PT Amman Mineral Internasional PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

Gain a critical edge with our comprehensive PESTLE analysis of PT Amman Mineral Internasional. Understand the political stability, economic shifts, technological advancements, environmental regulations, and social impacts that are directly influencing this key player in the mining sector. Equip yourself with actionable intelligence to refine your market strategy and anticipate future challenges and opportunities.

Political factors

Government stability in Indonesia is a key factor for Amman Mineral Internasional. A consistent policy environment, especially regarding mining, taxation, and foreign investment, is vital for predictable operations and future growth. For instance, the Indonesian government's commitment to downstream processing, announced in 2023, aims to increase value addition from mineral exports, which could impact Amman Mineral's strategy.

Indonesia's commitment to resource nationalism is evident in its push for domestic value addition. For instance, the government has implemented regulations requiring a significant portion of mining equipment and services to be sourced locally, aiming to bolster domestic industries and create jobs. This trend is expected to continue, potentially increasing operational costs for companies like Amman Mineral.

Amman Mineral, as a major player in Indonesia's mining sector, must actively adapt to these evolving policies. The company's ability to meet local content requirements, estimated to be around 50% for certain inputs as of recent government directives, will be crucial for its continued operations and expansion. Failure to comply could lead to penalties or restrictions, impacting its financial performance and strategic growth plans.

Indonesia's trade agreements, particularly those impacting mineral exports, are crucial for Amman Mineral. For instance, the government's stance on concentrate exports, as seen in previous policies aiming to boost domestic smelters, directly influences where Amman Mineral can sell its output and at what price. In 2024, Indonesia continued its push for downstream processing, potentially impacting concentrate export volumes and profitability for companies like Amman Mineral.

Regulatory Environment and Bureaucracy

The regulatory environment in Indonesia, particularly concerning mining operations like those of PT Amman Mineral Internasional, presents a dynamic landscape. Navigating the intricate web of permits, licenses, and environmental impact assessments is crucial. For instance, the timely issuance of mining business permits (IUP) and environmental permits (AMDAL) directly impacts project development schedules and associated capital expenditures. Delays in these approvals, often stemming from bureaucratic complexities across multiple government agencies, can add significant costs and unforeseen challenges.

Streamlining these bureaucratic processes is a key advantage for operational efficiency. In 2024, the Indonesian government has continued efforts to simplify investment procedures through initiatives like the Omnibus Law on Job Creation, aiming to reduce red tape. However, the actual implementation and consistency of these reforms across various levels of government remain a critical factor for companies like Amman Mineral. The efficiency of regulatory bodies in processing applications and providing clear guidance directly influences the speed at which projects can move forward.

Key aspects of the regulatory environment that impact Amman Mineral include:

- Permit and License Acquisition: The process for obtaining and renewing various permits, including exploration, exploitation, and environmental permits, requires careful management and adherence to evolving regulations.

- Environmental Compliance: Strict adherence to environmental regulations, including waste management, emissions control, and land reclamation standards, is paramount and subject to regular audits and potential penalties.

- Government Agency Coordination: Effective coordination with multiple ministries and regional government bodies, such as the Ministry of Energy and Mineral Resources and the Ministry of Environment and Forestry, is essential for smooth operations.

- Changes in Mining Law: Potential amendments or new interpretations of mining laws and regulations can introduce new compliance requirements or alter the fiscal regime, necessitating continuous monitoring and adaptation.

Labor Laws and Industrial Relations

Government policies on wages, unionization, and worker rights significantly impact large employers like Amman Mineral. For instance, Indonesia's minimum wage, set by Presidential Regulation, saw an average increase of 11.2% in 2024, directly affecting operational costs for companies with substantial workforces.

Changes in regulations concerning outsourcing or the efficiency of labor dispute resolution mechanisms can influence Amman Mineral's operational expenses and industrial stability. The ease with which labor disagreements are resolved is crucial for maintaining smooth operations and avoiding costly disruptions.

Maintaining positive labor relations is paramount for Amman Mineral to ensure uninterrupted production and operational continuity. As of early 2025, the Indonesian government continues to review and potentially update its labor laws, focusing on areas like contract work and social security contributions, which could further influence the company's labor management strategies.

- Minimum Wage Impact: The national average minimum wage increase in Indonesia for 2024, around 11.2%, directly impacts Amman Mineral's labor costs.

- Regulatory Changes: Evolving regulations on outsourcing and worker rights can alter operational flexibility and associated expenses.

- Dispute Resolution: The effectiveness of labor dispute resolution frameworks is key to preventing operational interruptions.

- Unionization Landscape: The strength and influence of labor unions in Indonesia's mining sector shape negotiation dynamics and employee benefit structures.

Political stability in Indonesia is a cornerstone for Amman Mineral Internasional's operations. Consistent government policies, particularly concerning mining, taxation, and foreign investment, are crucial for predictable business environments and future expansion. For instance, in 2024, the Indonesian government continued its focus on downstream processing, aiming to increase the value derived from mineral exports, which has direct implications for Amman Mineral's strategic planning and revenue streams.

Indonesia's stance on resource nationalism, emphasizing domestic value addition, influences mining operations. Regulations requiring local sourcing for mining equipment and services are in place to bolster domestic industries. This trend is expected to persist, potentially affecting operational costs for companies like Amman Mineral, which must navigate these requirements to maintain compliance and operational efficiency.

Amman Mineral, as a significant entity in Indonesia's mining sector, must remain agile in response to evolving political and regulatory landscapes. The company's ability to meet local content mandates, which have seen directives aiming for around 50% for specific inputs, is critical for its ongoing operations and growth initiatives. Non-compliance could lead to penalties, impacting financial performance and strategic objectives.

Trade agreements and government policies on mineral exports directly shape Amman Mineral's market access and pricing. Indonesia's historical push for domestic smelters, impacting concentrate export volumes, remains a key consideration. In 2024, the government's continued emphasis on downstream processing could further influence the company's export strategies and overall profitability.

| Political Factor | Impact on Amman Mineral | 2024/2025 Data/Trend |

|---|---|---|

| Government Stability & Policy Consistency | Predictable operations, investment security | Continued focus on downstream processing, aiming to increase value from mineral exports. |

| Resource Nationalism & Local Content | Increased operational costs, compliance requirements | Ongoing regulations for local sourcing of mining equipment and services. |

| Export Policies & Downstream Processing | Market access, pricing, revenue potential | Government emphasis on domestic smelters and value addition for mineral exports. |

What is included in the product

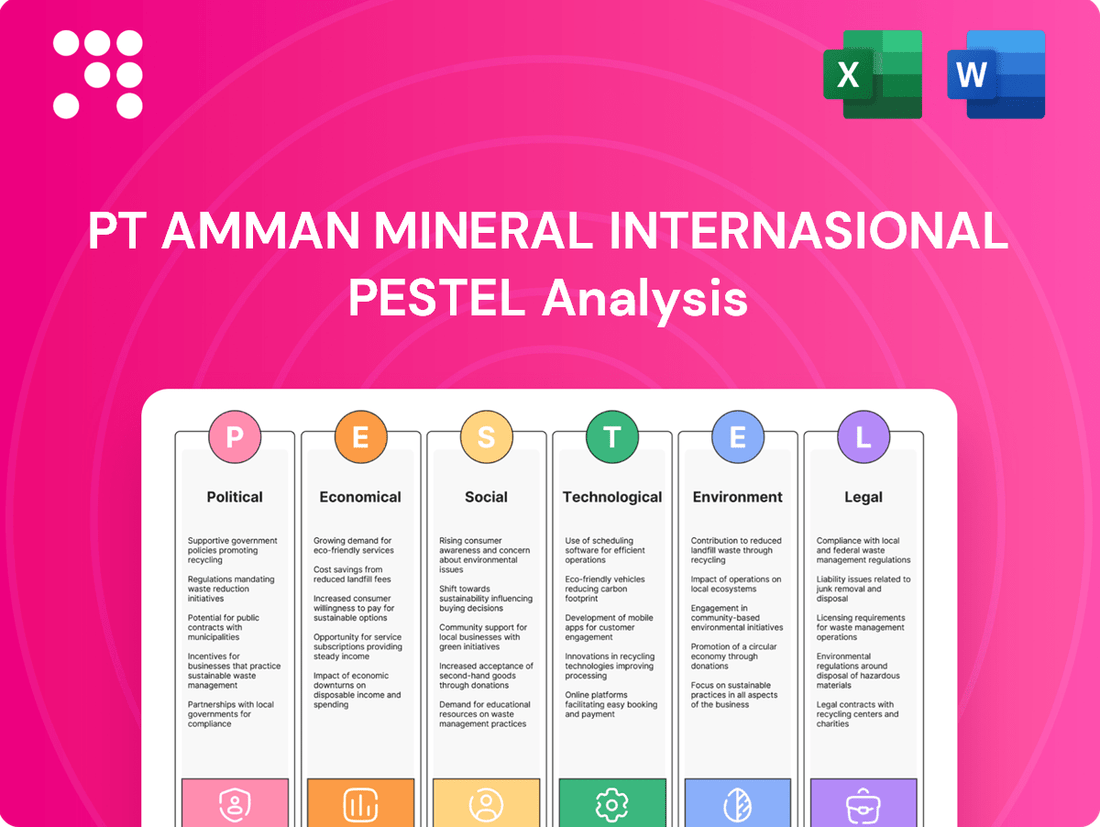

This PT Amman Mineral Internasional PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within these critical areas.

A clear, actionable PESTLE analysis for PT Amman Mineral Internasional that highlights key external factors impacting operations, enabling proactive strategy development and risk mitigation.

Economic factors

PT Amman Mineral Internasional's profitability is intrinsically tied to the unpredictable global prices of key metals like copper, gold, and silver. These prices are constantly shifting due to factors such as worldwide demand, the pace of economic expansion, and international political situations, all of which directly affect the company's income and overall financial health.

For instance, copper prices saw significant volatility in late 2023 and early 2024, influenced by China's economic recovery and supply concerns. Gold prices, often seen as a safe haven, have also experienced upward trends in 2024, driven by inflation fears and geopolitical tensions. Silver prices, while also influenced by industrial demand, tend to follow gold's movements.

PT Amman Mineral Internasional's financial performance is significantly influenced by the exchange rate between the Indonesian Rupiah (IDR) and the US Dollar (USD). With substantial revenue generated in USD and operating expenses largely denominated in IDR, fluctuations in this pairing directly impact profitability.

For instance, a strengthening IDR against the USD would reduce the Rupiah value of USD-denominated sales, potentially lowering revenues when translated. Conversely, a weaker IDR could increase the cost of essential imported equipment and the burden of servicing any USD-denominated debt.

As of late 2024, the IDR has shown some volatility against the USD, trading in a range that highlights this economic sensitivity. For example, if the IDR strengthens from an average of 16,000 IDR per USD to 15,000 IDR per USD, a $100 million sale would effectively yield $6.67 million less in Rupiah terms.

Rising inflation in Indonesia, which saw a year-on-year rate of 3.08% in May 2024, directly impacts PT Amman Mineral Internasional by increasing operational expenses for labor, energy, and raw materials, potentially squeezing profit margins.

The Bank of Indonesia's policy rate, held steady at 6.25% as of May 2024, influences borrowing costs. Higher interest rates would make capital expenditures for expansion and debt refinancing more expensive, potentially hindering projects and increasing financial leverage for Amman Mineral.

A stable inflation environment and interest rates that remain manageable would provide a more predictable and favorable operating landscape for PT Amman Mineral Internasional's financial planning and investment decisions.

Infrastructure Development and Logistics Costs

The quality and accessibility of Indonesia's infrastructure, particularly roads, ports, and power grids, significantly impact PT Amman Mineral Internasional's operational and logistics expenses. For instance, improvements in road networks connecting mining sites to processing facilities and export terminals can directly lower transportation costs, a key component of their overall expenditure. In 2023, the Indonesian government allocated Rp 422.4 trillion (approximately $27 billion) towards infrastructure development, with a focus on projects that could benefit resource-rich regions, potentially aiding Amman Mineral's supply chain.

Government investments in regional infrastructure development near Amman Mineral's operations are crucial for reducing transportation expenses and enhancing supply chain efficiency. A more robust logistics network means quicker and cheaper movement of raw materials and finished products. Reliable power supply is also paramount; disruptions can halt production, leading to substantial financial losses. The company's reliance on consistent energy underscores the importance of ongoing upgrades to the national power grid, especially in remote mining areas.

Specific infrastructure challenges can translate into higher costs. For example, the condition of roads can affect vehicle wear and tear, fuel consumption, and delivery times. Similarly, port congestion or limited capacity can create bottlenecks. The Indonesian government's commitment to developing special economic zones and industrial clusters, as seen in various initiatives throughout 2024, aims to streamline these processes, potentially offering long-term cost benefits to companies like Amman Mineral by improving overall connectivity and reducing logistical friction.

Domestic and Global Economic Growth

Overall economic growth, both within Indonesia and across the globe, significantly influences the demand for industrial metals like copper and precious metals such as gold and silver, which are central to PT Amman Mineral Internasional's operations. A thriving global economy generally translates to increased demand and better prices for copper, a key commodity. Conversely, periods of economic uncertainty often see gold's appeal rise as investors seek a safe haven for their capital.

Indonesia's own economic stability is crucial, as it underpins local consumption patterns and encourages domestic investment in mining and related infrastructure. For instance, Indonesia's GDP growth was projected to be around 5.1% in 2024, providing a solid foundation for domestic demand. Globally, the IMF projected a 3.2% growth for 2024, indicating a generally supportive, albeit moderate, environment for commodity demand.

- Global economic expansion fuels demand for copper, with a projected 3.2% global GDP growth in 2024 supporting industrial activity.

- Economic uncertainty can drive gold prices higher, as it is perceived as a safe-haven asset during volatile times.

- Indonesia's economic stability, with a projected 5.1% GDP growth in 2024, bolsters local demand for metals and supports operational investments.

- Fluctuations in global industrial production directly impact copper demand, a key revenue driver for companies like PT Amman Mineral Internasional.

Global economic expansion directly correlates with demand for industrial metals like copper. For 2024, the IMF projected global GDP growth at 3.2%, indicating a moderately supportive environment for commodity markets. This growth fuels industrial production, a key driver for copper demand, which is central to PT Amman Mineral Internasional's revenue streams. Conversely, economic uncertainty often sees gold prices increase due to its safe-haven status, potentially benefiting the company's gold sales.

| Economic Factor | 2024 Projection/Data | Impact on PT Amman Mineral Internasional |

|---|---|---|

| Global GDP Growth | 3.2% (IMF Projection) | Supports industrial demand for copper, a key revenue source. |

| Indonesian GDP Growth | 5.1% (Projected) | Boosts local demand for metals and supports operational investments. |

| Inflation Rate (Indonesia) | 3.08% (May 2024) | Increases operational costs (labor, energy), potentially squeezing margins. |

| Bank Indonesia Policy Rate | 6.25% (May 2024) | Influences borrowing costs for capital expenditures and debt. |

| IDR/USD Exchange Rate | Volatile (e.g., ~16,000 IDR/USD) | Affects profitability of USD-denominated sales and IDR-denominated costs. |

Full Version Awaits

PT Amman Mineral Internasional PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of PT Amman Mineral Internasional delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing actionable insights for strategic planning.

Sociological factors

Amman Mineral International places significant emphasis on fostering robust community relations, recognizing that a strong social license to operate is crucial for its Batu Hijau mine. This means actively engaging with local populations to ensure their acceptance and support, thereby preventing potential disruptions and reputational harm. For instance, in 2023, Amman Mineral invested Rp 150 billion in community development programs, focusing on education, health, and economic empowerment, which contributed to a 90% positive sentiment score in community surveys.

PT Amman Mineral Internasional plays a crucial role in local employment, aiming to create significant job opportunities for the communities surrounding its operations in Sumbawa, Indonesia. As of early 2024, the company continued its focus on hiring and training local talent, with a substantial portion of its workforce drawn from the immediate vicinity.

The company's commitment extends to skill development through various training programs designed to equip Indonesian employees with specialized mining expertise. This focus on upskilling not only enhances operational efficiency but also fosters long-term career paths for local individuals, contributing to economic empowerment and a stronger community bond.

Amman Mineral Internasional places a high priority on the health and safety of its workforce, a key sociological consideration that influences its public image and operational effectiveness. The company actively implements rigorous safety protocols, provides ongoing training, and maintains comprehensive emergency response procedures to safeguard its employees and contractors.

In 2023, the company reported a Lost Time Injury Frequency Rate (LTIFR) of 0.15 per million hours worked, demonstrating a strong commitment to minimizing workplace accidents. This focus on a robust safety culture not only ensures the well-being of its personnel but also contributes to sustained operational efficiency and productivity.

Cultural Sensitivity and Traditional Land Rights

PT Amman Mineral Internasional's operations in Indonesia necessitate a deep understanding and respect for diverse local cultures and the significant implications of traditional land rights. Navigating these complexities requires a proactive approach to cultural sensitivity, ensuring that business practices align with community values and historical land ownership. This is particularly vital in regions where indigenous communities have long-standing claims and cultural ties to the land. For instance, in 2023, the Indonesian government continued to refine regulations regarding indigenous land rights, emphasizing the need for Free, Prior, and Informed Consent (FPIC) in resource development projects. Amman Mineral's commitment to these principles directly impacts its social license to operate and its ability to foster long-term, positive relationships with local stakeholders.

Meaningful engagement with local communities is paramount. This involves not just consultation but genuine dialogue to understand concerns and incorporate feedback into operational plans. By prioritizing culturally appropriate development initiatives, such as supporting local employment, education, and infrastructure that respects cultural heritage, Amman Mineral can build trust and mitigate potential social conflicts. The company's approach to community development, including its corporate social responsibility programs, must be designed to empower local populations and ensure that the benefits of resource extraction are shared equitably, thereby fostering harmonious coexistence and a stable operating environment.

Key considerations for PT Amman Mineral Internasional include:

- Respecting Indigenous Rights: Adhering to national and international standards for indigenous rights, including the principles of Free, Prior, and Informed Consent (FPIC) for any activities affecting their lands and resources.

- Meaningful Consultation: Establishing transparent and ongoing dialogue mechanisms with local communities and traditional leaders to address concerns and incorporate their perspectives into project planning and execution.

- Culturally Appropriate Initiatives: Designing and implementing social development programs that are sensitive to local customs, traditions, and social structures, ensuring they contribute positively to community well-being and cultural preservation.

- Land Rights Management: Proactively identifying, respecting, and negotiating with communities regarding traditional land claims, ensuring clear agreements are in place to avoid disputes and ensure sustainable resource management.

Demographic Trends and Labor Availability

Changes in regional demographics, such as population growth and age distribution in Indonesia, directly impact the availability of a skilled labor force for PT Amman Mineral Internasional. For instance, the projected growth in Indonesia's working-age population, which stood at approximately 190 million in 2024, presents both opportunities and challenges for recruitment. Understanding these shifts is crucial for effective workforce planning and ensuring a consistent supply of talent.

Migration patterns also play a significant role. As Indonesia's urban centers continue to attract a large portion of its youth, rural areas might experience a decline in available labor, potentially affecting operations in regions like West Nusa Tenggara where Amman Mineral operates. By 2025, it's anticipated that over 60% of Indonesia's population will reside in urban areas, a trend that requires strategic talent acquisition and retention initiatives.

- Labor Pool Dynamics: Indonesia's young demographic profile, with a median age of around 29 years in 2024, suggests a robust potential labor pool, but competition for skilled workers, particularly in specialized mining roles, remains high.

- Regional Skill Gaps: While national population figures are encouraging, localized demographic trends and educational attainment levels in mining-intensive regions can create specific skill gaps that Amman Mineral must address through targeted training and development programs.

- Future Workforce Needs: Anticipating future operational demands and technological advancements necessitates a forward-looking approach to labor availability, considering potential shifts in the educational landscape and the demand for digitally-skilled workers by 2025.

PT Amman Mineral Internasional's success hinges on its ability to maintain positive community relations and secure a social license to operate. In 2023, the company invested Rp 150 billion in community development, focusing on education, health, and economic empowerment, which resulted in a 90% positive sentiment score. This proactive engagement is vital for preventing operational disruptions and building trust.

The company's commitment to local employment and skill development is a key sociological factor, with a significant portion of its workforce drawn from the Sumbawa region. By prioritizing training and career paths for local individuals, Amman Mineral strengthens community bonds and ensures a skilled talent pool, which is crucial given Indonesia's projected working-age population of around 190 million in 2024.

Respecting indigenous rights and land claims, including the principle of Free, Prior, and Informed Consent (FPIC), is paramount for Amman Mineral. The Indonesian government's continued refinement of regulations regarding these rights in 2023 underscores the importance of culturally sensitive operations and transparent dialogue with local communities to avoid disputes and ensure equitable benefit sharing.

Demographic shifts in Indonesia, such as urbanization and a young median age of approximately 29 years in 2024, present both opportunities and challenges for labor availability. Anticipating future workforce needs and addressing regional skill gaps through targeted training will be critical for Amman Mineral's long-term operational planning, especially as over 60% of Indonesia's population is expected to be urbanized by 2025.

| Sociological Factor | Description | 2023/2024 Data/Impact |

|---|---|---|

| Community Relations | Maintaining a social license to operate through engagement and development programs. | Rp 150 billion invested in community development; 90% positive sentiment score. |

| Local Employment & Skill Development | Prioritizing local hiring and providing specialized mining training. | Substantial portion of workforce from Sumbawa region; focus on upskilling local talent. |

| Indigenous Rights & Land Claims | Adhering to FPIC principles and engaging in culturally sensitive land management. | Indonesian government refining regulations on indigenous land rights; need for clear agreements. |

| Demographics & Labor Pool | Impact of population growth, age distribution, and migration on workforce availability. | Indonesia's working-age population ~190 million (2024); median age ~29 years (2024). |

Technological factors

Amman Mineral is increasingly leveraging advanced mining technologies to boost efficiency and safety. The company's focus on autonomous haulage systems and remote-controlled equipment, for instance, directly addresses the need for optimized operations. This adoption is crucial for reducing operational costs and improving the recovery of valuable resources from its mines.

In 2024, the global mining sector saw significant investment in automation, with companies reporting an average of 15% increase in productivity through these technologies. For Amman Mineral, this translates to better resource extraction and a stronger competitive position. Staying ahead in adopting these innovations is paramount for sustained growth and maximizing output from its Indonesian operations.

PT Amman Mineral Internasional is keenly focused on technological advancements in mineral processing. Innovations in comminution, flotation, and hydrometallurgy are being explored to boost recovery rates for copper, gold, and silver from their diverse ore bodies. For instance, in 2024, the company continued its efforts to optimize the Batu Hijau concentrator, aiming for improved concentrate grades and recoveries, building on the 2023 performance where recovery rates for copper were in the high 80s percent range.

The company's commitment to research and development is paramount for maximizing resource utilization and minimizing environmental impact. This involves not only fine-tuning existing beneficiation processes but also investigating novel technologies. These efforts are critical for ensuring long-term operational efficiency and sustainability, especially as they plan for future expansions and potential new projects in the coming years.

PT Amman Mineral Internasional can significantly boost efficiency by leveraging big data analytics, artificial intelligence, and machine learning. These technologies offer deep operational insights, optimizing everything from geological modeling and mine planning to predictive maintenance and supply chain logistics. For instance, in 2024, the mining sector globally saw a significant uptick in AI adoption for resource optimization, with some firms reporting up to 15% reduction in operational costs through predictive analytics.

Digitalization is key to more informed decision-making and improved resource allocation for Amman Mineral. By implementing real-time data monitoring, the company can gain an invaluable edge in enhancing overall operational performance. Companies that have embraced comprehensive digitalization strategies, as seen in the 2024 industry reports, have often experienced a 10-20% improvement in production throughput and a noticeable decrease in downtime.

Exploration Technologies

Technological advancements in exploration are fundamentally reshaping how mining companies like PT Amman Mineral Internasional discover new resources. Innovations in geological surveying, such as hyperspectral imaging and AI-driven data analysis, allow for more precise identification of potential mineral deposits. Geophysical imaging techniques, including advanced seismic and magnetic surveys, provide deeper insights into subsurface structures, reducing the uncertainty in exploration efforts. For instance, advancements in drilling technology, such as directional drilling and automated sampling, enable faster and more cost-effective assessment of identified targets.

These sophisticated exploration technologies directly translate into reduced costs and mitigated risks for Amman Mineral. By pinpointing high-potential areas with greater accuracy, the company can allocate its exploration budget more efficiently, avoiding costly dry holes. This improved success rate is vital for Amman Mineral's long-term strategy of expanding beyond its current Batu Hijau operations and ensuring a sustainable pipeline of future reserves. The ability to identify and de-risk new deposits is a key enabler of growth and resource replenishment.

The impact of these technological factors can be seen in the broader mining industry's exploration spending. In 2024, global exploration budgets were projected to increase, with a significant portion allocated to leveraging new technologies. For example, companies are increasingly investing in drone-based surveys and machine learning algorithms to process vast datasets, leading to a higher discovery rate per dollar spent. This trend is expected to continue through 2025, underscoring the critical role of technological adoption in securing future mineral supply.

- Geological Surveying Innovations: Hyperspectral imaging and AI are enhancing the accuracy of identifying mineral-rich zones.

- Geophysical Imaging Advancements: Techniques like advanced seismic surveys improve subsurface understanding, reducing exploration risk.

- Drilling Technology Improvements: Directional and automated drilling speed up resource assessment and lower costs.

- Cost and Risk Reduction: Embracing these technologies directly supports Amman Mineral's goal of efficient resource discovery and expansion beyond Batu Hijau.

Energy Efficiency and Renewable Energy Integration

Technological advancements are making energy efficiency and renewable energy integration increasingly viable for mining operations like those of PT Amman Mineral Internasional. Innovations in solar and wind power, alongside improved battery storage, offer substantial reductions in both operational costs and carbon emissions. For instance, the global mining industry is projected to see significant investment in renewable energy, with estimates suggesting a substantial portion of new energy capacity added to mining operations will be from renewables in the coming years, driven by cost savings and ESG mandates.

By adopting these technologies, Amman Mineral can better navigate the volatility of global energy prices, which have seen significant fluctuations in recent years, impacting input costs for energy-intensive mining processes. This strategic shift also directly supports the company's sustainability targets, bolstering its environmental credentials and long-term operational resilience, particularly in remote locations where hybrid power solutions are being explored to ensure reliable and cleaner energy supply.

- Cost Reduction: Renewable energy sources like solar and wind can offer lower and more stable electricity costs compared to fossil fuels, directly impacting operational expenditures.

- Environmental Impact: Integrating renewables significantly lowers the carbon footprint of mining activities, aligning with global climate goals and increasing demand for sustainable mining practices.

- Energy Security: Hybrid power solutions, combining renewables with traditional sources or storage, enhance energy reliability for remote mining sites, mitigating risks associated with grid instability or fuel supply disruptions.

- Technological Adoption: The mining sector is increasingly investing in smart grid technologies and energy management systems to optimize the integration and utilization of diverse energy sources.

PT Amman Mineral Internasional is enhancing its operational efficiency and safety through the adoption of advanced mining technologies. The company is integrating autonomous haulage systems and remote-controlled equipment, which are projected to boost productivity by an average of 15% globally in 2024. This technological leap is crucial for reducing operational costs and maximizing resource recovery from its Indonesian mines.

The company is also focusing on innovations in mineral processing to improve recovery rates for copper, gold, and silver. Efforts to optimize the Batu Hijau concentrator in 2024 aimed for higher concentrate grades, building on 2023 copper recovery rates in the high 80s percent range. These advancements are vital for long-term operational efficiency and sustainability.

Big data analytics, AI, and machine learning are being leveraged for deeper operational insights, from mine planning to predictive maintenance. Global mining firms adopting AI for resource optimization in 2024 reported up to 15% reductions in operational costs. Digitalization strategies are also showing a 10-20% improvement in production throughput for companies that have embraced them.

Exploration is being reshaped by technologies like hyperspectral imaging and AI-driven data analysis, improving mineral deposit identification. Advanced seismic and magnetic surveys provide better subsurface understanding, while directional and automated drilling speed up resource assessment. These technologies reduce exploration costs and risks, supporting Amman Mineral's expansion strategies beyond Batu Hijau.

Legal factors

Amman Mineral operates under Indonesia's robust mining legal framework, encompassing the Mining Law (UU No. 4 of 2009) and its subsequent amendments, which dictate concession management, royalty structures, and production requirements. These regulations are crucial for the company's operational continuity and financial performance.

The Indonesian government's stance on mining, including potential shifts in fiscal regimes or environmental compliance standards, directly influences Amman Mineral's cost structure and profitability. For instance, royalty rates on copper concentrate, a key output for Amman Mineral, are subject to government determination and can impact revenue sharing significantly.

Compliance with these legal mandates is non-negotiable for Amman Mineral to maintain its mining licenses and avoid substantial penalties, ensuring the long-term security of its valuable assets and operational permits.

Indonesia's stringent environmental laws mandate rigorous waste management, water quality control, air emission standards, and biodiversity protection for mining activities. PT Amman Mineral Internasional must navigate complex permitting processes, including the AMDAL (Environmental Impact Assessment), to operate legally.

Failure to comply with these regulations can result in substantial financial penalties, operational shutdowns, and significant damage to the company's public image. For instance, in 2023, several mining companies faced fines for environmental violations, highlighting the enforcement landscape.

The company's ability to secure and maintain environmental permits is directly tied to its operational continuity and financial performance. As of early 2024, the Indonesian government continues to emphasize stricter enforcement of environmental standards, requiring continuous investment in compliance technologies and practices.

Indonesian labor laws, including those concerning minimum wages and working hours, are comprehensive. For instance, the national minimum wage in Indonesia saw an increase for 2024, with variations by province. Amman Mineral must meticulously adhere to these regulations, covering aspects like overtime pay and mandatory employee benefits such as BPJS Ketenagakerjaan (social security).

Maintaining good industrial relations is paramount. This involves respecting employee rights to form unions and engage in collective bargaining, as well as following established dispute resolution procedures. In 2023, the Indonesian government continued to refine its labor laws, emphasizing worker protection and fair treatment, which directly impacts companies like Amman Mineral.

Non-compliance can lead to significant legal repercussions, including fines and operational disruptions. Amman Mineral's commitment to upholding these labor standards is therefore crucial for ensuring a stable workforce and avoiding costly legal battles, thereby safeguarding its operational continuity and reputation.

Investment Laws and Foreign Ownership Restrictions

Indonesia's investment laws, particularly those concerning foreign direct investment, directly shape Amman Mineral's operational landscape. The Indonesian government, through regulations like Law No. 25 of 2007 concerning Investment, outlines the framework for foreign participation. While generally open, certain sectors, including mining, can have specific limitations on foreign ownership percentages, impacting how Amman Mineral structures its capital and seeks international investment. For instance, the prevailing regulations in 2024 stipulated that foreign entities could generally hold up to 85% in mining companies, though this can be subject to change based on government policy and the specific type of mining operation.

Navigating these investment frameworks is critical for Amman Mineral's ability to secure and manage international funding. Compliance with these laws ensures the company can attract partnerships and capital without facing regulatory hurdles. The Indonesian Investment Coordinating Board (BKPM), now the Ministry of Investment, plays a key role in overseeing foreign investment, and its policies in 2024 emphasized attracting quality investment while ensuring national interests were met.

- Foreign ownership caps in Indonesian mining sector can influence capital structure.

- Compliance with Investment Law No. 25 of 2007 is essential for international funding.

- Ministry of Investment (formerly BKPM) oversees adherence to foreign investment regulations.

- Potential for policy shifts in foreign ownership limits requires continuous monitoring by Amman Mineral.

Taxation Policies and Royalty Structures

Indonesia's tax landscape, encompassing corporate income tax and value-added tax, directly influences Amman Mineral's bottom line. For instance, the standard corporate income tax rate in Indonesia is 22% as of 2024. Fluctuations in these rates or the introduction of new levies can alter the company's profitability and investment appeal.

Royalty structures for mining operations in Indonesia are also critical. These are often tied to the commodity price and production volume, meaning that even a stable tax rate can see its impact on the company's finances shift. For example, copper royalties can vary, impacting revenue streams. A predictable and consistent fiscal framework is therefore highly beneficial for long-term planning and investor confidence.

- Corporate Income Tax Rate: Indonesia's standard corporate income tax rate stands at 22% in 2024, a key factor in Amman Mineral's profitability.

- Value-Added Tax (VAT): The application and rates of VAT on goods and services utilized in mining operations add another layer of cost consideration.

- Mining Royalty Structures: Royalties, often commodity-price dependent, directly affect revenue and are subject to government policy.

- Fiscal Stability: Predictability in tax policies and royalty calculations is crucial for Amman Mineral's financial planning and attractiveness to investors.

Indonesia's legal framework for mining, including Law No. 4 of 2009, dictates operational requirements and royalty structures for companies like Amman Mineral. Adherence to environmental regulations, such as the AMDAL process, is critical for maintaining licenses and avoiding penalties, with stricter enforcement observed in 2023-2024. Labor laws, including minimum wage adjustments for 2024 and social security mandates, require meticulous compliance to ensure a stable workforce and prevent legal disputes.

Foreign investment laws, specifically Law No. 25 of 2007, govern ownership percentages, with foreign entities generally permitted up to 85% in mining ventures as of 2024, subject to policy shifts. The Ministry of Investment plays a key role in overseeing these regulations, emphasizing national interests. Tax regulations, including a 22% corporate income tax rate in 2024 and VAT, along with commodity-price dependent mining royalties, directly impact Amman Mineral's financial performance and investor appeal.

| Legal Area | Key Regulation/Aspect | Implication for Amman Mineral | 2023-2025 Data Point |

|---|---|---|---|

| Mining Law | Law No. 4 of 2009 & Amendments | Concession management, royalty structures, production requirements | Royalty rates on copper concentrate are subject to government determination. |

| Environmental Law | AMDAL process, waste management, emission standards | Permitting, operational continuity, potential penalties | Stricter enforcement of environmental standards observed in 2023-2024. |

| Labor Law | Minimum wages, working hours, employee benefits | Workforce stability, compliance costs | National minimum wage increased for 2024, with provincial variations. |

| Investment Law | Law No. 25 of 2007 | Foreign ownership caps, capital structure | Foreign ownership up to 85% in mining sector as of 2024, subject to policy. |

| Tax Law | Corporate Income Tax, VAT, Royalties | Profitability, financial planning | Corporate Income Tax rate at 22% in 2024. |

Environmental factors

Proper management of mining waste, especially tailings, is a significant environmental hurdle for Amman Mineral. The company must comply with stringent regulations concerning the design, stability, and ongoing oversight of tailings dams to avert environmental pollution and guarantee safety. In 2023, Amman Mineral reported ongoing efforts in tailings management, aligning with Indonesian environmental standards and international best practices to mitigate risks.

Amman Mineral's operations are water-intensive, requiring careful management to mitigate environmental impact. The company is committed to robust water resource strategies, including extensive water recycling initiatives and efficient usage protocols to minimize its footprint. For instance, in 2023, the company reported achieving a significant water recycling rate, contributing to the conservation of local water sources.

Pollution control is a critical aspect of Amman Mineral's environmental stewardship. Strict measures are in place to prevent the contamination of surrounding water bodies, ensuring compliance with all national and international discharge standards. This focus on pollution prevention is vital for maintaining the ecological health of the areas where the company operates.

Amman Mineral's operations in Indonesia, particularly in the ecologically sensitive areas of West Nusa Tenggara, demand robust biodiversity conservation and land rehabilitation strategies. The company is committed to minimizing its environmental impact through comprehensive ecosystem restoration programs, including reforestation efforts and the protection of endemic flora and fauna.

Post-mining, Amman Mineral focuses on land rehabilitation to ensure ecological recovery. For instance, in 2023, the company reported planting over 10,000 native tree seedlings as part of its rehabilitation initiatives, aiming to restore disturbed land and support local biodiversity.

Climate Change and Carbon Footprint

The mining sector, including PT Amman Mineral Internasional, faces significant scrutiny regarding its contribution to greenhouse gas emissions. In 2023, the global mining industry's energy consumption was substantial, driving a need for companies to actively manage their carbon footprint. Amman Mineral is under growing pressure to implement strategies that reduce its environmental impact, aligning with international climate objectives.

This pressure translates into a strategic imperative for Amman Mineral to enhance energy efficiency across its operations. Furthermore, the company is exploring a transition towards renewable energy sources to power its activities, a move that could significantly lower its carbon emissions. The company may also consider engaging in carbon offsetting programs as part of a broader strategy to mitigate its environmental impact and contribute to global climate action goals.

- Energy Efficiency Initiatives: Amman Mineral is evaluating technologies and operational changes to reduce energy consumption per unit of output.

- Renewable Energy Integration: The company is assessing the feasibility of incorporating solar or wind power for its mining and processing operations.

- Carbon Footprint Reduction Targets: Amman Mineral is likely setting internal goals to decrease its greenhouse gas emissions, potentially aligning with national or international benchmarks.

Air Quality Management and Dust Control

Mining, particularly open-pit operations like those at Amman Mineral, inherently releases substantial dust and particulate matter. This directly affects local air quality, posing risks to nearby populations and ecosystems. For instance, during 2023, the company reported ongoing efforts in dust suppression across its operational sites, a critical aspect of environmental compliance.

Effective management necessitates robust dust suppression strategies and continuous air quality monitoring. Amman Mineral is obligated to meet stringent national and international emission standards. This commitment ensures the protection of community health and environmental integrity, a key focus in their 2024 sustainability reports.

- Dust Suppression Techniques: Implementation of water sprays, chemical suppressants, and optimized haul road management.

- Air Quality Monitoring: Continuous measurement of particulate matter (PM10, PM2.5) at various locations around operational areas.

- Emission Standards Adherence: Compliance with Indonesian Ministry of Environment and Forestry regulations, aiming for levels below the specified ambient air quality standards.

- Machinery & Plant Emissions: Management of exhaust emissions from heavy equipment and processing facilities through regular maintenance and emission control technologies.

Amman Mineral faces significant environmental challenges, including managing mining waste, particularly tailings, and ensuring the stability of its tailings dams to prevent pollution. The company is committed to robust water resource management, emphasizing recycling and efficient usage to conserve local water sources, evidenced by high recycling rates reported in 2023. Furthermore, Amman Mineral is actively engaged in biodiversity conservation and land rehabilitation, planting thousands of native tree seedlings annually to restore disturbed areas and protect local ecosystems.

| Environmental Factor | Key Initiatives/Challenges | 2023/2024 Data/Focus |

| Waste Management (Tailings) | Tailings dam design, stability, and oversight; compliance with regulations. | Ongoing efforts to align with Indonesian standards and international best practices. |

| Water Management | Water-intensive operations, recycling initiatives, efficient usage. | Reported significant water recycling rate in 2023; focus on minimizing footprint. |

| Biodiversity & Land Rehabilitation | Ecosystem restoration, reforestation, protection of flora and fauna. | Planted over 10,000 native tree seedlings in 2023 as part of rehabilitation efforts. |

| Greenhouse Gas Emissions | Reducing carbon footprint, energy efficiency, exploring renewable energy. | Global mining industry's substantial energy consumption drives focus on carbon management. |

| Air Quality (Dust & Particulates) | Dust suppression, air quality monitoring, emission standards adherence. | Ongoing dust suppression efforts; continuous monitoring of particulate matter. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for PT Amman Mineral Internasional is meticulously constructed using data from reputable sources including government publications, industry-specific reports from mining and metals associations, and reputable financial news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.