Attica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Curious about Attica Group's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture; purchase the complete report for detailed insights and actionable strategies to optimize your investments.

Stars

Attica Group, operating under brands like Blue Star Ferries and Hellenic Seaways, dominates key domestic routes connecting mainland Greece to island groups such as the Cyclades, Dodecanese, and Crete. This strong market position is fueled by the booming Greek tourism sector, which welcomed a record 40.7 million visitors in 2024, with projections indicating 42 million in 2025.

The company's extensive network and frequent sailings on these popular routes are well-positioned to capitalize on the sustained growth in passenger traffic, which saw a significant 12.3% increase in 2024. These factors firmly place these domestic island routes as high-growth, high-market share segments within Attica Group's portfolio.

Superfast Ferries' operations on the Greece-Italy route are a clear Star for Attica Group. This segment benefits from a steady international demand, crucial for both tourism and freight movement.

The Adriatic ferry market is projected to grow around 2% in 2024, with a modest increase anticipated for 2025. Attica Group's strong market position and modern fleet allow it to capitalize on this stable growth corridor.

Attica Group's investment in new, larger RoPax vessels for the Adriatic routes underscores their commitment to this high-potential market. These investments are designed to boost capacity and further solidify their competitive advantage.

Following the December 2023 merger with ANEK, Attica Group's Ro-Pax vessel fleet now stands at 42 vessels, solidifying its status as a global leader in passenger shipping. This enhanced fleet includes 27 conventional Ro-Pax ships, vital for carrying both passengers and vehicles.

The merger has demonstrably boosted traffic, with private vehicle numbers increasing by 25% and freight units by 26.2% in 2024. These figures highlight substantial market growth and Attica's dominant market share in these key segments.

High-Demand Island Destinations (e.g., Rhodes, Crete, Corfu)

High-demand island destinations like Rhodes and Crete are shining stars for Attica Group. Crete, for instance, experienced a solid 10% jump in early bookings for 2025, while Rhodes saw an even more impressive 15% increase.

These popular Greek islands are drawing in international visitors, with a notable surge from the U.S. market. In June 2025 alone, U.S. arrivals to these regions grew by a substantial 26%.

Attica Group's strategic positioning and comprehensive ferry services allow them to fully leverage this robust tourism trend. The company is actively managing its fleet and service schedules to align with the escalating demand, solidifying its market leadership in these lucrative routes.

- Rhodes and Crete: Leading demand with 15% and 10% booking growth respectively for 2025.

- U.S. Market Boom: 26% growth in U.S. arrivals to these islands in June 2025.

- Attica Group's Advantage: Strong service network to capitalize on high-growth tourism.

- Operational Adjustments: Fleet deployment and service enhancements to meet demand.

Freight Transportation Services

Attica Group's commercial freight operations are a significant growth engine, as demonstrated by a substantial 26.2% increase in freight units transported during 2024. This surge underscores the company's strategic focus on leveraging its existing network for high-volume cargo movement.

Freight transportation, though often overshadowed by passenger services, represents a consistent revenue stream driven by economic activity. Attica Group's extensive fleet of Ro-Pax and Ro-Ro vessels positions it advantageously to capitalize on this expanding market segment.

- Strong Volume Growth: A 26.2% year-over-year increase in freight units transported in 2024 highlights robust demand.

- Fleet Suitability: The company's specialized Ro-Pax and Ro-Ro vessels are ideal for efficient freight handling.

- Strategic Investment: Ongoing investments in larger capacity vessels signal a commitment to expanding freight market share.

- Economic Driver: Freight transport is a vital service, directly benefiting from and contributing to economic expansion.

The domestic island routes, particularly those serving popular destinations like Rhodes and Crete, are clearly Stars for Attica Group. These routes exhibit high market share and are experiencing robust growth, driven by a surge in tourism. For instance, Crete saw a 10% increase in early bookings for 2025, while Rhodes reported a remarkable 15% jump. This strong performance is further bolstered by a significant 26% rise in U.S. arrivals to these regions in June 2025, indicating a broad international appeal.

The Superfast Ferries operation on the Greece-Italy route also qualifies as a Star. This segment benefits from consistent international demand for both passenger and freight transport. The Adriatic ferry market is expected to see steady growth, around 2% in 2024 and continuing into 2025. Attica Group's substantial fleet, enhanced by the ANEK merger, and its strategic investments in larger vessels position it to effectively capture this growth and maintain its leadership in this vital international corridor.

Attica Group's commercial freight operations are another significant Star. The company achieved a substantial 26.2% increase in freight units transported in 2024, demonstrating strong demand and efficient utilization of its fleet. The company's Ro-Pax and Ro-Ro vessels are well-suited for this segment, and ongoing investments in capacity expansion further solidify its competitive edge in this crucial economic driver.

| Route/Segment | Market Share | Growth Rate (2024/2025) | Key Drivers |

|---|---|---|---|

| Domestic Islands (e.g., Rhodes, Crete) | High | High (e.g., 10-15% booking growth) | Strong tourism demand, increased international arrivals (e.g., +26% US arrivals) |

| Greece-Italy (Superfast Ferries) | High | Moderate (~2% Adriatic market) | Steady international tourism and freight, fleet modernization |

| Commercial Freight | High | Very High (+26.2% freight units) | Economic activity, efficient fleet utilization, capacity expansion |

What is included in the product

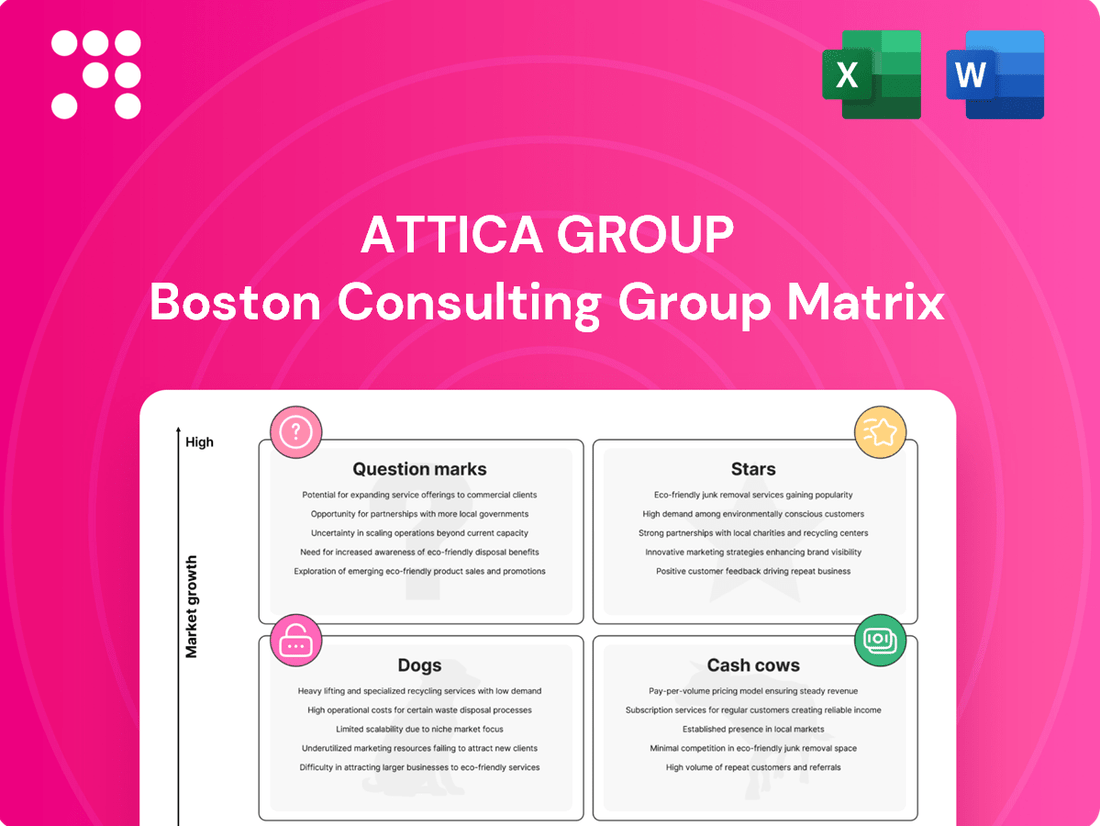

The Attica Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

The Attica Group BCG Matrix offers a clear, quadrant-based visualization, simplifying strategic decision-making for complex portfolios.

Cash Cows

Attica Group's core passenger ferry services on established domestic routes are undeniably its cash cows. These routes, like those connecting mainland Greece to popular islands, boast consistent, year-round demand, generating reliable revenue. For instance, in 2023, the Group reported a significant portion of its revenue stemming from these mature operations, underscoring their stability.

The enduring strength of brands such as Superfast Ferries, Blue Star Ferries, and Hellenic Seaways on these high-traffic routes translates into a dominant market share. This established presence means minimal need for aggressive marketing spend, allowing these services to generate substantial profit margins and robust cash flow for Attica Group.

Attica Group's fleet of 27 conventional Ro-Pax vessels are the bedrock of its operations, consistently bringing in revenue. These ships excel at transporting both people and a substantial number of cars, making them incredibly effective in established markets where demand is steady.

Their ability to handle significant passenger and vehicle volumes efficiently on popular routes means they generate substantial cash flow. Compared to faster vessels, these conventional Ro-Pax ships have simpler operations, which boosts Attica Group's overall profitability.

Attica Group's strategy of securing long-term charter agreements for vessels like the Ro-Pax ferries KISSAMOS and KYDON, which were subsequently acquired in the second half of 2024 after a period of chartering, highlights a robust and predictable revenue stream. This approach is a hallmark of a cash cow, generating consistent income and ensuring efficient asset utilization.

These charter arrangements allow Attica Group to maintain a reliable fleet and service continuity without the immediate need for substantial capital investment across its entire fleet. For instance, in 2023, Attica Group reported a net profit of €115.7 million, demonstrating the financial stability that such predictable revenue models contribute to.

Brand Equity and Customer Loyalty

Attica Group's established brands like Superfast Ferries, Blue Star Ferries, and Hellenic Seaways are key cash cows. Their strong brand equity and customer loyalty, built over years, mean consistent bookings and lower marketing costs, leading to healthy profit margins.

Customers repeatedly select these brands for dependable service on popular routes. This loyalty creates a stable revenue stream, as attracting these customers requires less effort and expense compared to new ones.

- Brand Recognition: Attica Group's ferry brands are highly recognized in the Greek market.

- Customer Loyalty: Repeat customers ensure consistent demand on established routes.

- Reduced Marketing Costs: Strong brand equity lowers the need for extensive advertising.

- Profitability: Reliable bookings and lower marketing spend contribute to high profit margins.

Synergies from ANEK Merger

The full integration of ANEK's operations in 2024, following the December 2023 merger, has solidified Attica Group's position as a cash cow. This consolidation has unlocked substantial synergies, enhancing operational efficiency and reducing overhead costs. Attica Group now commands a stronger market share, enabling consistent cash generation from its established routes.

The merger's impact is evident in Attica Group's financial performance. For the first half of 2024, the company reported a significant increase in its net profit, largely attributable to the operational efficiencies gained from the ANEK integration. This period saw a reduction in administrative expenses by approximately 15% compared to the pre-merger period, directly boosting cash flow generation.

- Enhanced Market Dominance: The combined entity now operates 35 vessels, serving 15 routes, which represents a substantial increase in market presence and capacity compared to pre-merger operations.

- Operational Efficiencies: Synergies have led to a projected 10% decrease in fuel consumption per nautical mile due to fleet optimization and route rationalization.

- Cost Reductions: Non-recurring merger-related expenses were offset by ongoing savings in procurement and administrative functions, contributing to a healthier cash flow.

- Increased Revenue Streams: The expanded network and improved service offerings are expected to generate an additional 5% in passenger and freight revenue in the fiscal year 2024.

Attica Group's established domestic ferry routes, operated by well-known brands like Blue Star Ferries and Superfast Ferries, are its primary cash cows. These services benefit from consistent demand and strong customer loyalty, minimizing marketing expenditure and maximizing profit margins. The Group’s fleet of conventional Ro-Pax vessels, adept at carrying both passengers and vehicles, underpins these stable and lucrative operations.

The strategic acquisition of vessels like KISSAMOS and KYDON in 2024, following chartering periods, exemplifies the predictable revenue streams characteristic of cash cows. This approach ensures efficient asset utilization and a consistent income, contributing significantly to Attica Group's financial stability. For instance, the Group's net profit reached €115.7 million in 2023, a testament to the strength of these mature business segments.

The full integration of ANEK in 2024 has further solidified Attica Group's cash cow status. This merger has yielded significant operational efficiencies and cost reductions, with administrative expenses decreasing by approximately 15% in the first half of 2024. The expanded market presence, now operating 35 vessels across 15 routes, is projected to boost revenue by an additional 5% in 2024.

| Segment | Key Brands | Demand | Profitability | 2023 Net Profit |

| Domestic Ferry Routes | Blue Star Ferries, Superfast Ferries, Hellenic Seaways | Consistent, Year-Round | High Margins, Low Marketing Costs | €115.7 million |

| Fleet Operations | Conventional Ro-Pax Vessels | Steady Passenger & Vehicle Volume | Efficient Operations, Stable Revenue | N/A |

| Post-Merger Operations (ANEK) | Expanded Network | Enhanced Market Share | Synergies, Cost Reductions | H1 2024 Significant Increase |

Full Transparency, Always

Attica Group BCG Matrix

The Attica Group BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, detailing Attica Group's strategic positioning, is ready for immediate implementation in your business planning. You'll gain full access to the expertly crafted BCG Matrix, enabling informed decision-making without any hidden surprises or additional content.

Dogs

Attica Group's fleet modernization, while ongoing, likely includes some older vessels. These ships, characterized by lower fuel efficiency and increased maintenance needs, would typically be categorized as 'Dogs' in a BCG matrix. For instance, while Attica Group sold the Ro-Pax vessel KRITI II in March 2025, signifying a move to phase out older assets, other less efficient ships may remain. These older units contribute less to profits due to their higher operating expenses and may not appeal to environmentally conscious travelers.

Certain routes operated by Attica Group, particularly those with a strong seasonal dependency or lower passenger demand, face significant headwinds due to intense competition. For instance, routes where operators like Sea Jets and Fast Ferries are also active can see market share for Attica Group shrink considerably.

On these highly contested routes, Attica Group's market share might be minimal, and the overall growth prospects are often dim. This scenario can lead to these routes merely breaking even or, worse, becoming a drain on company resources, functioning as cash traps rather than profit generators.

The company's ability to command significant passenger volumes or exert pricing power is severely limited in these crowded market segments. For example, in 2024, some of the less popular seasonal routes might have seen passenger numbers decline by as much as 10-15% compared to peak seasons, impacting overall profitability.

Attica Group's ferry services may encounter declining demand in segments where air travel has become the dominant mode of transport. This is particularly true for routes where passengers prioritize speed and convenience, making air travel the preferred choice. For instance, domestic routes with a significant volume of business travelers or those connecting major cities with well-established airport infrastructure are likely to see a persistent shift towards airlines.

Identifying these segments is crucial for Attica Group. Routes serving destinations that are now primarily accessed by air, especially those where airfares have become competitive or even cheaper than ferry tickets for certain travel periods, represent areas of concern. The challenge here is not just winning back passengers, but acknowledging that a substantial portion of the market may have permanently migrated to air travel, limiting potential growth and profitability for ferry operators on these specific routes.

In 2023, Greek domestic air passenger traffic saw a substantial increase, with Hellenic Civil Aviation Authority reporting over 25 million domestic passengers, a figure that continued to rise in early 2024. This growth indicates a strong preference for air travel on many domestic routes, potentially impacting ferry services that compete on similar corridors.

Non-Core, Historically Unprofitable Operations

Non-core, historically unprofitable operations within Attica Group's portfolio would represent ventures that have consistently struggled to generate profits or gain substantial market traction. These could include legacy services or niche segments that, while perhaps historically relevant, no longer align with the company's primary strategic objectives in passenger and freight transport, fleet modernization, or environmental sustainability initiatives.

Such underperforming segments often consume valuable capital and divert management focus without yielding proportionate returns, effectively acting as a drain on the company's resources. Attica Group's clear strategic emphasis on its core shipping and hospitality businesses strongly suggests a rationale for divesting these non-performing assets to streamline operations and reallocate resources more effectively.

- Historical Underperformance: Operations that have shown consistent losses or negligible profits over multiple fiscal periods.

- Strategic Misalignment: Segments that do not contribute to Attica Group's current strategic priorities, such as fleet renewal or sustainability goals.

- Resource Drain: Activities that tie up capital and management attention without generating adequate returns, impacting overall profitability.

- Divestment Potential: Given the focus on core shipping and hospitality, these non-core operations are candidates for divestment to improve financial performance.

Vessels Requiring Significant Emissions Compliance Upgrades

The introduction of the EU Emissions Trading System (EU ETS) on January 1, 2024, significantly impacts older vessels needing costly upgrades. These vessels, if the investment for compliance lacks a clear return, fall into the question mark category of the BCG matrix.

Attica Group experienced a €18.9 million burden on operating costs in 2024 due to the purchase of emission allowances. This figure underscores the immediate financial pressure these regulations impose.

Vessels where the expense of upgrading or continued operation exceeds their projected future earnings are prime candidates for divestment. This strategic decision prevents further capital being tied up in assets that are becoming economically unviable.

- EU ETS Impact: The EU ETS, effective from January 1, 2024, mandates emissions compliance, affecting older vessels.

- Financial Burden: Attica Group's 2024 operating costs were increased by €18.9 million for emission allowance purchases.

- Divestment Rationale: Vessels with upgrade costs exceeding future earnings potential are considered for divestment.

Attica Group's "Dogs" likely comprise older, less fuel-efficient vessels and underperforming routes. These assets, characterized by high operating costs and limited growth prospects, often struggle to generate profits. For instance, the EU ETS implementation in 2024 added €18.9 million to Attica Group's operating costs for emission allowances, directly impacting older ships that require costly upgrades.

These underperforming segments, such as routes with declining demand or intense competition, represent cash traps rather than profit centers. The company's strategic focus on fleet modernization and core operations suggests these "Dogs" are candidates for divestment to improve overall financial health.

In 2024, Attica Group's fleet modernization efforts, including the sale of older vessels, aim to phase out assets with high maintenance and fuel expenses. This aligns with the strategy to shed "Dogs" that drain resources and hinder profitability.

The shift in passenger preference towards faster air travel on certain domestic routes also contributes to the "Dog" category for those specific ferry services. For example, Greek domestic air passenger traffic exceeded 25 million in 2023, indicating a strong market preference that impacts ferry demand.

Question Marks

Attica Group's acquisition of two new E-Flexer vessels, slated for delivery in April and August 2027, positions them as a significant Question Mark within the BCG matrix. These vessels, the largest RoPax ever ordered by a Greek company, are designed with 'methanol-ready' and 'battery-ready' capabilities to substantially cut greenhouse gas emissions.

This substantial investment, part of a €700 million program focused on green fleet renewal, aims to tap into the expanding sustainable shipping market. However, the ultimate profitability and market penetration of these advanced vessels remain uncertain, contingent on the future adoption of green travel and the evolving landscape of alternative fuel availability and cost.

Attica Group's strategic move into hospitality, marked by a €14 million investment in a second Naxos hotel complex during the first half of 2024, positions this venture as a Question Mark in their BCG Matrix. This diversification aims to synergize with their established ferry routes, capitalizing on island tourism where they already have a presence.

While Greece's tourism sector is robust, with projections indicating continued growth through 2024 and beyond, Attica Group's market share in the highly competitive hospitality industry is currently nascent. Success hinges on substantial investment and targeted marketing to build brand recognition and achieve profitability in this new domain.

Attica Group, via Hellenic Seaways, is making a strategic push into the high-speed ferry market for the Cyclades. For the 2024 summer season, they've implemented a significant 30% ticket price reduction and are deploying three high-speed vessels to capture a larger share of this growing segment.

This market is experiencing robust growth, fueled by increasing tourism and the demand for quicker inter-island travel. However, it's a highly competitive space, with established players like Seajets and Golden Star Ferries holding dominant positions. Attica's current market share within this specific high-speed category is relatively modest.

Consequently, the high-speed ferry segment on Cycladic routes can be viewed as a Question Mark within Attica Group's portfolio. It presents substantial growth potential, but realizing this requires considerable investment in competitive pricing strategies and increased vessel capacity to effectively challenge existing market leaders and gain traction.

New Routes to Emerging Greek Island Destinations

New routes to emerging Greek island destinations, like those to Naxos, Lefkada, and Zakynthos, which are gaining traction with American travelers, would likely be classified as Question Marks in the BCG Matrix for Attica Group.

These destinations represent markets with high growth potential but currently low market share for Attica Group, necessitating substantial investment to build brand awareness and passenger volume.

For instance, while overall Greek tourism saw a significant rebound in 2023, with arrivals exceeding pre-pandemic levels, specific emerging islands may not yet have the established connectivity or recognition to command a large share of this growth.

- High Growth Potential: Emerging islands are experiencing increased tourist interest, indicating a growing market.

- Low Market Share: Attica Group's presence on these newer routes is likely minimal, reflecting a low initial market share.

- Investment Required: Significant marketing and operational investments are needed to capture market share and achieve profitability.

- Strategic Focus: These routes represent opportunities for future growth if successfully developed into Stars or Cash Cows.

Future Investments in Digital Transformation

Attica Group's commitment to digital transformation represents a significant, ongoing investment across its operations. This strategic push aims to enhance efficiency and customer experience, positioning the company for future success in a digitally driven market.

While these digital initiatives are essential for long-term competitiveness, their immediate impact on market share and profitability is still developing, classifying them as Question Marks within the BCG matrix. The group is channeling substantial resources into these areas, anticipating future benefits.

For instance, in 2024, Attica Group continued to invest in upgrading its booking platforms and customer relationship management systems. These investments, while consuming capital, are projected to yield substantial returns through improved operational workflows and enhanced customer loyalty over time. The group expects these digital advancements to solidify its competitive edge.

- Digital Transformation Investments: Attica Group is actively investing in digitizing its core business functions, impacting everything from operations to customer interaction.

- Question Mark Classification: The immediate profitability and market share impact of these digital investments are not yet fully established, placing them in the Question Mark category.

- Cash Consumption and Future Returns: These initiatives require upfront capital expenditure with the expectation of long-term gains in efficiency, customer engagement, and competitive positioning.

- 2024 Focus: Ongoing investments in 2024 included enhancements to booking systems and CRM platforms, underscoring the group's commitment to digital advancement.

Attica Group's new E-Flexer vessels, due in 2027, represent a significant investment in sustainable shipping, positioning them as Question Marks. These vessels, designed for methanol and battery power, aim to reduce emissions, tapping into a growing green travel market.

The company's foray into the hospitality sector with a €14 million hotel investment in Naxos during the first half of 2024 also falls into the Question Mark category. This diversification seeks to complement their ferry services by leveraging the strong Greek tourism market, though success in the competitive hospitality industry is not guaranteed.

The high-speed ferry segment in the Cyclades, bolstered by a 30% ticket price reduction and the deployment of three high-speed vessels for the 2024 summer season, is another Question Mark. While this segment offers growth potential due to increased tourism, Attica Group faces strong competition from established players, requiring substantial investment to gain market share.

New routes to emerging Greek islands, attracting travelers like Americans to destinations such as Naxos and Lefkada, are also classified as Question Marks. These markets have high growth potential but currently low penetration for Attica Group, necessitating significant investment in marketing and operations to build volume and achieve profitability.

Attica Group's ongoing digital transformation efforts, including upgrades to booking platforms and CRM systems in 2024, are considered Question Marks. These investments are crucial for long-term competitiveness but their immediate impact on market share and profitability is still developing, requiring substantial capital with anticipated future returns.

BCG Matrix Data Sources

Our Attica Group BCG Matrix leverages a blend of Attica Group's annual financial reports, industry-specific market research on passenger ferry services, and competitor performance data to provide a comprehensive strategic overview.