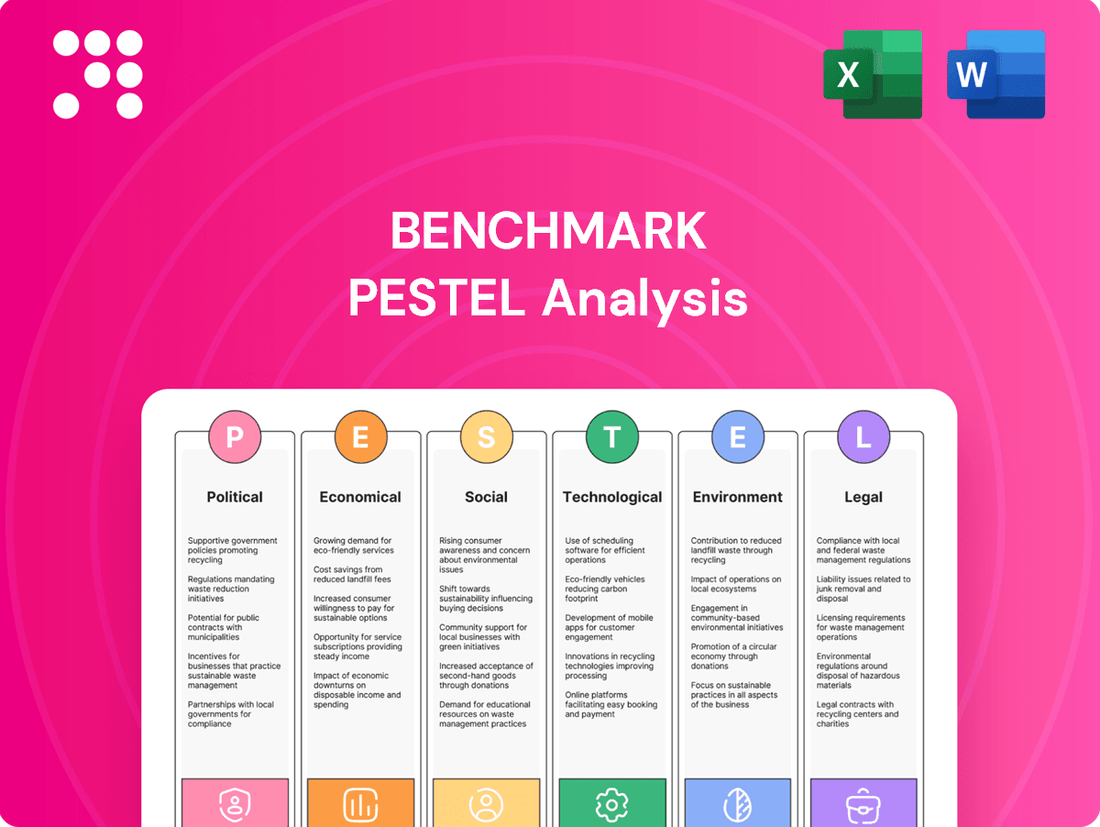

Benchmark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benchmark Bundle

Uncover the hidden forces shaping Benchmark's future with our expert PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its trajectory. Equip yourself with actionable intelligence to make informed decisions and gain a competitive edge. Download the full, comprehensive report now and unlock strategic insights.

Political factors

Changes in U.S. trade policies, including new tariffs on imports from China, are poised to significantly affect the electronics manufacturing sector. These adjustments directly impact the cost and availability of essential components, extending lead times and influencing the overall pricing strategies for Electronic Manufacturing Services (EMS) providers such as Benchmark Electronics.

The U.S. government's tariff policies are broad, touching numerous manufacturing industries. For instance, tariffs implemented in 2023 and early 2024 on goods originating from China could increase production expenses for manufacturers by an estimated 5-15% depending on the specific components and their origin.

Ongoing geopolitical tensions, like the conflicts in Eastern Europe and the Red Sea, significantly impact global supply chains, leading to shipping delays and increased costs for industries such as electronics. Benchmark Electronics, with its worldwide presence, faces these challenges by needing to diversify its sourcing and consider localized production to mitigate risks.

The disruptions in shipping lanes, such as those experienced in the Red Sea in late 2023 and early 2024, have caused rerouting and extended transit times, impacting inventory management and production schedules for companies like Benchmark. For instance, some shipping companies reported transit time increases of up to two weeks for certain routes.

Increased government spending in critical sectors like aerospace and defense directly benefits companies like Benchmark Electronics. For instance, global defense budgets are on the rise, and the U.S. Department of Defense's proposed budget for fiscal year 2025 signals a robust demand environment for specialized electronics manufacturing.

This heightened investment is particularly evident in areas such as advanced rocket technology, the development of unmanned systems, and expanding space capabilities, all of which are core competencies for Benchmark and indicate a strong future outlook.

Domestic Manufacturing Incentives

Government initiatives, like the U.S. CHIPS and Science Act of 2022, are actively promoting domestic manufacturing. This act allocates over $52 billion to boost semiconductor production and research within the United States. Such policies encourage reshoring and nearshoring, which can significantly benefit companies like Benchmark Electronics.

By fostering a more localized supply chain, these incentives can reduce Benchmark's reliance on overseas suppliers. This shift not only strengthens resilience against disruptions but also mitigates risks associated with geopolitical instability and trade tensions. For instance, the U.S. government aims to increase domestic semiconductor manufacturing capacity by 2030, a target that directly supports Benchmark's strategic positioning.

- CHIPS Act Funding: Over $52 billion allocated to semiconductor manufacturing and R&D in the U.S.

- Reshoring Trend: Government incentives encourage bringing production back to domestic or nearby regions.

- Supply Chain Resilience: Reduced dependence on distant suppliers improves stability and mitigates geopolitical risks.

- Market Opportunities: Domestic manufacturing growth creates new opportunities for electronics manufacturing services (EMS) providers like Benchmark.

Regulatory Stability and Policy Changes

Regulatory stability is a critical political factor. Uncertainty surrounding upcoming elections, both in the US and globally, could lead to shifts in climate policy and other regulations. This uncertainty directly impacts companies' willingness to invest in areas like clean technology and can influence consumer demand for these products. For instance, a change in government could alter subsidies or introduce new carbon taxes, making previously attractive investments less so.

Manufacturers, in particular, must closely track these political developments. Regulations and taxes are consistently cited as top factors affecting business operations and investment decisions. A significant policy change in 2024 or 2025 could reshape market conditions for various industries, requiring businesses to adapt their strategies quickly to remain competitive and compliant.

- Policy Volatility: Potential changes in environmental regulations and trade policies following major elections in 2024-2025 could create significant market uncertainty.

- Investment Climate: Shifting political landscapes can directly affect foreign direct investment and domestic capital allocation, particularly in sectors sensitive to government policy, like renewable energy.

- Compliance Costs: Evolving regulatory frameworks may increase compliance burdens and operational costs for businesses operating in or exporting to affected regions.

- Market Access: Changes in trade agreements or the imposition of new tariffs, driven by political shifts, can impact a company's ability to access international markets.

Political stability and government policies significantly shape the operational landscape for companies like Benchmark Electronics. Trade policies, such as tariffs on goods from China, directly influence manufacturing costs and supply chain dynamics, with some estimates suggesting a 5-15% increase in production expenses due to these tariffs.

Increased government spending in sectors like aerospace and defense, exemplified by the U.S. Department of Defense's proposed budget for fiscal year 2025, creates substantial demand for specialized electronics manufacturing. Furthermore, initiatives like the U.S. CHIPS and Science Act, allocating over $52 billion to boost domestic semiconductor production, encourage reshoring and enhance supply chain resilience.

Regulatory shifts and potential policy changes following elections in 2024-2025 can create market uncertainty, impacting investment decisions and compliance costs. For instance, evolving environmental regulations or changes in trade agreements can alter market access and operational strategies for global manufacturers.

| Political Factor | Impact on Electronics Manufacturing | Relevant Data/Examples (2024-2025) |

|---|---|---|

| Trade Policies & Tariffs | Increased component costs, extended lead times, pricing adjustments. | Tariffs on Chinese goods impacting production costs by an estimated 5-15%. |

| Government Spending (Defense/Aerospace) | Increased demand for specialized electronics. | U.S. DoD FY2025 budget signals robust demand for advanced electronics. |

| Domestic Manufacturing Initiatives (e.g., CHIPS Act) | Incentives for reshoring, supply chain resilience, reduced reliance on overseas suppliers. | $52 billion allocated by the U.S. CHIPS Act to boost domestic semiconductor production. |

| Regulatory Environment & Elections | Potential policy volatility, affecting investment climate and compliance costs. | Uncertainty surrounding 2024-2025 elections could shift climate policy and trade regulations. |

What is included in the product

The Benchmark PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and data-driven recommendations to help stakeholders navigate market complexities and identify strategic opportunities.

The Benchmark PESTLE Analysis offers a structured framework to identify and understand external factors impacting a business, thereby alleviating the pain of navigating complex market dynamics and potential disruptions.

Economic factors

The global Electronic Manufacturing Services (EMS) market is on a strong upward trajectory, with projections indicating it will reach USD 5.18 billion by 2025. This expansion is fueled by a consistent rise in demand across key sectors, including consumer electronics, automotive parts, and critical medical devices, showcasing broad-based economic activity.

However, the economic landscape presents a mixed picture for manufacturers. While the United States economy anticipates moderate growth in 2025, businesses are navigating a climate characterized by considerable challenges and unpredictability, which can impact investment and operational planning.

Even with inflation rates cooling, manufacturers like Benchmark Electronics are still grappling with elevated costs. The producer price index for input materials, a key indicator of manufacturing costs, remained elevated throughout 2024, putting pressure on profit margins.

Furthermore, total compensation, encompassing wages and benefits, continued its upward trajectory in 2024. This persistent increase in labor costs directly impacts companies' operational expenses, requiring strategic adjustments to maintain profitability in a competitive market.

Interest rate movements significantly influence investment decisions. For instance, anticipated further interest rate cuts by the Federal Reserve in 2024 could stimulate greater investment and business expansion, potentially boosting demand for manufactured products.

Conversely, the higher interest rate environment experienced throughout much of 2024 has presented challenges to immediate growth within the manufacturing sector. This has made borrowing more expensive, impacting capital expenditures and overall industry expansion plans.

Supply Chain Costs and Disruptions

Supply chain challenges are set to persist through 2025, with ongoing risks stemming from geopolitical instability and persistent labor shortages. These factors are contributing to elevated transportation and logistics costs, impacting overall operational expenses. Benchmark needs to maintain a flexible and efficient approach to navigate these persistent headwinds.

The International Monetary Fund (IMF) projected global inflation to moderate in 2025 but noted that supply chain bottlenecks could still exert upward pressure on prices. For instance, the cost of shipping a 40-foot container from Asia to Europe remained significantly higher in early 2025 compared to pre-pandemic levels, impacting the landed cost of goods.

- Geopolitical Tensions: Continued conflicts and trade disputes create uncertainty and can lead to sudden disruptions in the flow of goods.

- Labor Shortages: A lack of skilled workers across manufacturing, warehousing, and transportation sectors limits capacity and drives up wage costs.

- Transportation Costs: Fluctuations in fuel prices and ongoing capacity constraints in shipping and trucking maintain elevated logistics expenses.

- Inventory Management: Companies are investing more in buffer stock to mitigate disruptions, tying up capital and increasing holding costs.

Currency Exchange Rates

Currency exchange rates significantly influence Benchmark Electronics' international operations. For instance, a stronger US dollar can make Benchmark's exports more expensive for foreign buyers, potentially dampening demand. Conversely, a weaker dollar can reduce the cost of imported components, improving profit margins on products assembled in the US. The Euro's performance against the US dollar, for example, directly impacts the cost of goods and services sourced from or sold into the Eurozone.

Fluctuations create a dynamic cost environment. In 2024, the US dollar experienced periods of strength against major currencies like the Euro and Japanese Yen, which would have presented challenges for US-based manufacturers like Benchmark looking to export. Managing these currency exposures through hedging strategies is essential for maintaining predictable pricing and safeguarding profitability across Benchmark's diverse global supply chain and customer base.

- Impact on Exports: A stronger USD in 2024 made Benchmark's products pricier for customers in the Eurozone, potentially affecting sales volume.

- Impact on Imports: A weaker USD against the Chinese Yuan could lower the cost of components sourced from China, boosting margins.

- Hedging Importance: Benchmark likely employs financial instruments to mitigate the risk of adverse currency movements, ensuring more stable financial results.

- Profitability: Unfavorable currency shifts can directly erode profit margins on international sales or increase the cost of goods sold.

Economic factors continue to shape the manufacturing landscape. While global inflation is projected to moderate in 2025, persistent supply chain issues and geopolitical tensions are expected to keep transportation and logistics costs elevated. For instance, shipping costs from Asia to Europe remained significantly higher in early 2025 than pre-pandemic levels, impacting the final cost of goods.

Labor costs, including wages and benefits, have seen a steady increase through 2024, directly impacting operational expenses for companies like Benchmark Electronics. Simultaneously, interest rate fluctuations in 2024 presented a dual challenge: higher borrowing costs hindered capital expenditures, yet anticipated rate cuts in late 2024 could stimulate future investment and demand.

Currency exchange rates also play a critical role, with a strong US dollar in 2024 making exports more expensive for international buyers, potentially dampening sales. Companies must actively manage these currency exposures through hedging to ensure stable pricing and profitability across their global operations.

| Economic Factor | 2024/2025 Trend | Impact on EMS Sector | Example Data Point |

|---|---|---|---|

| Global Inflation | Moderating but with upward pressure from supply chains | Elevated input and logistics costs | Container shipping costs from Asia to Europe remain above pre-pandemic levels in early 2025. |

| Labor Costs | Continued upward trajectory | Increased operational expenses, pressure on margins | Total compensation continued to rise through 2024. |

| Interest Rates | Mixed: High in 2024, potential cuts in late 2024/2025 | Higher borrowing costs impacting capex; potential for future investment stimulation | Anticipated Federal Reserve rate cuts in 2024 could boost investment. |

| Currency Exchange Rates | Periods of USD strength against major currencies | Challenges for exports, potential benefits for imports | Stronger USD in 2024 made US exports pricier for Eurozone buyers. |

Full Version Awaits

Benchmark PESTLE Analysis

The preview shown here is the exact Benchmark PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors relevant to your chosen benchmark. This detailed analysis is professionally structured and ready for immediate application.

The content and structure shown in this preview is the same Benchmark PESTLE Analysis document you will download after payment, ensuring you get exactly what you need to inform your strategic decisions.

Sociological factors

The manufacturing sector, including Electronic Manufacturing Services (EMS), is grappling with a severe shortage of skilled labor. This is largely due to an aging workforce, with many experienced workers nearing retirement, and a noticeable decline in younger generations showing interest in technical trades. For instance, a 2024 report indicated that over 60% of manufacturing firms are struggling to find qualified workers, directly impacting production capacity and efficiency.

This skills gap creates a significant hurdle for companies like Benchmark. The mismatch between available job roles and the technical expertise of the applicant pool means that filling critical positions becomes a lengthy and costly process. Consequently, Benchmark may experience production delays and a rise in labor costs as they compete for a limited pool of qualified technicians and engineers, potentially affecting their overall profitability.

Addressing the skilled labor gap is crucial for manufacturers like Benchmark. In 2024, the U.S. manufacturing sector faced a shortage of an estimated 2.4 million workers, according to Deloitte and The Manufacturing Institute. This necessitates substantial investment in upskilling and reskilling programs to equip the current workforce with the abilities needed for evolving technologies.

Benchmark must prioritize continuous education and cultivate partnerships with educational institutions. This strategy is vital for building a robust talent pipeline, ensuring a steady supply of qualified individuals. For instance, many companies are now investing more in apprenticeships and vocational training, recognizing their effectiveness in developing job-ready talent.

The retirement of experienced workers, often referred to as the "silver tsunami," is a significant sociological shift impacting industries, particularly manufacturing. For instance, in the US, the Bureau of Labor Statistics projected that by 2030, over 70 million Americans would be over 65, with a substantial portion of these being skilled tradespeople. This exodus creates a knowledge gap, as valuable institutional memory and hands-on expertise walk out the door, leaving a void that younger generations, who may view manufacturing as less innovative, are not always eager to fill.

To counter this, businesses must adapt their recruitment and retention strategies. Offering competitive compensation packages, comprehensive benefits, and clear pathways for career advancement are crucial. Furthermore, fostering a positive workplace culture that emphasizes open communication and recognizes the value of all employees, regardless of age or experience, is essential for attracting and keeping talent in a competitive labor market.

Emphasis on Corporate Social Responsibility (CSR)

Societal expectations regarding Corporate Social Responsibility (CSR) are increasingly influencing business operations. Companies are facing growing pressure from consumers, investors, and regulators to demonstrate a commitment to ethical practices and sustainability. This trend is evident in the development of new regulations, such as the proposed Corporate Sustainability Due Diligence Directive (CSDDD) in the European Union, which aims to hold companies accountable for human rights and environmental impacts across their entire supply chains.

Benchmark, like other businesses, must proactively address these evolving demands. This includes ensuring ethical sourcing of materials and upholding fair labor practices throughout its value chain. Failure to do so not only poses reputational risks but also creates significant compliance challenges as these standards become more embedded in legal frameworks. For instance, a 2024 survey indicated that over 70% of consumers consider a company's social and environmental impact when making purchasing decisions, highlighting the direct link between CSR and market success.

- Growing Consumer Demand: A significant majority of consumers expect businesses to be socially responsible, impacting purchasing behavior.

- Regulatory Scrutiny: New directives like the CSDDD are mandating greater accountability for environmental and human rights impacts.

- Investor Expectations: Environmental, Social, and Governance (ESG) factors are increasingly critical for investment decisions, with ESG assets projected to reach $50 trillion globally by 2025.

- Supply Chain Transparency: Companies must ensure ethical sourcing and fair labor practices, a requirement becoming standard for market access and brand reputation.

Consumer Preferences and Demand Shifts

Consumer preferences are rapidly evolving, significantly impacting demand for electronics and transportation. The global market for consumer electronics, including smartphones and wearables, is projected to reach over $1.1 trillion by 2025, demonstrating a sustained appetite for new gadgets. This upward trend necessitates agile and responsive Electronic Manufacturing Services (EMS) providers like Benchmark to meet production demands.

Furthermore, the automotive sector is witnessing a pronounced shift towards electric vehicles (EVs). By 2024, global EV sales are expected to surpass 14 million units, a substantial increase from previous years. This surge in EV adoption directly translates into higher demand for specialized EMS capabilities in areas like battery management systems and advanced driver-assistance systems (ADAS).

- Growing Demand for Consumer Electronics: The global consumer electronics market is on a strong growth trajectory, with sales expected to exceed $1.1 trillion by 2025.

- Electric Vehicle Adoption: EV sales are projected to reach over 14 million units globally in 2024, indicating a significant market shift.

- EMS Role in Trends: Benchmark's ability to adapt to these consumer-driven shifts, particularly in electronics and EVs, is vital for its market position and growth.

Societal attitudes towards work and career progression are shifting, impacting industries like manufacturing. Younger generations often prioritize work-life balance and seek roles that align with their values, presenting a challenge for traditional manufacturing environments. For instance, a 2024 survey revealed that over 50% of Gen Z workers consider company culture and flexibility as primary factors when choosing an employer.

This evolving perception necessitates that companies like Benchmark adapt their employer branding and operational models. Offering flexible work arrangements where feasible and fostering an inclusive culture that values diverse perspectives are becoming increasingly important for attracting and retaining talent. By understanding and responding to these sociological shifts, Benchmark can better position itself in the competitive labor market.

Technological factors

The manufacturing sector is experiencing a significant surge in automation, robotics, and AI adoption. This push is driven by the need to boost production, increase efficiency, and address ongoing labor challenges. For instance, global spending on industrial robots reached an estimated $15 billion in 2023, with projections indicating continued growth.

Benchmark should focus its investments on areas promising high returns, such as AI-driven quality control systems and predictive maintenance analytics. These technologies can significantly reduce downtime and improve product consistency. By 2025, AI in manufacturing is expected to contribute over $1.5 trillion to the global economy.

The digitalization of supply chains is a major technological shift. Benchmark, like many companies, is leveraging tools like blockchain for enhanced product traceability and the Internet of Things (IoT) for real-time inventory and shipment monitoring. For instance, by 2024, the global supply chain management market, which includes these digital solutions, was projected to reach over $30 billion, indicating significant investment in these areas.

This digital transformation is crucial for improving operational efficiency and flexibility. Advanced data analytics, for example, allows Benchmark to better predict demand, optimize logistics, and reduce costs. Studies from 2024 suggest that companies with highly digitized supply chains experience up to 20% lower operational costs compared to their less digital counterparts.

Furthermore, digital tools foster greater transparency and collaboration with suppliers. This end-to-end visibility is essential for identifying potential disruptions early and ensuring a smoother flow of goods. By 2025, it's estimated that over 70% of large enterprises will have implemented some form of blockchain technology within their supply chains for improved security and transparency.

Benchmark's engagement with projects like the Aurora exascale supercomputer underscores its deep expertise in high-performance computing (HPC) subsystems and the rigorous testing required for such advanced systems. This involvement directly showcases the company's ability to support and develop solutions for cutting-edge technological demands.

The increasing reliance on advanced computing and communication technologies is a significant driver of innovation across diverse scientific and engineering sectors that Benchmark actively serves. For instance, the global HPC market was valued at approximately $40 billion in 2023 and is projected to grow substantially, reflecting the critical role of these technologies.

Product Miniaturization and Complexity

The relentless demand for smaller, more powerful electronic devices across consumer electronics, automotive, and industrial sectors is a significant technological driver. This trend necessitates advanced solutions in Printed Circuit Board (PCB) assembly and semiconductor packaging, areas where Benchmark Electronics is actively involved. For instance, the global semiconductor packaging market was valued at approximately $50 billion in 2023 and is projected to grow substantially, fueled by the need for integrated and high-performance chips.

Benchmark's ability to innovate in the design and manufacturing of increasingly complex electronic components is crucial for its competitive edge. As devices shrink, the density and sophistication of the components packed within them rise exponentially. This complexity requires specialized manufacturing processes and a deep understanding of material science and electrical engineering to ensure reliability and performance. The automotive sector, in particular, is seeing a surge in electronic content per vehicle, with advanced driver-assistance systems (ADAS) and infotainment requiring intricate PCB assemblies.

- Consumer electronics demand: The market for miniaturized smartphones, wearables, and other portable devices continues to expand, pushing the boundaries of component integration.

- Automotive electronics growth: The increasing complexity of vehicle electronics, driven by electrification and autonomous driving, requires sophisticated PCB solutions. In 2024, the average luxury vehicle is expected to contain over $5,000 worth of electronics.

- Semiconductor packaging advancements: Innovations like System-in-Package (SiP) and advanced substrate technologies are enabling higher component density and improved functionality in smaller form factors.

- Benchmark's role: Benchmark's expertise in advanced PCB assembly and semiconductor packaging positions it to capitalize on these technological shifts, requiring continuous investment in R&D and manufacturing capabilities.

Cybersecurity in Connected Manufacturing

The increasing reliance on connected manufacturing and the Internet of Things (IoT) in supply chains elevates cybersecurity to a critical concern. For companies like Benchmark, this necessitates substantial investment in safeguarding both physical and digital infrastructure.

This includes implementing robust security protocols for all connected devices and data streams. A significant aspect is the rigorous vetting of third-party suppliers to ensure their security practices align with industry best standards. For instance, the global cybersecurity market was projected to reach $345.4 billion in 2024, highlighting the scale of investment required.

- Increased IoT adoption in manufacturing drives demand for advanced cybersecurity solutions.

- Benchmark must allocate significant resources to protect its digital and physical assets.

- Supplier security vetting is crucial to prevent breaches through the supply chain.

- Compliance with evolving security standards is non-negotiable for maintaining operational integrity.

Technological advancements are reshaping the manufacturing landscape, with automation, AI, and robotics becoming central to boosting efficiency and addressing labor shortages. Global spending on industrial robots alone was expected to surpass $15 billion in 2023, with continued upward trends anticipated.

Benchmark's strategic focus on AI-driven quality control and predictive maintenance analytics is well-aligned with industry growth. By 2025, AI's contribution to the global economy, particularly in manufacturing, is projected to exceed $1.5 trillion.

The digitalization of supply chains, incorporating blockchain for traceability and IoT for real-time monitoring, is a key technological shift. The global supply chain management market, encompassing these digital solutions, was projected to exceed $30 billion in 2024, underscoring significant investment in this area.

Companies with highly digitized supply chains, leveraging advanced data analytics, can achieve up to 20% lower operational costs, according to 2024 studies, highlighting the efficiency gains from this digital transformation.

| Technology Area | 2023/2024 Value (Est.) | Projected Growth Driver | Benchmark Relevance |

|---|---|---|---|

| Industrial Automation/Robotics | >$15 billion (Robots, 2023) | Efficiency, labor shortage mitigation | Investment in AI quality control, predictive maintenance |

| Digital Supply Chain Solutions | >$30 billion (SCM Market, 2024) | Traceability, real-time monitoring | Leveraging blockchain, IoT |

| High-Performance Computing (HPC) | ~$40 billion (Global Market, 2023) | Scientific/engineering innovation | Expertise in HPC subsystems (e.g., Aurora project) |

| Semiconductor Packaging | ~$50 billion (Global Market, 2023) | Miniaturization, increased functionality | Advanced PCB assembly, SiP integration |

Legal factors

Governments globally are tightening environmental regulations, compelling businesses to prioritize sustainability. This includes mandates for reducing carbon emissions, increasing the use of recycled content, and improving energy efficiency in operations. For instance, the European Union's Ecodesign for Sustainable Products Regulation (ESPR), which began implementation in July 2024, sets ambitious new standards for product durability, repairability, and recyclability.

Extended Producer Responsibility (EPR) laws are significantly evolving, with many jurisdictions expanding their scope in 2025. This means manufacturers will increasingly bear responsibility for their products' entire lifecycle, from design to disposal. Expect more mandates for take-back programs, enhanced recycling initiatives, and proper end-of-life management, pushing companies toward more robust circular economy strategies.

These evolving EPR regulations demand greater transparency, particularly concerning the chemicals used within products. Companies must be prepared to track and report on these substances, ensuring compliance with new standards aimed at reducing environmental impact. For instance, the EU’s updated Waste Framework Directive, which influences many national EPR schemes, emphasizes resource efficiency and the safe management of materials throughout their lifespan.

The Corporate Sustainability Due Diligence Directive (CSDDD), enacted in 2024, mandates companies to proactively identify and address human rights and environmental risks within their supply chains. This directly affects electronics manufacturers like Benchmark, requiring them to implement thorough checks to ensure ethical sourcing and fair labor standards across their operations.

For Benchmark, this means conducting detailed audits of suppliers, potentially impacting sourcing costs and operational complexity as they verify compliance with the CSDDD's stringent requirements throughout 2024 and into 2025.

Hazardous Substance Restrictions (RoHS, REACH, PFAS)

Regulations like RoHS and REACH are becoming more stringent in 2025, demanding enhanced chemical tracking and supply chain transparency from manufacturers. This means companies need to be acutely aware of the substances within their products. For instance, the European Union's REACH regulation continues to evolve, with ongoing evaluations of chemical substances impacting market access.

Furthermore, the US Environmental Protection Agency (EPA) is implementing new PFAS reporting requirements starting July 2025. This will significantly affect industries that utilize per- and polyfluoroalkyl substances, requiring detailed reporting on their presence and use. The financial implications for non-compliance can be substantial, with potential fines and market access restrictions.

- RoHS and REACH Compliance: Manufacturers face increased scrutiny and potential costs associated with verifying and documenting the absence of restricted hazardous substances in their products.

- PFAS Reporting Mandates: The EPA's new requirements for PFAS reporting, effective July 2025, will necessitate significant investment in data collection and reporting infrastructure for affected businesses.

- Supply Chain Transparency: Companies must invest in robust systems to ensure full visibility of chemical components throughout their entire supply chain to meet regulatory demands.

- Market Access and Risk: Non-compliance with these evolving regulations can lead to product recalls, market access denial, and severe financial penalties, impacting overall business performance.

Product Safety and Data Privacy Standards

Consumer electronics safety standards are continually being updated, demanding rigorous adherence from manufacturers like Benchmark. For instance, the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) are setting stricter benchmarks for data handling. These regulations necessitate robust data protection mechanisms and crystal-clear privacy policies for all devices.

Benchmark must prioritize embedding advanced encryption technologies within its product line to safeguard user information effectively. Compliance with these evolving global data privacy laws is not just a legal requirement but a critical factor in maintaining consumer trust. Failure to comply could result in significant fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

- Evolving Safety Standards: Ongoing updates to consumer electronics safety regulations require continuous product adaptation.

- Data Privacy Regulations: GDPR and CCPA impose stringent requirements on data protection and transparency.

- Encryption Mandates: Benchmark must integrate advanced encryption to meet these privacy demands.

- Compliance Costs: Adherence to global data privacy laws can involve significant investment in technology and legal counsel.

Governmental bodies are increasingly focusing on product lifecycle management and material sourcing. The EU's Ecodesign for Sustainable Products Regulation, in effect since July 2024, mandates improved product durability and repairability, directly impacting manufacturing processes and design choices for companies like Benchmark.

Extended Producer Responsibility (EPR) laws are expanding globally, with new or revised frameworks expected in several key markets by 2025. This shift places greater financial and operational burden on manufacturers for product end-of-life management, encouraging investment in take-back programs and sustainable disposal methods.

New regulations like the Corporate Sustainability Due Diligence Directive (CSDDD), enacted in 2024, require businesses to actively identify and mitigate human rights and environmental risks within their supply chains. This necessitates rigorous supplier audits and increased transparency, potentially affecting sourcing strategies and costs for businesses operating internationally.

Stricter chemical regulations, such as updated PFAS reporting requirements from the US EPA starting July 2025, demand enhanced data collection and reporting capabilities. Non-compliance can lead to significant penalties, with potential fines and restrictions on market access impacting profitability.

Data privacy laws like GDPR and CCPA continue to evolve, setting higher standards for consumer data protection. Benchmark must invest in robust encryption and transparent privacy policies, as non-compliance can result in substantial fines, up to 4% of global annual turnover.

| Regulation/Directive | Effective Date | Key Impact | Potential Cost/Penalty |

|---|---|---|---|

| Ecodesign for Sustainable Products Regulation (EU) | July 2024 | Product durability & repairability mandates | R&D investment, design changes |

| Corporate Sustainability Due Diligence Directive (CSDDD) | Enacted 2024 | Supply chain risk mitigation | Audit costs, supplier vetting |

| PFAS Reporting Requirements (US EPA) | July 2025 | Chemical usage transparency | Data collection, reporting infrastructure |

| GDPR/CCPA | Ongoing Evolution | Data protection & privacy | Up to 4% global turnover fine (GDPR) |

Environmental factors

The push for circular economy principles is fundamentally reshaping product design, particularly in the electronics sector. Mandatory requirements now span the entire product lifecycle, emphasizing durability, ease of repair, reusability, and energy efficiency. This shift is compelling manufacturers to adopt strategies such as component recycling and improved energy performance.

For instance, the EU's Ecodesign Regulation, which came into full effect in 2021, mandates that certain appliances must be repairable for up to 10 years, significantly impacting how products are conceived and built. This focus on longevity and resourcefulness is projected to boost the global circular economy market, estimated to reach $4.5 trillion by 2030, according to some market analyses.

The electronics sector grapples with the availability and fluctuating costs of essential raw materials like rare earth elements and lithium, critical for everything from smartphones to electric vehicle batteries. Geopolitical tensions and the relentless demand for cutting-edge technology are intensifying these pressures, with prices for some key minerals seeing significant spikes in late 2023 and early 2024.

To navigate this, electronics manufacturers are actively seeking alternative materials and broadening their supplier networks. Diversifying sourcing is crucial for building more robust and less vulnerable supply chains, ensuring continued production in the face of global disruptions.

Governments and consumers are increasingly demanding reduced emissions and greater energy efficiency from manufacturers. Benchmark must prioritize carbon-neutral production and energy-efficient processes to satisfy these growing environmental expectations and maintain market access. For instance, in 2023, the global average temperature was approximately 1.45°C above pre-industrial levels, highlighting the urgency of climate action.

Waste Management and E-waste Regulations

New amendments to the Basel Convention, effective January 2025, will significantly tighten regulations around the disposal of electrical and electronic waste. These changes will impose stricter requirements on both hazardous and non-hazardous e-waste, impacting international shipments and demanding more robust waste management strategies from businesses worldwide.

This regulatory shift underscores the growing global focus on sustainable practices and the circular economy. For instance, in 2024, the global e-waste generation reached an estimated 62 million metric tons, a figure projected to climb further, highlighting the urgency of effective management systems.

- Stricter Compliance: Businesses must adapt to new international standards for e-waste handling and disposal.

- Increased Costs: Enhanced waste management and compliance measures may lead to higher operational expenses.

- Innovation Drive: The regulations are expected to spur innovation in recycling technologies and product design for easier disassembly.

Climate Change Impacts on Operations

Climate change presents significant threats to supply chain resilience. Extreme weather events, like the widespread flooding in parts of Southeast Asia in early 2024, disrupted manufacturing hubs and transportation networks, leading to an estimated 15% increase in shipping costs for affected regions. This necessitates a proactive approach to managing these physical risks.

Manufacturers must integrate comprehensive environmental impact assessments into their strategic planning to mitigate operational vulnerabilities. For instance, companies operating in coastal areas, such as those in the automotive sector in the Gulf Coast region of the United States, are increasingly evaluating the risk of sea-level rise on their facilities and logistics. A 2024 report by the World Economic Forum highlighted that 60% of businesses now consider climate-related physical risks a top-tier concern for their operations.

- Supply Chain Disruptions: Extreme weather events in 2024 led to an average of a 10% increase in lead times for critical components in the electronics sector.

- Increased Operational Costs: Companies are facing higher insurance premiums and costs for climate-resilient infrastructure, with some reporting a 5% rise in operational expenses directly attributable to climate adaptation measures.

- Physical Asset Vulnerability: Facilities located in flood plains or areas prone to extreme heat are reassessing their long-term viability and exploring relocation or significant retrofitting.

- Resource Scarcity: Water scarcity, exacerbated by changing climate patterns, is impacting industries reliant on large water volumes, such as agriculture and certain manufacturing processes, potentially driving up raw material costs.

The increasing global focus on sustainability is driving stringent environmental regulations. For instance, new amendments to the Basel Convention, effective January 2025, will significantly tighten rules on electrical and electronic waste disposal, impacting international shipments and requiring more robust waste management strategies.

Climate change poses a substantial risk to supply chains, with extreme weather events in early 2024 disrupting manufacturing and logistics, causing an estimated 15% increase in shipping costs for affected regions. Companies are increasingly incorporating environmental impact assessments into their planning to mitigate these vulnerabilities, with 60% of businesses in 2024 identifying climate-related physical risks as a top concern.

The demand for circular economy principles is reshaping product design, with regulations like the EU's Ecodesign Regulation emphasizing durability and repairability. This trend is projected to fuel the global circular economy market, anticipated to reach $4.5 trillion by 2030.

| Environmental Factor | Impact on Businesses | Key Data/Trends (2023-2025) |

|---|---|---|

| E-waste Regulations | Stricter compliance, increased waste management costs, drive for recycling innovation. | Basel Convention amendments effective Jan 2025; global e-waste reached 62 million metric tons in 2024. |

| Climate Change & Extreme Weather | Supply chain disruptions, increased operational costs (insurance, infrastructure), physical asset vulnerability. | ~1.45°C global average temp above pre-industrial levels (2023); 10% increase in lead times due to weather events (2024). |

| Circular Economy Push | Product design changes (durability, repairability), focus on resource efficiency. | EU Ecodesign Regulation (2021 onwards); projected global circular economy market of $4.5 trillion by 2030. |

| Resource Scarcity | Rising raw material costs, need for material substitution and supply chain diversification. | Fluctuating prices for rare earth elements and lithium in late 2023/early 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable international organizations like the World Bank and IMF, alongside government publications and leading market research firms. This ensures a comprehensive view of political, economic, social, technological, legal, and environmental factors.