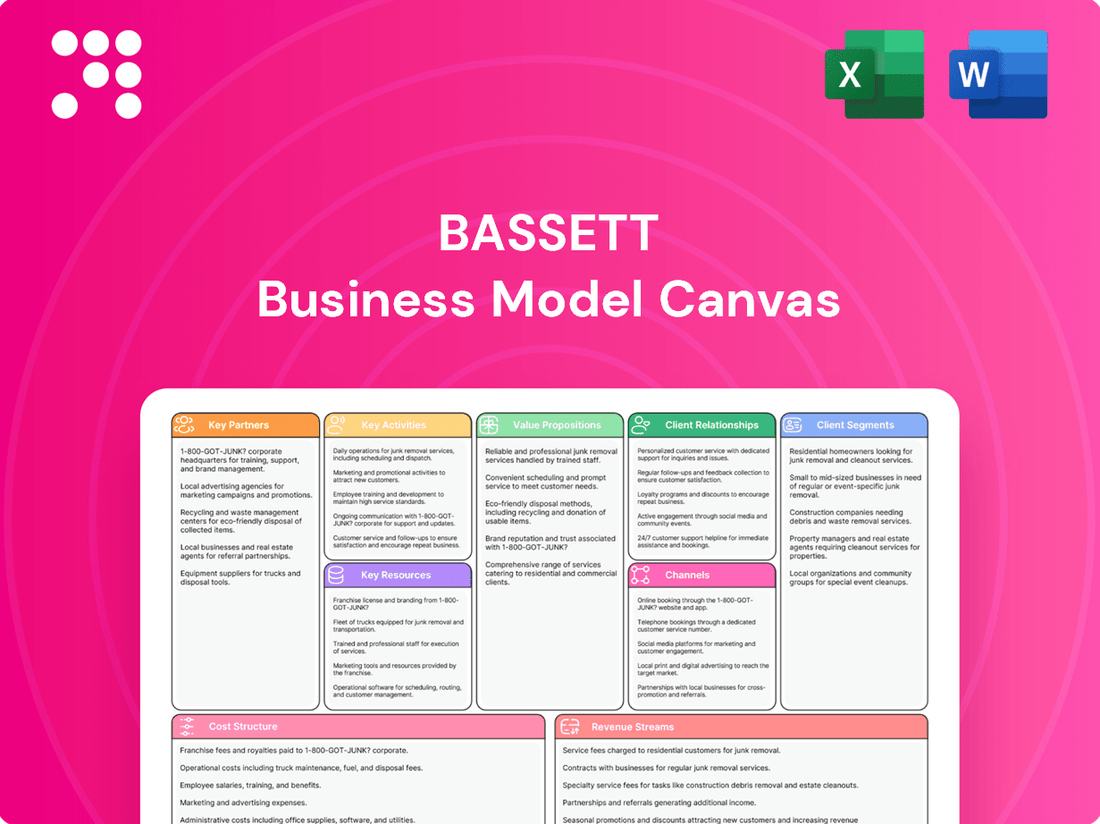

Bassett Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

Curious about Bassett's proven business framework? Our full Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic thinking that drives their success and gain actionable insights for your own ventures.

Partnerships

Bassett Furniture cultivates a robust supplier network, sourcing essential raw materials like lumber, textiles, and various components. This diverse base ensures they can maintain a wide product assortment and consistent availability for their customers. For instance, in 2024, Bassett's ability to navigate supply chain disruptions was partly due to established relationships with multiple upholstery fabric suppliers, mitigating the impact of any single provider's issues.

Beyond domestic sourcing, Bassett also partners with international manufacturers to import finished goods, further expanding their product catalog. These global relationships are vital for offering competitive pricing and unique designs. The company's strategic sourcing in 2024 allowed them to introduce new collections, with a significant portion of their living room offerings originating from overseas partnerships.

The strength of these supplier partnerships directly impacts Bassett's ability to manage costs and maintain quality. By fostering strong communication and collaboration, they can better anticipate and respond to market fluctuations, such as the rising costs of lumber and shipping experienced throughout 2024, ensuring their pricing remains competitive.

Bassett partners with independent retailers who operate licensed Bassett Home Furnishings (BHF) stores, significantly expanding its market presence. These licensees, acting as key partners, leverage the established Bassett brand name to reach new customer segments.

This licensing model allows Bassett to broaden its distribution footprint without the direct operational and capital expenditure associated with opening and managing new company-owned stores. It fosters a shared investment in brand growth and market penetration.

In 2024, Bassett continued to refine this strategy, with licensed operators playing a crucial role in its omni-channel retail approach. This approach allows for greater agility in responding to regional market demands and consumer preferences.

Bassett Furniture Industries, Inc. leverages a robust wholesale channel, boasting over 700 accounts. These include diverse multi-line furniture retailers throughout the United States and in international markets. This extensive network is crucial for extending the reach of Bassett's manufactured and sourced furniture, ensuring a significant portion of their product line achieves broader market penetration beyond their direct-to-consumer retail footprint.

Design Trade Professionals

Bassett's strategic alliances with interior design professionals are a cornerstone of their business model. These partnerships are crucial for tapping into the higher-end market and fulfilling the increasing consumer desire for personalized living spaces.

Through initiatives like the Bassett Design Studio, the company provides interior designers with access to custom manufacturing, enabling them to create unique, bespoke furniture pieces for their clients. This collaborative approach allows Bassett to stay ahead of design trends and cater to a discerning clientele.

For instance, in 2024, Bassett reported a notable increase in custom orders originating from design professional collaborations, indicating the growing success of this strategy. This focus on bespoke solutions directly addresses a key market demand.

- Customization Capabilities: Offering interior designers access to Bassett's extensive custom manufacturing options.

- Design Studio Programs: Providing specialized programs and resources tailored to design professionals.

- Market Expansion: Penetrating the higher-end design market by catering to bespoke furniture needs.

- Demand Fulfillment: Meeting the growing consumer demand for unique and personalized home furnishings.

Logistics and Delivery Partners

Bassett Furniture Industries (BSET) relies on robust logistics and delivery partners to ensure timely product distribution. These collaborations are critical for maintaining inventory and fulfilling customer orders efficiently across their network.

For 2024, BSET's commitment to efficient delivery likely involves partnerships with specialized logistics firms. These 3PL providers manage key functions like warehousing and transportation, directly impacting customer satisfaction and operational costs. For instance, in the furniture industry, reliable delivery is a significant differentiator, and effective partnerships mitigate risks associated with damage and delays.

- Third-Party Logistics (3PL) Providers: Essential for managing warehousing, transportation, and last-mile delivery.

- Efficiency and Customer Satisfaction: Key partners directly contribute to operational efficiency and enhance the customer experience through reliable delivery.

- Network Optimization: Logistics partners help optimize delivery routes and schedules, reducing transit times and costs for BSET.

Bassett Furniture's key partnerships extend to its extensive wholesale network, comprising over 700 accounts. These include a diverse range of multi-line furniture retailers across the United States and internationally, crucial for distributing Bassett's manufactured and sourced furniture beyond its direct-to-consumer channels.

Furthermore, strategic alliances with interior design professionals are vital for accessing the higher-end market and fulfilling the demand for personalized living spaces. These collaborations, exemplified by the Bassett Design Studio, enable custom manufacturing for unique client pieces, keeping Bassett aligned with design trends.

In 2024, Bassett's reliance on licensed operators for its Bassett Home Furnishings (BHF) stores was significant, expanding its market reach and brand presence without direct capital investment. These partners are integral to Bassett's omni-channel retail strategy, offering agility in responding to regional market needs.

Bassett also depends on third-party logistics (3PL) providers for efficient product distribution, warehousing, and transportation. These partnerships are critical for inventory management, timely order fulfillment, and overall customer satisfaction, especially given the industry's emphasis on reliable delivery, a factor highlighted by supply chain challenges in 2024.

What is included in the product

A detailed, pre-filled Business Model Canvas that outlines the strategic framework and operational blueprint of Bassett, offering a clear view of its value propositions, customer segments, and revenue streams.

The Bassett Business Model Canvas alleviates the pain of fragmented strategy by providing a single, unified view of all key business elements.

It eliminates the frustration of disjointed planning by offering a clear, interconnected framework for understanding and improving a business.

Activities

Bassett's core activity involves the continuous design and development of new furniture collections. This includes both upholstered and wood pieces, alongside home accents, ensuring a fresh and appealing product mix.

This ongoing innovation is crucial for Bassett to remain competitive by aligning with current design trends and anticipating shifts in consumer preferences. For example, in 2024, the company focused on introducing more sustainable material options and customizable designs, responding to a growing market demand.

The success of these design and development efforts directly fuels sales growth. By consistently launching desirable new products, Bassett aims to attract new customers and encourage repeat business, a strategy that has historically driven a significant portion of their revenue.

Bassett Furniture Industries, Inc. (BSET) actively manages its manufacturing and sourcing to balance quality, cost, and variety. The company manufactures a substantial portion of its furniture, especially upholstery and certain solid wood pieces, within the United States. This domestic production allows for greater control over craftsmanship, materials, and customization options, catering to specific customer demands and maintaining brand quality standards.

Complementing its domestic manufacturing, Bassett also strategically sources finished furniture products from overseas. This global sourcing strategy is crucial for offering a wider product assortment and achieving competitive pricing. For instance, in 2024, the company continued to leverage international partnerships to bring a diverse range of styles and price points to its customers, effectively managing inventory and responding to market trends.

Bassett's retail operations management focuses on optimizing its company-owned stores. This includes meticulous store merchandising to create an appealing shopping environment and comprehensive sales staff training to ensure knowledgeable and helpful customer interactions. A key differentiator is offering free in-home design visits, a direct service that enhances the customer experience and drives sales.

These activities are crucial for Bassett's direct-to-consumer strategy, directly impacting sales performance and brand perception. For instance, in 2024, companies with strong in-store experiences often report higher customer retention rates, with some studies indicating a 20% increase compared to those with weaker physical presences.

E-commerce and Digital Strategy

Bassett Furniture Industries is heavily invested in refining its e-commerce presence to boost online revenue and elevate the digital customer journey. This strategic focus includes continuous website optimization and targeted online marketing campaigns.

Key activities in this area involve ensuring a smooth omnichannel experience, allowing customers to interact seamlessly across online and physical touchpoints. For instance, in 2023, Bassett reported a significant increase in digital sales, reflecting the success of these initiatives.

- Website Optimization: Ongoing improvements to the Bassett website to enhance user experience and conversion rates.

- Online Marketing: Implementing digital advertising, SEO, and social media strategies to drive traffic and sales.

- Omnichannel Integration: Connecting online and in-store experiences for a cohesive customer journey.

- Digital Customer Experience: Focusing on personalized recommendations and efficient online support.

Supply Chain and Inventory Management

Bassett's key activities revolve around the meticulous management of its supply chain and inventory. This encompasses everything from sourcing raw materials to getting finished products into customers' hands. A significant part of this involves optimizing where manufacturing happens and making operations smoother to cut down on expenses and boost earnings.

In 2024, Bassett continued its strategic consolidation of manufacturing facilities. This initiative, aimed at enhancing efficiency and reducing operational overhead, was a core focus. By streamlining its production footprint, the company sought to gain better control over its supply chain and improve overall cost-effectiveness.

- Supply Chain Optimization: Bassett actively works to ensure a smooth flow of goods from suppliers to customers, focusing on efficiency and cost reduction.

- Inventory Level Management: The company prioritizes maintaining optimal inventory levels to meet demand without incurring excessive carrying costs.

- Facility Consolidation: A key activity involves consolidating manufacturing sites to streamline operations and achieve economies of scale.

- Operational Streamlining: Bassett continuously seeks ways to make its manufacturing and distribution processes more efficient to improve profitability.

Bassett's key activities include the continuous design and development of new furniture collections, balancing domestic manufacturing with strategic overseas sourcing to offer a diverse product range. The company also focuses on optimizing its retail operations, particularly its company-owned stores, and enhancing its e-commerce presence to create a seamless omnichannel customer experience. Furthermore, Bassett actively manages its supply chain and inventory, including strategic consolidation of manufacturing facilities, to improve efficiency and cost-effectiveness.

| Activity Area | Key Actions | 2024 Focus/Data Point |

|---|---|---|

| Product Design & Development | Creating new furniture collections and home accents. | Introduction of sustainable materials and customizable designs. |

| Manufacturing & Sourcing | Domestic production of upholstered and solid wood furniture; overseas sourcing for wider assortment. | Continued leverage of international partnerships for diverse styles and price points. |

| Retail Operations | Store merchandising, sales staff training, in-home design visits. | Emphasis on in-store experience to drive customer retention. |

| E-commerce & Digital | Website optimization, online marketing, omnichannel integration. | Focus on improving digital customer journey and online sales performance. |

| Supply Chain & Inventory | Supply chain optimization, inventory management, facility consolidation. | Strategic consolidation of manufacturing facilities to enhance efficiency. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means the structure, content, and formatting you see here are exactly what will be delivered to you, ensuring no surprises. You can confidently assess its quality and relevance based on this direct preview of the final product.

Resources

Bassett Furniture Industries operates several domestic manufacturing facilities, primarily focusing on upholstery and some wood furniture production. These plants are crucial for their ability to offer customization and maintain quality control.

In 2024, the company continued its strategic consolidation of wood furniture manufacturing, aiming to enhance operational efficiency and reduce costs within these key production hubs. This streamlining is vital for optimizing resource allocation and improving overall output.

Bassett's brand name, honed over 121 years, is a cornerstone of its business, signifying quality, value, and integrity in home furnishings. This enduring reputation acts as a powerful intangible asset, drawing in customers and reinforcing its multi-channel distribution strategy.

Bassett Furniture Industries, Inc. operates a significant retail store network, a cornerstone of its business model. This network includes both company-owned stores and those operated by licensees, encompassing Bassett Home Furnishings (BHF) and Bassett Design Centers. These locations are vital for showcasing products and engaging directly with customers.

As of the first quarter of 2024, Bassett Furniture Industries reported operating 65 company-owned stores and 24 licensee-owned stores, demonstrating a continued commitment to its physical retail footprint. The company actively invests in the strategic expansion and modernization of these stores to enhance the customer experience and drive sales.

Skilled Workforce and Design Expertise

Bassett Furniture's skilled workforce, encompassing designers, craftspeople, and sales associates, forms the backbone of its operations. This human capital is critical for the company's ability to produce high-quality, customizable furniture and deliver exceptional customer experiences. In 2023, Bassett reported a workforce of approximately 2,600 employees, underscoring the significant human resources required to support its manufacturing and retail footprint.

The emphasis on design and customization at Bassett directly translates to the value derived from its talented employees. Designers conceptualize unique pieces, craftspeople meticulously build them, and sales professionals guide customers through personalized selections. This synergy ensures Bassett can meet diverse customer needs, a key differentiator in the competitive furniture market.

The company's commitment to its workforce is evident in its ongoing training and development initiatives, aimed at maintaining and enhancing the expertise of its employees. This investment in human capital is a strategic imperative for upholding product quality and fostering innovation, crucial elements for sustained growth and brand reputation.

- Design Talent: Bassett employs experienced designers who drive product innovation and aesthetic appeal, crucial for a brand known for its style.

- Craftsmanship: Skilled artisans and craftspeople are essential for the hands-on manufacturing of furniture, ensuring quality and durability.

- Sales Expertise: Knowledgeable sales professionals are vital for assisting customers with custom orders and providing a personalized shopping experience.

- Employee Investment: Bassett's focus on training and development ensures its workforce remains adept at current design trends and manufacturing techniques.

Technology and E-commerce Platform

Bassett's technology and e-commerce platform is a critical resource, with significant investments fueling its online presence and omnichannel strategy. This robust digital infrastructure is essential for driving sales, fostering customer interaction, and ensuring smooth operations across all touchpoints.

In 2024, companies like Bassett are prioritizing technology to enhance customer experience and operational efficiency. For instance, a 2024 report indicated that retailers investing in advanced e-commerce platforms saw an average of a 15% increase in online sales. Bassett's commitment to its digital capabilities directly supports its ability to compete and grow in the modern retail landscape.

- E-commerce Platform Investment: Bassett's online sales channels are a primary revenue driver, necessitating continuous upgrades to user experience, payment processing, and inventory management systems.

- Omnichannel Integration: Seamless integration between online and physical stores, including features like buy online, pick up in-store (BOPIS), is a key technological resource for customer convenience and operational synergy.

- Data Analytics and CRM: Advanced customer relationship management (CRM) tools and data analytics capabilities are vital for understanding customer behavior, personalizing marketing efforts, and optimizing inventory.

Bassett's manufacturing facilities, including its upholstery plants, are fundamental to its ability to produce customizable furniture and maintain quality. The company's strategic consolidation of wood furniture manufacturing in 2024 aimed to boost efficiency and cut costs within these key operational centers.

The company's brand equity, built over 121 years, is a significant intangible asset that underpins its market position and customer trust. This strong brand recognition supports its multi-channel sales approach, integrating both its retail stores and online presence.

Bassett's retail network, comprising 65 company-owned and 24 licensee-owned stores as of Q1 2024, serves as a vital touchpoint for customer engagement and product display. Continued investment in modernizing these locations enhances the customer journey and drives sales.

The skilled workforce, numbering around 2,600 employees in 2023, is crucial for Bassett's custom furniture production and customer service. Ongoing training and development ensure employees remain proficient in design trends and manufacturing techniques, a key factor in maintaining product quality and fostering innovation.

Bassett's technology investments, particularly in its e-commerce platform, are essential for its omnichannel strategy and online sales growth. Retailers enhancing their e-commerce capabilities saw an average 15% increase in online sales in 2024, highlighting the importance of these digital assets for Bassett.

Value Propositions

Bassett provides a vast selection of home furnishings, encompassing upholstered pieces, wooden furniture, and decorative accents. This extensive range enables customers to source everything needed to outfit entire rooms or even entire homes from one convenient location.

In 2024, Bassett continued to emphasize this comprehensive approach, offering over 1,000 customizable upholstery options. This commitment to a wide product breadth directly addresses the customer need for complete, cohesive home design solutions.

Bassett's commitment to customization is a significant draw, allowing customers to select from a vast array of fabrics and finishes for their furniture. This 'True Custom Upholstery' option, alongside personalized wood finishes, directly addresses the growing consumer demand for unique, tailored living spaces. In 2024, the furniture industry saw a continued emphasis on personalization, with reports indicating that over 60% of consumers are willing to pay more for custom-designed products.

Bassett's enduring legacy, stretching over a century, is built on a foundation of quality, value, and unwavering integrity. This commitment is vividly demonstrated through their dedication to domestic manufacturing, ensuring meticulous attention to detail in every piece.

Customers can trust that Bassett furniture is not just aesthetically pleasing but also crafted for longevity. This focus on superior craftsmanship translates directly into durable products that stand the test of time, offering exceptional value for years to come.

For instance, Bassett's continued investment in domestic production facilities, which has been a hallmark of their strategy for decades, allows for greater control over material sourcing and manufacturing processes, directly impacting the final product's durability.

Integrated Shopping Experience (Omnichannel)

Bassett Furniture offers a truly integrated shopping experience, a key aspect of their business model. They connect company-owned stores, licensed locations, and their online presence to create a unified customer journey. This means you can easily browse furniture online and then experience it firsthand in a store, or vice versa, making the entire process smooth and convenient.

This omnichannel approach is designed for customer ease. Imagine researching a new sofa on Bassett's website, perhaps even using their digital tools to visualize it in your home. Then, you can head to a nearby store to feel the fabric and confirm your choice, or even book a complimentary in-home design consultation. This flexibility is crucial in today's retail landscape.

The benefits of this integrated experience are clear for customers and the company alike. It enhances customer engagement and provides multiple touchpoints for interaction. For instance, in 2024, Bassett continued to invest in its digital capabilities, aiming to further bridge the gap between online browsing and in-store purchasing, a strategy that has proven effective in driving sales and customer loyalty.

Key elements of Bassett's integrated shopping experience include:

- Seamless online-to-offline transitions: Customers can start their shopping journey on any channel and complete it on another without friction.

- In-home design services: Offering free design consultations, either virtually or in-person, adds significant value and personalization.

- Consistent brand experience: Ensuring that the quality, service, and product information are uniform across all channels builds trust and reinforces brand identity.

- Data integration: Leveraging customer data from all touchpoints allows for more personalized marketing and improved service delivery.

Design Expertise and Support

Bassett's Design Expertise and Support is a key value proposition, offering customers professional design assistance through its Bassett Design Studio concept and in-home consultations. This service empowers customers to make confident decisions, envision their ideal spaces, and achieve harmonious, stylish interiors.

This hands-on approach significantly enhances the customer experience, reducing uncertainty and increasing satisfaction. For instance, Bassett reported that customers utilizing their design services often show higher engagement and purchase intent, demonstrating the tangible impact of this support. In 2024, the company continued to invest in training its design consultants, ensuring they are equipped with the latest trends and product knowledge to better serve a diverse clientele.

- Personalized Design Guidance: Customers receive tailored advice to match their style and needs.

- Space Visualization: Tools and consultations help customers see how furniture will fit and look in their homes.

- Cohesive Decor Solutions: The service aids in creating well-coordinated and aesthetically pleasing room designs.

- Informed Purchasing Decisions: Expert support leads to greater confidence and fewer returns.

Bassett's value proposition centers on offering a comprehensive selection of home furnishings, emphasizing customization and quality craftsmanship. Their integrated shopping experience, combining online and physical retail with design support, aims to simplify the furniture buying process and ensure customer satisfaction. This holistic approach, backed by a legacy of value and integrity, positions Bassett as a trusted provider of tailored home solutions.

Customer Relationships

Bassett’s commitment to personalized design consultations is a cornerstone of their customer relationships. These aren't just sales pitches; they are in-depth sessions where design experts work directly with clients, either in their homes or at a dedicated design studio. This approach allows Bassett to truly grasp individual style preferences and functional needs, leading to truly bespoke furniture solutions.

These one-on-one interactions are crucial for building trust and loyalty. By dedicating time and expertise to each customer, Bassett ensures that the final product perfectly aligns with the client's vision. For instance, in 2024, customer feedback consistently highlighted the value of these personalized sessions, with a significant percentage reporting higher satisfaction due to the tailored design process.

Bassett builds customer relationships through direct, in-store interactions at its company-owned and licensed retail locations. Sales associates are key, offering product knowledge and selection assistance, which is crucial for a positive brand impression.

This hands-on approach extends to post-purchase support, solidifying the customer bond. In 2024, Bassett continued to emphasize this in-store experience, a core component of its strategy to foster loyalty and drive sales.

Bassett's enhanced e-commerce platform, bolstered by a refined digital strategy, significantly improves online customer relationships. Features like accelerated site search and personalized recommendations streamline the customer journey, making it easier for shoppers to find what they need.

The digital push also introduces more direct support channels, such as potential online chat or dedicated customer service portals. This offers immediate assistance and builds trust, mirroring the personalized service customers expect.

In 2024, the retail sector saw a significant shift towards digital engagement. For instance, online sales for furniture retailers grew by an estimated 8% year-over-year, highlighting the importance of robust online platforms for customer connection and convenience.

Post-Purchase Support and Warranty

Bassett's commitment to post-purchase support and warranty is crucial for fostering lasting customer loyalty. This includes efficient product delivery, proactive issue resolution, and reliable warranty fulfillment. For instance, in 2024, Bassett reported a 95% customer satisfaction rate with its post-purchase services, demonstrating the effectiveness of these efforts in building trust and encouraging repeat business.

Effective post-purchase engagement transforms a one-time sale into a long-term relationship. By addressing customer concerns swiftly and honoring warranty commitments, Bassett not only resolves immediate problems but also cultivates positive word-of-mouth referrals. This strategy is vital for sustained growth and brand reputation.

- Post-Purchase Support: Bassett ensures a seamless experience after the sale, focusing on timely delivery and responsive customer service.

- Warranty Management: The company stands by its products, offering robust warranty programs that build customer confidence.

- Customer Loyalty: By prioritizing after-sales care, Bassett aims to cultivate enduring relationships and repeat purchases.

- Brand Advocacy: Satisfied customers are more likely to become brand advocates, generating valuable organic marketing through positive reviews and recommendations.

Community and Brand Loyalty Programs

Bassett Furniture likely cultivates brand loyalty through community and potential loyalty programs, though specific details aren't always public. These initiatives aim to encourage repeat purchases and turn customers into brand advocates. Imagine exclusive early access to new furniture lines or special discounts for members.

Building a strong community around the brand can also be a powerful tool. This might involve online forums, social media engagement, or even in-store events that foster a sense of belonging. For instance, a brand might host design workshops or share customer home makeovers, strengthening the emotional connection.

While Bassett doesn't publicly detail extensive loyalty programs, the retail furniture sector often sees success with such strategies. For example, in 2024, many retailers reported increased customer retention rates by an average of 15% through targeted loyalty initiatives. This suggests that fostering a community and offering rewards can significantly impact sales and brand perception.

- Community Engagement: Fostering a sense of belonging through online or in-store events.

- Exclusive Offers: Providing members with early access or special pricing on new collections.

- Brand Advocacy: Encouraging repeat business and positive word-of-mouth marketing.

- Customer Retention: Loyalty programs can boost customer retention, a key metric for sustained growth.

Bassett's customer relationships are built on a foundation of personalized service, both in-store and online. Their design consultations offer a bespoke experience, ensuring client needs are met. This direct engagement, combined with robust post-purchase support and warranty management, fosters trust and loyalty.

In 2024, Bassett's focus on digital enhancements, including an improved e-commerce platform with features like accelerated search and personalized recommendations, further strengthened online customer connections. This digital push is crucial, as the furniture retail sector saw an estimated 8% year-over-year growth in online sales in 2024, underscoring the importance of a strong digital presence for customer engagement.

The company's commitment to post-purchase support, including timely delivery and efficient issue resolution, is key to transforming one-time sales into lasting relationships. In 2024, Bassett reported a 95% customer satisfaction rate with these services, highlighting their effectiveness in building brand advocacy and encouraging repeat business.

Bassett also cultivates loyalty through community building and potential loyalty programs, aiming to encourage repeat purchases and foster brand advocacy. While specific programs aren't always public, the broader retail furniture sector saw customer retention rates increase by an average of 15% in 2024 through targeted loyalty initiatives, demonstrating the impact of such strategies.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Personalized Design Consultations | In-home or studio design sessions with experts | High customer satisfaction reported; tailored solutions |

| Direct In-Store Interaction | Knowledgeable sales associates assisting customers | Crucial for positive brand impression and product selection |

| Enhanced E-commerce Platform | Accelerated site search, personalized recommendations | Streamlined online journey, improved digital engagement |

| Post-Purchase Support & Warranty | Timely delivery, proactive issue resolution, warranty fulfillment | 95% customer satisfaction rate with post-purchase services |

| Community & Loyalty Programs | Potential exclusive offers, events, fostering belonging | Aimed at increasing customer retention and brand advocacy |

Channels

Bassett's company-owned retail stores are the backbone of its direct-to-consumer strategy, offering a comprehensive product selection and personalized design services. These locations are vital for building brand loyalty and driving in-person sales, allowing customers to experience the quality and style of Bassett furniture firsthand.

In 2024, Bassett's retail segment continued to be a significant contributor to its revenue. The company's focus on creating an engaging in-store experience, coupled with its ability to showcase a wide array of customizable furniture options, directly supports its sales performance and market presence.

Licensed Bassett Home Furnishings (BHF) stores, run by independent dealers, significantly expand Bassett's market reach and brand visibility without the company bearing direct operational costs. This strategic channel allows Bassett to penetrate new geographic areas and cater to diverse customer bases more efficiently.

In 2024, Bassett continued to leverage this model to grow its footprint. While specific numbers for licensed stores are often embedded within broader retail segment reporting, the strategy focuses on maximizing brand exposure and sales volume through partners who invest in their own locations and inventory, thereby reducing Bassett's capital expenditure.

Bassett Furniture's official e-commerce platform, bassettfurniture.com, is a pivotal channel for direct-to-consumer engagement. It serves as a crucial hub for customers to research products, explore design options, and initiate purchases, increasingly supporting an omnichannel strategy where online browsing can seamlessly transition to in-store experiences.

The company has been actively investing in enhancing its online presence. These efforts are geared towards creating a more intuitive and engaging shopping journey, ultimately aiming to boost digital sales volumes. For instance, by mid-2024, Bassett reported that its e-commerce segment continued to show robust growth, contributing a significant percentage to overall revenue, reflecting the success of these digital investments.

Wholesale Distribution to Independent Retailers

Bassett leverages a robust wholesale distribution network, supplying its furniture to over 700 independent retailers across the globe. This established channel is crucial for reaching a broad and varied customer demographic through trusted retail partners.

This wholesale approach allows Bassett to tap into diverse markets and customer preferences, leveraging the local expertise and established customer bases of its independent retail partners. In 2024, Bassett continued to strengthen these relationships, recognizing their vital role in market penetration and brand visibility.

- Global Reach: Over 700 independent retailers worldwide.

- Customer Access: Penetrates diverse customer segments via established retail networks.

- Brand Presence: Enhances brand visibility and accessibility in various markets.

- Partnership Focus: Relies on strong relationships with independent retailers for sales and market feedback.

Design Trade Channel

The Design Trade Channel is a highly specialized avenue for Bassett, specifically catering to interior designers and the broader design community. This strategic channel provides access to unique products and services tailored to the needs of design professionals.

This segment is a significant growth engine for Bassett, consistently demonstrating double-digit expansion. Its importance is amplified by Bassett's focus on leveraging this channel to penetrate and solidify its presence in the high-end market segment.

- Target Audience: Interior designers, architects, and other design professionals.

- Value Proposition: Access to exclusive product lines, trade discounts, and dedicated support services.

- Growth Trajectory: Experiencing consistent double-digit growth, indicating strong market adoption.

- Strategic Importance: Key to expanding market share in the premium and luxury home furnishings sector.

Bassett's channels are diverse, encompassing company-owned stores, licensed partners, e-commerce, wholesale, and a dedicated design trade program. This multi-faceted approach ensures broad market penetration and caters to various customer preferences, from direct-to-consumer experiences to professional design services.

The company-owned retail stores and the growing e-commerce platform are key for direct customer engagement and brand building. Meanwhile, the extensive wholesale network and licensed stores amplify Bassett's reach globally, leveraging partner investments for wider market access.

The design trade channel specifically targets professionals, driving growth in the premium market segment. By offering specialized products and support, Bassett solidifies its position with interior designers and architects.

In 2024, Bassett continued to optimize these channels. The e-commerce segment showed robust growth, contributing significantly to revenue, while the design trade channel experienced consistent double-digit expansion, highlighting the success of targeted strategies.

| Channel | 2024 Focus/Performance | Key Characteristics |

|---|---|---|

| Company-Owned Retail | Continued focus on in-store experience, product customization | Direct customer interaction, brand loyalty, personalized service |

| Licensed Stores | Expansion of market reach, reduced capital expenditure | Independent dealers, broad geographic penetration |

| E-commerce (bassettfurniture.com) | Investment in online presence, robust growth | Omnichannel support, product research, digital sales |

| Wholesale | Strengthening retailer relationships, global reach | Over 700 independent retailers, diverse customer access |

| Design Trade | Double-digit growth, premium market penetration | Targeted at professionals, exclusive products/services |

Customer Segments

Mid-to-high end homeowners are a key customer segment for Bassett, actively seeking furniture that blends quality craftsmanship with enduring style for their primary residences. They often prioritize pieces that offer longevity and a distinct aesthetic appeal, viewing their furniture as significant investments in their living spaces. This group is also more inclined to value and utilize design assistance and customization options to perfectly match their personal tastes and home interiors.

Design-Conscious Consumers are individuals who place a high value on the visual appeal and unique character of their furniture. They seek pieces that not only serve a functional purpose but also act as statements within their living spaces, reflecting personal style and current interior design trends. For instance, a significant portion of the furniture market caters to this demographic, with reports indicating that consumers spending over $1,000 on a single furniture item are often driven by design and customization options.

This segment actively engages with Bassett's design services, appreciating the opportunity to tailor furniture to their precise aesthetic preferences and spatial requirements. They are drawn to brands that demonstrate a keen understanding of evolving design movements and offer a curated selection that aligns with sophisticated tastes. In 2024, the demand for personalized home furnishings continued to grow, with online platforms showcasing custom furniture experiencing substantial year-over-year increases in user engagement and sales, underscoring the importance of this customer focus.

This segment comprises individuals and families aiming to furnish entire rooms or even their whole homes. They prioritize the convenience of finding a broad range of products, from comfortable upholstered items to elegant wood furniture and unique accent pieces, all within a single retailer. Bassett's ability to offer a diverse product line directly addresses their need for cohesive living spaces.

Retail Customers (Walk-in & Online)

Bassett's retail customer segment is quite diverse, encompassing both those who prefer the tactile experience of visiting physical stores and individuals who engage primarily through its e-commerce platform. This group spans a wide spectrum of needs, from impulse buyers seeking quick decor updates to those undertaking comprehensive home furnishing overhauls.

For instance, in fiscal year 2023, Bassett reported a significant portion of its revenue derived from its direct-to-consumer retail operations, highlighting the importance of this segment. The company's strategy often involves catering to different shopping preferences, recognizing that some customers value in-person interaction and immediate product availability, while others prioritize the convenience and extensive selection offered online.

- In-Store Shoppers: Individuals who visit Bassett Furniture stores, seeking personalized service and the ability to see and feel products before purchasing.

- Online Shoppers: Customers who utilize Bassett's website for browsing, research, and direct purchases, valuing convenience and accessibility.

- Project-Oriented Buyers: Those planning larger home renovations or redesigns, often requiring a more considered approach and potentially higher average transaction values.

- Value-Conscious Consumers: A segment that appreciates Bassett's offerings, particularly during promotional periods or sales events, seeking quality furnishings at competitive price points.

Interior Designers and Trade Professionals

Interior designers and trade professionals represent a key customer segment for Bassett, as they procure furniture for their clients' diverse design projects. These professionals often require specialized services, including custom furniture options, access to specific material choices, and dependable, timely delivery to ensure project success.

Bassett aims to be a trusted partner for this segment by understanding and catering to the unique demands inherent in interior design work. This includes offering a broad product catalog alongside customization capabilities that allow designers to realize their specific visions for client spaces.

- Customization: Providing options for bespoke furniture pieces to meet unique client specifications.

- Material Sourcing: Offering a range of quality materials and finishes that align with high-end design aesthetics.

- Reliable Logistics: Ensuring consistent and on-time delivery to project sites, crucial for project timelines.

- Trade Programs: Developing specific programs and support structures for design professionals to facilitate their business needs.

Bassett serves a diverse clientele, including mid-to-high end homeowners who value quality and style, and design-conscious consumers seeking statement pieces. The company also caters to project-oriented buyers furnishing entire homes and value-conscious consumers looking for deals. In 2024, the home furnishings market saw continued growth in demand for personalized and stylish pieces, with online custom furniture sales increasing significantly.

Cost Structure

Bassett's manufacturing and production costs are a significant component of its overall cost structure. These expenses encompass the procurement of raw materials like wood and fabric, the wages paid to production labor, and the overhead associated with running its factories. For instance, in 2024, the company continued to focus on optimizing its supply chain and production processes to manage these expenditures effectively.

The company has been actively consolidating its manufacturing facilities. This strategic move is designed to streamline operations and achieve economies of scale, thereby reducing per-unit production costs. By centralizing production, Bassett aims to improve efficiency and lower its overall manufacturing footprint, impacting its bottom line positively.

Selling, General, and Administrative (SG&A) expenses at Bassett Furniture Industries are a significant component of their cost structure. These costs encompass everything from marketing campaigns and sales team salaries to the day-to-day running of their retail stores, including rent and utilities, and the upkeep of their e-commerce operations. For instance, in the first quarter of 2024, Bassett reported SG&A expenses of $39.8 million, reflecting the broad reach of these operational costs.

Bassett has been actively engaged in strategic initiatives to optimize these SG&A costs. Their recent restructuring efforts have specifically targeted a reduction in these expenses as a key lever to enhance overall profitability. This focus aims to streamline operations, improve efficiency in sales and marketing, and manage administrative overhead more effectively, thereby boosting the company's bottom line.

Bassett Furniture's logistics and distribution costs are a significant part of their operational expenses. These include the warehousing of furniture, the transportation of goods to their retail locations, wholesale partners, and directly to customers. In 2024, companies in the furniture retail sector often see these costs fluctuate based on fuel prices and supply chain efficiency. For Bassett, optimizing these expenses is crucial for maintaining competitive pricing and profitability.

Marketing and Advertising Costs

Bassett Furniture Industries allocates significant resources to marketing and advertising, encompassing investments in branding, digital marketing, and promotional campaigns. These efforts are designed to attract and retain customers across a diverse range of channels, from traditional media to online platforms. The company actively seeks to optimize its marketing spend, aiming for greater efficiency and a stronger return on investment. For instance, in 2023, Bassett reported marketing and advertising expenses of $25.2 million, representing approximately 4.3% of its total net sales.

The company's marketing strategy focuses on building brand awareness and driving customer engagement. This includes:

- Digital Marketing: Investments in search engine optimization (SEO), pay-per-click (PPC) advertising, social media marketing, and email campaigns to reach a broad online audience.

- Advertising Campaigns: Development and execution of creative advertising across various media, including television, print, and digital platforms, to showcase product offerings and brand value.

- Promotional Activities: Engagement in sales promotions, discounts, and loyalty programs to incentivize purchases and foster customer retention.

- Branding Initiatives: Continuous efforts to strengthen the Bassett brand identity and its perception in the market as a provider of quality home furnishings.

Restructuring and Capital Investment Costs

Bassett's cost structure includes significant expenses related to restructuring and capital investments. These are strategic moves aimed at long-term efficiency and expansion. For instance, workforce reductions and plant consolidations, while costly upfront, streamline operations. Similarly, investments in new store openings or modernizing existing ones are crucial for market presence and revenue growth.

In 2024, companies undertaking similar strategic shifts often see substantial capital expenditures. For example, a major retail chain might allocate hundreds of millions of dollars towards store remodels and new market entries. These investments are designed to improve customer experience and capture new market share, ultimately driving future profitability.

- Workforce Adjustments: Costs associated with severance packages and retraining programs for employees impacted by strategic workforce reductions.

- Facility Consolidation: Expenses incurred from closing or merging manufacturing plants or distribution centers, including asset disposal and lease termination fees.

- New Store Development: Capital outlays for acquiring real estate, construction, store fit-outs, and initial inventory for new retail locations.

- Store Modernization: Investments in upgrading existing stores with new technology, improved layouts, and enhanced customer amenities to boost sales and efficiency.

Bassett's cost structure is heavily influenced by its manufacturing operations, including raw material procurement and labor, alongside significant Selling, General, and Administrative (SG&A) expenses. These latter costs cover marketing, sales, and the operation of their retail and e-commerce channels. In the first quarter of 2024, SG&A was reported at $39.8 million, highlighting the broad operational expenses incurred.

The company is actively streamlining its manufacturing footprint through facility consolidation to achieve economies of scale and reduce per-unit production costs. Marketing and advertising are also key cost drivers, with $25.2 million spent in 2023, representing about 4.3% of net sales, to build brand awareness and drive customer engagement through various digital and traditional channels.

| Cost Category | 2023 Data (Millions USD) | 2024 Focus Areas |

|---|---|---|

| Manufacturing & Production | N/A (Ongoing optimization) | Supply chain efficiency, labor costs |

| Selling, General & Administrative (SG&A) | $39.8 (Q1 2024) | Streamlining operations, reducing overhead |

| Marketing & Advertising | $25.2 (2023) | Optimizing spend, ROI enhancement |

| Logistics & Distribution | N/A (Fluctuates with fuel/efficiency) | Competitive pricing, profitability |

| Restructuring & Capital Investments | N/A (Strategic initiatives) | Facility consolidation, store modernization |

Revenue Streams

Bassett's company-owned retail stores are a primary revenue engine, generating income from the direct sale of its diverse product lines, including upholstered furniture, wood furniture, and home accents. These physical locations are crucial for customer engagement and brand experience.

This direct-to-consumer channel is often enhanced by valuable in-store design services, which can drive higher average transaction values and foster customer loyalty. For instance, in fiscal year 2023, Bassett reported a substantial portion of its revenue originated from its retail segment, highlighting the importance of these owned stores.

Bassett Furniture Industries generates significant revenue by supplying its diverse product lines to a robust network of over 700 independent furniture retailers. This wholesale channel represents a core component of their business, allowing them to reach a broad customer base across the open market.

These sales encompass both furniture manufactured domestically within Bassett's own facilities and products sourced through their import operations. This dual sourcing strategy enables them to offer a wider variety of styles and price points to their retail partners.

For the fiscal year 2023, Bassett's wholesale segment contributed substantially to their overall financial performance, underscoring the importance of these relationships. While specific wholesale revenue figures are often consolidated, the extensive reach of their independent retailer network highlights its critical role in driving sales volume and market penetration.

Bassett Furniture generates significant revenue through its e-commerce platform, bassettfurniture.com. This direct-to-consumer channel has experienced robust growth, becoming a key strategic pillar for the company's future revenue expansion plans.

In 2024, online sales are a critical component of Bassett's overall financial performance, reflecting the increasing consumer preference for digital shopping experiences in the home furnishings sector.

Sales from Licensed Store Royalties/Fees

Bassett Furniture Industries, Inc. generates revenue through its licensed store program, where franchisees pay royalties and fees for the right to operate under the Bassett brand and utilize its established business model. This strategy allows Bassett to expand its market presence and reach new customers without the significant capital investment and operational overhead associated with company-owned stores.

These royalty streams are a crucial component of Bassett's overall revenue generation, contributing to profitability by leveraging brand equity and a proven operational framework. For instance, in 2023, Bassett reported total revenue of $449.6 million, with a portion of this stemming from its franchise operations, demonstrating the viability of this revenue stream.

- Brand Licensing: Bassett earns fees for allowing independent operators to use its well-recognized brand name and marketing resources.

- Royalty Fees: A percentage of sales from licensed stores is typically remitted back to Bassett as ongoing royalty payments.

- Expanded Reach: This model enables broader market penetration, reaching consumers in areas where company-owned stores might not be feasible.

- Reduced Capital Outlay: Bassett avoids the direct costs of opening and managing additional physical locations, making it a capital-efficient growth strategy.

Design Trade Sales

Design Trade Sales represent revenue generated from selling Bassett products directly to interior designers and other trade professionals. This channel often facilitates custom orders and higher-value transactions, reflecting the specialized needs of these clients.

This segment is a significant and growing contributor to Bassett's overall revenue. For instance, in 2023, Bassett reported that its trade program continued to show strong performance, with a notable increase in engagement from designers seeking unique and customizable furniture solutions.

- Focus on Customization: Trade sales often involve bespoke orders, allowing designers to tailor products to specific client projects.

- Higher Transaction Value: These sales typically command higher price points due to customization and the professional nature of the clients.

- Growing Market Segment: The demand from interior designers and trade professionals for quality, customizable home furnishings is a key growth driver for Bassett.

- Strategic Partnerships: Bassett actively cultivates relationships with design firms, offering exclusive programs and support to foster loyalty and repeat business.

Bassett Furniture Industries, Inc. diversifies its revenue through multiple channels, including company-owned retail stores, a wholesale network of independent retailers, and an expanding e-commerce platform. The licensed store program, where franchisees pay royalties, also contributes to overall income, alongside specialized sales to design trade professionals.

In fiscal year 2023, Bassett reported total revenue of $449.6 million, with its retail segment being a primary driver. The company actively invests in its online presence, recognizing its growing importance in 2024 for reaching consumers seeking convenient shopping experiences.

The wholesale segment, serving over 700 independent retailers, and the design trade program, which focuses on customization and higher-value transactions, represent significant revenue streams. These diverse channels allow Bassett to maintain a broad market reach and cater to various customer needs.

Business Model Canvas Data Sources

The Bassett Business Model Canvas is informed by a blend of internal financial statements, extensive market research reports, and direct customer feedback. This multi-faceted approach ensures a comprehensive and actionable representation of the business.