Ambev Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

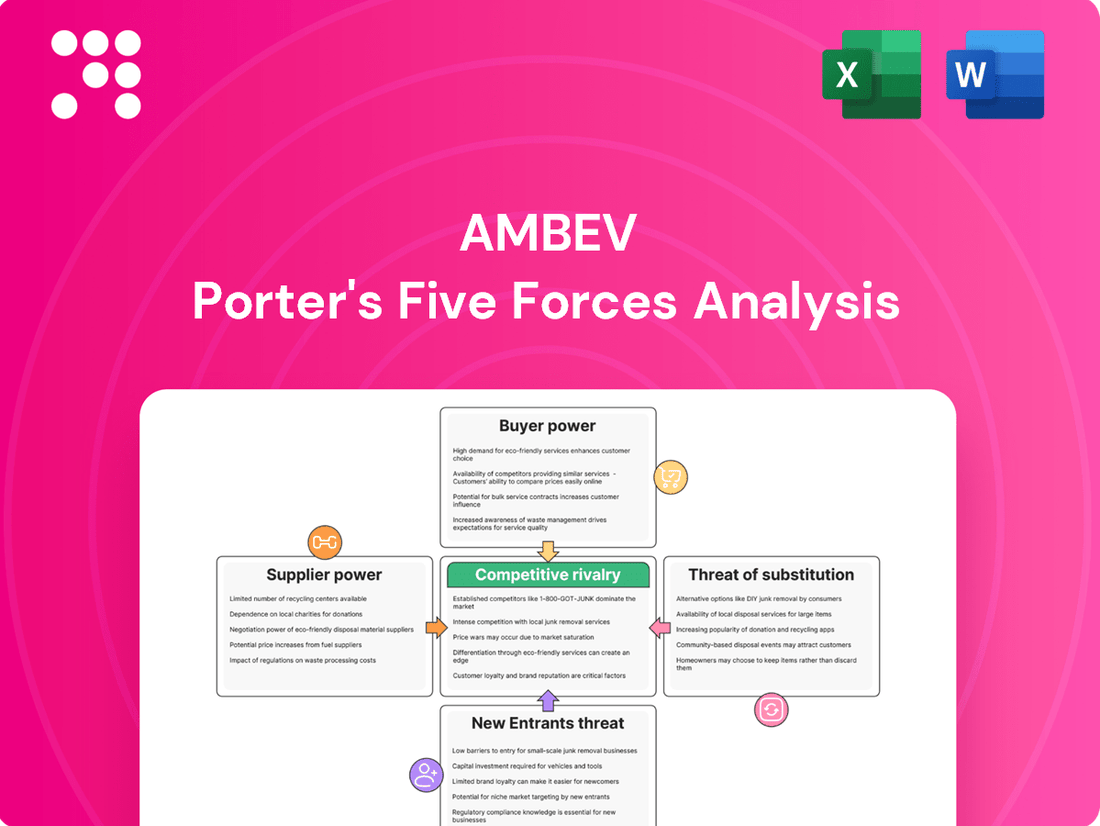

Ambev operates in a highly competitive beverage industry, where understanding the interplay of Porter's Five Forces is crucial for strategic success. This analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the sector.

The complete report reveals the real forces shaping Ambev’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ambev's reliance on key raw materials such as malt, hops, water, and sugar means suppliers hold significant sway. While water is widely available, the market for high-quality malt and hops is often dominated by a limited number of large global or regional suppliers, giving them considerable bargaining power.

For instance, in 2024, the global hop market, crucial for beer flavor and aroma, is characterized by a few major producers controlling a substantial share of the supply. This concentration means Ambev, despite its scale, must carefully manage relationships and contracts to secure consistent, quality ingredients.

Ambev's immense purchasing volume and its ability to enter into long-term supply agreements are critical strategies to offset this supplier concentration. These measures help secure favorable pricing and ensure a steady flow of essential materials, thereby mitigating the risk of supply disruptions or excessive cost increases.

The availability of substitutes for Ambev's inputs plays a significant role in its bargaining power with suppliers. For many common ingredients, like various grains or sweeteners used across its broad beverage portfolio, Ambev can often switch between suppliers or alternative materials. This flexibility limits the power of any single supplier of these more commoditized inputs.

However, for specialized ingredients that are crucial for Ambev's unique beer formulations or proprietary beverage blends, the availability of substitutes can be quite limited. In such cases, suppliers of these niche inputs can wield considerable bargaining power, potentially dictating terms and prices. For instance, a unique hop variety or a specific yeast strain might only be available from a few producers.

Ambev's extensive product range, which extends beyond beer to include a wide array of non-alcoholic beverages, also contributes to its sourcing flexibility. This diversification means that if one input becomes too costly or its supply is threatened, Ambev may be able to shift production or sourcing strategies within its broader operational framework, thereby mitigating the impact of supplier power for specific inputs.

Ambev faces considerable switching costs when dealing with its suppliers. These costs encompass the rigorous process of qualifying new suppliers, which involves extensive testing and validation to ensure they meet Ambev's high standards for quality and reliability. Furthermore, any change in supplier might necessitate adjustments to Ambev's complex production processes, potentially leading to temporary disruptions and increased operational expenses.

These substantial switching costs effectively bolster the bargaining power of Ambev's established suppliers. When it becomes costly and time-consuming to find and integrate alternative sources, Ambev is less inclined to frequently switch, giving existing suppliers more leverage in price negotiations and contract terms. For instance, a major supplier of specialized malt or hops, critical for Ambev's diverse beverage portfolio, could command better terms due to the difficulty in finding an equally suitable and readily available replacement.

Supplier's Ability to Forward Integrate

Suppliers' ability to forward integrate, meaning they could start producing beverages themselves to compete directly with Ambev, is a key factor in their bargaining power. This threat, if realized, would significantly shift leverage towards the supplier.

However, the beverage industry demands substantial capital for production facilities and establishing widespread distribution channels. For instance, building a new brewery or bottling plant requires hundreds of millions of dollars in investment, a barrier that most raw material suppliers, like hop farmers or malt producers, find prohibitively expensive. This high barrier to entry limits the practical threat of suppliers forward integrating.

Therefore, while the theoretical possibility exists, the economic realities and operational complexities of the beverage market mean that direct competition from raw material suppliers through forward integration is relatively low for Ambev.

- High Capital Investment: Establishing beverage production facilities can cost upwards of $200 million, deterring most raw material suppliers.

- Complex Distribution Networks: Replicating Ambev's extensive logistics and retail relationships is a significant hurdle.

- Limited Supplier Capability: Most suppliers focus on their core competencies in raw material production, not beverage manufacturing.

Importance of Ambev to the Supplier's Business

Ambev's immense scale as a global brewing leader, part of the even larger AB InBev group, makes it a critical partner for its suppliers. For instance, in 2023, AB InBev reported total revenue of $54.7 billion, showcasing the sheer volume of business Ambev's parent company commands. This substantial demand means that many suppliers rely heavily on Ambev for a significant portion of their sales, making them hesitant to jeopardize this relationship through aggressive pricing or unfavorable terms.

The bargaining power of suppliers is therefore considerably weakened when dealing with Ambev. Losing Ambev as a major customer would represent a severe blow to a supplier's revenue stream, potentially impacting their financial stability and growth prospects. This dependency shifts the power dynamic in Ambev's favor, allowing it to negotiate more favorable contracts and prices for its raw materials and services.

- Significant Customer Dependence: Many suppliers depend on Ambev for a substantial percentage of their annual revenue, limiting their ability to dictate terms.

- Volume-Based Negotiations: Ambev's massive purchasing volumes allow it to leverage economies of scale, securing lower prices from suppliers.

- Supplier Consolidation: In some sectors, Ambev's purchasing power may contribute to supplier consolidation, further reducing the number of viable alternatives and increasing Ambev's leverage.

- Impact of Lost Business: The financial repercussions of losing Ambev as a client are often too great for individual suppliers to risk, thus diminishing their bargaining power.

Ambev's bargaining power with suppliers is significantly influenced by the concentration of key ingredient markets and the availability of substitutes. While Ambev’s scale provides leverage, specialized inputs and high switching costs empower certain suppliers.

The global hop market, for example, is dominated by a few major producers as of 2024, granting them considerable influence. However, Ambev’s ability to secure long-term contracts and its vast purchasing volume help mitigate these supplier advantages, ensuring consistent supply and favorable pricing for many essential materials.

Conversely, the threat of suppliers forward integrating into beverage production is low due to the substantial capital investment required, estimated at over $200 million for new facilities, and the complexity of establishing extensive distribution networks, which most raw material suppliers cannot overcome.

| Factor | Impact on Ambev | Key Considerations |

| Supplier Concentration (Malt, Hops) | Moderate to High Supplier Power | Limited number of major global suppliers for specialized ingredients. |

| Availability of Substitutes | Low Supplier Power for Commoditized Inputs | Ambev can switch suppliers or materials for common ingredients. |

| Switching Costs | High Switching Costs Bolster Supplier Power | Supplier qualification, process adjustments, and potential disruptions are costly. |

| Forward Integration Threat | Low Supplier Power | High capital requirements and complex distribution networks deter suppliers. |

| Ambev's Scale & Dependence | Low Supplier Power | Suppliers rely heavily on Ambev's substantial revenue, limiting their leverage. |

What is included in the product

This analysis delves into Ambev's competitive environment, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the beverage industry.

Instantly identify and mitigate Ambev's competitive pressures with a dynamic, interactive visualization of Porter's Five Forces.

Customers Bargaining Power

The bargaining power of Ambev's customers is significantly shaped by the concentration within retail channels. Large supermarket chains and hypermarkets, like Carrefour or Walmart in various markets, represent major purchasers, often accounting for substantial portions of Ambev's sales volume. This concentration means these retailers wield considerable leverage.

These powerful retail channels can effectively pressure Ambev on pricing, demanding lower wholesale costs and favorable promotional terms. Their ability to dictate shelf space and influence consumer purchasing decisions directly through placement and in-store marketing further amplifies their bargaining strength. For instance, in 2024, major grocery retailers continued to consolidate, increasing their market share and, consequently, their negotiating power with beverage producers like Ambev.

In key Ambev markets like Brazil and Argentina, a significant portion of consumers, especially in the value and core beer segments, exhibit considerable price sensitivity. This means Ambev faces a challenge in raising prices without potentially losing sales volume.

For instance, in 2023, inflation in Argentina reached over 200%, making consumers even more attuned to price changes. This heightened sensitivity directly amplifies the bargaining power of these end consumers, forcing Ambev to carefully consider its pricing strategies to maintain market share.

Customers today have unprecedented access to information. Digital channels and social media empower them to easily compare Ambev's products with those of competitors, scrutinizing prices, features, and ongoing promotions. This heightened transparency means customers are better equipped than ever to seek out the best value.

For instance, in 2024, online review platforms and price comparison websites saw significant growth in user engagement. This trend directly translates to increased customer leverage, as they can readily identify and exploit price discrepancies or superior product offerings, putting pressure on Ambev to maintain competitive pricing and product quality.

Switching Costs for Customers

For most individual consumers, the cost of switching between beverage brands like beer or soft drinks is minimal. They can easily opt for a different product without significant financial or time investment. However, Ambev works to counteract this by cultivating strong brand loyalty through its diverse portfolio and ensuring widespread availability via its robust distribution channels, making it more convenient for consumers to stick with their offerings.

Ambev's strategies to increase switching costs are evident in its efforts to build brand equity. For instance, in 2023, Ambev invested heavily in marketing and promotional activities across its key markets, aiming to deepen consumer connection with brands like Skol and Brahma in Brazil, and Quilmes in Argentina. This focus on brand perception and customer engagement is crucial in a market where direct product switching is otherwise effortless.

- Low Individual Switching Costs: Consumers can easily switch between beverage brands without incurring significant financial penalties or time commitments.

- Ambev's Mitigation Strategies: Ambev leverages its strong brand portfolio and extensive distribution network to foster brand loyalty and enhance convenience, thereby increasing perceived switching costs.

- Brand Loyalty Initiatives: Investments in marketing and promotions, as seen in 2023, aim to build deeper consumer connections, making brand switching less appealing.

Customer Loyalty and Brand Strength

Ambev benefits significantly from deep-seated customer loyalty towards its iconic brands, such as Brahma, Skol, and Antarctica, especially within its core market of Brazil where it commands a substantial market share. This established brand equity is a powerful deterrent against customers seeking alternative suppliers, thereby diminishing their bargaining leverage.

The company's strategic emphasis on premiumization further solidifies this customer retention. By offering high-quality, desirable products, Ambev encourages consumers to remain loyal, even at a higher price point. This reduced price sensitivity directly translates to lower bargaining power for the customer base.

- Brand Dominance: Ambev's flagship brands, like Skol, Brahma, and Antarctica, hold significant market share, particularly in Brazil, fostering strong consumer preference.

- Premiumization Strategy: The company's focus on offering premium products enhances customer loyalty and willingness to pay more, reducing price sensitivity.

- Reduced Bargaining Power: Strong brand loyalty and the premiumization strategy collectively weaken customers' ability to negotiate lower prices or demand better terms.

The bargaining power of Ambev's customers is a multifaceted force, significantly influenced by the structure of retail channels and consumer price sensitivity. Large retail chains, due to their volume purchasing, wield considerable influence, often demanding lower prices and favorable terms. In 2024, continued consolidation among major grocery retailers amplified this effect, as these entities increased their market share and thus their negotiating leverage with beverage producers.

Consumer price sensitivity, particularly in value segments, remains a key factor. High inflation rates, such as the over 200% seen in Argentina in 2023, make consumers highly responsive to price changes, compelling Ambev to manage its pricing strategies carefully to avoid volume erosion.

Furthermore, the digital age has empowered consumers with unprecedented access to information. Price comparison websites and online reviews, which saw increased engagement in 2024, allow customers to easily scrutinize offerings and identify the best value, putting pressure on Ambev to maintain competitive pricing and product quality.

While individual switching costs are generally low, Ambev actively works to mitigate this by cultivating strong brand loyalty through its extensive portfolio and distribution network. Initiatives like significant marketing investments in 2023, aimed at deepening consumer connections with brands such as Skol and Brahma, are crucial in a market where product differentiation can be challenging.

| Factor | Impact on Ambev's Customer Bargaining Power | 2023-2024 Trend/Data Point |

| Retail Channel Concentration | High | Continued consolidation of major grocery chains increased their purchasing power. |

| Consumer Price Sensitivity | Moderate to High (especially in value segments) | Inflationary pressures (e.g., Argentina >200% in 2023) heightened price awareness. |

| Information Accessibility | High | Increased engagement with online review and price comparison platforms in 2024. |

| Brand Loyalty & Switching Costs | Low (inherently), but actively managed by Ambev | Ambev invested heavily in brand building and promotions in 2023 to counter low switching costs. |

Same Document Delivered

Ambev Porter's Five Forces Analysis

This preview shows the exact Ambev Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the beverage industry. This detailed document is professionally formatted and ready for your immediate use.

Rivalry Among Competitors

Ambev faces a dynamic competitive environment in Latin America, where its dominance in many beverage categories is challenged by a diverse array of players. Global powerhouses like Heineken and Molson Coors actively compete, bringing substantial resources and brand recognition to the region.

Beyond these international giants, Ambev must also contend with robust local competitors who possess deep understanding of regional tastes and distribution networks. Furthermore, the burgeoning craft beer movement introduces a growing number of agile, niche players that cater to evolving consumer preferences, intensifying the rivalry for market share.

The Latin American beverage market is showing steady growth, with alcoholic beverages expected to expand by 10% between 2024 and 2028. Carbonated soft drinks are also on an upward trajectory, with nearly 4.8% growth anticipated from 2025 to 2030.

This expanding market presents significant opportunities for companies like Ambev. However, this growth also fuels more intense rivalry as numerous players compete to capture a greater slice of the increasing demand.

Ambev actively cultivates brand loyalty through significant investments in brand building and premiumization strategies. For instance, the strong performance of brands like Corona and Spaten demonstrates their success in creating distinct market positions and consumer preference.

However, this differentiation is a dynamic battleground. Competitors are also heavily focused on innovation, consistently introducing new flavors, updating packaging, and employing creative marketing campaigns to capture and retain consumer attention in the crowded beverage market.

Exit Barriers for Competitors

High capital investments in brewing facilities and extensive distribution networks create significant exit barriers for existing competitors in the beverage industry. These substantial sunk costs mean that even underperforming companies might continue operating rather than exiting, thereby sustaining competitive intensity. For instance, Ambev's vast production capacity, which includes numerous breweries across Brazil and other Latin American countries, represents a massive capital commitment that is difficult to recoup if a company decides to leave the market.

The need to maintain a broad geographic reach through established distribution channels further entrenches competitors. Companies like Ambev have built complex logistics networks, often involving significant investments in warehousing, transportation fleets, and relationships with retailers. Divesting these assets or abandoning these networks would likely result in substantial losses, discouraging potential exits and keeping the number of active players high.

These elevated exit barriers contribute to a more crowded competitive landscape. Even in periods of lower profitability, the cost of exiting the market can be prohibitive. This can lead to a situation where numerous companies, despite facing challenges, remain in operation, intensifying rivalry for market share and potentially impacting overall industry profitability.

- Significant Capital Investments: Building and maintaining large-scale brewing operations requires billions in capital, making it difficult for companies to exit without substantial financial losses.

- Extensive Distribution Networks: Ambev's established presence in over 15 countries, with a vast network of distributors and retailers, represents a critical asset that is costly to dismantle.

- Sustained Competitive Intensity: The difficulty in exiting the market forces companies to remain competitive, even when facing financial headwinds, thus perpetuating rivalry.

- Brand Loyalty and Market Share: Companies that have invested heavily in building strong brands and securing market share are less likely to exit, further solidifying the competitive environment.

Market Share and Concentration

Ambev's commanding presence in Brazil, holding approximately 60% of the beer market and a substantial 25% of the soft drink sector, underscores its significant market share. This dominance extends across other Latin American nations, where Ambev also maintains leading positions.

The high concentration of market share by Ambev intensifies competitive rivalry. When rivals make strategic moves, Ambev often responds forcefully, leading to a dynamic environment characterized by strategic maneuvering and the potential for aggressive pricing strategies.

- Dominant Brazilian Market Share: Ambev commands around 60% of Brazil's beer market and 25% of its soft drink market.

- Regional Leadership: Ambev holds leading positions in several other Latin American countries.

- Intensified Rivalry: High market concentration leads to strong competitive responses and strategic maneuvering among players.

- Potential for Price Competition: Ambev's dominance can trigger price wars as competitors vie for market share.

Competitive rivalry within Ambev's operating regions is fierce, fueled by global beverage giants and agile local players. The expanding Latin American market, with projected growth in alcoholic beverages and carbonated soft drinks, attracts more competition, intensifying the battle for market share.

| Competitor Type | Examples | Impact on Rivalry |

|---|---|---|

| Global Giants | Heineken, Molson Coors | Bring substantial resources and brand recognition, increasing competitive pressure. |

| Local Competitors | Various regional brands | Possess deep understanding of local tastes and established distribution networks, offering tailored competition. |

| Craft Breweries | Niche, agile players | Cater to evolving consumer preferences, fragmenting market share and demanding constant innovation. |

SSubstitutes Threaten

The threat of substitutes for Ambev's extensive beverage portfolio is considerable, primarily driven by the sheer availability and competitive price-performance of alternative drinks. Consumers can readily shift from Ambev's core offerings like beer to categories such as wine, spirits, or even non-alcoholic options like bottled water, juices, coffee, and tea. This ease of switching is amplified when these substitutes are available at comparable or even lower price points, particularly for those consumers not seeking premium brands.

A significant shift in consumer preferences across Latin America, particularly towards health and wellness, is directly impacting the beverage market. This trend is fueling demand for options that are low-sugar, sugar-free, natural, and even functional, offering benefits beyond simple hydration.

This growing inclination towards healthier choices acts as a potent substitute threat to traditional offerings. For instance, the rise of sparkling water and kombucha directly challenges the market share of sugary carbonated soft drinks. Similarly, in the alcoholic beverage sector, consumers are increasingly exploring options like hard seltzers or low-calorie craft beers over traditional, higher-sugar alternatives.

In 2024, Ambev, a dominant player in the region, faces this evolving landscape. Reports indicate a notable slowdown in growth for certain legacy product categories, while the company is actively investing in and expanding its portfolio of healthier and lower-alcohol options to capture this burgeoning market segment.

The beverage market is dynamic, with new categories like cannabis-infused drinks, although their growth is heavily influenced by evolving regulations. In 2024, we're also observing a significant rise in sophisticated non-alcoholic spirits and ready-to-drink mixed beverages, offering consumers premium alternatives.

These innovative products directly challenge Ambev's core portfolio by providing novel consumption experiences. For instance, the global market for non-alcoholic beer alone was projected to reach over $20 billion by 2024, indicating a substantial shift in consumer preference that could impact traditional beer sales.

Home Brewing and DIY Trends

The rise of home brewing and DIY beverage making presents a growing, albeit niche, threat of substitutes for Ambev. For craft beer aficionados, the ability to create their own beer at home offers a direct alternative to purchasing commercially produced craft beers. While the overall volume of home-brewed beverages remains relatively small compared to the industrial market, this trend directly competes for consumer attention and spending within specific segments.

This DIY movement taps into a desire for customization and a hands-on experience, which can be particularly appealing to younger demographics and those interested in unique flavor profiles. For instance, in 2024, the homebrewing supply market continued to see steady growth, with online sales platforms reporting increased customer engagement in starter kits and specialized ingredients.

- Growing DIY Beverage Culture: Consumers are increasingly interested in making their own alcoholic and non-alcoholic beverages, from beer and wine to kombucha and sodas.

- Niche but Growing Impact: While not a mass-market threat, this trend directly substitutes for purchases in the craft and premium beverage segments.

- Consumer Engagement: The appeal lies in customization, cost savings, and the experience of creating something unique.

- Market Data: Reports from 2024 indicated a consistent uptick in sales of homebrewing equipment and ingredients, suggesting a persistent consumer interest.

Substitution Across Occasions

Consumers often switch beverages depending on the occasion, directly affecting Ambev's market share. For instance, a casual barbecue might traditionally call for beer, but a growing trend sees consumers opting for hard seltzers, craft sodas, or even ready-to-drink cocktails as substitutes. This shift highlights the threat of substitution, as these alternatives cater to changing tastes and lifestyle preferences, potentially drawing demand away from Ambev's core beer products.

The rise of premium non-alcoholic beverages also presents a significant substitution threat. As health consciousness grows, consumers are increasingly seeking sophisticated alternatives to traditional alcoholic drinks for social events or personal enjoyment. This trend means Ambev must consider not only other alcoholic beverages but also the expanding market of craft juices, sparkling waters, and mocktails, which can replace beer or other Ambev offerings in various consumption scenarios.

In 2024, the global non-alcoholic beverage market was projected to reach over $1.1 trillion, demonstrating the substantial scale of this substitution opportunity. Ambev's performance is therefore influenced by its ability to innovate and compete within this broader beverage landscape, not just within the beer segment. For example, while Ambev is a leader in beer, the increasing popularity of spirits and wine, particularly in emerging markets, represents a constant substitution pressure.

- Substitution by Occasion: Beer is often substituted by wine, cocktails, or premium non-alcoholic options at social gatherings.

- Evolving Consumer Preferences: Trends towards healthier or more sophisticated drinks challenge traditional beverage choices.

- Market Size of Substitutes: The global non-alcoholic beverage market's significant size indicates a substantial threat.

- Competitive Landscape: Ambev faces competition not only from other beer brands but also from spirits, wine, and innovative non-alcoholic products.

The threat of substitutes for Ambev is significant, driven by a wide array of beverage categories like wine, spirits, and non-alcoholic options such as water and juices. Consumers can easily switch, especially when substitutes offer similar or better value, impacting Ambev's beer and soft drink sales.

Health and wellness trends in 2024 continue to fuel demand for low-sugar and natural beverages, directly challenging traditional offerings. For instance, the market for non-alcoholic beer alone was projected to exceed $20 billion globally by 2024, highlighting a substantial shift away from conventional alcoholic beverages.

Innovative products like hard seltzers and premium non-alcoholic spirits offer novel consumption experiences, directly competing with Ambev's core portfolio. The burgeoning DIY beverage culture, including homebrewing, also presents a niche but growing substitution threat, particularly in craft segments.

| Substitute Category | Key Drivers | Impact on Ambev |

| Non-Alcoholic Beverages | Health consciousness, wellness trends | Direct competition for market share in soft drinks and beer segments. Global market projected over $1.1 trillion in 2024. |

| Wine & Spirits | Occasion-based consumption, premiumization | Substitution at social events and for consumers seeking different taste profiles. |

| Homebrewing/DIY | Customization, cost-saving, unique experiences | Niche but growing threat in craft beverage segments, impacting premium product sales. |

Entrants Threaten

The beverage industry, especially brewing, requires significant upfront investment. Think about the cost of building breweries, buying sophisticated equipment, and setting up widespread distribution. For example, a new large-scale brewery could easily cost hundreds of millions of dollars to construct and equip.

These substantial capital needs act as a major hurdle for potential new competitors looking to challenge established players like Ambev. It's not just about having a good product; it's about having the financial muscle to build the entire operation from the ground up, which deters many smaller or less-funded entrants.

Ambev enjoys significant brand loyalty, especially in its core markets like Brazil, where brands like Skol and Brahma are deeply ingrained in consumer culture. This loyalty makes it challenging for newcomers to gain market share, as consumers often stick with familiar and trusted names.

Ambev's formidable distribution network, encompassing both traditional channels and innovative digital platforms like Zé Delivery and BEES, presents a significant barrier to new entrants. This established infrastructure, honed over years of operation and investment, allows Ambev to efficiently reach a vast customer base across Latin America. In 2023, Ambev reported delivering over 200 million hectoliters of beverages, underscoring the sheer scale and reach of its logistics capabilities.

Replicating Ambev's extensive and optimized distribution system would require substantial capital investment and considerable time for new companies. Without comparable reach, emerging players would find it challenging to compete effectively, limiting their market penetration and ability to serve diverse consumer segments. This difficulty in accessing and building out comparable distribution channels significantly deters potential new entrants.

Economies of Scale and Cost Advantages

Ambev's massive production volumes translate into significant economies of scale across its operations. This includes manufacturing, where larger output lowers per-unit production costs, and procurement, where bulk purchasing of raw materials like malt and hops yields better pricing. For instance, in 2024, Ambev's extensive distribution network, covering millions of points of sale across Brazil and other Latin American markets, further solidifies these cost advantages.

These scale-driven cost advantages create a formidable barrier to entry for new competitors. A smaller entrant would struggle to match Ambev's efficiency in production and its purchasing power, making it challenging to compete on price. Furthermore, Ambev's ability to invest heavily in marketing and brand building, supported by its cost efficiencies, presents another hurdle for newcomers aiming to gain market share.

- Economies of Scale: Ambev benefits from lower per-unit costs due to high production volumes in manufacturing and efficient logistics.

- Purchasing Power: Large-scale procurement of raw materials provides Ambev with significant cost savings compared to smaller rivals.

- Distribution Network: Ambev's extensive reach in 2024 across numerous markets reduces per-unit distribution costs.

- Marketing Investment: Cost advantages enable Ambev to allocate substantial resources to marketing, creating a brand barrier.

Regulatory Hurdles and Licensing

The beverage industry faces significant regulatory hurdles, including stringent licensing requirements, varying tax structures across jurisdictions, and restrictions on advertising, all of which increase the cost and complexity for potential new entrants. For instance, in Brazil, where Ambev is a major player, the legal framework for alcohol production and distribution involves obtaining numerous permits and adhering to specific labeling and sales regulations. These complexities can deter smaller or less established companies from entering the market, thereby reducing the threat of new competition.

These regulatory barriers translate into substantial upfront investment and ongoing compliance costs. New entrants must navigate a labyrinth of national, regional, and local laws, which can be time-consuming and expensive to understand and implement. This financial and administrative burden acts as a powerful deterrent, protecting incumbent firms like Ambev from a flood of new competitors.

- Licensing Complexity: Obtaining and maintaining necessary operational licenses can be a protracted and costly process, requiring significant legal and administrative resources.

- Taxation Disparities: Differential excise taxes and VAT rates on beverages across different markets can create uneven playing fields and add to the financial burden for new businesses.

- Advertising Restrictions: Strict regulations on marketing and advertising, particularly for alcoholic beverages, limit brand building and customer acquisition efforts for newcomers.

- Compliance Costs: Adhering to product safety, labeling, and distribution standards necessitates ongoing investment in quality control and legal counsel.

The threat of new entrants for Ambev is generally considered moderate to low due to several significant barriers. High capital requirements for establishing production facilities and distribution networks are substantial deterrents. For example, building a modern brewery with the capacity to compete at scale can easily run into hundreds of millions of dollars.

Ambev's established brand loyalty and extensive distribution infrastructure, which reached over 200 million hectoliters in 2023, further solidify its market position. Replicating this reach and consumer preference requires immense investment and time, making it difficult for newcomers to gain traction. Additionally, economies of scale in production and procurement, driven by Ambev's vast operational size, create cost advantages that are hard for smaller entrants to match.

Regulatory complexities, including licensing and varying tax structures across different markets, also add to the barriers. Navigating these legal and administrative hurdles demands significant resources, acting as a protective shield for incumbent players like Ambev.

| Barrier to Entry | Impact on New Entrants | Ambev's Advantage |

|---|---|---|

| Capital Requirements | High upfront investment for production and distribution. | Established infrastructure and financial capacity. |

| Brand Loyalty & Distribution | Difficulty in building brand recognition and market access. | Strong brand equity (e.g., Skol, Brahma) and extensive 2024 distribution network. |

| Economies of Scale | Higher per-unit costs compared to large incumbents. | Lower production and procurement costs due to high volumes. |

| Regulatory Hurdles | Complex licensing, taxes, and advertising restrictions. | Experience and resources to navigate compliance efficiently. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ambev is built upon a robust foundation of data, including Ambev's annual reports, investor presentations, and financial statements. We also leverage industry-specific reports from market research firms and macroeconomic data from reputable sources to provide a comprehensive view of the competitive landscape.