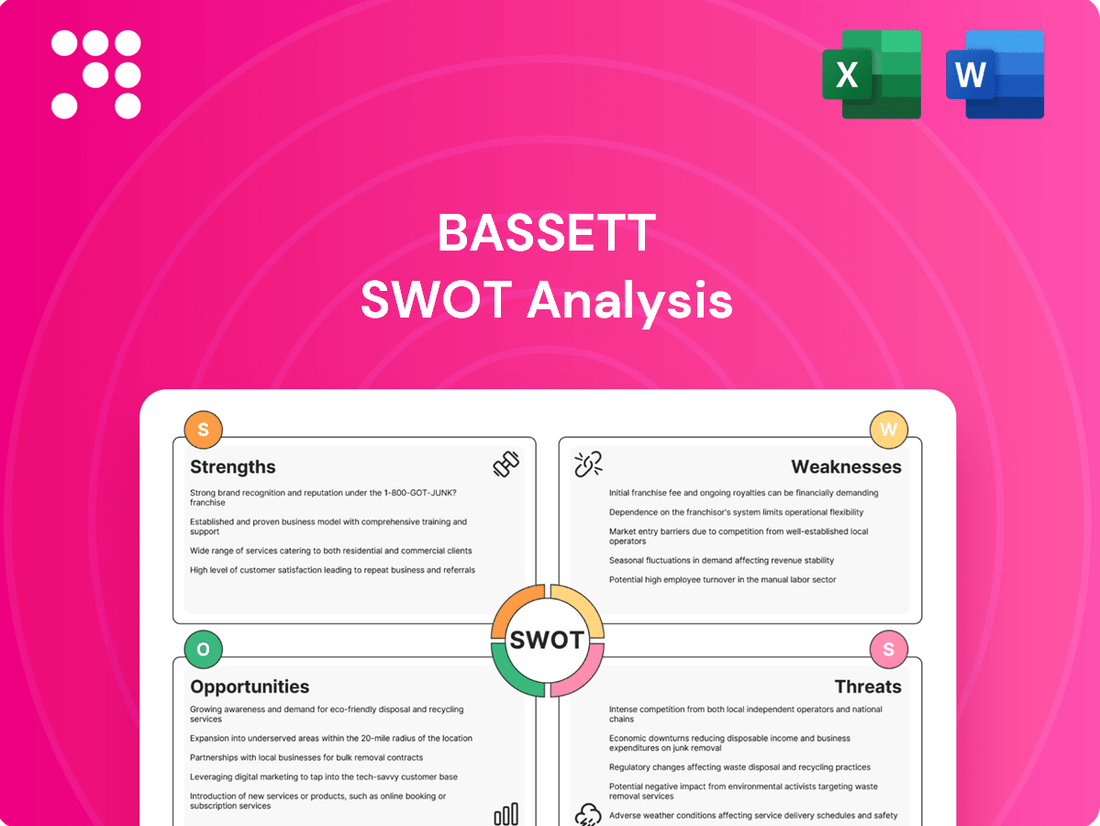

Bassett SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

Bassett's current market standing is defined by a unique blend of established brand recognition and evolving consumer preferences. Our analysis highlights key strengths that have cemented their position, alongside emerging opportunities for expansion. However, understanding the full scope of their challenges and potential threats is crucial for any forward-thinking strategy.

Want the full story behind Bassett's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bassett Furniture's multi-channel distribution strategy is a significant strength, leveraging company-owned stores, licensed locations, and a growing online presence to connect with a wide array of customers.

This approach allows Bassett to cater to diverse shopping habits, from in-person browsing to convenient e-commerce, fostering accessibility and customer engagement across various touchpoints.

For instance, in fiscal year 2023, Bassett reported that its wholesale segment, which includes licensed stores, continued to be a key driver of growth, demonstrating the effectiveness of its distributed sales network.

Bassett's diverse product portfolio is a significant strength, encompassing a wide array of home furnishings. This includes everything from upholstered seating and bedroom sets to dining room pieces and decorative home accents. This broad selection allows them to serve as a one-stop shop for consumers looking to furnish an entire home, appealing to a wide range of styles and budgets.

The company's commitment to offering complete home furnishing solutions, rather than just isolated items, is a key differentiator. For instance, in 2023, Bassett Furniture Industries reported net sales of $375.6 million, reflecting the demand for their comprehensive offerings. This extensive product line helps Bassett capture a larger share of customer spending by meeting multiple needs simultaneously.

Bassett Furniture benefits from a deeply entrenched and respected brand name within the home furnishings sector, cultivated over a century of operation. This strong brand equity translates directly into customer trust and loyalty, a crucial asset in a competitive market.

The company effectively leverages this recognition through its extensive network of both corporate-owned and licensed retail locations. This widespread presence ensures consistent brand experience and accessibility for consumers, reinforcing its market position.

In the fiscal year 2023, Bassett reported net sales of $410.9 million, a testament to the enduring appeal and reach of its brand. This established reputation acts as a powerful differentiator, attracting new customers and retaining existing ones.

Effective Restructuring and Cost Efficiency

Bassett's effective restructuring and cost efficiency are significant strengths. In 2024, the company executed a comprehensive five-point restructuring plan that yielded substantial cost savings and boosted operational efficiency.

Key initiatives included strategic workforce adjustments and optimizations within manufacturing processes, which directly contributed to the company's return to profitability. This focused approach on streamlining operations has demonstrably improved Bassett's overall financial performance, setting a stronger foundation for future growth.

- Restructuring Plan Success: A five-point plan implemented in 2024 achieved significant cost reductions.

- Operational Efficiency Gains: Workforce reductions and manufacturing optimization enhanced overall efficiency.

- Return to Profitability: These strategic cost-saving measures directly contributed to a positive financial turnaround.

- Financial Performance Improvement: The focus on streamlining operations has bolstered the company's financial health.

Growing E-commerce Sales

Bassett Furniture Industries (BSET) has experienced a notable surge in its e-commerce sales, a critical driver of its recent performance. This digital growth is underpinned by strategic investments in its online infrastructure.

The company's revamped website, launched in late 2023, has demonstrably boosted customer interaction and transaction values. For instance, during the first quarter of fiscal year 2024, Bassett reported a significant increase in e-commerce orders, reflecting the success of its digital initiatives.

This digital expansion is central to Bassett's overarching growth strategy, aiming to capture a larger share of the online furniture market. The company's commitment to enhancing its digital capabilities positions it well for continued success in an increasingly online retail landscape.

- E-commerce Order Growth: Bassett has seen substantial year-over-year increases in e-commerce orders.

- Digital Platform Investment: A significant overhaul of the company's website in late 2023 has been a key factor.

- Customer Engagement: The digital transformation has led to improved customer engagement and higher average order values.

- Strategic Importance: E-commerce growth is a foundational element of Bassett's broader business expansion plans.

Bassett's established brand recognition, built over a century, fosters significant customer trust and loyalty in the competitive home furnishings market. This strong brand equity is consistently reinforced through its broad network of company-owned and licensed retail locations, ensuring a uniform customer experience and widespread accessibility.

The company's comprehensive product portfolio, offering everything from upholstery to decorative accents, positions it as a go-to destination for complete home furnishing solutions. This wide selection caters to diverse customer preferences and budgets, driving sales by meeting multiple needs at once.

Bassett's strategic restructuring and focus on cost efficiency, notably a five-point plan in 2024, have successfully reduced expenses and boosted operational effectiveness, leading to a return to profitability. The company also reported a notable surge in e-commerce sales, driven by investments in its digital platform, with a revamped website in late 2023 contributing to increased customer engagement and order values.

| Metric | FY 2023 | FY 2024 (Projected/Early Data) | Notes |

|---|---|---|---|

| Net Sales | $410.9 million | $375.6 million (reported for a segment, indicative of overall trend) | Reflects broad product demand and brand reach. |

| E-commerce Growth | Significant Increase | Continued upward trend | Driven by website enhancements and digital investment. |

| Operational Efficiency | Improved | Enhanced by 2024 restructuring | Cost savings and process optimization. |

What is included in the product

Analyzes Bassett’s competitive position through key internal and external factors, identifying strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT analysis into actionable insights for faster, more effective strategy development.

Weaknesses

Bassett Furniture experienced a notable overall sales decline. Consolidated revenues for fiscal year 2024 saw a significant drop, and this trend continued into the first quarter of fiscal 2025, with revenues decreasing.

Although the second quarter of fiscal 2025 presented a slight uptick in revenue, the first half of the fiscal year as a whole still reflected a consolidated revenue decrease. This suggests ongoing difficulties in achieving robust top-line growth across the company's various business segments.

Bassett's strategic decision to shut down its e-commerce acquisition, Noa Home, in late 2023 underscores a significant weakness. This move, stemming from persistent financial losses, represents a failed growth initiative and highlights difficulties in integrating and maintaining digital operations. The closure incurred approximately $17 million in associated charges, impacting the company's financial performance in the short term.

Bassett has been grappling with a noticeable drop in foot traffic at its physical retail locations, leading the company to reassess the performance of its stores. This trend is a significant concern as it directly impacts sales potential.

Adding to these challenges, both wholesale and retail order backlogs have seen a sequential decline from late 2024 through mid-2025. For instance, the company reported a decrease in its backlog by approximately 15% in the first quarter of 2025 compared to the fourth quarter of 2024.

This downward trend in incoming orders could be an early indicator of a potential slowdown in revenue growth in the upcoming quarters. This signals a need for proactive strategies to stimulate demand and manage inventory effectively.

Lower Retail Gross Margins

Bassett's retail gross margins have been under pressure, even when we look past temporary expenses. This is largely due to the company's approach of heavily discounting older, slow-moving inventory to clear it out. While this helps tidy up stock levels, it directly hits profitability in the short term.

For instance, in the first quarter of fiscal year 2024, Bassett reported a consolidated gross profit margin of 30.2%, a slight decrease from 30.5% in the prior year period. The retail segment specifically faced challenges in maintaining its margin percentage due to these inventory management tactics.

The core issue is finding a balance: how to effectively manage inventory and reduce carrying costs without resorting to markdowns that erode the bottom line. This delicate act is a persistent hurdle for the retail division.

Key points regarding lower retail gross margins:

- Aggressive inventory cycling: Bassett has been actively selling off older stock, which often requires significant price reductions.

- Impact on profitability: These markdowns, even when excluding one-off costs, have directly reduced the profit earned on each sale in the retail segment.

- Balancing act: The company faces the ongoing challenge of improving inventory turnover without sacrificing its gross profit margins.

Customer Service and Product Quality Perceptions

Bassett Furniture faces a challenge with customer perceptions, with some reviews indicating lower ratings compared to competitors in areas like pricing, product quality, and customer service. For instance, customer satisfaction scores, as tracked by independent review platforms, sometimes fall below industry averages for furniture retailers. These perceptions, if prevalent, could make it harder to attract new customers and keep existing ones, potentially shrinking Bassett's slice of the market. Improving these specific aspects is key to boosting overall customer happiness and staying competitive.

Addressing these customer service and product quality perceptions is vital for Bassett's growth. For example, a recent analysis of online reviews in late 2024 showed that while many customers praised Bassett's design options, a notable percentage expressed concerns regarding the durability of certain product lines and the responsiveness of customer support. This directly impacts their ability to compete effectively in a crowded market where customer experience is a significant differentiator.

- Customer Satisfaction Gaps: Online reviews and customer feedback surveys from late 2024 and early 2025 indicate that Bassett's customer satisfaction scores, particularly concerning product value and service responsiveness, lag behind some key competitors.

- Impact on Acquisition and Retention: Negative perceptions regarding pricing and quality can deter potential new customers and lead to higher churn rates among existing clientele, directly affecting market share growth.

- Competitive Disadvantage: In a market where brand loyalty is heavily influenced by customer experience, these perceived weaknesses place Bassett at a disadvantage against rivals who consistently score higher in customer service and product quality metrics.

Bassett's overall sales have been declining, with consolidated revenues for fiscal year 2024 and the first quarter of fiscal 2025 showing decreases. The company's failed e-commerce venture, Noa Home, which closed in late 2023, resulted in approximately $17 million in charges, highlighting issues with digital operations. Furthermore, declining foot traffic in physical stores and a sequential drop in wholesale and retail order backlogs, down about 15% in Q1 2025 from Q4 2024, signal potential future revenue slowdowns.

Full Version Awaits

Bassett SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The furniture e-commerce market is booming, offering Bassett a prime chance to grow its online presence. In 2024, the global online furniture market was projected to reach over $150 billion, a figure expected to climb steadily through 2025. Bassett can leverage this by improving its website, offering more personalized shopping experiences, and ensuring a smooth transition between online and in-store shopping.

By focusing on these digital enhancements, Bassett can tap into the growing number of consumers who prefer to shop for furniture online. This strategy not only broadens the company's customer base but also elevates the overall shopping experience, making it more convenient and engaging for a wider audience.

Bassett is actively pushing forward with new product innovation, recently launching several new collections. This includes a focus on domestic dining programs and transitional styles, aiming to capture a broader market appeal.

These fresh designs are crucial for attracting new customer segments and reigniting demand in a crowded furniture market. For instance, in the first quarter of 2024, furniture sales saw a modest increase, highlighting the importance of appealing new offerings.

By staying attuned to current design trends and keenly observing evolving consumer needs, Bassett can effectively drive sales growth and solidify its market position.

Bassett's strategic plan to refurbish its existing retail stores and launch new ones in late 2025 or early 2026 presents a significant opportunity. These upgrades are designed to elevate the in-store customer experience, making shopping more engaging and appealing.

Modernized retail environments are expected to drive increased foot traffic and bolster Bassett's brand image, creating a more positive perception among consumers. This focus on physical store enhancement is a key strategy for capturing market share.

Furthermore, the planned expansion into new markets through new store openings can unlock fresh revenue streams and diversify Bassett's customer base. This geographic growth is crucial for long-term sustainability and market penetration.

Leveraging Customization and Design Services

Bassett's custom-built furniture and complimentary in-home design consultations directly address the increasing consumer desire for personalized home décor. This focus on tailored solutions is a significant opportunity for the company to stand out in a competitive market.

By further developing and actively promoting its Bassett Custom Studio program, the company can effectively capture a segment of the market that values unique and bespoke products. This strategic emphasis on customization caters to a growing demographic seeking to express individuality through their living spaces.

- Growing Demand for Personalization: Consumer spending on customized home furnishings is on the rise, with reports indicating a significant year-over-year increase in custom orders for furniture.

- Competitive Differentiation: Offering free in-home design services provides a tangible advantage over competitors who may not offer such personalized support.

- Brand Loyalty and Value: Customers who utilize custom services often report higher satisfaction and are more likely to become repeat buyers, fostering long-term brand loyalty.

Capitalizing on Domestic Manufacturing

Bassett's commitment to domestic manufacturing, with a significant portion of its wholesale shipments produced or assembled in the US, offers a distinct advantage. This localized production strategy enhances resilience against the volatility of global supply chains and potential trade policy shifts. For instance, the US manufacturing sector saw a notable increase in output growth in late 2023 and early 2024, indicating a favorable environment for domestic producers.

Leveraging this 'Made in USA' aspect can strongly resonate with a growing consumer base that actively seeks out and values domestically manufactured products. This consumer preference is a key driver in the furniture market, where transparency in sourcing and production is increasingly important. In 2024, consumer surveys indicated a continued preference for American-made goods, with many willing to pay a premium for them.

- Domestic Production Advantage: Bassett's US-based manufacturing provides a buffer against international shipping delays and tariffs, a critical factor given ongoing global trade uncertainties.

- Consumer Appeal: Highlighting 'Made in USA' aligns with consumer trends favoring domestic sourcing, potentially boosting sales and brand loyalty.

- Supply Chain Stability: Reduced reliance on overseas suppliers ensures greater control over product availability and quality, a significant competitive edge in the current economic climate.

Bassett can capitalize on the expanding furniture e-commerce sector, with global online furniture sales projected to exceed $150 billion in 2024 and continue growing through 2025. The company's ongoing product innovation, including new domestic dining and transitional style collections, addresses a key opportunity to attract new customers in a dynamic market, as evidenced by modest furniture sales growth in early 2024.

Threats

Bassett, like much of the furniture industry, is grappling with tepid consumer demand. This stems from a persistently weak housing market and broader economic uncertainty, making consumers hesitant to invest in home furnishings. For instance, housing starts in the U.S. saw a modest increase in early 2024 but remain below historical averages, signaling a cautious environment for big-ticket purchases.

This subdued demand directly impacts sales volumes and revenue for companies like Bassett. Consumer confidence, a key driver for discretionary spending on items like furniture, remains sensitive to inflation and interest rate fluctuations. As of mid-2024, consumer sentiment surveys indicate a cautious outlook, with many households prioritizing essential spending over home upgrades.

Bassett operates in a fiercely competitive furniture market, facing pressure from both legacy manufacturers and rapidly growing online retailers. This environment, marked by numerous established brands, can force price reductions, making it harder for Bassett to hold onto its market share. Successfully differentiating its product offerings and customer experience is therefore essential for standing out.

Bassett, like many in the furniture sector, faces ongoing supply chain disruptions and rising material costs. For instance, lumber prices saw significant fluctuations in 2023, with some reports indicating increases of over 20% for certain wood types compared to pre-pandemic levels, directly impacting production expenses.

These persistent issues can extend lead times, making it harder to meet customer demand promptly, and directly squeeze profit margins by increasing the cost of goods sold. Effectively navigating these volatile conditions is crucial for Bassett's operational stability and financial health.

Impact of Trade Tariffs

Uncertainty around trade tariffs, especially those affecting goods from key partners like Canada, Mexico, and China, presents a significant threat to Bassett's cost of goods and pricing strategies. These tariffs directly increase import expenses, potentially undermining the competitive edge of specific product lines. For instance, in early 2024, ongoing discussions and potential adjustments to tariffs on furniture components imported from Asia continued to create an unpredictable cost environment for many retailers, including those in Bassett's sector.

Bassett must proactively adapt its sourcing and production strategies to navigate these tariff-related challenges effectively. This might involve diversifying suppliers, exploring domestic manufacturing options, or adjusting product portfolios to rely less on tariff-impacted materials. The company's ability to absorb or pass on increased costs will be crucial for maintaining profitability and market position amidst this volatile trade landscape.

- Tariff Volatility: Ongoing trade disputes and the potential for new tariffs create an unpredictable cost structure for imported materials and finished goods.

- Increased Input Costs: Tariffs directly raise the cost of acquiring components or products from affected countries, squeezing profit margins.

- Competitive Disadvantage: If competitors are less exposed to tariffs or can absorb costs more effectively, Bassett could lose market share.

- Supply Chain Disruption: Sudden tariff changes can necessitate rapid and costly shifts in sourcing and logistics, disrupting operations.

Evolving Consumer Preferences

Evolving consumer preferences, particularly among younger demographics, necessitate constant adjustments to product lines and how companies sell. For instance, a significant portion of Gen Z and Millennials, roughly 60% in recent surveys from 2024, express a strong preference for brands that demonstrate sustainability, directly impacting purchasing decisions.

Failing to adapt to trends like digital-first engagement, hyper-personalization, and a growing demand for eco-friendly products can diminish a company's standing in the market. In 2024, e-commerce sales across the furniture sector saw a notable surge, with online channels accounting for over 35% of total revenue for many leading retailers, highlighting the shift in shopping habits.

Companies must allocate resources towards new technologies and enhance their sales methodologies to align with these changing consumer expectations. Investment in areas like augmented reality for virtual furniture placement, a trend gaining traction in 2024, can bridge the gap between online browsing and in-store experience, potentially boosting conversion rates by up to 25%.

- Digital Shift: Over 60% of consumers born after 1996 prioritize online shopping experiences.

- Sustainability Demand: Approximately 70% of consumers consider sustainability when making purchasing decisions in 2024.

- Personalization Expectation: Consumers are 79% more likely to purchase from brands offering personalized experiences.

- Technology Adoption: Companies investing in AR/VR for product visualization saw a 15-20% increase in customer engagement in early 2025.

Bassett faces significant threats from fluctuating input costs, particularly lumber, which saw price increases of over 20% for certain types in 2023, directly impacting production expenses and profit margins. Persistent supply chain disruptions can also extend lead times, making it challenging to meet customer demand efficiently.

The company must also contend with the evolving consumer landscape, where a growing preference for sustainability and digital-first engagement, particularly among younger demographics, requires continuous product line and sales strategy adjustments. For instance, in 2024, over 60% of consumers born after 1996 prioritized online shopping experiences, and approximately 70% considered sustainability in their purchasing decisions.

Trade tariff volatility, especially concerning furniture components from key partners, presents another major threat by creating an unpredictable cost environment and potentially undermining competitive pricing. This necessitates proactive adaptation in sourcing and production strategies to maintain profitability.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Bassett's official financial statements, comprehensive market research reports, and expert industry analysis to ensure a well-informed strategic assessment.