Attica Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Attica Group's SWOT analysis reveals a strong brand reputation and a dedicated customer base as key strengths, but also highlights potential vulnerabilities in market diversification and emerging competitive threats. Understanding these dynamics is crucial for navigating the dynamic travel and tourism sector.

Want the full story behind Attica Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Attica Group stands as a dominant force in the passenger shipping industry, recognized as one of the largest global operators of Ro-Pax vessels. This leading market position was significantly bolstered by the full integration of ANEK's operations in 2024, a move that expanded its passenger capacity and market reach.

The company now commands a formidable fleet of 42 vessels, enhancing its operational flexibility and coverage across its extensive network. This substantial fleet size is a key driver of economies of scale, allowing Attica Group to operate more efficiently and maintain a strong competitive edge in the market.

Attica Group commands significant market trust through its well-established brand portfolio, including Superfast Ferries, Blue Star Ferries, Hellenic Seaways, and Anek Lines. This strong brand recognition translates into customer loyalty, fostering consistent demand across its operational routes.

Attica Group's strength lies in its comprehensive network, linking mainland Greece to a multitude of islands like the Cyclades, Dodecanese, Crete, and the North-East Aegean, alongside international routes to Italian ports such as Ancona, Bari, and Venice. This extensive reach, coupled with a high frequency of sailings, solidifies its position as a dependable provider of maritime transport for both passengers and cargo.

In 2024, Attica Group significantly enhanced its operational capacity, with its fleet navigating an impressive array of routes and increasing the number of sailings offered. This strategic expansion in service frequency directly supports its extensive network coverage, ensuring consistent and reliable connectivity across its operational areas.

Diversified Revenue Streams from Passenger and Freight Services

Attica Group's dual focus on passenger and freight transport creates a robust business model. By serving both the tourism industry, moving millions of passengers and private vehicles, and the commercial sector, transporting substantial freight volumes, the company builds a more resilient revenue stream. This diversification helps mitigate the impact of seasonality inherent in the tourism market.

The group saw significant growth in 2024, with notable increases in traffic volumes across all its service categories. This expansion underscores the effectiveness of its diversified approach.

- Passenger Traffic Growth: Attica Group reported a significant increase in passenger numbers in 2024, contributing to stable revenue.

- Freight Volume Increase: The transport of trucks and freight units also saw substantial growth, reinforcing the company's diversified income.

- Reduced Seasonality Impact: The balanced revenue from both passenger and freight services lessens the group's dependence on peak tourist seasons.

Proactive Commitment to Sustainability and Fleet Modernization

Attica Group is demonstrating a strong commitment to sustainability through significant investments in fleet modernization. A substantial €700 million investment program is underway, focusing on introducing new generation vessels that are environmentally friendly. This proactive approach includes securing agreements for E-Flexer vessels that are methanol-ready and battery-ready by 2027, a move designed to substantially cut greenhouse gas emissions.

The company's dedication to environmental, social, and governance (ESG) principles is further underscored by its latest reporting. Attica Group's 16th Sustainability Report, released in July 2025, not only details its progress but also points to global ESG recognition. This report reinforces the company's clear decarbonization roadmap, showcasing tangible steps towards a greener future in maritime transport.

Key initiatives and achievements include:

- €700 million investment program for fleet renewal and green transition.

- Agreements for methanol and battery-ready E-Flexer vessels by 2027.

- Significant reduction of greenhouse gas emissions as a primary objective.

- Global ESG recognition highlighted in the July 2025 Sustainability Report.

Attica Group's considerable market share, especially after integrating ANEK in 2024, positions it as a leader in the passenger ferry sector. Its substantial fleet of 42 vessels enables significant economies of scale, reinforcing its competitive advantage.

The company benefits from strong brand recognition across its portfolio, including Superfast Ferries and Blue Star Ferries, fostering customer loyalty and consistent demand. This broad appeal is a critical asset in attracting and retaining passengers.

Attica Group's extensive network, connecting mainland Greece to numerous islands and international ports, ensures broad market coverage. This robust infrastructure, combined with frequent sailings, makes it a reliable transport provider.

The dual focus on passenger and freight traffic creates a resilient business model, mitigating the impact of seasonal tourism fluctuations. In 2024, the group saw notable traffic volume growth across all segments, demonstrating the success of this diversified strategy.

What is included in the product

Delivers a strategic overview of Attica Group’s internal and external business factors, highlighting its competitive position and the opportunities and risks shaping its future.

Identifies key competitive advantages and potential threats for targeted strategic action.

Weaknesses

Attica Group's financial performance in 2024 was significantly affected by €28.2 million in non-recurring expenses tied to the merger with ANEK. These costs, which included voluntary redundancy packages and integration activities, directly reduced the company's consolidated earnings after tax.

This substantial one-time expenditure highlights the immediate financial strain that strategic consolidation can impose. While the merger promises long-term benefits, these integration costs represent a clear short-term weakness impacting profitability.

Attica Group's ambitious fleet renewal, environmental upgrades, and digitization initiatives have led to substantial cash outflows. In 2024, these investments totaled €162 million, with €145.1 million spent in the first nine months of that year alone.

While these investments are crucial for long-term competitiveness and sustainability, they significantly reduce the company's readily available cash. This reduction in cash and cash equivalents could potentially affect its short-term liquidity position.

The implementation of the European Union Emissions Trading System (EU ETS) starting January 1, 2024, has introduced significant new operating expenses for Attica Group, primarily through the purchase of emission allowances. In 2024, these costs reached €18.9 million, directly impacting the company's bottom line.

This ongoing financial obligation underscores the challenge of adapting to increasingly stringent environmental regulations, which will likely continue to affect profitability as compliance requirements evolve.

High Seasonality of Passenger Traffic

While Attica Group benefits from the steady income of its freight operations, its core passenger ferry business experiences significant seasonal swings. Passenger traffic typically surges between July and September, creating a concentrated period of high demand and revenue. This leaves the company facing lower utilization and reduced earnings during the quieter months, particularly from November through February.

This pronounced seasonality presents an ongoing hurdle for Attica Group in optimizing its capacity and maintaining consistent profitability throughout the year. For instance, in 2024, while freight volumes remained robust, the passenger segment's performance was heavily weighted towards the summer months. Managing the ebb and flow of passenger demand requires careful planning and strategic deployment of resources to mitigate the impact of off-peak periods.

- Peak Passenger Season: July - September

- Off-Peak Passenger Months: November - February

- Impact: Lower utilization and revenue during off-peak periods

- Challenge: Managing capacity and profitability across seasonal fluctuations

Challenges in Fleet Age and Modernization Pace

While Attica Group is actively investing in new vessels, the recent integration of ANEK means the combined fleet still contains older ships. Some of these older vessels are being retired and sent for environmentally responsible recycling, reflecting a commitment to upgrading. This ongoing process of fleet renewal and modernization demands significant and continuous capital expenditure to maintain competitiveness.

The necessity of replacing and upgrading portions of the fleet means that substantial capital will be required consistently. To ensure the fleet remains competitive and adheres to increasingly stringent environmental regulations, Attica Group must sustain a high level of investment over the long term.

- Fleet Age and Modernization Challenges: The integration of ANEK has introduced older vessels into Attica Group's fleet, necessitating ongoing investment in modernization and replacement.

- Capital Expenditure Requirements: Continuous capital expenditure is essential for replacing aging vessels and modernizing the fleet to meet market and environmental standards.

- Environmental Compliance and Competitiveness: Maintaining a modern, environmentally compliant, and competitive fleet requires a sustained high level of investment.

Attica Group faces the challenge of managing a fleet that, despite modernization efforts, still includes older vessels. This necessitates continuous capital investment for upgrades and replacements, impacting cash flow and requiring sustained financial commitment to maintain competitiveness and meet evolving environmental standards.

Same Document Delivered

Attica Group SWOT Analysis

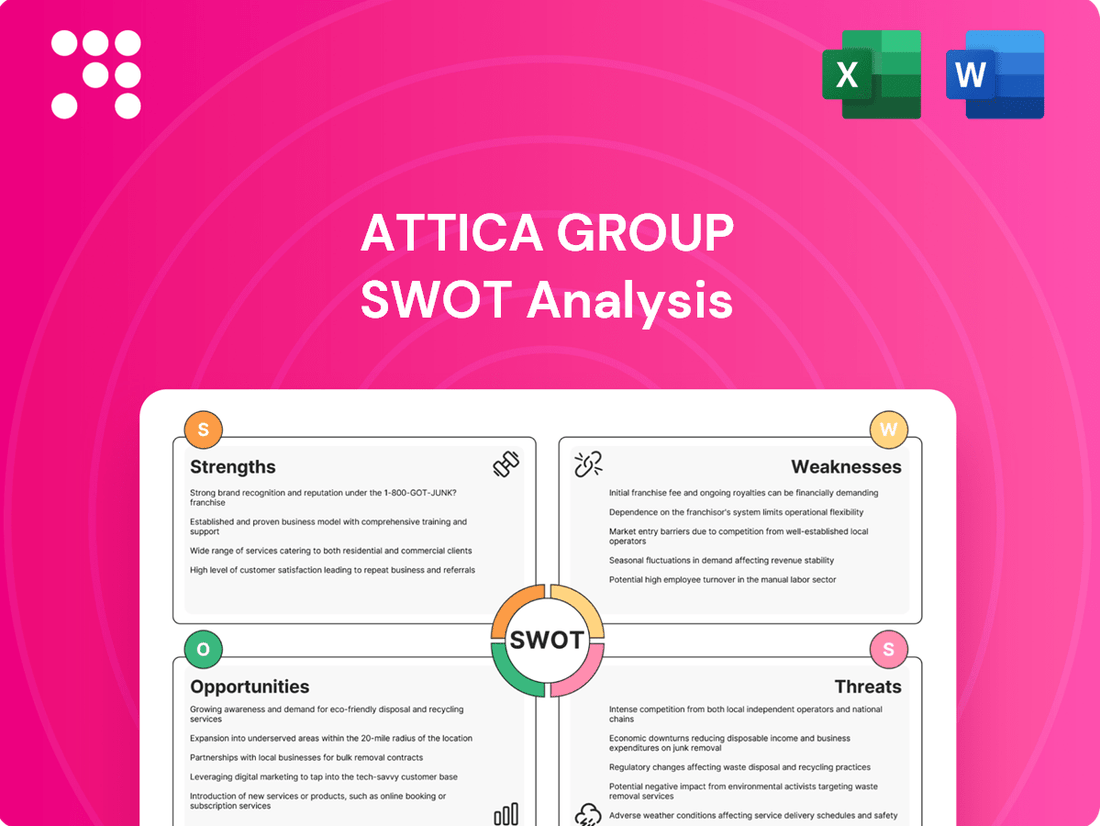

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Attica Group SWOT analysis, providing a clear overview of its strategic positioning. The full, detailed report is unlocked upon purchase.

Opportunities

The Greek tourism sector is experiencing a significant upswing, with travel receipts reaching €20.5 billion in the first ten months of 2023, a 14.5% increase compared to the same period in 2022. This robust growth, fueled by a rising interest in short-term rentals and island destinations, directly benefits Attica Group by boosting demand for its ferry services. The company is well-positioned to leverage this trend for increased passenger and vehicle traffic.

Attica Group is strategically diversifying into hospitality, acquiring hotel complexes on islands served by its ferry routes. This vertical integration aims to create synergistic bundled travel packages, enhancing the overall customer experience. The acquisition of a second hotel complex in Naxos during the first half of 2024 underscores this expansion strategy.

Attica Group is strategically investing in cutting-edge green shipping technologies, including vessels designed for methanol and battery power, alongside scrubber installations. These forward-thinking upgrades are partially supported by significant funding streams, such as the European Union's Recovery and Resilience Facility (RRF), which aims to bolster sustainable development. For instance, the RRF has allocated substantial funds across member states to support green transitions in various sectors, including maritime transport, potentially benefiting companies like Attica Group.

These technological advancements are not just about environmental stewardship; they translate into tangible operational efficiencies. By optimizing fuel consumption through these greener systems, Attica Group can anticipate notable long-term reductions in operating expenses. This proactive approach to sustainability also significantly bolsters the company's corporate image, positioning it as a leader in environmentally responsible maritime operations, a factor increasingly valued by investors and customers alike in 2024 and beyond.

Fleet Optimization and Redeployment for Enhanced Efficiency

Attica Group is set to significantly enhance its operational efficiency through strategic fleet optimization and redeployment, particularly with the arrival of new, larger Ro-Pax vessels slated for delivery in 2027. This initiative will facilitate the retirement of older, less efficient vessels, thereby reducing the company's environmental impact and lowering the average age of its fleet. Such a move is expected to bolster transport capacity on crucial routes, such as those in the Adriatic Sea, leading to a more competitive and streamlined service offering.

The planned fleet upgrades are designed to yield tangible benefits:

- Reduced Operational Costs: Newer vessels typically consume less fuel, directly impacting operating expenses.

- Enhanced Capacity: Larger Ro-Pax vessels can accommodate more passengers and vehicles, increasing revenue potential on high-demand routes.

- Environmental Benefits: Retiring older vessels and introducing modern ones with improved fuel efficiency contributes to a lower carbon footprint.

- Improved Service Reliability: A younger, more modern fleet generally experiences fewer breakdowns, leading to more consistent service delivery.

Continued Digital Transformation for Operational Improvement

Attica Group is heavily investing in its digital transformation, aiming to boost efficiency across its entire operation, from booking to onboard services. This push for digitization is crucial for streamlining processes and enhancing the customer journey.

The company's commitment to digital solutions is expected to yield significant operational improvements. For instance, by the end of 2024, Attica Group anticipates that over 80% of its customer interactions will be handled through digital channels, a substantial increase from 55% in 2023.

- Enhanced Efficiency: Digital tools are projected to reduce turnaround times at ports by an average of 15% by mid-2025.

- Improved Customer Experience: Upgraded booking platforms and onboard digital services are designed to increase customer satisfaction scores by 10% in the next fiscal year.

- Competitive Advantage: Continued investment in technology, including AI-driven route optimization expected in 2025, will solidify Attica Group's position in a competitive market.

The robust growth in Greek tourism, with travel receipts hitting €20.5 billion in the first ten months of 2023, presents a significant opportunity for Attica Group to increase passenger and vehicle traffic on its ferry routes. The company's strategic expansion into hospitality, including the acquisition of hotel complexes on popular islands, allows for the creation of integrated travel packages, capitalizing on this tourism boom.

Threats

The shipping industry, including Attica Group, is inherently vulnerable to fluctuating fuel prices. For instance, the price of High Sulphur Fuel Oil (HSFO) saw significant volatility in early 2024, with prices ranging from approximately $550 to $650 per metric ton, directly impacting operating expenses.

Geopolitical events, such as the ongoing tensions in the Red Sea, have a pronounced effect. This disruption led to rerouting of vessels, increasing transit times and fuel consumption, and consequently pushing freight rates higher for certain routes in late 2023 and early 2024.

While Attica Group employs hedging strategies to mitigate fuel price risks, prolonged periods of elevated fuel costs, exacerbated by such geopolitical instability, continue to pose a substantial threat to the company's profitability and financial resilience.

The EU Emissions Trading System (ETS), which expanded to maritime transport in 2024, directly impacts Attica Group by requiring the purchase of emission allowances. This adds a significant operational cost that directly affects the bottom line.

Anticipated future regulations focused on decarbonization will likely bring further compliance requirements and potentially new environmental taxes. Attica Group must anticipate these escalating costs, which will necessitate ongoing investment in more sustainable vessel technologies to maintain profitability.

The Eastern Mediterranean passenger shipping sector, especially routes linking mainland Greece to its islands, is experiencing a significant uptick in competitive intensity. This surge is driven by both established domestic players looking to expand their reach and the potential emergence of new entrants eager to capture market share.

This heightened competition directly translates into considerable price pressures for Attica Group. Such pressures can erode market share and compress profit margins, making it crucial for the company to adapt its strategies to maintain financial health.

Attica Group must therefore prioritize continuous innovation in its services, fleet modernization, and operational efficiency to sustain its competitive advantage in this dynamic market. For instance, in 2023, the company invested significantly in upgrading its fleet, introducing new routes, and enhancing onboard passenger experiences, aiming to differentiate itself from rivals.

Economic Downturns and Their Impact on Travel and Trade

Economic downturns, whether global or concentrated in key markets like Greece and Italy, present a significant threat to Attica Group. A slowdown in economic activity directly translates to reduced consumer spending on travel and potentially lower demand for goods, impacting both passenger and freight volumes. For instance, a global recession in 2024 or 2025 could see discretionary travel budgets shrink considerably.

Attica Group's reliance on passenger and vehicle ferry services means that economic contractions directly affect ticket sales and the number of vehicles transported. Similarly, commercial freight volumes, crucial for the company's cargo operations, are highly sensitive to the overall health of the economy. A recessionary environment would likely lead to decreased industrial output and trade, thereby reducing the need for freight transport.

The company's financial performance is therefore intrinsically linked to macroeconomic stability. A prolonged economic slump could lead to a notable decrease in revenue, impacting profitability and potentially hindering investment in fleet modernization or expansion. Attica Group's exposure to these cyclical economic trends is a key vulnerability.

Key impacts include:

- Reduced Passenger Numbers: Economic hardship often leads individuals to cut back on non-essential travel, directly impacting ferry passenger volumes.

- Lower Freight Volumes: A decline in manufacturing and trade during economic downturns results in fewer goods needing transportation, affecting Attica Group's cargo business.

- Decreased Disposable Income: With less money available, consumers are less likely to opt for ferry travel, especially for leisure purposes.

Shortage of Skilled Labor in the Maritime Industry

The Greek maritime sector, including companies like Attica Group, grapples with a persistent shortage of skilled labor, especially for crucial auxiliary crew positions. This difficulty in attracting and retaining younger talent creates a significant skills gap. For instance, in 2024, reports indicated a growing concern among Greek shipping companies regarding the availability of qualified seafarers, impacting recruitment pipelines.

This scarcity of qualified personnel poses a direct threat to Attica Group's operations. It can translate into escalating labor costs as companies compete for a limited pool of workers. Furthermore, operational inefficiencies may arise due to a lack of experienced crew, potentially leading to service disruptions across its ferry routes. The International Chamber of Shipping has highlighted that by 2026, the global maritime industry could face a deficit of over 100,000 officers.

- Attracting and retaining young talent remains a challenge for the Greek shipping industry.

- A broader skills gap exists within the maritime sector, impacting the availability of qualified personnel.

- Potential consequences include increased labor costs and operational inefficiencies for Attica Group.

- Service disruptions are a risk if a steady supply of trained maritime professionals cannot be ensured.

Intensified competition within the Eastern Mediterranean passenger shipping sector, particularly on routes connecting mainland Greece to its islands, poses a significant threat. This heightened rivalry, driven by both existing domestic operators and potential new entrants, leads to considerable price pressures that can erode Attica Group's market share and compress profit margins.

Economic downturns, whether global or localized in key markets like Greece and Italy, directly impact Attica Group by reducing consumer spending on travel and lowering demand for goods. This translates to fewer passengers and potentially lower freight volumes, affecting overall revenue and profitability.

The expansion of the EU Emissions Trading System (ETS) to maritime transport in 2024 introduces direct operational costs for Attica Group through the purchase of emission allowances. Future decarbonization regulations are also anticipated to bring further compliance requirements and potential environmental taxes, necessitating ongoing investment in sustainable technologies.

A persistent shortage of skilled labor, especially for auxiliary crew positions, within the Greek maritime sector presents a threat to Attica Group's operations. This scarcity can drive up labor costs and lead to operational inefficiencies or service disruptions due to a lack of experienced personnel.

SWOT Analysis Data Sources

This SWOT analysis for Attica Group is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a clear view of the company's performance, competitive landscape, and future projections.