ASMedia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

Uncover the strategic positioning of ASMedia's product portfolio with our comprehensive BCG Matrix analysis. See which products are driving growth, which are generating consistent revenue, and which require careful consideration. Purchase the full report to gain actionable insights and a clear roadmap for optimizing ASMedia's market performance.

Stars

ASMedia's USB4 host controller, the ASM4242, and its device controller, the ASM2464PDX, are making significant waves in the rapidly expanding USB4 market. Their dual certification for both USB4 and Thunderbolt 4 immediately sets them apart, establishing ASMedia as a formidable player even beyond Intel's traditional dominance in this space.

The demand for these advanced controllers has been robust, with shipments seeing a substantial increase, largely fueled by the premium segment of the motherboard market. This strong performance underscores the market's appetite for high-speed connectivity solutions.

Beyond their success in traditional PCs, ASMedia's USB4 controllers are strategically expanding into new, high-growth sectors. This includes critical areas like automotive, where enhanced data transfer is paramount, as well as the burgeoning fields of AI development and medical applications, showcasing the versatility and future-proofing of their technology.

ASMedia is making significant strides in the PCIe Gen 5 solutions market with its ASM68080 series, which is nearing the completion of its physical layer design and is set for an upcoming launch. This strategic move positions ASMedia to capitalize on the burgeoning demand for high-speed interconnectivity.

The controller market for PCIe 4.0 and especially PCIe 5.0 is experiencing substantial growth. This expansion is fueled by the escalating requirements for faster data transfer in critical sectors like servers, artificial intelligence and machine learning, and other high-performance computing environments. For instance, the global data center interconnect market, which heavily relies on PCIe technology, was valued at approximately $10.5 billion in 2023 and is projected to reach around $25 billion by 2028, exhibiting a compound annual growth rate of over 18% during that period.

ASMedia's robust research and development in PCIe Gen 5 technology, coupled with its established presence as a key provider of PCIe switches, suggests a strong potential for high market share within this rapidly expanding segment. Their commitment to innovation in this area is a critical factor for their future success.

ASMedia's PCIe Packet Switch solutions, particularly the upcoming ASM58048 slated for Q3 2025 sampling, are positioned as a strong contender in the high-growth AI infrastructure market. This product line, supporting PCIe Gen 2 through Gen 6, offers crucial flexibility with its configurable channel options, catering to demanding applications in servers, edge computing, and NAS systems. The focus on high bandwidth and robust performance directly addresses the escalating market need for efficient data transfer.

High-Speed SERDES Technology

ASMedia's mastery of high-speed SERDES technology is the bedrock of its product portfolio, powering its advanced USB and PCIe offerings. This in-house expertise allows ASMedia to deliver exceptional performance, a critical differentiator in the fast-paced data communication sector.

Their commitment to advancing SERDES technology ensures ASMedia maintains its leadership position. For instance, in 2024, ASMedia continued to push boundaries with its latest PCIe Gen 5 and USB4 solutions, which rely heavily on sophisticated SERDES designs for their impressive data transfer rates.

- ASMedia's SERDES technology enables industry-leading data rates.

- This foundational IP is crucial for their competitive advantage in USB and PCIe markets.

- Continuous R&D in SERDES supports their status as a top-tier semiconductor supplier.

Solutions for AI and Edge Computing

ASMedia is strategically leveraging its expertise in USB4 and PCIe technologies to address the significant growth opportunities within the AI and edge computing sectors. The company's product roadmap is specifically designed to support these rapidly expanding markets.

The ASM2464PDX USB4 controller is a prime example of this strategy, offering optimized performance for edge AI applications. This controller facilitates seamless plug-and-play connectivity for external GPUs, a critical component for accelerating both AI model training and inference processes.

This targeted approach to high-growth AI applications underscores ASMedia's commitment to capturing substantial market share in this transformative industry. The demand for efficient data transfer and processing at the edge is projected to surge, with the edge AI market expected to reach USD 18.3 billion by 2024, growing at a CAGR of 32.5%.

- ASMedia's USB4 and PCIe solutions are tailored for AI and edge computing.

- The ASM2464PDX controller supports external GPUs for edge AI, boosting training and inference.

- The global edge AI market is projected to reach $18.3 billion in 2024.

- ASMedia aims to capitalize on the high-growth potential of AI applications.

ASMedia's USB4 and PCIe Gen 5 solutions are positioned as Stars in the BCG matrix due to their strong market growth and ASMedia's leading competitive position. The company's dual-certified USB4/Thunderbolt 4 controllers are gaining significant traction, particularly in the premium PC segment, with shipments increasing. Their strategic expansion into high-growth areas like automotive and AI further solidifies their Star status.

What is included in the product

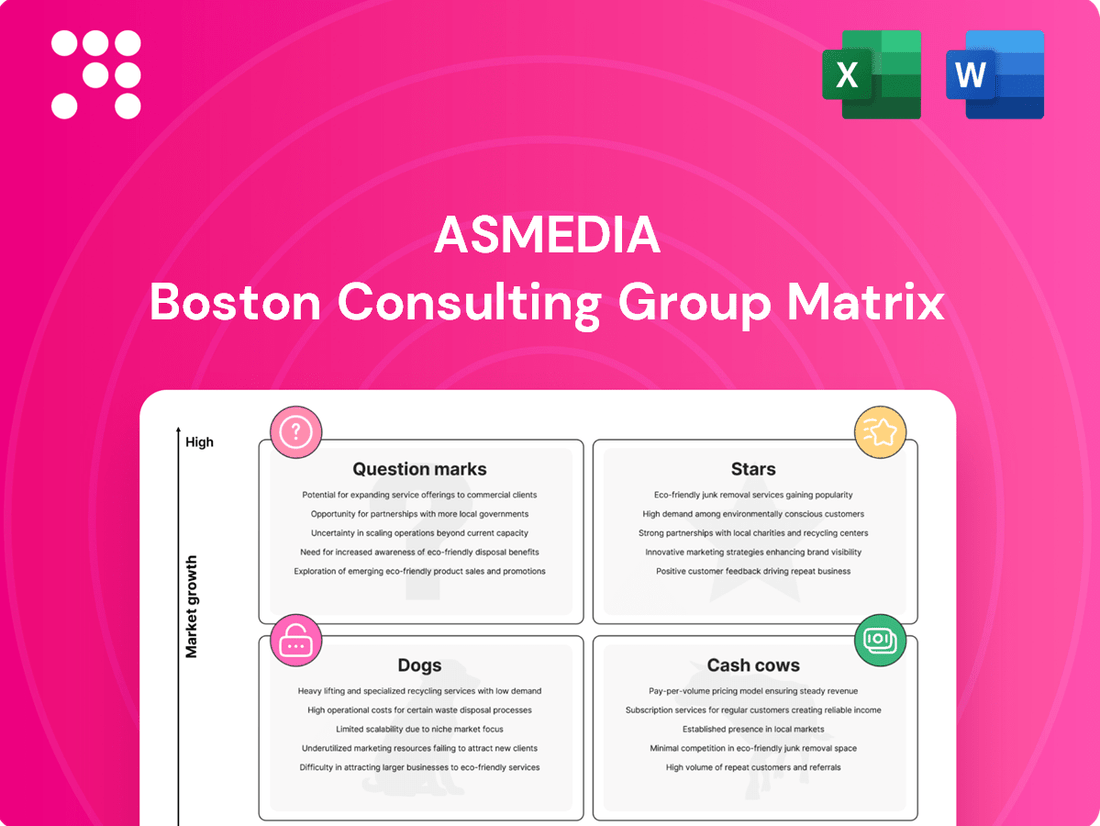

This analysis categorizes ASMedia's products into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

ASMedia BCG Matrix provides a clear, visual representation of your portfolio, eliminating the pain of complex data analysis.

Cash Cows

ASMedia's USB 3.2 Gen 2x2 controllers are a prime example of a Cash Cow within their business portfolio. These controllers have found significant traction, especially within the personal computer and external storage device markets, demonstrating robust and consistent demand.

Despite the industry's gradual shift towards the newer USB4 standard, USB 3.2 Gen 2x2 continues to be a widely adopted and mature technology. This sustained utilization translates into reliable and predictable revenue streams for ASMedia, supported by ASMedia's established market position and a reputation for dependable product quality.

The lower research and development intensity associated with these mature products, compared to cutting-edge technologies, further solidifies their Cash Cow status. This allows ASMedia to capitalize on existing market share and brand recognition, ensuring continued profitability with less investment.

USB 3.2 Gen 2x1 and Gen 1 controllers are ASMedia's cash cows. These are mature technologies with a dominant market share, found in countless consumer electronics and computers. Their widespread adoption ensures a consistent, reliable revenue stream for ASMedia without demanding significant new investment.

The demand for these controllers remains strong due to their essential role in a vast ecosystem of devices. ASMedia benefits from this high-volume, low-growth market, where their established presence provides a stable financial foundation. This segment continues to be a critical contributor to ASMedia's overall financial health.

ASMedia's SATA bridge and controller ICs cater to the enduring market for traditional storage, including HDDs and some SSDs. This segment represents a stable revenue generator due to the continued demand for these interfaces, even as newer technologies emerge.

Despite the rise of PCIe NVMe for speed, SATA's widespread adoption ensures a predictable cash flow for ASMedia. The market for SATA controllers is mature, characterized by steady demand rather than rapid expansion, allowing ASMedia to leverage its established position.

In 2024, the global market for storage controllers, including SATA, continued to see steady demand, particularly in the consumer electronics and enterprise storage sectors where cost-effectiveness and broad compatibility remain key. ASMedia's consistent market share in this segment underscores its role as a cash cow.

PCIe Gen 3 and Gen 4 Solutions

ASMedia's PCIe Gen 3 and Gen 4 solutions are firmly established as cash cows within their product portfolio. These technologies, widely adopted across computing, data centers, and industrial sectors, represent a stable and significant revenue stream for the company. Their mature market position ensures consistent cash flow generation, underpinning ASMedia's financial stability.

- Market Dominance: PCIe Gen 3 and Gen 4 are the current industry standards, driving demand for ASMedia's controllers and bridges.

- Consistent Revenue: These products contribute a substantial and predictable portion of ASMedia's overall revenue, reflecting their widespread integration.

- Mature Technology: ASMedia benefits from a strong, established position in these markets, allowing for efficient production and reliable sales.

- Foundation for Growth: The cash generated from these mature products provides the financial flexibility to invest in newer, emerging technologies.

High-Speed Signal Switches

ASMedia's high-speed signal switches are critical components that facilitate efficient data management across a wide array of electronic devices. These switches are fundamental to the operation of many consumer electronics and computing systems, benefiting from a stable demand within a well-established market.

The consistent need for these signal switches from a diverse customer base positions them as a reliable revenue generator for ASMedia. While the market for these components is mature and not characterized by rapid expansion, their essential function ensures a steady and predictable income stream.

- Market Position: ASMedia's high-speed signal switches serve a mature market with stable demand.

- Revenue Contribution: These products are considered cash cows due to their consistent revenue generation.

- Product Importance: They are essential for managing data flow in numerous electronic systems.

- Growth Outlook: While not experiencing explosive growth, their fundamental role ensures reliability.

ASMedia's USB 3.2 Gen 2x1 and Gen 1 controllers are considered cash cows. These mature technologies hold a dominant market share in consumer electronics and computers, ensuring a consistent and reliable revenue stream without requiring significant new investment from ASMedia.

The persistent demand for these controllers, driven by their integral role in a vast device ecosystem, allows ASMedia to benefit from a high-volume, low-growth market. This segment provides a stable financial foundation, consistently contributing to ASMedia's overall financial health.

In 2024, the market for these established USB controllers remained robust, with ASMedia leveraging its strong market presence to generate predictable income. The widespread integration of these interfaces across numerous devices continues to solidify their cash cow status.

| Product Segment | Market Maturity | Revenue Stability | ASMedia's Role | 2024 Contribution |

|---|---|---|---|---|

| USB 3.2 Gen 2x1 & Gen 1 Controllers | Mature | High | Dominant Market Share | Significant & Predictable |

| SATA Bridge & Controller ICs | Mature | High | Established Presence | Consistent Revenue Generator |

| PCIe Gen 3 & Gen 4 Solutions | Mature | High | Industry Standard Adoption | Substantial Revenue Stream |

| High-Speed Signal Switches | Mature | High | Essential Component | Steady Income Stream |

Delivered as Shown

ASMedia BCG Matrix

The ASMedia BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you're seeing the final, analysis-ready report without any watermarks or placeholder content, ensuring you get exactly what you need for strategic decision-making.

Dogs

Legacy or Niche SATA Solutions in the ASMedia BCG Matrix represent products that have struggled to keep pace with evolving technology. These might include older SATA controller chips that haven't been updated to support faster speeds or more advanced features, making them less attractive to consumers and businesses alike.

These offerings typically hold a small portion of the market share and experience very little growth, as newer interfaces like PCIe NVMe have become the standard for high-performance storage. For ASMedia, products in this category would likely represent a drain on resources, offering minimal return on investment.

Within ASMedia's broad USB controller lineup, older hub controller models that are caught in intense market competition or are built for outdated system designs can be considered underperforming. These products often struggle with low market share and minimal growth, reflecting a declining relevance in the current technological landscape.

Such underperforming controllers would likely contribute very little to ASMedia's overall revenue and profitability. The resources needed to maintain and support these legacy products might outweigh the returns they generate, making them candidates for strategic review.

Within ASMedia's product portfolio, discontinued or phased-out lines represent the 'Dogs' in the BCG Matrix. These are products ASMedia has strategically decided to exit, often due to factors like becoming technologically outdated or facing a significant drop in consumer interest. For instance, ASMedia might have phased out older generations of its USB controllers, which are no longer competitive with newer, faster interfaces.

These 'Dog' products typically generate very little revenue for ASMedia, and their market share is minimal. Continuing to invest in them would be a drain on resources, offering little prospect of future growth or profitability. ASMedia's focus is on reallocating capital from these underperforming assets to more promising areas of the business, such as their high-growth product lines.

Unsuccessful Custom ASIC Projects

Some custom ASIC projects at ASMedia might fall into the "dog" category of the BCG matrix. This happens when the specialized market they were designed for doesn't grow as expected or even shrinks. For example, if ASMedia invested heavily in developing a custom ASIC for a niche communication protocol that ultimately saw little adoption, it would become a dog.

These projects, despite consuming substantial research and development (R&D) funds, end up with a very small market share and minimal growth prospects. This situation is exemplified by projects where market demand projections were overly optimistic. The lack of significant sales means these ASICs are not generating enough revenue to justify the initial investment.

- Low Market Adoption: Custom ASICs targeting highly specialized or emerging markets may fail to gain traction if the market doesn't develop as anticipated.

- R&D Investment Drain: Significant capital and engineering resources are sunk into development, with little return due to poor commercialization.

- Shrinking Niche Markets: If the intended user base for a custom ASIC diminishes due to technological shifts or changing industry standards, the product becomes a dog.

- Example Scenario: A custom ASIC designed for a specific type of legacy industrial equipment that is being phased out would likely become a dog.

Products with Limited Scalability in Mature Markets

Products with limited scalability in mature markets, often found in highly commoditized segments like certain interface ICs, typically fall into the Dogs category of the BCG Matrix. These offerings struggle to gain substantial market share or achieve significant growth.

Their inherent inability to leverage economies of scale or differentiate effectively against larger, established competitors or lower-cost alternatives severely restricts their potential. For instance, in the mature USB 2.0 controller market, ASMedia might face challenges differentiating its products, leading to a low market share and minimal growth prospects. This is particularly true when facing intense price competition from high-volume manufacturers.

- Limited Growth Potential: These products operate in markets with little to no expansion, offering few opportunities for increased sales volume.

- Low Market Share: Difficulty in competing on price or features results in a small slice of the overall market.

- Struggles with Economies of Scale: The inability to produce at a lower per-unit cost hinders profitability and competitive pricing.

- High Competition: Mature markets are often saturated with numerous players, intensifying price wars and reducing margins.

ASMedia's "Dogs" are products with low market share and low growth, often representing legacy technologies or niche offerings that are no longer competitive. These can include older USB controllers or custom ASICs for markets that haven't expanded as predicted. For example, ASMedia's older USB 2.0 controllers might struggle in a market dominated by faster USB standards, leading to minimal growth and a small market share.

These products typically consume resources without generating significant returns, making them candidates for divestment or discontinuation. In 2024, ASMedia's strategic focus remains on high-growth areas like PCIe solutions, indicating a deliberate shift away from underperforming product lines.

The company's financial reports would likely show minimal revenue contribution from these "dog" segments, highlighting the need for capital reallocation to more promising ventures.

Question Marks

ASMedia is heavily invested in PCIe Gen 6, a technology poised for significant growth driven by the burgeoning needs of AI and cloud computing. This next-generation interface promises double the bandwidth of PCIe Gen 5, reaching up to 128 GT/s per lane, which is crucial for high-performance applications.

While the potential is immense, PCIe Gen 6 is currently in its early stages, meaning its market share is minimal. ASMedia's commitment here reflects a strategic bet on future market dominance, requiring substantial capital for R&D and manufacturing scale-up to capture this nascent but high-potential segment.

ASMedia's development of USB4 80Gbps and 120Gbps physical layers represents a significant technological leap, positioning them as a potential leader in ultra-high-speed connectivity. These advancements are crucial for next-generation devices demanding faster data and video transmission, a growing market segment.

Despite the impressive technical capabilities, these advanced USB4 physical layers are currently in the nascent stages of market adoption. The primary hurdle is achieving broad industry acceptance and securing design wins across various product categories, which is essential for realizing their substantial growth potential and capturing significant market share.

ASMedia is strategically expanding its USB4 technology into promising new sectors like automotive and medical. Think advanced driver-assistance systems and high-resolution medical imaging, areas where robust data transfer is crucial.

These emerging markets, while offering substantial growth potential, represent new territory for ASMedia. Their current penetration in these specialized verticals is likely minimal, necessitating significant investment in developing customized solutions and cultivating these nascent markets.

Solutions from Techpoint Acquisition

ASMedia's acquisition of Techpoint Inc. in June 2025 marks a significant move into new industries, but the acquired product lines are currently question marks within the ASMedia BCG matrix. Their market share and growth potential are still being assessed.

This uncertainty necessitates careful strategic planning and investment to determine their future position. For instance, if Techpoint's acquired semiconductor solutions for the automotive sector, a market projected to grow by 15% annually through 2028, fail to gain traction against established players, they could remain question marks or even decline.

- Uncertain Market Share: The precise percentage of ASMedia's total revenue contributed by Techpoint's product lines is not yet defined, making their current market position unclear.

- Developing Growth Trajectory: The future growth rate of these acquired segments under ASMedia's management is speculative, pending successful integration and market penetration strategies.

- Strategic Integration Needs: Significant resources and focused effort will be required to integrate Techpoint's operations and products effectively into ASMedia's existing business model.

- Potential for Growth or Decline: Without established market leadership or a clear growth path, these assets could either become stars with substantial investment or fall behind if market conditions are unfavorable.

Future High-Bandwidth USB4 Dock Solutions

ASMedia's future high-bandwidth USB4 dock solutions are positioned to enter a market with significant growth potential. These multi-functional docks, slated for sampling in 2025, aim to provide robust high-speed data transmission and advanced power delivery, crucial for demanding workstation setups. The company is targeting a burgeoning need for integrated connectivity hubs that can handle complex I/O requirements.

While this product category represents a promising avenue for ASMedia, its current market share is minimal, reflecting its nascent stage. Success hinges on achieving strong market adoption and demonstrating superior performance and feature sets compared to existing solutions. The development of these USB4 docks aligns with the broader industry trend towards higher bandwidth and more integrated peripheral management.

- Market Entry: ASMedia plans to sample multi-functional USB4 Docks in 2025.

- Target Application: Designed for high-speed transmission and power delivery in complex workstation environments.

- Market Position: Currently low market share, requiring successful adoption to grow.

- Strategic Importance: Addresses growing demand for versatile connectivity hubs.

Question Marks in ASMedia's portfolio represent areas with high growth potential but currently low market share. These segments require careful evaluation and strategic investment to determine if they can evolve into Stars or if they will remain Question Marks. The key challenge is converting potential into tangible market penetration.

ASMedia's PCIe Gen 6 technology is a prime example of a Question Mark, offering a significant performance upgrade with double the bandwidth of PCIe Gen 5. However, its adoption is still in the early stages, meaning its market share is minimal. Significant R&D and manufacturing scale-up investments are needed to capitalize on its future growth prospects, particularly driven by AI and cloud computing demands.

Similarly, ASMedia's advanced USB4 physical layers (80Gbps and 120Gbps) are also Question Marks. While technically superior, broad industry acceptance and design wins are still pending. The automotive and medical sectors, targeted for USB4 expansion, represent new markets where ASMedia's penetration is currently minimal, necessitating tailored solutions and market development efforts.

The Techpoint acquisition in June 2025 adds further uncertainty, with its product lines entering ASMedia's portfolio as Question Marks. Their success hinges on effective integration and market traction, especially in sectors like automotive, which is projected to grow at a 15% annual rate through 2028. Failure to gain market share could see these assets stagnate.

BCG Matrix Data Sources

Our ASMedia BCG Matrix is built on comprehensive data, integrating financial disclosures, market research reports, and competitive analysis to provide a robust strategic overview.