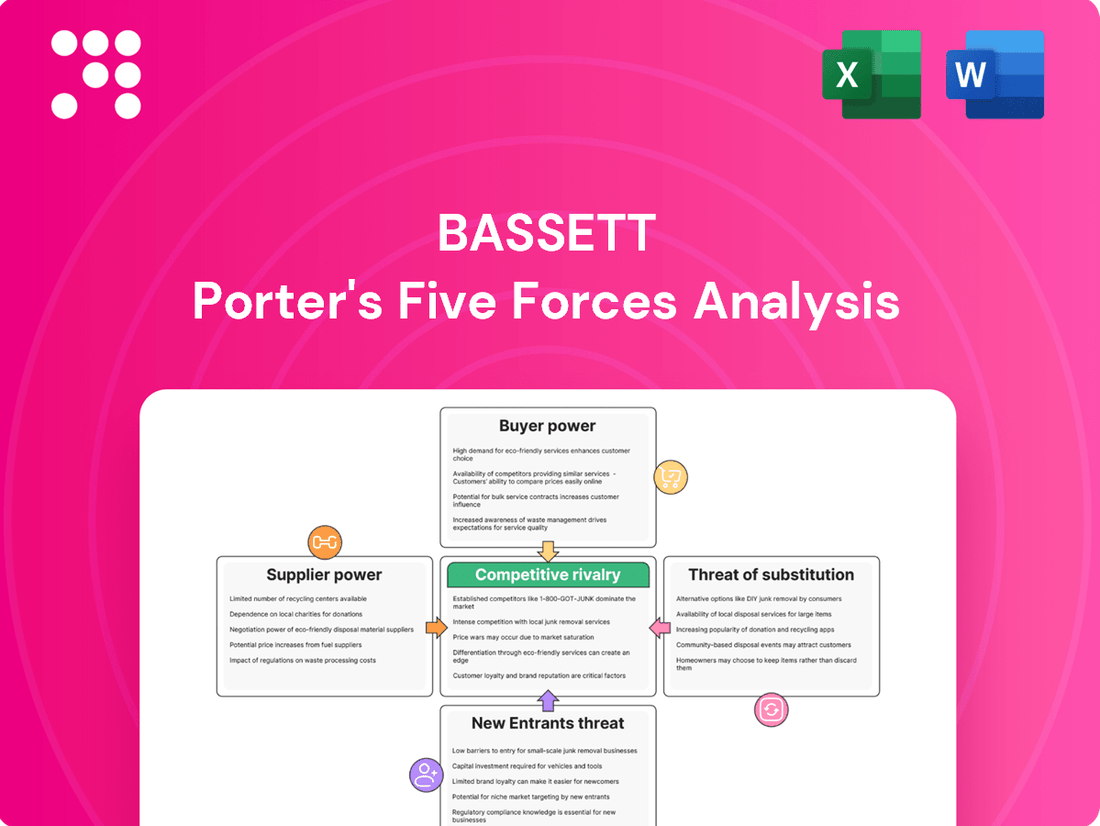

Bassett Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

Bassett's Porter's Five Forces Analysis reveals the intense competitive landscape, highlighting the significant bargaining power of buyers and the moderate threat of new entrants. Understanding these forces is crucial for navigating the furniture industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bassett’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The furniture industry, including companies like Bassett Furniture Industries, depends heavily on essential raw materials like wood, various fabrics, and metals. While a broad market may exist for common materials, the need for specialized grades or unique types of wood, for instance, can significantly narrow the pool of available suppliers. This scarcity of specialized options grants these few key providers greater bargaining power.

For Bassett, a limited number of suppliers for critical components means they have less leverage in price negotiations. If a specialized wood or a unique fabric comes from only a handful of producers, those producers can dictate terms more effectively. This concentration can lead to Bassett facing increased costs or potential disruptions if these key suppliers decide to raise prices or face their own production issues.

In 2023, the global furniture market was valued at approximately $730 billion, highlighting the scale of operations and the importance of managing supply chain costs. A study by Statista indicated that raw material costs, particularly for lumber and textiles, represent a significant portion of furniture manufacturing expenses, underscoring the impact of supplier bargaining power on profitability.

The bargaining power of suppliers is significantly influenced by the volatility in raw material costs. For instance, prices for key inputs in the furniture industry, such as lumber and wood furniture and fixtures, experienced notable increases throughout 2024. This upward trend in raw material expenses directly translates to higher manufacturing costs for companies like Bassett.

When suppliers can successfully pass these increased costs onto manufacturers, their bargaining power strengthens. This is particularly true when demand for these essential raw materials is robust, giving suppliers more leverage to dictate terms and pricing.

Ongoing trade tariff uncertainty, especially concerning goods from China, Canada, and Mexico, directly impacts Bassett's component and finished product costs. This geopolitical landscape can strengthen the bargaining power of international suppliers unaffected by tariffs or those with diversified supply chains, potentially driving up Bassett's input expenses.

The furniture sector has grappled with persistent global supply chain disruptions. For instance, in 2023, the average lead time for furniture orders experienced significant increases, with some components seeing delays of over six months, directly empowering suppliers who can meet these demands more reliably.

Domestic Manufacturing vs. Imported Components

Bassett Furniture Industries' domestic manufacturing focus, with nearly 80% of wholesale shipments produced in-house, offers a degree of insulation from the volatility of finished goods imports. This domestic production base can mitigate risks associated with tariffs and international shipping disruptions. However, the bargaining power of suppliers remains a factor, particularly for essential components that may still be sourced internationally.

Even with a strong domestic manufacturing footprint, Bassett’s reliance on imported components can grant significant leverage to those specific suppliers, especially if those components are unique or have limited alternative sources. This is a critical consideration for managing input costs and ensuring production continuity.

- Domestic Production Advantage: Bassett's domestic manufacturing insulates it from finished goods import tariffs and disruptions, a key factor in managing supply chain risk.

- Component Sourcing Vulnerability: Reliance on imported components, even for domestically assembled products, can concentrate bargaining power with those specific suppliers.

- Strategic Sourcing: Bassett’s blended strategy of custom domestic production and sourced major collections aims to balance value, quality, and supplier dependency.

- 2024 Impact: Ongoing geopolitical tensions and trade policies in 2024 continue to highlight the importance of managing supplier relationships for critical imported components.

Supplier's Ability to Differentiate Offerings

Suppliers offering unique materials or specialized finishes can significantly influence pricing. For instance, a supplier providing a proprietary wood treatment essential for Bassett's premium furniture lines holds considerable sway. This differentiation makes it harder for Bassett to find comparable alternatives, thus increasing supplier bargaining power.

When Bassett's product quality or distinctiveness relies heavily on a supplier's specialized technology or unique components, the switching costs can be substantial. This dependency amplifies the supplier's leverage, potentially leading to higher prices or less favorable payment terms for Bassett. In 2024, the furniture industry saw increased demand for sustainable and ethically sourced materials, giving suppliers of certified lumber or recycled components a stronger negotiating position.

- Differentiated Offerings: Suppliers with unique materials, finishes, or proprietary technology gain leverage.

- Switching Costs: High switching costs for Bassett due to reliance on specialized supplier inputs increase supplier influence.

- Industry Trends (2024): Demand for sustainable materials empowered suppliers in this niche, impacting Bassett's sourcing.

Suppliers hold significant bargaining power when they offer unique or specialized inputs that are difficult for furniture manufacturers like Bassett to substitute. This power is amplified if switching to another supplier involves high costs or potential quality compromises.

In 2024, the furniture industry's focus on sustainability has empowered suppliers of certified or recycled materials, giving them a stronger negotiating position. This trend directly affects Bassett's sourcing strategies and input costs.

The concentration of suppliers for critical components, especially specialized ones, allows those providers to dictate terms and prices more effectively. Bassett's reliance on a limited number of these specialized suppliers can lead to increased expenses and potential supply chain disruptions.

| Factor | Impact on Bassett | 2024 Relevance |

|---|---|---|

| Supplier Specialization | Increases supplier leverage; higher costs | Growing demand for unique finishes |

| Switching Costs | High dependency; limits negotiation options | Essential for proprietary treatments |

| Supplier Concentration | Reduced price negotiation power for Bassett | Key for specialized components |

What is included in the product

Bassett's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Effortlessly identify and mitigate competitive threats with a pre-built framework that simplifies complex market dynamics.

Customers Bargaining Power

Customers in the home furnishings sector are increasingly blending online research with in-store visits. This hybrid approach allows them to meticulously compare prices, styles, and customer reviews from multiple retailers, giving them a distinct advantage. For instance, a 2024 study indicated that over 70% of furniture purchases involved some form of online research beforehand, highlighting the amplified bargaining power of the informed consumer.

Customers often scrutinize prices, particularly for significant investments like furniture, and are on the lookout for the best deals. Bassett's CEO highlighted a strategic emphasis on price value messaging for 2025, underscoring customer responsiveness to competitive pricing strategies.

The sheer volume of furniture options available amplifies this customer price sensitivity, forcing companies to remain competitive to attract and retain buyers.

The home furnishings sector is intensely competitive, featuring a multitude of providers. Companies like Wayfair, Ashley Furniture Industries, Ethan Allen Interiors, and La-Z-Boy are prominent players, offering customers a broad spectrum of choices.

This abundance of options significantly strengthens customer bargaining power. If a customer finds Bassett's pricing, product quality, or service unsatisfactory, they can readily shift their business to any of the numerous competitors.

Declining Store Traffic and Housing Market Impact

Bassett Furniture Industries (BSET) has faced a notable decline in store traffic within its retail segment. This trend directly influences customer demand, inherently shifting more bargaining power into the hands of consumers. When fewer customers are visiting physical stores, the imperative for Bassett to attract and retain them increases, making them more sensitive to pricing and product offerings.

The broader economic climate, particularly the housing market, significantly amplifies this dynamic. A historically weak housing market, coupled with elevated interest rates as seen throughout much of 2023 and into 2024, dampens consumer confidence. This cautious sentiment directly impacts discretionary spending on big-ticket items like home furnishings, further empowering buyers who may delay purchases or seek better value.

- Declining Foot Traffic: Bassett's retail segment has experienced a downward trend in store visits, a key indicator of reduced customer engagement and increased buyer leverage.

- Housing Market Weakness: The sluggish housing market, a critical sector for home furnishings demand, directly correlates with lower consumer spending in this category.

- Interest Rate Impact: High interest rates, prevalent in the recent economic environment, increase the cost of borrowing for consumers, leading to reduced purchasing power and a greater emphasis on price sensitivity.

- Consumer Confidence: A general decline in consumer confidence, often linked to economic uncertainty and housing market conditions, makes customers less likely to make significant purchases, thereby strengthening their bargaining position.

Demand for Customization and Personalization

Modern consumers increasingly seek furniture that mirrors their unique tastes, fueling a strong demand for customization and personalized retail experiences. This trend allows customers to hold significant bargaining power, as they can leverage their desire for tailored products to negotiate better terms or seek out competitors who offer more bespoke options. For instance, a significant portion of furniture buyers in 2024 expressed interest in custom sizing and fabric choices, with some willing to pay a premium, but also expecting greater flexibility in the design process.

Retailers are responding by integrating advanced digital tools, such as 3D visualization software and AI-driven design assistants, to enhance the customer journey. These technologies allow shoppers to preview furniture in their own spaces and experiment with different configurations, making the customization process more engaging. Companies like Bassett, which already offer custom-built furniture and in-house design consultations, are well-positioned to meet this demand. However, this very ability to personalize can empower customers to push for more specific modifications or even price concessions, knowing that the company has the infrastructure to accommodate their requests.

- Consumer Demand for Personalization: A 2024 survey indicated that over 60% of furniture buyers considered customization options important when making a purchase decision.

- Impact of Digital Tools: Retailers employing virtual room planning tools saw an average increase of 15% in customer engagement and a 10% uplift in conversion rates for customized items.

- Leveraging Customization: Customers who actively use personalization features are more likely to negotiate for specific material upgrades or delivery timelines, increasing their bargaining leverage.

Customers in the home furnishings market wield significant bargaining power due to increased price transparency and a vast array of choices. The ease of online research, coupled with a competitive retail landscape featuring major players like Wayfair and Ashley Furniture, means customers can readily compare options and seek the best value. This heightened awareness, amplified by economic factors like interest rates and housing market conditions, compels companies to offer competitive pricing and compelling product assortments to capture and retain buyer loyalty.

The demand for personalized furniture further enhances customer leverage. As consumers increasingly seek unique styles and customization, they gain power by being able to negotiate for specific modifications or explore competitors offering bespoke solutions. Retailers investing in digital tools to facilitate customization, while enhancing the customer experience, also create opportunities for customers to leverage these capabilities in their purchasing decisions.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024 unless noted) |

|---|---|---|

| Online Price Comparison | Significantly Increases | Over 70% of furniture purchases involved online research prior to buying. |

| Number of Competitors | High | Presence of numerous large players (e.g., Wayfair, Ashley Furniture) offers wide choice. |

| Economic Conditions | Amplifies | Weak housing market and high interest rates (prevalent through 2023-2024) lead to cautious consumer spending. |

| Demand for Customization | Increases | Over 60% of furniture buyers considered customization important in 2024. |

Preview Before You Purchase

Bassett Porter's Five Forces Analysis

This preview showcases the complete Bassett Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring no surprises or missing content. You can confidently download and utilize this comprehensive analysis for your strategic planning and decision-making processes.

Rivalry Among Competitors

The home furnishings sector is characterized by its fragmentation, featuring a vast number of competitors from large national retailers to niche online sellers. Bassett Furniture Industries faces intense rivalry from established players like Mohawk Industries, Flexsteel Industries, Wayfair, Ethan Allen Interiors, and Hooker Furniture, among many others.

This crowded marketplace exerts significant pressure on pricing strategies and the ability to capture and retain market share. For instance, in 2023, the U.S. home furnishings market was valued at approximately $130 billion, with numerous companies vying for a piece of this substantial pie.

The furniture and home furnishings sector experienced a noticeable dip in new orders and sales throughout much of 2024. This downturn is largely attributed to a sluggish housing market and persistent economic uncertainty, which naturally dampens consumer spending on discretionary items like furniture.

While industry forecasts suggest a potential rebound in 2025, the current environment of declining demand significantly heightens competitive rivalry. Companies are increasingly fighting for a smaller or stagnant customer base, leading to more aggressive pricing and promotional activities.

The furniture industry is seeing fierce competition driven by a significant shift towards e-commerce and omnichannel strategies. Competitors are pouring resources into their digital infrastructure, offering features like immersive 3D product views and seamless online-to-in-store experiences to capture market share. This digital arms race is a critical battleground for customer engagement and sales.

Bassett Furniture Companies (BSET) is actively participating in this trend, investing in its own e-commerce expansion and omnichannel capabilities. For instance, in their fiscal year 2024, Bassett continued to refine its digital presence, aiming to provide a cohesive customer journey across all touchpoints. This focus underscores the intense rivalry in leveraging technology to meet evolving consumer shopping habits.

Product Differentiation and Customization as Competitive Levers

Companies within the furniture industry, including Bassett, actively differentiate their offerings through distinctive product designs, superior quality, and the flexibility to provide tailored solutions. This focus on uniqueness is crucial for standing out in a competitive landscape.

Bassett Furniture particularly leverages this by highlighting its stylish, high-quality, and custom-built furniture. A key differentiator for them is the offering of free in-home design visits, which directly addresses customer needs for personalized spaces and expert guidance.

The intense rivalry in the furniture sector compels businesses to constantly innovate and clearly communicate their unique selling propositions. This sustained effort is essential for capturing and maintaining customer loyalty in a market where choices are abundant.

- Product Design & Quality: Bassett's commitment to stylish and quality-crafted furniture forms a core part of its appeal.

- Customization: The ability to offer custom-built furniture allows Bassett to meet specific consumer preferences, a significant competitive advantage.

- Service Differentiation: Free in-home design consultations provide a valuable service that enhances customer experience and commitment.

- Market Impact: In 2023, the U.S. furniture and bedding stores sector generated approximately $140 billion in revenue, underscoring the high stakes of differentiation in this market.

Cost Structure and Operational Efficiency

Bassett's commitment to cost management is evident in its strategic restructuring. In 2024, the company continued its efforts to optimize its operational footprint, which included workforce adjustments and the consolidation of warehouse facilities. These moves are designed to create a more agile and cost-effective business model.

Achieving operational efficiency is paramount in the face of intense industry competition. Bassett's focus on streamlining its supply chain and internal processes aims to reduce overheads and improve its ability to respond to market demands. Companies that excel in maintaining a lean operating structure while consistently delivering high-quality products are better positioned to thrive.

- Workforce Reductions: Bassett has undertaken targeted workforce reductions as part of its ongoing efficiency drive.

- Warehouse Consolidation: The company is consolidating its warehouse network to reduce logistical costs and improve inventory management.

- Cost-Saving Initiatives: These operational changes are projected to yield significant cost savings, enhancing Bassett's competitive standing.

The competitive rivalry in the home furnishings sector is fierce due to a fragmented market with numerous players, from large retailers to niche online sellers. Bassett Furniture faces significant competition from established companies like Mohawk Industries and Wayfair. This intense competition pressures pricing and market share, especially as the U.S. home furnishings market, valued at approximately $130 billion in 2023, sees a slowdown in demand during 2024.

The industry's shift towards e-commerce and omnichannel strategies fuels this rivalry, with companies investing heavily in digital capabilities. Bassett itself is enhancing its digital presence to offer a seamless customer journey. Differentiation through product design, quality, customization, and services like free in-home design visits are crucial for standing out. For example, the U.S. furniture and bedding stores sector generated about $140 billion in revenue in 2023, highlighting the importance of these strategies.

| Key Competitors | 2023 Revenue (Approx.) | Key Differentiators |

|---|---|---|

| Mohawk Industries | $10.5 billion | Broad product portfolio, strong brand recognition |

| Wayfair | $12.2 billion | Extensive online selection, fast delivery |

| Ethan Allen Interiors | $750 million | Design services, classic styles |

| Hooker Furniture | $350 million | Quality craftsmanship, diverse collections |

SSubstitutes Threaten

The rise of DIY and home improvement presents a significant threat of substitutes for furniture retailers like Bassett. Consumers are increasingly channeling their spending into personalizing and upgrading existing spaces, often through DIY projects, rather than buying new furniture. This shift is fueled by a desire for unique aesthetics and cost-effectiveness. For example, in 2024, the global home improvement market was projected to reach over $900 billion, indicating substantial consumer investment in this area.

The expanding market for used, vintage, and second-hand furniture presents a considerable threat to new furniture sales. Consumers are increasingly drawn to these options for their unique character and more accessible price points. For instance, online marketplaces and consignment shops saw a surge in activity throughout 2024, with many reporting double-digit growth in sales volume.

This trend directly challenges traditional furniture retailers as consumers opt for pre-owned items or even upcycle existing pieces, offering an environmentally conscious and budget-friendly alternative to purchasing brand-new furniture. The ability to find distinctive items at a fraction of the cost makes the re-used furniture market a potent competitive force.

The rise of furniture rental services presents a notable threat of substitutes for traditional furniture retailers like Bassett. These services cater to individuals needing furniture for short-term leases, temporary housing, or home staging, offering a flexible alternative to purchasing. This trend is particularly relevant in urban areas with high rental populations.

For instance, companies like CORT and Feather have seen significant growth, with the furniture rental market projected to reach over $10 billion globally by 2027, indicating a substantial shift in consumer preferences. This growing segment of the market avoids the long-term commitment and upfront cost associated with buying furniture.

Focus on Smaller Decor and Accessories

During periods of economic downturn or a sluggish housing market, consumers often pivot their spending. Instead of committing to substantial furniture investments, they gravitate towards smaller, more budget-friendly home décor items and accessories. This trend effectively positions these smaller enhancements as viable substitutes for larger furniture purchases, impacting demand for Bassett's core offerings.

For instance, in 2024, the home furnishings sector experienced varied consumer behavior. While demand for large furniture remained somewhat subdued due to persistent inflation concerns, the market for decorative accessories saw a notable uptick. Data from the U.S. Census Bureau indicated that sales of home goods, excluding major appliances and furniture, showed resilience. This suggests that consumers are still engaging with home improvement, but through more accessible, lower-cost channels.

- Consumer Preference Shift: Economic uncertainty encourages spending on smaller, less expensive décor items over large furniture pieces.

- Market Data (2024): Sales of home goods, excluding major furniture, demonstrated resilience amidst inflation, indicating a preference for accessories.

- Impact on Bassett: This substitution threat can reduce the necessity for consumers to purchase new, high-ticket furniture items.

Multi-functional and Space-Saving Solutions

The growing demand for multifunctional and space-saving furniture presents a significant threat of substitutes for traditional furniture retailers like Bassett. This trend, particularly pronounced in urban environments where space is at a premium, encourages consumers to opt for single pieces that can serve multiple functions. For instance, a sofa bed can replace the need for both a sofa and a guest bed, directly impacting the sales volume of individual furniture items.

This shift in consumer preference means fewer individual furniture pieces are purchased. Consumers are increasingly prioritizing versatility and efficiency, leading them to invest in solutions that maximize utility in smaller living spaces. This can translate to a reduced overall furniture spend per household, as one adaptable item fulfills the role of several traditional ones.

- Urbanization drives demand for space-saving furniture.

- Sofa beds and modular furniture are key substitutes.

- Reduced unit sales are a direct consequence for traditional furniture.

- By 2024, the global furniture market saw a notable increase in demand for multi-functional pieces, especially in apartment-centric markets.

The increasing popularity of DIY home projects and the robust growth of the home improvement sector represent a significant substitute threat for furniture retailers. Consumers are increasingly investing in enhancing their existing living spaces, often through personalized, do-it-yourself renovations, rather than purchasing new furniture. This trend is driven by a desire for unique aesthetics and cost savings. For example, the global home improvement market was projected to exceed $900 billion in 2024, highlighting substantial consumer expenditure in this area.

The expanding market for used, vintage, and second-hand furniture offers a compelling alternative to new purchases. Consumers are drawn to these options for their unique character and more accessible price points. Online marketplaces and consignment shops saw significant activity throughout 2024, with many reporting substantial sales volume growth.

Furniture rental services are also emerging as a notable substitute, catering to short-term needs and offering flexibility. The furniture rental market was projected to reach over $10 billion globally by 2027, indicating a growing consumer preference for non-ownership models.

| Substitute Category | Key Characteristics | Market Trend (2024) | Impact on Furniture Retailers |

|---|---|---|---|

| DIY Home Improvement | Cost-effective, personalized, enhances existing spaces | Global market projected over $900 billion | Reduces demand for new furniture purchases |

| Used/Vintage Furniture | Unique character, lower price point, sustainable | Surge in online marketplace activity | Direct competition for new furniture sales |

| Furniture Rental | Flexibility, short-term use, lower upfront cost | Market projected over $10 billion by 2027 | Captures consumers avoiding long-term commitments |

Entrants Threaten

The furniture industry, particularly for established players like Bassett Furniture Industries, presents a formidable threat of new entrants due to the sheer capital required. Setting up manufacturing facilities, alongside a robust retail network encompassing company-owned stores, licensed locations, and online channels, demands significant upfront investment. This financial barrier effectively deters many potential competitors from entering the market.

Established companies like Bassett Furniture Industries, with a history dating back to 1902, possess powerful brand recognition and deep-rooted customer loyalty. This makes it incredibly difficult for new entrants to gain traction, as consumers often rely on trusted names for significant purchases like furniture.

Newcomers face a steep uphill battle in replicating the trust and familiarity that incumbents have cultivated over decades. For instance, in 2024, the furniture industry continues to see consumers prioritize established brands, with many major players reporting sustained customer engagement.

National and international furniture chains, in particular, leverage their widespread brand awareness to draw customers away from less-known competitors. This established presence acts as a significant barrier, requiring substantial marketing investment and time for any new player to overcome.

Existing giants in the furniture industry, like IKEA, benefit significantly from economies of scale. They can secure raw materials and manage manufacturing and distribution at a much lower cost per unit. For instance, in 2024, major furniture manufacturers often reported production costs that were 15-20% lower than smaller competitors due to bulk purchasing power.

This cost advantage creates a substantial barrier for newcomers. A new entrant would likely start with smaller production volumes, resulting in higher per-unit expenses. This makes it incredibly challenging to match the pricing strategies of established, large-scale players, hindering their ability to gain market share quickly.

Regulatory and Compliance Burdens

New environmental obligations, like those starting in Europe in January 2025, demand suppliers finance product collection, recycling, and disposal. This creates substantial administrative and financial hurdles.

Firms without established reverse-logistics networks will face fees and penalties, acting as a significant barrier for new, smaller, or less established market entrants.

- Increased operational costs for new entrants due to compliance with Extended Producer Responsibility (EPR) schemes.

- Capital investment required for building or partnering for reverse logistics infrastructure.

- Potential penalties for non-compliance, impacting profitability and market entry viability.

Distribution Channel Access and Established Relationships

New entrants often struggle to secure access to crucial distribution channels, a significant barrier to entry. Building a retail presence or establishing wholesale accounts requires substantial investment and time. For instance, Bassett's existing network of 87 company- and licensee-owned stores, coupled with over 1,000 wholesale accounts, presents a formidable challenge for any newcomer aiming to reach customers effectively.

These established relationships create a moat around Bassett's market share. Newcomers must expend considerable resources to replicate this reach, whether through costly store build-outs or arduous negotiations with retailers. The sheer scale of Bassett's distribution network in 2024, encompassing numerous physical locations and a vast wholesale base, underscores the difficulty new firms face in gaining comparable market penetration.

- Established Distribution Network: Bassett operates 87 company- and licensee-owned stores.

- Wholesale Reach: Bassett boasts over 1,000 wholesale accounts.

- Barrier to Entry: Gaining similar access requires significant capital and time investment for new entrants.

- Competitive Advantage: Bassett's extensive distribution network provides a strong competitive advantage.

The threat of new entrants in the furniture industry is significantly mitigated by high capital requirements for manufacturing and retail expansion. Furthermore, established brands like Bassett Furniture Industries benefit from decades of cultivated customer loyalty and trust, making it difficult for newcomers to gain market share. Existing economies of scale enjoyed by large players create a cost advantage that new entrants struggle to overcome, impacting pricing strategies and profitability.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|

| Capital Requirements | High barrier due to manufacturing and retail setup costs. | Setting up a new furniture manufacturing plant can cost millions of dollars. |

| Brand Recognition & Loyalty | Difficult to replicate established trust and customer preference. | Consumers often prefer established brands for large purchases, leading to sustained engagement for major players. |

| Economies of Scale | New entrants face higher per-unit costs compared to large competitors. | Major furniture manufacturers in 2024 reported production costs 15-20% lower than smaller competitors due to bulk purchasing. |

| Distribution Channels | Securing access to retail and wholesale networks is challenging and costly. | Bassett Furniture's network of 87 stores and over 1,000 wholesale accounts represents a significant hurdle for new firms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including proprietary market research, government economic reports, and publicly available financial statements. This blend ensures a comprehensive understanding of industry structure and competitive dynamics.