Attica Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Navigate the complex external environment impacting Attica Group with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping their strategic landscape. Unlock actionable intelligence to inform your own market approach. Download the full PESTLE analysis now for a decisive competitive edge.

Political factors

The Greek government, through its Ministry of Maritime Affairs and Island Policy, is channeling significant investment into a green transition for its maritime sector. With over 2 billion euros earmarked for maritime transport and island policy, a substantial portion is dedicated to modernizing the fleet and embracing sustainable practices.

A key aspect of this governmental support involves public-private partnerships aimed at replacing older vessels, particularly those serving remote island routes. The European Union has allocated an increased funding of 265 million euros specifically for these renewal efforts, creating a favorable financial landscape for companies like Attica Group to invest in greener, more efficient ships.

The EU's 'Fit for 55' package, particularly the EU Emissions Trading System (ETS) and FuelEU Maritime Regulation, is reshaping the maritime landscape. These initiatives aim to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly affecting shipping operations.

For companies like Attica Group, this means increased operating expenses due to the need to purchase emission allowances under the ETS. However, it also acts as a powerful incentive for adopting greener technologies and fuels, fostering innovation within the sector.

Attica Group, operating extensively in the Eastern Mediterranean, faces the critical task of adapting its fleet and strategies to meet these stringent EU compliance demands. This regulatory evolution is a key political factor influencing their operational costs and long-term investment decisions as of 2024 and into 2025.

The Greek Ministry's push for an integrated slots system, leveraging digitalization and automation, is set to enhance port efficiency for coastal shipping. This policy directly impacts Attica Group by potentially streamlining their ferry operations and improving turnaround times.

Ensuring territorial continuity and social cohesion through responsible operations is a key government objective. This means Attica Group must maintain essential services to islands, even on less profitable routes, impacting their strategic route planning and operational costs.

Policies related to transportation equivalents, designed to subsidize island residents' travel costs, will influence Attica Group's pricing strategies. For instance, in 2023, the Greek government allocated €26.4 million for these subsidies, directly affecting the revenue potential on specific island connections.

Geopolitical Stability and Regional Conflicts

Geopolitical stability is a critical consideration for Attica Group, given its primary operational focus in the Eastern Mediterranean. While direct impacts might seem localized, broader global events like the disruptions in the Red Sea, which began intensifying in late 2023 and continued into 2024, can significantly affect shipping. These incidents lead to increased insurance premiums and rerouting, indirectly impacting operational costs and market sentiment for ferry and shipping companies.

Despite regional tensions, the Greek cruise tourism sector has demonstrated notable resilience. For instance, in 2024, Greece remained a top destination for cruise ships, with major ports like Piraeus and Heraklion experiencing substantial passenger traffic. This stability in a key market underscores the importance of international relations for the maritime sector's overall health.

- Red Sea Disruptions: Attacks on commercial shipping in the Red Sea, which escalated in late 2023 and early 2024, forced many vessels to take longer routes around Africa, increasing transit times and fuel costs.

- Insurance Costs: Geopolitical instability often correlates with higher war risk and piracy insurance premiums for maritime operators, adding to the overall cost of doing business.

- Market Sentiment: Broader geopolitical uncertainty can dampen consumer confidence and business investment, potentially affecting travel demand and freight volumes for ferry and shipping services.

- Greek Tourism Resilience: In 2024, Greece continued to be a highly sought-after cruise destination, with projections indicating a strong recovery and growth in passenger numbers, showcasing the sector's ability to withstand some regional geopolitical challenges.

International Maritime Organization (IMO) Targets

Beyond European Union directives, the International Maritime Organization (IMO) is setting ambitious new targets for reducing greenhouse gas emissions. A key milestone is the planned adoption of a comprehensive basket of measures in 2025, which will significantly shape the future of global shipping. Attica Group’s decarbonization strategy is already closely aligned with these evolving international climate goals, demonstrating a forward-thinking approach to meeting anticipated global standards. This proactive stance is crucial for ensuring the company's long-term operational sustainability and maintaining its competitive edge in the international maritime sector.

Governmental policies are driving a significant green transition in Greece's maritime sector, with over 2 billion euros allocated for modernization and sustainability. The EU's increased funding of 265 million euros for fleet renewal, coupled with the 'Fit for 55' package including the Emissions Trading System and FuelEU Maritime, directly impacts Attica Group by incentivizing greener operations and potentially increasing costs for non-compliance.

The Greek government's focus on an integrated slots system aims to boost port efficiency, which could streamline Attica Group's ferry operations. Furthermore, policies ensuring territorial continuity necessitate maintaining essential services to islands, influencing route planning and operational costs, while transportation subsidies for island residents, like the €26.4 million allocated in 2023, affect pricing strategies.

Geopolitical stability in the Eastern Mediterranean remains crucial, with events like the Red Sea disruptions in late 2023 and 2024 leading to increased insurance premiums and rerouting. Despite regional tensions, Greece's cruise tourism sector showed resilience in 2024, with strong passenger traffic in key ports like Piraeus, highlighting the importance of international relations for maritime health.

The International Maritime Organization's (IMO) ambitious greenhouse gas emission reduction targets, with a comprehensive basket of measures expected in 2025, will further shape global shipping. Attica Group's decarbonization strategy is already aligned with these international climate goals, positioning them for long-term sustainability and competitiveness.

| Political Factor | Description | Impact on Attica Group | 2024/2025 Data/Projections |

| Green Transition Investment | Greek government funding for maritime sector modernization. | Incentivizes investment in greener ships, potentially increasing operational costs for older vessels. | Over €2 billion allocated; €265 million EU funding for fleet renewal. |

| EU Emissions Regulations | 'Fit for 55' package (ETS, FuelEU Maritime). | Increases operating expenses via emission allowance purchases; drives adoption of greener technologies. | Aim to cut emissions by 55% by 2030. |

| Port Efficiency Policies | Integrated slots system for coastal shipping. | Potential for streamlined ferry operations and improved turnaround times. | Digitalization and automation focus. |

| Island Connectivity Policies | Ensuring essential services; travel subsidies. | Impacts strategic route planning and pricing strategies on island routes. | €26.4 million in subsidies allocated in 2023. |

| Geopolitical Stability | Eastern Mediterranean tensions; Red Sea disruptions. | Increases insurance premiums, rerouting costs, and affects market sentiment. | Escalation of Red Sea attacks in late 2023/early 2024. |

| International Climate Goals | IMO emission reduction targets. | Requires proactive decarbonization strategy for long-term sustainability and competitiveness. | Comprehensive measures expected adoption in 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Attica Group's operations and strategic planning.

It offers actionable insights into how political, economic, social, technological, environmental, and legal forces present both challenges and opportunities for the company.

Provides a concise version of the Attica Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, ensuring efficient communication of external factors.

Economic factors

Attica Group demonstrated exceptional revenue growth in 2024, achieving a record 747.8 million euros. This represents a significant 27% increase compared to the previous year, primarily driven by the strategic acquisition and integration of ANEK Lines. The group's strong performance extended into the first nine months of 2024, with revenues climbing 27.4% to 593.4 million euros.

This impressive financial trajectory underscores Attica Group's expanding market presence and its capability to effectively leverage new assets. The substantial revenue uplift signals a healthy demand for its services and a robust operational performance within the current economic climate.

The introduction of the European Union Emissions Trading System (EU ETS) on January 1, 2024, has directly impacted Attica Group's operating expenses. For the first nine months of 2024, the company incurred 14.1 million euros in costs for emission allowances. Projections indicate these costs will reach 18.9 million euros for the entirety of 2024.

Further financial pressure is anticipated as the EU ETS coverage expands. With the percentage of emissions subject to the system increasing to 70% in 2025, Attica Group can expect these operational costs related to emissions trading to escalate beyond the 2024 figures.

Greece's tourism sector is poised for a strong 2025, with forecasts indicating a rise in air arrivals and scheduled flights, which typically translates to increased demand for ferry services. This positive trend in the broader travel industry suggests a favorable environment for companies like Attica Group.

Despite the optimistic tourism outlook, Attica Group experienced a notable dip in passenger traffic. For the first five months of 2025, passenger numbers across Greek ports fell by 3-4% when compared to the same period in 2024. Certain routes saw even more significant declines, with some experiencing drops of up to 12%.

The primary driver behind this passenger traffic decline appears to be elevated ferry ticket prices. In response, ferry operators, including Attica Group, have begun implementing discounts and promotional offers in an effort to boost passenger volumes and counteract the impact of higher fares.

Investment in Fleet Renewal and Expansion

Attica Group is making substantial investments in its fleet, planning to spend 700 million euros by the end of 2029. This strategic move focuses on upgrading and expanding its vessel capacity with modern, eco-friendlier ships. The company is set to receive two new E-Flexer vessels in 2027 under a long-term charter agreement that includes a purchase option, alongside acquiring other vessels.

These fleet modernization efforts are designed to boost Attica Group's competitive edge and improve how efficiently it operates. The new generation of high-speed and conventional ships will offer greater passenger and vehicle capacity while also reducing environmental impact.

- Total Investment: €700 million by end of decade (2029).

- Key Acquisitions: Two E-Flexer vessels on long-term charter with purchase option, due 2027.

- Focus: New generation high-speed and conventional ships with increased capacity and lower environmental footprint.

- Objectives: Enhance competitiveness and operational efficiency.

Debt Management and Financial Liquidity

Attica Group has demonstrated proactive debt management, with its total debt reducing from 588.5 million euros at the close of 2023 to 578.2 million euros by September 30, 2024. This reduction is complemented by a healthy 34 million euros in unutilized credit lines, providing financial flexibility.

The group's cash and cash equivalents saw a decrease primarily due to significant investment activities, with 145.1 million euros in investment cash outflows recorded in the first nine months of 2024. A key financial maneuver was the full repayment of a 175 million euro common bond loan in July 2024, underscoring active financial stewardship.

- Debt Reduction: Total debt decreased from €588.5 million (Dec 31, 2023) to €578.2 million (Sep 30, 2024).

- Liquidity Position: Unutilized credit lines stood at €34 million as of September 30, 2024.

- Investment Impact: Cash and cash equivalents were affected by €145.1 million in investment outflows during the first nine months of 2024.

- Bond Repayment: A €175 million common bond loan was fully repaid in July 2024.

Economic factors present a mixed landscape for Attica Group. While the Greek tourism sector shows promise for 2025, leading to anticipated higher demand for ferry services, the group has observed a decline in passenger traffic for the first five months of 2025, with some routes experiencing significant drops. This downturn is attributed to elevated ferry ticket prices, prompting operators to introduce discounts to stimulate bookings.

The introduction of the EU Emissions Trading System (EU ETS) in January 2024 has added to operational costs, with Attica Group incurring €14.1 million in emission allowance costs for the first nine months of 2024, projected to reach €18.9 million for the full year. This cost is expected to rise further in 2025 as EU ETS coverage expands.

| Metric | 2024 (YTD Sep) | 2024 (Full Year Projection) | 2025 (YTD May) |

|---|---|---|---|

| Revenue Growth | +27.4% | +27% (2023 vs 2024) | N/A |

| EU ETS Costs | €14.1 million | €18.9 million | Projected increase |

| Passenger Traffic Change | N/A | N/A | -3% to -4% |

| Ferry Ticket Prices | Elevated | Elevated | Elevated (leading to discounts) |

Preview Before You Purchase

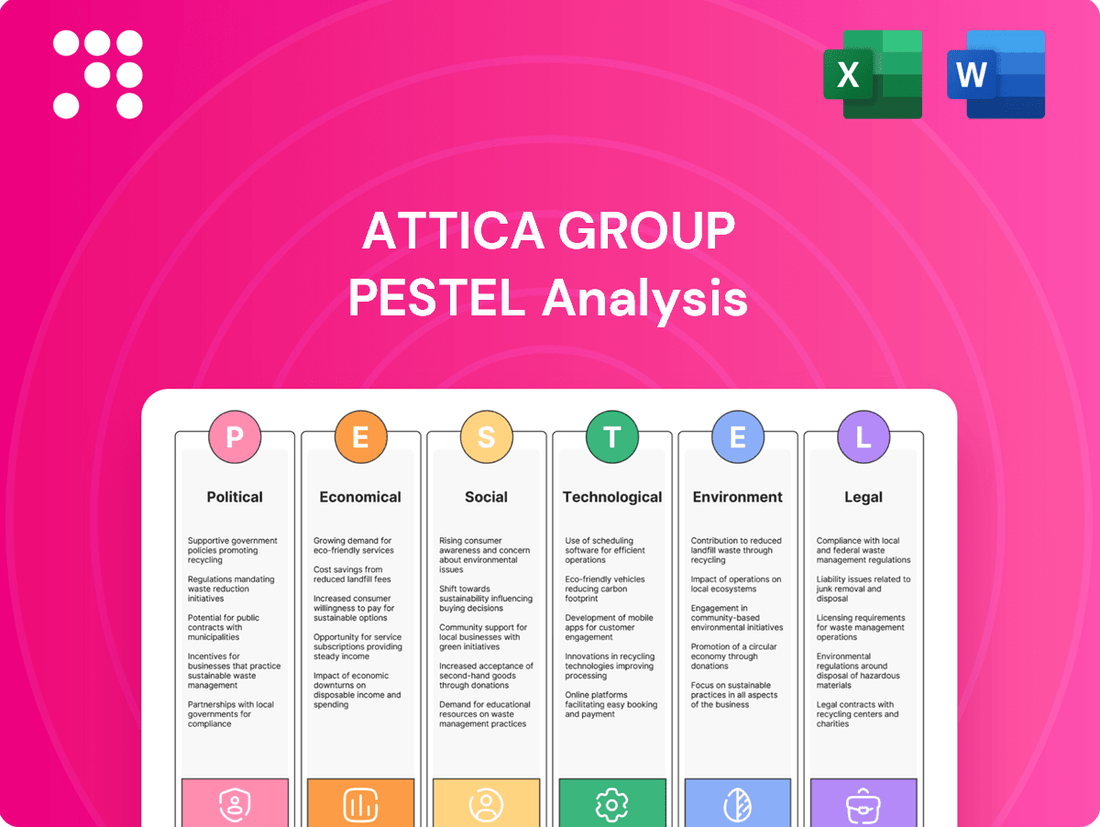

Attica Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of the Attica Group provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

Sociological factors

Consumer demand for swift and premium travel experiences is a significant driver for Attica Group. This trend is evident in their strategic investments in modern, high-speed ferry technology and the development of advanced digital platforms for booking and onboard services, aiming to meet expectations for efficiency and quality.

Recent data indicates a dip in ferry passenger numbers, with reports suggesting that elevated ticket prices may be contributing to this decline. This highlights a strong consumer price sensitivity and a growing consideration of alternative, potentially more affordable, travel options, such as overland routes.

To counter this, Attica Group must implement agile pricing strategies and continuously refine its service offerings. Adapting to these evolving consumer preferences, particularly regarding cost-effectiveness and convenience, is crucial for maintaining passenger volume and attracting new customers in a competitive market.

Greek tourism saw a remarkable rebound, with arrivals reaching approximately 32 million in 2023, a significant increase from previous years, bolstering Attica Group's passenger ferry operations. This surge, driven by a 15% rise in air arrivals and a substantial uptick in cruise ship passengers, creates a favorable environment for the company's core business.

However, the inherent seasonality of tourism, with summer months experiencing peak demand and winter months showing a notable dip, necessitates careful planning for Attica Group. Managing fleet deployment and optimizing marketing campaigns during off-peak periods are crucial for consistent revenue generation and efficient resource utilization throughout the year.

Attica Group's strategic diversification into the hospitality sector, exemplified by its investments in hotels and resorts, directly addresses the evolving demands of modern travelers. This expansion aims to capture a larger share of tourist spending by offering integrated travel and accommodation experiences, moving beyond traditional ferry services.

Attica Group demonstrates a strong commitment to its social role, distributing 974.5 million euros in total economic value in 2024, marking a significant 43.2% increase from the previous year. This substantial economic contribution underscores their impact on the communities they serve.

Through initiatives like 'Environmental Escape', Attica Group actively engages young minds in environmental stewardship on Greek islands, fostering a sense of responsibility and connection to local ecosystems. This program directly benefits community development by investing in future generations.

Furthermore, the provision of discounted ferry tickets for various social programs highlights Attica Group's dedication to enhancing social cohesion and accessibility. These efforts directly support vulnerable groups and strengthen community bonds.

Employee Training and Human Capital Development

Attica Group recognizes the critical role of employee training and human capital development in its operational success. In 2024, the company dedicated over 14,000 hours to staff training, specifically targeting reskilling and upskilling employees in emerging technologies. This proactive approach is essential for maintaining a competitive edge and ensuring the delivery of high-quality services in a rapidly evolving industry.

The recent merger with ANEK Lines presented a unique opportunity and challenge for human capital integration. Attica Group implemented comprehensive training programs to onboard ANEK's personnel, fostering a unified workforce and ensuring seamless operational transitions. This focus on integration underscores the company's commitment to its people as a key strategic asset.

- Investment in Training: Over 14,000 hours of staff training were conducted in 2024.

- Focus Areas: Reskilling and upskilling professionals in new technologies.

- Merger Integration: Significant training and integration efforts for ANEK personnel.

- Strategic Importance: Crucial for adapting to technological advancements and maintaining service quality.

Public Perception and Brand Reputation

Attica Group, operating under prominent brands like Blue Star Ferries and Superfast Ferries, understands that public perception is a cornerstone of its success. A strong brand reputation, built on consistent service and reliability, directly influences customer loyalty and willingness to choose their services.

The company's commitment to responsible and sustainable development, as detailed in their 2023 sustainability report, actively cultivates a positive brand image. This focus on environmental and social responsibility fosters trust among passengers, investors, and the wider community, which is crucial for a leading passenger shipping operator. For instance, their initiatives in reducing emissions contributed to a 5% decrease in CO2 per passenger kilometer in 2023.

Addressing public concerns, such as the perceived high cost of ferry tickets, is also paramount. In 2024, Attica Group introduced a new loyalty program offering discounts and benefits to frequent travelers, aiming to improve affordability and maintain positive public sentiment. This proactive approach to customer feedback is vital for retaining market share and ensuring continued public approval.

- Brand Strength: Attica Group's well-recognized brands are a significant asset in shaping public opinion.

- Sustainability Impact: Investments in sustainable practices, evidenced by their 2023 reports, enhance brand reputation and stakeholder trust.

- Customer Affordability: Initiatives like loyalty programs in 2024 aim to mitigate concerns about ferry ticket prices, bolstering public favor.

- Reputation Management: Proactive engagement with public concerns is key to maintaining a positive image in the competitive passenger shipping market.

Attica Group's commitment to community well-being is evident in its substantial economic contributions, distributing 974.5 million euros in total economic value in 2024, a significant 43.2% increase year-over-year. This highlights a strong societal impact through job creation and local economic support.

The company actively invests in future generations through programs like 'Environmental Escape,' fostering environmental awareness among youth on Greek islands, thereby contributing to community development and education.

Furthermore, Attica Group's provision of discounted ferry tickets for social programs underscores its dedication to social inclusion and accessibility, directly benefiting vulnerable populations and strengthening community ties.

Technological factors

Attica Group is actively modernizing its fleet with E-Flexer vessels, designed to be methanol and battery-ready. These ships feature advanced engines capable of running on three different fuel types, incorporating cutting-edge technology to significantly improve fuel efficiency.

This strategic investment in new vessels is projected to cut greenhouse gas emissions per transport work by an impressive 60% when compared to their current fleet. This commitment to a greener future is further evidenced by the company's substantial 700 million euro investment plan dedicated to fleet transformation.

Attica Group is actively pushing forward with digital transformation across its entire operations to improve customer service. A key development is the launch of their mobile app, 'seamore,' designed to deliver a more personalized and user-friendly travel experience. This app allows for quicker bookings, easy access to past travel records, and straightforward use of loyalty points.

The company's digitalization efforts also impact its port operations, as seen with the implementation of integrated slot systems for coastal shipping. This focus on technology aims to streamline processes and enhance efficiency throughout the group's services, reflecting a commitment to modernizing its infrastructure and customer interactions.

Attica Group is actively investing in energy efficiency devices, including scrubbers, to improve how its vessels perform. This strategy is key to staying competitive, as it directly lowers operating expenses and ensures compliance with increasingly strict environmental rules. For instance, by mid-2024, the group reported significant progress in installing these technologies across its fleet, aiming for a 10% reduction in fuel consumption on retrofitted vessels.

Development of Alternative Fuels and Propulsion Systems

Attica Group's strategic investments in new high-speed vessels are closely tied to the maturation and accessibility of green fuels. The company is actively monitoring advancements in this sector, recognizing that the viability of these new ships hinges on the availability and cost-effectiveness of sustainable propulsion systems. This cautious approach reflects a broader industry trend where technological readiness directly impacts capital deployment decisions.

The Greek government is actively fostering this transition by incentivizing the adoption of green vessels and nurturing a maritime cluster dedicated to green technologies. This policy direction, observed in 2024 and continuing into 2025, signals a strong governmental push for decarbonization within the maritime sector. For instance, the Greek Ministry of Maritime Affairs and Insular Policy has been instrumental in supporting pilot projects for alternative fuels, aiming to establish Greece as a leader in sustainable shipping practices.

- Fuel Dependency: Attica Group's expansion plans for high-speed ferries are contingent on the successful development and widespread availability of green fuels like methanol or ammonia.

- Governmental Support: The Greek government's commitment to promoting green vessels and developing a maritime cluster focused on green technologies provides a supportive regulatory environment for such advancements.

- Industry Shift: This focus on alternative fuels and propulsion systems represents a significant industry-wide movement towards decarbonization, influencing shipbuilding and operational strategies across the sector.

Advanced Navigation and Communication Systems

The maritime industry, including ferry operators like Attica Group, is increasingly embracing advanced navigation and communication systems. These technologies are crucial for improving safety and streamlining operations. For instance, the adoption of Electronic Chart Display and Information Systems (ECDIS) is becoming standard, enhancing navigational accuracy and reducing the risk of collisions. In 2024, the global maritime navigation systems market was valued at approximately $7.5 billion, with a projected compound annual growth rate (CAGR) of over 5% through 2030, indicating strong investment in these areas.

Digitization efforts across Attica Group's operations likely involve the integration of these advanced systems. This includes enhanced real-time communication between vessels and shore-based management, as well as sophisticated route planning and monitoring tools. Such advancements contribute to more efficient fuel consumption and optimized voyage schedules. By 2025, it's expected that over 90% of new large commercial vessels will be equipped with advanced satellite communication systems, enabling seamless data transfer and connectivity.

- Enhanced Safety: Advanced navigation systems like ECDIS and Automatic Identification Systems (AIS) significantly reduce navigational risks.

- Operational Efficiency: Improved communication and real-time data allow for better route optimization and faster response times.

- Digitization Integration: These systems are key components in the broader trend of digital transformation within the maritime sector.

- Market Growth: The maritime navigation systems market is experiencing robust growth, reflecting industry-wide investment in these technologies.

Attica Group is prioritizing technological advancements, evident in its fleet modernization with E-Flexer vessels designed for methanol and battery readiness. These ships boast advanced engines capable of using three fuel types, significantly boosting fuel efficiency and projected to cut greenhouse gas emissions by 60% per transport work compared to their current fleet. This commitment is backed by a substantial 700 million euro investment in fleet transformation.

The company is also driving digital transformation, enhancing customer service through its mobile app, 'seamore,' for personalized travel experiences, and streamlining port operations with integrated slot systems. Furthermore, Attica Group is investing in energy efficiency devices like scrubbers, aiming for a 10% fuel consumption reduction on retrofitted vessels by mid-2024, ensuring compliance and lowering operating costs.

The maritime sector, including Attica Group, is adopting advanced navigation and communication systems like ECDIS, enhancing safety and operational efficiency. The global maritime navigation systems market, valued at approximately $7.5 billion in 2024, is expected to grow at a CAGR of over 5% through 2030, underscoring the industry's investment in these critical technologies.

These technological shifts are supported by governmental initiatives, with the Greek government actively incentivizing green vessels and fostering a green technology maritime cluster. This policy direction, prominent in 2024 and continuing into 2025, aims to drive decarbonization within the sector, with ministries supporting pilot projects for alternative fuels.

| Technology Area | Attica Group Initiatives | Industry Trend/Data (2024-2025) |

|---|---|---|

| Fleet Modernization | E-Flexer vessels (methanol/battery-ready), advanced engines | Focus on fuel efficiency and emissions reduction |

| Digital Transformation | 'seamore' mobile app, integrated port systems | Enhanced customer experience and operational streamlining |

| Energy Efficiency | Scrubber installation | Targeting 10% fuel reduction on retrofitted vessels (by mid-2024) |

| Navigation & Communication | Adoption of ECDIS, satellite communication | Maritime navigation systems market valued at ~$7.5B (2024), projected 5%+ CAGR |

| Green Fuels | Monitoring advancements for methanol/ammonia | Industry-wide shift towards decarbonization and alternative fuels |

Legal factors

Attica Group must navigate the European Union Emissions Trading System (EU ETS), a significant legal factor impacting its operations. Starting January 1, 2024, shipping companies, including Attica Group, are mandated to purchase emission allowances for their greenhouse gas output. This means a new cost structure is in place for emissions generated by vessels calling at EU ports.

The compliance burden is escalating; the percentage of emissions requiring allowances is set to rise from 40% in 2024 to 70% in 2025, and will reach a full 100% by 2026. This progressive increase directly affects Attica Group's operating expenses, demanding careful financial planning and robust systems for accurate emissions reporting and timely surrender of allowances.

The FuelEU Maritime Regulation, commencing January 1, 2025, will impose yearly average greenhouse gas intensity limits on fuels used by vessels entering European ports. This legislation is designed to encourage the adoption of renewable and low-carbon energy sources for maritime transport.

Attica Group will need to ensure its fleet complies with these evolving standards, which aim to reduce the maritime sector's environmental impact. Ships will also be mandated to utilize on-shore power or other zero-emission technologies when docked from 2030 onwards.

Greece's legal framework significantly impacts Attica Group, with the updated Private Maritime Law Code (Law 5020/2023) now in effect. This legislation, alongside ratified international conventions on collision, pollution, and passenger carriage, directly shapes the company's operational responsibilities and liabilities.

These regulations set crucial safety standards and define passenger rights, influencing everything from vessel maintenance to emergency protocols. Furthermore, revisions to laws concerning non-EU flagged vessels and their transit logs may also affect operational logistics and compliance for certain routes or vessel types within Attica Group's extensive fleet.

Import Control System 2 (ICS2) Requirements

New EU Import Control System 2 (ICS2) regulations, effective December 1, 2024, mandate more granular data for all goods entering or transiting the EU from non-EU nations. This includes precise commodity codes and complete buyer/seller addresses, with EU legal entities needing mandatory EORI numbers.

Attica Group, as a freight carrier, must adapt its processes to meet these stringent customs filing obligations. Failure to comply could lead to delays and penalties, impacting supply chain efficiency. For instance, the EU anticipates a significant increase in data submissions with ICS2, potentially millions more declarations annually, highlighting the scale of compliance needed.

Key compliance points for Attica Group include:

- Accurate Data Submission: Ensuring all required commodity codes and full addresses are submitted correctly for every shipment.

- EORI Number Verification: Confirming that all EU-based business partners possess valid EORI numbers.

- System Integration: Adapting internal systems to capture and transmit the enhanced data required by ICS2.

- Training and Awareness: Educating staff on the new requirements to prevent errors and ensure smooth processing.

International Maritime Organization (IMO) Conventions and Standards

Attica Group navigates a complex legal landscape, extending beyond EU directives to adhere to international maritime regulations established by the International Maritime Organization (IMO). The IMO is actively developing ambitious targets and concrete measures for greenhouse gas (GHG) emission reductions, aiming for net-zero emissions by or around 2050. Compliance with these evolving IMO standards, alongside stringent EU legislation, creates a comprehensive legal framework that governs Attica Group’s global and regional shipping operations.

Key IMO initiatives impacting Attica Group include:

- The IMO's GHG Strategy: This strategy, updated in 2023, sets ambitious emission reduction goals, including a commitment to reduce total annual GHG emissions from international shipping by at least 20% by 2030, and striving for at least 30% by 2030, while aiming for at least 70% reduction by 2040 compared to 2008 levels.

- Energy Efficiency Existing Ship Index (EEXI) and Carbon Intensity Indicator (CII): These regulations, which came into force in 2023, require ships to meet minimum energy efficiency standards and rate their operational carbon intensity. Attica Group must ensure its fleet complies with these metrics, potentially necessitating operational adjustments or fleet upgrades.

- Future Regulations: The IMO is continuously exploring further measures, including the potential implementation of a global carbon levy or emissions trading system, which could significantly impact operational costs and investment decisions for companies like Attica Group.

Attica Group faces significant legal shifts, particularly with the EU ETS and FuelEU Maritime regulations impacting emissions costs and fuel choices from 2024 and 2025 respectively. The progressive increase in required emission allowances, reaching 100% by 2026, necessitates strategic financial planning. Furthermore, updated Greek maritime laws and international conventions like those from the IMO dictate operational responsibilities and safety standards.

The EU's new Import Control System 2 (ICS2), effective December 2024, mandates more detailed customs data for goods entering the EU, requiring Attica Group to enhance its data submission processes. Compliance with these evolving legal frameworks, from emissions trading to customs declarations and international safety standards, is critical for smooth operations and avoiding penalties.

| Regulation | Effective Date | Impact on Attica Group | Key Compliance Aspect |

| EU ETS | Jan 1, 2024 (40% allowances) | Increased operational costs due to emissions allowances | Accurate emissions reporting and allowance surrender |

| FuelEU Maritime | Jan 1, 2025 | Encourages adoption of low-carbon fuels | Fleet compliance with fuel intensity limits |

| Greek Maritime Law Code (Law 5020/2023) | In effect | Defines operational responsibilities and liabilities | Adherence to safety and passenger rights regulations |

| IMO GHG Strategy (Updated 2023) | Ongoing | Commitment to net-zero emissions by ~2050 | Meeting short-term (2030, 2040) emission reduction targets |

| EEXI & CII | Jan 1, 2023 | Minimum energy efficiency standards for ships | Ensuring fleet meets efficiency metrics |

| ICS2 | Dec 1, 2024 | More granular customs data required for EU imports | Accurate commodity codes and address submission |

Environmental factors

Attica Group has laid out a clear path to reduce its environmental impact, finalizing a new Environmental Strategy and Decarbonization Roadmap extending to 2030. This plan includes concrete steps and targets aimed at cutting greenhouse gas emissions.

The group is making progress towards its goal of reducing CO2 emissions per mile by 14% by 2030, compared to 2019 levels. This ambitious target is being pursued through a comprehensive approach that involves optimizing operational procedures, adjusting vessel speeds, and actively researching the feasibility of alternative fuels.

Attica Group's operating expenses have seen a notable increase due to the EU Emissions Trading System (EU ETS). In 2024, the company incurred substantial costs for emission allowances, directly impacting its bottom line and highlighting the financial implications of carbon pricing on its ferry operations.

Looking ahead to 2025, the FuelEU Maritime Regulation will introduce further environmental obligations. This regulation mandates a gradual reduction in the greenhouse gas intensity of marine fuels used by ships calling at European ports. This will necessitate strategic adjustments in fuel sourcing and potentially the adoption of alternative, lower-emission fuels.

These regulatory frameworks are pivotal for Attica Group's environmental strategy, compelling significant investments in cleaner technologies and more sustainable operational practices. The company is actively exploring and implementing solutions to meet these evolving compliance requirements and reduce its carbon footprint.

Attica Group is making substantial investments in its fleet's environmental performance, with a 700 million euro program dedicated to building new, eco-friendly vessels. These new ships are designed for versatility, ready for methanol and battery power, and capable of running on multiple fuel types, significantly reducing their environmental footprint.

Beyond new builds, the company is retrofitting its existing fleet with advanced technologies like scrubbers and energy-saving devices. This dual approach, focusing on both new, greener vessels and upgrading current ones, underscores Attica Group's commitment to sustainability and operational efficiency in the face of evolving environmental regulations and market demands.

Waste Management and Pollution Prevention

Attica Group is actively enhancing its environmental stewardship by focusing on robust waste management and pollution prevention strategies, aiming to minimize its ecological footprint on both land and sea. This commitment is underscored by their adherence to international environmental regulations, such as MARPOL 73/78, which governs the prevention of pollution from ships. The group is investing in advanced systems to manage waste streams effectively, including recycling and proper disposal methods, to ensure compliance and reduce environmental impact.

These efforts are crucial given the increasing global focus on sustainability in the maritime industry. For instance, the European Union’s Green Deal initiatives are pushing for stricter environmental standards across all sectors, including shipping. Attica Group's proactive approach positions them favorably to meet these evolving regulatory demands and growing stakeholder expectations for environmental responsibility.

The group's sustainability initiatives include:

- Implementing advanced waste segregation and recycling programs onboard vessels.

- Investing in technologies to prevent and mitigate marine pollution, such as oil spill response equipment and advanced wastewater treatment systems.

- Ensuring strict compliance with MARPOL 73/78 Annexes, covering oil, noxious liquid substances, sewage, and garbage pollution.

- Exploring innovative solutions for waste-to-energy conversion and circular economy principles within their operations.

Climate Risk Disclosure and Sustainability Reporting

Attica Group's 2024 Responsibility and Sustainable Development Report, their sixteenth, underscores a robust commitment to Environmental, Social, and Governance (ESG) performance. This proactive stance is further evidenced by their pioneering inclusion of a Climate Change Study within their financial statements, a first for a Greek company.

This comprehensive study incorporates detailed short-, medium-, and long-term scenarios, offering unparalleled transparency into how climate change might impact the company's operations and financial health. Such detailed disclosure is crucial for investors and stakeholders seeking to understand the company's resilience and strategic planning in the face of evolving environmental regulations and physical climate risks.

- 2024 ESG Report: Attica Group released its 16th Responsibility and Sustainable Development Report.

- Climate Study Integration: First Greek company to include a Climate Change Study in financial statements.

- Scenario Analysis: The study covers short-, medium-, and long-term climate change scenarios.

- Transparency: Demonstrates proactive environmental governance and risk management.

Attica Group is actively navigating environmental regulations, with a 2030 target to reduce CO2 emissions per mile by 14% from 2019 levels. The company incurred significant costs for emission allowances in 2024 due to the EU Emissions Trading System (EU ETS). Looking ahead, the FuelEU Maritime Regulation will impose further obligations on fuel usage from 2025, requiring strategic shifts towards lower-emission alternatives.

The group is investing €700 million in new, eco-friendly vessels designed for alternative fuels like methanol and battery power. Simultaneously, existing fleet upgrades include scrubbers and energy-saving devices to enhance environmental performance and ensure compliance with stricter standards.

Attica Group's commitment to sustainability is further demonstrated by its pioneering inclusion of a Climate Change Study in its 2024 financial statements, detailing short-, medium-, and long-term climate scenarios. This proactive approach to environmental stewardship and regulatory compliance is crucial for long-term resilience.

PESTLE Analysis Data Sources

Our Attica Group PESTLE Analysis is meticulously constructed using data from reputable sources such as the Hellenic Statistical Authority (ELSTAT), Eurostat, and the International Monetary Fund (IMF). We also incorporate insights from industry-specific reports and maritime news outlets to ensure a comprehensive understanding of the operating environment.