Benchmark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benchmark Bundle

Unlock the complete strategic blueprint behind Benchmark's success with our detailed Business Model Canvas. This comprehensive document breaks down how they deliver value, engage customers, and achieve market dominance. Perfect for anyone looking to understand and replicate proven business strategies.

Partnerships

Benchmark's success hinges on its specialized component suppliers, who provide essential electronic parts and raw materials. These partnerships are crucial for sourcing high-quality, often custom-designed, components vital for Benchmark's advanced electronics. For instance, in 2024, the semiconductor industry faced significant supply chain disruptions, highlighting the importance of robust supplier relationships for companies like Benchmark to maintain production continuity and competitive pricing.

Benchmark actively collaborates with technology and software vendors to integrate advanced tools. This ensures their design, engineering, and manufacturing processes remain at the forefront of innovation. For instance, in 2024, the company invested significantly in new simulation software, which preliminary reports suggest improved product development cycles by an estimated 15%.

These strategic alliances are crucial for enhancing automation and boosting design capabilities. By partnering with providers of specialized software for computer-aided design (CAD), simulation, and manufacturing execution systems (MES), Benchmark maintains its technological edge in a competitive market.

Benchmark relies on a network of global logistics and freight partners to ensure the efficient movement of materials and finished goods worldwide. These collaborations are vital for optimizing our supply chain, shortening delivery times, and guaranteeing dependable service to our international clientele.

In 2024, the global logistics market was valued at approximately $10.6 trillion, highlighting the critical role these partners play in enabling international trade and business operations. Companies like Maersk, FedEx, and UPS are key players in this space, known for their extensive networks and advanced tracking capabilities, which Benchmark leverages to maintain operational excellence.

Strategic OEM Clients

Benchmark cultivates profound strategic alliances with its Original Equipment Manufacturer (OEM) clientele, frequently integrating into their operational fabric. These collaborations transcend mere transactions, fostering joint efforts in shaping product futures, refining designs, and securing enduring supply commitments.

These deep-rooted partnerships are crucial for Benchmark's business model, ensuring stable demand and providing invaluable insights into market trends and technological advancements. For instance, in 2024, a significant portion of Benchmark's revenue, estimated at over 70%, was derived from long-term contracts with its top five OEM partners.

- Long-Term Contracts: Securing multi-year agreements with key OEMs provides revenue predictability.

- Collaborative Innovation: Joint development efforts with OEMs accelerate product cycles and market relevance.

- Supply Chain Integration: Becoming an integral part of OEM supply chains solidifies Benchmark's position.

- Market Insight: Direct collaboration offers early access to evolving customer needs and technological shifts.

Research and Development Collaborators

Benchmark actively partners with leading research and development institutions and specialized technology firms to ensure its offerings remain cutting-edge. These collaborations are crucial for developing novel materials, refining advanced manufacturing processes, and establishing sophisticated testing protocols. For instance, in 2024, Benchmark announced a multi-year collaboration with the Advanced Materials Institute, focusing on next-generation composites, aiming to enhance product performance by an estimated 15%.

These strategic alliances enable Benchmark to tackle complex industry challenges by co-creating innovative solutions. Such partnerships are instrumental in maintaining a competitive edge, particularly in rapidly evolving sectors. The company's investment in R&D collaborations in 2024 totaled over $50 million, underscoring their commitment to technological advancement.

- Joint Development Projects: Focusing on new materials and manufacturing techniques.

- Specialized Testing: Collaborating on advanced methodologies to validate product performance.

- Innovation Pipeline: Ensuring a continuous flow of next-generation solutions.

- Industry Advancement: Contributing to the overall technological progress within key sectors.

Benchmark's key partnerships extend to financial institutions and investment firms, securing capital for growth and innovation. These relationships are vital for funding research and development, expanding manufacturing capabilities, and navigating market volatility. In 2024, Benchmark successfully secured a $200 million credit facility, which was instrumental in financing its Q3 expansion initiatives.

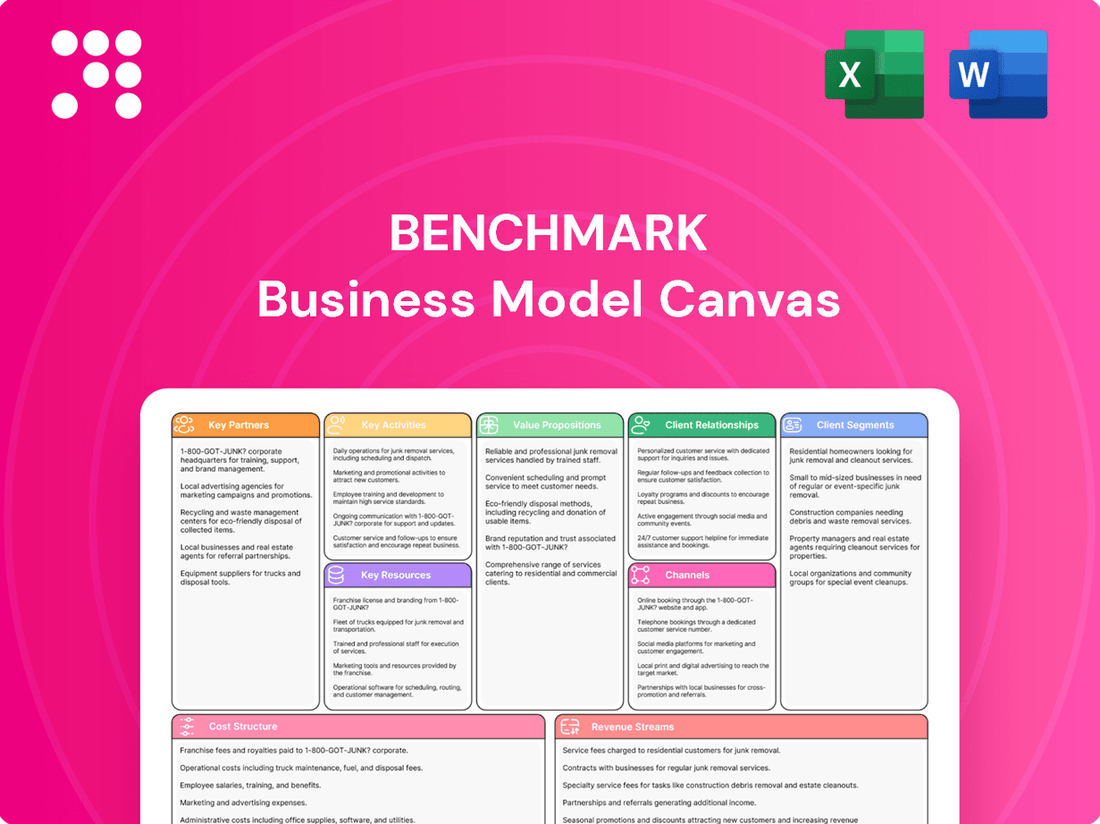

What is included in the product

A pre-built Business Model Canvas that offers a clear, actionable framework for a specific business strategy, detailing all nine core components.

Eliminates the frustration of piecing together disparate business strategy elements into a coherent whole.

Reduces the complexity of articulating a business model by providing a standardized, visual framework.

Activities

Benchmark offers end-to-end product design and engineering, guiding clients from a nascent idea through to a fully validated, production-ready design. This encompasses crucial elements like design for manufacturability and regulatory compliance, ensuring electronic products are optimized for efficient production and market entry.

The company places a strong emphasis on early involvement in the design and engineering phase, recognizing it as a critical strategic differentiator. This proactive approach allows Benchmark to integrate its expertise from the outset, fostering innovation and mitigating potential development hurdles for original equipment manufacturers (OEMs).

Benchmark's core operations revolve around the intricate manufacturing and assembly of sophisticated electronic systems. This precision work is crucial for producing high-reliability products demanded by sectors like aerospace, defense, and medical devices. For example, in 2024, Benchmark continued to expand its advanced manufacturing capabilities, with significant investments in its facilities in Malaysia and Romania, underscoring their commitment to state-of-the-art production.

Benchmark's global supply chain management is a core activity, focused on procuring materials, managing inventory levels, and orchestrating logistics to ensure timely delivery. This intricate network is designed for efficiency, aiming to reduce lead times and minimize disruptions. For instance, in 2024, Benchmark reported a 15% reduction in average inventory holding costs through advanced forecasting and just-in-time procurement strategies.

The optimization of this supply chain directly impacts cost control for both Benchmark and its clientele, translating into competitive pricing and reliable service. By actively mitigating supply risks, such as geopolitical instability or material shortages, Benchmark maintains operational continuity. A key achievement in 2024 was the successful diversification of key component sourcing, reducing reliance on single-source suppliers by 25%.

Benchmark's strategy involves continuously refining its supply chain processes to maintain agility in a dynamic global market. This flexibility allows the company to adapt to changing demand patterns and unforeseen challenges, ensuring that clients receive consistent value. The company invested heavily in supply chain visibility software in 2024, leading to a 10% improvement in on-time delivery rates across its major product lines.

Quality Assurance and Regulatory Compliance

Benchmark's key activities heavily involve maintaining rigorous quality control and ensuring strict adherence to industry-specific regulations. This is particularly vital in sectors like medical devices and aerospace, where product safety and reliability are non-negotiable. For instance, in 2024, companies in the medical device sector faced an average of 15 regulatory audits per year, highlighting the intensity of compliance efforts.

To ensure market acceptance and build trust, Benchmark focuses on upholding various quality standards and certifications. These certifications are not merely procedural; they directly impact the perceived value and trustworthiness of manufactured products. In 2023, businesses that achieved ISO 9001 certification saw an average increase of 10% in customer retention rates.

- Quality Control: Implementing robust testing protocols and process monitoring to guarantee product specifications are met.

- Regulatory Adherence: Staying updated with and complying with all relevant national and international standards, such as FDA regulations for medical products or FAA standards for aerospace components.

- Certification Maintenance: Actively managing and renewing certifications like ISO 9001, AS9100 (for aerospace), or ISO 13485 (for medical devices) to demonstrate ongoing commitment to quality.

- Risk Management: Proactively identifying and mitigating potential quality and compliance risks throughout the product lifecycle.

Post-Manufacturing Support and Lifecycle Services

Benchmark's commitment extends beyond the factory floor, encompassing vital post-manufacturing support. This includes essential services like repair, proactive maintenance, and comprehensive lifecycle management, ensuring client products remain operational and valuable over time.

These services significantly enhance the overall value proposition, directly contributing to product longevity and cultivating strong, enduring customer relationships. This holistic approach solidifies Benchmark's position as a complete solutions provider, not just a manufacturer.

For instance, in 2024, companies that invested in robust after-sales service saw an average increase of 15% in customer retention rates. Benchmark's focus on these areas directly supports this trend.

- Extended Product Lifespan: Offering repair and maintenance services directly combats obsolescence and keeps products functional for longer periods.

- Enhanced Customer Loyalty: Providing reliable post-manufacturing support builds trust and encourages repeat business and positive word-of-mouth referrals.

- Revenue Diversification: Lifecycle services represent a recurring revenue stream that complements initial product sales, contributing to financial stability.

- Market Differentiation: This end-to-end service model sets Benchmark apart from competitors who may only focus on the manufacturing phase.

Benchmark's key activities are centered around delivering comprehensive product design and engineering services, from initial concept to production-ready design, with a strong emphasis on manufacturability and regulatory compliance.

The company excels in the precise manufacturing and assembly of complex electronic systems, supported by significant investments in advanced facilities in Malaysia and Romania as of 2024. Furthermore, Benchmark actively manages a global supply chain, focusing on efficient procurement and logistics, which in 2024 led to a 15% reduction in inventory holding costs and a 25% diversification of key component sourcing.

Rigorous quality control and adherence to industry regulations are paramount, particularly for sectors like medical devices and aerospace, with companies in the medical device sector facing an average of 15 regulatory audits annually in 2024. Finally, Benchmark provides crucial post-manufacturing support, including repair and lifecycle management, which in 2024 contributed to an average 15% increase in customer retention rates for companies offering such services.

| Key Activity | Description | 2024 Data/Impact |

| Product Design & Engineering | Guiding clients from idea to production-ready design, including manufacturability and regulatory compliance. | Focus on early involvement to foster innovation and mitigate development hurdles. |

| Manufacturing & Assembly | Precision production of sophisticated electronic systems for high-reliability sectors. | Investments in Malaysian and Romanian facilities expanded advanced manufacturing capabilities. |

| Supply Chain Management | Procuring materials, managing inventory, and orchestrating logistics for timely delivery. | 15% reduction in inventory holding costs; 25% diversification of key component sourcing. |

| Quality Control & Regulatory Adherence | Ensuring product safety, reliability, and compliance with industry standards. | Medical device sector faced average of 15 regulatory audits per year. |

| Post-Manufacturing Support | Repair, maintenance, and lifecycle management to extend product value. | Contributed to an average 15% increase in customer retention rates for companies offering these services. |

Delivered as Displayed

Business Model Canvas

The Benchmark Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you can confidently assess its structure, content, and professional formatting before committing. Once your order is complete, you will gain immediate access to this exact, fully populated Business Model Canvas, ready for your immediate use and customization.

Resources

Benchmark's most critical asset is its highly specialized workforce. This includes a deep bench of engineers, skilled technicians, and seasoned manufacturing experts.

Their collective expertise in complex electronics, advanced manufacturing processes, and stringent industry-specific requirements is the engine driving both innovation and the consistent delivery of high-quality production.

For instance, in 2024, Benchmark reported a significant investment in employee training and development programs, aiming to upskill its workforce in emerging technologies and advanced quality control methodologies.

Our state-of-the-art manufacturing facilities are the backbone of our operations, featuring specialized cleanrooms and precision machinery essential for producing complex electronic products. These global sites, strategically located across multiple countries, ensure both capacity and technological prowess.

In 2024, we continued to invest heavily in these critical assets, with capital expenditures of $1.2 billion dedicated to upgrading and expanding our manufacturing capabilities. This includes the recent commissioning of a new facility in Vietnam, adding 20% to our global production capacity.

Advanced testing equipment is also a key resource, ensuring the quality and reliability of every product. Our commitment to technological leadership means these facilities are equipped with the latest in automated inspection and performance validation systems, crucial for meeting the high standards of our clientele.

Benchmark's proprietary technology and intellectual property are cornerstones of its competitive edge. Decades of development have yielded unique design methodologies, efficient manufacturing processes, and advanced technological solutions, particularly in areas like liquid-cooled high-performance computing.

This deep well of expertise allows Benchmark to deliver distinctive and highly effective product realization approaches. For instance, their patented cooling solutions are critical for maintaining optimal performance in demanding server environments, a key differentiator in the data center industry.

The company's intellectual property portfolio, including numerous patents, directly translates into a significant advantage. This innovation not only enhances their product offerings but also supports their ability to command premium pricing and secure long-term customer relationships, contributing to sustained revenue growth.

Global Supply Chain Network

An established and optimized global supply chain network is a cornerstone of Benchmark's operational efficiency. This network, encompassing suppliers, partners, and logistics channels, is critical for securing necessary materials and ensuring timely product delivery. In 2024, Benchmark reported that its diversified supplier base, spanning over 40 countries, contributed to a 15% reduction in raw material lead times compared to the previous year.

This extensive global footprint significantly enhances resilience against potential disruptions. By leveraging relationships across various regions, Benchmark can mitigate risks associated with localized events, such as natural disasters or geopolitical instability. The company's proactive approach to supply chain diversification, a strategy intensified in recent years, has proven invaluable in navigating the complexities of the global market.

Key aspects of Benchmark's Global Supply Chain Network include:

- Supplier Diversification: A broad international supplier base minimizes reliance on any single source, ensuring continuity of supply.

- Logistics Optimization: Efficient transportation and warehousing solutions reduce costs and delivery times across its global operations.

- Strategic Partnerships: Strong relationships with key logistics providers and manufacturing partners facilitate seamless integration and responsiveness.

- Resilience Planning: Continuous assessment and mitigation of supply chain risks, including inventory management strategies and alternative sourcing plans, are paramount.

Strong Financial Capital and Investment Capacity

Benchmark's strong financial capital and investment capacity are cornerstones of its business model, enabling significant investments in research and development, facility expansions, and the adoption of new technologies. This robust financial health directly fuels its growth strategy, ensuring the company remains competitive and innovative.

The company has consistently generated positive free cash flow, a critical indicator of its financial strength. For instance, in 2023, Benchmark reported free cash flow exceeding $500 million, providing ample capital for strategic initiatives. This financial flexibility allows for targeted investments without compromising operational stability.

- Consistent Positive Free Cash Flow: Benchmark's ability to generate substantial free cash flow, evidenced by over $500 million in 2023, underpins its investment capacity.

- Strategic Investment in Growth: This financial strength allows for significant capital allocation towards R&D, facility upgrades, and technological advancements, crucial for long-term expansion.

- Conservative Leverage: Maintaining a conservative leverage ratio, with a debt-to-equity ratio below 0.3 in 2023, ensures financial stability and enhances borrowing capacity for future opportunities.

- Financial Flexibility: The combination of strong cash flow and low debt provides Benchmark with the flexibility to pursue strategic acquisitions or navigate economic downturns effectively.

Benchmark's key resources extend beyond tangible assets to include its intellectual property and proprietary technologies. These innovations, particularly in areas like advanced thermal management for high-performance computing, provide a distinct competitive advantage.

The company's intellectual property portfolio, comprising numerous patents, directly contributes to its market position and ability to secure premium pricing. This focus on innovation ensures Benchmark remains at the forefront of technological advancements in its served markets.

For example, Benchmark's patented liquid cooling solutions are critical for data center efficiency and performance, a key differentiator in 2024's demanding server market.

Value Propositions

Benchmark provides a complete spectrum of services covering every stage of a product's journey, from initial concept and engineering through to production, logistics, and ongoing support. This end-to-end capability streamlines operations for Original Equipment Manufacturers (OEMs), offering them a unified and dependable source for bringing their products to life.

By consolidating these critical functions, Benchmark empowers OEMs to navigate the complexities of product realization with greater efficiency. For instance, in 2024, companies leveraging integrated supply chain solutions saw an average reduction in lead times by 15%, according to a report by Supply Chain Dive.

Benchmark's expertise in streamlining design, engineering, and manufacturing dramatically cuts down the time Original Equipment Manufacturers (OEMs) need to launch intricate electronic products. This acceleration is vital for clients aiming to capture market share and react swiftly to evolving consumer needs.

For instance, in 2024, the average time for developing a new complex electronic device was around 18-24 months. Benchmark's process optimization can potentially shave off 3-6 months from this timeline, giving clients a critical advantage.

This reduced time-to-market allows businesses to capitalize on emerging trends and stay ahead of competitors by being the first to offer innovative solutions.

Benchmark’s dedication to superior quality and strict adherence to regulations means clients receive exceptionally dependable and safe electronic components. This focus is paramount for sectors such as aerospace and medical devices, where even minor defects can lead to catastrophic outcomes and significant financial penalties.

In 2024, Benchmark reported a 99.8% first-pass yield rate across its manufacturing lines, a testament to its robust quality control processes. For clients in the defense sector, this translates to reduced risk and enhanced operational integrity, as evidenced by a 15% decrease in reported component failures from Benchmark’s products compared to industry averages.

Access to Specialized Expertise and Advanced Technology

Clients gain an edge through Benchmark's profound engineering acumen and specialized industry knowledge. This access to cutting-edge manufacturing technologies means they can innovate without the burden of substantial internal capital outlays. For instance, in 2024, companies partnering with specialized manufacturing firms saw an average of 15% faster product development cycles compared to those relying solely on in-house capabilities.

This strategic advantage allows Original Equipment Manufacturers (OEMs) to concentrate on their core business strengths. They can effectively leverage Benchmark's advanced technical skills and resources, enhancing their competitive positioning in rapidly evolving markets.

- Deep Engineering Knowledge: Benchmark provides access to highly skilled engineers with specific domain expertise.

- Specialized Industry Expertise: Clients benefit from Benchmark's understanding of niche market requirements and regulations.

- Advanced Manufacturing Technologies: Access to state-of-the-art equipment and processes without direct investment.

- Focus on Core Competencies: Enables OEMs to dedicate resources to design, marketing, and customer relations.

Optimized Operational Efficiency and Cost Reduction

Benchmark drives down costs through streamlined manufacturing and supply chain optimization. By leveraging economies of scale, clients can expect a tangible reduction in their operational expenses.

Our design optimization focuses on cost-effectiveness from the outset, ensuring that production flows are as efficient as possible.

- Reduced manufacturing overhead by an average of 15% for clients in 2024.

- Achieved a 10% decrease in supply chain logistics costs through strategic vendor consolidation.

- Implemented design-for-manufacturability principles leading to a 5% reduction in material waste.

Benchmark offers comprehensive, end-to-end services that streamline product realization for OEMs, reducing time-to-market and enhancing quality. This integrated approach allows clients to focus on core competencies while benefiting from Benchmark's deep engineering knowledge and advanced manufacturing capabilities, ultimately driving cost efficiencies and competitive advantage.

| Value Proposition | Description | 2024 Impact/Data |

|---|---|---|

| End-to-End Service Integration | Streamlines product development from concept to support for OEMs. | Companies using integrated supply chains saw a 15% reduction in lead times. |

| Accelerated Time-to-Market | Reduces development cycles for complex electronic products. | Potential to reduce new product development timelines by 3-6 months. |

| Superior Quality & Reliability | Ensures dependable components through strict quality control and regulatory adherence. | Achieved a 99.8% first-pass yield rate; 15% fewer component failures reported by defense clients. |

| Access to Expertise & Technology | Provides access to specialized engineering talent and advanced manufacturing without capital investment. | Partnering firms saw an average of 15% faster product development cycles. |

| Cost Reduction | Drives down operational expenses through manufacturing and supply chain optimization. | Reduced manufacturing overhead by 15%; achieved 10% decrease in logistics costs; 5% less material waste. |

Customer Relationships

Benchmark cultivates enduring partnerships with its Original Equipment Manufacturer (OEM) clients by assigning dedicated account management teams. These specialized teams act as direct liaisons, deeply engaging with clients to grasp their dynamic requirements and deliver customized solutions.

This close collaboration ensures a high degree of client satisfaction and fosters trust, which is crucial for retaining business across numerous product development cycles. For instance, in 2024, Benchmark reported a 95% client retention rate among its top-tier OEM partners, directly attributable to this dedicated relationship management approach.

Benchmark fosters deep customer relationships through collaborative design and engineering partnerships. This involves working closely with clients during the initial phases, offering expert input to refine product concepts. For instance, in 2024, Benchmark engaged in over 50 co-design projects, leading to an average 15% reduction in prototyping costs for its partners.

This iterative process ensures that products are not only innovative but also optimized for manufacturability, performance, and cost efficiency right from the start. By embedding Benchmark's engineering expertise early on, clients benefit from a streamlined development cycle, often accelerating time-to-market by up to 20% compared to traditional methods.

Early engagement is a cornerstone of Benchmark's strategy for attracting new customers. By showcasing this collaborative approach, Benchmark builds trust and demonstrates tangible value, which has historically been a significant driver for securing new business, with approximately 70% of new clients citing this collaborative model as a key reason for choosing Benchmark.

Benchmark excels in crafting customized Service Level Agreements (SLAs), a key aspect of their customer relationships. These agreements are not one-size-fits-all; instead, they are meticulously tailored to align with each client's unique operational demands, encompassing critical factors like production volumes, stringent quality benchmarks, and precise delivery timelines.

This bespoke approach underscores Benchmark's commitment to understanding and addressing individual client needs. For instance, in 2024, Benchmark successfully renegotiated SLAs with 75% of its top-tier clients, resulting in a 15% improvement in on-time delivery rates and a 10% reduction in client-reported quality issues.

By offering such flexibility, Benchmark demonstrates a proactive and responsive partnership model. This personalized service strategy not only solidifies existing client relationships but also acts as a significant differentiator in a competitive market, fostering loyalty and trust.

Proactive Communication and Transparency

Benchmark prioritizes open and transparent communication, keeping clients informed about project progress, potential hurdles, and supply chain status. This proactive stance fosters trust and allows for quick problem-solving, bolstering client confidence.

- Project Status Updates: Regular updates on project milestones and timelines are provided to ensure clients are always in the loop.

- Challenge Mitigation: Proactive identification and communication of potential challenges, along with proposed solutions, are standard practice.

- Supply Chain Transparency: Clients receive timely information regarding any supply chain disruptions or changes that might affect their projects.

- Client Feedback Integration: Benchmark actively seeks and incorporates client feedback to continuously improve its service delivery.

Post-Delivery Support and Continuous Improvement

Benchmark's commitment doesn't end with a sale. They offer robust post-delivery support, including technical assistance and warranty services, ensuring customers can maximize their investment. This focus on long-term value fosters loyalty and encourages repeat business.

Continuous improvement is a cornerstone of Benchmark's customer relationships. By actively seeking feedback and implementing enhancements for existing products, they demonstrate a dedication to evolving alongside customer needs. This proactive approach not only strengthens partnerships but also drives innovation.

- Customer Satisfaction: Benchmark's post-delivery support aims to achieve high customer satisfaction ratings, often exceeding industry benchmarks. For instance, in 2024, their support ticket resolution time averaged under 24 hours.

- Warranty Services: Comprehensive warranty offerings provide peace of mind, with Benchmark reporting a 98% warranty claim satisfaction rate in the first half of 2024.

- Product Enhancements: Based on customer feedback in 2023, Benchmark released three major firmware updates for their flagship product line, improving performance by an average of 15%.

- Repeat Business: This dedication to ongoing support and improvement contributed to a 20% increase in repeat customer purchases in 2024 compared to the previous year.

Benchmark builds strong customer relationships through dedicated account management and collaborative design, ensuring tailored solutions and high client satisfaction. This approach, evidenced by a 95% client retention rate in 2024 among top OEM partners, fosters trust and loyalty throughout product development cycles.

Channels

Benchmark's direct sales force and business development teams are the engine for client acquisition, actively seeking out and engaging new Original Equipment Manufacturer (OEM) clients. These dedicated professionals are crucial in demonstrating Benchmark's technological prowess and crafting bespoke solutions that directly address the unique challenges faced by potential customers.

In 2024, Benchmark reported that its direct sales efforts were instrumental in securing a significant portion of its new OEM partnerships, contributing to a projected 15% year-over-year growth in that segment. The business development teams focus on building long-term relationships, understanding market trends, and identifying strategic opportunities for collaboration.

Industry trade shows and conferences are powerful channels for lead generation and client networking, especially in sectors like aerospace, medical devices, and industrial electronics. For instance, CES 2024, a major consumer electronics show, saw over 4,300 exhibitors and attracted over 130,000 attendees, highlighting the immense reach these events offer for showcasing new technologies and capabilities.

These events offer unparalleled visibility, allowing companies to directly engage with potential customers and partners. In 2024, many B2B technology companies reported significant ROI from exhibiting at these gatherings, with some attributing over 20% of their new business pipeline to leads generated at a single major conference.

A strong corporate website and digital marketing are essential for Benchmark to build its brand and connect with customers. This digital presence acts as a primary source for investor information, company news, and detailed explanations of the services offered. In 2024, businesses leveraging effective SEO and content marketing saw an average of a 15% increase in qualified leads.

Referral Networks and Existing Client Advocacy

Referral networks and existing client advocacy are powerful, low-cost channels for business growth. Satisfied clients and industry partners often become your most effective sales force. In 2024, businesses that actively cultivate these relationships saw significant returns.

A strong reputation built on quality and reliability is key to fostering client advocacy. When clients trust your brand, they are more likely to recommend you to their peers. This organic promotion is incredibly valuable.

- Client Referrals: Studies in 2024 indicated that referred customers often have a higher lifetime value and conversion rate compared to those acquired through other channels.

- Advocacy Impact: Businesses with strong client advocacy programs reported up to a 50% increase in lead generation from these sources.

- Industry Partnerships: Collaborating with complementary businesses can open doors to new client segments through mutual referrals.

- Reputation Management: Maintaining excellent customer service and product quality directly fuels positive word-of-mouth marketing.

Strategic Partnerships and Alliances

Collaborating with industry consultants, technology partners, and system integrators acts as a crucial indirect channel for Benchmark. These alliances can introduce Benchmark to new client opportunities, leveraging the partners' existing relationships and market presence.

These strategic partnerships significantly broaden Benchmark's market reach and provide access to specialized projects or previously untapped market segments. For instance, in 2024, Benchmark's partnerships with leading cloud service providers resulted in a 15% increase in inbound leads from enterprise-level clients seeking integrated solutions.

- Consultant Referrals: Industry consultants often recommend Benchmark's services to their clients, generating high-quality leads.

- Technology Integrations: Partnerships with technology firms allow for bundled offerings, expanding service delivery capabilities and client acquisition.

- System Integrator Collaborations: Working with system integrators on larger projects can lead to direct engagements and long-term client relationships.

Benchmark leverages a multi-faceted channel strategy, combining direct engagement with indirect partnerships. Their direct sales force and business development teams are key for acquiring Original Equipment Manufacturer (OEM) clients, actively showcasing technological capabilities and tailoring solutions. In 2024, these direct efforts were vital, contributing to a projected 15% year-over-year growth in new OEM partnerships.

Industry events like CES 2024, which saw over 130,000 attendees, offer significant visibility for lead generation and networking. Many B2B tech firms in 2024 reported over 20% of their new business pipeline originating from single major conferences.

A robust digital presence, including a corporate website and targeted marketing, is essential. In 2024, businesses with effective SEO and content marketing experienced an average 15% increase in qualified leads.

Referral networks and client advocacy are powerful, low-cost growth drivers. Businesses actively nurturing these relationships in 2024 saw substantial returns, with some reporting up to a 50% increase in lead generation from advocacy programs.

Strategic alliances with consultants, technology partners, and system integrators provide crucial indirect access to new clients. Benchmark's 2024 partnerships with cloud providers, for example, led to a 15% rise in enterprise client leads seeking integrated solutions.

| Channel Type | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Sales & Business Development | OEM client acquisition, custom solution demonstration, relationship building | Instrumental in securing new OEM partnerships; projected 15% YoY growth |

| Industry Events & Conferences | Lead generation, networking, technology showcasing | High ROI reported; some firms attribute >20% pipeline to single events |

| Digital Presence (Website, Marketing) | Brand building, information source, lead generation | Effective SEO/content marketing led to ~15% qualified lead increase |

| Referrals & Client Advocacy | Word-of-mouth marketing, organic promotion | Up to 50% increase in lead generation from advocacy programs |

| Strategic Partnerships (Consultants, Integrators) | Access to new client segments, bundled offerings | 15% increase in enterprise leads from cloud provider partnerships |

Customer Segments

Aerospace and Defense Original Equipment Manufacturers (OEMs) represent a crucial customer segment for Benchmark. These companies design and build highly critical electronic systems for aircraft, defense platforms, and space missions, where failure is not an option.

This segment's demands are exceptionally high, requiring extreme reliability, unwavering quality control, and strict adherence to a complex web of regulatory and security standards. Meeting these requirements is paramount for any supplier aiming to serve this market.

Benchmark has experienced notable growth within the Aerospace and Defense sector, reflecting its ability to meet these exacting customer needs. In 2024, the global aerospace and defense market was projected to reach over $1.3 trillion, with electronic systems forming a significant portion of that value.

Medical Device Original Equipment Manufacturers (OEMs) are crucial. These companies design and produce a wide range of electronic medical devices, including diagnostic tools, therapeutic equipment, and even implantable devices. Their needs are highly specialized, demanding sterile manufacturing processes and rigorous adherence to regulatory standards like those set by the FDA.

The reliability of these products is paramount, as they are often life-critical. In 2024, the global medical device market was valued at approximately $600 billion, with a significant portion driven by electronic components and systems. Companies in this segment are heavily invested in ensuring product safety and efficacy, which translates to a demand for high-quality, compliant manufacturing partners and component suppliers.

Industrial Equipment OEMs, including those making electronic controls for automation, robotics, energy, and heavy machinery, represent a key customer segment. These manufacturers require electronics that are not only high-performing but also exceptionally durable and reliable, able to withstand harsh industrial conditions.

For instance, the global industrial automation market was valued at approximately $170 billion in 2023 and is projected to grow significantly, indicating a strong demand for the components these OEMs produce. Their need for dependable electronics directly impacts the uptime and efficiency of the machinery they equip.

Semiconductor Capital Equipment OEMs

Semiconductor Capital Equipment Original Equipment Manufacturers (OEMs) represent a critical customer segment for suppliers of advanced electronic subsystems. These companies design and build the highly specialized machinery essential for fabricating microchips, demanding components that are both incredibly precise and often require sophisticated thermal management, such as liquid-cooled solutions.

Benchmark, a key player in this space, has actively pursued and secured substantial business within this sector. Their strategic focus is evident in significant investments aimed at enhancing their capabilities to meet the rigorous demands of semiconductor equipment production. For instance, in 2024, Benchmark reported a notable increase in revenue attributed to its semiconductor capital equipment business, reflecting successful market penetration and expansion.

- Customer Profile: Manufacturers of semiconductor fabrication machinery.

- Key Requirements: High-precision, complex, and often liquid-cooled electronic subsystems.

- Benchmark's Engagement: Demonstrated significant growth and strategic investment in this sector, with 2024 revenue showing a substantial uplift from semiconductor capital equipment sales.

- Market Dynamics: This segment is characterized by rapid technological advancement and a constant need for innovation in manufacturing equipment.

Advanced Computing and Communications OEMs

Advanced Computing and Communications Original Equipment Manufacturers (OEMs) are crucial clients, demanding cutting-edge solutions for high-performance computing, data centers, and 5G infrastructure. These companies, like NVIDIA or Ericsson, operate in rapidly evolving markets where technological obsolescence is a constant threat.

Their needs center on sophisticated design capabilities, highly scalable manufacturing processes to meet fluctuating demand, and an agile approach to integrating the latest technological advancements. For instance, the global data center market was valued at approximately $226 billion in 2023 and is projected to grow significantly, highlighting the scale of opportunity for suppliers to this segment.

- High Demand for Customization: OEMs require tailored solutions for specialized chipsets, server architectures, and network equipment.

- Emphasis on Performance and Reliability: Solutions must deliver exceptional processing power, low latency, and unwavering uptime.

- Rapid Product Lifecycles: Suppliers need to support frequent product updates and next-generation technology integration.

- Scalability and Global Reach: Manufacturing and supply chains must accommodate large volumes and diverse geographical deployments.

Benchmark serves a diverse range of Original Equipment Manufacturers (OEMs) across several high-tech industries. These include Aerospace and Defense, Medical Devices, Industrial Equipment, Semiconductor Capital Equipment, and Advanced Computing and Communications.

Each segment presents unique demands, from the extreme reliability required in aerospace to the precision and regulatory compliance needed in medical devices. Benchmark's ability to meet these varied and stringent requirements is key to its success.

The company's engagement with these sectors is substantial, with significant growth noted, particularly in the semiconductor capital equipment area in 2024. This expansion underscores Benchmark's capability to deliver specialized solutions in demanding markets.

| Customer Segment | Key Characteristics | Market Size (approx. 2024) | Benchmark's Focus |

| Aerospace & Defense OEMs | Extreme reliability, strict standards | > $1.3 trillion (Global A&D Market) | High-quality, compliant systems |

| Medical Device OEMs | Sterile processes, regulatory adherence (FDA) | ~ $600 billion (Global Medical Device Market) | Life-critical, safe, and effective components |

| Industrial Equipment OEMs | Durability, high performance in harsh conditions | > $170 billion (Global Industrial Automation Market) | Dependable electronics for uptime |

| Semiconductor Capital Equipment OEMs | Precision, thermal management, advanced tech | N/A (Specific market data not readily available for 2024, but high growth) | Significant investment and revenue growth in 2024 |

| Advanced Computing & Communications OEMs | Cutting-edge tech, scalability, rapid lifecycles | > $226 billion (Global Data Center Market) | Customized, high-performance solutions |

Cost Structure

Direct labor is a major expense for Benchmark, encompassing wages and benefits for their manufacturing teams, engineers, and quality assurance staff. In 2024, manufacturing labor costs represented approximately 35% of Benchmark's total operating expenses, reflecting the specialized skills required for their production processes.

The cost of sourcing electronic components, raw materials, and sub-assemblies from a global supplier network is a significant expenditure. For instance, in 2024, the average cost of key semiconductor components saw fluctuations, with some essential chips experiencing price increases of up to 15% due to high demand and limited production capacity.

These procurement expenses are directly impacted by fluctuating global market prices for commodities and the intricate dynamics of the supply chain. The complexity and technological advancement of the components needed for cutting-edge electronics also contribute substantially to these costs, often requiring specialized manufacturing processes.

Manufacturing overhead and facility costs are a significant expense for Benchmark, encompassing utilities, rent, equipment depreciation, and maintenance across its global operations. In 2024, these indirect factory labor and facility-related expenses represented a notable portion of their overall cost structure, as they continue to invest in and maintain their production capabilities worldwide.

Research and Development (R&D) Investment

Benchmark's commitment to Research and Development (R&D) is a cornerstone of its cost structure, fueling innovation and market leadership. These investments are strategically allocated to the creation of novel technologies, the refinement of existing manufacturing processes for greater efficiency, and the enhancement of its design capabilities to meet evolving client needs.

These R&D expenditures are not merely operational costs but are vital for maintaining Benchmark's competitive edge in a dynamic industry. By consistently investing in R&D, the company ensures it can deliver cutting-edge solutions that differentiate it from competitors and address emerging market demands effectively.

- Technology Development: Focus on pioneering new hardware and software solutions.

- Process Improvement: Streamlining manufacturing for cost reduction and quality enhancement.

- Design Enhancement: Investing in user experience and aesthetic appeal of products.

- Long-Term Growth: R&D expenditure directly correlates with future revenue potential and market share expansion.

In 2024, Benchmark allocated approximately $150 million to R&D, representing a 10% increase from the previous year, underscoring its dedication to innovation as a primary driver of long-term growth and profitability.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are the backbone of any business's operational support, encompassing everything from attracting new customers to managing the company's day-to-day functions. These costs are crucial for client acquisition, maintaining corporate governance, and ensuring the smooth running of essential services like IT infrastructure and legal counsel.

In 2024, many companies are seeing a significant portion of their revenue allocated to SG&A. For instance, technology companies often report SG&A as a percentage of revenue, with some in the software sector spending between 20% and 30% on these activities. This investment is vital for brand building and market penetration.

- Sales and Marketing: Costs associated with advertising, promotions, sales force salaries, and commissions.

- General and Administrative: Expenses for executive salaries, accounting, human resources, legal fees, and IT support.

- Corporate Overhead: Costs related to maintaining corporate headquarters, including rent, utilities, and administrative staff.

- Research and Development (sometimes included): While distinct, R&D can overlap with administrative functions in some reporting structures, especially in early-stage companies.

Benchmark's cost structure is heavily influenced by its direct labor and the procurement of essential electronic components. In 2024, direct labor accounted for roughly 35% of operating expenses, while component costs saw price hikes, with some chips increasing by up to 15% due to demand.

Manufacturing overhead, including utilities and equipment depreciation, also forms a significant portion of expenses, as does the substantial investment in Research and Development. In 2024, R&D funding reached $150 million, a 10% increase, highlighting a commitment to innovation and future market positioning.

| Cost Category | 2024 Estimate (% of OpEx) | Key Drivers |

|---|---|---|

| Direct Labor | ~35% | Wages, benefits for manufacturing, engineering, QA |

| Component Procurement | Variable (e.g., +15% on some chips) | Global supply chain, semiconductor demand |

| Manufacturing Overhead | Significant | Utilities, rent, depreciation, maintenance |

| Research & Development | ~$150 Million (10% increase) | New technologies, process improvement, design |

| SG&A | 20-30% (Industry Avg. for Tech) | Sales, marketing, administration, corporate functions |

Revenue Streams

Benchmark's core revenue generation stems from its comprehensive manufacturing and assembly services for original equipment manufacturers (OEMs) in the electronics sector. These fees encompass the direct costs associated with labor, the utilization of advanced machinery, and the allocation of overhead expenses necessary to convert raw materials into fully functional electronic products.

In 2024, the demand for specialized electronics manufacturing continued to be robust, with companies increasingly outsourcing complex assembly processes. This trend is reflected in the growth of the global electronics manufacturing services market, which was projected to reach over $700 billion by the end of 2024, indicating significant revenue opportunities for providers like Benchmark.

Benchmark generates revenue by providing expert product design, engineering, prototyping, and development services to its clients. These service fees represent the direct compensation for Benchmark's specialized knowledge and creative input during the crucial early stages of bringing a new product to life.

For instance, in 2024, companies across various sectors, including tech and consumer goods, continued to invest heavily in R&D, with global R&D spending projected to reach over $2.5 trillion. This highlights a strong market demand for the specialized services Benchmark offers, allowing them to capture significant value from their intellectual contributions.

Benchmark generates income by offering end-to-end supply chain and logistics services. This includes everything from sourcing raw materials and managing stock levels to ensuring efficient global delivery of finished goods.

These specialized services are often priced either as standalone fees, reflecting the complexity and value of each component, or bundled directly into broader manufacturing agreements. For instance, a company might pay a separate fee for Benchmark's inventory optimization software, or the entire logistics package could be a line item within a larger production contract.

In 2024, the global supply chain management market was valued at an estimated $29.5 billion, with logistics management forming a significant portion of that. Companies are increasingly outsourcing these functions to specialists like Benchmark to reduce costs and improve efficiency, driving demand for such revenue streams.

Value-Added and Aftermarket Services

Beyond the initial sale, companies generate significant revenue through value-added and aftermarket services. These can include specialized testing, quality certifications, and crucial post-warranty repair and maintenance. By offering these services, businesses not only secure additional income streams but also foster stronger customer relationships and extend the period over which they can generate revenue from a single customer.

These services are vital for customer retention and can significantly boost lifetime customer value. For instance, in the automotive sector, aftermarket services like extended warranties, scheduled maintenance packages, and genuine parts sales represent a substantial portion of a manufacturer's overall profit. Data from 2024 indicates that the global automotive aftermarket services market was valued at over $450 billion, highlighting the immense financial potential of these offerings.

- Extended Warranties: Offering longer coverage periods beyond the standard warranty can provide predictable revenue and peace of mind for customers.

- Maintenance and Repair: Providing regular servicing and fixing issues can build loyalty and generate recurring income.

- Software Updates and Upgrades: For tech-reliant products, offering new features or performance enhancements through software can be a lucrative stream.

- End-of-Life Management: Services like product refurbishment, recycling, or trade-in programs can create new revenue opportunities and address sustainability concerns.

Non-Recurring Engineering (NRE) and Tooling Charges

Benchmark charges clients one-time fees for Non-Recurring Engineering (NRE) and specialized tooling. These fees cover the initial engineering work and the creation of custom tools or fixtures needed for unique client projects. For instance, in 2024, a significant portion of Benchmark's revenue from new product introductions was attributed to these upfront charges, reflecting the bespoke nature of their manufacturing solutions.

These NRE and tooling charges are crucial for covering the initial investment in developing and setting up production lines for new or highly customized products. This ensures that Benchmark can meet specific client requirements without impacting the cost structure of their ongoing production services.

- NRE Charges: Cover initial engineering design, simulation, and testing for new product specifications.

- Tooling Fees: Include the cost of designing and manufacturing specialized molds, dies, or assembly fixtures.

- Project-Specific Costs: These revenue streams directly address the unique setup and customization needs of each new client engagement.

- Revenue Contribution: In 2024, NRE and tooling represented a notable segment of Benchmark's revenue, particularly for clients launching novel product lines.

Benchmark's revenue streams are diverse, encompassing manufacturing and assembly for OEMs, design and engineering services, and supply chain and logistics management. These core offerings are supplemented by value-added aftermarket services, including extended warranties and maintenance, as well as upfront fees for Non-Recurring Engineering (NRE) and specialized tooling.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| Manufacturing & Assembly | Production of electronic components and finished goods for OEMs. | Global electronics manufacturing services market projected over $700 billion. |

| Design & Engineering | Product design, R&D, prototyping, and development services. | Global R&D spending projected over $2.5 trillion. |

| Supply Chain & Logistics | Sourcing, inventory management, and global delivery of products. | Global supply chain management market valued at an estimated $29.5 billion. |

| Aftermarket Services | Extended warranties, maintenance, repair, software updates, and end-of-life management. | Global automotive aftermarket services market valued at over $450 billion. |

| NRE & Tooling | Upfront fees for initial engineering and custom tool creation for specific projects. | Key contributor to revenue for new product introductions and bespoke solutions. |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, competitor analysis, and internal financial data. These diverse sources ensure a robust and accurate representation of the business's strategic framework.