PT Amman Mineral Internasional Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PT Amman Mineral Internasional Bundle

Discover the core of PT Amman Mineral Internasional's market strategy, examining their product offerings, pricing structures, distribution networks, and promotional efforts. This analysis provides a foundational understanding of how they engage their target audience and secure their position in the competitive landscape.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for PT Amman Mineral Internasional. This detailed report offers strategic insights into their product, price, place, and promotion tactics, perfect for business professionals, students, and consultants seeking actionable data.

Product

PT Amman Mineral Internasional's primary product offering revolves around high-grade copper concentrates, serving as a vital semi-processed commodity for global industries. These concentrates are highly sought after for their exceptional purity, making them a critical feedstock for copper smelters and refineries worldwide.

The company's commitment to quality is evident in its continuous efforts to optimize mining and processing operations. This focus ensures a consistent supply of high-grade copper concentrates, meeting the stringent demands of its international clientele.

In 2023, PT Amman Mineral Internasional reported significant production figures, with its Batu Hijau mine contributing substantially to copper output. The company aims to maintain and enhance its production capacity, with projected increases in concentrate grades and volumes over the coming years, reflecting its strategic importance in the global copper market.

Gold dore and refined gold bars are key products for PT Amman Mineral Internasional, stemming from their copper mining activities. In 2024, production surged, notably due to high-grade ore from Batu Hijau's Phase 7, highlighting operational success.

The company's strategic investment in a Precious Metal Refinery (PMR) is set to elevate the value of their gold. This refinery will enable Amman Mineral to produce higher-purity gold bars, directly impacting their market position and revenue potential.

Silver, a valuable by-product of Amman Mineral's copper and gold extraction, diversifies the company's revenue streams. While not the primary focus, its contribution to the overall product portfolio is significant, catering to both industrial applications and investment markets. For instance, in 2023, PT Amman Mineral Internasional's Batu Hijau mine produced approximately 1.6 million ounces of silver, adding to its substantial gold and copper output.

The upcoming Precious Metal Refinery is set to enhance the value proposition of silver by producing refined silver bars. This move will allow Amman Mineral to capture more value from this precious metal, potentially increasing its market appeal and profitability. The global silver market is projected to see demand growth, driven by industrial uses like electronics and solar panels, alongside its traditional role as an investment asset.

Copper Cathodes

Amman Mineral's strategic shift with its copper smelter, set to commence operations in early 2025, positions it to produce copper cathodes, a significant upgrade from its previous concentrate-only output. This vertical integration allows Amman Mineral to directly supply refined, higher-value copper to manufacturers, bypassing intermediate processing stages. The smelter is projected to substantially boost the company's capacity for finished copper products, enhancing its market competitiveness.

This transition is supported by substantial investment, with the smelter project representing a key component of Amman Mineral's growth strategy. The company anticipates that the production of copper cathodes will unlock new revenue streams and improve margins by capturing more of the value chain.

- Increased Value Addition: Moving from concentrates to cathodes offers a more refined product, commanding higher prices and attracting direct buyers in the manufacturing sector.

- Vertical Integration: Control over the smelting process allows for greater oversight of quality and production, aligning with global standards for high-purity copper.

- Enhanced Output Capacity: The smelter is designed to process a significant volume of copper, estimated to contribute substantially to the company's overall finished copper output in the coming years, potentially reaching hundreds of thousands of tonnes annually post-commissioning.

- Market Diversification: The ability to produce cathodes opens doors to direct sales to industries like electronics, automotive, and construction, diversifying Amman Mineral's customer base.

Sulfuric Acid and Selenium

PT Amman Mineral Internasional's new copper smelter and precious metals refinery are set to generate sulfuric acid and selenium as significant by-products, diversifying its product portfolio. Sulfuric acid, a foundational industrial chemical, is crucial for sectors like fertilizer manufacturing and general chemical production, with global demand projected to grow. Selenium, while a smaller output, caters to niche industrial uses, including electronics and specialized glass manufacturing.

The strategic production of these by-products enhances the overall economic viability of the smelter and refinery operations. For instance, the global sulfuric acid market was valued at approximately USD 35 billion in 2023 and is expected to reach over USD 45 billion by 2028, indicating strong market potential for Amman Mineral's output. Selenium's market, though smaller, is also experiencing steady growth due to its critical role in emerging technologies.

- Sulfuric Acid: A key industrial chemical with widespread applications, particularly in fertilizer production.

- Selenium: A valuable by-product serving specialized industrial needs, such as in the electronics sector.

- Market Potential: The global sulfuric acid market is robust, with significant growth projected through 2028.

- Diversification: By-product generation enhances the financial performance and market reach of Amman Mineral's core operations.

PT Amman Mineral Internasional's product strategy centers on high-grade copper concentrates, gold dore, refined gold bars, and silver. The company is enhancing its product offering through vertical integration, moving into copper cathode production with its new smelter commencing operations in early 2025. Additionally, a precious metal refinery will boost the value of its gold and silver output.

| Product Category | Primary Form | Key Characteristics | 2023/2024 Highlights | Future Development |

|---|---|---|---|---|

| Copper | Concentrates | High-grade purity | Significant production from Batu Hijau mine | Transitioning to copper cathodes |

| Gold | Dore & Refined Bars | High purity | Production surge in 2024 from Batu Hijau Phase 7 | Refined bars via new Precious Metal Refinery |

| Silver | By-product | Valuable diversification | Approx. 1.6 million ounces produced in 2023 | Refined silver bars from PMR |

| By-products | Sulfuric Acid, Selenium | Industrial applications | Projected output from smelter/refinery | Leveraging growing global demand |

What is included in the product

This analysis offers a comprehensive breakdown of PT Amman Mineral Internasional's marketing strategies, examining their Product offerings, pricing structures, distribution channels (Place), and promotional activities to reveal their market positioning.

Streamlines the understanding of PT Amman Mineral Internasional's marketing strategy by clearly articulating how each of the 4Ps addresses specific market challenges and customer needs.

Provides a concise, actionable framework for identifying and alleviating key pain points in the company's product, pricing, place, and promotion strategies.

Place

PT Amman Mineral Internasional focuses its distribution strategy on direct sales to industrial buyers, primarily large smelters, refiners, and manufacturers across the globe. This business-to-business model facilitates the negotiation of tailored contracts and fosters direct relationships with crucial clients, enabling substantial, high-volume transactions.

The company's sales approach prioritizes the establishment of long-term supply agreements, ensuring consistent demand and predictable revenue streams. For instance, in 2023, Amman Mineral's copper concentrate sales volume reached approximately 1.3 million wet metric tons, with a significant portion directed to international smelters, underscoring the importance of these direct industrial relationships.

The Batu Hijau mine's strategic location in West Nusa Tenggara, Indonesia, is a significant asset for PT Amman Mineral Internasional. This placement is key for efficient global distribution of its copper and gold products. In 2023, PT Amman Mineral Internasional reported significant production volumes, with copper concentrate exports contributing substantially to its revenue, underscoring the importance of this logistical advantage.

Its proximity to the Benete port is a critical factor, enabling the smooth and cost-effective movement of large quantities of concentrate, and as the company expands its downstream processing, refined metals. This geographical advantage directly translates into lower transportation expenses and a more dependable supply chain, which is vital for meeting international market demands.

Amman Mineral's strategic 'place' involves the development of integrated copper smelter and precious metal refinery (PMR) facilities close to its Batu Hijau mine. This move is crucial for processing concentrates into higher-value copper cathodes, gold, and silver domestically.

This integration streamlines Amman Mineral's supply chain and ensures compliance with Indonesian government regulations mandating mineral processing within the country. The smelter reached mechanical completion in May 2024, with initial copper cathode production commencing in early 2025, marking a significant step in value addition.

Global Commodity Markets Access

PT Amman Mineral Internasional's access to global commodity markets is a critical factor in its marketing mix. While the company focuses on direct sales, its copper and gold products are intrinsically linked to international trading platforms and their inherent price fluctuations. This positions Amman Mineral as a price taker, meaning its revenue is directly impacted by global market forces beyond its control.

The company's strategy acknowledges this reality, as pricing and overall demand for its output are dictated by the dynamics of global commodity trading. For instance, LME (London Metal Exchange) copper prices, a key benchmark, have seen significant volatility. In early 2024, copper prices reached multi-year highs, exceeding $9,000 per tonne, before experiencing some retracement. Similarly, gold prices, often influenced by inflation expectations and geopolitical stability, have also shown upward trends, with spot gold trading around $2,300 per ounce in mid-2024.

- Global Price Benchmarks: Amman Mineral's pricing is directly influenced by benchmarks like the London Metal Exchange (LME) for copper and COMEX for gold.

- Market Volatility: The company operates as a price taker, meaning it must accept prevailing global market prices for its commodities, which can fluctuate significantly.

- Demand Drivers: International demand for copper is driven by industrial activity, particularly in sectors like electric vehicles and renewable energy infrastructure, while gold demand is often linked to its safe-haven status during economic uncertainty.

- 2024/2025 Outlook: Analysts anticipate continued demand for copper due to the green energy transition, potentially supporting prices, while gold's performance in 2025 will likely depend on interest rate policies and global economic sentiment.

Managed Inventory and Logistics

PT Amman Mineral Internasional manages substantial inventories of copper concentrate and other essential materials at its mine and port locations. This strategic inventory management ensures a steady supply chain for its global customer base. For instance, in 2023, the company processed 1.31 million tonnes of copper concentrate, highlighting the scale of materials handled.

Efficient logistics are paramount for PT Amman Mineral Internasional, given its role as a bulk commodity supplier. The company relies on large-scale shipping and international freight to deliver its products to markets worldwide. This operational aspect is crucial for maintaining competitiveness and meeting buyer demands effectively.

The company's strategic shift towards producing copper cathodes will introduce new dynamics to its inventory and logistics. This transition necessitates adjustments in storage, handling, and transportation methods to accommodate the refined product. The ability to adapt its logistics for copper cathodes will be key to capitalizing on this new production phase.

- Inventory Scale: Manages significant stockpiles of copper concentrate at mine and port facilities to ensure supply continuity.

- Logistics Network: Employs large-scale shipping and international freight for global delivery of bulk commodities.

- Production Transition Impact: Adapting inventory and logistics for the upcoming copper cathode production phase.

PT Amman Mineral Internasional's 'Place' strategy centers on its strategically located Batu Hijau mine in West Nusa Tenggara, Indonesia, leveraging proximity to Benete port for efficient global distribution. The company's move to establish integrated copper smelter and precious metal refinery (PMR) facilities, with the smelter reaching mechanical completion in May 2024 and initial cathode production expected in early 2025, signifies a crucial step in domestic value addition and supply chain streamlining.

| Key Place Elements | Description | 2023/2024/2025 Data/Outlook |

| Mine Location | Batu Hijau, West Nusa Tenggara, Indonesia | Strategic for global distribution. |

| Port Proximity | Benete Port | Facilitates cost-effective bulk concentrate movement. |

| Downstream Processing | Integrated Copper Smelter & PMR | Mechanical completion May 2024; cathode production starts early 2025. Enhances value addition and domestic processing. |

| Distribution Channels | Direct sales to global industrial buyers (smelters, refiners) | Focus on high-volume transactions and long-term supply agreements. |

What You See Is What You Get

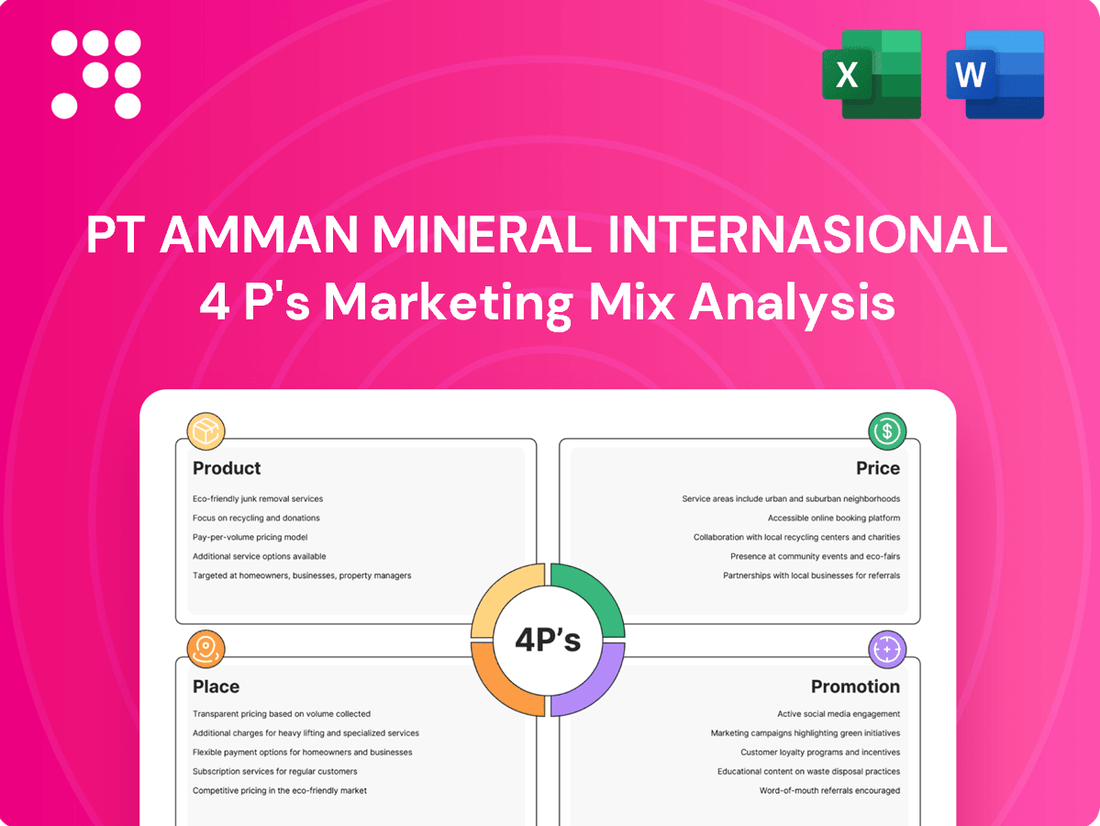

PT Amman Mineral Internasional 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive PT Amman Mineral Internasional 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

Amman Mineral prioritizes robust investor relations and transparent financial reporting to effectively communicate its performance and strategic direction. This commitment aims to attract and retain a wide range of stakeholders, from individual investors to institutional fund managers.

The company actively engages with the financial community through regular updates, including its FY 2024 earnings results released in March 2025. These disclosures, alongside comprehensive annual reports and investor presentations, are vital for building trust and demonstrating the company's growth potential.

For instance, Amman Mineral's 2024 financial statements, available in early 2025, are expected to highlight key operational achievements and financial metrics, providing valuable data for valuation and strategic analysis by financial professionals and business strategists.

PT Amman Mineral Internasional actively manages its public image through strategic corporate communications and public relations initiatives. These efforts aim to keep stakeholders informed about significant operational updates and future plans, fostering transparency and trust.

The company regularly issues press releases detailing key achievements, such as the successful commissioning of its smelter, a critical step in its value chain. They also highlight progress in their mining operations, like entering Phase 8, demonstrating consistent growth and operational capacity.

Furthermore, Amman Mineral Internasional publishes articles emphasizing its dedication to environmental sustainability and positive community engagement. These communications showcase their commitment to responsible mining practices and their role in local economic development, reinforcing their social license to operate.

Amman Mineral International emphasizes its dedication to sustainable mining and robust Environmental, Social, and Governance (ESG) principles. This commitment is a core part of its marketing strategy, aiming to attract investors and stakeholders who prioritize responsible corporate behavior.

The company actively communicates its sustainability efforts through published reports, showcasing initiatives like land reclamation, secure tailings management, and the adoption of cleaner energy solutions. For instance, in its 2023 sustainability report, Amman Mineral detailed a 15% reduction in water intensity compared to the previous year, a key metric for environmental performance.

Industry Conferences and B2B Engagement

Amman Mineral Internasional, recognizing its position in the business-to-business (B2B) sector, actively engages in industry conferences and trade shows. These events are crucial for forging connections with potential clients, nurturing relationships with current customers, and staying informed about the latest developments in the mining and metals industry.

Participation in these forums allows Amman Mineral to showcase its capabilities and offerings directly to key stakeholders. For instance, in 2024, the global mining industry saw significant investment in new technologies, with an estimated USD 15 billion allocated to digital transformation initiatives. Amman Mineral's presence at such events would highlight its adoption of these advancements.

- Networking Opportunities: Direct interaction with potential buyers and partners.

- Market Intelligence: Gathering insights on competitor activities and emerging trends.

- Brand Visibility: Reinforcing its position as a key player in the mining sector.

- Technological Showcase: Presenting innovative solutions and operational efficiencies.

Digitalization and Technology Innovation

Amman Mineral is actively embracing digitalization and technology to boost its mining operations. This includes implementing advanced systems for greater efficiency and safety. For instance, in 2023, the company continued its focus on integrating data analytics to optimize mining processes and resource management, aiming for improved productivity.

The company communicates its commitment to innovation by highlighting how technology drives sustainability and long-term value. This forward-thinking approach is crucial in the modern mining landscape, where efficiency and environmental responsibility go hand in hand. Amman Mineral's investment in digital tools is a testament to its strategy for future growth and market leadership.

- Operational Efficiency: Digitalization efforts are geared towards streamlining workflows and reducing downtime, directly impacting output.

- Safety Enhancements: Advanced technologies are deployed to improve worker safety and mine site monitoring.

- Environmental Sustainability: Technology adoption supports better environmental management and resource utilization.

- Data-Driven Decisions: The use of data analytics enables more informed and strategic operational planning.

Amman Mineral International uses promotion to build its brand and inform stakeholders about its operations and values. This includes robust investor relations, transparent financial reporting, and strategic corporate communications to foster trust and showcase growth potential.

The company highlights its commitment to sustainability and ESG principles through published reports, detailing initiatives like land reclamation and cleaner energy solutions. For example, their 2023 sustainability report noted a 15% reduction in water intensity.

Amman Mineral also actively participates in industry conferences and trade shows to connect with clients and showcase its technological advancements, aligning with the mining industry's estimated USD 15 billion investment in digital transformation in 2024.

Their promotional efforts emphasize digitalization for operational efficiency, safety enhancements, and environmental sustainability, supported by data analytics for informed decision-making.

Price

PT Amman Mineral Internasional's pricing strategy for its core products, copper and gold, is intrinsically linked to the ebb and flow of global commodity markets. As a price taker, the company's financial performance directly reflects international market fluctuations.

Global supply and demand dynamics are paramount. For instance, in early 2024, copper prices saw significant upward movement, reaching over $9,000 per metric ton, driven by supply constraints and robust demand from the electric vehicle sector. This directly benefits Amman Mineral's revenue streams.

Furthermore, the broader economic outlook and geopolitical stability play crucial roles. A positive global economic forecast generally bolsters demand for industrial metals like copper, while geopolitical tensions can disrupt supply chains, leading to price volatility. For example, ongoing trade discussions and regional conflicts in 2024 have introduced an element of uncertainty impacting commodity valuations.

Amman Mineral Internasional prioritizes operational efficiency and rigorous cost control, solidifying its position as a global leader in low-cost copper production. This unwavering commitment to cost leadership is a cornerstone of its pricing strategy, ensuring profitability and competitiveness even amidst volatile commodity markets.

For the first half of 2024, Amman Mineral reported a significant decrease in its all-in sustaining costs (AISC) to $1.35 per pound, down from $1.52 per pound in the same period of 2023. This reduction highlights their successful cost management initiatives and reinforces their status as a low-cost producer.

PT Amman Mineral Internasional frequently secures long-term supply contracts with industrial purchasers. These agreements are crucial for stabilizing prices and ensuring predictable revenue streams, acting as a buffer against the inherent price fluctuations in the spot market for substantial quantities of minerals.

The terms of these contracts are meticulously negotiated, taking into account current market conditions and future projections. For instance, in 2024, major copper producers like Freeport-McMoRan have seen contract prices for refined copper often trading at a premium to spot prices, reflecting the value of guaranteed supply and price certainty for buyers.

Value-Added Product Pricing

PT Amman Mineral Internasional's pricing strategy for its value-added products, such as copper cathodes and gold/silver bars, is directly influenced by its new smelter and refinery capabilities. These refined products fetch premium prices compared to raw concentrates, enabling Amman Mineral to capture greater value downstream. For instance, in the first half of 2024, the company reported significant revenue growth, partly attributed to the sale of these higher-value output.

The ability to process concentrates into refined metals allows Amman Mineral to benefit from the price differentials in the global market. This shift enhances their revenue margins by moving up the value chain. Looking at 2024, the global price of copper cathodes averaged around $8,500 per tonne, a substantial increase from the value of copper concentrates.

Key pricing considerations include:

- Market Premiums: The price of refined copper cathodes and precious metal bars is benchmarked against global spot prices, with additional premiums for purity and delivery terms.

- Production Costs: Pricing must account for the operational costs of the smelter and refinery, ensuring profitability.

- Supply and Demand: Global supply dynamics and demand from industries like electronics and automotive significantly impact the pricing of these refined products.

Capital Expenditure and Project Financing Impact

PT Amman Mineral Internasional's significant capital expenditures for expansion, such as the smelter and processing plant upgrades, directly shape its financial strategy. These investments, estimated to be substantial in the 2024-2025 period, necessitate robust project financing to ensure operational continuity and future growth.

The company's ability to secure efficient project financing and maintain prudent financial management is paramount. This is crucial for supporting these large-scale investments without placing undue pressure on product pricing or overall profitability.

- Capital Expenditure: Amman Mineral International has earmarked significant funds for the development of its smelter and processing facilities, aiming for completion and operational readiness in the 2024-2025 timeframe.

- Project Financing: The financing strategy for these projects is designed to leverage a mix of debt and equity, ensuring a stable financial structure to support long-term operational goals.

- Financial Management: Prudent financial oversight is key to managing these expenditures, minimizing financial risk, and maintaining competitive product pricing in the global market.

- Impact on Pricing: While expansion drives costs, effective financing and management aim to absorb these impacts, preventing significant price hikes that could deter market demand.

PT Amman Mineral Internasional's pricing strategy is a delicate balance between global commodity market forces and its own cost structure. As a price taker, the company's revenue is directly tied to international copper and gold prices, which saw copper averaging over $8,500 per tonne in the first half of 2024.

The company's commitment to cost leadership, evidenced by a reduction in all-in sustaining costs to $1.35 per pound in H1 2024, allows it to remain competitive. Long-term supply contracts further stabilize revenue streams, providing a buffer against spot market volatility.

The development of its smelter and refinery capabilities enables Amman Mineral to sell refined products at premium prices, enhancing profit margins. This strategic move up the value chain, supported by prudent financial management and project financing for expansion in 2024-2025, is key to its pricing approach.

| Metric | 2023 (H1) | 2024 (H1) | Change |

|---|---|---|---|

| Copper Price (Avg. Spot) | ~$8,000/tonne | ~$8,500/tonne | +6.25% |

| All-in Sustaining Costs (AISC) | $1.52/lb | $1.35/lb | -11.18% |

| Refined vs. Concentrate Value | Premium for refined | Premium for refined | Consistent |

4P's Marketing Mix Analysis Data Sources

Our PT Amman Mineral Internasional 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available company disclosures, including annual reports and investor presentations. We also incorporate insights from industry-specific market research and news articles to provide a robust understanding of their strategic positioning.