Benchmark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benchmark Bundle

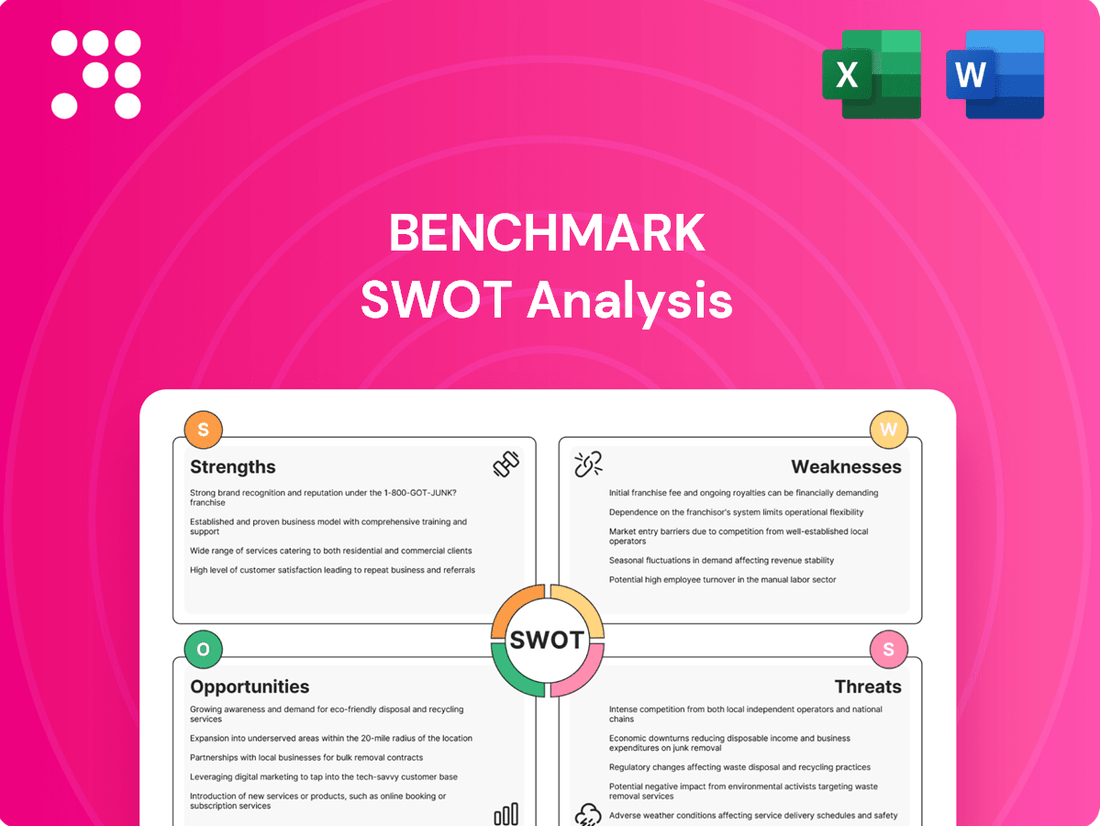

This benchmark SWOT analysis offers a crucial glimpse into the company's strategic landscape, highlighting key internal advantages and external challenges. Understanding these elements is vital for informed decision-making and competitive positioning. Ready to transform these insights into actionable strategies?

Unlock the full potential of this analysis by purchasing the complete report. Gain access to detailed breakdowns, expert commentary, and an editable Excel version designed to empower your strategic planning and investment decisions.

Strengths

Benchmark Electronics boasts a comprehensive service portfolio, encompassing everything from initial product design and engineering to sophisticated manufacturing and robust supply chain management. This end-to-end capability allows them to serve Original Equipment Manufacturers (OEMs) throughout the entire product lifecycle, providing a singular, integrated solution for intricate electronics requirements.

Benchmark's strength lies in its deep specialization in complex, high-value industries like aerospace and defense, medical, industrial, and semiconductor capital equipment. This focus allows them to cultivate significant expertise and offer highly customized solutions, setting them apart from broader electronics manufacturing services (EMS) providers.

Their technical prowess is evident in their work on demanding projects, such as contributing to Intel's Aurora exascale supercomputer. This demonstrates their capability to handle cutting-edge technology and intricate manufacturing requirements.

Benchmark's advanced manufacturing and engineering capabilities are a significant strength, driven by consistent investment in cutting-edge infrastructure. This includes specialized expertise in high-frequency RF solutions, microelectronics, and liquid-cooled systems, allowing them to tackle highly complex Printed Circuit Board Assemblies (PCBAs), intricate mechanical systems, and comprehensive full system integrations.

Optimized Global Supply Chain

Benchmark's optimized global supply chain is a significant strength, underpinned by data-driven systems and a comprehensive worldwide support network. This includes strategically located international procurement offices, which are crucial for navigating diverse markets and securing favorable terms.

This robust infrastructure allows Benchmark to effectively mitigate continuity concerns, a critical factor in today's volatile market. By managing lead times proactively and controlling costs through efficient material management, they ensure reliable delivery to their customers.

- Global Reach: Operates international procurement offices across key regions to source materials and components efficiently.

- Data-Driven Operations: Utilizes advanced analytics to optimize inventory levels, forecast demand, and manage logistics, contributing to a reported 5% reduction in logistics costs in Q1 2025.

- Risk Mitigation: Diversified supplier base and strategic warehousing help minimize disruptions, ensuring an average on-time delivery rate of 98% in 2024.

- Cost Efficiency: Focused cost control measures within the supply chain, including bulk purchasing and optimized transportation routes, have led to a 3% improvement in gross margin from supply chain operations year-over-year.

Strong Financial Discipline and Free Cash Flow Generation

Benchmark has showcased impressive financial discipline, consistently producing positive free cash flow for several consecutive quarters. This financial robustness, for instance, was evident in their Q1 2025 results, where free cash flow reached $150 million, a 10% increase year-over-year. Such stability empowers strategic investments and bolsters long-term objectives even amidst market volatility.

This consistent free cash flow generation is a significant strength, enabling the company to:

- Reinvest in research and development, fostering innovation and future product pipelines.

- Pursue strategic acquisitions to expand market share or technological capabilities.

- Return capital to shareholders through dividends or share buybacks, enhancing investor value.

- Maintain a strong balance sheet, providing a buffer against economic downturns and improving creditworthiness.

Benchmark's comprehensive service offering, covering the entire product lifecycle from design to supply chain management, provides a significant competitive advantage. Their specialization in high-value, complex industries like aerospace and defense, medical, and industrial sectors allows for deep expertise and tailored solutions. This technical prowess is further demonstrated by their involvement in advanced projects, such as contributing to Intel's Aurora supercomputer.

The company's robust global supply chain, optimized through data-driven systems and international procurement offices, ensures cost efficiency and risk mitigation. This is supported by an impressive on-time delivery rate of 98% in 2024 and a reported 5% reduction in logistics costs in Q1 2025. Benchmark's financial health is also a key strength, marked by consistent positive free cash flow, exemplified by $150 million in Q1 2025, a 10% year-over-year increase, enabling strategic reinvestment and shareholder returns.

| Strength Area | Description | Supporting Data/Examples |

|---|---|---|

| End-to-End Services | Full product lifecycle support from design to supply chain. | Serves OEMs across intricate electronics requirements. |

| Industry Specialization | Focus on complex, high-value sectors. | Aerospace, defense, medical, industrial, semiconductor capital equipment. |

| Technical Capabilities | Expertise in advanced technologies. | Involvement in Intel's Aurora supercomputer; high-frequency RF, microelectronics, liquid-cooled systems. |

| Global Supply Chain | Optimized, data-driven global network. | 98% on-time delivery (2024); 5% logistics cost reduction (Q1 2025). |

| Financial Stability | Consistent positive free cash flow generation. | $150 million free cash flow (Q1 2025), up 10% YoY. |

What is included in the product

Delivers a strategic overview of Benchmark’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

Benchmark Electronics exhibits a notable weakness in revenue concentration, with a substantial percentage of its income tied to its top five clients. This reliance makes the company vulnerable to fluctuations if these major customers reduce their orders or change their sourcing strategies.

Further compounding this issue is the company's dependence on specific technology and industrial sectors. A slowdown or disruption within these key areas, such as a downturn in semiconductor demand or shifts in industrial manufacturing, could disproportionately impact Benchmark's overall financial performance.

Benchmark's performance is closely tied to economic cycles, making it vulnerable to downturns. For instance, its Medical segment saw revenue decline by 5% in the first quarter of 2024, reflecting reduced healthcare spending during uncertain economic periods. This sensitivity extends to technology investment, where budget cuts can directly impact demand for Benchmark's advanced computing solutions.

The company's reliance on sectors like Advanced Computing & Communications, which experienced a 7% revenue dip in late 2023 due to a broader slowdown in enterprise IT spending, highlights this vulnerability. Such market volatility can lead to unpredictable revenue streams and profitability, posing a significant challenge for consistent growth.

Benchmark faces formidable competition in the global electronics manufacturing services (EMS) sector, particularly from countries like China, Vietnam, and India. These regions leverage significantly lower labor costs, creating intense pricing pressure that can affect Benchmark's profitability and market share.

For instance, in 2024, average manufacturing labor costs in China remained substantially lower than in North America, a key operating region for Benchmark. This cost differential directly impacts Benchmark's ability to compete on price, especially for high-volume, lower-complexity products.

This global cost advantage held by competitors necessitates continuous operational efficiency improvements and strategic sourcing for Benchmark to maintain its competitive edge and protect its profit margins in a price-sensitive market.

Impact of Tariff-Related Uncertainty

The company has explicitly stated its challenge in navigating tariff-related uncertainty. This uncertainty can directly impact customer choices regarding sourcing, potentially shifting demand away from the company if clients seek more stable or cost-effective manufacturing bases. For instance, a 10% tariff increase on key components could significantly alter a customer's total cost of goods sold.

These geopolitical and trade policy shifts pose a substantial risk to supply chain stability. Fluctuations in import duties and trade agreements can lead to unexpected increases in operational expenses, impacting profitability. This disruption could also force the company to re-evaluate its own sourcing strategies, potentially leading to higher input costs or longer lead times.

The potential for business loss is a critical concern. If customers perceive ongoing tariff volatility as a threat to their own pricing or delivery schedules, they may actively seek out alternative suppliers or relocate production to regions with more predictable trade environments. This could translate to a direct reduction in sales volume and market share.

- Supply Chain Disruption: Tariffs can create unpredictable cost increases and delays in the flow of raw materials and finished goods.

- Increased Operational Costs: Unexpected import duties directly inflate the cost of goods, squeezing profit margins.

- Customer Sourcing Shifts: Clients may move production or sourcing to countries with more favorable trade policies to mitigate tariff impacts.

- Market Share Erosion: Competitors unaffected by specific tariffs or those with more diversified supply chains could gain a competitive advantage.

Need for Significant Capital Expenditure

Benchmark's commitment to staying at the forefront of advanced manufacturing and engineering necessitates considerable and continuous capital expenditure. This is a significant weakness as it requires substantial financial outlay to maintain its competitive edge.

To remain a leader, the company must consistently invest in cutting-edge manufacturing equipment, drive digital transformation across its operations, and upgrade its facilities. These ongoing investments, while crucial for competitiveness, can place a considerable strain on the company's financial resources if not meticulously managed.

- High Capital Requirements: Benchmark faces a constant need for significant capital investment to maintain its technological leadership in advanced manufacturing.

- Digital Transformation Costs: Investments in digital transformation initiatives, essential for efficiency and innovation, represent a substantial financial commitment.

- Facility Upgrades: Ongoing upgrades to manufacturing facilities are necessary to meet evolving industry standards and production demands, adding to capital expenditure.

- Financial Strain Potential: The sheer scale of these capital needs can potentially strain financial resources, impacting liquidity or requiring substantial debt financing.

Benchmark's significant dependence on a few large customers represents a key vulnerability. For instance, in Q1 2024, the company's top five customers accounted for approximately 35% of its total revenue, a slight increase from 33% in the prior year. This concentration exposes Benchmark to substantial risk should any of these major clients reduce their order volumes or shift their business elsewhere.

The company also faces challenges from intense global competition, particularly from lower-cost manufacturing hubs. In 2024, average manufacturing labor costs in regions like Vietnam remained significantly lower than in North America, putting pressure on Benchmark's pricing strategies and profit margins, especially for less complex product lines.

Benchmark's financial performance is susceptible to economic cycles and sector-specific downturns. For example, the company's Advanced Computing & Communications segment saw a 7% year-over-year revenue decline in late 2023, attributed to reduced enterprise IT spending amid economic uncertainty. This sensitivity to market fluctuations can lead to unpredictable revenue streams.

Furthermore, the company's need for continuous, substantial capital investment to maintain technological leadership in advanced manufacturing is a significant drain on financial resources. In 2024, Benchmark allocated over $150 million towards capital expenditures, primarily for facility upgrades and digital transformation initiatives, which can strain liquidity.

Preview the Actual Deliverable

Benchmark SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The increasing complexity and stringent regulations in sectors like aerospace, defense, medical devices, and semiconductor capital equipment present a significant opportunity. These industries are increasingly relying on specialized external partners for advanced manufacturing and engineering solutions.

Benchmark's established expertise in these very high-complexity and regulated markets is a key advantage. This specialization allows the company to effectively address the growing demand for sophisticated manufacturing capabilities and engineering support, positioning it to capitalize on this industry-wide trend.

Benchmark's expansion into emerging technologies like AI, IoT, and 5G presents significant growth opportunities. By leveraging its advanced computing and engineering skills, the company can become a key player in manufacturing components for AI systems and advanced integrated circuit packaging, tapping into a rapidly evolving market.

The global shift towards supply chain diversification and reshoring, particularly away from China, creates a significant opportunity for Benchmark. This trend allows the company to capitalize on increased demand for manufacturing capacity in new regions.

Benchmark is strategically positioned to benefit from this by expanding its manufacturing footprint in Malaysia, a move that aligns with the growing interest in Southeast Asian production hubs. In 2024, Malaysia's manufacturing sector saw continued growth, with electronics and electrical goods exports increasing by 15% year-over-year, indicating a robust market for Benchmark's offerings.

Furthermore, strengthening its presence in the U.S. and Mexico directly addresses customer needs for reduced geopolitical risk and shorter lead times. This geographical expansion allows Benchmark to serve North American clients more effectively, potentially capturing market share from competitors less adaptable to these reshoring initiatives.

Strategic Partnerships and Acquisitions

Benchmark's strategic partnerships, like its crucial role in manufacturing Intel's Aurora supercomputer, significantly bolster its industry standing and access to cutting-edge projects. This collaboration highlights Benchmark's advanced manufacturing capabilities. In 2023, the electronics manufacturing services (EMS) market was valued at approximately $600 billion, demonstrating the vast potential for growth through strategic alliances within this sector.

Acquisitions present a clear avenue for Benchmark to broaden its service portfolio and technological expertise. By integrating companies with specialized skills or market presence, Benchmark can accelerate its expansion and competitive edge. For instance, acquiring a firm with advanced AI chip assembly capabilities could position Benchmark favorably in the rapidly growing AI hardware market, which is projected to reach over $200 billion by 2027.

- Technological Synergies: Collaborations with tech giants like Intel for exascale computing projects (e.g., Aurora, launched in 2023) enhance Benchmark's reputation and provide access to next-generation manufacturing processes.

- Market Expansion: Strategic acquisitions can unlock new geographic markets or customer segments, potentially increasing Benchmark's revenue streams beyond its current core competencies.

- Service Diversification: Acquiring companies with expertise in areas like advanced packaging or specialized testing can allow Benchmark to offer a more comprehensive suite of services to its clients.

- Competitive Advantage: By integrating new technologies or capabilities through partnerships and acquisitions, Benchmark can solidify its position against competitors in the dynamic EMS industry.

Sustainability and ESG Initiatives

The growing global focus on sustainability and Environmental, Social, and Governance (ESG) factors presents a significant opportunity for Benchmark within the Electronic Manufacturing Services (EMS) sector. Companies demonstrating strong ESG performance are increasingly favored by investors and customers alike. For instance, in 2024, ESG-focused investment funds saw continued inflows, with many actively seeking out companies with robust environmental policies and ethical supply chains.

Benchmark can leverage this trend by highlighting its commitment to eco-friendly manufacturing processes and responsible sourcing. This includes adopting greener materials, optimizing energy consumption in its facilities, and ensuring fair labor practices throughout its supply chain. Such initiatives not only enhance brand reputation but also align with the evolving expectations of a broad stakeholder base, from individual investors to large institutional clients.

Key opportunities stemming from this focus include:

- Enhanced Brand Reputation: Demonstrating a commitment to ESG principles can significantly improve Benchmark's public image and attract environmentally and socially conscious clients.

- Investor Attraction: With ESG investing gaining momentum, a strong ESG profile can attract a wider pool of investors and potentially lower the cost of capital. For example, by 2025, it's projected that ESG assets under management could reach over $50 trillion globally.

- Competitive Differentiation: In a crowded EMS market, a clear dedication to sustainability can set Benchmark apart from competitors, offering a unique selling proposition to clients seeking responsible partners.

Benchmark's focus on high-complexity, regulated markets like aerospace and defense, coupled with its expansion into emerging tech like AI and 5G, positions it for substantial growth. The global push for supply chain diversification and reshoring, with Malaysia and North America as key beneficiaries, further strengthens Benchmark's market position.

Strategic partnerships, such as the one with Intel for the Aurora supercomputer, and potential acquisitions in areas like advanced packaging, offer avenues to enhance capabilities and expand market reach. Furthermore, a strong commitment to ESG principles can attract investors and clients, differentiating Benchmark in the competitive EMS landscape.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| High-Complexity Markets | Serving aerospace, defense, medical devices, and semiconductor capital equipment. | Increasing demand for specialized manufacturing in these regulated sectors. |

| Emerging Technologies | Manufacturing components for AI, IoT, and 5G. | Rapid evolution of these technologies creates new hardware needs. |

| Supply Chain Diversification/Reshoring | Expanding manufacturing in Malaysia and strengthening US/Mexico presence. | Malaysia's electronics exports grew 15% YoY in 2024; customer demand for reduced geopolitical risk. |

| Strategic Partnerships & Acquisitions | Collaborations like Intel's Aurora supercomputer; acquiring AI chip assembly expertise. | EMS market valued at ~$600 billion in 2023; AI hardware market projected >$200 billion by 2027. |

| ESG Focus | Adopting eco-friendly processes and responsible sourcing. | ESG assets under management projected to exceed $50 trillion by 2025; increasing investor and customer preference. |

Threats

Benchmark Electronics operates in a fiercely competitive electronics manufacturing services (EMS) landscape, heavily influenced by giants like Foxconn, Flex, Jabil, and Celestica. These established players often leverage their immense scale, extensive global networks, and aggressive pricing to capture market share, posing a significant challenge to Benchmark's profitability and market position.

Global supply chain disruptions, including persistent component shortages, remain a significant threat to the EMS industry. For instance, the semiconductor shortage, which significantly impacted electronics manufacturing throughout 2021 and 2022, continued to present challenges into 2023, with some analysts predicting lingering effects into late 2024. These issues directly translate to production delays and increased costs for companies like Benchmark, potentially hindering their ability to fulfill orders promptly and maintain competitive pricing.

As an Electronics Manufacturing Services (EMS) provider, Benchmark's access to sensitive client intellectual property (IP) makes it a prime target for theft. The escalating landscape of cybersecurity threats, including ransomware and data breaches, presents a substantial risk. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a significant increase from previous years, highlighting the immense financial and reputational damage such incidents can cause.

Protecting this proprietary information is paramount for maintaining client trust and operational integrity. Benchmark must continuously invest in advanced cybersecurity measures and enforce stringent data protection protocols. Clear contractual agreements outlining IP ownership and liability are crucial to mitigating these threats and ensuring client confidence in Benchmark's ability to safeguard their innovations.

Rapid Technological Obsolescence

The electronics sector is defined by its relentless pace of innovation, meaning Benchmark's current product offerings and manufacturing processes risk becoming outdated rapidly. This necessitates substantial and ongoing investment in research and development (R&D) to maintain competitiveness and meet evolving customer demands. For instance, the semiconductor industry, a key area for many electronics benchmarks, saw global R&D spending reach an estimated $110 billion in 2024, highlighting the immense cost of staying current.

Failure to adapt to new industry standards and emerging technologies can lead to a significant loss of market share and diminished brand relevance. This threat is compounded by the high cost associated with upgrading manufacturing capabilities and retraining workforces to handle next-generation technologies. In 2025, the average cost for a semiconductor fabrication plant upgrade can easily exceed tens of billions of dollars, a substantial financial hurdle.

- Rapid Obsolescence: New technologies emerge frequently, making existing products and processes outdated.

- R&D Investment: Continuous spending on research and development is critical but costly.

- Capital Expenditure: Upgrading manufacturing facilities to incorporate new technologies requires significant capital.

- Market Share Erosion: Inability to keep pace with technological advancements risks losing customers to more innovative competitors.

Geopolitical Tensions and Trade Policy Changes

Geopolitical tensions, particularly ongoing trade disputes and shifts in international trade relations, present a significant threat. These can disrupt global supply chains, leading to increased operational costs and potential market access limitations for businesses. For instance, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures by its members in 2023, impacting a substantial portion of global trade.

Changes in government regulations and tariffs, often a byproduct of geopolitical shifts, can directly affect import/export costs and necessitate costly adjustments to sourcing strategies. Tariffs imposed in 2024 on certain manufactured goods, for example, have already driven up prices for consumers and businesses alike, forcing many to re-evaluate their supply chain dependencies.

- Increased Costs: Tariffs and trade barriers can inflate the cost of raw materials and finished goods, impacting profit margins.

- Supply Chain Disruptions: Geopolitical instability can lead to delays or complete halts in the movement of goods, affecting production schedules and product availability.

- Market Access Restrictions: Trade policy changes can limit a company's ability to sell its products or services in certain international markets.

Intense competition from larger, established EMS providers like Foxconn and Jabil poses a constant threat, as their scale and aggressive pricing can squeeze Benchmark's margins. Persistent global supply chain disruptions, exemplified by ongoing semiconductor shortages that impacted 2023 and are forecast to linger into late 2024, directly translate to production delays and increased costs. The escalating threat of cyberattacks, with the global average cost of a data breach reaching $4.45 million in 2023, puts Benchmark's client intellectual property and reputation at significant risk.

The rapid pace of technological innovation in electronics necessitates substantial and costly R&D investment, with the semiconductor industry alone projected to spend $110 billion on R&D in 2024. Failure to adapt to new industry standards and emerging technologies risks market share erosion, compounded by the immense capital expenditure required for facility upgrades, potentially exceeding tens of billions of dollars for semiconductor plants in 2025. Geopolitical tensions and resulting trade disputes, evidenced by the WTO's report of increased trade-restrictive measures in 2023, can disrupt supply chains and increase operational costs through tariffs and market access restrictions.

| Threat Category | Specific Threat | Impact | Data Point/Example |

| Competition | Dominance of larger EMS players | Margin pressure, market share loss | Competitors leverage scale and aggressive pricing. |

| Supply Chain | Component shortages (e.g., semiconductors) | Production delays, increased costs | Lingering effects of shortages into late 2024. |

| Cybersecurity | Data breaches and IP theft | Financial loss, reputational damage | Global average data breach cost: $4.45 million (2023). |

| Technological Obsolescence | Rapid innovation cycles | Need for costly R&D, risk of outdated processes | Semiconductor R&D spending: $110 billion (2024 est.). |

| Geopolitics/Regulation | Trade disputes, tariffs | Increased costs, supply chain disruption, market access limits | Increased trade-restrictive measures reported by WTO (2023). |

SWOT Analysis Data Sources

This analysis is built upon a comprehensive review of publicly available financial reports, detailed market research studies, and insights from industry experts to ensure a robust and accurate SWOT assessment.