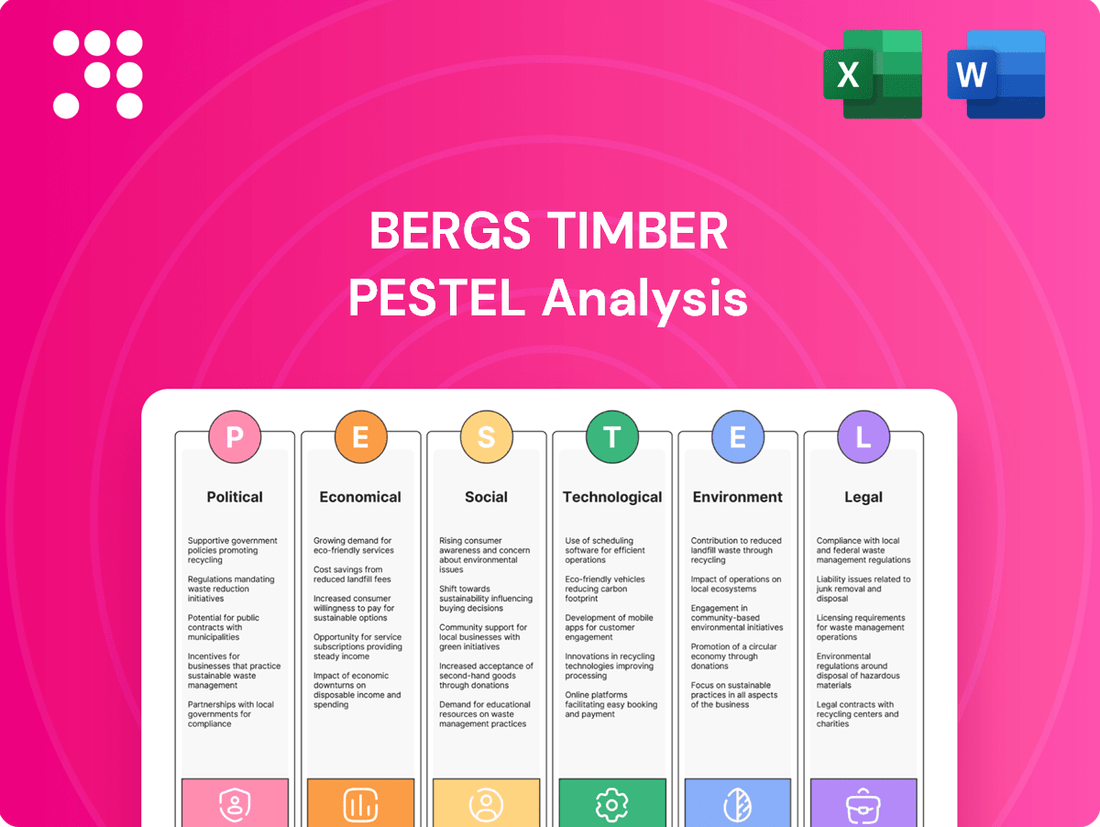

Bergs Timber PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bergs Timber Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Bergs Timber's future. Our comprehensive PESTEL analysis provides actionable intelligence to anticipate market shifts and secure your competitive advantage. Download the full version now for expert insights and strategic clarity.

Political factors

Swedish and EU forestry policies are pivotal for Bergs Timber. The Swedish Forest Act mandates reforestation and sustainable management, balancing timber output with environmental protection. This framework ensures a continuous supply of raw materials while adhering to ecological standards.

The EU's evolving regulatory landscape, particularly the REDIII and the Nature Restoration Regulation effective from 2025, presents both challenges and opportunities. Stricter sustainability criteria for biomass could increase raw material costs, while restoration targets might influence land availability for timber harvesting. For instance, the EU's commitment to restoring 3 billion trees by 2030 under the EU Forest Strategy highlights the increasing focus on ecological balance.

The EU Deforestation Regulation (EUDR), set to fully apply from December 30, 2025, is a significant political shift for companies like Bergs Timber exporting wood products to the European Union. This regulation replaces the existing EU Timber Regulation and demands that all wood products entering the EU market must be verifiably deforestation-free. This means suppliers must demonstrate their products do not originate from land deforested or degraded after December 31, 2020.

Compliance with the EUDR necessitates robust due diligence processes, including the collection of precise geolocation data for all relevant commodities. Bergs Timber must implement systems to gather and provide verifiable information proving their wood products meet these stringent traceability standards. Failure to comply could result in penalties, including product seizure and market exclusion, impacting Bergs Timber's access to the crucial EU market.

Trade policies and tariffs significantly impact Bergs Timber's global competitiveness. For instance, in 2024, while the Swedish forest industry demonstrated resilience with strong exports even amidst economic slowdowns, potential increases in tariffs, particularly from the United States, introduce considerable uncertainty for companies like Bergs Timber. Navigating these evolving trade dynamics is crucial for maintaining market access and favorable pricing structures.

Political Stability and Geopolitical Events

Geopolitical events, such as the ongoing conflict in Ukraine, have fundamentally reshaped global timber supply chains. The cessation of imports from Russia and Belarus, major timber producers, has created a vacuum that Swedish exporters like Bergs Timber are positioned to fill, potentially leading to reduced competition and increased market share. In 2023, Russia's share of global sawn wood exports, which was around 20% prior to the conflict, saw a significant decline due to sanctions and self-imposed restrictions.

However, the broader landscape of political stability remains a critical consideration. Any resurgence of instability in key European or Asian markets, for instance, could introduce new disruptions. Such disruptions might manifest as renewed trade barriers, shifts in consumer demand due to economic uncertainty, or unforeseen operational hurdles that could impact Bergs Timber's ability to source raw materials or deliver finished products efficiently. For example, a sudden imposition of tariffs on timber products in a major importing nation could directly affect Bergs Timber's export revenues.

- Impact of Ukraine War: Sanctions on Russia and Belarus have disrupted traditional timber flows, potentially benefiting Swedish exporters by creating market opportunities.

- Supply Chain Vulnerability: Broader political instability in key markets can lead to supply chain disruptions, affecting both sourcing and sales for companies like Bergs Timber.

- Market Access Risks: Geopolitical tensions can result in new trade barriers or tariffs, directly impacting the cost-effectiveness and accessibility of international markets.

Bioeconomy Strategies and Green Deal Initiatives

The European Union's commitment to a bio-based economy, reinforced by its updated Bioeconomy Strategy expected in 2025, signals a significant shift. This strategic direction, coupled with initiatives like the New European Bauhaus focusing on sustainable and energy-efficient housing, directly benefits the forestry and timber industries.

These policies champion wood as a primary fossil-free and sustainable material, a move that is projected to significantly boost demand for timber products. For Bergs Timber, this translates into a favorable market environment where its offerings align perfectly with the EU's environmental and economic objectives.

- EU Bioeconomy Strategy Update (2025): Focus on sustainable resource utilization and circular economy principles.

- New European Bauhaus: Promotion of energy-efficient and aesthetically pleasing buildings, favoring sustainable materials like wood.

- Increased Demand for Wood: Growing preference for fossil-free construction materials is expected to drive market growth.

- Market Opportunities: Bergs Timber is well-positioned to capitalize on these trends, offering sustainable timber solutions.

Swedish and EU forestry policies, including the Forest Act and the upcoming Nature Restoration Regulation (effective 2025), shape Bergs Timber's operations by mandating sustainable practices. The EU Deforestation Regulation (EUDR), fully applicable from December 30, 2025, requires verifiable deforestation-free sourcing for wood products entering the EU, necessitating robust due diligence and geolocation data.

Geopolitical events, such as the Ukraine conflict, have altered global timber supply chains, potentially benefiting Swedish exporters by reducing competition from Russia and Belarus, which previously accounted for approximately 20% of global sawn wood exports. However, broader political instability in key markets poses risks of trade barriers and demand shifts, impacting Bergs Timber's market access and operational efficiency.

The EU's updated Bioeconomy Strategy (2025) and initiatives like the New European Bauhaus champion wood as a sustainable material, expected to boost demand for timber products. This aligns with Bergs Timber's offerings, positioning the company favorably within the EU's environmental and economic objectives.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Bergs Timber, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a clear, actionable overview of external factors impacting Bergs Timber, simplifying complex market dynamics for strategic decision-making.

Economic factors

The construction sector's health is a critical factor for Bergs Timber, as demand for its wood products directly correlates with building activity. Following a sluggish 2024, where construction volumes saw a notable slowdown across Europe, the outlook for 2025 suggests a potential turnaround.

Expectations for 2025 point towards a possible recovery, potentially spurred by anticipated interest rate reductions that could encourage new investments in housing and infrastructure projects. This rebound, if realized, would translate into increased demand for timber and other wood-based materials, benefiting companies like Bergs Timber.

The cost and accessibility of sawlogs and pulpwood are fundamental to Bergs Timber's operations. For instance, in Q2 2024, a notable increase in raw material prices presented a challenge, potentially squeezing sawmill profit margins even as export prices for sawn softwood adjusted. Ensuring a consistent and sustainable supply of timber is therefore paramount for maintaining operational efficiency and profitability.

Currency exchange rates significantly impact Bergs Timber's international sales. A weaker Swedish krona (SEK) generally boosts the attractiveness of Swedish forest products abroad, potentially increasing export demand. For instance, in early 2024, the SEK traded around 10.50 against the US dollar, a level that historically supported export competitiveness.

Conversely, a stronger SEK, perhaps trading closer to 9.50 SEK per USD, would make Bergs Timber's products more expensive for international buyers, potentially dampening export volumes and profitability. The company's financial results are therefore directly sensitive to these currency movements, as fluctuations can alter the real value of its export revenues when converted back into SEK.

Inflation and Interest Rates

High inflation in 2024 has significantly increased production costs for companies like Bergs Timber, affecting everything from raw materials to energy. Simultaneously, elevated interest rates, which remained high through much of 2024, have made borrowing more expensive, dampening investment in new construction projects. This directly translates to reduced demand for wood products.

Looking ahead to 2025, a projected easing of interest rates is expected to provide a much-needed tailwind for the construction sector. Lower borrowing costs should stimulate housing starts and commercial development, leading to a more favorable environment for timber demand. This shift could translate into improved sales volumes and potentially better pricing for Bergs Timber.

- Inflationary Pressures: Global inflation remained a key concern throughout 2024, with many economies experiencing rates above central bank targets. For instance, the Eurozone's inflation rate hovered around 2.5% in early 2024, impacting input costs for timber processing.

- Interest Rate Environment: Central banks, including the European Central Bank and the US Federal Reserve, maintained relatively high interest rates in 2024 to combat inflation. Projections for 2025 suggest a gradual reduction in these rates, with some forecasts indicating a potential cut of 0.50% to 0.75% by mid-2025.

- Impact on Construction: Higher interest rates directly affect mortgage affordability and the cost of capital for developers, leading to a slowdown in construction activity. In 2024, new housing starts in key European markets saw a contraction of approximately 5-7% compared to the previous year.

- Timber Demand Outlook: The anticipated decrease in interest rates in 2025 is forecast to revive construction activity, potentially increasing demand for timber by 3-5% across major markets.

Global Market Supply and Competition

The global market for wood products is experiencing a reduced supply, significantly impacting competition. Challenges like widespread insect infestations in Canada and the halt of imports from Russia and Belarus have tightened availability. This scarcity is a key driver for increased prices, making Swedish forest products, including those from Bergs Timber, more strategically important on the international stage.

This shift in global supply dynamics creates a favorable environment for Bergs Timber. As other major producers face disruptions, the company is well-positioned to capitalize on this reduced competition. Gaining market share becomes a tangible opportunity as demand outstrips supply, especially for sustainably sourced timber.

- Reduced Supply: Global wood product availability has tightened due to factors like Canadian insect infestations and sanctions impacting Russian/Belarusian exports.

- Price Inflation: Supply constraints are leading to higher prices for wood products worldwide.

- Swedish Advantage: This situation enhances the competitive position and importance of Swedish forest products.

- Market Share Opportunity: Bergs Timber can leverage these conditions to expand its market presence.

Economic factors present a mixed but potentially improving landscape for Bergs Timber. While high inflation in 2024 increased operational costs and elevated interest rates dampened construction, projections for 2025 indicate a shift. Anticipated interest rate reductions are expected to stimulate the construction sector, leading to increased demand for timber products.

| Economic Factor | 2024 Impact | 2025 Outlook |

|---|---|---|

| Inflation | Increased input costs, impacting margins | Projected to ease, potentially lowering costs |

| Interest Rates | High rates slowed construction, increased borrowing costs | Expected reductions to boost construction activity |

| Construction Demand | Slowdown observed, with housing starts down 5-7% in key European markets | Forecasted to recover, with timber demand potentially up 3-5% |

| Currency (SEK) | Fluctuations impact export competitiveness | Continued volatility expected, influencing international sales |

Same Document Delivered

Bergs Timber PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bergs Timber PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain immediate access to this detailed strategic tool upon completing your purchase.

Sociological factors

Consumers increasingly favor eco-friendly products, a trend that directly benefits wood as a sustainable building material. This growing preference is a significant driver for companies like Bergs Timber, which specialize in renewable resources.

European initiatives are further bolstering the demand for wood construction. For instance, France's mandate for wooden construction in public buildings, effective from 2025, is a prime example of policy supporting sustainable materials and directly enhances the market appeal for Bergs Timber's products.

Public perception of forestry significantly impacts companies like Bergs Timber. Growing concerns about old-growth forests and biodiversity preservation can lead to increased regulatory scrutiny and affect market acceptance of timber products. For instance, in 2023, a significant portion of the Swedish public expressed strong support for enhanced protection of old-growth forests, according to a survey by the Swedish Forest Agency.

While Bergs Timber adheres to sustainable forestry principles, external critiques from environmental organizations can shape public opinion. Reports from groups like Greenpeace in late 2024, which raised questions about the effectiveness of certain forest certification schemes, necessitate clear and transparent communication from companies to maintain trust and market standing. This scrutiny demands a proactive approach to demonstrating responsible forest management practices.

The availability of skilled labor in rural Sweden, where Bergs Timber's forestry and wood processing facilities are often situated, presents a significant challenge. A 2024 report indicated a shortage of skilled forestry workers across the Nordic region, potentially increasing labor costs and impacting operational efficiency for Bergs Timber.

Demographic shifts, such as an aging workforce and a declining birth rate in some rural areas, are also influencing labor market trends within Sweden's forest industry. This can lead to a reduced pool of potential employees for companies like Bergs Timber, necessitating increased investment in training and recruitment efforts to maintain sufficient operational capacity.

Health and Safety Standards

Societal expectations and legal mandates for worker health and safety in industrial environments like sawmills and processing plants are critical. In 2024, for instance, the European Agency for Safety and Health at Work (EU-OSHA) reported that workplace accidents still represent a significant cost, with millions of working days lost annually across the EU. This underscores the ongoing importance of robust safety protocols.

Adhering to stringent safety standards is not just about compliance; it's fundamental for building and maintaining a positive corporate reputation. Companies like Bergs Timber, operating in sectors with inherent risks, must demonstrate a commitment to worker well-being to attract and retain skilled labor. A strong safety record can also be a key differentiator in a competitive market.

Failure to meet these health and safety benchmarks can lead to severe legal repercussions, including hefty fines and operational disruptions. For example, in 2025, regulatory bodies globally are expected to increase scrutiny on industrial safety practices, potentially leading to more stringent enforcement and penalties for non-compliance. This makes proactive safety management a crucial business imperative.

Key aspects of health and safety standards include:

- Implementation of comprehensive safety training programs for all employees.

- Regular maintenance and upgrading of machinery to prevent accidents.

- Provision of appropriate personal protective equipment (PPE) and ensuring its consistent use.

- Establishment of clear emergency procedures and regular drills.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility (CSR) are intensifying, pushing companies like Bergs Timber to go beyond mere legal adherence and showcase genuine ethical conduct. This involves actively engaging with communities, ensuring fair treatment of workers, and transparently reporting on their social contributions, all of which bolster brand image and foster stakeholder confidence.

For instance, in 2024, a significant majority of consumers, estimated at over 70%, indicated that they consider a company's social and environmental impact when making purchasing decisions. This trend directly impacts Bergs Timber, as demonstrating robust CSR initiatives can translate into tangible market advantages and stronger investor relations.

- Ethical Labor: Ensuring fair wages, safe working conditions, and no forced labor throughout the supply chain.

- Community Investment: Supporting local initiatives, job creation, and economic development in regions where Bergs Timber operates.

- Transparent Reporting: Publishing detailed reports on social impact, environmental performance, and governance practices.

- Stakeholder Engagement: Actively listening to and addressing the concerns of employees, customers, and local communities.

Societal shifts toward sustainability and ethical consumption are increasingly influencing consumer choices, directly benefiting companies like Bergs Timber that offer wood products derived from renewable resources. This trend is amplified by policy support, such as France's 2025 mandate for wooden construction in public buildings, which boosts demand for sustainable materials.

Public perception of forestry practices, particularly concerning old-growth forests, poses a challenge. A 2023 Swedish survey revealed strong public support for enhanced forest protection, highlighting the need for companies to demonstrate responsible management to maintain market acceptance.

The labor market in rural Sweden presents challenges due to a shortage of skilled forestry workers, as noted in a 2024 Nordic region report, potentially increasing operational costs for Bergs Timber.

Societal expectations for robust health and safety in industrial settings are paramount. In 2024, EU-OSHA data indicated that workplace accidents result in significant costs, underscoring the need for companies like Bergs Timber to maintain stringent safety protocols to prevent accidents and ensure worker well-being.

Technological factors

Bergs Timber is seeing significant gains from technological advancements in wood processing. Digitization and automation, particularly through AI and robotics, are streamlining operations. This tech is enhancing efficiency, boosting product quality, and crucially, cutting down on waste in the production cycle.

Specific technologies are already making a real impact. For instance, systems like CT Log and Logeye Stereo enable real-time grading of timber and optimized cutting patterns. This directly translates to increased operational efficiency within sawmills, allowing Bergs Timber to make the most of every log.

The push for supply chain transparency, amplified by regulations like the EU's Deforestation Regulation (EUDR), is a significant technological driver. This means companies like Bergs Timber need to invest in tracking and tracing technologies to prove the origin and sustainability of their timber.

Implementing solutions such as radio-frequency identification (RFID) chips and sophisticated traceability software is becoming essential for compliance and for providing customers with verifiable data. For instance, by mid-2024, many companies in the wood products sector were actively exploring or piloting such digital solutions to meet the EUDR's due diligence requirements.

Technological advancements are significantly reshaping sustainable forestry. For instance, artificial intelligence is now being used with satellite imagery to detect pest damage, like that from the spruce bark beetle, with increased accuracy. This allows companies like Bergs Timber to proactively manage their timber sourcing by identifying and addressing forest health issues more efficiently.

Furthermore, new inventory methods and enhanced digital tools are improving the monitoring of forest resources and wildlife habitats. These innovations in precision forestry can lead to better resource allocation and more sustainable timber harvesting practices, directly benefiting Bergs Timber's supply chain and long-term operational viability.

Product Innovation and Wood Treatment

Innovative wood treatment methods, like thermal modification and acetylation, are gaining traction. These processes significantly enhance wood's durability, stability, and resistance to decay and insects, opening up new possibilities for its use in demanding applications such as exterior cladding, decking, and even structural components. For instance, thermally modified wood can exhibit improved performance characteristics compared to traditional treated lumber. Bergs Timber's strategic emphasis on product diversification and ongoing innovation allows it to capitalize on these advancements, offering a broader portfolio of high-performance wood solutions to meet evolving market needs.

The market for modified wood is projected for substantial growth. Analysts predict the global modified wood market could reach over USD 1.5 billion by 2027, driven by increasing demand for sustainable and durable building materials. This trend directly benefits companies like Bergs Timber that are investing in and adapting to these technological shifts.

- Enhanced Durability: Wood treatments like thermal modification improve resistance to rot and pests, extending product lifespan.

- Expanded Applications: Treated wood is now viable for exterior use, furniture, and structural elements where untreated wood would fail.

- Market Growth: The global modified wood market is expanding, indicating strong consumer and industry adoption of these innovative products.

Energy Efficiency in Production

Technological advancements in energy efficiency are reshaping production for companies like Bergs Timber. Upgrading to more efficient kilns and processing equipment can drastically cut energy consumption. For instance, modern sawmills are seeing energy use reductions of up to 20% compared to older models, directly impacting operational costs.

These improvements aren't just about saving money; they're crucial for environmental stewardship. By minimizing energy use, Bergs Timber can lower its carbon footprint, a key consideration for sustainability-focused investors and consumers. This focus on efficiency also boosts competitiveness in a market increasingly sensitive to ecological impact.

- Reduced Operational Costs: Investment in energy-efficient machinery can lower energy bills by an estimated 15-25% annually.

- Environmental Compliance: Meeting stricter environmental regulations becomes easier with reduced energy consumption and emissions.

- Enhanced Competitiveness: Lower operating costs and a stronger sustainability profile improve market position.

- Technological Adoption: The adoption of variable frequency drives (VFDs) on motors can save up to 50% of the energy used by those motors.

Technological advancements are significantly boosting efficiency in timber processing. AI-driven grading systems and automated cutting optimize log usage, reducing waste and improving product quality. For example, advanced optical scanning technology can identify defects with greater precision than manual inspection, leading to more efficient material allocation.

The drive for supply chain transparency, spurred by regulations like the EU Deforestation Regulation, necessitates investment in traceability technologies. Solutions such as RFID tagging and blockchain are becoming crucial for verifying timber origin and sustainability, with many companies in the sector actively implementing these by mid-2024.

Innovations in wood modification, such as thermal treatment, are expanding its applications and market potential. This technology enhances durability and pest resistance, making wood suitable for exterior use and structural components. The global modified wood market is expected to exceed USD 1.5 billion by 2027, reflecting strong demand for these advanced materials.

Energy efficiency in production is another key technological factor. Upgrading to modern, energy-efficient kilns and processing equipment can reduce energy consumption by up to 20%, directly lowering operational costs and environmental impact. For instance, the adoption of variable frequency drives (VFDs) on motors can yield energy savings of up to 50% for those specific components.

Legal factors

The EU Deforestation Regulation (EUDR), set to take full effect on December 30, 2025, mandates that companies exporting wood products to the EU must rigorously prove their materials are free from deforestation. This places substantial due diligence responsibilities on businesses like Bergs Timber, with potential penalties reaching up to 4% of their annual turnover for non-compliance.

To navigate these legal requirements, Bergs Timber must implement robust systems for meticulous documentation and complete traceability throughout its entire supply chain, ensuring all wood products destined for the European market adhere to the EUDR's strict standards.

Sweden's forest sector is heavily regulated by national legislation, primarily the Swedish Forest Act and the Environmental Protection Act. These laws are crucial for Bergs Timber, as they mandate sustainable forest management, balancing timber harvesting with ecological preservation. For instance, the Forest Act requires reforestation after harvesting, ensuring forest cover is maintained. In 2023, Sweden's total forest area was approximately 28 million hectares, with a significant portion managed under these regulations.

Bergs Timber must navigate a complex web of Swedish and EU labor laws, encompassing everything from fair wages and working hours to stringent workplace safety standards. For instance, the EU's Working Time Directive sets limits on weekly hours and mandates rest periods, a key consideration for Bergs Timber's operational planning.

Compliance is not merely a legal obligation but a cornerstone of maintaining a social license to operate and preventing costly legal battles. In 2023, Sweden reported a slight increase in workplace accident notifications, underscoring the continuous need for vigilance in safety protocols, a factor directly impacting Bergs Timber's operational continuity and employee well-being.

Competition Law and Market Practices

Bergs Timber operates in a highly competitive timber industry, necessitating strict adherence to both national and international competition laws. These regulations are crucial for preventing anti-competitive practices, ensuring fair market conduct, and averting the formation of monopolies, particularly in the wake of significant ownership shifts such as Norvik's acquisition of Bergs Timber in late 2023. The European Commission, for instance, actively monitors mergers and acquisitions to maintain market fairness.

Key legal considerations for Bergs Timber include:

- Antitrust Compliance: Ensuring that pricing, distribution agreements, and market behavior do not unfairly disadvantage competitors or consumers.

- Merger Control: Navigating regulatory approvals for significant transactions, like the Norvik takeover, to ensure they do not lead to substantial lessening of competition.

- Abuse of Dominance: Preventing any actions that could exploit a dominant market position, should one arise, to the detriment of smaller players or end-users.

- International Trade Regulations: Complying with global trade laws that impact the import and export of timber products, ensuring fair trade practices across borders.

Product Standards and Certifications

Bergs Timber, like all players in the forest products industry, must navigate a landscape of legal and market-driven product standards. These are essential for ensuring quality, safety, and environmental responsibility. For instance, CE marking is a legal requirement for many timber products sold within the European Economic Area, signifying conformity with health, safety, and environmental protection standards.

While certifications such as those from the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC) are voluntary, they are increasingly becoming critical for market access, especially for companies like Bergs Timber that highlight sustainability. In 2023, for example, the global market for certified forest products continued to show strong demand, with FSC-certified wood products accounting for a significant share of sales in key European markets.

These certifications act as a tangible demonstration of compliance with rigorous sustainability criteria, which resonates with environmentally conscious consumers and business partners. Failure to meet these evolving standards can limit market reach and impact brand reputation.

- CE Marking: A mandatory legal requirement for many timber products entering the European market, ensuring compliance with EU safety, health, and environmental standards.

- FSC and PEFC Certifications: Voluntary but increasingly essential for market access, these certifications validate responsible forest management and supply chain practices.

- Market Demand for Certified Products: In 2024, the demand for sustainably sourced timber remains robust, with businesses and consumers prioritizing products with recognized environmental credentials.

- Impact on Market Access: Adherence to these standards is not just about compliance but a strategic imperative for Bergs Timber to maintain and expand its presence in environmentally sensitive markets.

The EU Deforestation Regulation (EUDR), effective December 30, 2025, imposes strict due diligence on companies like Bergs Timber to prove their wood products are deforestation-free, with non-compliance potentially costing up to 4% of annual turnover.

Sweden's Forest Act and Environmental Protection Act mandate sustainable forest management, including reforestation post-harvest, ensuring forest cover is maintained across its approximately 28 million hectares of forest land as of 2023.

Navigating EU labor laws, such as the Working Time Directive, is critical for Bergs Timber, dictating fair wages, working hours, and safety standards, especially given a slight increase in Swedish workplace accident notifications in 2023.

Antitrust and merger control laws, exemplified by the European Commission's oversight of transactions like Norvik's 2023 acquisition of Bergs Timber, are vital for maintaining fair market competition.

Environmental factors

Bergs Timber's operations are deeply tied to sustainable forestry practices, particularly in Sweden, where the commitment to replanting 2-3 trees for every one harvested ensures forest regeneration. A significant portion of Sweden's productive forest land, over 70% as of recent reports, is certified, underscoring the industry's dedication to responsible resource management.

Adherence to voluntary certification standards such as the Programme for the Endorsement of Forest Certification (PEFC) and the Forest Stewardship Council (FSC) is paramount for Bergs Timber. These certifications, covering substantial areas of productive forest land, are vital for maintaining environmental credibility and securing access to global markets that increasingly demand sustainably sourced timber.

Climate change presents a dual challenge for Bergs Timber: increased risks to forest health, such as heightened bark beetle activity which impacted Swedish forests significantly in recent years, but also a significant opportunity. Wood, as a renewable material, plays a crucial role in climate mitigation by sequestering carbon and offering a sustainable alternative to fossil-based products.

Bergs Timber's business inherently supports climate goals by providing these renewable materials. For instance, the construction sector's demand for sustainable building materials is growing, with wood construction gaining traction as a way to reduce embodied carbon in buildings.

Active and adaptive forest management is therefore paramount for Bergs Timber to ensure forest resilience against climate-related threats and to maintain a sustainable supply of timber. This includes practices aimed at increasing forest biodiversity and adapting species composition to changing climatic conditions, a strategy increasingly adopted by leading forestry companies in Northern Europe.

Protecting and enhancing biodiversity within managed forests is a critical environmental consideration for Bergs Timber. National legislation increasingly mandates a careful balance between sustainable timber harvesting and the preservation of diverse ecosystems. This means practices must actively support the conservation of sensitive habitats and the promotion of species, such as wood-living insects, which are vital indicators of forest health.

Bergs Timber's commitment to biodiversity aligns with global initiatives like the Kunming-Montreal Global Biodiversity Framework, which aims to halt and reverse biodiversity loss by 2030. For instance, in 2023, Sweden, where Bergs Timber operates, continued to implement conservation plans focusing on forest biodiversity, with specific targets for habitat restoration and species protection, directly impacting forest management strategies and operational costs.

Resource Efficiency and Waste Management

Bergs Timber prioritizes the efficient use of raw timber, aiming to reduce waste across its operations. This focus is crucial for environmental sustainability and maximizing the value derived from each log. For instance, in 2023, the company reported a continued emphasis on optimizing its sawing processes, which directly impacts resource yield.

Technological advancements play a key role in this strategy. Innovations in wood processing and treatment methods help Bergs Timber extract more value from its timber resources while simultaneously minimizing its environmental impact. This includes adopting more precise cutting techniques and exploring new applications for wood by-products.

- Resource Yield: Bergs Timber aims to improve its timber yield by 2% by the end of 2025 through enhanced sawing technologies.

- Waste Reduction: The company has set a target to reduce processing waste by 5% in 2024 compared to 2023 levels.

- By-product Utilization: In 2023, Bergs Timber utilized approximately 85% of its wood by-products for energy generation or further processing into engineered wood products.

- Sustainable Forestry: The company sources over 90% of its timber from sustainably managed forests, certified by recognized bodies.

Water and Air Quality Management

Bergs Timber's operations, like other industrial wood processors, face scrutiny regarding their impact on water and air quality. Managing emissions from kilns and wastewater from treatment processes is essential. For instance, in 2023, the European Union's Industrial Emissions Directive continued to set stringent standards for facilities, requiring continuous monitoring and reporting of pollutants. Failure to comply can result in significant fines and operational disruptions.

Adherence to these environmental regulations is not just about avoiding penalties; it's crucial for maintaining Bergs Timber's social license to operate. Communities expect responsible environmental stewardship. In 2024, several Swedish municipalities where Bergs Timber has facilities have increased their local environmental oversight, focusing on air particulate matter and water discharge limits. This means proactive management and investment in cleaner technologies are paramount for Bergs Timber's long-term sustainability and reputation.

- Regulatory Compliance: Bergs Timber must meet emission and wastewater discharge standards set by national and international bodies, as exemplified by the EU's Industrial Emissions Directive.

- Community Relations: Maintaining good relationships with local communities hinges on demonstrating responsible environmental management, particularly concerning air and water quality.

- Technological Investment: Investing in advanced pollution control technologies is necessary to meet evolving environmental standards and minimize operational risks.

- Monitoring and Reporting: Continuous monitoring of emissions and wastewater, coupled with transparent reporting, is vital for demonstrating compliance and building trust.

Bergs Timber's environmental performance is closely linked to climate change mitigation, as wood is a carbon-sequestering material. The company's commitment to sustainable forestry, with over 90% of timber sourced from certified forests, directly supports this. By utilizing wood as a renewable alternative to fossil-based products, Bergs Timber contributes to reducing embodied carbon, especially in the growing demand for sustainable construction materials.

Biodiversity conservation is another key environmental focus, with legislation increasingly requiring a balance between timber harvesting and ecosystem preservation. Bergs Timber actively supports initiatives to protect sensitive habitats and promote species diversity, aligning with global frameworks like the Kunming-Montreal Global Biodiversity Framework. This focus on biodiversity is essential for maintaining forest resilience and ecological health.

Resource efficiency and waste reduction are critical operational priorities. Bergs Timber aims to improve timber yield by 2% by the end of 2025 and reduce processing waste by 5% in 2024. In 2023, approximately 85% of wood by-products were utilized for energy or further processing.

Compliance with stringent environmental regulations regarding emissions and wastewater is paramount, as highlighted by the EU's Industrial Emissions Directive. Proactive management and investment in cleaner technologies are necessary to meet evolving standards and maintain community trust, with local oversight increasing in 2024.

| Environmental Aspect | Target/Status (2023/2024/2025) | Key Initiatives/Data |

|---|---|---|

| Sustainable Sourcing | >90% Certified Forests | Adherence to PEFC and FSC standards. |

| Climate Mitigation | Carbon Sequestration | Providing renewable wood alternatives to fossil-based products. |

| Biodiversity | Habitat & Species Protection | Alignment with Kunming-Montreal Framework; focus on forest health indicators. |

| Resource Yield | +2% by end of 2025 | Enhanced sawing technologies. |

| Waste Reduction | -5% in 2024 (vs. 2023) | Optimized sawing processes and by-product utilization. |

| By-product Utilization | ~85% (2023) | Used for energy generation and engineered wood products. |

| Emissions & Wastewater | Regulatory Compliance | Adherence to EU Industrial Emissions Directive; increased local oversight. |

PESTLE Analysis Data Sources

Our Bergs Timber PESTLE Analysis draws from a comprehensive blend of official government publications, international economic reports, and leading industry analyses. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting the timber sector.