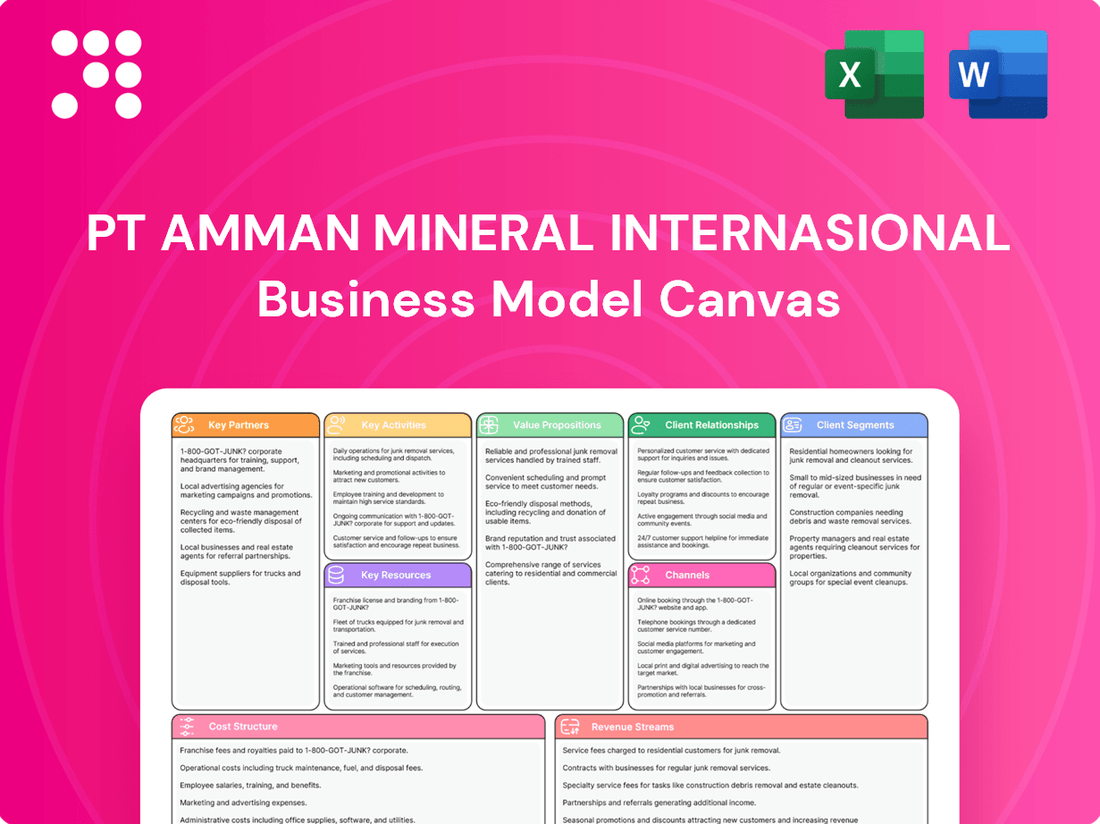

PT Amman Mineral Internasional Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

Discover the strategic core of PT Amman Mineral Internasional's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational framework. For anyone seeking to understand market-leading strategies in the mining sector, this is an essential resource.

Partnerships

Amman Mineral's relationship with the Indonesian government is foundational, securing essential mining licenses and export permits. This partnership is critical for the company's operational continuity, allowing it to extract and process valuable mineral resources.

The government's role extends to supporting strategic national projects, such as the development of a smelter. This collaboration ensures Amman Mineral's operations align with Indonesia's broader industrialization and downstream processing objectives, a key aspect of the company's business model.

Government backing is also instrumental in enabling Amman Mineral's significant capital expenditures. In 2023, the company continued to invest heavily in its smelter project, demonstrating the government's crucial role in facilitating such large-scale investments for national economic benefit.

PT Amman Mineral Internasional's key partnership with Glencore International AG is crucial for its operational strategy. This agreement, spanning from 2024 to 2026, guarantees a significant off-take for a substantial volume of copper concentrate produced at the Batu Hijau mine.

This vital arrangement ensures market access for Amman Mineral's copper concentrate, particularly during the period leading up to the full commissioning of its own smelter. Glencore's commitment provides a stable revenue stream and de-risks a portion of Amman Mineral's production, solidifying its position in the global copper market.

PT Amman Mineral Internasional collaborates with international contractors like China Non-ferrous Metal Industry's Foreign Engineering and Construction Co., Ltd (NFC) for its significant infrastructure projects. These partnerships are vital for the construction of its copper smelter and precious metal refinery.

These collaborations provide access to specialized expertise and advanced technologies essential for the successful execution of large-scale projects. This ensures operational efficiency and the adoption of best practices in the mining and processing industry.

Local Communities and Regional Governments

Amman Mineral's engagement with local communities and regional governments in West Nusa Tenggara, especially the West Sumbawa Regency, is a cornerstone of its operational strategy. These collaborations are vital for securing a social license to operate, fostering local talent through vocational training, and driving community development. For instance, in 2023, the company reported significant progress in its social forestry programs, contributing to environmental sustainability and community well-being.

These partnerships are not merely about compliance; they are integral to creating a stable and supportive environment for Amman Mineral's mining activities. By investing in local human capital and actively participating in regional development, the company builds trust and mutual benefit. This approach is crucial for long-term success, as evidenced by the positive feedback received from community leaders regarding the impact of joint initiatives.

Key aspects of these collaborations include:

- Social Forestry Programs: Enhancing environmental stewardship and providing sustainable livelihoods.

- Vocational Training: Equipping local residents with skills for employment within the mining sector and beyond.

- Community Development Initiatives: Supporting infrastructure, education, and health programs to improve quality of life.

- Stakeholder Engagement: Maintaining open dialogue with regional governments and community representatives to address concerns and align objectives.

Financial Institutions and Investors

PT Amman Mineral Internasional actively cultivates relationships with financial institutions to secure crucial capital expenditure financing. This includes strategic refinancing of existing term loans, ensuring operational efficiency and financial stability for its significant expansion initiatives.

The company also engages with a broad spectrum of investors, notably through its successful Initial Public Offering (IPO) in 2023. This public offering raised approximately Rp 10.3 trillion (around $680 million USD), demonstrating strong investor confidence and providing substantial capital for future growth.

- Capital Expenditure Financing: Partnerships with banks and financial institutions are vital for funding large-scale projects, including loan refinancing to optimize debt structure.

- Investor Relations: The 2023 IPO provided a significant capital injection, allowing Amman Mineral to broaden its investor base and enhance its financial flexibility.

- Funding Growth: These financial partnerships are fundamental to supporting the company's ambitious expansion plans and maintaining a healthy balance sheet.

PT Amman Mineral Internasional's strategic partnerships are designed to ensure operational continuity, market access, and financial stability. The company's collaboration with Glencore International AG, a vital off-take agreement for copper concentrate from 2024 to 2026, provides guaranteed market access and revenue stability. Furthermore, partnerships with international contractors like China Non-ferrous Metal Industry's Foreign Engineering and Construction Co., Ltd (NFC) are essential for the development of its critical smelter and refinery infrastructure, bringing specialized expertise and technology.

The company also relies on strong relationships with financial institutions for capital expenditure financing, including refinancing existing loans to optimize its debt structure. Its 2023 Initial Public Offering (IPO), which raised approximately Rp 10.3 trillion (around $680 million USD), significantly broadened its investor base and provided substantial capital for future growth. These financial partnerships are fundamental to supporting the company's ambitious expansion plans.

Beyond commercial and financial ties, Amman Mineral prioritizes partnerships with local communities and regional governments in West Nusa Tenggara. These collaborations are crucial for securing a social license to operate, fostering local talent through vocational training, and implementing community development initiatives, as seen in its 2023 social forestry programs. These engagements build trust and ensure a supportive environment for long-term operations.

| Partner Type | Key Partner Example | Purpose of Partnership | Key Benefit | Notable 2023/2024 Data |

|---|---|---|---|---|

| Off-take Agreement | Glencore International AG | Guaranteed market access for copper concentrate | Stable revenue stream, de-risked production | Agreement spans 2024-2026 |

| Construction Contractor | China Non-ferrous Metal Industry's Foreign Engineering and Construction Co., Ltd (NFC) | Smelter and refinery construction | Access to specialized expertise and technology | Ongoing project development |

| Financial Institutions | Various Banks | Capital expenditure financing, loan refinancing | Funding for expansion, optimized debt structure | Successful 2023 IPO raised Rp 10.3 trillion |

| Community & Government | Local Communities, West Nusa Tenggara Government | Social license to operate, local development | Stable operating environment, skilled local workforce | Progress in social forestry programs in 2023 |

What is included in the product

This Business Model Canvas outlines PT Amman Mineral Internasional's strategy for large-scale copper and gold mining, focusing on efficient resource extraction and global market access.

It details key partners, essential activities, and the cost structure required to deliver value to its diverse customer segments through reliable supply chains.

PT Amman Mineral Internasional's Business Model Canvas offers a clear, structured approach to navigating the complexities of large-scale mining operations, alleviating the pain point of fragmented strategic planning.

It provides a concise, visual representation of their value proposition and operational flow, simplifying communication and alignment across diverse stakeholder groups.

Activities

The core activity is large-scale open-pit mining at Batu Hijau, Indonesia's second-largest copper and gold mine. This involves extracting ore from diverse phases, including transitioning to new high-grade zones and managing substantial material movement.

In 2023, PT Amman Mineral Internasional reported a significant increase in copper production, reaching 461.2 million pounds, up from 306.2 million pounds in 2022. Gold production also saw a substantial jump to 521.7 thousand ounces in 2023, compared to 386.2 thousand ounces the previous year, demonstrating effective ore extraction and management.

PT Amman Mineral Internasional's key activity in mineral processing and concentration involves transforming mined ore into valuable, high-grade copper concentrate. This concentrate is further enriched with precious metals like gold and silver, significantly increasing its market value.

The company employs sophisticated beneficiation processes to meticulously separate and upgrade the desired minerals from the raw ore. This complex undertaking ensures that the final product meets stringent quality standards for further refining or international export.

In 2023, Amman Mineral's Batu Hijau mine, a primary source for these activities, produced approximately 189,000 tonnes of copper and 660,000 ounces of gold. This output underscores the scale and effectiveness of their mineral processing operations.

A core activity for PT Amman Mineral Internasional is the ongoing construction, commissioning, and operation of its copper smelter and precious metal refinery (PMR) facilities. This ambitious project is central to their business model, aiming to transform raw materials into higher-value products.

These operations are designed to produce copper cathodes, gold bullion, and silver bullion. The facility will also generate sulfuric acid as a byproduct, contributing to Indonesia's goal of developing its downstream industries and increasing domestic processing capabilities.

By mid-2024, significant progress has been made on the smelter and refinery, with construction reaching advanced stages. The company anticipates these facilities will be operational, commencing production by late 2024 or early 2025, marking a crucial step in their value chain integration.

Exploration and Mine Development

PT Amman Mineral Internasional's key activities include aggressive exploration, notably at the Elang project. This site is recognized for its substantial undeveloped porphyry copper and gold deposits, representing a crucial element in the company's long-term growth strategy. The company is committed to advancing these prospects through detailed feasibility studies and comprehensive development plans, aiming to secure future production capacity.

These development efforts are designed to extend the company's reserve base, ensuring operational continuity beyond the current lifespan of the Batu Hijau mine. By investing in the Elang project, Amman Mineral is actively working to bolster its future production profile and maintain its position in the global copper and gold markets.

- Exploration Focus: Elang project, targeting significant porphyry copper and gold deposits.

- Development Strategy: Conducting feasibility studies and creating development plans for new reserves.

- Future Production: Aiming to extend operational life and production capacity beyond the Batu Hijau mine.

Infrastructure Development and Maintenance

PT Amman Mineral Internasional's commitment to infrastructure development is a cornerstone of its operations. This includes significant investments in energy generation, such as the construction and operation of gas and steam power plants. These facilities are vital for meeting the growing energy demands of their expanding mining and processing activities, ensuring reliable power supply.

Beyond power generation, the company is also developing essential logistics infrastructure. This encompasses the creation of LNG facilities, which are critical for the efficient handling and transportation of liquefied natural gas, a key energy source. Furthermore, the development of an airport is underway, designed to streamline personnel and cargo movement, thereby enhancing operational efficiency and accessibility to remote sites.

These infrastructure projects are not merely supportive but are integral to Amman Mineral's long-term strategy for growth and operational sustainability. By controlling key infrastructure elements, the company can better manage costs, ensure supply chain reliability, and facilitate the expansion of its mining and processing capabilities. For instance, the company reported capital expenditures of approximately $1.2 billion in 2023, a significant portion of which was allocated to these infrastructure developments.

- Power Generation: Construction and operation of gas and steam power plants to fuel operations.

- LNG Facilities: Development of infrastructure for liquefied natural gas handling and transport.

- Airport Development: Building an airport to improve logistics and accessibility for personnel and materials.

- Strategic Importance: These developments are crucial for operational efficiency, cost management, and future expansion.

PT Amman Mineral Internasional's key activities revolve around the large-scale extraction of copper and gold at its Batu Hijau mine. This includes the complex processes of mineral processing and beneficiation to produce high-grade copper concentrate, enriched with gold and silver. Furthermore, a significant focus is placed on the development and operation of its copper smelter and precious metal refinery, aiming to add substantial value through downstream processing.

The company is also actively engaged in exploration, particularly at the Elang project, to secure future resource potential and extend its operational lifespan. Complementing these core activities is a robust commitment to infrastructure development, including power generation, LNG facilities, and an airport, all designed to support and enhance its expanding mining and processing operations.

| Key Activity | Description | 2023 Data/Status |

| Mining Operations | Open-pit extraction of copper and gold ore at Batu Hijau. | Copper production: 461.2 million pounds; Gold production: 521.7 thousand ounces. |

| Mineral Processing | Transforming ore into high-grade copper concentrate with gold and silver. | Batu Hijau produced approx. 189,000 tonnes copper and 660,000 ounces gold. |

| Smelter & Refinery Development | Construction and commissioning of facilities for copper cathodes, gold, and silver bullion. | Construction advanced, anticipating operational commencement late 2024/early 2025. |

| Exploration | Advancing the Elang project for future resource potential. | Detailed feasibility studies and development plans underway. |

| Infrastructure Development | Building power plants, LNG facilities, and an airport. | Capital expenditures of approx. $1.2 billion in 2023, with significant allocation to infrastructure. |

Full Version Awaits

Business Model Canvas

The PT Amman Mineral Internasional Business Model Canvas you are previewing is the identical document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises and complete transparency. You'll gain immediate access to this comprehensive analysis, ready for your strategic review and application.

Resources

Amman Mineral's most critical resource is its extensive copper and gold ore reserves, particularly at the operational Batu Hijau mine and the undeveloped Elang project. These world-class reserves are the bedrock of the company's long-term production capabilities and its significant global standing in the mining industry.

As of the end of 2023, Batu Hijau held proven and probable reserves of 2.4 billion pounds of copper and 3.7 million ounces of gold. Furthermore, the Elang project, located in close proximity to Batu Hijau, boasts substantial undeveloped resources, estimated at 10.1 billion pounds of copper and 15.9 million ounces of gold, highlighting significant future growth potential.

PT Amman Mineral Internasional's advanced mining and processing infrastructure is a cornerstone of its business model. This includes state-of-the-art mining equipment, a large-scale processing plant, and crucial new facilities like the copper smelter and precious metal refinery.

This robust infrastructure is absolutely vital for the efficient extraction, beneficiation, and refining of minerals, directly supporting the company's high production volumes. For instance, in 2023, the Batu Hijau mine, a key asset, produced 173,000 tonnes of copper and 490,000 ounces of gold, showcasing the operational capacity enabled by this infrastructure.

The ongoing development of the Elang copper-gold project, which commenced construction in 2023, further emphasizes this commitment. This expansion is expected to significantly increase production capacity and operational efficiency, leveraging the company's existing advanced infrastructure and adding new capabilities.

A dedicated and skilled workforce, encompassing technical experts, engineers, and seasoned management, forms the backbone of our operations. This human capital is crucial for driving efficiency and innovation within the mining sector.

PT Amman Mineral Integrasi (AMIG), a key subsidiary, specializes in furnishing this skilled manpower. Their focus on operational excellence and stringent safety protocols ensures that our projects are managed with the highest professional standards.

In 2024, AMIG's workforce development programs have seen significant investment, aiming to enhance the technical capabilities of over 3,000 employees. This commitment to training directly supports our goal of maintaining a competitive edge in a demanding industry.

Energy and Logistics Infrastructure

Amman Mineral Internasional's key resources in energy and logistics infrastructure are foundational to its operations. The company operates its own power generation facilities, encompassing diesel, coal, and importantly, new gas-fired power plants, which include LNG facilities. This self-sufficiency in power generation is critical for maintaining operational continuity and managing energy costs. For instance, in 2023, the company continued to advance its 300 MW gas-fired power plant project, aiming to further diversify its energy mix and enhance reliability.

These robust infrastructure assets are not just about power; they are integral to the entire supply chain. The company also possesses port facilities, which are vital for the efficient transportation of raw materials, such as copper and gold concentrates, and the export of finished products. This control over logistics ensures timely delivery and reduces reliance on third-party providers, thereby optimizing operational efficiency and cost-effectiveness. The strategic development of these resources underpins the company's competitive advantage.

Key resources include:

- Owned Power Generation Facilities: Diesel, coal, and new gas-fired power plants, including LNG facilities, providing a stable and cost-controlled energy supply.

- Port Facilities: Essential for the efficient inbound logistics of raw materials and the outbound logistics of processed products, ensuring smooth supply chain operations.

- Infrastructure Investment: Ongoing development, such as the 300 MW gas-fired power plant project, highlights a commitment to enhancing energy security and operational efficiency.

Strategic Capital and Financial Strength

PT Amman Mineral Internasional's strategic capital and financial strength are cornerstones of its business model. Access to substantial funding, exemplified by its successful Initial Public Offering (IPO) which raised Rp 10.3 trillion (approximately $700 million USD at the time of listing in early 2024), directly fuels its ambitious expansion plans and ensures robust operational liquidity. This financial muscle is crucial for undertaking capital-intensive projects in the mining sector.

The company's recent financial performance further solidifies its capacity for sustained investment and growth. For instance, in 2023, Amman Mineral reported a significant increase in revenue, reaching Rp 22.2 trillion, driven by strong production volumes and favorable commodity prices. This financial health provides a solid foundation for future capital allocation decisions.

- Access to Capital: Raised Rp 10.3 trillion through its IPO in early 2024, providing significant funds for expansion.

- Operational Liquidity: Maintains strong financial reserves to support ongoing and future operational needs.

- Financial Performance: Reported Rp 22.2 trillion in revenue for 2023, demonstrating a healthy financial standing.

- Investment Capacity: The company's financial strength enables it to pursue large-scale development and investment opportunities.

Amman Mineral's key resources are its vast copper and gold reserves, notably at Batu Hijau and the developing Elang project. These reserves are fundamental to its long-term production and global mining position. As of year-end 2023, Batu Hijau held 2.4 billion pounds of copper and 3.7 million ounces of gold, while Elang contains an estimated 10.1 billion pounds of copper and 15.9 million ounces of gold.

Value Propositions

Amman Mineral International is a significant producer of high-grade copper concentrate, a crucial component for various global industries. The company also refines copper into cathodes, a more advanced product sought after by manufacturers.

Beyond copper, Amman Mineral is increasingly focused on producing refined gold and silver bullion. This diversification into precious metals caters to the robust demand in international bullion markets, meeting high purity standards.

In 2024, the company's operational focus on quality production is a key value proposition, ensuring its copper, gold, and silver products consistently meet the rigorous specifications demanded by international industrial buyers and the discerning precious metals sector.

PT Amman Mineral Internasional guarantees a steady flow of essential base and precious metals. This reliability stems from its substantial, world-class mineral reserves, which are continually being expanded through ongoing production efforts.

The company's production capacity is further bolstered by the imminent completion of its integrated smelter. This facility is poised to significantly enhance processing capabilities, ensuring a robust and consistent output for its global clientele.

Customers engaging in long-term supply agreements can depend on Amman Mineral's commitment to stability. For instance, in 2023, the company reported significant progress in its smelter construction, a key indicator of its future production strength.

Amman Mineral International is deeply committed to sustainable and responsible mining. This commitment is not just a statement but is actively demonstrated through robust environmental management systems, significant investments in community empowerment programs, and stringent safety standards, all detailed in their annual sustainability reports.

This focus on ethical operations strongly resonates with a growing segment of stakeholders, including investors and consumers, who increasingly demand responsibly sourced materials and value companies with strong ethical business practices. For instance, in 2023, Amman Mineral reported a 15% year-on-year increase in community development project funding, underscoring their dedication.

Strategic Contribution to Indonesia's Downstream Industry

Amman Mineral's investment in domestic smelting and refining facilities directly supports Indonesia's ambitious mineral downstreaming agenda. This strategic move transforms raw ore into higher-value processed materials within the country, aligning perfectly with national economic development objectives.

This commitment fosters the creation of value-added products domestically, significantly reducing the nation's historical reliance on exporting unprocessed raw materials. This is a core component of their value proposition, demonstrating a clear alignment with Indonesia's economic sovereignty goals.

- National Value Creation: By processing minerals domestically, Amman Mineral contributes to a more robust national industrial base.

- Reduced Export Reliance: Shifting from raw material exports to processed goods strengthens Indonesia's trade balance.

- Alignment with Government Strategy: The company's actions are a direct response to and support for the government's push for mineral downstreaming.

- Economic Diversification: Developing local processing capabilities diversifies the economy beyond primary resource extraction.

Operational Efficiency and Cost Competitiveness

PT Amman Mineral Internasional sustains its position as a leading low-cost copper and gold producer globally by prioritizing operational efficiency. This dedication to cost control is fundamental to its competitiveness, enabling the company to navigate market fluctuations and varying commodity prices effectively.

The company’s commitment to operational excellence directly translates into cost competitiveness. For instance, in 2023, Amman Mineral reported a significant focus on optimizing its mining and processing operations to keep production costs at the lower end of the industry spectrum, a strategy that continues into 2024.

- Focus on continuous improvement in mining and processing techniques to reduce unit costs.

- Strategic procurement and supply chain management to secure favorable input prices.

- Investment in technology and automation to enhance productivity and lower labor costs.

- Maintaining a lean organizational structure and efficient overhead management.

Amman Mineral International offers a reliable supply of high-quality copper, gold, and silver, meeting stringent international standards. This reliability is underpinned by substantial mineral reserves and expanding production capabilities, including the near-completion of its integrated smelter, which is set to boost processing capacity significantly. Customers can expect consistent product availability, a key advantage in volatile commodity markets.

| Value Proposition | Description | Supporting Data/Focus (2023-2024) |

|---|---|---|

| Product Quality & Diversification | High-grade copper concentrate, refined copper cathodes, and refined gold/silver bullion. | Consistent adherence to international purity standards. Focus on expanding precious metals production. |

| Supply Reliability | World-class mineral reserves and growing production capacity. | Significant progress in smelter construction in 2023, enhancing future output reliability. |

| Sustainable & Responsible Operations | Commitment to environmental management, community empowerment, and safety. | Reported 15% year-on-year increase in community development funding in 2023. |

| National Value Creation | Domestic processing of minerals to support Indonesia's downstreaming agenda. | Investment in domestic smelter and refining facilities, aligning with national economic development. |

| Cost Competitiveness | Prioritization of operational efficiency and cost control. | Focus on optimizing operations to maintain low production costs within the industry spectrum in 2023 and 2024. |

Customer Relationships

PT Amman Mineral Internasional secures its revenue streams through long-term off-take agreements, notably with Glencore. These crucial contracts ensure consistent demand for its copper and gold concentrate, providing a stable financial foundation. For instance, the sale of concentrate to Glencore underpins a significant portion of Amman Mineral's projected earnings.

PT Amman Mineral Internasional focuses on direct sales of its copper concentrate and refined metals, primarily to industrial buyers and refiners. This direct approach allows for a deeper understanding of customer needs and market demands.

The company provides essential technical support, ensuring that product specifications precisely match client requirements. This commitment to quality and tailored solutions fosters robust business-to-business relationships, crucial for long-term partnerships.

For instance, in 2024, Amman Mineral's direct sales strategy contributed significantly to its revenue, with a substantial portion of its copper concentrate sales finalized through direct negotiations with major international smelters, highlighting the effectiveness of this customer relationship channel.

PT Amman Mineral Internasional prioritizes robust engagement with the Indonesian government and its regulatory agencies. This proactive approach is vital for securing and renewing essential mining permits, ensuring compliance with national policies, and effectively navigating the intricate landscape of mining regulations. For instance, in 2023, the company successfully completed the extension of its Contract of Work (KK) for the Batu Hijau mine, a testament to strong governmental relations.

Maintaining these relationships directly supports operational stability and is fundamental for the successful execution of strategic development projects. By fostering open communication and demonstrating commitment to national objectives, Amman Mineral Internasional aims to create a predictable and supportive operating environment. This includes collaboration on environmental standards and community development initiatives, aligning with Indonesia's broader economic and social development goals.

Investor Relations and Transparency

Amman Mineral International places a strong emphasis on investor relations, ensuring transparency through consistent delivery of financial statements and earnings presentations. This commitment to open communication is vital for building and maintaining trust with its shareholder base and attracting new capital. For instance, in the first quarter of 2024, the company reported revenue of IDR 5.3 trillion, demonstrating its operational performance to investors.

The company's proactive approach to public disclosures further solidifies its reputation as a transparent entity. This includes timely updates on operational milestones and financial health, which are critical for a publicly listed company like Amman Mineral. In 2023, Amman Mineral successfully completed its initial public offering, raising approximately IDR 10.3 trillion, a testament to investor confidence built through its transparent practices.

- Regular Financial Reporting: Provides quarterly and annual financial statements to keep stakeholders informed.

- Earnings Presentations: Conducts regular calls and presentations to discuss financial results and strategic updates.

- Public Disclosures: Adheres to strict regulatory requirements for timely and accurate public announcements.

- Investor Engagement: Actively participates in investor conferences and roadshows to foster direct communication.

Community Engagement and Social Programs

PT Amman Mineral Internasional actively cultivates strong ties with local communities by implementing a range of social responsibility programs. These initiatives focus on critical areas such as education, healthcare, and economic development, aiming to foster regional prosperity and well-being.

This dedication to proactive community engagement is instrumental in securing the company's social license to operate. For instance, in 2023, Amman Mineral's corporate social responsibility (CSR) programs reached over 15,000 beneficiaries across various educational and health initiatives.

- Educational Support: Providing scholarships and improving school infrastructure to enhance learning opportunities.

- Healthcare Access: Facilitating health check-ups, medical assistance, and improving local clinic facilities.

- Economic Empowerment: Offering vocational training and supporting local small and medium enterprises (SMEs) to boost regional economies.

- Environmental Stewardship: Engaging communities in conservation efforts and sustainable resource management.

PT Amman Mineral Internasional builds customer relationships through direct sales to industrial buyers, supported by tailored technical assistance to meet specific product needs. For instance, in 2024, direct sales to international smelters formed a significant revenue component. The company also maintains crucial relationships with off-take partners like Glencore, ensuring consistent demand for its copper and gold concentrate, a key driver of its financial stability.

| Customer Segment | Relationship Type | Key Engagement Activities | 2024 Relevance |

|---|---|---|---|

| Industrial Buyers & Refiners | Direct Sales, Technical Support | Tailored product specifications, ongoing technical assistance | Significant revenue contributor from copper concentrate sales |

| Off-take Partners (e.g., Glencore) | Long-term Agreements | Consistent demand fulfillment, stable financial foundation | Underpins a substantial portion of projected earnings |

| Government & Regulatory Agencies | Proactive Engagement, Compliance | Permit acquisition, policy adherence, regulatory navigation | Crucial for operational stability and project execution (e.g., KK extension in 2023) |

| Investors | Transparency, Communication | Regular financial reporting, earnings presentations, public disclosures | IDR 5.3 trillion revenue in Q1 2024 reported to investors; IDR 10.3 trillion raised in IPO in 2023 |

| Local Communities | Social Responsibility Programs | Education, healthcare, economic empowerment, environmental stewardship | Over 15,000 beneficiaries in 2023 CSR programs |

Channels

Amman Mineral primarily utilizes direct sales to industrial buyers and refiners, both domestically and internationally, as its core distribution channel for copper concentrate and refined metal products. This approach facilitates direct negotiation, enabling the creation of customized agreements tailored to specific client needs and fostering robust, close relationships.

In 2024, Amman Mineral continued to solidify these direct relationships, which are crucial for securing stable off-take agreements and understanding evolving market demands. The company's ability to negotiate directly allows for greater control over pricing and terms, directly impacting revenue streams and profitability.

Global Commodity Trading Houses are crucial distribution partners for PT Amman Mineral Internasional, enabling the sale of significant volumes of copper concentrate. These houses, such as Glencore, possess vast global networks and sophisticated logistics, ensuring efficient delivery to a wide array of international markets. In 2024, the demand for copper remained robust, driven by electrification and infrastructure projects worldwide, underscoring the importance of these partnerships for market access.

The company website and its investor relations portal are key communication channels. They provide shareholders, analysts, and the public with access to vital information like financial reports, sustainability updates, and important company news. This commitment to transparency ensures everyone stays informed.

For instance, in 2024, PT Amman Mineral Internasional likely updated its website with quarterly earnings reports and significant operational updates, reflecting its ongoing commitment to open communication with stakeholders.

Industry Conferences and Trade Shows

Participating in key industry conferences and trade shows is crucial for PT Amman Mineral Internasional. These events serve as vital platforms for showcasing the company's operational prowess, technological advancements, and commitment to sustainable mining practices. For instance, in 2024, the company actively engaged in discussions at major mining expos, highlighting its significant contributions to the Indonesian economy and its role as a major copper and gold producer. This visibility helps in strengthening brand recognition and attracting potential strategic alliances.

These gatherings offer unparalleled opportunities for business development and market intelligence gathering. Amman Mineral leverages these forums to connect with potential off-takers, suppliers, and technology providers, fostering new business relationships and exploring collaborative ventures. Staying informed about the latest market trends, regulatory changes, and technological innovations within the global mining sector is paramount for maintaining a competitive edge. By actively participating, Amman Mineral can better anticipate market shifts and adapt its strategies accordingly.

The strategic value of these engagements is evident in the direct impact on market perception and business growth. For 2024, Amman Mineral's presence at international mining forums aimed to reinforce its position as a reliable and significant player in the global metals market. Such participation directly supports the company's objective of expanding its market reach and securing favorable long-term contracts, thereby contributing to sustained revenue streams and overall business model robustness.

- Showcasing Capabilities: Demonstrating operational excellence and technological innovation at industry events.

- Networking Opportunities: Building relationships with potential buyers, partners, and stakeholders.

- Market Intelligence: Gathering insights on market trends, competitor activities, and regulatory developments.

- Business Development: Identifying new markets, securing contracts, and exploring strategic alliances.

Logistics and Shipping Networks

Amman Mineral leverages its robust logistics and shipping networks, which include proprietary port facilities, to ensure the efficient movement of its heavy mineral products. This is crucial for delivering its output from the Batu Hijau mine to both domestic and international customers.

The company's strategic use of these established networks, including its own port infrastructure, is a key channel for product distribution. This allows for reliable and timely delivery, a critical component of its business model.

- Batu Hijau Mine Output: In 2024, Amman Mineral continued its production operations, with logistics playing a vital role in moving copper and gold concentrate.

- Port Facilities: The company's investment in port infrastructure is designed to optimize the export process, reducing transit times and costs for international shipments.

- Market Reach: These logistics channels enable Amman Mineral to serve a broad customer base, reaching key markets for its mineral products.

Amman Mineral's channels extend beyond direct sales to include strategic partnerships with global commodity trading houses. These entities, such as Glencore, are vital for distributing significant volumes of copper concentrate internationally, leveraging their extensive networks and logistics expertise. In 2024, the sustained global demand for copper, fueled by electrification initiatives, underscored the critical role these trading houses play in ensuring market access for Amman Mineral's products.

The company also prioritizes digital and event-based channels for stakeholder engagement and market intelligence. Its corporate website and investor relations portal serve as primary sources for financial reports and operational updates, fostering transparency. Furthermore, participation in industry conferences in 2024 allowed Amman Mineral to showcase its capabilities, gather market insights, and forge new business relationships.

Efficient logistics and proprietary port facilities form a crucial channel for product delivery, ensuring timely movement of mineral output from the Batu Hijau mine to customers. This infrastructure is key to serving a wide customer base and maintaining competitive delivery times and costs for international shipments.

| Channel Type | Key Activities | 2024 Relevance | Impact on Revenue |

|---|---|---|---|

| Direct Sales | Negotiating custom agreements with industrial buyers and refiners | Securing stable off-take agreements, controlling pricing | Directly impacts revenue streams and profitability |

| Commodity Trading Houses | Distributing large volumes of copper concentrate globally | Facilitating market access amidst strong global copper demand | Expands market reach and sales volume |

| Digital Presence (Website/Investor Relations) | Disseminating financial reports, operational updates, and news | Ensuring transparency and stakeholder information access | Builds investor confidence and brand reputation |

| Industry Conferences/Trade Shows | Showcasing capabilities, gathering market intelligence, networking | Strengthening brand recognition, identifying new opportunities | Supports business development and strategic alliances |

| Logistics & Port Facilities | Efficient movement of mineral products from mine to customers | Ensuring reliable and timely delivery of output | Reduces transit times and costs, enhancing competitiveness |

Customer Segments

Global copper smelters and refiners represent a crucial customer segment for PT Amman Mineral Internasional, as they are the primary purchasers of the company's copper concentrate. These entities, ranging from major international players to domestic Indonesian operations, rely on a steady influx of concentrate to fuel their production of refined copper cathodes. For instance, in 2024, the global demand for refined copper was projected to rise, creating a robust market for concentrate suppliers like Amman Mineral.

Consistency in supply is paramount for these smelters and refiners. They operate complex industrial processes that require uninterrupted raw material flow to maintain efficiency and meet their own production targets. Furthermore, specific product quality, including copper grade and impurity levels, is a non-negotiable requirement. Amman Mineral's ability to deliver concentrate that meets these stringent specifications directly impacts their value proposition to this segment.

Precious metal refiners and bullion dealers represent a key customer segment for PT Amman Mineral Internasional, especially as the company commissions its new refinery. These businesses are direct purchasers of refined gold and silver bullion, seeking high-purity materials. Their demand is driven by both investment portfolios and industrial uses, such as in electronics and dentistry.

Amman Mineral International's copper cathodes are poised to serve a crucial role for industrial manufacturers. These downstream customers, including those in the electronics, construction, and automotive sectors, rely on high-purity copper for their production lines. This focus signifies a strategic move to capture more value by supplying refined materials rather than just raw ore.

The demand for refined copper is substantial. In 2023, global copper demand reached approximately 25 million metric tons, with industrial applications forming the bulk of this consumption. Amman Mineral's entry into this market, particularly with its planned production capacity, positions it to be a significant supplier to these vital industries.

Investors (Institutional and Retail)

Institutional and retail investors are crucial customer segments for PT Amman Mineral Internasional Tbk (AMMN). These shareholders, trading AMMN shares on the Indonesia Stock Exchange, are primarily driven by the prospect of financial returns. For instance, as of late 2024, AMMN's market capitalization reflects the collective investment of these diverse groups.

Their investment decisions are underpinned by a demand for transparency in AMMN's operations and financial reporting. Furthermore, a growing emphasis on environmental, social, and governance (ESG) factors influences their choices, making sustainable business practices a key consideration. This segment actively monitors company performance metrics and strategic announcements to gauge future profitability and risk.

- Shareholders: Both large institutions like pension funds and individual retail investors participate in AMMN's stock.

- Investment Goals: Seeking capital appreciation and dividends are primary motivators.

- Key Information Needs: Transparency in financial statements and operational updates are paramount.

- Growing Interest: ESG performance is increasingly influencing investment decisions for this segment.

Government Entities and State-Owned Enterprises

The Indonesian government, through its ministries like the Ministry of Energy and Mineral Resources, acts as a crucial customer and stakeholder for PT Amman Mineral Internasional. Compliance with national mining regulations and environmental standards is paramount, directly impacting operational permits and future expansion. For instance, in 2024, the government continued to emphasize downstream processing of mineral resources, a mandate that influences Amman Mineral's strategic investments in smelters and refineries.

State-owned enterprises (SOEs) also represent significant potential customers. As Indonesia pushes for increased domestic value addition in its mining sector, SOEs involved in manufacturing or infrastructure development could procure refined copper and gold from Amman Mineral. This aligns with national development goals, aiming to reduce reliance on imported processed materials and bolster domestic industrial capacity.

Furthermore, the government's role extends to ensuring national resource security and economic contribution. Amman Mineral's operations, including its significant contribution to national revenue through taxes and royalties, solidify its relationship with government entities. In 2023, the company reported significant revenue, a portion of which directly flowed back to the state, underscoring this symbiotic relationship.

- Regulatory Compliance: Adherence to Indonesian mining laws and environmental protection acts is a non-negotiable aspect of operations.

- Downstreaming Mandate: Government policies encourage the processing of raw minerals into higher-value products domestically.

- Domestic Procurement: State-owned enterprises may become direct buyers of refined metals for industrial and infrastructure projects.

- Economic Contribution: Taxes, royalties, and job creation are key metrics valued by government stakeholders.

PT Amman Mineral Internasional's customer base is diverse, encompassing global copper smelters and refiners who are primary buyers of its copper concentrate. These entities require consistent, high-quality concentrate to maintain their production cycles, with global refined copper demand projected to rise in 2024.

The company also targets precious metal refiners and bullion dealers for its refined gold and silver, catering to both investment and industrial needs. Furthermore, industrial manufacturers in sectors like electronics, construction, and automotive are key consumers of Amman Mineral's copper cathodes, a market projected to consume over 25 million metric tons globally in 2023.

Beyond industrial buyers, institutional and retail investors are crucial, driven by financial returns and increasingly by ESG performance, as reflected in AMMN's market capitalization in late 2024. The Indonesian government and state-owned enterprises also form important segments, influenced by regulations and national downstreaming policies, with Amman Mineral contributing significantly to national revenue through taxes and royalties as seen in its 2023 performance.

Cost Structure

PT Amman Mineral Internasional's mining operations at Batu Hijau involve substantial costs for drilling, blasting, loading, and hauling both ore and waste. These essential activities directly impact the overall cost structure, reflecting the intensive nature of resource extraction.

Factors like fluctuating fuel prices, labor expenses, and ongoing equipment maintenance significantly influence these operational costs. For instance, in 2023, fuel costs represented a considerable portion of the operating expenses for mining companies globally, and this trend is expected to continue influencing Amman Mineral's expenditures.

The complexity of the mining plan, including the depth of extraction and the required processing of materials, also plays a crucial role in determining the scale of these costs. Deeper or more challenging ore bodies naturally lead to higher extraction expenses, impacting the profitability of the operation.

Processing and smelting costs are a major component of PT Amman Mineral Internasional's business model, reflecting the significant investment in transforming raw ore into valuable metals. These expenses encompass the energy-intensive processes of beneficiation, where ore is refined into concentrate, and the subsequent smelting and refining stages that yield finished metals.

Key cost drivers include substantial energy consumption, particularly from dedicated power generation facilities and the use of Liquefied Natural Gas (LNG). Additionally, the procurement of chemical reagents essential for these complex metallurgical processes, along with the general operational expenses required to maintain sophisticated industrial infrastructure, contribute significantly to the overall cost structure.

For instance, in 2024, the global copper concentrate treatment and refining charges (TC/RCs) saw fluctuations, impacting the profitability of such operations. While specific figures for PT Amman Mineral Internasional are proprietary, industry benchmarks suggest these processing costs can represent a considerable percentage of the final metal's sale price, underscoring their critical importance in the company's financial performance.

Amman Mineral's commitment to future growth is evident in its significant capital expenditures for expansion projects. These investments, including a new smelter, gas and steam power plants, LNG facilities, and processing plant upgrades, are crucial for increasing production capacity.

In 2024, the company continued to allocate substantial funds towards these strategic initiatives. For instance, its smelter project, a key component of its long-term vision, has seen ongoing capital deployment to ensure its timely completion and operational readiness.

Labor and Personnel Costs

Labor and personnel costs represent a major component of PT Amman Mineral Internasional's cost structure, reflecting the demands of operating a large-scale mining and processing enterprise. These expenses encompass wages, comprehensive benefits packages, ongoing training initiatives, and critical safety programs designed to protect its considerable workforce.

The company's commitment to maintaining a skilled and safe operational team translates into continuous investment in its human capital. This focus is essential for efficient production and adherence to stringent industry standards.

- Employee Wages and Salaries: Direct compensation for the large workforce involved in mining, processing, and support functions.

- Benefits and Insurance: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Training and Development: Investment in skill enhancement, safety certifications, and professional development for employees.

- Safety Programs and Equipment: Expenditure on safety protocols, personal protective equipment (PPE), and workplace safety infrastructure.

Regulatory Compliance and Environmental Costs

PT Amman Mineral Internasional faces substantial costs in adhering to Indonesia's stringent mining and environmental regulations. These expenses are crucial for maintaining operational licenses and demonstrating corporate responsibility.

Key expenditures include securing various permits, which are essential for exploration, extraction, and export activities. For instance, in 2024, the company continued to invest in environmental impact assessments and ongoing monitoring to ensure compliance with national standards.

Significant financial resources are allocated to environmental management programs. This encompasses:

- Land Reclamation: Costs associated with restoring mined areas to their original or a stable state, a process that can span many years and require substantial capital.

- Waste Management: Implementing advanced systems for tailings management to prevent environmental contamination, a critical aspect given the scale of operations.

- Social Responsibility Initiatives: Funding programs aimed at benefiting local communities, which is a regulatory requirement and a key part of maintaining social license to operate.

The cost structure of PT Amman Mineral Internasional is heavily influenced by operational expenditures, including drilling, blasting, and hauling, which are fundamental to its mining activities. Fluctuating fuel prices and labor expenses are key drivers, with global fuel costs remaining a significant factor in 2024. The complexity of the mining plan, such as ore body depth, directly impacts extraction expenses.

Processing and smelting represent another major cost area, involving energy-intensive beneficiation and refining processes. Substantial energy consumption, particularly from LNG, and the procurement of chemical reagents are critical cost components. Industry benchmarks in 2024 indicated that processing costs can form a considerable portion of the final metal sale price.

Capital expenditures for expansion projects, including a new smelter and power plants, are significant investments for future growth. Labor and personnel costs, encompassing wages, benefits, training, and safety programs, are also substantial, reflecting the company's commitment to its workforce and operational standards.

| Cost Category | Key Components | 2024 Relevance |

|---|---|---|

| Operational Costs | Drilling, blasting, hauling, fuel, labor, equipment maintenance | Directly impacted by global fuel price volatility and labor market conditions. |

| Processing & Smelting | Energy consumption (LNG), chemical reagents, infrastructure maintenance | Treatment and refining charges (TC/RCs) are a significant variable cost, influenced by market dynamics. |

| Capital Expenditures | New smelter, power plants, LNG facilities, processing plant upgrades | Ongoing investment to increase production capacity and improve efficiency. |

| Labor & Personnel | Wages, benefits, training, safety programs | Essential for maintaining a skilled workforce and ensuring safe, efficient operations. |

| Regulatory & Environmental | Permits, environmental impact assessments, land reclamation, waste management, social programs | Crucial for compliance and maintaining social license to operate; ongoing investment in environmental stewardship. |

Revenue Streams

PT Amman Mineral Internasional's primary revenue stream historically, and still significantly, comes from selling copper concentrate. This concentrate is produced at their Batu Hijau mine and is sold to both international and domestic customers. The income generated here is closely tied to fluctuating global copper prices and any applicable export regulations.

In 2024, the company's performance in this area is crucial. For instance, during the first quarter of 2024, PT Amman Mineral Internasional reported significant sales volumes of copper concentrate, contributing substantially to their overall revenue. The average selling price of copper concentrate in the first half of 2024 hovered around $8,500 per ton, providing a strong basis for their financial results.

PT Amman Mineral Internasional generates revenue from selling gold, a significant by-product of its copper mining operations. This dual-commodity approach diversifies income and leverages existing infrastructure.

The company's revenue stream from gold is set to grow substantially with the upcoming commissioning of its precious metal refinery. This will allow Amman Mineral to sell refined gold bullion, capturing a higher premium compared to selling unrefined by-products. For instance, in the first half of 2024, the company reported significant gold production, contributing to its overall financial performance.

Silver is a crucial by-product for PT Amman Mineral Internasional, generating substantial revenue much like gold. In 2023, the company reported sales of 1,824,900 ounces of silver, contributing significantly to its overall financial performance.

The upcoming refinery expansion is set to unlock a new, high-value revenue stream through the production and sale of refined silver bullion. This move is expected to enhance the company's profitability by allowing for the sale of a more refined and marketable silver product.

Copper Cathode Sales

The sale of refined copper cathodes represents a significant new revenue stream for PT Amman Mineral Internasional, stemming from the recent commissioning of its smelter. This development marks a strategic move up the value chain, transforming raw copper concentrate into higher-value refined product.

This initiative directly supports Indonesia's national policy of downstreaming, encouraging the processing of raw materials domestically rather than exporting them in their unprocessed state. By adding value through smelting and refining, Amman Mineral contributes to national economic development and captures a greater share of the global copper market.

For instance, in the first quarter of 2024, the company reported that its smelter and refinery had commenced operations, with the first shipment of copper cathodes planned for the second quarter of 2024. This new revenue stream is expected to bolster the company's financial performance significantly in the coming periods.

- New Revenue Source: Sales of refined copper cathodes after smelter commissioning.

- Strategic Value Addition: Shift from concentrate to higher-value refined product.

- Policy Alignment: Supports Indonesia's downstreaming initiative.

- Market Position: Enhances competitiveness in the global copper market.

Sales of Other By-products (e.g., Sulfuric Acid)

PT Amman Mineral Internasional's smelting operations generate valuable by-products, notably sulfuric acid. This acid finds application across various industrial sectors, including fertilizer production and chemical manufacturing, creating an additional revenue stream.

While sales of these by-products may represent a smaller portion of total revenue compared to primary metal sales, they are crucial for revenue diversification. This strategy enhances financial resilience by reducing reliance on the price volatility of core commodities.

- Sulfuric Acid Sales: A key by-product from the smelting process, sold to industries like fertilizer and chemical manufacturing.

- Revenue Diversification: Contributes to a more stable and varied income stream for the company.

- Market Demand: The demand for sulfuric acid in industrial applications supports the viability of this revenue stream.

PT Amman Mineral Internasional's revenue is primarily driven by the sale of copper concentrate, with significant contributions also coming from gold and silver by-products. The company is strategically expanding its revenue base by moving into the sale of refined copper cathodes, a move supported by the commissioning of its smelter and refinery operations.

This transition to refined products, alongside the sale of by-products like sulfuric acid, enhances revenue diversification and aligns with national downstreaming policies. The company's financial performance in 2024, particularly in the first quarter, shows strong sales volumes for copper concentrate and initial progress in its refined product sales.

| Revenue Stream | Primary Product | Key By-products | 2024 Performance Indicator |

|---|---|---|---|

| Copper Concentrate Sales | Copper Concentrate | N/A | Strong Q1 2024 sales volumes reported |

| Precious Metal Sales | Gold, Silver | N/A | Significant production in H1 2024; refinery expansion planned |

| Refined Copper Sales | Copper Cathodes | N/A | Smelter/Refinery commenced operations Q1 2024; first cathodes shipment Q2 2024 |

| By-product Sales | Sulfuric Acid | N/A | Supplies industrial sectors; contributes to revenue diversification |

Business Model Canvas Data Sources

The PT Amman Mineral Internasional Business Model Canvas is built upon extensive market research, internal financial reports, and operational data. These sources provide a comprehensive understanding of our customer segments, value propositions, and revenue streams.