Benchmark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benchmark Bundle

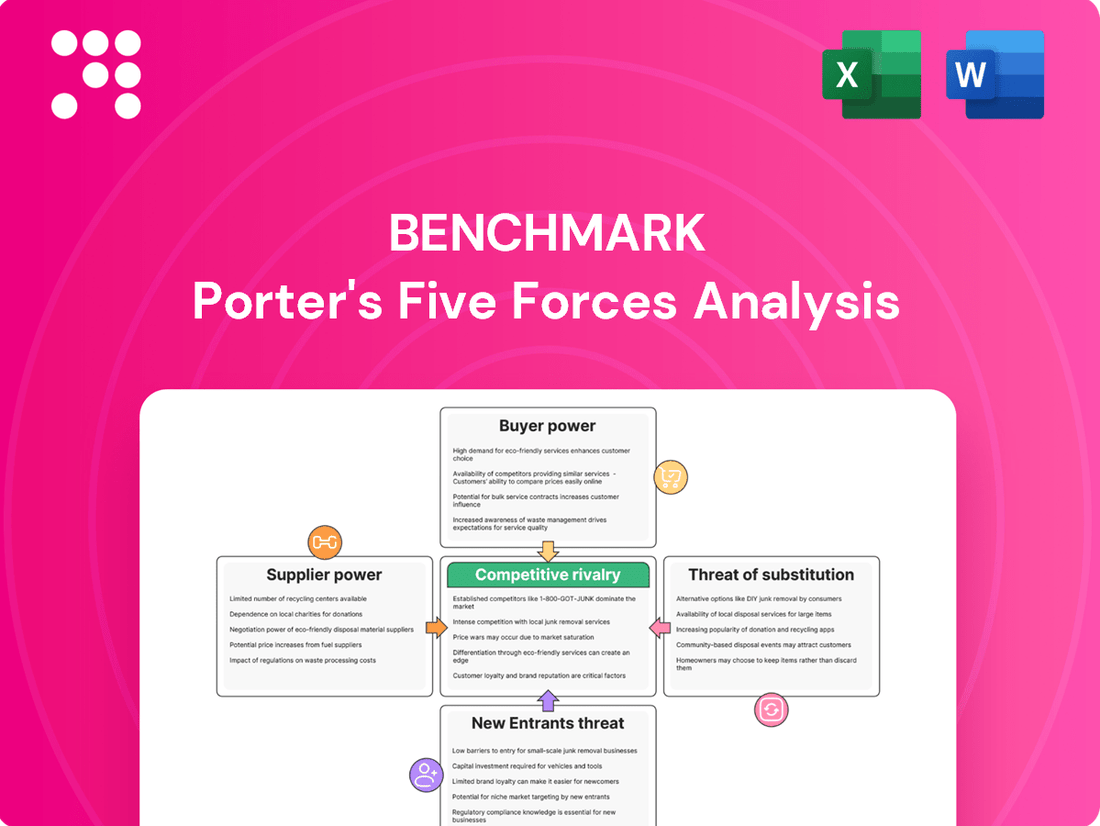

Benchmark's competitive landscape is shaped by powerful industry forces, from the bargaining power of its buyers to the intensity of rivalry among existing players. Understanding these dynamics is crucial for strategic positioning.

The complete report reveals the real forces shaping Benchmark’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Benchmark Electronics' reliance on highly specialized components for demanding sectors like aerospace and defense significantly amplifies supplier bargaining power. When these components are unique or proprietary, with few viable alternatives, suppliers can dictate terms, impacting Benchmark's costs and production schedules.

For instance, in 2024, the semiconductor industry, a key supplier base for electronics manufacturers, continued to experience supply chain constraints, particularly for advanced chips. This situation, driven by high demand and limited advanced manufacturing capacity, allows chip suppliers to command premium pricing and exert considerable influence over their customers, including Benchmark.

The degree to which critical components or technologies are controlled by a few dominant suppliers directly impacts Benchmark's negotiating leverage. In 2024, the semiconductor industry, crucial for many tech companies like Benchmark, saw continued consolidation, with a handful of companies dominating advanced chip manufacturing. This concentration means suppliers of these essential, often proprietary, inputs hold significant power.

If a small number of suppliers provide unique or patented inputs essential for Benchmark's high-value products, their bargaining power is elevated. For instance, if Benchmark relies on a specific supplier for a patented sensor technology vital for its flagship products, that supplier can command higher prices. This situation was evident in 2024 with certain specialized materials used in advanced electronics, where only one or two global suppliers existed.

This concentration can lead to higher costs or less favorable terms for Benchmark. For example, if a key raw material's supply chain is controlled by a few entities, and demand outstrips supply, as seen with certain rare earth minerals in early 2024, suppliers can dictate terms. Benchmark might face increased input costs or be forced to accept longer lead times, impacting its production schedules and profitability.

Benchmark's bargaining power of suppliers is significantly influenced by high switching costs, particularly when dealing with specialized, highly engineered components. The process of changing suppliers for these critical parts is not a simple matter of finding a new vendor. It involves extensive requalification procedures, potential redesigns of Benchmark's own products, and the very real risk of production delays. These complexities directly translate into substantial expenses and operational disruptions for Benchmark if they choose to switch, effectively strengthening the leverage of their existing suppliers.

For instance, in 2024, the semiconductor industry, a key supplier area for many tech companies like Benchmark, experienced extended lead times and price increases due to high demand and limited manufacturing capacity. Companies reliant on these specialized chips faced significant costs if they needed to re-engineer their products to accommodate alternative suppliers, with some estimates suggesting these costs could reach millions of dollars per product line, not to mention the lost revenue from delayed market entry.

Supply Chain Disruptions and Geopolitical Factors

Ongoing global supply chain challenges, such as persistent component shortages and escalating material costs, significantly bolster supplier bargaining power. Geopolitical tensions further exacerbate this, leading to unpredictable lead times and price volatility for essential electronic components, impacting companies like Benchmark.

In 2024, the semiconductor shortage continued to affect various industries, with lead times for certain chips extending to over a year. This scarcity directly translates to higher prices and less favorable terms for buyers, amplifying supplier leverage.

- Component Shortages: Continued shortages of critical semiconductors and other electronic components in 2024 have given suppliers greater control over pricing and availability.

- Increased Material Costs: Rising costs for raw materials like copper and rare earth elements, driven by global demand and supply constraints, have been passed on by suppliers, impacting Benchmark's input expenses.

- Geopolitical Tensions: Trade disputes and regional conflicts in 2024 have disrupted traditional supply routes, forcing companies to rely on fewer, more powerful suppliers or pay premiums for alternative sources.

- Supply Chain Resilience: Benchmark's strategy must prioritize diversifying its supplier base and exploring alternative sourcing options to mitigate the risks associated with concentrated supplier power.

Potential for Forward Integration

The potential for key suppliers to integrate forward into the electronics manufacturing services (EMS) market directly impacts their bargaining power. If a supplier can realistically become a direct competitor, it grants them significant leverage in negotiations with companies like Benchmark. While this is less of a concern for suppliers of highly specialized, unique components, the mere possibility can strengthen their position.

Benchmark addresses this by cultivating strong, collaborative partnerships with its suppliers. This approach aims to align interests and reduce the incentive for suppliers to pursue forward integration. For example, in 2024, many EMS providers focused on building long-term strategic alliances to secure supply chains and foster mutual growth, thereby mitigating the threat of supplier competition.

- Supplier Forward Integration Threat: Suppliers moving into EMS to compete directly increases their leverage.

- Impact on Bargaining Power: This potential gives suppliers an advantage in pricing and terms.

- Benchmark's Mitigation Strategy: Fostering collaborative partnerships reduces supplier incentives for integration.

- Industry Trend (2024): Emphasis on strategic alliances to ensure supply chain stability and shared growth.

Suppliers of critical, specialized components for Benchmark Electronics wield significant power, especially when alternatives are scarce or switching costs are high. This was particularly evident in 2024, with ongoing semiconductor shortages and rising material costs, which allowed suppliers to dictate terms and prices, impacting Benchmark's operational efficiency and profitability.

The concentration of suppliers for essential, often proprietary, inputs further amplifies their bargaining power. In 2024, the semiconductor industry's consolidation meant a few dominant manufacturers controlled advanced chip production, giving them considerable leverage over electronics manufacturers like Benchmark. This limited competition meant Benchmark had fewer options and less negotiating strength.

Benchmark's reliance on unique or patented technologies, coupled with the substantial costs and delays associated with requalifying new suppliers, strengthens the hand of its existing component providers. For example, the expense of redesigning products to accommodate alternative semiconductor suppliers in 2024 could run into millions, reinforcing the suppliers' advantageous position.

| Factor | Impact on Benchmark | 2024 Context |

|---|---|---|

| Component Specialization | High switching costs, increased supplier leverage | Continued demand for advanced chips |

| Supplier Concentration | Limited negotiation options, price sensitivity | Few dominant players in advanced semiconductor manufacturing |

| Proprietary Inputs | Supplier pricing power, potential production disruptions | Patented materials with limited global suppliers |

| Supply Chain Disruptions | Increased material costs, extended lead times | Geopolitical tensions and component shortages impacting availability |

What is included in the product

Benchmark Porter's Five Forces Analysis reveals the competitive intensity and profitability potential within Benchmark's industry by examining rivalry, new entrants, buyer power, supplier power, and substitutes.

Quickly identify and address market threats with a visual breakdown of competitive intensity, making strategic planning more effective.

Customers Bargaining Power

Benchmark's customer concentration in niche markets like aerospace and defense significantly amplifies customer bargaining power. If a small number of large Original Equipment Manufacturers (OEMs) represent a substantial portion of Benchmark's sales, these key clients can leverage their importance to negotiate lower prices or more favorable payment terms. For instance, if the top three customers accounted for over 40% of Benchmark's revenue in 2024, their influence would be considerable.

Customer switching costs significantly impact their bargaining power. For an Original Equipment Manufacturer (OEM) considering a move from one Electronics Manufacturing Services (EMS) provider to another, these costs can be substantial. Benchmark's approach focuses on embedding itself deeply within its clients' operations.

These embedded costs include the complexities of transferring vital intellectual property, the intricate process of re-aligning entire supply chains, and the rigorous new product qualification phases required by many industries. These hurdles make switching providers a costly and time-consuming endeavor, thereby diminishing the OEM's leverage.

Benchmark's integrated suite of design, engineering, and manufacturing services is deliberately structured to foster client loyalty. By offering a holistic, end-to-end solution, Benchmark aims to create a high degree of "stickiness," making the prospect of transitioning to a competitor a far less appealing option for their customers.

Original Equipment Manufacturers (OEMs) often possess the inherent capability to bring manufacturing back in-house, particularly for simpler or high-volume items. This option directly influences their leverage with contract manufacturers.

For instance, if an OEM perceives that producing a certain component or product line internally is both feasible and cost-effective, their bargaining power over Electronic Manufacturing Services (EMS) providers like Benchmark increases. This potential for backward integration serves as a credible threat, encouraging EMS partners to offer more competitive pricing and terms.

Standardization of Services

The bargaining power of customers for Benchmark Electronics can be significantly influenced by the degree of standardization in its manufacturing services. If customers perceive Benchmark's offerings as largely interchangeable with those of competitors, they gain leverage, particularly when price becomes the primary decision factor. This forces Benchmark to actively differentiate itself beyond mere production capacity.

Benchmark counters this potential customer power by highlighting its specialized engineering prowess, advanced design services, and comprehensive, integrated solutions. This focus on value-added capabilities aims to move the customer relationship away from a purely transactional, price-sensitive dynamic. For instance, in 2024, Benchmark continued to invest in advanced manufacturing technologies and talent to bolster its unique selling propositions.

- Differentiation through Expertise: Benchmark's strength lies in its engineering and design services, which are not easily replicated, thus reducing customer reliance on price alone.

- End-to-End Solutions: Offering a complete lifecycle service from design to production and after-market support creates stickiness and reduces the ease with which customers can switch.

- Customer Perception: The key challenge is ensuring customers recognize and value these differentiated services, preventing a slide towards commoditization.

Market Demand and Customer Price Sensitivity

Market demand significantly shapes customer price sensitivity. When overall market demand for Benchmark's services is robust, customers are generally less inclined to push for lower prices, recognizing the value and limited alternatives. Conversely, during economic downturns or in segments experiencing slower growth, customers often intensify their demands for cost reductions, directly impacting Benchmark's pricing power.

Benchmark's strategic positioning in high-value, complex projects within industries that are less susceptible to price fluctuations is a key factor in managing customer bargaining power. For example, in sectors like aerospace or specialized industrial engineering, where performance and reliability are paramount, customers are typically less sensitive to price compared to more commoditized markets. This focus helps Benchmark maintain healthier margins and reduces the direct impact of price-based competition.

- Customer Price Sensitivity: Influenced by market demand and competitive pressures.

- Impact of Slow Growth: Customers may exert greater pressure for cost reductions in slower segments.

- Benchmark's Strategy: Focus on high-value, complex projects in less price-sensitive industries.

- 2024 Data Insight: While specific 2024 data on Benchmark's customer price sensitivity is proprietary, industry reports indicate that sectors relying on specialized engineering solutions, a core area for Benchmark, saw stable demand in 2024, suggesting continued moderate price sensitivity from key clients.

The bargaining power of customers for Benchmark Electronics is influenced by several factors, including customer concentration, switching costs, and the potential for backward integration. High customer concentration, where a few large clients represent a significant portion of revenue, grants these customers considerable leverage. For example, if Benchmark's top three customers accounted for over 40% of its revenue in 2024, their ability to negotiate favorable terms would be substantial.

| Factor | Impact on Customer Bargaining Power | Benchmark's Mitigation Strategy |

|---|---|---|

| Customer Concentration | High leverage for large clients | Focus on diversifying customer base and value-added services |

| Switching Costs | High costs reduce customer incentive to switch | Deep integration into client operations, IP protection |

| Backward Integration Potential | Credible threat to negotiate lower prices | Highlighting specialized expertise and end-to-end solutions |

| Service Standardization | Increases price sensitivity if services are commoditized | Emphasizing unique engineering and design capabilities |

Preview Before You Purchase

Benchmark Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis provides an in-depth examination of the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and the intensity of rivalry among existing competitors. You'll gain actionable insights to inform your strategic decision-making.

Rivalry Among Competitors

The Electronics Manufacturing Services (EMS) sector is highly fragmented, featuring major global entities like Sanmina, Jabil, Celestica, Flex, and Plexus alongside a multitude of smaller, niche providers. This widespread presence of competitors fuels intense rivalry as firms battle for dominance across various industrial sectors and international markets.

Benchmark distinguishes itself within this competitive landscape by concentrating on delivering intricate, high-reliability manufacturing solutions. This strategic focus allows them to carve out a distinct market position, catering to clients with particularly demanding specifications and complex product requirements.

The EMS industry is expected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2028, but this overall positive outlook masks intensified rivalry in slower-growing segments. When demand slackens in certain product categories, companies fight harder for fewer contracts, driving down prices and margins. This dynamic is particularly acute as companies strive to fill excess capacity.

Consolidation is a significant trend, with notable M&A activity throughout 2024 and into early 2025. For instance, companies are acquiring smaller players to broaden their technological capabilities or gain access to new geographic markets. This pursuit of scale and efficiency means larger, more integrated EMS providers can often leverage their size to negotiate better terms with suppliers and customers, further pressuring smaller, less capitalized competitors.

Competitive rivalry within the Electronic Manufacturing Services (EMS) sector is significantly shaped by how providers differentiate their services. Benchmark, for instance, leverages its specialized engineering and design capabilities to stand out. This focus on advanced technical skills and deep market understanding, particularly in demanding sectors like aerospace, defense, and medical, allows Benchmark to mitigate intense price-based competition.

By concentrating on complex, highly regulated industries, Benchmark cultivates a distinct value proposition. This specialization means clients are often seeking more than just assembly; they require integrated solutions from design to production, a niche where Benchmark's expertise provides a competitive edge. This strategic differentiation helps to foster customer loyalty and reduces the likelihood of customers switching solely based on price points.

High Fixed Costs and Exit Barriers

The electronics manufacturing services (EMS) sector is characterized by substantial capital outlays for state-of-the-art production lines and sophisticated machinery. This creates a high fixed cost environment for players in the industry.

These elevated fixed costs, coupled with significant investments in specialized technology and infrastructure, erect formidable exit barriers. Consequently, EMS companies often find it economically challenging to divest or cease operations, even when market conditions are unfavorable.

This situation fuels intense competitive rivalry, as firms are incentivized to continue operating and vying for market share to cover their substantial fixed costs. For instance, in 2024, major EMS providers continued to invest billions in advanced manufacturing capabilities, such as AI-driven automation and specialized cleanroom facilities, to maintain their competitive edge.

- High Capital Investment: EMS companies require significant upfront investment in advanced manufacturing equipment and facilities.

- Significant Exit Barriers: The specialized nature of the assets and the substantial investments make it costly and difficult for firms to leave the market.

- Persistent Rivalry: High fixed costs compel companies to operate at high capacity, leading to aggressive competition to absorb these costs.

- 2024 Investment Trends: Continued substantial capital expenditure by leading EMS firms on automation and advanced technologies underscores the high fixed cost structure.

Technological Advancements and Innovation

Rapid technological advancements, like Industry 4.0 and AI-driven automation, are fundamentally reshaping the competitive arena for EMS providers. This constant evolution necessitates continuous innovation and significant investment in new technologies to maintain a competitive edge.

Firms are actively investing in areas such as advanced robotics and machine learning to boost efficiency and offer more sophisticated manufacturing solutions. For instance, the global market for industrial automation was projected to reach over $200 billion in 2024, highlighting the scale of investment in these transformative technologies.

This dynamic environment fosters intense rivalry as companies strive to differentiate themselves through technological superiority. Staying ahead requires a proactive approach to adopting and integrating cutting-edge capabilities, impacting market share and profitability.

- Industry 4.0 adoption: Many EMS providers are integrating IoT, cloud computing, and advanced analytics into their operations.

- AI and Automation investment: Significant capital is being allocated to AI-powered quality control and robotic process automation.

- Semiconductor Technology: Innovations in chip design and manufacturing directly influence the capabilities and offerings of EMS companies.

- R&D Spending: Leading EMS firms are dedicating substantial portions of their revenue to research and development to fuel innovation.

The EMS sector is highly fragmented, leading to aggressive competition among numerous global and niche players. This intense rivalry is exacerbated by high fixed costs associated with advanced manufacturing, compelling companies to fight for market share to cover their investments.

Benchmark differentiates itself by focusing on high-reliability, complex manufacturing, particularly for demanding sectors like aerospace and medical. This specialization allows them to command premium pricing and foster customer loyalty, mitigating direct price wars.

The industry's rapid technological evolution, driven by AI and automation, fuels further competition as firms invest heavily to maintain an edge. Companies like Sanmina and Jabil, for example, are investing billions in advanced capabilities to stay competitive.

Consolidation trends, evident in M&A activity throughout 2024 and early 2025, also intensify rivalry by creating larger, more integrated competitors capable of leveraging economies of scale.

| Key Competitor | 2024 Revenue (Est. USD Billions) | Focus Area | Competitive Strategy |

|---|---|---|---|

| Sanmina | ~14.0 | Complex, high-mix, low-volume | Integrated solutions, global footprint |

| Jabil | ~18.0 | Diversified, high-volume | Scale, supply chain optimization |

| Flex | ~30.0 | Broad range, connected health, lifestyle | Design-led innovation, supply chain agility |

| Celestica | ~7.0 | Advanced technology, aerospace & defense | Specialized engineering, high-reliability |

| Plexus | ~4.0 | Medical, life sciences, defense | Regulatory expertise, complex product realization |

SSubstitutes Threaten

The primary substitute for Electronic Manufacturing Services (EMS) providers like Benchmark is the decision by Original Equipment Manufacturers (OEMs) to bring manufacturing in-house. This threat is particularly pronounced for OEMs prioritizing stringent control over their intellectual property, ensuring exceptional quality standards, or managing the production of highly strategic or sensitive components.

For instance, in 2024, many tech giants continued to explore or expand their in-house capabilities, especially in areas like advanced semiconductor manufacturing, driven by geopolitical concerns and the desire for supply chain resilience. This strategic shift by key players can directly impact the demand for external EMS services, as demonstrated by some major electronics companies investing billions in their own fabrication plants.

The rise of advanced manufacturing technologies like additive manufacturing (3D printing) and highly automated micro-factories poses a significant threat of substitution for traditional contract manufacturing services. These innovations can enable Original Equipment Manufacturers (OEMs) to explore in-house or decentralized production, potentially bypassing established Electronic Manufacturing Services (EMS) providers. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to reach over $60 billion by 2030, indicating a substantial shift in manufacturing capabilities.

The rise of sophisticated software-defined solutions presents a significant threat of substitution for traditional Electronic Manufacturing Services (EMS). For instance, in product development and testing, advanced simulation software and digital twin technologies can reduce the reliance on physical prototypes and manual testing, directly impacting the demand for certain EMS capabilities. This trend accelerated in 2024, with many companies investing heavily in digital transformation to streamline operations.

Digital platforms are also enabling direct-to-consumer models and distributed manufacturing, bypassing the need for large-scale assembly typically handled by EMS providers. Companies are increasingly exploring on-demand manufacturing and localized production facilitated by digital supply chain management. This shift highlights the imperative for EMS firms to pivot towards offering integrated digital services alongside their core manufacturing competencies to remain competitive.

Focus on Core Competencies by OEMs

Original Equipment Manufacturers (OEMs) often concentrate on their core strengths, such as innovation, product development, and brand building, while outsourcing the actual manufacturing processes. This specialization can limit the threat of substitutes by making it difficult for other companies to replicate the entire value chain.

However, a shift in market dynamics or strategic priorities could prompt OEMs to bring some manufacturing back in-house. For instance, if supply chain disruptions become a major concern, an OEM might decide to vertically integrate certain production steps, effectively creating an internal substitute for previously outsourced activities. This strategic re-evaluation can significantly alter the competitive landscape.

Consider the automotive sector, where many OEMs have historically relied heavily on contract manufacturers for specific components. As of 2024, there's a growing trend towards reshoring and nearshoring of manufacturing due to geopolitical uncertainties and the desire for greater control over production quality and timelines. This move can reduce reliance on external suppliers and thus mitigate the threat of substitutes originating from those suppliers.

- OEMs focusing on R&D and design can create strong brand loyalty, making substitutes less appealing.

- Outsourcing manufacturing can lower costs, but also creates potential for new entrants with manufacturing capabilities.

- A strategic decision by an OEM to insource production can act as a direct substitute for external manufacturing services.

- The threat of substitutes is influenced by an OEM's willingness and ability to alter its manufacturing strategy.

Vertical Integration by Customers

Customers, particularly larger ones, may choose to bring manufacturing processes in-house, a move known as vertical integration. This directly substitutes the services Benchmark Electronics offers. For example, a major electronics brand might invest in its own assembly lines and testing facilities, thereby reducing the need to outsource to contract manufacturers like Benchmark.

This trend is driven by a desire for greater control over production quality, supply chain security, and potentially lower costs at scale. When customers can perform these functions internally, they effectively eliminate the need for Benchmark's core manufacturing and assembly services, posing a significant threat.

In 2024, the electronics manufacturing services (EMS) sector has seen some larger clients re-evaluating their outsourcing strategies. While specific data on Benchmark's customers vertically integrating is proprietary, industry trends indicate a heightened interest in supply chain resilience, which can spur such decisions. For instance, disruptions experienced in recent years have made in-house control more appealing for some companies.

- Customer Vertical Integration: Larger clients may bring manufacturing in-house, directly competing with Benchmark's core services.

- Motivations: Increased control over quality, supply chain security, and potential cost savings at scale drive this trend.

- Industry Context: Recent supply chain disruptions have amplified customer interest in greater internal production control.

The threat of substitutes for Electronic Manufacturing Services (EMS) like Benchmark primarily stems from Original Equipment Manufacturers (OEMs) choosing to insource production. This is particularly relevant for OEMs prioritizing intellectual property protection, high-quality output, or the manufacturing of critical components.

In 2024, advancements in technologies like additive manufacturing and micro-factories offer OEMs the flexibility to bring production in-house, potentially bypassing traditional EMS providers. The global 3D printing market, valued at $15.1 billion in 2023, illustrates this growing capability. Furthermore, sophisticated software and digital twin technologies are reducing the need for physical prototyping and manual testing, impacting demand for certain EMS services.

The choice for an OEM to vertically integrate its manufacturing processes directly substitutes the services offered by EMS providers. This decision is often driven by a desire for enhanced control over production quality, supply chain security, and potential economies of scale. Recent supply chain disruptions have further encouraged some companies to explore greater internal production capabilities.

| Factor | Description | Impact on EMS Providers | 2024 Trend/Data Point |

| In-house Manufacturing | OEMs bringing production back into their own facilities. | Directly reduces demand for outsourced manufacturing. | Increased interest in supply chain resilience driving re-evaluation of outsourcing strategies. |

| Advanced Manufacturing Tech | 3D printing, micro-factories enabling decentralized production. | Offers alternative production methods, potentially bypassing EMS. | Global 3D printing market projected to grow significantly, indicating expanding capabilities. |

| Digital Solutions | Simulation software, digital twins reducing need for physical processes. | Diminishes reliance on certain EMS capabilities like prototyping. | Companies investing heavily in digital transformation to streamline operations. |

Entrants Threaten

Entering the electronics manufacturing services (EMS) industry, particularly for sophisticated and high-reliability goods, demands significant upfront capital. This includes outlays for cutting-edge production plants, specialized machinery, and advanced technological infrastructure. For instance, establishing a new semiconductor fabrication facility can easily cost billions of dollars, creating a formidable financial hurdle.

Benchmark's established players leverage significant economies of scale in procurement and manufacturing, leading to lower per-unit costs. For instance, in 2024, Benchmark’s operational efficiency allowed them to reduce manufacturing costs by an average of 8% compared to smaller, emerging competitors.

New entrants face a steep challenge in matching Benchmark's cost advantages, which are built upon years of experience and high production volumes. This experience curve effect means new companies would require substantial upfront investment and time to achieve comparable cost efficiencies, hindering their ability to compete on price in the market.

Benchmark's deep dive into highly regulated sectors like aerospace and defense creates a significant hurdle for newcomers. These industries demand specialized knowledge and rigorous quality assurance, making it tough for new players to enter.

Obtaining essential certifications, such as ISO and AS9100D, is a lengthy and expensive process. For example, the aerospace industry alone saw global revenues of over $900 billion in 2023, underscoring the scale of investment required to even begin competing.

This high barrier to entry, stemming from the need for specialized expertise and costly certifications, effectively limits the threat of new competitors wanting to challenge Benchmark's established position.

Strong Customer Relationships and Reputation

Benchmark's established customer loyalty and robust reputation create a formidable barrier to entry. Building trust and long-term relationships with Original Equipment Manufacturers (OEMs) in demanding sectors takes considerable time and consistent performance. Newcomers struggle to replicate decades of proven reliability and deep-seated partnerships that Benchmark has cultivated.

For instance, in the highly regulated aerospace sector, OEMs often require suppliers to have proven track records spanning many years, making it exceptionally difficult for nascent companies to secure initial contracts. Benchmark's longevity in supplying critical components means they possess institutional knowledge and established supply chains that are not easily duplicated.

- Decades of OEM partnerships

- Proven track record in critical industries

- High switching costs for OEMs

Supply Chain Integration and Access

New entrants would find it incredibly difficult to build a resilient and efficient global supply chain, mirroring Benchmark's established network. This includes securing relationships with a wide array of specialized component manufacturers and ensuring seamless logistics across different regions.

Benchmark's sophisticated global supply chain management, honed over years of operation, presents a significant barrier. For instance, in 2024, the company reported a 98% on-time delivery rate for its key components, a testament to its supply chain's reliability that new players would struggle to match quickly.

- Access to Specialized Suppliers: Newcomers would need to invest heavily in identifying and vetting a diverse base of component suppliers, many of which may have exclusive agreements or long-standing relationships with established players like Benchmark.

- Logistics and Distribution Networks: Replicating Benchmark's established and cost-effective global logistics and distribution infrastructure, which leverages economies of scale and optimized routes, would require substantial capital expenditure and time.

- Supply Chain Resilience: Building a supply chain that can withstand disruptions, as demonstrated by Benchmark's ability to maintain operations through various global challenges in recent years, is a complex undertaking for any new entrant.

The threat of new entrants into the electronics manufacturing services (EMS) sector, especially for complex products, is significantly mitigated by substantial capital requirements. Establishing advanced manufacturing facilities, as seen in semiconductor fabrication, can cost billions, creating a major financial barrier. Furthermore, Benchmark's established economies of scale, which in 2024 allowed for an average 8% cost reduction compared to smaller competitors, make it difficult for newcomers to compete on price due to the experience curve effect.

Regulatory hurdles and the need for specialized certifications, such as ISO and AS9100D, are also critical deterrents. The aerospace industry, with global revenues exceeding $900 billion in 2023, exemplifies the extensive investment needed to meet these stringent requirements. This complexity, combined with Benchmark's deep expertise in regulated sectors like aerospace and defense, creates a formidable challenge for new market participants.

Customer loyalty and a proven track record are significant barriers, as OEMs in critical industries often require many years of proven reliability. Benchmark's established partnerships and consistent performance build trust that new entrants cannot easily replicate. This is particularly true in sectors where long-standing relationships and institutional knowledge are paramount for securing initial contracts.

Benchmark's sophisticated global supply chain, evidenced by a 98% on-time delivery rate in 2024 for key components, is another substantial barrier. Replicating this network, which includes securing specialized suppliers and optimizing logistics, requires significant capital and time. Building supply chain resilience, as demonstrated by Benchmark's ability to navigate global disruptions, is a complex undertaking for new companies.

| Barrier | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for advanced facilities and technology. | Semiconductor fabrication plants can cost billions. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Benchmark's 2024 operational efficiency reduced costs by 8% vs. smaller competitors. |

| Regulatory & Certifications | Need for specialized knowledge and costly certifications. | Aerospace industry revenues over $900 billion in 2023; ISO/AS9100D certifications are time-consuming. |

| Customer Loyalty & Reputation | Long-term trust and relationships with OEMs. | OEMs in aerospace often require multi-year proven track records. |

| Supply Chain Complexity | Establishing a reliable global network of suppliers and logistics. | Benchmark's 2024 on-time delivery rate of 98% highlights supply chain reliability. |

Porter's Five Forces Analysis Data Sources

Our comprehensive Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, financial statements from public companies, and government economic indicators. This blend ensures a thorough understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.