ASMedia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

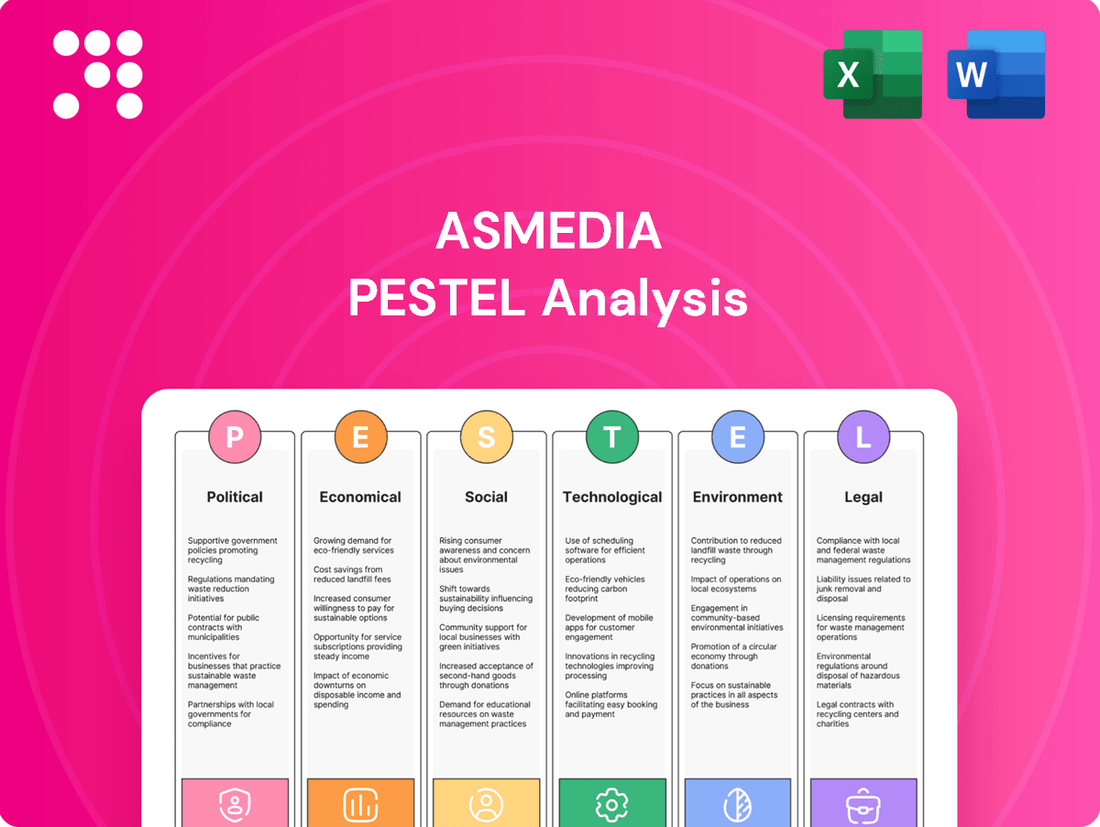

Unlock the critical external factors shaping ASMedia's trajectory. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental forces at play, offering you a strategic advantage. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now to gain actionable intelligence and fortify your business strategy.

Political factors

Geopolitical tensions, particularly the ongoing US-China trade dispute, directly influence ASMedia's operating environment by disrupting the global semiconductor supply chain. Export restrictions imposed by various nations on critical materials like gallium and germanium present significant hurdles for semiconductor manufacturers, potentially increasing costs and limiting access to essential components.

Taiwan's central role in advanced semiconductor manufacturing makes it a key consideration in these geopolitical shifts. The US strategy to diversify manufacturing away from Taiwan, coupled with Taiwan's efforts to solidify its industry leadership, creates a dynamic landscape that ASMedia must navigate. For instance, TSMC, a major foundry partner for many fabless companies, has been actively expanding its manufacturing presence in the US and Japan, signaling a global realignment in chip production.

Governments globally are actively investing in semiconductor manufacturing through industrial policies and subsidies. For instance, the US CHIPS Act allocated $52.7 billion, while the EU's European Chips Act aims for €43 billion in public and private investment. Taiwan's Semiconductor Strategic Policy 2025 and similar initiatives in South Korea, Japan, and India underscore a concerted effort to bolster domestic production and supply chain security.

Taiwan's government is doubling down on its semiconductor dominance, viewing it as a critical national security asset. The Taiwan Semiconductor Strategic Policy 2025, for instance, is a clear signal of this commitment, aiming to solidify the island's technological sovereignty and R&D leadership.

This policy specifically targets securing Taiwan's place in global chip supply chains by fostering next-generation chip technologies. It also includes provisions for grants to promising startups, indicating a proactive approach to innovation and future growth in the sector.

Export Control Regulations

New export control regulations, particularly from the United States, are increasingly targeting advanced semiconductor technologies, including high-bandwidth memory (HBM) chips. These measures, which also involve lowering de minimis thresholds for certain goods, are designed to restrict access to critical chip technologies, especially those with potential dual-use applications in military advancement. For ASMedia, this translates to potential impacts on its market access and necessitates careful consideration of its global supply chain strategies to navigate these evolving restrictions.

The expansion of export controls to HBM, a key component in AI accelerators, highlights a growing geopolitical focus on controlling the flow of cutting-edge semiconductor technology. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has been actively updating its Entity List and export regulations throughout 2024. These actions can directly affect ASMedia's ability to source components or sell its products in certain international markets, potentially influencing its revenue streams and strategic partnerships.

- US export controls are broadening to encompass HBM chips, a critical component for AI.

- Lowering de minimis thresholds can increase scrutiny and compliance burdens on cross-border shipments.

- These regulations aim to limit access to advanced semiconductor tech with potential military applications.

Intellectual Property Protection

The semiconductor industry, including companies like ASMedia, hinges on strong intellectual property (IP) protection. Robust IP frameworks are vital for safeguarding innovations and maintaining a competitive advantage. For instance, in 2023, the global semiconductor market was valued at approximately $600 billion, underscoring the immense value of the IP that drives its advancements.

Weak or inconsistent IP enforcement can lead to significant legal battles and disrupt business operations. The United States, a major player in semiconductor design, has consistently advocated for strong global IP standards. A 2024 report indicated that IP-related litigation in the tech sector, which heavily impacts semiconductors, can cost companies millions in legal fees and lost revenue.

- Global semiconductor market value in 2023: ~$600 billion

- High cost of IP litigation in the tech sector

- Importance of IP for competitive edge in IC design

- US advocacy for strong global IP standards

Geopolitical tensions continue to shape the semiconductor landscape, impacting ASMedia's operations. For instance, US export controls, updated throughout 2024, are increasingly targeting advanced technologies like High Bandwidth Memory (HBM) chips, crucial for AI development.

Governments worldwide are actively bolstering their domestic semiconductor industries. The US CHIPS Act, with its $52.7 billion allocation, and the EU's €43 billion European Chips Act exemplify this trend, aiming to enhance supply chain resilience and technological sovereignty.

Taiwan's strategic importance in chip manufacturing is undeniable, with its Semiconductor Strategic Policy 2025 reinforcing its commitment to R&D and technological leadership. This focus on national security assets influences global supply chain dynamics, prompting diversification efforts by major players like TSMC.

What is included in the product

This ASMedia PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats.

Provides a concise, actionable summary of ASMedia's external environment, streamlining strategic decision-making and mitigating the risk of overlooking critical market shifts.

Economic factors

The global semiconductor market is on a significant upswing, with sales hitting an impressive $600 billion in 2024. Projections indicate a continued double-digit growth trajectory into 2025, fueled largely by the insatiable demand for chips powering artificial intelligence and high-performance computing. This overall market expansion presents a favorable backdrop for ASMedia, as the increasing need for advanced connectivity solutions across numerous sectors directly benefits its core business of high-speed interface integrated circuits.

While the explosive growth in generative AI and data center expansion are key demand drivers for semiconductors, ASMedia also benefits from a projected recovery in PC and smartphone sales heading into 2025. This resurgence in traditional consumer electronics markets is crucial for ASMedia, as their USB, PCIe, and SATA solutions are integral components.

For ASMedia, the turnaround in PC shipments, which saw a slight decline in early 2024 but is anticipated to stabilize and potentially grow by 3-5% in 2025 according to industry forecasts, directly translates to increased demand for their connectivity chips. Similarly, the smartphone market, which experienced a contraction in 2023 but is showing signs of renewed consumer interest, will boost sales of ASMedia's components.

Despite a general market rebound, the semiconductor supply chain, especially for mature nodes and advanced packaging, still grapples with persistent challenges. For ASMedia, this means potential disruptions impacting production capacity and delivery timelines.

Geopolitical tensions, alongside the lingering effects of natural disasters and critical material scarcity, pose ongoing risks. These factors can create significant supply-demand imbalances, necessitating robust resilience strategies for companies like ASMedia to navigate potential constraints.

For instance, the global semiconductor shortage, which peaked in 2022-2023, saw lead times for certain components extend to over a year, impacting various industries. While improving, the demand for advanced packaging solutions, crucial for high-performance chips ASMedia designs, continues to outstrip supply, with some estimates suggesting capacity constraints could persist into late 2025.

Capital Expenditures and Investment

Global capital expenditures in wafer fabrication and advanced packaging are surging, fueled by government initiatives and the escalating demand for sophisticated semiconductors. For instance, the U.S. CHIPS and Science Act has allocated billions to bolster domestic chip manufacturing, with companies like Intel announcing multi-billion dollar investments in new fabrication plants. This significant capital influx signals a robust and growing sector, promising enhanced manufacturing capabilities that ASMedia can utilize for its high-speed interface integrated circuits.

The semiconductor industry's investment landscape in 2024 and 2025 highlights several key trends:

- Increased Foundry Investments: Major foundries are committing substantial capital to expand capacity and adopt next-generation process nodes, with TSMC and Samsung leading the charge with planned investments exceeding $100 billion combined over the next few years for advanced manufacturing.

- Focus on Advanced Packaging: Investments are also pouring into advanced packaging technologies, such as chiplets and 2.5D/3D integration, crucial for ASMedia's high-performance products. Companies are investing heavily to develop and scale these solutions.

- Government Support: Initiatives like the European Chips Act and similar programs in Asia are providing significant financial incentives, de-risking large-scale capital expenditures and encouraging the establishment of new, state-of-the-art facilities.

- ASMedia's Potential Leverage: This widespread investment in advanced manufacturing infrastructure presents ASMedia with opportunities to access cutting-edge fabrication processes and packaging solutions, potentially improving product performance and reducing time-to-market for its high-speed interface ICs.

Inflation and Interest Rates

The global economic landscape is currently shaped by elevated inflation and interest rates, which directly affect consumer purchasing power and investment appetite within the technology sector. For ASMedia, this translates to a potential dampening of demand for its chipsets, particularly those used in consumer electronics.

While the semiconductor industry has demonstrated notable resilience, these macroeconomic headwinds cannot be ignored. For instance, the US Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through mid-2024, reflecting ongoing efforts to control inflation, which hovered around 3.4% year-over-year in April 2024. This environment can lead consumers to postpone discretionary purchases, impacting sales volumes for devices relying on ASMedia's technology.

- Inflationary Pressures: Persistent inflation erodes consumer disposable income, making high-ticket technology items less accessible.

- Higher Borrowing Costs: Increased interest rates make financing for both consumers and businesses more expensive, potentially slowing down adoption of new technologies.

- Impact on Consumer Electronics: A slowdown in consumer spending directly affects the demand for smartphones, smart TVs, and other devices that incorporate ASMedia's semiconductor solutions.

- Supply Chain Sensitivity: While ASMedia designs chips, the manufacturing process is outsourced, and higher interest rates can increase the cost of capital for foundries, potentially affecting overall supply chain economics.

The global economic climate in 2024-2025 is characterized by persistent inflation and elevated interest rates, impacting consumer spending and investment. For ASMedia, this means a potential slowdown in demand for its connectivity chips used in consumer electronics, as higher borrowing costs and reduced disposable income make technology purchases less attractive. For example, inflation remained above the Federal Reserve's target, with the Consumer Price Index (CPI) showing a 3.4% increase year-over-year in April 2024, influencing consumer purchasing decisions.

These macroeconomic factors directly affect ASMedia's sales volumes, as consumers may delay upgrades for devices like PCs and smartphones. While the semiconductor industry has shown resilience, the current economic environment necessitates careful navigation of potential demand fluctuations. For instance, the average interest rate for a 30-year fixed mortgage remained above 6.5% through mid-2024, increasing the cost of financing for major purchases.

| Economic Factor | 2024 Impact | 2025 Outlook | ASMedia Relevance |

| Inflation | Elevated (approx. 3.4% YoY April 2024) | Projected to moderate but remain a concern | Reduces consumer disposable income, impacting demand for electronics |

| Interest Rates | High (Fed Funds Rate 5.25%-5.50% mid-2024) | Expected to remain elevated or decrease slowly | Increases cost of capital for foundries and financing for consumers/businesses |

| Consumer Spending | Cautious due to inflation and rates | Slight recovery anticipated, but sensitive to economic conditions | Directly impacts sales of devices using ASMedia's components |

Preview Before You Purchase

ASMedia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive ASMedia PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ASMedia.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into ASMedia's strategic environment.

Sociological factors

Societal trends show a significant increase in digital connectivity. By 2024, it's estimated that over 6.9 billion people worldwide will be using smartphones, a number projected to grow further. This reliance on digital tools for work, learning, and leisure, combined with the surge in Internet of Things (IoT) devices, creates an insatiable demand for faster and more reliable data transfer.

ASMedia’s focus on high-speed interface integrated circuits (ICs) directly aligns with this societal shift. Their products are crucial for enabling the seamless and rapid flow of information that underpins our increasingly interconnected lives, from smart homes to advanced communication networks.

Consumers are actively seeking out more advanced electronics, with a particular interest in AI-integrated smart devices and sophisticated wearable technology. This growing demand fuels the market for components like ASMedia's high-speed interface solutions, which are essential for delivering the enhanced performance and user experiences expected in these cutting-edge products.

The global market for AI-powered consumer electronics was projected to reach over $60 billion in 2024, highlighting a significant consumer appetite for innovation. This trend directly translates into a need for the advanced semiconductor technologies that ASMedia specializes in, enabling features such as seamless data transfer and complex processing in next-generation devices.

The semiconductor industry faces a significant talent crunch, a direct consequence of its rapid expansion. This global demand for specialized skills, particularly in integrated circuit design and advanced manufacturing, presents a major challenge for companies like ASMedia. For instance, a 2023 report highlighted that the industry would need an additional 1.2 million skilled workers by 2030, with a substantial portion requiring advanced degrees in engineering and computer science.

Attracting and retaining top-tier engineers and researchers is paramount for ASMedia's continued innovation. This involves not only competitive compensation but also fostering an environment that encourages cutting-edge research and development. The intense competition for this talent pool means companies must invest heavily in recruitment and employee development to stay ahead in designing next-generation chips.

Work-from-Home and Hybrid Work Models

The widespread adoption of remote and hybrid work models, a trend solidified in recent years, continues to fuel demand for personal electronics. This includes essential devices like laptops, webcams, and various wireless accessories that facilitate effective remote collaboration. For instance, a significant portion of the workforce, estimated by some reports to be around 30% or more in many developed economies, continues to operate in hybrid or fully remote capacities post-2022.

ASMedia's product portfolio, which focuses on enabling high-speed data transfer and seamless device connectivity within personal computers, is well-positioned to capitalize on this enduring shift in work culture. The increasing reliance on robust internal connectivity for multitasking and peripheral integration directly benefits companies like ASMedia. Market analysis from late 2024 indicated continued strong sales growth in the PC component sector, with connectivity solutions being a key driver.

- Sustained Demand for Personal Electronics: The ongoing preference for remote and hybrid work ensures continued robust sales for laptops, webcams, and wireless peripherals.

- ASMedia's Product Relevance: ASMedia's core offerings in data transfer and device connectivity are directly aligned with the needs of modern personal computing environments.

- Market Growth Indicators: Projections for the PC component market in 2024 and 2025 show continued expansion, with connectivity solutions playing a vital role.

Societal Adoption of AI and High-Performance Computing

The increasing societal embrace of artificial intelligence (AI) and high-performance computing (HPC) is a major driver for the semiconductor industry. This trend is evident in the rapid expansion of cloud data centers, which require increasingly sophisticated chips to handle complex AI workloads. For instance, the global AI chip market was projected to reach over $100 billion by 2025, showcasing the immense demand. ASMedia, with its expertise in high-speed interface solutions, is strategically positioned to capitalize on this growth, providing the essential components that enable these advanced computing systems.

This societal shift is not limited to large-scale data centers; it's also impacting everyday devices. From smart assistants and advanced automotive systems to augmented reality applications, the integration of AI is becoming ubiquitous. This widespread adoption translates directly into a heightened need for specialized semiconductors that can process information efficiently and at high speeds. ASMedia's portfolio of advanced connectivity solutions, such as USB4 and PCIe, are critical enablers for these next-generation consumer electronics and automotive applications, ensuring seamless data flow and enhanced performance.

The demand for AI and HPC is creating a ripple effect across the entire technology ecosystem. This includes a growing need for:

- Advanced AI accelerators for deep learning and machine learning tasks.

- High-bandwidth memory solutions to support the massive data requirements of AI models.

- Next-generation networking interfaces to facilitate faster communication between processors and memory.

- Energy-efficient chip designs to manage the power consumption of increasingly complex systems.

Societal demand for enhanced digital experiences, driven by AI and the Internet of Things, continues to surge. By 2025, the number of connected IoT devices globally is expected to exceed 29 billion, necessitating robust high-speed connectivity solutions. ASMedia's focus on advanced interface ICs directly addresses this need, enabling the seamless data flow required for these increasingly complex and interconnected systems.

The growing integration of AI into consumer electronics and automotive systems is a significant trend. For instance, the global market for AI in automotive was projected to reach over $10 billion in 2024, with a compound annual growth rate of nearly 30%. This escalating demand for AI capabilities translates directly into a greater need for high-performance semiconductors that can handle complex data processing and rapid communication, areas where ASMedia's products are crucial.

The semiconductor industry is experiencing a persistent talent shortage, particularly in specialized engineering roles. By 2025, the demand for skilled semiconductor professionals is anticipated to outstrip supply, creating a competitive landscape for talent acquisition and retention. ASMedia, like its peers, must invest in attracting and nurturing top engineering talent to maintain its innovation edge and meet the growing market demand for its advanced interface solutions.

The ongoing shift towards remote and hybrid work models continues to bolster the personal electronics market. In 2024, the global PC market saw a resurgence in demand for high-performance laptops and peripherals, with connectivity solutions being a key component. ASMedia's expertise in providing high-speed interfaces for these devices positions it to benefit from this sustained trend in how people work and interact digitally.

| Societal Trend | Impact on ASMedia | Supporting Data (2024/2025 Estimates) |

| Increased Digital Connectivity & IoT Adoption | Drives demand for high-speed interface ICs | Over 29 billion connected IoT devices globally by 2025. |

| AI Integration in Consumer Electronics & Automotive | Requires advanced semiconductors for data processing and communication | Global AI in Automotive market projected over $10 billion in 2024, with ~30% CAGR. |

| Talent Shortage in Semiconductor Industry | Challenges talent acquisition and retention, impacting innovation | Demand for skilled semiconductor professionals expected to exceed supply by 2025. |

| Remote/Hybrid Work Models | Sustains demand for personal electronics and their connectivity components | Continued strong demand in the PC market for high-performance laptops and peripherals. |

Technological factors

ASMedia's business thrives on the evolution of interface standards. The increasing adoption of USB4, offering speeds up to 40Gbps, and PCIe Gen 5, doubling bandwidth to 32GT/s compared to Gen 4, directly shapes their product development. These advancements necessitate significant and continuous investment in research and development to stay ahead.

The accelerating adoption of Artificial Intelligence (AI) and High-Performance Computing (HPC) is a powerful technological force reshaping the semiconductor landscape. This surge fuels an immense demand for sophisticated chips, encompassing specialized processors like GPUs and TPUs, advanced memory solutions, and ultra-fast interconnects. These technologies are the backbone of AI training, inference, and complex data processing.

ASMedia, with its core competency in high-speed data transfer solutions, is strategically positioned to capitalize on this trend. The company's expertise in developing robust connectivity technologies, such as advanced USB and PCIe controllers, directly addresses the critical need for efficient data movement within AI and HPC infrastructure. For instance, the increasing complexity of AI models requires faster data pipelines between CPUs, GPUs, and storage, areas where ASMedia's products are essential.

The global AI chip market is projected for significant expansion, with some estimates suggesting it could reach hundreds of billions of dollars by the end of the decade. This growth is directly linked to the increasing computational demands of AI applications across various sectors, from cloud computing and autonomous vehicles to scientific research and advanced analytics. ASMedia's ability to deliver high-bandwidth, low-latency interconnects will be crucial for enabling these advancements.

The relentless drive for smaller, more powerful electronics is a key technological trend. Miniaturization, coupled with advanced packaging like chiplets and 3D stacking, allows for unprecedented device density and performance. For instance, the global advanced packaging market was valued at approximately $40 billion in 2023 and is projected to reach over $70 billion by 2029, demonstrating significant growth.

These technological shifts directly benefit ASMedia, a provider of high-speed interface solutions. As devices shrink and integrate more functionality, the demand for efficient, high-bandwidth connectivity to manage data flow between these miniaturized components escalates. ASMedia's expertise in USB and HDMI controllers positions them well to capitalize on this growing need for sophisticated interconnects.

Innovation in Chip Design and Manufacturing Processes

The semiconductor industry is a hotbed of innovation, constantly pushing the boundaries of what's possible in chip design and manufacturing. This relentless progress, particularly in areas like advanced node technologies such as 2nm, directly impacts companies like ASMedia. As a fabless semiconductor company, ASMedia relies heavily on the cutting-edge capabilities of foundries to bring its complex integrated circuits (ICs) to life.

These advancements in manufacturing processes and electronic design automation (EDA) tools empower ASMedia to design more sophisticated and power-efficient chips. For instance, TSMC, a key foundry partner, has been a leader in adopting new process nodes, with their 2nm technology expected to enter mass production around 2025. This allows ASMedia to develop next-generation products that offer superior performance and reduced energy consumption, crucial for staying competitive in markets like high-speed interconnects and storage controllers.

- Advancements in Node Technology: The progression towards 2nm and even smaller process nodes by foundries enables ASMedia to design ICs with higher transistor densities and improved performance.

- EDA Tool Sophistication: Enhanced EDA tools streamline the complex design process, allowing ASMedia to accelerate time-to-market for its innovative chip solutions.

- Foundry Collaboration: ASMedia's success is closely tied to its ability to leverage foundry partners' investments in next-generation manufacturing, such as TSMC's 2nm node, which is projected to significantly boost performance and efficiency.

- Market Competitiveness: By adopting these technological leaps, ASMedia can offer products that meet the increasing demands for speed, power efficiency, and functionality in data centers, PCs, and mobile devices.

Emergence of New Computing Paradigms

The exploration of new computing paradigms, like neuromorphic computing and AI-native processors, signals a significant long-term technological shift. While these advancements may not directly affect ASMedia's current product portfolio in the immediate future, they hold the potential to reshape the demand for specialized high-speed interfaces down the line.

The market for AI-specific hardware is projected for substantial growth. For instance, the global AI hardware market was valued at approximately $21.6 billion in 2023 and is anticipated to reach over $120 billion by 2030, exhibiting a compound annual growth rate of around 27%. This expansion underscores a growing need for sophisticated processing capabilities.

- Neuromorphic Computing: Mimics the human brain's structure and function, promising greater energy efficiency and parallel processing for AI tasks.

- AI-Native Processors: Designed from the ground up to accelerate AI workloads, offering significant performance gains over general-purpose CPUs and GPUs.

- Impact on Interfaces: As these new paradigms evolve, the demand for faster, more efficient data transfer and communication interfaces will likely increase, potentially creating new opportunities or requiring adaptation in ASMedia's offerings.

- Market Growth: The ongoing investment in AI research and development, with global spending expected to exceed $500 billion by 2024, indicates a strong underlying trend driving innovation in computing architectures.

Technological advancements are a primary driver for ASMedia. The increasing adoption of USB4 (up to 40Gbps) and PCIe Gen 5 (32GT/s) necessitates continuous R&D investment to maintain a competitive edge in high-speed data transfer solutions. This directly fuels demand for ASMedia's core products.

The surge in AI and High-Performance Computing (HPC) creates a massive need for specialized chips, including GPUs and TPUs, and ultra-fast interconnects. ASMedia's expertise in connectivity technologies is critical for efficient data movement within these complex systems, enabling faster AI model training and data processing.

Miniaturization trends and advanced packaging like chiplets are driving demand for sophisticated interconnects to manage data flow in smaller, more powerful devices. ASMedia's USB and HDMI controllers are well-positioned to meet this escalating need for efficient, high-bandwidth solutions.

The semiconductor industry's innovation, especially in advanced node technologies like 2nm, directly benefits ASMedia. Leveraging foundry partners like TSMC, which is expected to introduce 2nm mass production around 2025, allows ASMedia to design more powerful and energy-efficient chips, crucial for market competitiveness.

| Technological Factor | ASMedia Relevance | Market Data/Projection (2024/2025 Focus) |

| Interface Standards (USB4, PCIe Gen 5) | Core product development driver | USB4 adoption growing; PCIe Gen 5 bandwidth at 32GT/s. |

| AI & HPC Demand | Critical for high-speed interconnects | Global AI chip market projected for significant expansion; AI hardware market to reach over $120 billion by 2030. |

| Miniaturization & Advanced Packaging | Drives need for efficient data flow | Advanced packaging market projected to reach over $70 billion by 2029. |

| Advanced Node Technology (e.g., 2nm) | Enables higher performance, efficiency | TSMC's 2nm node expected in mass production around 2025. |

Legal factors

ASMedia's global operations necessitate strict adherence to international trade laws and export controls, especially concerning advanced semiconductor technology. Navigating these regulations, particularly U.S. restrictions on high-end chips and manufacturing equipment, is paramount for avoiding severe penalties and preserving market access. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) continually updates its Entity List and export control measures, impacting companies like ASMedia that rely on global supply chains.

Intellectual property laws are the bedrock of ASMedia's fabless semiconductor model. Protecting its cutting-edge chip designs and technological innovations through patents is paramount to securing its market position and deterring rivals from copying its work.

In 2024, the global semiconductor industry continued to navigate complex IP landscapes. ASMedia, like its peers, relies on a strong patent portfolio to safeguard its investments in research and development. For instance, the company's focus on high-speed interconnect technologies, such as USB4 and Thunderbolt, is heavily protected by a web of patents, ensuring its technological lead.

Data privacy and security regulations, like the EU's GDPR and similar regional laws enacted globally, can indirectly impact ASMedia. As ASMedia's components facilitate data transfer within electronic devices, their products must be designed to support systems that are compliant with these stringent data protection mandates. For instance, the increasing focus on data security in the automotive sector, a key market for ASMedia, means their semiconductor solutions need to enable robust data handling for connected vehicles, adhering to evolving cybersecurity standards by 2024-2025.

Environmental Regulations and Compliance

Environmental regulations are a significant legal factor for ASMedia, even as a fabless semiconductor company. The manufacturing process, handled by its partners, inherently involves hazardous materials and substantial resource usage, necessitating strict adherence to environmental laws. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive, updated in 2024, continues to limit the use of certain materials in electronic products, impacting component sourcing and design.

ASMedia's supply chain partners must comply with regulations concerning emissions, waste disposal, and the management of restricted substances. Non-compliance by any partner can lead to production delays, increased costs, and reputational damage, ultimately affecting ASMedia's operational continuity and market access.

- Emissions Control: Semiconductor fabrication plants are subject to stringent air and water emission standards. In 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, targeting volatile organic compounds (VOCs) and greenhouse gases from manufacturing sites.

- Waste Management: Proper disposal of chemical waste generated during wafer fabrication is legally mandated. For example, regulations in Taiwan, where many foundries operate, require specific treatment and disposal methods for hazardous semiconductor waste, with penalties for non-compliance.

- Substance Restrictions: Global regulations, such as the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) framework, updated in early 2025 with new substance evaluations, impact the materials used in semiconductor packaging and components.

- Resource Consumption: Water and energy usage in semiconductor manufacturing are under increasing scrutiny. While not always direct legal mandates for fabless firms, rising water scarcity and energy costs, influenced by environmental policies, indirectly pressure supply chain partners to adopt more sustainable practices.

Product Liability and Safety Standards

ASMedia's integrated circuits are vital components in countless electronic devices, making adherence to stringent product liability and safety standards paramount. Failure to meet these benchmarks, such as those set by the Consumer Product Safety Commission (CPSC) in the US or similar bodies globally, can lead to significant legal repercussions and damage to brand reputation. For instance, in 2024, the global semiconductor industry faced increased scrutiny following reports of certain components failing to meet thermal management standards, highlighting the critical nature of ASMedia's quality control.

Ensuring compliance with evolving consumer protection laws across diverse markets is a continuous challenge. ASMedia must navigate varying regulations regarding material safety, electrical performance, and electromagnetic compatibility (EMC). This proactive approach helps mitigate risks associated with product recalls or lawsuits, which can be incredibly costly. For example, the European Union's General Product Safety Regulation (GPSR), updated in 2024, places greater emphasis on manufacturer responsibility for product safety throughout the supply chain.

- Global Compliance: ASMedia must track and comply with over 100 distinct product safety and consumer protection regulations worldwide, impacting design and manufacturing processes.

- Liability Mitigation: Proactive testing and certification against standards like IEC 62368 (Audio/video, information and communication technology equipment) and ISO 9001 (Quality Management Systems) are crucial for reducing potential product liability claims.

- Market Access: Non-compliance can result in market exclusion; for example, products failing CE marking requirements in the EU cannot be legally sold there, affecting ASMedia's market reach.

ASMedia's operations are heavily influenced by international trade regulations and export controls, particularly concerning advanced semiconductor technology. Navigating U.S. restrictions on high-end chips and manufacturing equipment is critical to avoid penalties and maintain market access, with entities like the Bureau of Industry and Security (BIS) continuously updating its measures impacting global supply chains in 2024-2025.

Intellectual property protection is fundamental to ASMedia's fabless model, safeguarding its chip designs and technological innovations through patents to maintain its market edge. The company's focus on high-speed interconnects like USB4 and Thunderbolt is protected by a robust patent portfolio, ensuring its leadership in these areas as of 2024.

Data privacy laws such as GDPR impact ASMedia indirectly, as its components must support compliant data handling in devices, especially in sectors like automotive where robust cybersecurity for connected vehicles is paramount by 2025.

Environmental regulations affect ASMedia's supply chain partners, requiring adherence to emissions, waste disposal, and substance restrictions. For instance, the EU's RoHS directive, updated in 2024, limits hazardous materials in electronics, influencing component sourcing.

Environmental factors

Semiconductor manufacturing, especially for cutting-edge chips, demands a substantial amount of energy. While ASMedia operates as a fabless company, the energy usage of its manufacturing partners, particularly foundries, directly impacts its environmental footprint and supply chain sustainability.

The semiconductor industry, including ASMedia's partners, is under growing pressure to curb greenhouse gas emissions. This push is driving a significant shift towards adopting renewable energy sources to power fabrication plants, aiming to meet stricter environmental regulations and corporate sustainability goals.

For instance, TSMC, a major foundry partner for many fabless companies, has committed to sourcing 100% renewable energy by 2050. This commitment reflects the broader industry trend and the increasing importance of energy efficiency and clean energy adoption in semiconductor production.

Chip fabrication is incredibly water-intensive, with advanced semiconductor manufacturing plants consuming millions of gallons of ultra-pure water daily. For instance, a single advanced chip fab can use upwards of 10 million gallons of water per day. This reliance places significant pressure on water resources, particularly in regions with a high density of semiconductor operations.

Taiwan, a global leader in chip manufacturing, has experienced firsthand the impact of water scarcity. During a severe drought in 2021, the government implemented water restrictions, impacting industrial users, including semiconductor facilities. This situation underscores the critical need for robust water management strategies and the adoption of water-saving technologies across the semiconductor supply chain.

To mitigate these risks, companies are investing in advanced water recycling and reclamation systems, aiming to significantly reduce their freshwater intake. Efforts to improve water-use efficiency are becoming a key operational and strategic imperative for the industry, especially as climate change exacerbates water stress in many manufacturing hubs.

The semiconductor industry, including players like ASMedia, faces significant challenges with waste generation, encompassing both hazardous materials from manufacturing processes and electronic waste (e-waste) from discarded products. For instance, in 2024, the global e-waste volume was projected to reach 61.3 million metric tons, a figure expected to grow substantially. This highlights the environmental pressure to manage these waste streams responsibly.

There's a strong, increasing global push towards minimizing waste and enhancing recycling within the semiconductor sector. Many companies are actively exploring and implementing circular economy models. By 2025, regulatory frameworks and consumer demand are expected to further incentivize higher recycling rates and the adoption of sustainable manufacturing practices to lessen the environmental footprint of semiconductor production and product lifecycles.

Climate Change and Supply Chain Resilience

Climate change is increasingly impacting the semiconductor industry by causing more frequent and severe extreme weather events. These events directly threaten ASMedia's production facilities and the sourcing of critical raw materials, leading to potential supply chain disruptions. For instance, the severe droughts experienced in Taiwan in 2021, a major hub for semiconductor manufacturing, highlighted the vulnerability of water-intensive chip production to climate shifts.

To address these risks, ASMedia must prioritize strengthening its supply chain resilience. This involves diversifying geographical locations for manufacturing and sourcing key materials to reduce reliance on single regions susceptible to climate-related impacts. Expanding the supplier base for essential components and raw materials will be crucial in mitigating the effects of climate-induced disruptions.

- Increased Frequency of Extreme Weather: Events like floods, heatwaves, and typhoons directly impact manufacturing uptime and logistics.

- Raw Material Sourcing Vulnerability: Climate change affects the availability and cost of essential materials like silicon and rare earth elements.

- Supply Chain Diversification: ASMedia needs to explore manufacturing and sourcing options beyond current key regions to build resilience.

- Investment in Climate Adaptation: Proactive investments in facility hardening and water management are essential for long-term operational stability.

Responsible Sourcing of Materials

The semiconductor industry, including companies like ASMedia, faces significant challenges in the responsible sourcing of materials. Manufacturing semiconductors requires critical inputs such as rare earth minerals, silicon, and specialized chemicals. For instance, cobalt, essential for some advanced battery technologies that power electronics, is predominantly mined in the Democratic Republic of Congo, a region often associated with human rights concerns and political instability. This reliance on specific geographical locations creates supply chain vulnerabilities and ethical dilemmas.

There's a growing demand from consumers, investors, and regulators for greater transparency and traceability in these supply chains. Companies are increasingly expected to demonstrate that their materials are not linked to conflict, child labor, or environmental degradation. This pressure is driving the need for robust auditing processes and supplier engagement to ensure ethical and sustainable practices are maintained throughout the entire material lifecycle, from extraction to final product.

- Geopolitical Risk: Reliance on minerals from politically unstable regions like parts of Africa and Asia poses a significant risk to supply chain continuity.

- Ethical Scrutiny: Allegations of human rights abuses and poor labor conditions in mining operations, particularly for minerals like cobalt, draw intense public and regulatory attention.

- Supply Chain Transparency: Investors and consumers are demanding clearer visibility into the origin of raw materials, pushing companies to implement advanced tracking systems.

- Sustainability Demands: Growing environmental concerns necessitate sourcing materials with minimal ecological impact, requiring careful selection of suppliers and processing methods.

Environmental factors significantly influence ASMedia's operations and supply chain. The energy-intensive nature of semiconductor manufacturing, even for fabless companies, necessitates a focus on the energy consumption and renewable energy commitments of foundry partners, such as TSMC's goal of 100% renewable energy by 2050.

Water scarcity is another critical environmental concern, with advanced fabs consuming millions of gallons of water daily, as evidenced by Taiwan's water restrictions in 2021 impacting industrial users. Waste generation, including e-waste projected to reach 61.3 million metric tons globally by 2024, also demands responsible management and circular economy approaches.

Climate change poses risks through extreme weather events, impacting manufacturing and raw material sourcing, underscoring the need for supply chain diversification and climate adaptation investments. Furthermore, responsible sourcing of materials like cobalt, often from regions with ethical concerns, requires increased transparency and traceability to meet growing demands for sustainability.

PESTLE Analysis Data Sources

Our ASMedia PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable industry-specific reports, and leading economic and technological forecasting agencies. This comprehensive approach ensures that each factor, from political stability to emerging social trends, is grounded in credible and current information.