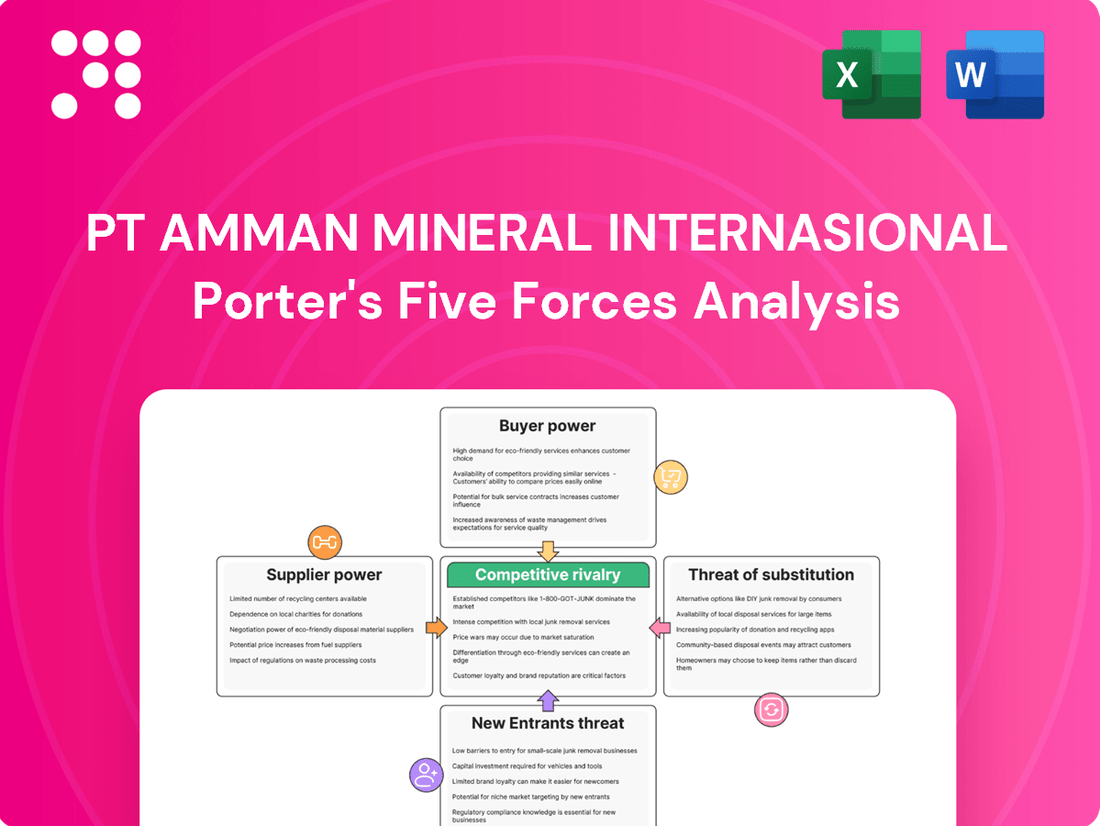

PT Amman Mineral Internasional Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

PT Amman Mineral Internasional operates within a dynamic mining sector, where understanding competitive forces is paramount. Our analysis reveals significant pressures from powerful buyers and the constant threat of substitute materials, impacting pricing and market share.

The complete report reveals the real forces shaping PT Amman Mineral Internasional’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

PT Amman Mineral Internasional's reliance on highly specialized mining equipment and technology, often sourced from a limited number of global suppliers, grants these providers substantial bargaining power. The intricate and large-scale nature of their operations, encompassing the Batu Hijau mine and the ongoing Elang project development, results in exceptionally high switching costs for critical machinery and software.

The mining sector, especially for significant copper and gold ventures like those operated by PT Amman Mineral Internasional, relies heavily on a specialized workforce. This includes crucial roles such as mining engineers, geologists, and seasoned mine operators who possess unique skills and experience.

While Amman Mineral Integrasi (AMIG) actively works to develop and supply skilled manpower, the overall availability of this highly specialized talent within Indonesia can be constrained. This scarcity can elevate the bargaining power of these skilled labor resources, as their expertise becomes a more valuable and sought-after commodity.

Mining is a thirsty business when it comes to energy, needing significant fuel and electricity. Amman Mineral is taking steps to control its power destiny by building its own LNG storage, regasification facilities, and a 450 MW combined cycle power plant. This move is designed to lessen reliance on outside energy companies over time.

However, during the construction phase and until these new facilities are fully operational, external energy providers can wield considerable influence. Their pricing and availability directly impact Amman Mineral's operational costs and project timelines during this critical period.

Critical Consumables and Materials

Suppliers of critical consumables like chemicals, explosives, and large-scale tires for mining vehicles can wield significant power. This is particularly true when there are limited alternative sources or when these materials are indispensable for maintaining continuous operations. For instance, a shortage or price hike in specialized mining explosives, which are often produced by a concentrated number of manufacturers, can directly inflate operational expenses for PT Amman Mineral Internasional.

Disruptions in the supply chain for these essential items can have a cascading effect, impacting production schedules and overall efficiency. In 2024, the global mining industry faced ongoing challenges with the availability and cost of key consumables, driven by geopolitical factors and increased demand.

- Limited Supplier Base: The market for certain specialized mining chemicals and explosives often features a small number of dominant global suppliers, concentrating bargaining power.

- High Switching Costs: Transitioning to alternative suppliers for critical, highly regulated materials like explosives can involve significant re-qualification, logistical, and safety protocol investments.

- Essential for Operations: Without a steady supply of consumables such as large tires for haul trucks or specific processing chemicals, mining operations can grind to a halt, giving suppliers leverage.

- Impact on Production: In 2024, reports indicated that price volatility for some mining consumables contributed to a notable increase in operating costs for mining firms, underscoring supplier influence.

Logistics and Transportation Services

PT Amman Mineral Internasional's reliance on logistics and transportation services for its remote Batu Hijau mine in West Nusa Tenggara significantly influences supplier bargaining power. The specialized nature of moving raw materials, heavy equipment, and finished copper and gold concentrates means few providers can meet these demands.

The cost and availability of these critical services, particularly for shipping and heavy haulage, can be a major factor. For instance, in 2024, global shipping rates saw volatility due to geopolitical events and increased demand, potentially impacting Amman Mineral's operational costs if logistics providers pass these on.

- High dependence on specialized logistics: The remote mine location necessitates unique transport solutions.

- Limited provider options: The specialized nature of the services narrows the field of potential suppliers.

- Cost sensitivity: Fluctuations in global shipping and fuel prices directly affect operational expenses.

- Strategic importance of reliable transport: Disruptions in logistics can halt production and impact revenue streams.

PT Amman Mineral Internasional faces significant bargaining power from suppliers of specialized mining equipment and critical consumables. The limited number of global providers for advanced machinery and chemicals, coupled with high switching costs, grants these suppliers considerable leverage. This was evident in 2024, where global supply chain disruptions and increased demand for raw materials led to price volatility for essential mining inputs, directly impacting Amman Mineral's operating expenses.

The company's strategic investments in its own power generation aim to mitigate reliance on external energy suppliers, but during the transition, these energy providers maintain considerable influence over costs and operational continuity. Similarly, the scarcity of highly specialized mining talent, despite internal development efforts, empowers skilled labor, increasing their bargaining power in the market.

| Supplier Category | Bargaining Power Factors | 2024 Impact Example |

|---|---|---|

| Specialized Mining Equipment | Limited suppliers, high switching costs | Increased capital expenditure on new machinery |

| Critical Consumables (Explosives, Chemicals) | Few dominant manufacturers, essential for operations | Higher input costs due to global price hikes |

| Energy (Pre-Power Plant) | External dependence, pricing influence | Volatile operational costs impacting profitability |

| Specialized Labor | Scarcity of unique skills, high demand | Increased labor costs and recruitment challenges |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to PT Amman Mineral Internasional's position in the global copper and gold mining sector.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for PT Amman Mineral Internasional.

Gain actionable insights into supplier and buyer power, enabling more effective negotiation strategies and cost control.

Customers Bargaining Power

PT Amman Mineral Internasional functions as a price taker within the global copper and gold markets. This means that the company has minimal direct influence over the prices it receives for its products, as these are largely dictated by broader market forces.

Global supply and demand trends, encompassing everything from mining output to industrial consumption and inventory levels, are the primary drivers of copper and gold prices. For instance, in early 2024, copper prices saw significant volatility, influenced by factors such as production disruptions in major producing countries and robust demand from the electric vehicle sector.

Macroeconomic indicators like inflation rates, interest rate decisions by central banks, and currency fluctuations also play a crucial role in commodity pricing. Geopolitical events, such as trade disputes or conflicts in resource-rich regions, can further impact market sentiment and, consequently, the prices of metals like copper and gold, reinforcing Amman Mineral’s position as a price taker.

Amman Mineral's move to refined copper cathodes and precious metals by late 2024 significantly alters its customer dynamic. Instead of selling concentrate to a few large buyers, they will be supplying industrial users and refiners, potentially increasing customer bargaining power due to a wider pool of potential buyers for standardized refined products.

Indonesia's ban on raw mineral exports, effective from June 2023, further strengthens Amman Mineral's need for domestic processing. This policy aims to boost domestic value addition, but it also means that if their downstream facilities face operational issues, their ability to export is severely limited, potentially giving domestic buyers more leverage.

The company's investment in its smelter and refinery, projected to cost billions of dollars, signifies a commitment to domestic value addition. While this integration aims to capture more of the value chain, the success of these facilities will be crucial in determining how much control Amman Mineral retains over its pricing and customer relationships in the refined metals market.

Historically, buyers of copper concentrate, a primary product for companies like PT Amman Mineral Internasional, could wield some influence if there were many other suppliers or if they bought in very large quantities. This situation could put pressure on pricing.

However, recent Indonesian government policies, particularly the ban on raw concentrate exports implemented in mid-2023, have significantly altered this landscape. This directive aims to encourage domestic processing and value addition within Indonesia.

This shift means that buyers seeking raw copper concentrate now face a more limited pool of suppliers who are permitted to export. For PT Amman Mineral Internasional, this could translate to a stronger negotiating position with international buyers, as the supply of readily exportable concentrate has tightened.

Industrial End-Users

The bargaining power of industrial end-users for PT Amman Mineral Internasional's refined copper, gold, and silver is generally low. These ultimate customers operate across various sectors, including electronics, construction, automotive (with a growing demand from electric vehicles), and the jewelry industry. While individual large buyers might have some leverage to negotiate terms based on the sheer volume of their purchases, the overarching influence on pricing is dictated by global commodity markets rather than the power of any single customer.

The dispersed nature of these industrial customers means that no single entity can significantly dictate terms. For instance, the global copper market, essential for electronics and EVs, saw prices fluctuate significantly in 2024, driven by macroeconomic factors and supply-demand dynamics rather than the purchasing power of specific manufacturers. Similarly, gold and silver prices are heavily influenced by investment demand and central bank policies, dwarfing the impact of any individual industrial buyer's volume.

- Diverse End-Use Sectors: Electronics, construction, automotive (EVs), and jewelry are the primary consumers of refined metals.

- Volume-Based Negotiation: Very large industrial buyers may negotiate terms, but this is limited by overall commodity price trends.

- Commodity Price Dominance: Global market forces, not individual customer power, are the primary determinants of metal prices.

- Limited Individual Leverage: The fragmentation of the customer base prevents any single end-user from exerting substantial bargaining power.

Market Demand for Green Technologies

The increasing global demand for copper, largely fueled by the green technology revolution and the burgeoning electric vehicle (EV) market, significantly bolsters the market position of companies like PT Amman Mineral Internasional. This robust demand translates directly into reduced bargaining power for customers, as copper becomes an indispensable and increasingly sought-after commodity.

For instance, the International Energy Agency (IEA) projected in 2024 that the global demand for critical minerals, including copper, will surge dramatically. EVs alone are expected to account for a substantial portion of this growth, with projections indicating a near doubling of copper demand from the EV sector between 2023 and 2030. This escalating consumption means customers have fewer alternatives and less leverage when negotiating prices for this essential raw material.

- Growing EV Production: Global EV sales continued their upward trajectory in 2024, driving significant demand for copper in batteries, charging infrastructure, and vehicle wiring.

- Renewable Energy Expansion: Investments in solar and wind power, both critical for decarbonization efforts, also require substantial amounts of copper for turbines, panels, and grid connections.

- Limited Substitutes: For many applications in these green technologies, copper remains the material of choice due to its superior conductivity and durability, limiting customer options.

PT Amman Mineral Internasional's customers, primarily industrial end-users of refined copper, gold, and silver, generally possess low bargaining power. While very large buyers might negotiate terms based on volume, their influence is dwarfed by global commodity market forces. The wide array of sectors consuming these metals, from electronics to automotive, means no single customer can dictate terms, especially given the strong demand driven by the green technology revolution and electric vehicles.

The escalating demand for copper, particularly from the electric vehicle (EV) and renewable energy sectors, significantly weakens customer bargaining power. For instance, the International Energy Agency projected in 2024 that global copper demand from EVs alone could nearly double between 2023 and 2030. This trend, coupled with copper's essential role in solar and wind power infrastructure, limits customer alternatives and their ability to negotiate prices.

| Customer Segment | Bargaining Power Factor | Impact on Amman Mineral |

| Industrial End-Users (Electronics, Construction, Automotive, Jewelry) | Low (due to fragmented base and commodity price dominance) | Minimal ability to influence pricing; prices dictated by global markets. |

| Large Volume Buyers | Moderate (volume-based negotiation possible) | May secure slightly better terms, but overall pricing remains market-driven. |

| EV Manufacturers | Low (due to rapidly growing demand and limited substitutes) | High demand for copper limits their negotiation leverage. |

| Renewable Energy Developers | Low (due to essential nature of copper in infrastructure) | Dependence on copper for projects reduces their bargaining power. |

Full Version Awaits

PT Amman Mineral Internasional Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of PT Amman Mineral Internasional you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain a thorough understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This document is fully formatted and ready for your immediate use, offering actionable insights into PT Amman Mineral Internasional's market position.

Rivalry Among Competitors

PT Amman Mineral Internasional faces a competitive environment in Indonesia, largely shaped by the presence of a few major players. The Batu Hijau mine, operated by Amman Mineral, is the nation's second-largest copper and gold operation, trailing only Freeport Indonesia's massive Grasberg mine.

While other mining firms like Merdeka Copper Gold are active, the number of companies capable of large-scale copper-gold extraction in Indonesia remains relatively small. This concentration means that competition among the top-tier producers can be quite intense, as they vie for market share and resources.

Amman Mineral operates within the fiercely competitive global copper and gold markets. Major international mining corporations, with vast resources and established global supply chains, exert significant influence, often dictating market prices. This competitive landscape means Amman Mineral, despite its strong domestic standing, functions as a price taker rather than a price setter.

To navigate this intense global rivalry, Amman Mineral's core strategy centers on achieving and maintaining operational excellence. By focusing on efficiency and cost management, the company aims to solidify its position as a low-cost producer. This approach is crucial for remaining competitive against larger, more diversified global players and for ensuring profitability in a commodity-driven environment.

Copper, gold, and silver are essentially the same no matter who produces them. This means buyers often choose based on price, how good the metal is, and if the seller can reliably deliver. For PT Amman Mineral Internasional, this product homogeneity means competition heats up, with companies battling mainly on who can produce at the lowest cost and in the largest quantities.

Industry Growth Rate and Expansion

Indonesia's mining sector, especially for key commodities like copper, is poised for a notable recovery and expansion. This growth is fueled by substantial investments and a strategic push towards downstream processing, aiming to add value domestically.

Amman Mineral Internasional is at the forefront of this expansion, actively developing major projects. These include the construction of a new smelter and the expansion of its existing processing facilities, signaling a competitive landscape where companies are investing heavily to boost capacity and capture greater market share.

The industry's dynamism is underscored by these significant capital expenditures. For instance, Amman Mineral's ongoing projects are designed to process a larger volume of ore, directly impacting supply dynamics and the competitive intensity among players in the Indonesian metal ore market.

- Projected rebound in Indonesian metal ore mining, driven by investment.

- Amman Mineral's expansion includes a new smelter and processing plant upgrades.

- Companies are investing to increase market share and production capacity.

Government Regulations and Export Policies

Indonesian government regulations, particularly the ban on raw mineral exports and the push for domestic processing, create a significant competitive dynamic. Companies that align with these policies by investing in downstream processing, like smelters and refineries, secure a distinct advantage. This strategic move not only ensures compliance but also captures greater value from mineral resources, impacting the overall competitive landscape for all players in the sector.

Amman Mineral Internasional, through its significant investments in the Batu Hijau smelter, is well-positioned to navigate these regulations. This smelter, with a planned capacity of 1 million tonnes of copper concentrate per year, exemplifies the type of downstream development favored by the Indonesian government. For instance, in 2023, Indonesia's Ministry of Energy and Mineral Resources continued to emphasize the importance of domestic processing, with ongoing discussions about further value-added activities for mined commodities.

- Downstream Investment Advantage: Companies like Amman Mineral, by investing in facilities such as the Batu Hijau smelter, gain a competitive edge by complying with and benefiting from Indonesia's domestic processing mandates.

- Export Policy Impact: The Indonesian government's ban on raw mineral exports forces companies to adapt, creating challenges for those reliant on unprocessed exports and opportunities for those with processing capabilities.

- Value Chain Capture: By processing minerals domestically, companies can capture more of the value chain, moving beyond raw material extraction to intermediate or finished goods, thereby enhancing profitability and market position.

- Regulatory Alignment: Staying abreast of and proactively aligning with evolving government policies, such as those promoting local content and industrialization, is crucial for sustained competitive advantage in Indonesia's mining sector.

The competitive rivalry within Indonesia's copper and gold mining sector is intense, primarily due to the presence of a few dominant players like PT Amman Mineral Internasional and Freeport Indonesia. These large-scale operations compete fiercely for market share and resources.

The homogenous nature of copper and gold means that competition often boils down to cost efficiency and production volume, with companies like Amman Mineral striving for operational excellence to remain competitive against global giants.

Significant investments in downstream processing, such as smelters, are becoming a key differentiator, influenced by government regulations that favor domestic value addition, thereby intensifying the rivalry among companies that can meet these requirements.

| Competitor | Key Operations | Estimated Production (2023/2024 Data) |

|---|---|---|

| PT Amman Mineral Internasional | Batu Hijau Mine | Copper: ~150,000-200,000 tonnes (estimated annualized) Gold: ~500,000-700,000 ounces (estimated annual) |

| PT Freeport Indonesia | Grasberg Mine | Copper: ~1,000,000-1,200,000 tonnes (estimated annual) Gold: ~2,000,000-3,000,000 ounces (estimated annual) |

| PT Merdeka Copper Gold Tbk | Tujuh Bukit Mine | Copper: ~50,000-70,000 tonnes (estimated annual) Gold: ~150,000-200,000 ounces (estimated annual) |

SSubstitutes Threaten

For many of copper's core industrial uses, such as electrical wiring, electronics, and construction, there are few truly effective substitutes. Its exceptional electrical conductivity, ability to be drawn into wires, and resistance to corrosion make it difficult to replace. For instance, in 2024, the demand for copper in the electrical sector remained robust, driven by renewable energy infrastructure and electric vehicle production, highlighting its essential role.

While aluminum can sometimes be used as a substitute, particularly in power transmission lines, it often requires larger diameters to achieve similar conductivity and can present challenges in terms of joining and corrosion. These performance differences mean that for many high-demand applications, aluminum is not a perfect, or even a close, substitute for copper.

Gold's primary appeal stems from its established role as a store of value and a luxury good, particularly in jewelry. This dual function significantly insulates it from direct substitution threats.

Unlike commodities with more industrial applications, gold's perceived stability as a safe-haven asset, especially during economic uncertainty, means investors often turn to it regardless of alternative investment options. In 2024, gold prices have shown resilience, reflecting this ongoing demand as a hedge against inflation and geopolitical risks.

Furthermore, the cultural significance and deep-rooted tradition of gold in jewelry across many societies create a demand that is not easily met by other materials. While platinum or silver are also used in jewelry, they do not command the same universal appeal or historical weight as gold, limiting their substitutive power.

The threat of substitutes for silver is moderate, influenced by its dual role as an industrial input and a store of value. In industrial applications, particularly within the burgeoning solar panel industry, silver's unique conductivity makes it highly desirable. For instance, global solar power capacity reached approximately 1,370 GW by the end of 2023, a significant driver for silver demand. However, ongoing research into alternative conductive materials for photovoltaic cells could eventually reduce reliance on silver.

As an investment and for jewelry, silver faces substitution threats from other precious metals, most notably gold. Gold prices, which often trade at a much higher premium to silver, can influence investor sentiment. In 2024, the gold-silver ratio has fluctuated, with silver often seen as a more accessible alternative for investors seeking exposure to precious metals. While industrial demand remains robust, the potential for material substitution in manufacturing and the availability of gold as an investment alternative temper the overall threat of substitutes.

Recycling and Scrap Metal

The availability of recycled copper and gold presents a significant threat of substitutes for PT Amman Mineral Internasional. As recycling processes become more efficient and cost-effective, scrap metal can increasingly serve as an alternative to newly mined resources.

This trend is particularly impactful when commodity prices are high, making recycled materials more economically attractive. For instance, the global copper recycling rate has been steadily increasing, with estimates suggesting that recycled copper accounts for a substantial portion of total copper supply, potentially impacting demand for primary production.

- Growing Recycling Infrastructure: Investments in advanced sorting and smelting technologies are making the recovery of valuable metals from electronic waste and other scrap more feasible.

- Price Sensitivity: Higher market prices for copper and gold directly boost the economic incentive to collect and process scrap, thereby increasing the threat of substitution.

- Environmental Drivers: Increasing environmental regulations and corporate sustainability goals also encourage the use of recycled content, further diminishing reliance on primary mining.

Technological Advancements in Material Science

While not an immediate concern for PT Amman Mineral Internasional, ongoing technological advancements in material science pose a long-term threat of substitutes. Researchers are continuously exploring and developing new materials that could potentially offer comparable or even superior performance to copper and silver in certain applications.

For instance, breakthroughs in nanotechnology and composite materials might yield alternatives that are lighter, stronger, or more conductive. However, the sheer scale of existing infrastructure and the deeply entrenched reliance on copper and silver in critical sectors like electrical grids, telecommunications, and electronics make widespread substitution a distant prospect. The established supply chains and proven reliability of these traditional metals present significant barriers to entry for any emerging substitute.

As of early 2024, the global copper market continues to be robust, with prices fluctuating but generally holding strong due to demand from renewable energy and electric vehicle sectors. Similarly, silver remains a vital component in solar panels and industrial applications. These entrenched uses, backed by decades of development and investment, mean that any material substitute would need to overcome substantial technological and economic hurdles to gain significant market share.

- Long-term Threat: Advancements in material science could eventually yield substitutes for copper and silver.

- Performance Rivalry: New materials might match or exceed the properties of current metals in specific uses.

- Established Infrastructure: The existing infrastructure for copper and silver is a significant barrier to substitution.

- Distant Prospect: Widespread adoption of substitute materials is unlikely in the near to medium term.

The threat of substitutes for PT Amman Mineral Internasional's primary products, copper and silver, is generally low to moderate. For copper, its unique properties in electrical conductivity and corrosion resistance make it difficult to replace in critical applications like electrical wiring and electronics, where demand remained strong in 2024 due to renewable energy and EV growth.

While aluminum can substitute in some areas, like power transmission, its performance limitations prevent it from being a perfect replacement. Silver, essential for solar panels, faces some substitution risk from developing conductive materials, but its industrial and investment roles, particularly as a more accessible precious metal compared to gold in 2024, provide resilience.

The increasing efficiency of recycling processes for copper and silver presents a notable threat, especially when commodity prices are high, making recycled materials more economically viable. For instance, the global copper recycling rate has steadily climbed, impacting demand for primary production.

Technological advancements in material science pose a long-term, but currently distant, threat. While new materials might emerge with comparable properties, the established infrastructure and proven reliability of copper and silver create significant barriers to widespread substitution in the near to medium term.

| Metal | Primary Uses | Substitute | Threat Level | Notes |

|---|---|---|---|---|

| Copper | Electrical wiring, electronics, construction | Aluminum (in some applications) | Low to Moderate | Aluminum requires larger diameters for similar conductivity and has joining/corrosion issues. Robust 2024 demand from renewables and EVs. |

| Silver | Solar panels, electronics, jewelry, investment | Other conductive materials, Gold | Moderate | Essential for solar panels (global capacity ~1,370 GW end-2023). Gold offers a higher-priced alternative for investment. |

Entrants Threaten

The sheer scale of investment needed to enter the copper and gold mining sector presents a formidable barrier. Developing and operating a mine like Batu Hijau, which involves extensive exploration, extraction, and processing, alongside building essential infrastructure such as smelters, demands billions of dollars. For instance, PT Amman Mineral Internasional's ongoing capital expenditure plans, which have seen substantial allocations for projects like the Elang project and smelter upgrades, underscore this high capital requirement.

The mining sector in Indonesia faces significant barriers to entry due to its intricate and constantly changing regulatory environment. This includes stringent environmental standards, complex land acquisition procedures, and specific export regulations that new players must meticulously adhere to.

Securing the required permits and successfully navigating these legal complexities represents a substantial investment of both time and capital. For instance, in 2024, the average time to obtain a new mining permit in Indonesia was reported to be over 18 months, with associated costs often exceeding hundreds of thousands of dollars, effectively discouraging potential new entrants.

Securing access to world-class copper and gold ore reserves, like those held by PT Amman Mineral Internasional at Batu Hijau and Elang, presents a significant barrier to entry. These high-grade, economically viable deposits are scarce, with most already under the control of established mining giants, making it exceedingly difficult for new players to find and develop comparable resources.

Long Project Development Timelines

The sheer length of time it takes to bring a mining project from initial exploration to full production acts as a substantial barrier to entry. These projects can easily span decades, requiring immense patience and significant capital commitment before any returns are realized. This extended timeline deters many potential new competitors, particularly those lacking substantial financial backing or a long-term strategic outlook.

For instance, developing a new mine can involve years of geological surveys, feasibility studies, environmental impact assessments, permitting processes, and construction. Consider the Grasberg mine in Indonesia, which has undergone multiple phases of development over many decades, demonstrating the protracted nature of such undertakings. This capital-intensive and time-consuming process means only well-established players or those with very deep pockets can realistically consider entering the market.

- Extended Project Lifecycles: Mining ventures often require 10-15 years from discovery to production, sometimes much longer.

- High Capital Requirements: Initial exploration, infrastructure development, and processing facilities demand billions of dollars.

- Regulatory Hurdles: Navigating complex and evolving environmental and mining regulations adds significant time and cost.

- Technological Expertise: Advanced extraction and processing technologies require specialized knowledge and investment.

Established Infrastructure and Operational Expertise

Established players like PT Amman Mineral Internasional possess significant advantages due to their existing infrastructure and deep operational expertise. This includes well-developed supply chains, efficient processing facilities, and a skilled workforce honed through years of experience in complex mining operations.

New entrants face substantial hurdles in replicating this established base. They would need to invest heavily in building new infrastructure, establishing reliable supply networks, and recruiting experienced talent, all while competing with the cost efficiencies and operational know-how of incumbents. For instance, in 2024, the capital expenditure required to establish a new large-scale copper-gold mine can easily run into billions of dollars, a significant barrier for potential new market participants.

- High Capital Investment: New entrants require massive upfront capital for infrastructure, equipment, and exploration.

- Operational Know-How: Decades of experience translate to optimized processes and cost management for existing firms.

- Supply Chain Integration: Established players have secured and efficient supply chains, difficult for newcomers to replicate quickly.

- Talent Acquisition: Access to specialized mining engineers and geologists is a competitive advantage for established companies.

The threat of new entrants in the copper and gold mining sector, particularly for a company like PT Amman Mineral Internasional, is significantly low. The immense capital outlay required for exploration, mine development, and infrastructure, often in the billions of dollars, acts as a primary deterrent. For example, the Elang project by Amman Mineral is projected to require substantial investment, illustrating this barrier.

Navigating Indonesia's complex regulatory landscape, including environmental standards and permitting processes, demands considerable time and resources, further discouraging new players. In 2024, obtaining mining permits could take over 18 months, adding to initial costs and project timelines. Access to high-grade ore reserves is also a major hurdle, as prime deposits are largely controlled by established entities.

| Barrier Type | Description | Example/Data Point (2024) |

| Capital Requirements | Vast sums needed for exploration, development, and infrastructure. | Billions of USD for new large-scale mine development. |

| Regulatory Complexity | Intricate and evolving environmental and mining laws. | Average 18+ months to secure new mining permits. |

| Resource Scarcity | Limited availability of high-grade, economically viable ore deposits. | Prime deposits are already under control of established players. |

| Project Timelines | Decades-long commitment from exploration to production. | Projects can easily span 10-15 years or more. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PT Amman Mineral Internasional leverages data from the company's annual reports, investor presentations, and relevant Indonesian mining industry publications. We also incorporate information from financial news outlets and government regulatory bodies to provide a comprehensive view of the competitive landscape.