Bassett Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

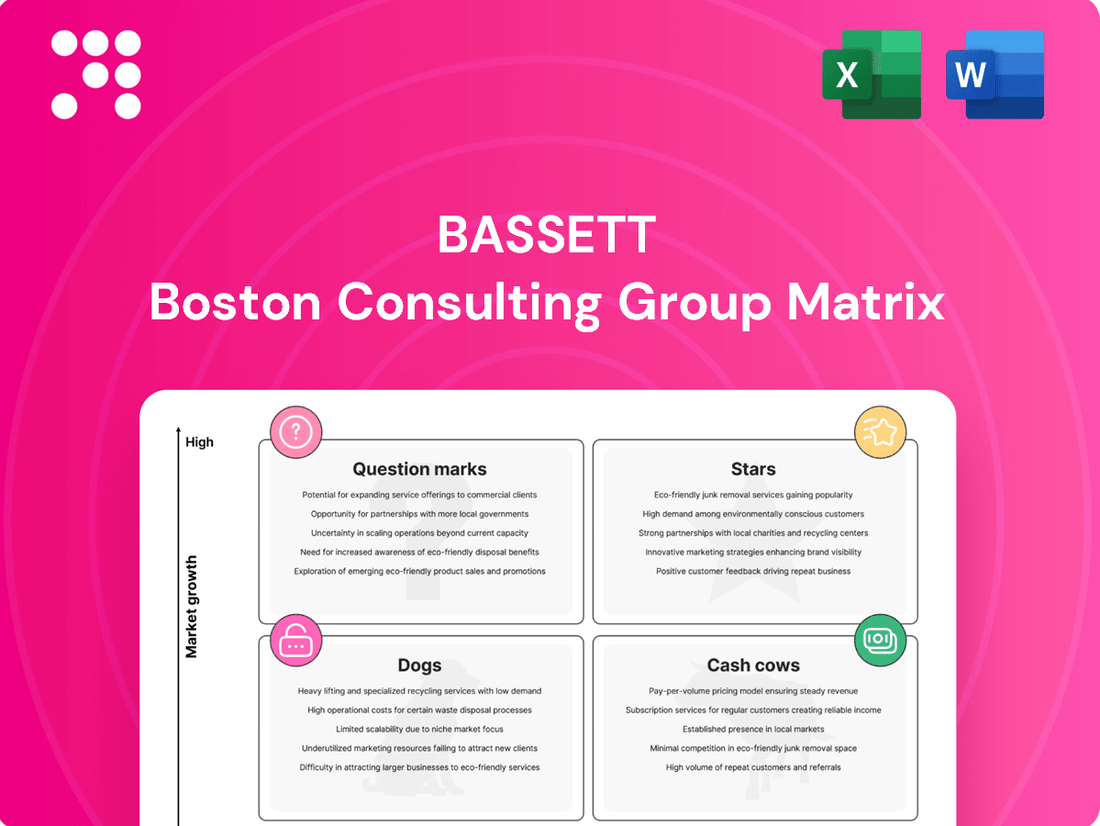

Understand the core principles of the BCG Matrix, a powerful tool for analyzing product portfolios. This preview highlights how it categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Purchase the full BCG Matrix for a comprehensive breakdown of your company's specific product positioning, complete with actionable strategies to optimize your portfolio.

Stars

Bassett Furniture's growing e-commerce sales are a clear indicator of its star status within the BCG matrix. As of early 2025, online orders have surged by an impressive 27% year-over-year, with written sales on bassettfurniture.com climbing 31% in the second quarter of 2025. This robust digital performance reflects a broader trend of increasing online furniture demand, positioning Bassett favorably in a growing market.

Bassett Furniture's strategic move into new product collections, including the Copenhagen, Newbury, and Andorra whole-home case goods, alongside the Benchmade Hideaway dining program, positions them within the Stars quadrant of the BCG Matrix. These introductions signify a commitment to innovation, aiming to capture emerging market trends and consumer preferences.

The anticipation for these collections to reach retail floors from early to fall 2025 highlights Bassett's forward-looking strategy. Positive market reception suggests strong potential for high growth and increased market share in the dynamic home furnishings sector.

Bassett Furniture is making significant strides in the interior design trade, experiencing double-digit sales growth in this segment during the second quarter of fiscal 2025. This expansion is a strategic move to capitalize on a burgeoning market where consumers increasingly seek professional design expertise.

The company's focus on this high-growth area involves targeted investments in new product lines, dedicated marketing efforts, and enhanced systems specifically designed to serve interior designers. This approach aims to solidify Bassett's position and capture a greater market share within the lucrative design trade channel.

New Retail Store Openings

Bassett Furniture's strategy of opening new retail stores in promising markets like Cincinnati and Orlando, alongside revitalizing existing ones, shows a commitment to growing its physical presence. This move is designed to capture organic growth by targeting specific, expanding areas, even amidst broader housing market headwinds.

These expansions are crucial for increasing direct customer interaction and solidifying market share.

- Expansion Markets: Cincinnati and Orlando are identified as key growth areas for new store openings.

- Investment Focus: The company is also investing in remodeling existing locations to enhance the customer experience.

- Strategic Rationale: This physical footprint expansion aims to drive organic growth and increase direct consumer engagement.

Enhanced Customization Offerings

Bassett's strategic focus on enhanced customization, exemplified by its BenchMade line and the expanding Bassett Design Studio concept, directly addresses the increasing consumer desire for bespoke home furnishings. This approach allows Bassett to stand out in a crowded marketplace and potentially achieve better profit margins.

The company's expansion of the Design Studio concept to independent retailers broadens its footprint in this lucrative, high-margin segment. This strategy is crucial for growth, especially as consumer preferences lean towards personalized products.

- Customization as a Differentiator: Bassett's BenchMade line offers consumers extensive choices in fabric, finishes, and configurations, allowing for a highly personalized product.

- Higher Margin Potential: Customization typically commands premium pricing, contributing to improved profitability compared to mass-produced furniture.

- Market Reach Expansion: Extending the Design Studio concept to independent retailers increases accessibility for consumers seeking customized options, driving sales volume in this key area.

Bassett Furniture's classification as a Star within the BCG matrix is supported by its substantial growth in e-commerce, with online sales up 27% year-over-year by early 2025. This digital expansion, coupled with new product introductions like the Copenhagen and Andorra collections, positions the company favorably in a high-growth market segment.

The company's strategic emphasis on the interior design trade also contributes to its Star status, showing double-digit sales growth in this sector during Q2 2025. By investing in product lines and marketing for designers, Bassett is tapping into a growing demand for professional design services.

Furthermore, Bassett's commitment to physical expansion, with new stores in Cincinnati and Orlando and revitalized existing locations, aims to drive organic growth. This, combined with their focus on customization through the BenchMade line and the expanding Design Studio concept, caters to evolving consumer preferences for personalized home furnishings.

| Category | Growth Rate | Market Share | Strategic Focus |

|---|---|---|---|

| E-commerce | 27% YoY (early 2025) | Increasing | Digital expansion, online sales growth |

| New Product Collections | High Potential | Gaining | Innovation, capturing emerging trends |

| Interior Design Trade | Double-digit Q2 2025 | Growing | Targeted investment, dedicated marketing |

| Customization (BenchMade, Design Studio) | High Demand | Expanding | Bespoke offerings, premium pricing |

What is included in the product

Strategic guidance on investing, holding, or divesting product lines based on market growth and share.

The Bassett BCG Matrix provides a clear, visual overview of your portfolio, alleviating the pain of strategic indecision.

Cash Cows

Bassett's established upholstered furniture segment is a prime example of a Cash Cow within its BCG Matrix. This category boasts a strong, decades-long brand legacy, indicating a deep-rooted presence and customer trust in the market.

The company likely holds a significant market share in the mature upholstered furniture sector, translating into reliable and consistent cash flow generation for Bassett. This stability is crucial for funding other business ventures.

Bassett's commitment to quality craftsmanship, distinctive design, and exceptional customer service solidifies its competitive edge. For instance, in 2024, Bassett reported continued strength in its upholstery offerings, contributing significantly to overall revenue and profitability.

Bassett's core wood furniture business, following the consolidation of its U.S. manufacturing, is a prime example of a cash cow. This strategic move is expected to boost efficiency and profitability in its dining and bedroom furniture segments, which remain a cornerstone of their product line.

With reduced operational costs, this segment is poised to generate substantial cash flow. For instance, in 2023, Bassett reported that its furniture segment, which heavily features wood products, contributed significantly to its overall financial performance, underscoring its role as a reliable revenue generator.

Bassett's company-owned retail store network functions as a significant cash cow within its business model. These stores represent established sales channels with a strong brand presence, likely holding a considerable market share in their operating regions.

This network consistently generates robust revenue and cash flow, offering the financial bedrock for Bassett to pursue other growth opportunities or investments. For instance, in 2024, Bassett's retail segment continued to be a primary revenue driver, demonstrating the enduring strength of its physical store footprint.

Traditional Wholesale Business

Bassett's traditional wholesale business is a cornerstone of its operations, boasting over 700 accounts across the United States and internationally. This extensive network taps into established distribution channels, ensuring a reliable revenue stream. While the market may present challenges, the sheer breadth of its reach and its long-standing presence solidify its position as a consistent cash generator.

This segment's strength lies in its ability to leverage existing relationships and infrastructure. For instance, in 2024, wholesale revenue continued to be a significant contributor to Bassett's overall financial performance, demonstrating its resilience. The business model benefits from economies of scale and predictable demand patterns, characteristic of mature markets.

- Significant Market Penetration: Over 700 active wholesale accounts domestically and internationally.

- Stable Revenue Generation: Benefits from established distribution channels and long-term client relationships.

- Resilience in Mature Markets: Continues to be a dependable cash flow source despite potential market saturation.

- Leverages Existing Infrastructure: Operates with established logistical and sales frameworks, optimizing costs.

Logistics Business

Bassett's logistics business, focused on home furnishings, acts as a strategic internal asset and a potential external revenue stream. This specialized segment offers critical infrastructure, helping to lower Bassett's own supply chain costs.

By optimizing operations and potentially serving third-party clients, this logistics arm likely represents a stable, low-growth cash generator within the company's portfolio, fitting the profile of a Cash Cow in the BCG Matrix.

- Specialized Niche: Focuses specifically on home furnishings logistics, creating expertise and efficiency.

- Cost Reduction: Supports internal operations by reducing reliance on external logistics providers.

- Revenue Potential: Offers services to external clients, creating an additional income stream.

- Stable Cash Flow: Expected to be a consistent, low-growth generator of cash due to its operational efficiency and specialized market.

Bassett's upholstered furniture, core wood furniture, company-owned retail, and traditional wholesale segments all function as Cash Cows. These areas exhibit strong market share and generate consistent, reliable cash flow, vital for funding other business initiatives.

The company's commitment to quality and established brand presence, particularly in upholstered and wood furniture, ensures stable demand. For instance, in 2024, Bassett's retail segment continued to be a primary revenue driver, showcasing the enduring strength of its physical store footprint.

These mature segments benefit from established distribution networks and operational efficiencies, contributing significantly to overall financial performance. In 2023, Bassett reported that its furniture segment, heavily featuring wood products, underscored its role as a reliable revenue generator.

Bassett's logistics business also fits the Cash Cow profile, offering specialized expertise in home furnishings logistics, reducing internal costs, and providing an additional revenue stream through third-party services.

| Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

|---|---|---|---|

| Upholstered Furniture | Cash Cow | Strong brand legacy, deep market presence, consistent cash generation. | Continued strength contributing significantly to revenue and profitability in 2024. |

| Core Wood Furniture | Cash Cow | Consolidated U.S. manufacturing, boosted efficiency, cornerstone product line. | Furniture segment contributed significantly to overall financial performance in 2023. |

| Company-Owned Retail | Cash Cow | Established sales channels, strong brand presence, considerable market share. | Primary revenue driver, demonstrating enduring strength of physical store footprint in 2024. |

| Traditional Wholesale | Cash Cow | Over 700 accounts, established distribution, long-term client relationships. | Significant contributor to overall financial performance in 2024, demonstrating resilience. |

| Logistics Business | Cash Cow | Specialized home furnishings logistics, cost reduction, external revenue potential. | Stable, low-growth generator due to operational efficiency and specialized market. |

What You See Is What You Get

Bassett BCG Matrix

The Bassett BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no hidden watermarks or incomplete sections; you get the complete, analysis-ready strategic tool as presented. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. This ensures transparency and immediate utility for your business planning and decision-making processes.

Dogs

The Noa Home e-commerce venture, a strategic initiative by Bassett Furniture, was unfortunately discontinued in late 2024. This decision stemmed from a broader restructuring effort aimed at optimizing the company's operational efficiency and financial health.

This online furniture business was categorized as a Dog within Bassett's portfolio. It consumed significant cash resources without generating the anticipated revenue or market traction, pointing to both a low market share and limited growth potential for Bassett in this specific segment.

The closure of Noa Home was a deliberate move to divest from underperforming assets and refocus capital on more promising areas of the business. In 2023, Bassett's total revenue was $447.6 million, and the decision to close Noa Home was part of a larger strategy to improve profitability and shareholder value.

Bassett's strategic restructuring includes shedding unproductive product lines, a move designed to streamline operations and boost profitability. These are typically items with a low market share that don't generate substantial revenue or profit, effectively locking up valuable capital.

By discontinuing these underperforming lines, Bassett aims to free up resources and capital, allowing for a sharper focus on more lucrative and growth-oriented ventures. This is a critical component of their five-point plan to enhance overall business efficiency.

Certain segments within Bassett's wholesale operations, specifically those involving Club Level program accounts that source containers directly from Asia, have seen a downturn in sales. This underperformance is largely attributed to dealer hesitancy, a direct consequence of ongoing tariff uncertainties impacting import costs and predictability.

These particular wholesale accounts, if they continue to exhibit sluggish sales and a lack of growth potential, would be classified as 'dogs' in the context of the BCG Matrix. For instance, if the Club Level program's contribution to overall wholesale revenue, which was around 20% in early 2024, falls below a certain threshold and shows no signs of recovery, it solidifies its 'dog' status.

Outdated Retail Store Formats

Outdated retail store formats at Bassett, particularly those not aligned with the company's evolving strategy, would likely fall into the 'dog' category of the BCG Matrix. These locations may exhibit low market share and struggle to generate sufficient returns despite potential capital injections for renovations. Bassett's commitment to optimizing its store portfolio, as evidenced by ongoing evaluations of efficiency and cost structures, suggests a proactive approach to identifying and addressing such underperforming assets.

Consider these points regarding Bassett's outdated retail formats:

- Low Market Share: Stores with declining foot traffic and sales that lag behind competitors in their local markets represent a significant drag on overall performance.

- High Renovation Costs: Upgrading older, less efficient store layouts to meet modern consumer expectations can require substantial capital expenditure, often with uncertain payback periods.

- Strategic Misalignment: Retail locations that do not fit Bassett's refreshed brand image or product assortment strategy, and are unlikely to be revitalized effectively, are prime candidates for divestment or closure.

Legacy Manufacturing Facilities (Pre-Consolidation)

The consolidation of U.S. wood manufacturing from two locations into one primary facility with a satellite operation signals that the prior two-plant structure was inefficient. This move suggests the scaled-down or absorbed facility likely represented a 'dog' in the BCG matrix due to operational inefficiencies or excess capacity.

This strategic restructuring was implemented to reduce costs and improve overall performance. The previous setup, with its inherent inefficiencies, was likely a significant drag on Bassett's profitability, necessitating this consolidation effort to streamline operations and enhance financial health.

- Operational Inefficiencies: The absorption of one facility into another points to a situation where one plant was underperforming or had higher operating costs, making it a 'dog'.

- Excess Capacity: The need to consolidate implies that at least one of the legacy facilities likely had more production capacity than market demand justified, leading to underutilization and increased per-unit costs.

- Cost Reduction Focus: By consolidating, Bassett aimed to eliminate redundant overheads, optimize logistics, and leverage economies of scale, directly addressing the cost burdens associated with the 'dog' business unit.

- Performance Improvement: The ultimate goal of such a move is to shed underperforming assets and focus resources on more productive areas, thereby boosting the company's overall financial performance.

Dogs in the BCG Matrix represent business units or products with low market share and low growth potential. Bassett Furniture's discontinued Noa Home e-commerce venture serves as a prime example. This initiative consumed resources without achieving significant market traction, fitting the 'dog' profile due to its low revenue generation and limited growth prospects within the online furniture segment.

Similarly, certain underperforming wholesale accounts within Bassett's Club Level program, particularly those struggling with sales due to tariff uncertainties, can be classified as dogs. Outdated retail store formats that exhibit declining foot traffic and sales, and are unlikely to be revitalized effectively, also fall into this category. These underperforming assets tie up capital and do not contribute significantly to overall profitability.

Bassett's strategic decision to consolidate U.S. wood manufacturing from two locations into one primary facility suggests that at least one of the former plants likely operated as a 'dog'. This consolidation was driven by operational inefficiencies and excess capacity, common characteristics of 'dog' business units that necessitate divestment or streamlining to improve financial health.

| BCG Category | Bassett Example | Characteristics | Strategic Action |

| Dogs | Noa Home E-commerce | Low Market Share, Low Growth Potential, Consumes Resources | Discontinued/Divested |

| Dogs | Underperforming Wholesale Accounts (e.g., Club Level) | Sluggish Sales, Limited Growth, Impacted by External Factors (e.g., Tariffs) | Evaluate for Divestment or Restructuring |

| Dogs | Outdated Retail Store Formats | Declining Foot Traffic, Low Sales, Strategic Misalignment | Closure or Revitalization (if feasible) |

| Dogs | Inefficient Manufacturing Facility (Consolidated) | Operational Inefficiencies, Excess Capacity, High Costs | Absorbed or Closed |

Question Marks

Bassett's re-platformed e-commerce business, despite showing substantial growth in orders and sales, currently represents a minor fraction of the company's total revenue. This positions it as a potential question mark within the BCG framework, indicating high growth potential but currently low market share.

The furniture industry is witnessing a significant shift towards online purchasing, with e-commerce sales in the furniture sector projected to reach $161.7 billion in the US by 2027, a notable increase from previous years. This strong market growth highlights the opportunity for Bassett's digital channel.

To transform this question mark into a star, Bassett must undertake substantial and ongoing investments in its digital infrastructure, targeted online marketing campaigns, and enhancing the overall customer user experience on its e-commerce platform. This strategic focus is essential to capture a larger share of the burgeoning online furniture market.

Bassett's new retail store ventures in Cincinnati and Orlando are classic examples of question marks in the BCG matrix. These are investments in markets with potential for high growth, but their current market share is low, making their future success uncertain. For instance, the home furnishings market saw a 5.2% growth in 2023, reaching an estimated $145 billion in the US, according to Statista.

These new locations require substantial initial capital for inventory, store build-out, and marketing campaigns. Bassett must invest heavily to build brand awareness and attract customers in these new territories, aiming to capture a significant market share. The success hinges on effective market penetration strategies and consumer adoption.

Bassett's newly launched product collections, such as the Newbury and Andorra lines slated for spring and fall 2025 respectively, represent classic question marks in the BCG matrix. These collections are currently in their nascent stages of market adoption, showing promising initial feedback from industry markets.

Despite positive initial reception, their true market share and long-term viability remain uncertain in a crowded furniture market. For instance, the home furnishings market in 2024 is projected to see continued growth, with online sales expected to reach $178 billion, highlighting the competitive landscape these new collections must navigate.

Sustained marketing efforts and strong consumer demand are crucial for these question marks to gain traction and potentially evolve into stars. Without significant market penetration and a clear competitive advantage, they risk remaining in this uncertain growth phase.

Bassett Design Studio Concept Expansion

Bassett Design Studio's expansion to independent retailers is a calculated effort to capture a larger share of the burgeoning design trade market. This segment, valued at billions annually, presents a significant growth opportunity for Bassett, though its current penetration within this niche is still developing. The company's 2024 strategy involves substantial investment in these studios and cultivating strong relationships with interior designers to boost market presence and revenue.

- Market Focus: Targeting the design trade market through expanded studio concepts.

- Growth Potential: Capitalizing on the expanding design services sector.

- Strategic Investment: Allocating resources to support independent retail studios and designer partnerships.

- Market Share Objective: Aiming to increase Bassett's footprint and profitability within this specific market segment.

International Wholesale Market Expansion

Bassett's international wholesale operations, while existing, don't currently dominate global markets. This positions them as question marks in the BCG matrix, indicating potential for growth but also uncertainty.

The global furniture market is a significant opportunity, with projections showing continued expansion. For instance, the Asia-Pacific furniture market alone was valued at approximately $150 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 5% through 2028, according to industry reports.

To capitalize on this growth, Bassett would need to invest heavily in market research, distribution networks, and localized marketing strategies. Without a clear, established market share, these ventures carry inherent risks, making successful expansion a key question.

- International Wholesale: Existing but not dominant market presence.

- Global Furniture Market Growth: Significant opportunity, especially in Asia-Pacific.

- Investment Required: Substantial capital needed for targeted strategies and market penetration.

- Potential Question Mark: High growth potential coupled with the uncertainty of market capture.

Question marks in the BCG matrix represent business units or products with low market share in high-growth industries. These ventures require careful consideration due to their uncertain future. For Bassett, these could include new product lines or emerging markets where initial traction is still being established.

The furniture industry's continued growth, with US furniture e-commerce sales projected to reach $161.7 billion by 2027, underscores the high-growth aspect for potential question marks. However, achieving a significant market share in these dynamic sectors demands substantial investment and strategic execution.

Bassett's new e-commerce platform and international wholesale operations exemplify these question marks. While they operate in expanding markets, their current market share is relatively small, necessitating significant capital and focused strategies to convert potential into market dominance.

The success of these question marks hinges on their ability to capture market share through aggressive marketing, superior product offerings, and efficient distribution. Without this, they risk remaining in a high-growth, low-share position, consuming resources without delivering proportional returns.

| Business Unit/Product | Market Growth Rate | Relative Market Share | BCG Classification |

| E-commerce Platform | High | Low | Question Mark |

| New Retail Stores (Cincinnati, Orlando) | High (Industry Growth) | Low | Question Mark |

| Newly Launched Product Collections (e.g., Newbury, Andorra) | High (Industry Growth) | Low | Question Mark |

| Bassett Design Studio Expansion | High (Design Trade Market) | Low | Question Mark |

| International Wholesale Operations | High (Global Market) | Low | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.