Ambev Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

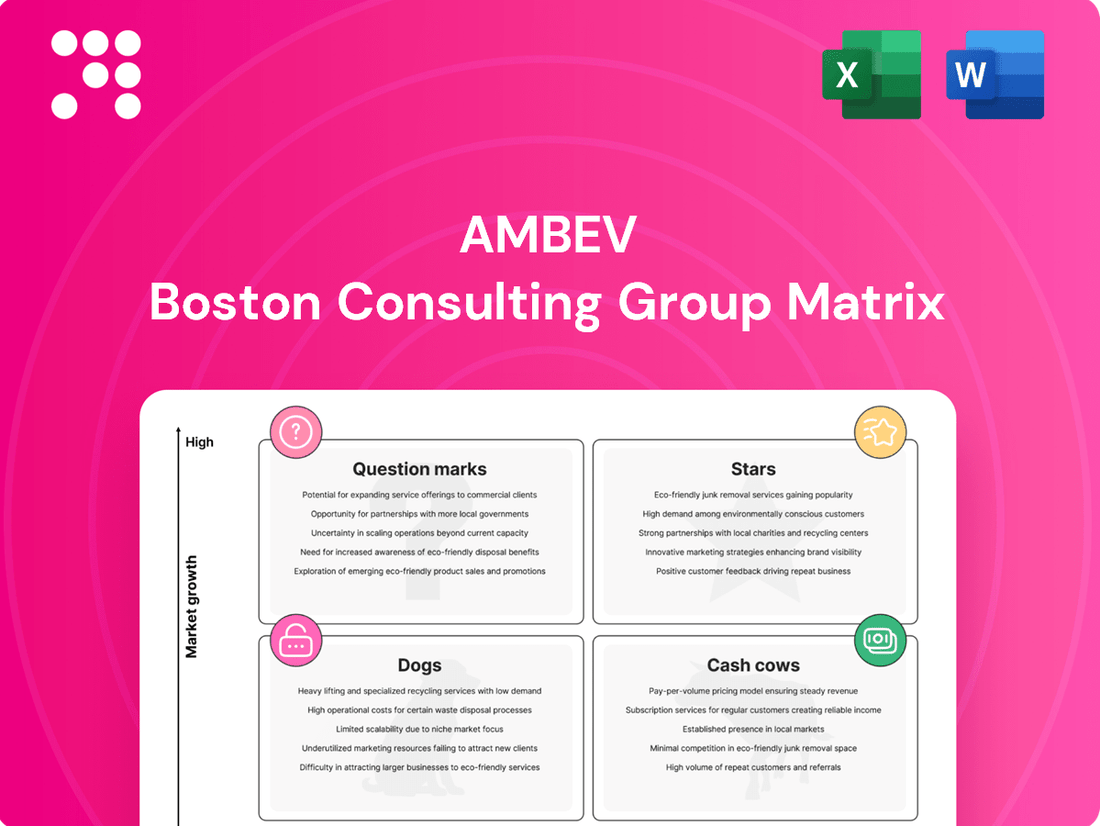

Ambev’s BCG Matrix offers a fascinating glimpse into its diverse product portfolio, highlighting potential growth areas and established revenue streams. Understanding which brands are Stars poised for future dominance, Cash Cows generating consistent returns, Dogs needing careful consideration, or Question Marks requiring strategic evaluation is crucial for any investor or business strategist.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Ambev.

Stars

Ambev's premium beer brands, such as Corona and Stella Artois, are performing exceptionally well. These brands have seen their premium volumes more than triple since 2020, highlighting a strong market position within a growing and profitable segment.

This strategic emphasis on premiumization is a key driver for Ambev, directly contributing to increased profitability and overall revenue growth. Brands like Spaten are also instrumental in this upward trend, solidifying Ambev's presence in the high-margin premium beer market.

Budweiser, positioned within Ambev's core plus segment, has demonstrated exceptional growth, with volume increasing by a substantial high forties percentage. This surge highlights the brand's effectiveness in capturing market share within a segment that Ambev is actively cultivating.

This impressive volume expansion signifies Budweiser's leadership and robust potential for continued expansion. Its performance is a key indicator of Ambev's successful strategy in revitalizing and growing this particular market segment.

Ambev's Zé Delivery platform is a prime example of a Star in the BCG matrix. The company's strategic investment has fueled significant growth, with online sales jumping 15% in 2025. This digital channel is clearly a high-growth market with strong consumer adoption.

Zé Delivery's impressive performance is underscored by its handling of over 66 million orders in 2024. This volume demonstrates its robust operational capacity and its ability to capture a significant share of the beverage delivery market.

The platform's success in attracting younger consumers and expanding Ambev's direct-to-consumer reach solidifies its position as a Star. The increasing order value further validates its leading role in the digital beverage delivery space.

Non-Alcoholic Beer Variants

Ambev has significantly boosted its innovation efforts, particularly with the introduction of low-calorie and non-alcoholic beer options. This strategic move directly addresses the growing demand from consumers who are increasingly prioritizing health and wellness in their beverage choices.

The non-alcoholic beer segment has shown remarkable growth, with volumes in Brazil alone surging by an impressive 40% in the first quarter of 2025. This substantial increase highlights a clear shift in consumer preferences and underscores the emergence of a high-growth market for these products.

Ambev's strong position in this burgeoning market is noteworthy. The company’s leadership in the non-alcoholic beer category suggests a substantial market share within this rapidly expanding niche, positioning it well for future expansion.

- Innovation Focus: Ambev’s investment in low-calorie and non-alcoholic beer variants caters to health-conscious consumers.

- Market Growth: Non-alcoholic beer volumes in Brazil increased by 40% in Q1 2025, indicating strong market expansion.

- Market Leadership: Ambev holds a leading position in this rapidly growing niche segment.

BEES Marketplace

BEES Marketplace, Ambev's digital solution for small retailers, has demonstrated significant traction. In 2024, the platform reached 1.3 million monthly active buyers, underscoring its broad reach within the small business segment.

This B2B platform is a key component of Ambev's strategy, contributing to its growth trajectory. In the first quarter of 2025, BEES Marketplace saw a substantial 60% increase in Gross Merchandise Volume (GMV).

The expansion of BEES Marketplace is notable, having been rolled out in eight of Ambev's top ten markets. This digital ecosystem not only bolsters Ambev's distribution capabilities but also enhances operational efficiency.

- Market Reach: 1.3 million monthly active buyers in 2024.

- GMV Growth: 60% increase in Q1 2025.

- Geographic Expansion: Active in eight of Ambev's top 10 markets.

- Strategic Importance: Strengthens distribution and operational efficiency.

Ambev's premium beer brands, such as Corona and Stella Artois, are performing exceptionally well, with premium volumes more than tripling since 2020. Brands like Spaten are also instrumental in this upward trend, solidifying Ambev's presence in the high-margin premium beer market.

Budweiser, positioned within Ambev's core plus segment, has demonstrated exceptional growth, with volume increasing by a substantial high forties percentage in 2024. This surge highlights the brand's effectiveness in capturing market share within a segment that Ambev is actively cultivating.

Ambev's Zé Delivery platform is a prime example of a Star in the BCG matrix, handling over 66 million orders in 2024 and seeing online sales jump 15% in 2025. The platform's success in attracting younger consumers and expanding Ambev's direct-to-consumer reach solidifies its position as a Star.

Ambev's innovation in low-calorie and non-alcoholic beer options is also a Star, with non-alcoholic beer volumes in Brazil surging by 40% in Q1 2025. Ambev holds a leading position in this rapidly growing niche segment.

BEES Marketplace, Ambev's digital solution for small retailers, reached 1.3 million monthly active buyers in 2024 and saw a 60% increase in GMV in Q1 2025. The platform is active in eight of Ambev's top 10 markets, strengthening distribution and operational efficiency.

| Brand/Platform | BCG Category | Key Growth Metric (2024/Q1 2025) | Market Share/Reach |

|---|---|---|---|

| Corona / Stella Artois | Star | Premium volumes tripled since 2020 | Strong position in growing premium segment |

| Budweiser | Star | Volume increased high forties % | Market leadership in core plus segment |

| Zé Delivery | Star | 66 million+ orders (2024); 15% online sales growth (2025) | Leading digital beverage delivery |

| Non-alcoholic Beer | Star | 40% volume growth in Brazil (Q1 2025) | Leading position in growing niche |

| BEES Marketplace | Star | 1.3 million active buyers (2024); 60% GMV growth (Q1 2025) | Active in 8 of 10 top markets |

What is included in the product

The Ambev BCG Matrix provides a framework for analyzing its diverse product portfolio, categorizing brands into Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

The Ambev BCG Matrix offers a clear, visual roadmap, relieving the pain of uncertainty by pinpointing which brands need investment and which can be leveraged.

Cash Cows

Brahma Beer stands as a cornerstone within Ambev's portfolio, firmly entrenched as a market leader in Brazil's beer industry. Its enduring popularity has translated into impressive performance, with the brand achieving record sales volumes in 2024, underscoring its continued dominance in a mature yet stable market.

As a quintessential Cash Cow, Brahma Beer exemplifies the BCG matrix model by generating substantial and consistent cash flow. This strong financial performance, driven by its leadership position, provides Ambev with the necessary capital to fuel investments in other business units or new ventures, showcasing its critical role in the company's overall financial strategy.

Antarctica, a key player for Ambev, experienced mid-single-digit growth in its core segment during 2024, solidifying its strong position within Brazil. This performance underscores its role as a reliable cash generator for the company.

With a well-established market share in a mature segment, Antarctica Beer consistently delivers stable results, contributing significantly to Ambev's profitability. Its operational efficiency and high profit margins are hallmarks of a successful cash cow.

PepsiCo-branded soft drinks in Brazil, managed by Ambev, are a significant Cash Cow. Ambev's exclusive rights to bottle, sell, and distribute these popular brands ensure a strong market presence.

This segment experienced robust growth, expanding by 7.8% in 2025, which highlights its sustained demand and contribution to Ambev's diverse revenue streams. The consistent cash generation from these established brands, a hallmark of Cash Cows, solidifies their importance in Ambev's portfolio.

Core Beer Portfolio in Brazil

Ambev's core beer portfolio in Brazil stands as a robust cash cow, consistently delivering strong performance. The company reported a significant 6.2% growth in Brazil beer volumes for the first quarter of 2025, underscoring the segment's enduring strength and Ambev's dominant market share.

This established portfolio, featuring well-recognized traditional beer brands, generates substantial and reliable cash flows. These mature products require comparatively lower marketing and promotional investments, allowing Ambev to leverage their established market presence for consistent profitability.

- Dominant Market Position: Ambev holds a leading share in the Brazilian beer market.

- Consistent Volume Growth: Brazil beer volumes increased by 6.2% in Q1 2025.

- Stable Cash Flow Generation: The core beer portfolio provides a steady income stream.

- Lower Investment Needs: Requires less aggressive promotional spending compared to newer products.

Established Distribution Network in Latin America

Ambev's established distribution network in Latin America, spanning numerous countries where it holds significant market share, functions as a prime cash cow. This extensive infrastructure in mature markets allows for efficient product delivery and consistent revenue generation, a testament to its operational strength.

The company's deep penetration and logistical capabilities across Latin America are a formidable competitive advantage. For instance, in 2023, Ambev reported net revenue of R$80.4 billion (approximately $16 billion USD), with Latin America being a cornerstone of this performance, highlighting the network's contribution to its overall profitability.

- Market Dominance: Ambev holds leading positions in key Latin American markets, such as Brazil, Argentina, and Peru, enabling economies of scale in its distribution.

- Efficient Logistics: The mature network minimizes per-unit distribution costs, directly boosting profit margins on its high-volume sales.

- Revenue Generation: This established infrastructure reliably converts sales volume into substantial and predictable cash flow, supporting investments in other business areas.

- Competitive Barrier: The sheer scale and efficiency of Ambev's Latin American distribution network create a significant barrier to entry for potential competitors.

Ambev's core beer brands in Brazil, including Brahma and Antarctica, are prime examples of cash cows. These established products benefit from high brand recognition and loyalty, leading to consistent sales volumes and strong profit margins. Their mature market status means they require less aggressive marketing investment, allowing them to generate substantial and reliable cash flow for the company.

| Brand | Market Status | Cash Flow Generation | 2024/2025 Data Point |

|---|---|---|---|

| Brahma Beer | Market Leader (Brazil) | High, Consistent | Record sales volumes in 2024 |

| Antarctica Beer | Strong Position (Brazil) | High, Consistent | Mid-single-digit growth in core segment (2024) |

| PepsiCo Brands (Brazil) | Strong Market Presence | High, Consistent | 7.8% growth in 2025 |

Delivered as Shown

Ambev BCG Matrix

The Ambev BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive upon purchase. This means you'll get the exact same professionally formatted analysis, ready for immediate strategic application within your business. No additional steps or hidden content are involved; what you see is precisely what you'll download, offering full access to Ambev's strategic positioning. This ensures you are acquiring a tangible and immediately usable tool for your business planning and decision-making processes.

Dogs

Within Ambev's extensive portfolio, certain localized or niche beer brands, especially those in economically challenged regions or experiencing shifts in consumer preferences, might show both low growth and low market share. For example, in 2024, some smaller craft brands in markets like Argentina, which faced significant inflation and currency devaluation, could fall into this category.

These brands often struggle to achieve profitability and can become cash traps, consuming resources through ongoing operational expenses without generating substantial returns. The continued investment in these brands, despite poor performance, might divert capital from more promising ventures within Ambev's business.

Consequently, Ambev may need to conduct a thorough evaluation of these brands' long-term viability. Divesting underperforming niche products could be a strategic move to streamline operations and reallocate resources to brands with higher growth potential or market dominance.

Ambev's performance in Central America and the Caribbean has been a point of concern, with a notable volume decline of 4.9% in the first quarter of 2025. This trend highlights areas where the company may be struggling to maintain market presence.

Brands in these regions that exhibit both a low market share and a consistent downward trend in sales, especially if they don't align with Ambev's long-term strategic objectives, would likely be classified as Dogs in the BCG matrix. These underperforming assets often drain valuable resources that could be better allocated to more promising ventures.

Within Ambev's vast portfolio, certain legacy soft drink brands might be experiencing stagnant sales. These brands, often operating in mature or declining market segments, could represent the Dogs in the BCG matrix if they also possess a low market share. For instance, while Ambev's overall non-alcoholic beverage segment is robust, specific older brands may struggle to gain traction against newer or more innovative competitors.

Brands Heavily Impacted by Adverse Weather in Brazil

Ambev's total volumes in Brazil experienced a 3.2% decline in Q4 2024 due to adverse weather conditions. This downturn disproportionately affected certain brands, particularly those already facing market challenges. Brands with weaker market positions that struggle to recover could become question marks in the BCG matrix if they continue to underperform in a slow-growth environment.

The impact of weather events on specific brands within Ambev's portfolio highlights potential vulnerabilities. For instance, brands heavily reliant on outdoor consumption occasions would likely see sales dip significantly during periods of heavy rain or unseasonable cold. This directly impacts their market share and profitability, pushing them towards a weaker standing.

- Weather Impact: Adverse weather in Brazil led to a 3.2% volume decline for Ambev in Q4 2024.

- Brand Vulnerability: Brands with weaker market positions are more susceptible to adverse weather impacts.

- BCG Matrix Implication: Brands failing to recover from weather-related sales drops could shift towards the question mark category.

- Market Conditions: A low-growth environment exacerbates the challenges for underperforming brands.

Products in Argentina Facing Economic Headwinds

Ambev's operations in Argentina have encountered considerable economic headwinds, impacting its overall performance. These challenges contributed to a modest dip in the company's total volumes for 2024.

Within this challenging Argentinian landscape, brands characterized by a low market share are particularly vulnerable. Soft consumer demand in the region further exacerbates their situation, positioning them as potential 'Dogs' in Ambev's BCG matrix.

- Argentinian Economic Impact: Ambev's 2024 performance saw a slight decline in total volumes, partly attributed to the difficult economic environment in Argentina.

- Low Market Share Brands: Brands with minimal market presence in Argentina are most susceptible to being classified as 'Dogs'.

- Consumer Demand Weakness: Soft consumer demand in Argentina amplifies the challenges for these low-share brands, leading to minimal returns.

- Potential for Losses: These 'Dog' brands in Argentina represent a potential for further financial losses due to their inability to gain traction in a struggling market.

Brands in Ambev's portfolio that exhibit low market share and operate in low-growth or declining segments are categorized as Dogs. These products, often niche or legacy offerings, struggle to generate significant revenue and can become a drain on resources. For example, certain regional beer brands in markets facing economic contraction, like some in Central America where Ambev saw a 4.9% volume decline in Q1 2025, could fit this description if their market share is also minimal.

These 'Dog' brands typically require ongoing investment for basic operations but offer little prospect of substantial growth or market leadership. Ambev's strategy often involves a critical assessment of these brands, with divestment being a common recourse to free up capital for more promising ventures.

The company's performance in markets like Argentina, which experienced economic headwinds throughout 2024, further illustrates this. Brands with low penetration in such challenging environments are prime candidates for the Dog classification, as they are unlikely to gain traction and may even incur losses.

Ultimately, identifying and managing these Dog brands is crucial for Ambev to optimize its portfolio, ensuring that resources are allocated efficiently to support Stars and Cash Cows, thereby driving overall profitability and market competitiveness.

Question Marks

Ambev's new hard seltzer offerings are positioned in a rapidly expanding global market. While parent company AB InBev is investing in brands like Nutrl, Ambev's presence in the Latin American hard seltzer segment is still developing, meaning their market share could be relatively small in this nascent category.

These seltzers represent a potential high-growth opportunity, but capturing significant market share will demand substantial investment. Consequently, they could evolve into Stars if they gain traction or become Dogs if they fail to gain momentum, highlighting the inherent risk and reward.

Ambev, via its parent AB InBev, has strategically expanded into the craft and specialty beverage arena. This diversification includes notable acquisitions and ventures aimed at capturing growth in these dynamic markets.

The craft beer sector, while experiencing robust expansion, presents a landscape where Ambev's individual craft brands may initially hold a modest market share. For instance, the U.S. craft beer market saw sales volume grow by 0.5% in 2023, reaching 24.7 million barrels, according to the Brewers Association, indicating a competitive but expanding space.

These emerging craft beer acquisitions and ventures can be viewed as Ambev's 'Question Marks' within the BCG Matrix framework. They represent opportunities in a growing market, but require significant investment in brand building, distribution, and innovation to ascend to higher market share positions.

Ambev's commitment to innovation means they're always exploring uncharted beverage territories. These early-stage concepts, like novel functional drinks or unique flavor fusions, are prime examples of Question Marks in their portfolio. They represent potential future growth drivers but currently require significant investment to build consumer awareness and market share.

For instance, while specific early-stage Ambev projects are proprietary, the broader beverage industry saw a surge in demand for adaptogenic beverages and zero-sugar options in 2024. These emerging categories, where Ambev might be testing new formulations, fit the Question Mark profile. They operate in high-potential segments but have yet to achieve widespread consumer adoption, necessitating substantial marketing and distribution efforts to gain traction.

Expansion into New Geographies (e.g., Peruvian Beverage Company Stake)

Ambev's acquisition of a 20% stake in a Peruvian beverage company in the second quarter of 2025 is a clear indicator of its strategy to enter new geographical territories. This move positions the investment as a Question Mark within the BCG matrix, reflecting a high-growth market with the potential for significant expansion, but also a current low market share.

The success of this Peruvian venture hinges on Ambev's ability to effectively penetrate the market and establish a stronger foothold. This requires substantial strategic investment and tailored market entry approaches to overcome existing competition and consumer preferences.

- Market Entry: Ambev's 20% stake acquisition in a Peruvian beverage company in Q2 2025 signifies a strategic push into a new geographic market.

- BCG Classification: This venture is classified as a Question Mark due to its high growth potential in Peru, coupled with an anticipated low initial market share.

- Strategic Imperative: Continued investment and focused market penetration efforts are crucial for transforming this Question Mark into a potential Star or Cash Cow.

- Growth Outlook: Peru's beverage market, projected to grow at a compound annual growth rate of 4.5% through 2028, offers a fertile ground for Ambev's expansion ambitions.

Health-Focused Functional Beverages Beyond Core Categories

Ambev's strategic expansion into health-focused functional beverages, moving beyond its traditional beer and soft drink stronghold, positions these newer ventures as potential question marks in its BCG matrix. Categories like energy drinks and emerging functional beverages, where Ambev might be a recent entrant, often exhibit rapid growth but currently hold a smaller market share.

These segments demand substantial investment to capture market leadership and capitalize on evolving consumer preferences for healthier options. For instance, the global functional beverage market was valued at approximately $127 billion in 2023 and is projected to grow significantly, offering Ambev a substantial opportunity.

- Energy Drinks: Ambev's presence in the energy drink market, with brands like Fusion, represents a category with high growth potential but also intense competition, requiring ongoing marketing and product innovation.

- Functional Water/Hydration: Expanding into enhanced waters with added vitamins or electrolytes taps into a growing wellness trend, though market penetration may still be developing.

- Plant-Based Beverages: While not explicitly mentioned, Ambev could explore plant-based milk alternatives or other plant-derived functional drinks, a rapidly expanding segment driven by health and sustainability concerns.

- Probiotic Drinks: The gut health trend fuels the growth of probiotic beverages, an area where Ambev may seek to establish or expand its presence, requiring significant R&D and consumer education.

Ambev's new ventures into emerging beverage categories, such as hard seltzers and functional drinks, are prime examples of Question Marks. These represent high-growth markets where Ambev is still establishing its presence and market share.

Significant investment in marketing, distribution, and product innovation is required for these products to gain traction and potentially become Stars.

The company's strategic acquisitions in the craft beer sector also fall into this category, offering growth potential but demanding resources to build brand recognition and market penetration.

Ambev's expansion into new geographic markets, like its stake in a Peruvian beverage company, are also classified as Question Marks, offering high growth prospects but currently low market share.

BCG Matrix Data Sources

Our Ambev BCG Matrix leverages comprehensive data from financial reports, market research, and internal sales figures to accurately position each business unit.