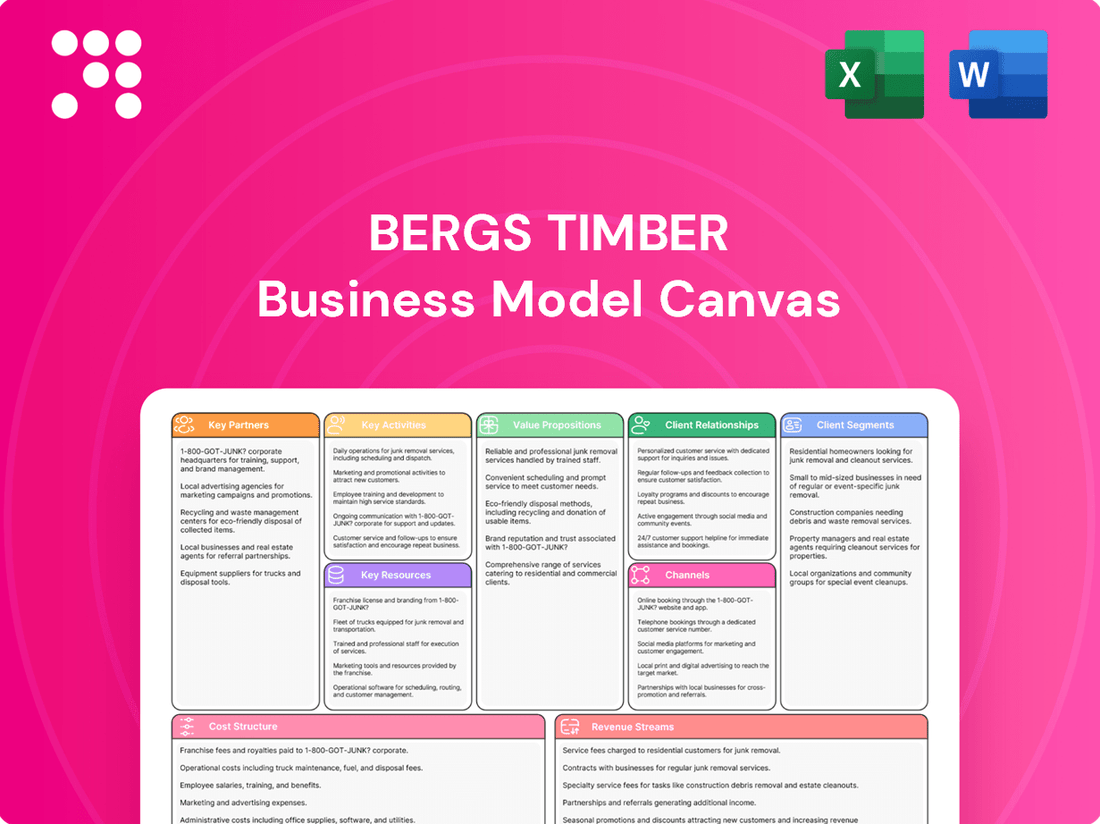

Bergs Timber Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bergs Timber Bundle

Unlock the strategic blueprint behind Bergs Timber's success with our comprehensive Business Model Canvas. This detailed analysis dives into their customer relationships, revenue streams, and key resources, offering a clear roadmap of their operations. Discover how they build value and maintain their competitive edge.

Ready to gain a deeper understanding of Bergs Timber's operational excellence? Our full Business Model Canvas breaks down their value proposition, key activities, and cost structure, providing actionable insights for your own strategic planning. Download the complete document to see how they thrive.

Partnerships

Bergs Timber's key partnerships with certified forest owners and suppliers are fundamental to its business model, ensuring a consistent and ethically sourced supply of timber. These collaborations are critical for upholding the company's commitment to environmentally responsible operations and securing its raw material needs.

The company has set a target to achieve at least 82% of its procured timber being certified by recognized standards like FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification) by 2025. This focus on certified timber underscores Bergs Timber's dedication to sustainability and responsible forest management.

Bergs Timber's key partnerships include industrial customers in construction, joinery, and packaging who rely on their sawn and processed wood. These relationships are crucial as they represent the primary demand for Bergs Timber's core products.

Strategic divestments also highlight partnership evolution. For instance, the sale of the Fågelfors pellet business to J. Rettenmaier & Söhne GmbH & Co KG in 2024, and Vika Wood to HS Timber Group, demonstrate a focus on optimizing the portfolio through partnerships that leverage specialized expertise or market access.

Bergs Timber relies heavily on a robust network of logistics and distribution partners to ensure its wood products reach customers efficiently across Scandinavia, the Baltic States, the UK, Iceland, and France. These collaborations are critical for managing the complexities of transporting timber and processed wood materials.

The company's strategic advantage is amplified by its own port and distribution operations in the UK, which streamline the supply chain for this key market. In 2023, Bergs Timber reported that its logistics costs represented a significant portion of its operating expenses, underscoring the importance of these partnerships for cost-effectiveness and timely delivery.

Technology and Processing Equipment Suppliers

Bergs Timber relies on technology and processing equipment suppliers to ensure its sawmills and wood processing facilities remain at the forefront of efficiency and modernization. These relationships are fundamental to the company's ability to innovate and expand its product offerings, such as high-quality treated timber and advanced wood materials.

These partnerships are vital for Bergs Timber to maintain a competitive edge by integrating the latest advancements in wood processing technology. This allows for the development of specialized products that cater to evolving market demands.

- Supplier Collaboration: Fostering strong ties with equipment providers enables Bergs Timber to access cutting-edge machinery and technical support, crucial for optimizing production yields and quality.

- Product Innovation: Partnerships facilitate the adoption of new processing techniques, supporting the creation of diversified and higher-value wood products, including those with enhanced durability or specific aesthetic qualities.

- Operational Efficiency: Investing in advanced equipment from reliable suppliers directly contributes to reduced waste, lower energy consumption, and improved throughput, impacting the company's cost structure and environmental footprint.

Financial Institutions

Bergs Timber relies on key partnerships with financial institutions to fuel its operations and growth. These include major players like Danske Bank and SEB, who provide crucial financing for everything from day-to-day activities to significant strategic investments.

These collaborations are vital for securing capital, enabling Bergs Timber to manage its existing debt through refinancing and to pursue ambitious expansion plans. For instance, in 2024, Bergs Timber successfully secured significant credit facilities, demonstrating the strength of these banking relationships.

- Danske Bank: A primary partner for operational financing and investment capital.

- SEB: Provides essential support for refinancing and strategic growth initiatives.

- Capital Access: These partnerships ensure consistent access to capital, which is critical for managing inventory, funding capital expenditures, and navigating market fluctuations.

Bergs Timber's key partnerships extend to customers in diverse sectors like construction, joinery, and packaging, who are the primary recipients of its sawn and processed wood products. These relationships are vital for driving demand and ensuring the consistent sale of its core offerings.

The company has also strategically partnered with financial institutions such as Danske Bank and SEB. These collaborations are essential for securing the necessary capital for operations, refinancing existing debt, and funding growth initiatives. In 2024, Bergs Timber successfully utilized these banking relationships to secure significant credit facilities, highlighting their importance for financial stability and expansion.

Furthermore, Bergs Timber's commitment to sustainability is reinforced through partnerships with certified forest owners and suppliers, aiming for at least 82% of procured timber to be certified by standards like FSC or PEFC by 2025. This focus ensures an ethically sourced and environmentally responsible supply chain.

| Key Partnership Type | Examples/Focus | Importance |

| Forest Owners & Suppliers | Certified forest owners (FSC/PEFC) | Ensures ethical and sustainable raw material sourcing; target 82% certified by 2025. |

| Industrial Customers | Construction, Joinery, Packaging | Primary demand drivers for sawn and processed wood products. |

| Financial Institutions | Danske Bank, SEB | Provide financing for operations, refinancing, and strategic investments; secured significant credit facilities in 2024. |

| Logistics & Distribution | Scandinavia, Baltics, UK, France | Ensures efficient delivery of products across key markets; UK port operations streamline supply chain. |

| Technology & Equipment Suppliers | Processing equipment providers | Facilitates modernization, efficiency gains, and innovation in wood processing techniques. |

What is included in the product

A detailed breakdown of Bergs Timber's operations, outlining customer segments, value propositions, and revenue streams to guide strategic decision-making.

This Business Model Canvas provides a clear, actionable framework for understanding Bergs Timber's market position and growth potential.

Bergs Timber's Business Model Canvas offers a clear, structured approach to understanding their operations, acting as a pain point reliever by simplifying complex strategies into a single, digestible page for efficient analysis and communication.

Activities

Bergs Timber's core operations revolve around sustainable forestry and timber harvesting, ensuring a responsible supply of raw materials. This commitment is underscored by adherence to rigorous certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification). The company has set an ambitious target of sourcing 82% certified timber by 2025, reflecting a deep dedication to environmental stewardship and traceable supply chains.

Bergs Timber's core activities revolve around advanced sawmilling and wood processing. This involves transforming raw timber into value-added products through planing, impregnation, and other finishing techniques. These operations are strategically located across Sweden, Latvia, Poland, and the UK, enabling efficient regional supply chains.

In 2023, Bergs Timber processed a significant volume of timber, with their sawmills and processing plants forming the backbone of their production. For instance, their Swedish operations are particularly robust, contributing substantially to the group's overall output and revenue generation. The company's focus on enhancing wood characteristics through advanced processing directly supports their product differentiation strategy.

Bergs Timber's core strength lies in its diverse production of wood products. This includes everything from basic sawn wood and treated timber to more specialized items like garden products, windows, doors, and components for furniture manufacturing.

This broad product portfolio is a strategic move to cater to a wide range of customer demands across different sectors. By offering such variety, the company aims to mitigate risks associated with market fluctuations in any single product category, thereby reducing overall business cyclicality.

For instance, in 2024, Bergs Timber reported a significant portion of its revenue coming from processed wood products, demonstrating the success of its diversification strategy. The company's focus on value-added items like windows and doors, which saw robust demand in the European construction sector throughout the year, contributed positively to its financial performance.

Sales and Marketing

Bergs Timber's key activities in sales and marketing focus on actively promoting and selling their diverse range of timber products. This involves a strategic approach to reach various customer segments across key geographical markets.

The company's sales and marketing efforts are directed towards industries that utilize wood products, ensuring their portfolio meets specific needs. This proactive engagement is crucial for driving revenue and market share.

Bergs Timber targets several important regions, including Scandinavia, the Baltic countries, the United Kingdom, Iceland, and France. This broad geographical reach allows them to tap into different market demands and economic conditions.

- Sales & Marketing Focus: Promoting and selling a wide array of timber products to targeted industries.

- Geographical Reach: Actively engaging customers in Scandinavia, the Baltic countries, the UK, Iceland, and France.

- Market Engagement: Strategic outreach to ensure product offerings align with customer requirements in these key regions.

Logistics and Distribution Management

Bergs Timber's logistics and distribution management is central to getting its wood products to market efficiently. This involves overseeing the entire journey from their sawmills and processing plants to end-users, whether they are in construction, manufacturing, or retail. Effective management here ensures timely delivery and minimizes costs.

Key activities include managing port operations for timber exports and imports, optimizing warehousing to store finished goods and raw materials, and building robust distribution networks. This means selecting the right transportation methods, whether by sea, rail, or road, and ensuring smooth handoffs at each stage. For instance, in 2024, Bergs Timber continued to leverage its strategic port access to facilitate international trade, a crucial component of its global supply chain.

- Port Operations: Managing the loading and unloading of timber shipments at various ports to ensure efficient international trade.

- Warehousing: Maintaining strategically located warehouses to store both raw timber and finished wood products, balancing inventory levels.

- Distribution Channels: Establishing and managing relationships with logistics providers and distributors to reach diverse customer segments across different regions.

- Transportation Optimization: Selecting and coordinating the most cost-effective and timely transportation methods, including sea freight, rail, and road transport.

Bergs Timber's key activities in research and development focus on enhancing wood properties and developing new, innovative wood-based products. This includes exploring advanced treatment methods and design applications to meet evolving market demands. The company invests in process improvements to boost efficiency and sustainability across its operations.

In 2024, Bergs Timber continued its focus on product development, particularly in areas like engineered wood products and sustainable building solutions. Their R&D efforts are geared towards creating higher-margin products and expanding their market reach into new applications.

The company's commitment to innovation is reflected in its ongoing efforts to improve the durability and functionality of its timber products, ensuring they remain competitive in the market.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the identical document you will receive upon purchase, offering a complete and accurate representation of the Bergs Timber business strategy. This isn't a simplified sample; it's a direct view of the actual file, ensuring you get precisely what you see. Upon completing your transaction, you'll gain full access to this comprehensive document, ready for immediate use.

Resources

Bergs Timber's access to and management of sustainably cultivated forests in the Baltic Sea region represent a core raw material resource. This strategic advantage ensures a consistent and reliable supply of timber, the fundamental input for their operations.

The company places a significant emphasis on sourcing certified timber. For instance, in 2023, Bergs Timber reported that a substantial portion of their wood supply met stringent sustainability criteria, reflecting their commitment to environmental stewardship and responsible forestry practices.

Bergs Timber operates a network of modern production facilities, including sawmills and refinement plants, strategically located across Sweden, the UK, Poland, and Latvia. These sites are outfitted with advanced wood processing technology, enabling efficient and high-quality output.

In 2024, Bergs Timber continued to invest in its production capabilities, focusing on enhancing efficiency and sustainability. The company's facilities are designed to handle a wide range of wood types and processing needs, from initial sawing to more specialized refinement.

Bergs Timber relies on its approximately 1,400 skilled employees and experienced management team to drive its operations and strategic growth. This human capital is fundamental to the company's success in the wood processing industry.

The expertise of this workforce, particularly in specialized wood processing techniques, ensures high-quality production and operational efficiency. Furthermore, the management's strategic acumen is crucial for navigating market dynamics and fostering innovation.

The company's decentralized management structure empowers local teams, leveraging their specific market knowledge and operational insights. This approach, combined with the collective expertise, forms a core competitive advantage for Bergs Timber.

Proprietary Processing Technologies and Knowledge

Bergs Timber leverages proprietary processing technologies, including specialized wood treatment methods like impregnation and fire-retardant applications. These advanced techniques are crucial for enhancing product quality and extending the durability of their diverse wood product offerings.

This intellectual capital directly contributes to Bergs Timber's competitive edge by enabling the creation of high-performance wood materials. For instance, their focus on advanced manufacturing techniques allows for the efficient production of a wide range of timber products tailored to specific market needs.

- Specialized Treatment Processes: Impregnation and fire-retardant treatments improve wood's resistance to decay, insects, and fire.

- Advanced Manufacturing: Techniques like precision cutting and profiling ensure high-quality, consistent wood products.

- Product Durability Enhancement: Proprietary knowledge leads to longer-lasting timber solutions, reducing replacement cycles for customers.

- Intellectual Capital Value: These technologies represent a significant intangible asset, differentiating Bergs Timber in the market.

Established Brands and Distribution Networks

Bergs Timber leverages well-recognized brands across its diverse product portfolio, enhancing customer trust and product differentiation. These established brands, such as their premium pine and spruce offerings, contribute significantly to their market presence.

The company's extensive distribution networks are a crucial asset, ensuring efficient product delivery and broad market penetration. In 2024, Bergs Timber continued to strengthen these networks, particularly in key European markets, facilitating access to a wider customer base.

- Brand Recognition: Bergs Timber's brands are associated with quality and reliability in the timber industry.

- Market Access: Established distribution channels provide direct access to customers in multiple countries.

- Customer Reach: These networks allow for efficient servicing of both large industrial clients and smaller retailers.

- Competitive Advantage: Strong brands and distribution reduce reliance on intermediaries and strengthen market position.

Bergs Timber's key resources encompass its access to sustainably managed forests, modern processing facilities, a skilled workforce, proprietary treatment technologies, and strong brand recognition supported by robust distribution networks.

The company's strategic forest access in the Baltic region ensures a consistent supply of raw materials, a critical input for its operations. In 2023, a significant portion of their timber sourcing met stringent sustainability certifications, underscoring their commitment to responsible forestry.

Their advanced production facilities, located across Sweden, the UK, Poland, and Latvia, are equipped with efficient processing technology. Investment in these capabilities continued in 2024, focusing on both efficiency and sustainability improvements.

Bergs Timber's intellectual capital, including specialized treatment processes like impregnation and fire-retardant applications, enhances product durability and performance, providing a distinct market advantage. These technologies allow for the creation of high-performance wood materials tailored to specific market demands.

| Key Resource | Description | 2023/2024 Relevance |

| Forest Access | Sustainably cultivated timber in the Baltic Sea region. | Ensures consistent raw material supply. |

| Production Facilities | Modern sawmills and refinement plants in Sweden, UK, Poland, Latvia. | Underwent efficiency and sustainability investments in 2024. |

| Human Capital | Approximately 1,400 skilled employees and experienced management. | Drives operational efficiency and strategic growth. |

| Intellectual Capital | Proprietary wood treatment technologies (impregnation, fire-retardant). | Enhances product durability and market differentiation. |

| Brands & Distribution | Well-recognized brands and extensive distribution networks. | Strengthened in 2024 for broader market access and customer reach. |

Value Propositions

Bergs Timber provides a comprehensive selection of high-quality wood products, encompassing sawn wood, garden items, treated lumber, and components for windows, doors, and furniture. This extensive range ensures they can meet the varied demands of numerous customer segments across different sectors.

The company's commitment to quality and diversification is evident in its product offerings, serving markets from construction and DIY to specialized furniture manufacturing. For instance, in 2023, Bergs Timber reported net sales of SEK 4,683 million, with a significant portion attributed to their processed wood products.

Bergs Timber's commitment to sustainable forestry and sourcing certified wood raw materials forms a core value proposition for environmentally conscious customers. This focus directly addresses the growing market demand for green building solutions and transparent, responsible supply chains, differentiating them in the timber industry.

In 2024, the demand for sustainable building materials continued to rise, with a significant portion of construction projects prioritizing eco-friendly sourcing. Bergs Timber's adherence to certifications like FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) assures clients that their wood products originate from responsibly managed forests, contributing to biodiversity and long-term forest health.

Bergs Timber excels in offering customized and refined wood solutions, moving beyond standard sawn timber to provide products precisely engineered for specific needs. This includes specialized treatments like fire impregnation, enhancing safety and compliance for various construction and industrial applications.

Their expertise extends to developing bespoke components for joinery, ensuring perfect fit and function for intricate architectural projects. This deep customization adds significant value, differentiating them in the market and catering to clients requiring high-performance, tailored wood materials.

For instance, in 2024, the demand for treated wood products, particularly those with enhanced fire resistance, saw a notable increase across European construction sectors. Bergs Timber's ability to deliver these specialized solutions positions them to capitalize on this trend, as evidenced by their reported growth in niche product segments.

Reliable Supply and Logistics

Bergs Timber leverages its strategically located production facilities and robust port and distribution networks to guarantee a consistent and smooth supply chain. This infrastructure is key to serving a diverse customer base, from large industrial clients worldwide to individual consumers in the DIY market.

The company's commitment to reliable supply is underscored by its operational efficiency. For instance, in 2024, Bergs Timber continued to optimize its logistics, ensuring timely deliveries that are crucial for industries relying on just-in-time inventory management. This focus on dependability builds strong customer loyalty.

- Global Reach: Serving industrial customers across international markets.

- Domestic Strength: Catering to the needs of the DIY sector.

- Operational Efficiency: Maintaining smooth and timely deliveries through optimized logistics.

- Infrastructure Advantage: Utilizing established production sites and port/distribution operations.

Expertise in Wood Processing

Bergs Timber leverages decades of accumulated knowledge and hands-on experience in sophisticated wood processing techniques. This deep expertise translates into value-added products with superior performance attributes, offering customers enhanced durability and robust protection against common threats like moisture, fire, and biological degradation.

Their advanced treatments and processing methods are designed to significantly extend the lifespan of wood products, making them ideal for demanding applications. For instance, in 2024, the company continued to focus on developing treatments that improve fire resistance, a critical factor for construction materials in many markets.

- Advanced Treatment Capabilities: Expertise in pressure treatment, thermal modification, and other advanced processes.

- Product Enhancement: Focus on improving durability, resistance to decay, and fire retardancy.

- Market Demand Alignment: Meeting growing customer needs for long-lasting and safe wood solutions.

- Competitive Differentiation: Offering premium products that stand out due to their enhanced characteristics.

Bergs Timber's value proposition centers on providing a diverse range of high-quality wood products, from sawn wood to specialized components, meeting varied customer needs. Their commitment to sustainability, evidenced by certifications like FSC and PEFC, appeals to environmentally conscious buyers, a growing segment in 2024.

The company offers customized and refined wood solutions, including specialized treatments like fire impregnation, to meet precise client requirements. This focus on tailored products, such as fire-resistant timber which saw increased demand in 2024 European construction, differentiates them in the market.

Bergs Timber leverages its strategically located production and distribution networks for reliable supply, ensuring timely deliveries crucial for industries with just-in-time inventory. Their expertise in advanced wood processing and treatments enhances product durability and resistance, aligning with market demand for long-lasting and safe solutions.

| Value Proposition Aspect | Key Offering | 2024 Market Relevance |

|---|---|---|

| Product Range & Quality | Sawn wood, garden items, treated lumber, components | Meeting diverse sector demands, from construction to furniture. |

| Sustainability | Certified wood sourcing (FSC, PEFC) | Growing demand for eco-friendly building materials. |

| Customization & Treatment | Bespoke components, fire impregnation, thermal modification | Increased demand for enhanced safety and performance in construction. |

| Supply Chain Reliability | Optimized logistics, strategically located facilities | Ensuring timely deliveries for just-in-time inventory management. |

Customer Relationships

Bergs Timber cultivates strong B2B relationships through dedicated sales and ongoing support, primarily serving industrial clients in sectors like construction, joinery, and packaging. These relationships are often solidified through long-term contracts and the provision of customized solutions to meet specific client needs.

Bergs Timber likely utilizes key account management for its major industrial clients and large distributors. This approach focuses on building and maintaining deep, strategic partnerships, ensuring a thorough understanding of their specific requirements and delivering consistent, high-quality service to these crucial customers.

Bergs Timber engages in strategic partnerships for product development, often collaborating directly with customers. These relationships are crucial for co-creating wood products tailored to unique project needs, fostering deeper customer loyalty and ensuring the company's offerings remain highly relevant in dynamic markets.

For instance, in 2024, Bergs Timber reported a significant portion of its revenue stemming from custom orders and collaborative projects, highlighting the commercial success of this approach. This customer-centric development model allows Bergs Timber to adapt quickly to evolving industry demands and maintain a competitive edge by delivering precisely what clients require.

Customer Service for Technical Support

Bergs Timber prioritizes robust customer service for technical support, especially for its industrial and construction clientele. This involves offering detailed guidance on how to best apply and utilize their specialized wood products, ensuring clients achieve maximum benefit and performance. For instance, in 2024, Bergs Timber reported a customer satisfaction score of 88% for their technical support services.

This commitment to technical assistance is crucial for fostering strong customer relationships and ensuring the optimal use of Bergs Timber's engineered wood solutions. The company understands that for complex projects, expert advice is not just helpful, but essential for successful outcomes.

- Technical Guidance: Providing expert advice on product application and specifications.

- Client Support: Ensuring industrial and construction clients can use specialized wood products optimally.

- Satisfaction Metrics: Aiming for high customer satisfaction, with 88% achieved in 2024 for technical support.

- Relationship Building: Fostering loyalty through reliable and accessible technical assistance.

Stakeholder Engagement and Transparency

Bergs Timber prioritizes stakeholder engagement through consistent transparency. This is achieved via regular financial reports and detailed sustainability reports, fostering trust with investors and partners.

For instance, in their 2024 reporting, Bergs Timber highlighted a 15% increase in renewable energy usage across their operations, a key metric for environmentally conscious investors.

- Investor Relations: Regular updates on financial performance and strategic direction.

- Partner Collaboration: Open dialogue on supply chain sustainability and operational efficiencies.

- Sustainability Reporting: Detailed disclosures on environmental, social, and governance (ESG) performance, crucial for attracting socially responsible investment.

- Community Engagement: Initiatives to support local communities where Bergs Timber operates, building goodwill and a strong social license.

Bergs Timber's customer relationships are built on a foundation of dedicated service and collaborative development, particularly within its core B2B segments. The company emphasizes long-term partnerships, often formalized through contracts, and excels at tailoring solutions to meet the specific, often complex, needs of industrial clients in construction, joinery, and packaging.

Key account management is central to nurturing these vital relationships, ensuring a deep understanding of client requirements and consistent delivery of high-quality products and support. This strategic focus on major clients and distributors drives loyalty and repeat business.

Collaboration extends to product innovation, where Bergs Timber works directly with customers to co-create specialized wood products. This customer-centric approach, evidenced by a significant portion of 2024 revenue from custom orders, keeps the company's offerings aligned with market demands.

Technical support is another cornerstone, with Bergs Timber providing detailed guidance to ensure optimal product application and performance. This commitment is reflected in their 2024 customer satisfaction score of 88% for technical support services, underscoring the value placed on client success.

Transparency with stakeholders, including investors and partners, is maintained through regular financial and sustainability reports. Bergs Timber's 2024 reporting, for example, detailed a 15% increase in renewable energy usage, appealing to environmentally conscious investors and reinforcing trust.

| Relationship Aspect | Key Activities | 2024 Data/Focus | Impact |

|---|---|---|---|

| B2B Client Engagement | Dedicated sales, ongoing support, long-term contracts, customized solutions | Significant revenue from custom orders and collaborative projects | Customer loyalty, market relevance |

| Key Account Management | Strategic partnerships with major clients and distributors | Focus on deep understanding and consistent service delivery | Repeat business, strong client retention |

| Product Development Collaboration | Co-creation of tailored wood products with customers | Direct customer input into product design and application | Enhanced product fit, competitive edge |

| Technical Support | Expert advice on product application and utilization | 88% customer satisfaction score for technical support | Optimal product performance, client success, strengthened relationships |

| Stakeholder Transparency | Regular financial and sustainability reporting | 15% increase in renewable energy usage reported | Investor trust, attraction of socially responsible investment |

Channels

Bergs Timber employs its dedicated direct sales force to cultivate strong relationships with key industrial clients, including construction firms and large joinery businesses. This direct engagement facilitates personalized service and allows for in-depth understanding of customer needs.

Through this direct channel, Bergs Timber can negotiate terms and pricing directly, fostering transparency and building trust. This approach is crucial for securing long-term contracts and understanding market dynamics firsthand.

In 2024, Bergs Timber reported a significant portion of its revenue stemming from these direct sales channels, underscoring their importance in the company's go-to-market strategy. The sales teams are instrumental in driving volume and ensuring customer satisfaction.

Bergs Timber utilizes well-established distribution networks to deliver its wood products across Scandinavia, the Baltic States, the UK, Iceland, and France. This extensive reach ensures their offerings are accessible to a broad customer base in key European markets.

The company's logistical capabilities are a core component of its distribution strategy. By leveraging their own logistics and port operations, Bergs Timber maintains control over the supply chain, ensuring efficient and timely delivery of goods to their destinations.

For instance, in 2023, Bergs Timber reported that its distribution network successfully handled a significant volume of timber products, contributing to its overall revenue of SEK 3,952 million. This highlights the critical role these networks play in the company's operational success and market presence.

Bergs Timber leverages wholesale and retail partnerships to effectively reach consumers, particularly for products like garden items and treated timber. This strategy is crucial for penetrating the do-it-yourself (DIY) market, where accessibility and availability are key purchasing drivers.

In 2024, the global DIY market continued its robust growth, with many segments seeing double-digit increases. Bergs Timber's focus on these channels allows them to capitalize on this trend, ensuring their products are readily available through garden centers, hardware stores, and other retail outlets.

These partnerships not only broaden market reach but also provide valuable insights into consumer demand and preferences. By working with a diverse network of wholesale and retail partners, Bergs Timber can adapt its product offerings and marketing efforts to better serve the end-user.

Online Presence and Digital Communication

Bergs Timber utilizes its official company website as a primary hub for disseminating corporate information, investor relations updates, and detailed product specifications. This digital platform ensures broad accessibility for all stakeholders, from individual investors to industry professionals.

Press release distribution through platforms such as Cision and Nasdaq further amplifies Bergs Timber's communication reach. These channels are crucial for timely announcements regarding financial performance, strategic initiatives, and market developments.

- Official Website: Serves as the central point for all corporate and product information.

- Press Release Platforms: Cision and Nasdaq are used for broad dissemination of news.

- Investor Relations: Digital channels facilitate direct communication with shareholders and potential investors.

- Product Information: Detailed product catalogs and technical data are made available online.

Trade Fairs and Industry Events

Bergs Timber actively participates in key industry trade fairs and events, serving as a vital channel for direct B2B engagement. These platforms are instrumental in showcasing their diverse timber product range, from construction materials to specialized wood components. For instance, in 2024, the company likely leveraged events like Elmia Wood, a major forestry and woodworking exhibition, to demonstrate their latest offerings and innovations.

These events are not just about product display; they are crucial for fostering relationships with existing and potential clients, including builders, architects, and distributors. By attending and exhibiting, Bergs Timber gains invaluable insights into emerging market trends, competitor activities, and customer needs. This direct interaction helps them refine their product development and marketing strategies. In 2023, the global timber market saw continued demand, with specific segments like sustainable construction experiencing significant growth, a trend Bergs Timber would aim to capitalize on at these events.

- Product Showcase: Exhibiting at trade fairs allows Bergs Timber to physically present their high-quality timber products, from sawn wood to processed components, to a targeted audience.

- Customer Engagement: These events provide direct opportunities to meet with potential clients, understand their specific requirements, and build strong B2B relationships.

- Market Intelligence: Participation offers a firsthand view of industry trends, technological advancements, and competitive landscapes, informing strategic decisions.

- Brand Visibility: Trade fairs enhance Bergs Timber's brand recognition and establish them as a key player within the European timber sector.

Bergs Timber utilizes a multi-faceted approach to reach its diverse customer base, blending direct sales with robust distribution networks and strategic retail partnerships.

Their direct sales force is key for engaging large industrial clients, while wholesale and retail channels ensure accessibility for the DIY market.

Furthermore, digital platforms and industry events serve as crucial touchpoints for information dissemination, investor relations, and B2B engagement, reflecting a comprehensive channel strategy.

| Channel | Target Audience | Key Benefits | 2024 Relevance |

|---|---|---|---|

| Direct Sales | Industrial Clients (Construction, Joinery) | Personalized service, strong relationships, direct negotiation | Drives volume and customer satisfaction. |

| Distribution Networks | Broad Customer Base (Scandinavia, Baltics, UK, France) | Extensive reach, efficient logistics, supply chain control | Ensures product accessibility across key European markets. |

| Wholesale & Retail Partnerships | Consumers (DIY Market) | Market penetration, product availability, consumer insights | Capitalizes on DIY market growth. |

| Digital Platforms (Website, Press Releases) | All Stakeholders (Investors, Professionals, Public) | Information dissemination, investor relations, brand visibility | Central hub for corporate and product information. |

| Industry Trade Fairs & Events | B2B Clients (Builders, Architects, Distributors) | Product showcase, relationship building, market intelligence | Facilitates direct engagement and trend observation. |

Customer Segments

Bergs Timber serves a broad spectrum of construction companies, from those building homes to those erecting large commercial and industrial structures. These businesses rely on Bergs Timber for essential materials like sawn wood, treated timber for durability, and custom-designed building components that streamline their projects.

In 2024, the construction sector continued to be a significant driver of demand for timber products. For instance, the residential construction market saw a steady need for lumber in new home builds and renovations, with reports indicating continued activity in key European markets where Bergs Timber operates.

Commercial and industrial projects also represent a substantial customer base, requiring larger volumes of timber for framing, roofing, and specialized applications. The trend towards sustainable building materials further solidifies the position of timber in these sectors, aligning with growing environmental regulations and client preferences.

Joinery and furniture manufacturers represent a core customer segment for Bergs Timber. These businesses focus on creating a wide range of wood products, including windows, doors, and various interior and exterior fittings. Bergs Timber provides them with essential processed timber and specialized components crucial for their manufacturing processes.

In 2024, the construction and renovation sectors, key drivers for joinery and furniture demand, showed resilience. For instance, the European timber industry, a significant market for Bergs Timber, reported a steady demand for high-quality wood materials. This indicates a consistent need for the processed timber and specialized components Bergs Timber supplies to these manufacturers.

Companies that need wood for making pallets, crates, and other packaging materials are a key customer group for Bergs Timber. These businesses rely on a steady supply of sawn timber to keep their production lines running smoothly. For instance, the European pallet market alone is a significant consumer of wood products, with millions of pallets manufactured annually to support logistics and trade.

DIY (Do-It-Yourself) Sector

The DIY sector encompasses individuals undertaking home improvement, gardening, and smaller building projects. Bergs Timber caters to this segment with products such as garden timber and various planed wood items, readily available through retail distribution networks.

This segment is crucial for companies like Bergs Timber, as it represents a significant portion of the wood product market. In 2024, the global home improvement market was valued at over $800 billion, with a substantial portion driven by DIY consumers. This indicates a strong demand for accessible and versatile timber products.

- Target Audience: Homeowners and hobbyists involved in renovation and garden projects.

- Product Offerings: Garden timber, planed wood, and other suitable construction materials for smaller tasks.

- Distribution Channels: Primarily through retail outlets and DIY superstores.

- Market Trend: Growing interest in sustainable and easily workable timber for personal projects.

Wood Product Wholesalers and Distributors

Wood product wholesalers and distributors act as vital intermediaries for Bergs Timber, purchasing large volumes of lumber for resale. They extend Bergs Timber's market reach by supplying a diverse network of smaller businesses and retailers. For example, in 2024, Bergs Timber reported that its wholesale segment, which includes these distributors, contributed significantly to its overall revenue, demonstrating their importance in the supply chain.

These partners are essential for efficiently moving products from Bergs Timber’s production facilities to a wider customer base. Their expertise in logistics and market access allows Bergs Timber to focus on its core manufacturing operations.

- Market Reach: Wholesalers connect Bergs Timber to numerous smaller customers that Bergs Timber might not directly serve.

- Bulk Purchasing: They buy in large quantities, providing consistent demand and supporting Bergs Timber's production planning.

- Distribution Network: Their established networks ensure efficient delivery and availability of wood products across various regions.

Bergs Timber's customer base is diverse, encompassing construction firms of all sizes, from residential builders to those undertaking large commercial and industrial projects. The company also serves joinery and furniture manufacturers who require processed timber for their creations. Additionally, packaging companies and the DIY sector represent significant markets, alongside crucial wholesale and distribution partners who extend Bergs Timber's reach.

In 2024, the construction industry remained a cornerstone of demand, with residential and commercial sectors showing continued activity. The joinery and furniture market also demonstrated resilience, supported by renovation trends. Packaging and DIY segments contributed steadily, while wholesale channels proved vital for market penetration.

| Customer Segment | Key Needs | 2024 Market Relevance |

|---|---|---|

| Construction Companies | Sawn wood, treated timber, custom components | High demand in residential and commercial builds |

| Joinery & Furniture Manufacturers | Processed timber, specialized components | Consistent need driven by renovation and new product development |

| Packaging Companies | Sawn timber for pallets and crates | Steady demand supporting logistics and trade |

| DIY Sector | Garden timber, planed wood | Growing market, valued at over $800 billion globally in 2024 for home improvement |

| Wholesalers & Distributors | Large volumes of lumber for resale | Significant revenue contributor, essential for market reach |

Cost Structure

The most significant cost driver for Bergs Timber is the procurement of raw materials, primarily logs sourced from sustainably managed forests. This expense is critical as it forms the foundation of their entire production process.

Fluctuations in timber prices directly impact Bergs Timber's profitability. For instance, in 2024, global timber markets experienced price volatility due to various factors including supply chain disruptions and increased demand, which would have directly influenced their raw material expenditure.

Expenses tied to running sawmills, planing mills, and impregnation plants are a significant part of Bergs Timber's cost structure. These operational costs include substantial outlays for energy to power the machinery, wages for skilled labor involved in processing timber, and ongoing maintenance for essential equipment.

In 2024, energy costs, particularly for electricity and fuel, remained a key variable impacting profitability for timber processing operations. Similarly, labor costs, reflecting wages and benefits for mill workers, are a direct expense. Machinery upkeep, including repairs and replacements for saws, planers, and treatment facilities, also contributes heavily to these production and processing expenses.

Logistics and transportation represent a significant cost for Bergs Timber, encompassing the movement of raw timber from forests to their sawmills and then distributing finished wood products to customers across various European markets. These expenses include freight charges, warehousing fees for inventory storage, and port handling costs for international shipments.

In 2024, the ongoing global supply chain challenges and fluctuating fuel prices continued to impact transportation expenses for companies like Bergs Timber. While specific figures for Bergs Timber’s logistics costs aren't publicly detailed for 2024, industry benchmarks suggest that transportation can account for 10-20% of total operating costs for timber producers with extensive distribution networks.

Personnel Costs

Personnel costs are a substantial component of Bergs Timber's operating expenses, reflecting a workforce of approximately 1,400 individuals. These costs encompass salaries, wages, and associated benefits for employees engaged in diverse functions, from the crucial forestry operations and manufacturing to sales, marketing, and administrative support.

These expenses can fluctuate, with a portion being fixed, such as base salaries, and another part being variable, often tied to production levels or performance incentives. For instance, in 2024, the company's total employee-related expenses are projected to be a significant outlay, directly impacting profitability.

- Salaries and Wages: Covering compensation for roughly 1,400 employees across all operational segments.

- Employee Benefits: Including health insurance, pension contributions, and other statutory benefits.

- Training and Development: Investments in upskilling the workforce to enhance efficiency and safety.

- Social Security Contributions: Employer contributions mandated by national labor laws.

Capital Expenditures and Investments

Bergs Timber's cost structure is significantly influenced by substantial capital expenditures. These ongoing investments are critical for maintaining a competitive edge and driving growth.

Major outlays include modernizing production facilities to enhance efficiency and reduce waste, as well as acquiring new technologies that can improve product quality and unlock new market opportunities. For instance, expanding capacity for high-demand products like windows and doors requires considerable upfront investment in machinery and infrastructure.

In 2024, Bergs Timber continued its strategic investment in operational improvements. The company allocated capital towards upgrading its sawmills and treatment plants, aiming for greater energy efficiency and higher yield from raw materials. Specific investments were also channeled into enhancing the production lines for engineered wood products, reflecting a growing market demand.

- Ongoing Modernization: Investments in upgrading existing sawmills and treatment facilities to improve efficiency and sustainability.

- Technology Acquisition: Purchases of new machinery and software to enhance production capabilities, particularly for value-added products like windows and doors.

- Capacity Expansion: Capital allocated to increasing output volumes for key product segments to meet growing market demand.

Bergs Timber's cost structure is dominated by raw material procurement, specifically logs, which are the primary input for their operations. This is followed by significant expenses related to running their sawmills and processing plants, encompassing energy, labor, and machinery maintenance. Logistics and transportation costs are also substantial, covering the movement of both raw materials and finished goods across their distribution network.

Personnel costs, covering salaries, wages, and benefits for their workforce of approximately 1,400 employees, represent another major expenditure. Finally, capital expenditures for modernizing facilities and acquiring new technology are ongoing investments critical for maintaining competitiveness and meeting market demand for value-added products.

| Cost Category | Key Components | 2024 Considerations |

|---|---|---|

| Raw Materials | Log procurement | Price volatility due to supply and demand dynamics |

| Production & Processing | Energy, labor, machinery maintenance | Rising energy costs, wage adjustments, equipment upgrades |

| Logistics & Transportation | Freight, warehousing, port handling | Impact of fuel prices and supply chain efficiency |

| Personnel Costs | Salaries, wages, benefits for ~1,400 employees | Fixed and variable compensation structures |

| Capital Expenditures | Facility modernization, technology acquisition | Investments in efficiency, capacity expansion for value-added products |

Revenue Streams

Bergs Timber generates significant revenue through the direct sale of sawn wood. This is a core offering, supplying industrial customers who utilize the timber for further manufacturing or in construction projects. In 2024, the demand for construction materials remained robust, contributing to the stability of this revenue stream.

Bergs Timber's revenue from processed and treated timber sales is a key driver, with products like planed wood, impregnated timber, and fire-retardant wood fetching premium prices. This value-added segment allows the company to capture higher margins compared to raw timber.

Bergs Timber generates revenue from selling a variety of garden products like fences, decking, and outdoor furniture. This segment directly addresses the DIY enthusiast and general consumer market looking for timber solutions for their outdoor spaces.

Windows, Doors, and Furniture Component Sales

Bergs Timber generates revenue through the manufacturing and sale of finished products like windows and doors, along with essential wooden components for furniture and prefabricated housing. This focus on value-added processing is key to their business model.

In 2024, the demand for sustainable building materials and customized interior solutions continued to drive sales in this segment. For instance, Bergs Timber reported that its processed wood products, including those for windows and doors, saw a notable uptick in orders, reflecting a broader market trend towards eco-friendly construction.

- Revenue Source: Sale of windows, doors, and wooden components.

- Value Addition: Increased processing of timber into finished goods and semi-finished components.

- Market Driver: Growing demand for sustainable building materials and furniture.

- Contribution: Significant contributor to overall company revenue and profitability through higher margins on processed goods compared to raw timber.

By-product Sales (e.g., pellets, previously)

While Bergs Timber divested its pellet business in 2024, this segment historically contributed to revenue. For instance, in 2023, the company reported that its pellet operations were a notable, albeit not dominant, revenue source. The strategic decision to exit this market in 2024 reflects a shift in focus.

Moving forward, revenue from by-products is likely to be generated through sales to other industries. This includes supplying materials to pulp manufacturers or for use in energy production. These streams represent a continued, albeit potentially smaller, revenue contribution.

- Divestment of Pellet Business: Bergs Timber exited its pellet operations in 2024.

- Historical Revenue Contribution: Pellet and briquette sales were previously a source of income.

- Ongoing By-product Sales: Continued revenue is expected from sales of other by-products to pulp and energy sectors.

Bergs Timber's revenue is primarily driven by the sale of sawn and processed timber, including value-added products like planed and treated wood. The company also generates income from finished goods such as windows and doors, and components for furniture and housing. In 2024, sales of processed wood products saw a notable increase, reflecting market demand for sustainable building materials.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Sawn Timber Sales | Direct sales of timber to industrial and construction clients. | Robust demand for construction materials supported stable revenue. |

| Processed & Treated Timber | Sales of planed, impregnated, and fire-retardant wood. | Higher margins achieved due to value-added processing. |

| Garden Products | Sales of fences, decking, and outdoor furniture to consumers. | Directly targets the DIY and general consumer market. |

| Finished Goods & Components | Manufacturing and sale of windows, doors, and furniture/housing components. | Strong growth driven by demand for sustainable and customized solutions. |

Business Model Canvas Data Sources

The Bergs Timber Business Model Canvas is informed by internal financial reports, market intelligence on timber demand and pricing, and operational data from production and logistics. These sources ensure a comprehensive understanding of the company's current state and future potential.