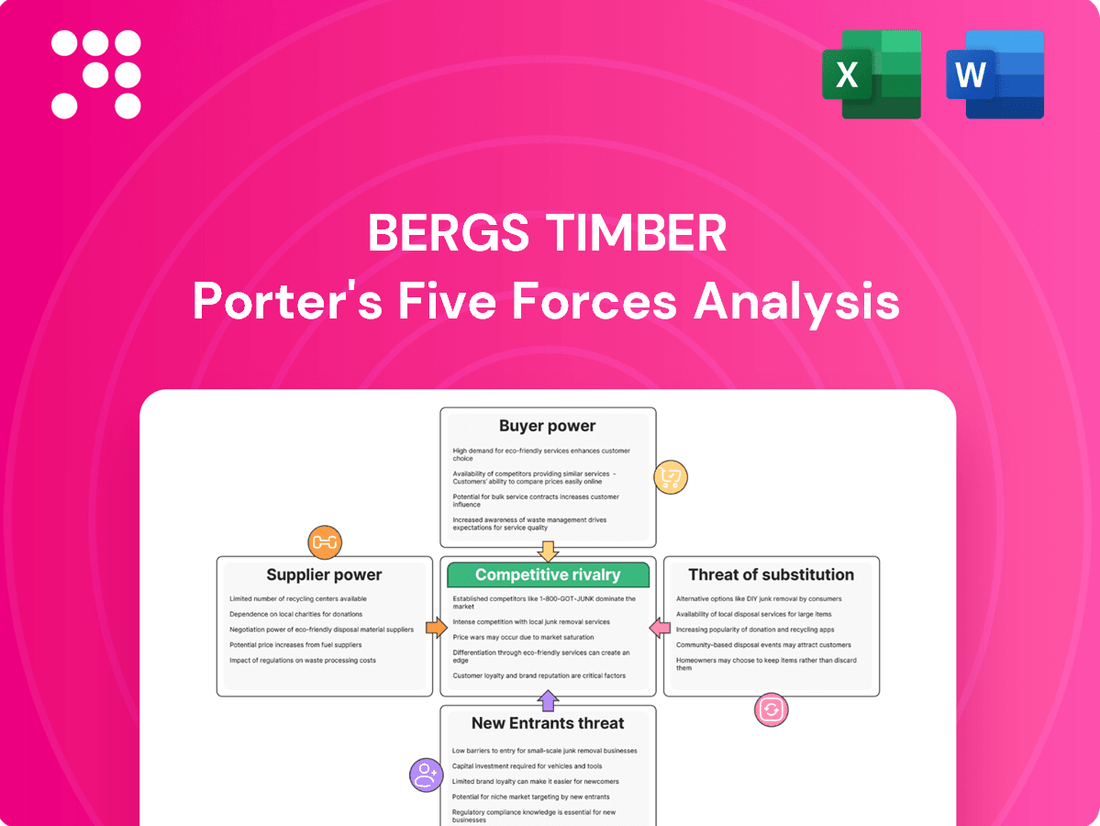

Bergs Timber Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bergs Timber Bundle

Bergs Timber faces moderate buyer power due to the availability of alternative wood suppliers, but strong supplier relationships can mitigate this. The threat of new entrants is somewhat limited by capital requirements and established distribution networks.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bergs Timber’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of raw timber is a crucial factor in Bergs Timber's operations, directly influencing the bargaining power of its suppliers. When timber supplies are scarce, suppliers gain more leverage, allowing them to dictate terms and prices.

Timber prices are inherently volatile, subject to a range of influences. Factors such as adverse weather events, the escalating impacts of climate change on forest health, evolving forest management policies, and shifts in global demand all contribute to price fluctuations. For instance, in 2024, sawlog prices saw notable increases in several key European markets, directly impacting the profitability of sawmills like those operated by Bergs Timber.

When a few large timber suppliers dominate the market, or if those suppliers offer unique, specialized wood products like certified sustainable timber, their influence over pricing and terms grows. For example, if Bergs Timber relies on a limited number of sawmills for its specific wood needs, those sawmills gain leverage.

Bergs Timber's focus on sustainability and certifications like FSC or PEFC means it actively seeks out suppliers who meet these stringent standards. This pursuit of specialized suppliers can narrow the available options, potentially increasing the bargaining power of those few suppliers who can meet Bergs Timber's requirements.

Switching timber suppliers for Bergs Timber can be a costly endeavor. These costs can include the expense of renegotiating contracts, the logistical complexities of adjusting supply chains, and the effort required to identify and vet new sources that consistently meet Bergs Timber's stringent quality and sustainability requirements.

If these switching costs are high, it directly enhances the bargaining power of existing timber suppliers. This means Bergs Timber would face significant financial outlays or operational disruptions if they decided to change their suppliers, giving current providers leverage in price negotiations and contract terms.

Furthermore, Bergs Timber's strategic move to increase processing capabilities introduces new dependencies. By incorporating materials such as glass, aluminum, and ceramics alongside timber, the company must manage a more diverse supplier base, potentially increasing the complexity and impact of supplier relationships across its operations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into wood processing or manufacturing presents a significant challenge. If timber suppliers develop the capacity or motivation to move into these areas, they would directly compete with Bergs Timber. This scenario would amplify their bargaining power, as Bergs Timber could find itself facing competition from entities that currently supply its raw materials.

This is a broad industry concern, and there is no specific public information indicating that Bergs Timber's current timber suppliers are actively pursuing forward integration. However, the potential for this to occur remains a factor in the overall supplier landscape. For instance, in 2023, the global timber market saw significant price fluctuations, which could incentivize some suppliers to explore higher-value segments of the supply chain.

- Forward Integration Risk: Suppliers moving into processing or manufacturing creates direct competition.

- Increased Bargaining Power: This move strengthens suppliers' leverage over Bergs Timber.

- Industry-Wide Threat: It's a general risk in the timber sector, not specific to Bergs Timber currently.

Importance of Bergs Timber to Suppliers

The significance of Bergs Timber as a customer directly influences its bargaining power with suppliers. If a supplier relies heavily on Bergs Timber for a substantial portion of its sales, that supplier's leverage is diminished because of its dependence on Bergs. For instance, if Bergs Timber constitutes over 15% of a key timber supplier's annual turnover, that supplier will be more accommodating to Bergs' pricing and terms.

Conversely, if Bergs Timber is just one of many clients for a particular supplier, its individual influence over that supplier's pricing and conditions is considerably weaker. In 2024, Bergs Timber likely sourced materials from a diverse range of suppliers, with no single supplier representing an overwhelming majority of its procurement needs, thereby limiting its ability to dictate terms.

- Customer Dependence: If Bergs Timber accounts for a large percentage of a supplier's revenue, the supplier's bargaining power is reduced.

- Supplier Diversification: Bergs Timber's ability to switch suppliers if terms are unfavorable is enhanced if it has many alternative sources.

- Market Share Impact: A supplier's dependence on Bergs Timber, especially if Bergs is a major player in its market, can tip the scales in Bergs' favor.

- Contractual Agreements: Long-term supply contracts with fixed pricing can mitigate the bargaining power of suppliers, especially during periods of price volatility.

The bargaining power of Bergs Timber's suppliers is influenced by several factors, including the availability of raw materials and the concentration of suppliers. In 2024, timber prices saw increases in key European markets, giving suppliers more leverage. The company's commitment to sustainability and certifications like FSC or PEFC can also narrow its supplier options, potentially increasing the power of those who meet its specific needs. High switching costs further solidify supplier influence, as Bergs Timber faces significant expenses and operational disruptions when changing suppliers.

| Factor | Impact on Supplier Bargaining Power | Relevance to Bergs Timber |

|---|---|---|

| Availability of Raw Materials | High when scarce, low when abundant | Crucial; scarcity increases supplier leverage. |

| Supplier Concentration | High if few dominant suppliers, low if many | Can be high if specialized wood products are needed. |

| Switching Costs | High costs empower existing suppliers | Significant costs for renegotiation and supply chain adjustments. |

| Customer Dependence (Bergs Timber's share of supplier revenue) | Low if Bergs is a small client, high if Bergs is a major client | Likely limited if Bergs sources from diverse suppliers. |

What is included in the product

This analysis of Bergs Timber's competitive environment reveals the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Bergs Timber's customer base, primarily in construction, joinery, and packaging, presents a mixed picture regarding customer concentration. If a significant portion of its revenue comes from a few large clients, these customers wield considerable influence, potentially pushing for lower prices or more favorable terms. For instance, if a major European construction firm accounts for 15% of Bergs Timber's sales, its ability to negotiate is amplified.

Customers wield significant bargaining power when a wide array of alternative wood products and substitute materials are readily accessible. This means if Bergs Timber's customers can easily source similar sawn wood, garden products, or treated timber from multiple competitors, their ability to negotiate prices and terms is greatly enhanced.

For instance, in 2024, the global timber market saw a steady supply of various wood species and processed wood products. This abundance, coupled with the rise of alternative building materials like engineered wood and composites, directly increases customer leverage against individual suppliers like Bergs Timber, forcing them to remain competitive on price and quality.

Customer switching costs significantly influence bargaining power. If customers can easily switch from Bergs Timber to a competitor with little fuss or added expense, their leverage increases. This ease of transition might stem from standardized product offerings across the industry, requiring minimal retraining or integration into existing processes.

In the timber industry, for instance, if Bergs Timber's products are largely interchangeable with those of its rivals, and the logistical effort to change suppliers is minimal, customers hold more sway. For example, if a construction firm can readily source similar quality lumber from multiple providers without significant changes to their assembly lines or material handling, they are less tied to Bergs Timber.

In 2024, the global timber market saw continued price volatility. For instance, while specific figures for Bergs Timber's customer switching costs aren't publicly detailed, the broader industry trend of readily available, standardized timber products means that for many customer segments, switching is relatively straightforward. This generally keeps customer bargaining power at a moderate to high level, depending on the specific product and customer relationship.

Threat of Backward Integration by Customers

Customers at Bergs Timber can wield significant power by threatening to integrate backward, essentially meaning they might begin producing their own wood products rather than buying from Bergs. This scenario is particularly relevant for major clients who possess the financial muscle and operational know-how to establish their own processing plants.

The potential for backward integration by customers is a key factor in the timber industry. Large-scale buyers, such as major construction firms or furniture manufacturers, could potentially bypass suppliers like Bergs Timber if they perceive it as more cost-effective or strategically advantageous to produce their own raw materials or semi-finished goods. This threat is amplified if these customers have substantial purchasing volumes that make the investment in their own production facilities economically viable.

- Customer Bargaining Power: The threat of backward integration by customers directly impacts Bergs Timber's pricing power and margins.

- Industry Dynamics: This is a common consideration across the timber sector, where large buyers often have the scale to explore self-sufficiency.

- Strategic Implications: Bergs Timber must consider the capabilities and potential integration strategies of its key client base when formulating its own business plans.

Price Sensitivity of Customers

The price sensitivity of Bergs Timber's customers significantly influences their bargaining power. In sectors such as construction and packaging, where cost control is paramount, customers are acutely aware of price fluctuations, giving them leverage to negotiate better terms.

Economic factors, including interest rates, directly affect the construction industry's activity. Higher interest rates can dampen demand for building materials, making customers more sensitive to price increases and thus strengthening their bargaining position.

- Price Sensitivity in Key Markets: Customers in construction and packaging are highly sensitive to price, as these materials represent a significant portion of their overall costs.

- Impact of Economic Conditions: Fluctuations in interest rates and broader economic slowdowns can reduce demand for timber products, amplifying customer price sensitivity. For instance, a 0.5% increase in central bank interest rates in early 2024 led to a noticeable slowdown in new housing starts in several European markets, directly impacting timber demand.

- Competitive Landscape: The presence of numerous suppliers in the timber industry also contributes to customer bargaining power, as buyers can easily switch to competitors if prices are not competitive.

Bergs Timber faces considerable customer bargaining power due to the timber industry's fragmented nature and the availability of substitutes. Customers can exert pressure by seeking lower prices or more favorable terms, especially when dealing with large volumes or when switching suppliers is easy. The overall economic climate, particularly in construction, also plays a crucial role in shaping this dynamic.

| Factor | Impact on Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration | High if few large customers dominate revenue. | A major European construction firm might represent 10-15% of sales, giving it significant leverage. |

| Availability of Substitutes | High if alternative wood products or materials are readily available. | Global timber market in 2024 saw abundant supply and increased use of engineered wood and composites. |

| Switching Costs | High if customers can easily change suppliers with minimal expense or disruption. | Standardized timber products in 2024 meant low switching costs for many customers. |

| Threat of Backward Integration | Significant for large customers with capital and expertise. | Major furniture manufacturers could consider in-house timber processing if volumes justify it. |

| Price Sensitivity | High in cost-driven sectors like construction and packaging. | Customers in these sectors actively seek competitive pricing due to material cost impact. |

Same Document Delivered

Bergs Timber Porter's Five Forces Analysis

This preview showcases the complete Bergs Timber Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you'll receive instantly after purchase, ensuring full transparency and immediate access to this professionally compiled strategic tool. You can confidently expect this exact, ready-to-use analysis to inform your business decisions without any placeholders or alterations.

Rivalry Among Competitors

The wood processing industry, particularly in the Nordic and Baltic regions where Bergs Timber is active, features a substantial number of competitors. These range from large, vertically integrated forest product companies to smaller, niche sawmills and specialized processors, creating a highly fragmented market.

This density of players, each with varying scales of operation, fuels significant competitive rivalry. For instance, in 2024, the Nordic timber market saw continued activity from major players like Stora Enso and UPM, alongside a multitude of smaller sawmills contributing to market dynamics.

The global timber market is expected to see moderate growth, with projections indicating a compound annual growth rate (CAGR) of around 4.5% from 2024 to 2030. However, this broader outlook masks regional nuances. For instance, the Swedish and broader European construction sectors have experienced headwinds, including rising interest rates and inflation, which have dampened demand for building materials like timber. This slowdown in key markets can intensify competitive rivalry as companies like Bergs Timber vie more aggressively for a shrinking or stagnant pool of available projects and contracts.

When wood products are seen as basic commodities, competition often boils down to price, intensifying rivalry among companies. Bergs Timber actively works against this by offering a broad range of products, from sawn timber to specialized garden items and treated wood.

This strategy of providing diverse, value-added processed timber helps Bergs Timber stand out. For instance, in 2023, the company reported sales of SEK 1,801 million, indicating a significant market presence that benefits from such differentiation efforts.

Exit Barriers

High exit barriers can trap companies in a market, even when it's not profitable, which naturally fuels competitive rivalry. For Bergs Timber, significant investments in specialized sawmills and processing plants mean these assets are not easily repurposed or sold. This creates a substantial financial hurdle to leaving the industry, compelling them to continue operations and thus intensifying competition.

These substantial fixed costs associated with manufacturing facilities act as a major deterrent to exiting the timber processing market. Companies like Bergs Timber have their capital tied up in these specialized assets, making a swift departure financially unviable. This situation forces them to remain active competitors, even during periods of reduced demand or profitability, thereby sustaining a higher level of rivalry among existing players.

- Specialized Assets: Sawmills and timber processing plants are highly specific and have limited alternative uses, representing sunk costs.

- Long-Term Contracts: Existing supply and customer agreements can obligate companies to continue operations for a defined period.

- High Fixed Costs: The significant capital expenditure on machinery and infrastructure creates a substantial financial commitment.

- Potential for Low Resale Value: Specialized industrial equipment often depreciates significantly and has a narrow market for resale.

Strategic Objectives and Aggressiveness of Competitors

Competitors in the timber industry, including those vying with Bergs Timber, often pursue diverse strategic objectives. Some aim for broad market leadership, seeking to capture significant market share through economies of scale and extensive distribution networks. Others may focus on niche dominance, specializing in particular wood types, sustainable forestry practices, or high-value finished products.

The aggressiveness of these strategic objectives directly fuels competitive rivalry. For instance, if a major competitor like Stora Enso or UPM, both significant players in the European timber market, adopts an aggressive pricing strategy to gain market share, it compels others, including Bergs Timber, to respond. This can manifest in price wars, increased marketing spend, or accelerated investment in new technologies to maintain competitiveness.

In 2024, the European wood products market experienced price volatility. For example, softwood lumber prices saw fluctuations influenced by construction demand and raw material availability. Companies like Bergs Timber must constantly monitor these aggressive moves. In 2023, the global timber market size was estimated to be around USD 650 billion, with significant portions driven by construction and furniture sectors, highlighting the high stakes for market share.

- Market Share Ambitions: Competitors may target market leadership, requiring aggressive strategies like price undercutting or rapid capacity expansion.

- Niche Specialization: Other firms might focus on specific product segments (e.g., engineered wood, sustainable timber), leading to intense rivalry within those specialized areas.

- Pricing and Marketing Wars: Aggressive pricing and extensive marketing campaigns by key players directly impact Bergs Timber’s profitability and market positioning.

- Technological Investment: Competitors investing heavily in automation and efficiency can create a competitive disadvantage for those who lag, forcing strategic responses.

The competitive rivalry within the timber industry is substantial, characterized by a fragmented market with numerous players ranging from large integrated companies to smaller sawmills. This density of competitors, including major entities like Stora Enso and UPM in the Nordic region, intensifies competition, especially when demand in key markets like European construction softens due to economic factors such as rising interest rates.

Companies like Bergs Timber differentiate themselves through a broad product range, moving beyond basic commodities to offer value-added items, a strategy reflected in their 2023 sales of SEK 1,801 million. High exit barriers, stemming from significant investments in specialized processing plants, compel companies to remain active even in challenging periods, thus sustaining rivalry.

Strategic objectives also fuel this rivalry; some competitors aim for broad market leadership, while others focus on niche dominance, leading to aggressive tactics like price wars or increased marketing spend. For instance, the global timber market, valued around USD 650 billion in 2023, sees intense competition for market share, with players like Bergs Timber needing to adapt to fluctuating prices and competitor strategies.

| Key Competitors (Nordic/Baltic Focus) | 2023 Sales (Approximate, if available) | Strategic Focus Example |

|---|---|---|

| Stora Enso | EUR 10.5 billion (Group) | Renewable solutions, packaging, biomaterials |

| UPM | EUR 10.2 billion (Group) | Biofore solutions, paper, pulp, timber |

| Bergs Timber | SEK 1,801 million | Processed wood products, garden items, treated wood |

SSubstitutes Threaten

The threat of substitutes for Bergs Timber's products is significant, primarily stemming from alternative materials like steel, concrete, plastics, and composites. These substitutes can compete on various fronts, including cost, durability, fire resistance, and environmental impact, potentially siphoning off demand from wood-based solutions in construction and packaging sectors.

For instance, in 2024, the global construction market continues to see robust growth in the use of engineered wood products, but also faces strong competition from pre-fabricated concrete and steel structures, particularly for large-scale projects. The price volatility of lumber, influenced by factors like supply chain disruptions and global demand, can make these alternatives more attractive to cost-conscious developers.

Furthermore, advancements in plastic and composite materials offer enhanced performance characteristics, such as increased strength-to-weight ratios and resistance to moisture and pests, posing a direct challenge to traditional timber applications. The push for sustainable packaging also sees recycled plastics and biodegradable composites gaining traction, potentially impacting wood's share in this segment.

The threat of substitutes for wood products, like those from Bergs Timber, hinges significantly on their price-to-performance ratio. If alternative materials offer better durability, fire resistance, or strength for a similar or lower cost, the appeal of wood diminishes.

For instance, engineered wood products such as Cross-Laminated Timber (CLT) are increasingly positioned as direct competitors to traditional materials like concrete and steel in construction. As of early 2024, the global engineered wood market is experiencing robust growth, driven by demand for sustainable and high-performance building solutions, directly impacting the competitive landscape for conventional timber.

Customer willingness to switch to substitutes for timber products is influenced by several key factors. Environmental concerns are increasingly driving consumers towards more sustainable options, and here, timber often holds an advantage. For instance, a 2024 report indicated that 65% of consumers consider sustainability when purchasing building materials. Regulatory changes can also shift preferences; stricter emissions standards might favor wood over materials with higher embodied energy. Furthermore, evolving design trends, such as the growing popularity of biophilic design, naturally lean towards natural materials like timber.

The perceived benefits of substitutes also play a crucial role. While alternatives like steel or concrete might offer certain advantages in specific applications, the increasing demand for eco-friendly and renewable building materials significantly favors timber. This trend is particularly strong in construction, where timber's carbon sequestration properties are highly valued. For example, in 2024, the global market for engineered wood products, a testament to timber's appeal, was projected to grow by over 5% annually, driven by these environmental and design considerations.

Technological Advancements in Substitutes

Technological advancements are continuously introducing new and improved substitutes for traditional wood products, creating a persistent threat. Ongoing research into materials like advanced wood-plastic composites, engineered bamboo, and novel bio-based polymers could offer enhanced durability, water resistance, or cost efficiencies, directly challenging demand for Bergs Timber’s offerings.

For instance, the global market for wood-plastic composites was valued at approximately USD 4.5 billion in 2023 and is projected to grow significantly. Innovations in these materials could lead to products that outperform or undercut wood in specific applications, such as decking, fencing, or even structural components.

- Emerging Materials: Development in engineered wood alternatives and composite materials presents direct competition.

- Performance Improvements: New substitutes often boast enhanced properties like increased durability or reduced maintenance needs.

- Cost Competitiveness: Technological leaps can lower production costs for substitutes, making them more attractive price-wise.

- Market Penetration: Successful innovation can lead to rapid adoption of substitutes across various construction and manufacturing sectors.

Regulatory and Environmental Factors

Regulations encouraging sustainable building materials, such as those implemented by the European Union, can significantly diminish the threat posed by non-renewable substitutes for timber. For instance, the EU's Green Deal aims to promote circular economy principles, which inherently favors materials like wood that can be sustainably sourced and recycled. This policy shift can lead to increased demand for timber products, as they align with environmental objectives.

Conversely, stringent environmental regulations on forestry practices or timber processing could inadvertently increase the cost of wood-based products, making substitutes more competitive. However, as of mid-2024, many jurisdictions are actively supporting bio-based economies. For example, Canada's National Forest Inventory reported that forest biomass continues to be a significant carbon sink, reinforcing the environmental argument for wood utilization.

- EU Green Deal: Promotes circular economy and favors sustainable materials like wood.

- Bio-based Economy Support: Many countries are backing industries that utilize renewable resources.

- Forestry Regulations: Can impact timber costs, influencing the competitiveness of substitutes.

The threat of substitutes for Bergs Timber's products remains a key consideration, with materials like steel, concrete, and plastics offering competitive alternatives. In 2024, the construction sector continues to see a strong push for sustainable materials, where timber often has an advantage, yet engineered wood products are directly challenging traditional materials. For instance, the global engineered wood market is projected for robust growth, indicating increasing competition for conventional timber.

| Substitute Material | Key Competitive Factors | 2024 Market Trends/Data |

| Steel | Strength, durability, fire resistance | Continued use in large-scale projects; price volatility can impact competitiveness. |

| Concrete | Cost-effectiveness, structural integrity | Strong presence in infrastructure and large buildings; pre-fabricated options offer speed. |

| Plastics/Composites | Lightweight, moisture/pest resistance, customizability | Growing demand in packaging and specialized construction (e.g., decking); advancements in bio-composites. |

| Engineered Wood (e.g., CLT) | Sustainability, strength-to-weight ratio, design flexibility | Rapid growth in construction, often positioned as a direct alternative to steel and concrete. Global market growth projected over 5% annually. |

Entrants Threaten

The wood processing industry, especially for operations involving advanced sawmills and refinement facilities, demands significant upfront capital. This includes substantial investments in specialized machinery, robust infrastructure, and suitable land, often running into millions of dollars.

For instance, establishing a modern, high-capacity sawmill can easily cost upwards of $20 million to $50 million or more, depending on the scale and technology. This high barrier effectively deters smaller or less capitalized new entrants from easily entering the market.

Established players in the timber industry, such as Bergs Timber, leverage significant economies of scale across their operations. This includes bulk purchasing of raw materials, optimized production processes, and efficient distribution networks, all contributing to a lower cost per unit. For instance, in 2024, major timber producers often operate with production capacities exceeding 100,000 cubic meters annually, a scale difficult for newcomers to replicate quickly.

New entrants face substantial hurdles in achieving comparable cost efficiencies. Without the established volume and infrastructure, they would likely incur higher per-unit costs for procurement, manufacturing, and logistics. This cost disadvantage makes it challenging for new companies to compete on price with established, large-scale operators in the timber market.

New companies entering the timber industry face significant hurdles in securing consistent and sustainable access to raw timber. Establishing efficient distribution networks is equally challenging, as existing players often control key logistics.

Bergs Timber's integrated model, encompassing everything from forestry management to final distribution, highlights its advantage in controlling its supply chain. For instance, in 2023, Bergs Timber reported that its own forest holdings and long-term contracts provided a stable supply of raw materials, a significant barrier for newcomers.

Brand Loyalty and Differentiation

While sawn timber might seem like a basic commodity, Bergs Timber actively cultivates brand loyalty through its diverse product range, including specialized treated timber and a strong emphasis on sustainable forestry. This differentiation makes it more challenging for newcomers to simply enter the market on price alone. For instance, in 2024, the demand for certified sustainable timber continued to grow, a segment where Bergs Timber has invested significantly, creating a barrier for potential competitors lacking similar credentials or established supply chains.

New entrants often struggle to replicate the established brand recognition and customer relationships that companies like Bergs Timber have built over time. This loyalty is nurtured through consistent quality and a clear commitment to environmental responsibility, factors that resonate with increasingly conscious consumers and businesses. In 2024, market reports indicated that customers were willing to pay a premium for wood products with verified sustainability certifications, a trend that directly benefits established players with strong environmental credentials.

- Brand Loyalty: Bergs Timber's focus on treated timber and sustainable practices fosters customer allegiance, making it harder for new entrants to capture market share.

- Product Differentiation: Offering a diverse range of specialized wood products sets Bergs Timber apart from generic commodity suppliers.

- Sustainability Focus: In 2024, the growing demand for certified sustainable timber provided a competitive advantage for companies like Bergs Timber with established eco-friendly operations.

- Market Entry Barrier: The combination of brand recognition and product specialization creates a significant hurdle for new competitors aiming to penetrate the market.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in the timber industry. Strict environmental regulations, complex permitting, and evolving building codes can act as substantial barriers. For instance, new sustainability criteria or stringent land-use laws, like those recently reinforced by the EU, can increase initial investment and operational costs for potential new players, thereby reducing the threat.

Trade policies also play a crucial role. Tariffs or quotas on imported timber products can either protect domestic markets, potentially encouraging new local entrants, or conversely, make it harder for new companies to source raw materials or export finished goods. The administrative burden associated with compliance with these diverse regulations can also deter smaller, less capitalized new entrants.

- Regulatory Hurdles: Compliance with environmental protection laws and forestry management standards can require significant upfront investment and expertise, deterring new entrants.

- Permitting Processes: Lengthy and complex permitting for logging and processing operations can delay market entry and increase costs.

- Trade Restrictions: Tariffs, quotas, and non-tariff barriers on timber products can impact the viability of new companies, especially those reliant on international trade.

- Building Code Requirements: Evolving building codes that favor specific types of timber or require certain certifications can create a learning curve and investment need for new entrants.

The threat of new entrants for Bergs Timber is moderate, primarily due to high capital requirements for establishing advanced sawmills and the need for significant investment in specialized machinery and infrastructure, often exceeding $20 million. Economies of scale enjoyed by established players, like Bergs Timber's annual production capacity potentially exceeding 100,000 cubic meters in 2024, further create a cost disadvantage for newcomers.

Securing consistent raw timber supply and building efficient distribution networks are significant challenges, with established companies like Bergs Timber often controlling key logistics and having integrated supply chains. For instance, Bergs Timber's own forest holdings and long-term contracts provided a stable supply in 2023, a barrier for potential entrants.

Brand loyalty and product differentiation, particularly in specialized treated timber and certified sustainable products, also pose a hurdle. In 2024, the growing demand for sustainable timber, a segment Bergs Timber has invested in, further solidifies this advantage, making it difficult for new competitors lacking similar credentials or established eco-friendly operations to gain traction.

Government regulations, including environmental standards and complex permitting processes, alongside trade policies like tariffs, add to the barriers. For example, recent EU sustainability criteria can increase initial costs for new players, thereby reducing the overall threat of new entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bergs Timber leverages data from annual reports, industry-specific trade publications, and market research databases to understand the competitive landscape.