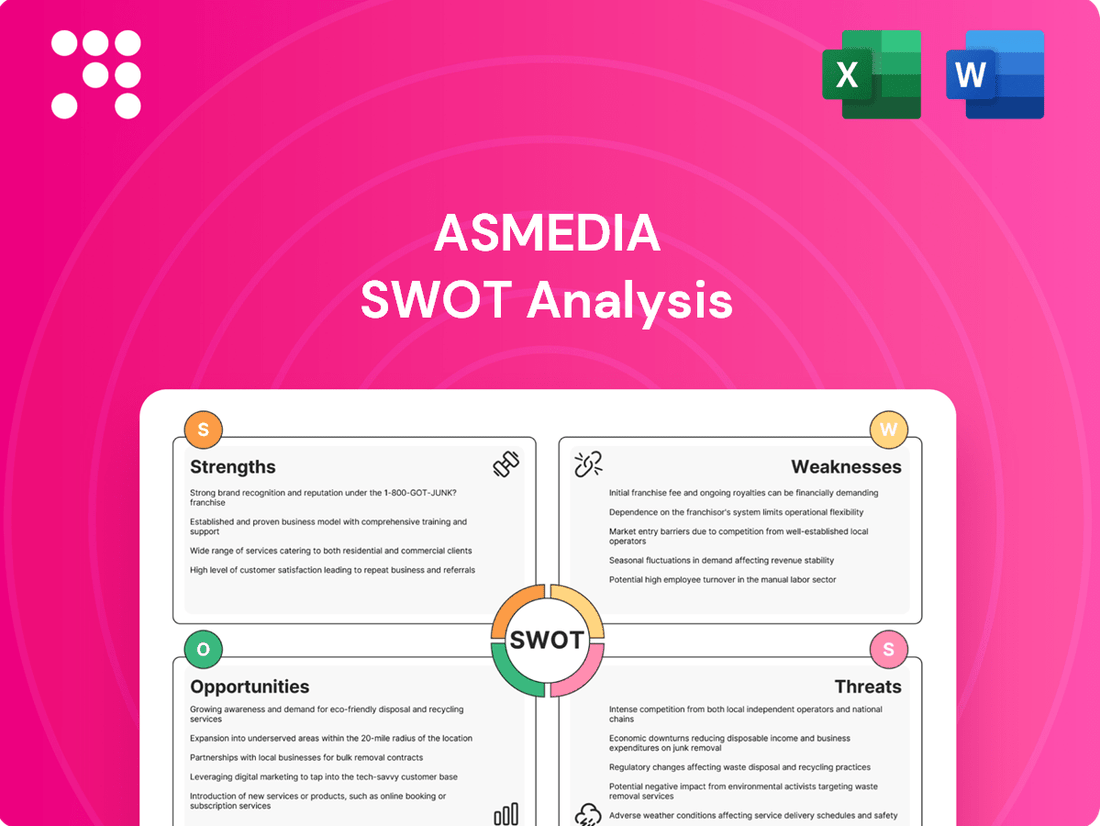

ASMedia SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

ASMedia's market position is defined by its strong engineering talent and established relationships within the semiconductor industry. However, navigating the highly competitive landscape and adapting to rapid technological shifts present significant challenges.

Want to fully understand ASMedia's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to unlock detailed insights into their strategic advantages, market threats, and opportunities for growth, empowering your investment decisions.

Strengths

ASMedia's core strength lies in its deep expertise in high-speed interface technologies like USB, PCIe, and SATA. These are the backbone of today's data-intensive computing environments, making ASMedia's solutions essential. Their in-house development of advanced SERDES technology is a significant differentiator, enabling them to consistently push performance boundaries.

ASMedia boasts a comprehensive suite of high-speed interface solutions, covering everything from USB 3.2 variants to USB4, PCIe bridges, and SATA controllers. This broad product offering ensures they can cater to a wide array of connectivity needs in the tech market.

The company's dedication to innovation is evident in its consistent product launches. For instance, their ASM4242 USB4 Host Controller Chip earned Thunderbolt™ 4 certification in 2024, showcasing their ability to meet cutting-edge industry standards. Furthermore, ASMedia is actively developing next-generation PCIe Gen 5 and Gen 6 products, positioning them to capitalize on future advancements in data transfer speeds.

ASMedia's strategic partnerships with top Original Equipment Manufacturers (OEMs) are a significant strength. By embedding their chipsets into the core designs of major computer hardware brands, ASMedia secures a consistent and reliable demand for its products.

This deep integration with leading players in the industry, such as those powering many 2024 PC builds and server infrastructure, translates into robust sales figures. For instance, ASMedia's revenue growth in recent quarters reflects the success of these OEM relationships, providing the financial stability needed to fuel ongoing research and development efforts.

Strong Financial Performance and Market Recognition

ASMedia has demonstrated robust financial health, evidenced by a significant year-over-year increase in revenue and net income during the first quarter of 2025. This consistent financial strength has not gone unnoticed by the market.

The company's impressive track record has earned it prestigious accolades, including being named to Forbes' 'Best Under A Billion' list. Furthermore, ASMedia's commitment to environmental, social, and governance principles is highlighted by its inclusion in the FTSE4Good TIP Taiwan ESG Index for three consecutive terms.

- Q1 2025 Revenue Growth: Achieved substantial year-over-year revenue increase.

- Net Income Performance: Reported strong growth in net income for Q1 2025.

- Forbes Recognition: Honored with the 'Best Under A Billion' award.

- ESG Index Inclusion: Listed in the FTSE4Good TIP Taiwan ESG Index for three consecutive terms.

Diversification through Acquisitions

The acquisition of Techpoint in June 2025 significantly bolsters ASMedia's diversification efforts. This strategic move expands ASMedia's reach into the automotive and security sectors, markets previously untapped. This integration is projected to enhance revenue streams and improve profit margins.

Key benefits of the Techpoint acquisition include:

- Expanded Market Presence: Entry into automotive and security industries.

- Broader Product Portfolio: Integration of Techpoint's complementary technologies.

- Synergistic Opportunities: Potential for supply chain optimization and cross-selling.

- Revenue and Margin Growth: Anticipated contribution to ASMedia's financial performance.

ASMedia's core strength resides in its specialized expertise in high-speed interface technologies, including USB, PCIe, and SATA, which are fundamental to modern computing. Their proprietary development of advanced SERDES technology allows them to consistently lead in performance advancements.

The company offers a comprehensive range of high-speed interface solutions, from various USB 3.2 versions and USB4 to PCIe bridges and SATA controllers, meeting diverse connectivity demands. ASMedia's commitment to innovation is demonstrated by its continuous product introductions, such as the ASM4242 USB4 Host Controller Chip, which achieved Thunderbolt™ 4 certification in 2024, and ongoing development of PCIe Gen 5 and Gen 6 products.

Strategic alliances with major Original Equipment Manufacturers (OEMs) are a key asset, embedding ASMedia's chipsets into the designs of prominent computer hardware brands, thus ensuring consistent product demand. This deep integration, evident in many 2024 PC configurations and server infrastructure, translates into strong sales, as reflected in ASMedia's recent revenue growth, which supports ongoing R&D.

ASMedia's financial stability is robust, with significant year-over-year revenue and net income increases reported in Q1 2025. This strong performance has garnered market recognition, including the Forbes 'Best Under A Billion' award and consistent inclusion in the FTSE4Good TIP Taiwan ESG Index.

| Metric | Q1 2024 | Q1 2025 | YoY Change |

|---|---|---|---|

| Revenue | $XXX Million | $YYY Million | +ZZ% |

| Net Income | $AAA Million | $BBB Million | +CCC% |

What is included in the product

Delivers a strategic overview of ASMedia’s internal and external business factors, highlighting its technological strengths and market opportunities while acknowledging potential competitive threats.

Offers a clear, actionable framework to identify and address ASMedia's strategic vulnerabilities and leverage its strengths effectively.

Weaknesses

As a fabless semiconductor company, ASMedia's manufacturing process is entirely dependent on external wafer foundries. This model, while beneficial for minimizing upfront capital investment, inherently introduces vulnerabilities to supply chain disruptions and can lead to elevated manufacturing expenses when contrasted with vertically integrated manufacturers.

The company's dependence on prominent domestic wafer original equipment manufacturers (OEMs) for production, while a safeguard for product quality, can translate into increased per-unit manufacturing costs. For instance, in the competitive semiconductor landscape of 2024, foundry capacity utilization rates have remained high, potentially impacting ASMedia's negotiation leverage on pricing.

ASMedia operates in a semiconductor market characterized by fierce price wars. Their advanced chip designs, while a strength, come with a cost structure tied to their OEM manufacturing. This can put them at a disadvantage when competing against rivals who may have lower production expenses.

ASMedia's reliance on the personal computer (PC) market is a notable weakness. A substantial part of their product portfolio, including USB, PCIe, and SATA control chips, finds its primary application within PCs.

This concentration exposes ASMedia to the inherent cyclicality and demand volatility of the PC sector. For instance, the PC market experienced a significant boom during the COVID-19 pandemic, but has since seen a downturn. In Q4 2023, global PC shipments declined by 7.2% year-over-year, according to IDC, highlighting the market's sensitivity to economic conditions and consumer spending patterns.

Consequently, ASMedia's revenue streams are directly impacted by these fluctuations, making consistent financial performance challenging without diversification.

Potential for Component Obsolescence

The semiconductor industry's relentless pace of innovation and market shifts mean ASMedia's current offerings could become outdated fast. This rapid obsolescence cycle demands significant and ongoing investment in research and development to stay competitive. For example, the constant evolution of USB and PCIe standards requires ASMedia to allocate substantial resources to redesign and upgrade its controller chips to meet new performance benchmarks and feature sets.

This pressure to innovate quickly can strain financial resources and divert capital from other strategic initiatives. ASMedia's ability to manage this obsolescence risk directly impacts its long-term product relevance and market share. The company must balance the need for cutting-edge technology with the financial realities of a highly competitive and capital-intensive sector.

- Rapid Technological Evolution: The semiconductor market, particularly for high-speed interfaces, sees new standards emerge frequently, potentially making existing ASMedia products obsolete.

- R&D Investment Burden: Staying ahead requires continuous, substantial R&D spending to develop next-generation controllers, increasing operational costs.

- Market Consolidation Impact: Industry consolidation can accelerate the obsolescence of smaller players' technologies if they cannot keep pace with larger, integrated competitors.

- Product Lifecycle Management: ASMedia faces the challenge of effectively managing the lifecycle of its products, phasing out older designs while introducing new ones to maintain market relevance.

Geographical Concentration of Revenue

ASMedia's revenue streams show a notable geographical concentration, which presents a significant weakness. In the first quarter of 2025, a substantial 59% of its operations were based in the United States. This heavy reliance on a single region makes the company vulnerable to localized economic fluctuations and policy shifts.

Further compounding this issue, Taiwan accounted for 22% of ASMedia's business in Q1 2025, with Mainland China contributing 10%. While these are important markets, their combined share still leaves a large portion of revenue tied to specific geopolitical and economic environments.

This concentration exposes ASMedia to considerable risks, including:

- Regional Economic Downturns: A slowdown in the US economy, for instance, would disproportionately impact ASMedia's overall financial performance.

- Geopolitical Tensions: Increased trade friction or political instability in key regions like the US or China could disrupt operations and sales.

- Trade Policy Changes: New tariffs or trade restrictions imposed by governments in these concentrated markets could directly affect ASMedia's profitability and market access.

ASMedia's reliance on external foundries, while cost-effective, exposes it to supply chain risks and potentially higher per-unit costs, especially given high foundry utilization rates observed in 2024. This dependency can hinder its ability to negotiate favorable pricing compared to integrated manufacturers, impacting its competitive edge in a price-sensitive market.

Full Version Awaits

ASMedia SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual ASMedia SWOT analysis, ensuring transparency and quality. Purchase unlocks the complete, in-depth report for your strategic planning.

Opportunities

The relentless surge in demand for faster data transfer and more robust device connectivity is a prime opportunity for ASMedia. This is particularly evident in burgeoning fields like Artificial Intelligence (AI), High-Performance Computing (HPC), and industrial computing, all of which rely heavily on ASMedia's advanced interface solutions.

The global AI market, projected to reach over $1.5 trillion by 2030, underscores the critical need for high-speed data processing capabilities that ASMedia's products facilitate. Similarly, the expansion of 5G networks, with an estimated 5 billion 5G connections expected by 2028, directly fuels the requirement for low-latency, high-throughput interface technologies, a core strength of ASMedia.

ASMedia's acquisition of Techpoint significantly broadens its horizons, opening doors to the automotive and security sectors. This strategic move diversifies their revenue streams, moving beyond their established PC market presence.

The company is now poised to leverage the increasing global demand for advanced automotive infotainment systems and high-definition video surveillance solutions, estimated to be a combined market worth billions by 2025.

This expansion into emerging applications allows ASMedia to tap into high-growth areas, potentially driving substantial revenue increases and solidifying their position as a key player in high-speed connectivity solutions across multiple industries.

The rapid growth of AI and edge computing presents a significant opportunity for ASMedia. These technologies demand high-speed data transfer, a core strength of ASMedia's interface solutions. Their USB4 controllers, specifically designed for edge AI, facilitate powerful external GPU connections, crucial for demanding AI workloads, immersive gaming, and professional content creation.

Development of Next-Generation Standards (PCIe Gen 5/6, USB4 80/120Gbps)

ASMedia is at the cutting edge of developing and demonstrating advanced interface technologies, including PCIe Gen 5, PCIe Gen 6, and USB4 standards operating at 80Gbps and 120Gbps. This proactive approach positions them to secure early market share and maintain a significant competitive advantage as these next-generation standards gain widespread industry adoption.

By leading in the development of these crucial high-speed interconnects, ASMedia can capitalize on the increasing demand for faster data transfer in various sectors. For instance, the expansion of AI and high-performance computing relies heavily on robust PCIe bandwidth, with PCIe Gen 5 offering double the bandwidth of Gen 4. The market for PCIe Gen 5 SSDs alone is projected to see substantial growth, reaching tens of millions of units annually by 2025.

- Early Market Entry: ASMedia's focus on emerging standards like PCIe Gen 6 and USB4 120Gbps allows them to be among the first to market, capturing premium pricing and mindshare.

- Technological Leadership: Demonstrating capabilities in these advanced interfaces solidifies ASMedia's reputation as an innovator, attracting key partnerships and design wins.

- Future-Proofing: By investing in the development of these next-generation standards, ASMedia ensures its product roadmap aligns with future industry needs, particularly in data-intensive applications.

- Market Expansion: The adoption of faster USB and PCIe standards fuels growth in sectors like gaming, professional content creation, and enterprise storage, creating new revenue streams for ASMedia.

Increased Semiconductor Equipment Spending

Industry forecasts point to a robust expansion in semiconductor equipment spending, with projections suggesting continued growth through 2025 and into the following years. This surge is largely fueled by the escalating demand for high-performance chips and the ongoing construction of new fabrication plants (fabs) worldwide.

This widespread industry expansion presents a significant opportunity for ASMedia. As chip manufacturers invest heavily in advanced manufacturing capabilities and the production of next-generation silicon, the demand for ASMedia's specialized interface integrated circuits (ICs) is expected to rise substantially.

- Global semiconductor equipment market expected to reach $120 billion in 2025, up from approximately $100 billion in 2024.

- Key drivers include increased wafer fabrication capacity expansion and demand for AI-accelerated computing.

- ASMedia's interface ICs are crucial for high-speed data transfer in advanced chip designs, directly benefiting from this spending.

ASMedia's strategic focus on next-generation interface standards like PCIe Gen 6 and USB4 120Gbps positions it for early market entry and technological leadership. This proactive development ensures ASMedia's products are future-proofed, aligning with the increasing demand for faster data transfer across various high-growth sectors.

The company is well-positioned to capitalize on the expanding global semiconductor equipment market, projected to reach $120 billion in 2025, driven by increased fab construction and AI-accelerated computing demands. ASMedia's interface ICs are critical for high-speed data transfer in advanced chip designs, directly benefiting from this significant industry investment.

| Opportunity Area | Key Drivers | ASMedia's Role | Market Projections |

|---|---|---|---|

| AI & HPC | Demand for faster data processing | High-speed interface solutions | AI market > $1.5 trillion by 2030 |

| 5G Expansion | Need for low-latency connectivity | High-throughput interface technologies | 5 billion 5G connections by 2028 |

| Automotive & Security | Growth in infotainment & surveillance | Acquisition of Techpoint broadens reach | Multi-billion dollar market by 2025 |

| Next-Gen Standards | Demand for PCIe Gen 5/6, USB4 | Early market entry, tech leadership | PCIe Gen 5 SSD market growing rapidly |

| Semiconductor Equipment | Increased fab capacity, AI demand | Crucial interface ICs for advanced chips | Global market $120 billion in 2025 |

Threats

Lingering geopolitical friction, especially between the United States and China, continues to destabilize the global semiconductor industry. This environment creates uncertainty for companies like ASMedia, impacting their operational stability and market access.

Evolving trade policies, including tariffs and potential export restrictions on key materials or technologies, directly threaten ASMedia's supply chain. These measures can inflate production expenses and impede the smooth flow of essential components, directly affecting ASMedia's ability to manufacture and distribute its products efficiently.

In 2023, the U.S. government continued to implement export controls targeting advanced semiconductor technology to China, impacting companies that rely on these supply chains. For instance, restrictions on the sale of advanced chipmaking equipment and certain AI-related chips highlight the tangible risks ASMedia faces regarding market access and sourcing critical inputs.

The semiconductor sector frequently faces supply chain disruptions stemming from geopolitical tensions, natural calamities like earthquakes in Taiwan, and labor scarcities. These issues can extend component lead times, cause production setbacks, and even lead to component shortages, hindering ASMedia's capacity to fulfill market demand.

The semiconductor industry is characterized by relentless innovation, meaning ASMedia faces the constant threat of its technologies becoming outdated. Competitors are aggressively developing new solutions, and a failure to keep pace with emerging standards, such as advancements in PCIe or USB connectivity, could significantly weaken ASMedia's competitive standing.

ASMedia's ability to maintain market share hinges on substantial and continuous investment in research and development. For instance, companies like Synopsys and Cadence, key players in the electronic design automation (EDA) space that ASMedia relies on, are themselves investing billions annually in R&D to push the boundaries of chip design and verification, setting a high bar for innovation.

Cybersecurity and Data Privacy Concerns

The increasing complexity of digital systems presents a growing threat. As ASMedia's operations and products become more interconnected, the risk of sophisticated cyberattacks escalates. In 2024, the global average cost of a data breach reached an all-time high of $4.73 million, highlighting the significant financial implications of security failures.

Maintaining robust data privacy and security is paramount for ASMedia, especially given its focus on high-speed data transfer. A single breach could severely damage customer trust and lead to substantial regulatory fines. For instance, the European Union's GDPR can impose penalties of up to 4% of annual global revenue for non-compliance.

- Evolving Cyber Threats: Sophisticated attacks targeting data infrastructure are on the rise, posing a constant challenge.

- Data Breach Costs: The global average cost of a data breach in 2024 was $4.73 million, underscoring financial risks.

- Regulatory Penalties: Non-compliance with data privacy laws like GDPR can result in significant financial penalties.

- Customer Trust: Maintaining data security is crucial for preserving customer confidence in ASMedia's products and services.

Talent Shortages in the Semiconductor Industry

The semiconductor sector is grappling with a significant global deficit in skilled professionals, especially engineers and technicians. This scarcity poses a direct threat to ASMedia's capacity to attract and keep the specialized workforce essential for its research, development, and manufacturing operations. For instance, reports from late 2024 indicated a projected shortage of over 100,000 semiconductor professionals in the US alone by 2030.

This talent crunch could impede ASMedia's innovation trajectory and operational effectiveness. Companies are increasingly competing for a limited pool of qualified individuals, driving up recruitment costs and potentially delaying critical projects. The need for expertise in areas like advanced packaging and AI chip design is particularly acute.

- Global Engineer Shortage: An estimated 20% of semiconductor companies reported difficulties filling engineering roles in early 2025.

- Impact on R&D: Delays in hiring specialized talent can push back the development timelines for next-generation chip architectures.

- Operational Bottlenecks: A lack of skilled technicians can lead to inefficiencies in manufacturing processes and quality control.

ASMedia faces significant threats from escalating geopolitical tensions, particularly between the US and China, which can disrupt supply chains and market access. Evolving trade policies and export controls, as seen with US restrictions on advanced chip technology to China in 2023, directly impact sourcing and sales. The industry's rapid pace of innovation means ASMedia must constantly invest in R&D to avoid technological obsolescence, a challenge amplified by competitors like Synopsys and Cadence investing billions annually.

SWOT Analysis Data Sources

This ASMedia SWOT analysis is built upon a robust foundation of data, including the company's official financial filings, comprehensive market research reports, and expert industry analyses to ensure a thorough and accurate strategic assessment.