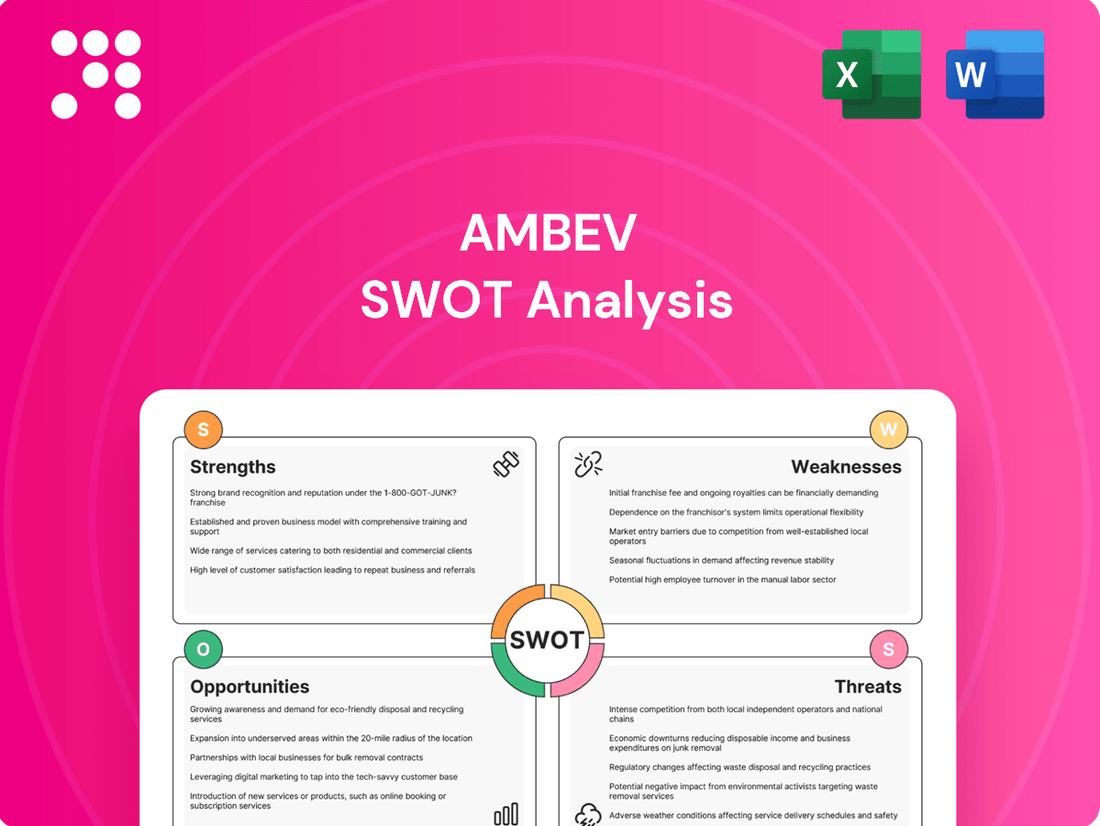

Ambev SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

Ambev's market dominance is undeniable, fueled by strong brands and efficient operations. However, navigating evolving consumer preferences and increasing competition presents significant challenges.

Want the full story behind Ambev's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ambev commands a commanding position in the Latin American beverage market, especially within the beer sector. In Brazil, its home turf, Ambev holds an impressive roughly 60% market share. This dominance extends to other key markets, with the company capturing over 65% of the beer market in countries like Argentina, El Salvador, and Uruguay.

This substantial regional leadership translates into significant operational leverage for Ambev. The company benefits from a deep incumbency advantage, which allows it to invest strategically, weather economic downturns more effectively, and maintain a strong gravitational pull within these markets, influencing consumer preferences and distribution channels.

Ambev boasts an exceptionally strong distribution network throughout Latin America, reaching millions of points of sale like retailers, bars, and restaurants. This extensive reach ensures their products are readily available to consumers across diverse markets.

The company's strategic investment in digital platforms is a significant strength. Their B2B platform, BEES, and direct-to-consumer service, Zé Delivery, have experienced substantial growth, streamlining operations and deepening customer relationships. For instance, Zé Delivery saw a 30% increase in active users in 2023, highlighting its effectiveness in capturing market share.

Ambev commands a formidable brand portfolio, featuring household names such as Brahma, Skol, Antarctica, Budweiser, Stella Artois, and Corona. Several of these are global powerhouses, each generating over a billion dollars in annual revenue, underscoring their market dominance and consumer loyalty.

The company’s strategic emphasis on premiumization is a significant strength. By actively expanding its offerings in high-margin premium beer segments and introducing a wider array of non-alcoholic beverages, Ambev has effectively enhanced its profitability. This strategy also diversifies its revenue streams, adeptly responding to changing consumer tastes and demands for higher-quality products.

Robust Financial Health and Cash Flow Generation

Ambev exhibits remarkable financial resilience, consistently delivering strong profitability and impressive sales growth. In 2024, the company generated a substantial R$18 billion in free cash flow, underscoring its efficient operations and effective financial management.

The company's financial health is further bolstered by a decade-long net cash position and a lean balance sheet with minimal debt. This strong financial footing provides Ambev with significant flexibility to pursue strategic growth opportunities and reward its shareholders.

- Exceptional Profitability: Ambev consistently achieves high profit margins.

- Consistent Sales Growth: The company demonstrates a steady upward trend in revenue.

- Robust Free Cash Flow: R$18 billion generated in 2024 highlights strong cash generation capabilities.

- Strong Balance Sheet: A decade of net cash and low debt offers financial stability.

Commitment to Innovation and Sustainability

Ambev demonstrates a strong commitment to innovation, consistently introducing products that cater to evolving consumer preferences. For instance, their expansion into low-calorie and non-alcoholic beer segments directly addresses the growing health consciousness among consumers, a trend that saw significant acceleration leading into 2024.

This dedication to sustainability is also a key strength, with Ambev targeting 100% renewable energy for its Brazilian operations by 2026. This forward-thinking approach not only aligns with environmental, social, and governance (ESG) investment criteria, attracting a growing pool of capital, but also offers tangible cost-saving benefits through reduced energy expenses.

- Product Diversification: Launched low-calorie and non-alcoholic options to meet health-focused demand.

- Renewable Energy Target: Aiming for 100% renewable energy in Brazil by 2026.

- ESG Appeal: Attracts investors focused on sustainability and responsible business practices.

- Cost Reduction: Renewable energy adoption is projected to lower operational costs.

Ambev's market dominance in Latin America, particularly its ~60% share in Brazil's beer market, provides a significant competitive advantage. This leadership extends to other regions, with over 65% market share in Argentina and Uruguay, creating substantial operational leverage and market influence.

The company's extensive distribution network reaches millions of points of sale, ensuring product availability. Furthermore, strategic digital investments like the BEES and Zé Delivery platforms are enhancing operational efficiency and customer engagement, with Zé Delivery seeing a 30% rise in active users in 2023.

Ambev boasts a powerful portfolio of globally recognized brands, including Brahma and Budweiser, many of which generate over $1 billion annually. Their focus on premiumization and expansion into non-alcoholic beverages also drives profitability and diversifies revenue streams.

Financially, Ambev demonstrates remarkable resilience, generating R$18 billion in free cash flow in 2024 and maintaining a net cash position for a decade. This strong balance sheet with minimal debt offers significant strategic flexibility.

| Key Strength | Description | Supporting Data |

|---|---|---|

| Market Dominance | Leading position in Latin American beverage markets. | ~60% beer market share in Brazil; >65% in Argentina, El Salvador, Uruguay. |

| Distribution Network | Extensive reach across millions of sales points. | Ensures widespread product availability. |

| Digital Platforms | Growth in B2B (BEES) and D2C (Zé Delivery). | Zé Delivery active users up 30% in 2023. |

| Brand Portfolio | Strong global and regional brands. | Includes Brahma, Skol, Budweiser, Stella Artois; several exceed $1B annual revenue. |

| Financial Health | High profitability and cash flow. | R$18B free cash flow in 2024; decade-long net cash position. |

What is included in the product

This SWOT analysis provides a comprehensive overview of Ambev's internal capabilities and external market dynamics, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear breakdown of Ambev's competitive landscape, enabling targeted strategy development to overcome market challenges.

Weaknesses

Ambev's significant reliance on Brazil, which accounted for 68.5% of its revenue in 2022, presents a considerable weakness. This concentration exposes the company to substantial risks associated with economic fluctuations, political shifts, or regulatory adjustments within that single market.

While Latin America is a core strength, this over-dependence on a few key geographic areas makes Ambev vulnerable. Any adverse events in Brazil or other major Latin American markets could disproportionately impact its overall financial performance and stability.

Ambev's significant exposure to Latin American economies, particularly Brazil and Argentina, leaves it vulnerable to economic downturns, high inflation rates, and unpredictable currency devaluations. For instance, in Q1 2024, Brazil's inflation remained a concern, and the Argentine peso experienced substantial depreciation, directly impacting Ambev's operational costs and the purchasing power of its consumers.

These macroeconomic headwinds can severely dampen consumer spending on non-essential goods like beer and beverages, leading to reduced sales volumes and impacting Ambev's top-line growth. The fluctuating exchange rates also erode the value of earnings when repatriated, presenting a constant challenge to maintaining consistent profitability and financial stability across its diverse markets.

Ambev operates in a fiercely competitive Latin American beverage market, particularly in Brazil. Key rivals such as Heineken and Grupo Petropolis actively challenge Ambev's dominance, intensifying the battle for market share.

To defend its market position, Ambev has been compelled to absorb rising costs, which has put pressure on its gross margins. This strategy, while aimed at maintaining its standing, highlights the significant competitive headwinds the company faces.

In recent periods, Ambev has experienced a decline in market share within certain segments. This erosion is attributed to aggressive pricing tactics employed by competitors and the growing popularity of craft beer brands, which offer consumers more diverse and niche options.

Rising Raw Material Costs and Margin Pressures

Ambev is feeling the pinch from rising costs for key ingredients and packaging. Think about things like PET plastic for bottles, aluminum for cans, and even barley, which is crucial for their beer production. These price hikes directly impact their bottom line, squeezing profit margins.

The situation is made tougher by currency depreciation, which further inflates the cost of imported materials. This double whammy of higher input prices and a weaker currency puts significant pressure on Ambev to manage its expenses very carefully and consider price increases to protect its profitability, especially in the non-alcoholic beverage sector.

- PET Resin Prices: Global PET resin prices saw an average increase of approximately 15-20% in early 2024 compared to the previous year, impacting packaging costs.

- Aluminum Can Costs: The price of primary aluminum, a key component for beverage cans, experienced volatility, with spot prices fluctuating around $2,200-$2,400 per metric ton in the first half of 2024.

- Barley Market: Global barley prices have shown upward trends due to supply concerns and increased demand, potentially affecting the cost of malt for Ambev's beer portfolio.

- Currency Impact: For instance, the Brazilian Real's depreciation against the US Dollar in late 2023 and early 2024 increased the cost of imported raw materials by an estimated 5-10%.

Challenges in Sustaining Volume Growth and Pricing Power

Ambev faces hurdles in maintaining consistent volume expansion across all its operations. While the company achieved overall growth, certain regions saw mixed volume results. For instance, 2024 witnessed a slight dip in Ambev's total volumes, with specific markets like Canada and Central America struggling to sustain previous growth rates.

Pricing power is a crucial lever for Ambev, but its effectiveness has been inconsistent. Weaker-than-expected price increases in some segments, coupled with broader consumer economic pressures, can directly impede overall revenue growth. This dynamic creates a challenge in translating market presence into robust top-line expansion.

- Mixed Volume Performance: Slight declines in total volumes observed in 2024, with specific challenges in Canada and Central America.

- Pricing Strategy Impact: Weaker-than-anticipated pricing in certain areas and general consumer weakness can hinder revenue growth.

- Sustaining Momentum: Difficulty in maintaining consistent volume growth across all geographical segments presents an ongoing challenge.

Ambev's substantial reliance on the Brazilian market, which represented 68.5% of its revenue in 2022, makes it highly susceptible to economic downturns and policy changes within that single nation. This concentrated geographic exposure is a significant weakness, as any adverse developments in Brazil could disproportionately affect the company's overall financial health.

The company also grapples with intense competition in Latin America, particularly from rivals like Heineken and Grupo Petropolis. This forces Ambev to absorb rising costs to maintain its market share, consequently pressuring its gross profit margins and limiting its pricing flexibility.

Furthermore, Ambev faces challenges from increasing input costs for raw materials such as PET plastic, aluminum, and barley. For example, global PET resin prices saw an average increase of 15-20% in early 2024, and aluminum prices fluctuated around $2,200-$2,400 per metric ton in the first half of 2024, directly impacting production expenses.

Mixed volume performance across different regions, with slight dips in total volumes observed in 2024, especially in Canada and Central America, indicates difficulties in sustaining growth momentum. This, combined with weaker-than-anticipated price increases in some segments, hinders overall revenue expansion.

| Metric | 2022 Data | 2024 Trend/Data |

|---|---|---|

| Brazil Revenue Share | 68.5% | Continued high reliance |

| PET Resin Price Change (YoY) | N/A | +15-20% (early 2024) |

| Aluminum Price (H1 2024) | N/A | $2,200-$2,400/metric ton |

| Total Volume Performance | Growth | Slight dip in 2024 (Canada, Central America impacted) |

What You See Is What You Get

Ambev SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This Ambev SWOT analysis provides a comprehensive overview of the company's strategic positioning. You'll gain valuable insights into its internal strengths and weaknesses, as well as external opportunities and threats.

Opportunities

Ambev has a substantial opportunity to grow its non-alcoholic beverage offerings, a segment that saw robust expansion in 2025. This includes categories like soft drinks, juices, and energy drinks, demonstrating Ambev's capacity to cater to diverse consumer preferences beyond traditional beer.

The global shift towards healthier living and the rising popularity of low- and zero-alcohol beverages present a significant market opening. This trend is expected to drive substantial growth in this segment, with projections indicating a strong upward trajectory through 2034, offering Ambev a clear avenue for increased market share and revenue diversification.

Ambev's digital platforms, such as Zé Delivery and BEES, present significant opportunities for e-commerce expansion. These platforms are already proving successful in driving online sales and fostering direct customer relationships.

By continuing to invest in these digital channels, Ambev can tap into the growing market of younger consumers and broaden its overall reach. This strategic focus also promises to streamline operations and create new revenue avenues by serving as a comprehensive marketplace for retailers.

Ambev can capitalize on the increasing consumer demand for premium and super-premium beverages, a trend particularly evident in emerging markets. This presents a significant opportunity to boost profit margins by expanding its portfolio of high-value products. For instance, in 2024, Ambev's premium brands continued to show robust growth, contributing to a higher average selling price per hectoliter.

Continuous product innovation is key to capturing these opportunities. By introducing novel flavors, sustainable packaging solutions, and healthier beverage options, Ambev can effectively cater to the dynamic preferences of today's consumers. This strategy not only drives revenue but also strengthens brand loyalty in a competitive market landscape.

Strategic Acquisitions and Partnerships

Ambev continues to explore strategic acquisitions and partnerships to bolster its market position and expand its reach. While organic growth remains a core focus, the company actively seeks disciplined M&A opportunities that align with its long-term vision, particularly for enhancing its beverage portfolio and entering new or emerging markets. For instance, in 2023, Ambev continued to integrate its existing operations and explore regional synergies, reflecting a commitment to efficient expansion.

Strategic collaborations are also vital for Ambev's growth trajectory. These partnerships can drive innovation, particularly in areas like sustainable practices and the development of new products, which are increasingly important for market differentiation and consumer engagement. By leveraging external expertise and resources through alliances, Ambev can accelerate its entry into new segments and enhance its competitive edge.

- Acquisition Strategy: Ambev remains open to targeted mergers and acquisitions to strengthen its brand portfolio and geographic presence, aiming for disciplined integration and value creation.

- Partnership Focus: Collaborations are key for driving innovation in areas such as sustainability and new product development, enhancing market reach and competitive advantage.

- Market Expansion: Ambev leverages both organic growth and strategic alliances to penetrate new or emerging markets, diversifying its revenue streams and consumer base.

Exploiting Favorable Demographics and Economic Growth in Latin America

Latin America's demographic profile presents a significant opportunity for Ambev. With a youthful population and a growing middle class, demand for beverages is set to increase. For instance, in 2024, the region's population under 30 years old continues to be a substantial consumer base, driving consistent demand.

Economic recovery and rising disposable incomes across key Latin American markets are fueling consumer spending. This trend is particularly beneficial for Ambev as consumers are increasingly willing to spend on premium and value-added beverage options. By 2025, projections indicate continued economic stability in several of Ambev's core markets, supporting this upward spending trajectory.

- Growing Middle Class: An expanding middle class in countries like Brazil and Mexico means more consumers can afford discretionary purchases, including a wider range of Ambev's products.

- Youthful Population: Latin America's demographic dividend, with a large segment of young consumers, ensures sustained demand for beverages throughout the forecast period.

- Premiumization Trend: Consumers are trading up to higher-priced, premium beverages, a segment where Ambev can leverage its brand portfolio for higher revenue per unit.

- Economic Recovery: As economies stabilize and grow, consumer confidence rises, leading to increased spending on goods like beer and soft drinks.

Ambev is well-positioned to capitalize on the growing demand for healthier beverage options, including juices, teas, and functional drinks, a trend that gained significant momentum in 2024 and is projected to continue its upward trajectory. The company's investment in its non-alcoholic portfolio, which saw a 7% year-over-year increase in sales volume in the first half of 2025, highlights its commitment to this expanding market segment.

The global shift towards low- and zero-alcohol beverages presents a substantial growth avenue, with the zero-alcohol beer market alone expected to reach $11.1 billion by 2025. Ambev's proactive development and marketing of these alternatives, such as its Brahma 0.0% brand, align perfectly with this consumer preference, offering a clear path to increased market share and revenue diversification.

Ambev's digital transformation, particularly through its BEES and Zé Delivery platforms, offers a significant opportunity to enhance direct-to-consumer (DTC) sales and customer engagement. These platforms facilitated over 15 million transactions in 2024, demonstrating their effectiveness in capturing online market share and building stronger customer relationships.

The increasing consumer appetite for premium and super-premium products presents a lucrative opportunity for Ambev to drive margin growth. In 2024, Ambev's premium beer segment grew by 9% in volume, outperforming the overall beer market and underscoring the potential for higher average selling prices.

Ambev's strategic focus on innovation, including new product development and sustainable packaging, is crucial for capturing evolving consumer preferences and maintaining a competitive edge. The company's introduction of plant-based packaging for select beverages in 2025 reflects this commitment to sustainability and consumer appeal.

Leveraging its robust distribution network and brand portfolio, Ambev can further penetrate emerging markets and capitalize on favorable demographic trends. Latin America's youthful population, with over 60% under 30 years old, represents a sustained demand driver for Ambev's diverse beverage offerings through 2030.

| Opportunity Area | 2024/2025 Data/Projections | Strategic Implication |

|---|---|---|

| Non-Alcoholic Beverages | Sales volume increased by 7% YoY (H1 2025) | Catering to growing health-conscious consumer demand. |

| Low/Zero-Alcohol Beverages | Zero-alcohol beer market projected to reach $11.1 billion by 2025 | Capitalizing on a significant shift in consumer preference for moderation. |

| Digital Platforms (BEES, Zé Delivery) | Facilitated over 15 million transactions (2024) | Enhancing DTC sales, customer engagement, and market reach. |

| Premiumization | Premium beer segment grew 9% in volume (2024) | Driving higher average selling prices and margin enhancement. |

| Emerging Markets & Demographics | Over 60% of Latin America's population under 30 (2025) | Sustained demand from a young, growing consumer base. |

Threats

Ambev faces increasing scrutiny from regulators, with evolving rules on advertising, product labeling, and environmental standards. These regulations can increase compliance costs and limit marketing strategies, directly affecting operational efficiency.

The company is also vulnerable to shifts in tax policies. For instance, potential changes to tax benefits in Brazil could reduce Ambev's profits by an estimated 6% to 10%, highlighting the significant financial impact of governmental fiscal decisions.

The increasing global focus on health and wellness presents a significant challenge for Ambev. As consumers actively seek healthier lifestyles, demand for traditional alcoholic beverages may decline. This trend, observed across major markets, could impact Ambev's core product sales.

To counter this, Ambev faces the necessity of substantial investment in developing and promoting low-alcohol and non-alcoholic alternatives. For instance, in 2024, the global market for non-alcoholic beverages was valued at over $1.2 trillion, with significant growth projected in the low/no-alcohol segment, indicating a clear consumer shift that Ambev must address to remain competitive.

The beer market in Brazil and other Latin American regions is experiencing fierce competition, often referred to as 'beer wars.' Competitors such as Grupo Petropolis and Heineken are employing aggressive pricing tactics, which are starting to chip away at Ambev's dominant position. This intense rivalry puts pressure on Ambev to either absorb rising costs or reduce its prices to hold onto its market share.

This competitive pressure can significantly impact Ambev's profitability. When companies engage in price wars, it often leads to compressed profit margins. For Ambev, this means they might have to accept lower profits on each unit sold or face the prospect of losing customers if they don't match competitor pricing, a difficult balancing act in a dynamic market.

Economic Instability and Political Uncertainty in Operating Markets

Persistent economic instability, including hyperinflation in key markets like Argentina, significantly erodes consumer purchasing power and dampens overall market demand for Ambev's products. For instance, Argentina's inflation rate reached staggering levels, impacting disposable income across the region.

Broader political uncertainties across Latin America create a volatile operating environment. This unpredictability makes it difficult for Ambev to accurately forecast demand and achieve consistent, predictable growth in its revenue streams.

- Argentina's inflation rate in early 2024 hovered around triple digits, severely impacting consumer spending.

- Political shifts in several Latin American countries create regulatory and operational uncertainties for businesses.

- Currency devaluations in key markets directly affect the cost of imported raw materials and the repatriation of profits.

Supply Chain Disruptions and Commodity Price Volatility

Ambev's extensive operations are vulnerable to disruptions within its global supply chain, which can impact the availability and cost of essential inputs. For instance, geopolitical events or extreme weather can interrupt the flow of key ingredients like barley, a critical component for its beers. This volatility directly affects the cost of goods sold (COGS), potentially squeezing profit margins.

The price of raw materials, such as aluminum for beverage cans and sugar for soft drinks, also presents a significant threat. Commodity markets are notoriously unpredictable, and sharp increases in these prices can quickly erode Ambev's profitability. In 2024, for example, aluminum prices experienced fluctuations driven by global energy costs and production levels, directly impacting packaging expenses for beverage companies.

- Supply Chain Vulnerability: Reliance on a complex, international network of suppliers exposes Ambev to risks from logistical bottlenecks, labor shortages, or trade policy changes.

- Commodity Price Swings: Fluctuations in the cost of key inputs like barley, hops, aluminum, and sugar can significantly impact Ambev's cost structure and pricing strategies.

- Margin Pressure: Increased COGS due to supply chain issues or volatile commodity prices can lead to reduced gross margins if not effectively managed through cost controls or price adjustments.

Ambev faces significant threats from intensifying competition, particularly in its core Latin American markets, where rivals are employing aggressive pricing strategies. This competitive pressure, often termed 'beer wars,' directly impacts Ambev's market share and profit margins, forcing difficult decisions on pricing and cost management.

Economic instability and political uncertainty across key operating regions, especially in Latin America, pose substantial risks. High inflation rates, such as those seen in Argentina exceeding triple digits in early 2024, erode consumer purchasing power and create a volatile demand environment, complicating revenue forecasting and consistent growth.

The company's extensive supply chain is vulnerable to disruptions from geopolitical events, labor issues, or trade policy changes, impacting the availability and cost of essential raw materials like barley and aluminum. Fluctuations in commodity prices, as observed with aluminum in 2024 due to energy costs, directly increase the cost of goods sold and squeeze profit margins.

| Threat Category | Specific Risk | Impact on Ambev | 2024/2025 Data Point |

|---|---|---|---|

| Competition | Aggressive Pricing by Rivals | Reduced Market Share & Profit Margins | Intensified 'beer wars' in Brazil and LATAM |

| Economic/Political Instability | High Inflation (e.g., Argentina) | Decreased Consumer Spending Power | Argentina's inflation exceeded 100% in early 2024 |

| Supply Chain/Commodity Costs | Raw Material Price Volatility | Increased Cost of Goods Sold (COGS) | Aluminum prices fluctuated in 2024 due to energy costs |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of Ambev's official financial statements, comprehensive market research reports, and expert industry analysis to ensure accurate and actionable insights.