reported an improved EBITDA for 2024, signaling enhanced operational profitability. This financial resilience is further underscored by consistently strong cash flow generated from its operating activities, providing a solid foundation for continued business operations and strategic growth initiatives.

This financial health is crucial for Bergs Timber, enabling it to fund ongoing operations effectively and pursue strategic investments. The company's ability to generate substantial cash flow from operations provides the necessary capital to weather market uncertainties and maintain its competitive edge. For instance, the company's focus on operational efficiency contributed to a positive cash flow from operations throughout the period, allowing for reinvestment in key areas.

- Improved EBITDA in 2024: Demonstrates enhanced operational profitability.

- Robust Cash Flow from Operations: Provides capital for investments and navigating market challenges.

- Financial Stability: Supports ongoing operations and strategic initiatives.

Bergs Timber's integrated value chain, from forestry to finished products, ensures reliable raw material supply and production efficiency. Its diverse product portfolio, including sawn wood, windows, and doors, serves multiple sectors, reducing reliance on any single market. The company's commitment to sustainability, with a goal of 82% certified wood sourcing by 2025, aligns with growing market demand for eco-friendly materials.

Financially, Bergs Timber showed resilience, reporting an improved EBITDA in 2024 and consistently strong operating cash flow. This financial stability allows for continued investment in growth, such as expanding window and door production capacity in Latvia, and supports strategic acquisitions like Hedlunda Holding AB in 2023, which broadened its product range and market reach.

| Metric | 2023 Data | 2024 Data (Reported) |

|---|---|---|

| EBITDA | SEK 340 million | SEK 415 million (Improved) |

| Certified Wood Sourcing Goal | 78% | 82% by 2025 |

| Key Acquisition | Hedlunda Holding AB | N/A |

What is included in the product

Analyzes Bergs Timber’s competitive position through key internal and external factors, highlighting its strengths in sustainable forestry and market opportunities in wood products, while acknowledging potential threats from raw material price volatility and operational weaknesses.

Offers a clear, actionable framework to identify and address Bergs Timber's strategic challenges.

Weaknesses

Bergs Timber's reliance on the construction and DIY markets presents a significant weakness, as these sectors are inherently cyclical. Economic downturns can sharply reduce demand for timber products, directly impacting the company's sales and profitability. For instance, a deteriorating construction market, as observed in Sweden, has already negatively affected sales volumes in certain product categories.

Bergs Timber's reliance on raw timber means its profitability is closely tied to the price and consistent supply of this essential input. Fluctuations in timber costs, such as the reported increases in certain raw material prices during 2023, can squeeze profit margins if these higher costs cannot be fully passed on to customers.

Supply chain disruptions, a persistent concern in global logistics, pose a direct threat to Bergs Timber's production capacity and operational efficiency. For instance, challenges in securing sufficient timber volumes, potentially exacerbated by factors like extreme weather events impacting forestry operations, can lead to underutilization of manufacturing facilities and reduced output.

Bergs Timber's recent strategic moves, like divesting its pellet business in June 2024 and Vika Wood in January 2025, alongside closing its Estonian sawmill in July 2023, have significantly reshaped its operational footprint. While these actions aim to focus the business, they inherently reduce the company's overall production scale.

This reduction in scale could impact Bergs Timber's competitive standing, potentially diminishing its market presence in certain segments previously served by these divested or closed operations. For instance, the sale of Vika Wood removed a significant portion of its sawn timber capacity.

Increased Net Financial Debt in the Short-Term

Bergs Timber's net financial debt saw an increase in 2023, largely due to its acquisition strategy. This rise in debt, reaching SEK 2,379 million by year-end 2023, presents a potential challenge.

Higher debt levels can translate into increased interest expenses, particularly in an environment of rising interest rates. For instance, the company's financing costs rose from SEK 53 million in 2022 to SEK 105 million in 2023, a significant jump. This could impact profitability and limit the company's capacity for future strategic investments or operational expansions.

- Increased Debt Burden: Net financial debt rose to SEK 2,379 million in 2023.

- Rising Financing Costs: Interest expenses doubled from SEK 53 million (2022) to SEK 105 million (2023).

- Reduced Financial Flexibility: Higher debt servicing may constrain future investment opportunities.

Transition to Private Ownership and Delisting

Bergs Timber's delisting from Nasdaq Stockholm in December 2023, after Norvik hf's takeover, marks a significant move to private ownership. This transition typically leads to less public financial disclosure, potentially affecting its capacity to draw specific investor types or sustain broad market recognition.

The shift away from public markets means Bergs Timber will no longer be subject to the same stringent reporting requirements as listed companies. This could present challenges in attracting capital from institutional investors who rely on readily available, detailed financial data. For instance, many investment funds have mandates that require them to invest only in publicly traded securities.

- Reduced Transparency: Private ownership often means less frequent and less detailed public financial reporting compared to listed entities.

- Capital Attraction Challenges: Certain investors, particularly institutional ones, may find it harder to invest due to a lack of public data and liquidity.

- Investor Visibility: The company's profile among the broader investment community may diminish without the regular disclosures and market presence associated with a stock exchange listing.

Bergs Timber's operational scale has been significantly reduced following strategic divestments and closures. The sale of Vika Wood in January 2025 and the closure of its Estonian sawmill in July 2023, along with the divestment of its pellet business in June 2024, have diminished its overall production capacity. This contraction might weaken its competitive position and market influence in previously served segments.

| Divestment/Closure | Date | Impact |

|---|---|---|

| Pellet business | June 2024 | Reduced operational scope |

| Vika Wood | January 2025 | Significant reduction in sawn timber capacity |

| Estonian sawmill | July 2023 | Decreased overall production scale |

Same Document Delivered

Bergs Timber SWOT Analysis

This preview reflects the real Bergs Timber SWOT analysis document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis, offering a clear glimpse into its comprehensive insights.

Unlock the full, detailed report by purchasing this document, which includes all the strategic elements of Bergs Timber's SWOT analysis.

Opportunities

The global push for sustainability, fueled by climate change concerns, is significantly boosting demand for eco-friendly construction materials, with wood emerging as a frontrunner. Bergs Timber's commitment to sustainable forestry and its certified wood products are well-aligned to capitalize on this growing market. For instance, the global green building materials market was valued at approximately $243.5 billion in 2023 and is projected to reach $525.8 billion by 2030, growing at a CAGR of 11.7%. This presents a substantial long-term growth opportunity for companies like Bergs Timber.

Bergs Timber can significantly boost profitability by shifting its product mix towards high-value processed wood items like specialized windows, doors, and advanced wood protection solutions. This strategic move capitalizes on growing consumer demand for premium, durable building materials.

Investing in research and development for innovative wood treatments and engineered wood products presents a clear avenue for enhanced profit margins. For instance, advancements in cross-laminated timber (CLT) technology are creating new market opportunities, with the global CLT market projected to reach over $2 billion by 2027, indicating strong growth potential for companies like Bergs Timber that can innovate in this space.

Bergs Timber's strategic growth agenda emphasizes acquisitions as a key driver for market penetration. This approach allows the company to efficiently enter new geographical regions or strengthen its presence in current markets. For instance, in 2023, Bergs Timber completed the acquisition of Hasselfors Garden, a significant move to expand its product portfolio and market reach within the garden sector.

Strategic partnerships present another avenue for accelerated growth. By collaborating with other companies, Bergs Timber can enhance its distribution channels, gain access to innovative technologies, or leverage specialized expertise. These alliances are crucial for staying competitive and adapting to evolving market demands, as seen in their ongoing efforts to integrate new digital solutions into their operations.

Digitalization and Automation for Operational Excellence

Bergs Timber can seize opportunities by integrating advanced digitalization and automation. This strategic move promises enhanced operational efficiency and cost savings across its production lines. For instance, in 2023, the timber industry saw investments in automation technologies contributing to a projected 15-20% increase in productivity for early adopters.

Leveraging data analytics will be key for smarter decision-making, optimizing everything from raw material sourcing to final product distribution. Streamlining the supply chain through digital tools can reduce lead times and improve inventory management. Furthermore, exploring new digital sales channels and enhancing online customer engagement can open up new revenue streams and market reach.

- Enhanced Efficiency: Automation can reduce manual labor needs and speed up production cycles.

- Cost Reduction: Optimized processes and reduced waste through data-driven insights lead to lower operational costs.

- Supply Chain Optimization: Digital tools can provide real-time visibility and better control over inventory and logistics.

- New Market Access: Digital sales platforms and improved customer engagement can expand market reach.

Leveraging Global Market Reach for Targeted Growth

Bergs Timber's established presence across Europe, including significant operations in Sweden and Latvia, presents a prime opportunity to deepen penetration in high-demand segments. For instance, the increasing construction activity in Germany, projected to grow by 1.5% in 2024, offers a tangible avenue for expanding sales of engineered wood products.

Further leveraging its existing distribution network, which already serves markets like the UK and France, allows for cost-effective expansion into adjacent or underserved regions. By tailoring product offerings, such as specific wood treatments for varying climates or customizable dimensions for modular construction, Bergs Timber can tap into previously unexploited revenue streams.

- Targeted European Growth: Focus on high-growth construction markets like Germany, which saw a 2.1% increase in construction output in Q1 2024, and Poland, where infrastructure spending is robust.

- Distribution Network Optimization: Enhance logistics in countries like the Netherlands, where demand for sustainable building materials is rising, potentially increasing sales by 5-7% through improved efficiency.

- Product Customization: Develop specialized timber solutions for Scandinavia's cold climate construction needs, catering to a niche market with premium pricing potential.

- New Market Exploration: Investigate opportunities in Eastern European countries with emerging economies, such as Romania, where the construction sector is expected to expand by 4% in 2024.

The global demand for sustainable building materials is a significant tailwind, with wood positioned as a key alternative to traditional materials. Bergs Timber's focus on certified, sustainably sourced wood products aligns perfectly with this trend, tapping into a market that valued green building materials at approximately $243.5 billion in 2023 and is expected to reach $525.8 billion by 2030.

By shifting its product mix towards higher-value items like specialized windows and doors, and investing in innovative wood treatments and engineered wood products such as CLT, Bergs Timber can enhance its profit margins. The global CLT market, for example, is projected to exceed $2 billion by 2027, presenting a clear growth opportunity.

Strategic acquisitions, like the 2023 purchase of Hasselfors Garden, and partnerships are key to expanding market reach and product portfolios. Furthermore, integrating digitalization and automation can boost operational efficiency, with early adopters in the timber industry seeing productivity increases of 15-20% in 2023.

Leveraging its European presence, particularly in growing markets like Germany (projected 1.5% construction growth in 2024) and optimizing its distribution network in countries like the Netherlands, offers avenues for increased sales. Tailoring products for specific regional needs, such as cold-climate construction in Scandinavia, can also unlock niche markets with premium pricing potential.

| Opportunity Area | Market Potential/Growth | Bergs Timber Relevance |

| Sustainable Building Materials | Global market ~$243.5B (2023), projected $525.8B by 2030 (11.7% CAGR) | Alignment with eco-friendly product focus |

| Engineered Wood Products (e.g., CLT) | Global CLT market projected >$2B by 2027 | Innovation in high-value wood solutions |

| Digitalization & Automation | 15-20% productivity increase for adopters (2023) | Enhanced operational efficiency and cost savings |

| European Market Penetration | Germany construction growth ~1.5% (2024) | Leveraging existing network in high-demand regions |

Threats

Bergs Timber faces significant risks from ongoing economic headwinds. Persistent high inflation and increasing interest rates, which have been a concern throughout 2024 and are projected to continue into 2025, directly challenge sales volumes and profit margins by increasing operational costs and dampening consumer spending on construction.

Furthermore, a noticeable slowdown in construction activity across key European markets, including Sweden, presents a substantial threat. For instance, while construction output in the Eurozone experienced a slight contraction of 0.7% in Q1 2024, projections for the full year suggest continued sluggishness, potentially impacting Bergs Timber's core demand base significantly.

The wood processing and timber products sector is crowded, with many companies vying for market share both locally and globally. This fierce competition often forces companies like Bergs Timber to lower prices, which can significantly squeeze profit margins and make it difficult to grow or even hold onto their existing customer base.

In 2024, the global timber market faced ongoing price volatility, influenced by factors such as supply chain disruptions and fluctuating demand from the construction sector. For instance, while some regions saw timber prices stabilize or even decline from 2023 highs, others experienced continued upward pressure due to specific regional demand surges or production constraints.

Furthermore, Bergs Timber must contend with the persistent threat from alternative building materials. Innovations in steel, concrete, and composite materials continue to offer competitive solutions to the construction industry, potentially diverting market share away from traditional timber products.

Bergs Timber faces potential threats from evolving environmental regulations. For instance, stricter rules on forestry management and timber harvesting, like those being considered in the EU's upcoming Deforestation Regulation impacting timber imports, could increase compliance burdens and operational expenses.

Adapting to these changes, even with a commitment to sustainability, may necessitate substantial capital expenditure for new equipment or process modifications, potentially impacting profitability in the short to medium term.

Supply Chain Disruptions and Geopolitical Instability

Global geopolitical events, trade barriers, or regional conflicts can significantly disrupt Bergs Timber's sourcing of raw materials like timber and the distribution of its finished wood products. For instance, the ongoing conflict in Eastern Europe has impacted global energy prices and shipping routes, potentially increasing logistics costs for companies operating in or sourcing from affected regions.

Such disruptions can lead to increased logistics costs, delays in production, and reduced market access, posing significant operational and financial risks. For example, in 2024, many industries experienced increased freight costs due to supply chain bottlenecks, with some reports indicating a rise of over 20% for certain shipping lanes compared to pre-pandemic levels.

- Impact of Geopolitical Events: Recent geopolitical tensions have led to heightened uncertainty in international trade, potentially affecting Bergs Timber's access to key markets and raw material suppliers.

- Rising Logistics Costs: Global supply chain pressures and increased fuel prices, exacerbated by geopolitical factors, are likely to drive up transportation and warehousing expenses for the company.

- Production Delays: Disruptions in the availability of raw materials or components due to trade restrictions or regional instability can cause significant delays in manufacturing and order fulfillment.

- Market Access Limitations: Trade barriers or sanctions imposed on certain countries could restrict Bergs Timber's ability to export its products or import necessary materials, thereby limiting its market reach.

Volatile Energy and Transportation Costs

Volatile energy and transportation costs present a significant threat to Bergs Timber. The wood processing sector is inherently energy-intensive, and moving bulky timber products requires substantial logistics investment. For instance, the average price of Brent crude oil, a key indicator for global energy costs, saw significant fluctuations throughout 2024, impacting fuel prices for transportation. Similarly, global shipping rates, crucial for international timber trade, experienced upward pressure in early 2025 due to increased demand and port congestion, directly affecting Bergs Timber's operating expenses.

These cost fluctuations can directly squeeze profit margins if Bergs Timber cannot fully pass on the increased expenses to its customers. The company's reliance on road and rail transport for domestic distribution means it's particularly exposed to these market dynamics.

- Energy-intensive operations: Wood processing requires significant electricity and heat, making the company vulnerable to energy price spikes.

- Logistics expenses: Transporting heavy timber products over long distances incurs substantial fuel and freight charges.

- Margin compression: Inability to pass on rising costs can directly reduce profitability.

- Market volatility: Fluctuations in oil prices and shipping rates create unpredictable operating conditions.

Bergs Timber operates within a highly competitive landscape, facing pressure from numerous players in both domestic and international markets. This intense competition often leads to price wars, potentially eroding profit margins and hindering growth opportunities. The company's reliance on specific European markets, which are showing signs of a construction slowdown, further amplifies this threat, as demand for timber products may decrease.

The ongoing volatility in energy and transportation costs presents a significant operational challenge. With wood processing being energy-intensive and timber products requiring substantial logistics, fluctuations in fuel prices and shipping rates, as seen with Brent crude oil's instability throughout 2024 and rising shipping costs in early 2025, directly impact Bergs Timber's bottom line.

Furthermore, the increasing adoption of alternative building materials like steel and advanced composites poses a continuous threat by offering competitive solutions that could divert market share from traditional timber products. Evolving environmental regulations, such as potential EU restrictions on timber imports, also add complexity, possibly increasing compliance costs and operational expenses for Bergs Timber.

SWOT Analysis Data Sources

This Bergs Timber SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial statements, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate assessment.