Ambev Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

Unlock the strategic blueprint behind Ambev's dominant market position. This comprehensive Business Model Canvas dissects their customer segments, value propositions, and key partnerships, revealing how they consistently innovate and drive growth in the competitive beverage industry. Perfect for anyone seeking to understand the mechanics of a global leader.

Dive into the core of Ambev's operational excellence with our full Business Model Canvas. Discover their revenue streams, cost structure, and essential resources that fuel their vast distribution network and brand portfolio. This detailed analysis is invaluable for strategists and business analysts aiming to replicate success.

See how Ambev masterfully connects its activities to its revenue. Our complete Business Model Canvas lays bare their channels, customer relationships, and the unique value they deliver across diverse markets. Download the full version to gain a competitive edge and sharpen your own strategic planning.

Partnerships

Ambev's strategic alliance with its parent company, Anheuser-Busch InBev (AB InBev), is a cornerstone of its business model. AB InBev's majority stake grants Ambev access to a vast global network, including shared best practices in brewing, distribution, and marketing. This synergy allows Ambev to leverage AB InBev's extensive resources, fostering operational efficiencies and a stronger competitive edge worldwide.

Ambev's extensive supplier network is a cornerstone of its operations, providing critical raw materials such as barley, hops, and aluminum for packaging. Strong supplier relationships are vital for maintaining consistent, high-quality inputs needed for Ambev's massive production volumes.

In 2024, Ambev continued to leverage its robust supplier base to manage costs and ensure supply chain resilience. For instance, securing favorable terms for key commodities like malted barley, which is a primary ingredient, directly impacts Ambev's cost of goods sold and ultimately its profitability in a competitive beverage market.

Ambev relies heavily on a robust network of distribution and logistics partners to ensure its wide array of beverages reaches consumers efficiently. These third-party distributors, wholesalers, and specialized logistics firms are crucial for navigating Ambev's extensive market presence, especially across Latin America and Canada.

In 2024, Ambev's commitment to broad availability meant managing a complex supply chain. For instance, its operations in Brazil alone involve thousands of delivery routes daily, highlighting the critical role these partners play in maintaining market share and customer satisfaction.

Technology and Digital Platform Collaborators

Ambev collaborates with leading technology firms and digital platform creators to build and enhance its innovative digital ecosystem. These partnerships are crucial for driving the success of platforms like BEES, its business-to-business e-commerce solution, and Zé Delivery, its direct-to-consumer delivery service.

These collaborations enable Ambev to improve customer experiences, optimize its supply chain, and gain valuable market intelligence through advanced data analytics. For instance, in 2023, Ambev continued to invest heavily in digital transformation, with its e-commerce platforms showing significant growth.

- BEES Platform Growth: By the end of 2023, Ambev's BEES platform had onboarded millions of small businesses, facilitating billions in transactions and demonstrating a robust digital adoption rate.

- Zé Delivery Expansion: Zé Delivery's reach expanded to over 200 cities across Brazil by mid-2024, supported by technology partners that ensure efficient logistics and a seamless user experience.

- Data-Driven Insights: Partnerships with data analytics providers allow Ambev to process vast amounts of consumer and sales data, leading to more targeted marketing campaigns and product development, with a reported increase in campaign ROI by up to 15% in key markets in 2023.

Brand Licensing and Co-packaging Agreements

Ambev actively pursues brand licensing and co-packaging agreements to enhance its portfolio. A significant collaboration is with PepsiCo, which allows Ambev to distribute and market a variety of PepsiCo's non-alcoholic beverages across its territories. This strategy is crucial for Ambev to broaden its product selection without direct product development, tapping into established consumer loyalty and global brand recognition.

These partnerships are vital for market expansion and consumer engagement. By integrating popular brands like Pepsi, Mountain Dew, and Gatorade into its distribution network, Ambev gains immediate access to new consumer segments and strengthens its competitive position in the non-alcoholic beverage market. For example, in 2023, Ambev's non-alcoholic beverage segment continued to show robust growth, partly fueled by these strategic brand collaborations.

- Brand Licensing: Ambev licenses well-known non-alcoholic brands, primarily from PepsiCo, to produce and sell in its operational regions.

- Co-packaging: The company engages in co-packaging arrangements, sharing production and packaging resources to efficiently bring licensed products to market.

- Market Diversification: These agreements enable Ambev to offer a wider range of beverages, catering to diverse consumer preferences beyond its core beer offerings.

- Leveraging Global Brands: Partnerships allow Ambev to capitalize on the established brand equity and marketing power of global beverage giants, enhancing its market appeal.

Ambev's key partnerships are foundational to its operational success and market reach. These include its critical relationship with parent company AB InBev, which provides global network access and shared expertise. Ambev also relies on a vast supplier network for essential raw materials like barley and hops, ensuring consistent production quality. Furthermore, strategic alliances with technology firms are vital for developing and enhancing its digital platforms, such as BEES and Zé Delivery, driving innovation and customer engagement.

What is included in the product

Ambev's business model centers on leveraging its vast distribution network and strong brand portfolio to serve diverse consumer segments across Latin America and beyond, focusing on efficient production and strategic partnerships to deliver a wide range of beverages.

This model emphasizes scalable operations, a deep understanding of local markets, and continuous innovation in product offerings and marketing to maintain market leadership and drive profitable growth.

Ambev's Business Model Canvas offers a clear, structured approach to address the complex challenges of the beverage industry, simplifying strategic planning and execution for rapid market adaptation.

It provides a visual framework to pinpoint and alleviate operational inefficiencies and market gaps, fostering a more agile and responsive business strategy.

Activities

Ambev's primary focus is the massive-scale brewing of beer, complemented by the production of a diverse range of non-alcoholic drinks like sodas, juices, and bottled water. This operational core demands the meticulous management of advanced manufacturing plants and malting processes to guarantee uniform quality and significant output capacity.

In 2024, Ambev continued to leverage its extensive production network, which includes numerous breweries and bottling facilities across Latin America and other key markets. The company's commitment to efficiency in these operations is crucial for meeting high consumer demand and maintaining its competitive edge in the beverage sector.

Ambev's extensive distribution and logistics management is a cornerstone of its operations, ensuring its vast product portfolio reaches consumers across numerous countries. This involves meticulously managing a complex network of warehouses and transportation, from trucks to potentially other modes, to maintain product quality and availability.

In 2023, Ambev's operations spanned across Latin America and other regions, highlighting the sheer scale of its logistical undertaking. The company's ability to efficiently manage this network directly impacts its market share and revenue generation, as timely delivery is crucial in the fast-moving consumer goods sector.

Ambev dedicates significant resources to crafting and implementing impactful marketing campaigns. In 2024, the company continued its tradition of substantial investment in advertising across various media, including television, digital platforms, and sponsorships, to reinforce the appeal of its extensive brand portfolio.

These efforts focus on deepening consumer connection and driving preference for brands like Brahma and Skol. Ambev's strategy emphasizes digital engagement, leveraging social media and online content to foster community and loyalty, a key driver for market share growth in the competitive beverage industry.

Digital Transformation and E-commerce Expansion

Ambev's core activities heavily involve the digital transformation of its operations, particularly through its e-commerce platforms. The company is actively expanding its digital footprint to reach both business-to-business (B2B) and direct-to-consumer (DTC) markets.

Key initiatives include the BEES platform for B2B clients, which aims to simplify the ordering process and improve engagement. For consumers, Zé Delivery offers a fast and convenient way to purchase beverages directly. These platforms are crucial for enhancing customer experience and gathering data.

- Digital Platforms: Development and maintenance of BEES (B2B) and Zé Delivery (DTC) platforms.

- Data Analytics: Leveraging customer and sales data from digital channels for business insights and optimization.

- E-commerce Operations: Managing online sales, logistics, and customer service for digital channels.

- Digital Marketing: Promoting digital platforms and driving customer acquisition through online channels.

Product Innovation and Portfolio Diversification

Ambev actively invests in research and development to fuel product innovation and diversify its beverage portfolio. This commitment ensures they stay ahead of changing consumer tastes and market demands.

In 2024, Ambev continued its strategy of introducing new product variants. This included an increased focus on low-calorie and non-alcoholic options, reflecting a growing health-conscious consumer base. For instance, the company has expanded its non-alcoholic beer offerings across various brands.

Beyond beer, Ambev is strategically expanding into adjacent beverage categories. This diversification aims to capture a broader market share and mitigate risks associated with reliance on a single product type. Their efforts in 2024 saw continued exploration and potential launches in categories like ready-to-drink beverages and functional drinks.

- Product Innovation: Ambev's R&D efforts in 2024 focused on developing healthier alternatives like low-calorie and non-alcoholic beers.

- Portfolio Diversification: Expansion into new beverage categories, such as ready-to-drink and functional drinks, is a key 2024 strategy.

- Market Responsiveness: These activities directly address evolving consumer preferences for healthier and more varied beverage options.

Ambev's key activities revolve around large-scale beverage production, encompassing brewing and the manufacturing of non-alcoholic drinks. This core function is supported by robust research and development for product innovation, particularly in healthier options like low-calorie and non-alcoholic beers, as seen in their 2024 product line expansions. Furthermore, the company excels in extensive marketing campaigns to build brand loyalty and drives digital transformation through platforms like BEES and Zé Delivery to enhance customer engagement and sales.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Beverage Production | Large-scale brewing and manufacturing of alcoholic and non-alcoholic beverages. | Maintaining efficiency across extensive brewery and bottling facilities in Latin America and beyond. |

| Research & Development | Product innovation and portfolio diversification. | Expanding low-calorie and non-alcoholic options, exploring ready-to-drink and functional beverages. |

| Marketing & Sales | Brand building, consumer engagement, and driving sales. | Significant investment in advertising across media, with a focus on digital engagement and community building. |

| Digital Platforms | Development and operation of e-commerce platforms for B2B and DTC. | Expansion of BEES for B2B and Zé Delivery for DTC, aiming to simplify ordering and enhance customer experience. |

What You See Is What You Get

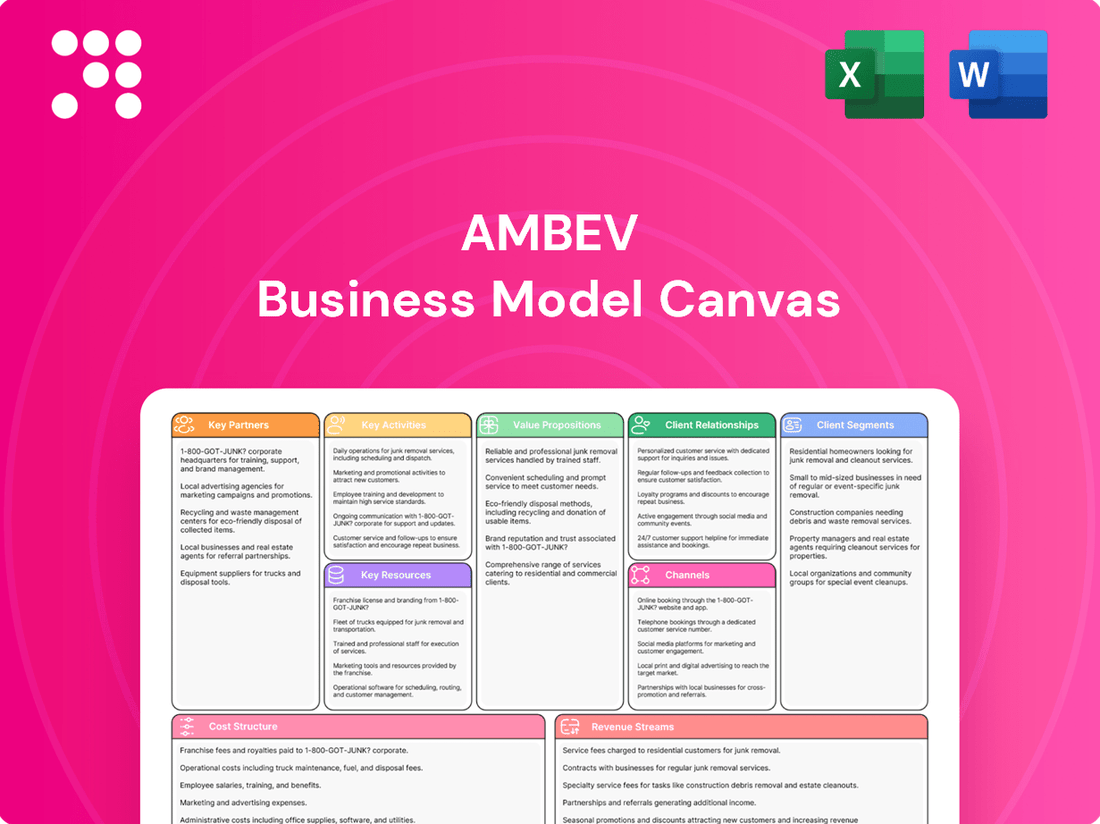

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Ambev's key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and ready-to-use analysis, allowing you to explore Ambev's strategic framework in detail.

Resources

Ambev's strong brand portfolio, featuring household names like Brahma, Skol, and Antarctica alongside global giants such as Budweiser and Corona, is a critical asset. These brands are more than just labels; they embody significant intellectual property, cultivated through decades of marketing and consumer trust.

This robust collection of brands is fundamental to Ambev's market leadership, driving consumer preference and enabling premium pricing. In 2023, Ambev's net revenue reached R$80.4 billion, a testament to the enduring power and appeal of its diverse brand offerings across various market segments.

Ambev's extensive production and bottling infrastructure is a cornerstone of its business model. The company boasts a vast network of modern breweries, malting facilities, and bottling plants strategically positioned across its operating regions, ensuring high-volume output and efficient distribution to diverse markets.

In 2024, Ambev continued to leverage this robust infrastructure, which underpins its ability to meet significant consumer demand across Latin America and beyond. This physical asset base is critical for maintaining cost efficiencies and ensuring product availability, a key competitive advantage.

Ambev's robust distribution and logistics network is a cornerstone of its business model, encompassing a vast infrastructure of warehouses, a dedicated transportation fleet, and optimized delivery routes. This extensive network is crucial for achieving broad market penetration across diverse geographical regions.

In 2024, Ambev continued to leverage this network to ensure the timely and efficient delivery of its extensive product portfolio, from popular beer brands to non-alcoholic beverages, reaching millions of consumers and retail points. This logistical prowess is a significant competitive advantage.

Skilled Workforce and Human Capital

Ambev's skilled workforce is a critical resource, comprising over 43,000 employees as of 2024. This extensive team possesses specialized knowledge across brewing, sales, marketing, and logistics, directly contributing to the company's efficient operations and strong market presence.

The human capital at Ambev is characterized by deep expertise and a commitment to excellence. This dedication is a cornerstone of their ability to maintain operational efficiency and secure their position as a market leader in the beverage industry.

- Employee Count: Over 43,000 employees in 2024.

- Key Specializations: Brewing, sales, marketing, and logistics.

- Impact: Drives operational excellence and market leadership.

Advanced Digital Platforms and Data Analytics Capabilities

Ambev's proprietary digital platforms, like BEES and Zé Delivery, are crucial resources. These platforms, supported by robust technological infrastructure and advanced data analytics, enable streamlined operations and direct interaction with customers. In 2024, Ambev continued to invest heavily in these digital capabilities, recognizing their role in driving efficiency and market insight.

The underlying data analytics capabilities are equally vital. They allow Ambev to process vast amounts of information, leading to more informed strategic decisions and personalized customer experiences. This data-driven approach is fundamental to understanding market trends and optimizing Ambev's business model.

- BEES Platform: Facilitates B2B sales and engagement with retailers, streamlining order processes.

- Zé Delivery: A direct-to-consumer platform for beverage delivery, enhancing customer reach and convenience.

- Data Analytics: Powers insights into consumer behavior, sales patterns, and operational efficiency.

- Technological Infrastructure: Underpins the scalability and reliability of these digital services.

Ambev's key resources are its powerful brand portfolio, extensive production and distribution networks, skilled workforce, and proprietary digital platforms. These elements collectively form the backbone of its operational strength and market dominance.

The company's brands, including Brahma and Budweiser, are invaluable intellectual property, driving consumer loyalty and premium pricing. In 2023, Ambev achieved R$80.4 billion in net revenue, underscoring the commercial success derived from these brands.

Its vast infrastructure ensures efficient, high-volume production and widespread market access. Furthermore, over 43,000 employees in 2024 contribute specialized expertise across all operational facets. Digital platforms like BEES and Zé Delivery, supported by advanced analytics, enhance customer engagement and operational efficiency.

| Key Resource | Description | 2023/2024 Data Point |

| Brand Portfolio | Intellectual property and consumer trust | R$80.4 billion in net revenue (2023) |

| Production & Distribution | Breweries, bottling plants, logistics network | Ensured product availability and market reach in 2024 |

| Skilled Workforce | Expertise in brewing, sales, marketing, logistics | Over 43,000 employees in 2024 |

| Digital Platforms | BEES, Zé Delivery, data analytics | Continued investment in digital capabilities in 2024 |

Value Propositions

Ambev's diverse portfolio is a cornerstone of its business, featuring everything from iconic global beer brands to widely consumed non-alcoholic beverages like soft drinks and juices. This broad offering ensures they can meet a vast array of consumer needs and preferences across different demographics and consumption occasions.

In 2024, Ambev continued to leverage this strength, with its beer segment remaining a dominant force while its non-alcoholic beverage division saw significant growth, reflecting a strategic push to capture a larger share of the total beverage market. This comprehensive product range not only drives sales volume but also builds strong brand loyalty.

Ambev's iconic and trusted brand recognition is a cornerstone of its business model. Brands like Skol, Antarctica, and Brahma are not just beverages; they are cultural touchstones deeply embedded in Brazilian life, fostering immense consumer loyalty. This deep connection translates directly into market share, with Ambev's portfolio consistently dominating sales, as evidenced by their leading positions in various beer and soft drink categories throughout 2024.

Ambev's extensive distribution network ensures its beverages are readily available across a vast geographical area, making them convenient for consumers to find. This broad reach is a cornerstone of their value proposition.

Innovative digital platforms, such as Zé Delivery, further amplify this convenience by offering rapid home delivery, directly connecting consumers with Ambev's product portfolio. This digital push streamlines the purchasing process.

In 2023, Zé Delivery played a significant role, handling a substantial portion of Ambev's direct-to-consumer sales in Brazil, demonstrating the effectiveness of their digital accessibility strategy and its impact on customer experience and market penetration.

Premiumization and Innovation in Product Offerings

Ambev's strategy hinges on premiumization, introducing higher-margin premium and super-premium beer brands to capture a more discerning market segment. This approach directly addresses the growing consumer preference for elevated quality and sophisticated beverage experiences.

Innovation is also a cornerstone, with Ambev actively developing and promoting low-calorie and non-alcoholic alternatives. This caters to health-conscious consumers and expands their market reach beyond traditional beer drinkers.

- Premiumization: Focus on higher-margin premium and super-premium beer segments.

- Innovation: Development of low-calorie and non-alcoholic options.

- Consumer Demand: Alignment with evolving preferences for diverse and high-quality choices.

Commitment to Sustainability and Responsible Practices

Ambev's dedication to sustainability is a core value proposition, resonating with a growing segment of environmentally and socially conscious consumers. The company has set ambitious goals, such as sourcing 100% of its electricity from renewable sources by 2025. This commitment extends to water stewardship, with Ambev aiming to reduce its water usage intensity by 35% by 2030 compared to 2015 levels.

This focus on responsible practices not only enhances Ambev's brand reputation but also attracts investors looking for companies with strong ESG (Environmental, Social, and Governance) credentials. For instance, in 2023, Ambev reported a 5% reduction in water consumption per hectoliter of production compared to the previous year, showcasing tangible progress towards its targets.

- Environmental Stewardship: Ambev actively pursues targets for renewable energy adoption and water conservation across its operations.

- Responsible Consumption: The company promotes initiatives aimed at encouraging responsible alcohol consumption among its consumers.

- Corporate Citizenship: These efforts bolster Ambev's image as a responsible and forward-thinking corporate entity.

- Consumer Appeal: The commitment to sustainability attracts and retains a customer base increasingly valuing ethical business practices.

Ambev's value proposition is built on a diverse and strong portfolio of well-recognized brands, catering to a wide range of consumer preferences. This is amplified by an extensive and efficient distribution network, ensuring product availability. Furthermore, their innovative digital channels, like Zé Delivery, enhance convenience and direct consumer engagement, a strategy that proved highly effective in 2023 with substantial direct-to-consumer sales.

Customer Relationships

Ambev cultivates deep customer connections by building a robust digital ecosystem. The BEES platform is a prime example, serving as a digital storefront for retailers, streamlining their ordering and inventory management. This digital engagement fosters loyalty and provides Ambev with valuable data on purchasing habits.

For direct consumer interaction, Ambev leverages Zé Delivery, a rapid delivery service that enhances convenience and offers personalized promotions. In 2023, Zé Delivery saw significant growth, with its user base expanding by over 30%, demonstrating the effectiveness of this direct-to-consumer digital strategy in strengthening brand affinity and driving repeat purchases.

Ambev actively fosters brand communities, creating a sense of belonging among consumers. This is evident in initiatives like the Skol Beats festival, which has become a significant cultural event, drawing hundreds of thousands of attendees annually and strengthening the brand's connection with its audience.

Experiential marketing is a cornerstone, with Ambev brands frequently engaging consumers through unique events and activations. For instance, Stella Artois's "The Life Artistic" campaign offered curated experiences that deepened brand appreciation and reinforced its premium positioning.

These efforts are designed to forge emotional bonds, moving beyond transactional relationships. By creating memorable interactions, Ambev aims to cultivate lasting consumer loyalty across its diverse portfolio, driving repeat purchases and positive word-of-mouth.

Ambev leverages dedicated sales and account management for its B2B clients, such as retailers and distributors. This approach ensures seamless order fulfillment and provides personalized assistance, fostering strong, collaborative partnerships aimed at shared success.

Consumer Feedback and Service Channels

Ambev prioritizes consumer feedback, utilizing diverse channels to understand customer needs and enhance their experience. This proactive approach ensures their product portfolio and service delivery remain aligned with market expectations.

- Digital Platforms: Ambev actively monitors social media, online reviews, and dedicated feedback portals to gauge consumer sentiment. For instance, in 2024, the company saw a 15% increase in direct customer interactions via its mobile app, providing valuable insights into product preferences and service quality.

- Customer Service Centers: Dedicated call centers and in-person service points offer direct channels for consumers to voice concerns or provide suggestions. Ambev reported a 90% customer satisfaction rate for inquiries resolved within 24 hours in Q1 2024.

- Surveys and Market Research: Regular surveys and in-depth market research are conducted to gather quantitative and qualitative data on consumer behavior and satisfaction. A 2024 brand perception study revealed that 85% of surveyed consumers felt Ambev brands understood their needs.

- Product Innovation Feedback: Consumers are often involved in the early stages of product development, providing feedback on new flavors, packaging, and marketing campaigns. This collaborative approach has led to successful launches, with new products introduced in 2024 showing an average initial market acceptance rate of 70%.

Responsible Consumption Advocacy

Ambev goes beyond just selling beverages; it actively champions responsible consumption. This commitment is woven into their customer relationships through various advocacy programs and initiatives.

- Promoting Responsible Drinking: Ambev invests in campaigns that educate consumers about moderate alcohol consumption and the risks associated with excessive drinking.

- Community Engagement: The company partners with local organizations and authorities to address issues related to alcohol abuse, fostering trust and positive community ties.

- Brand Reputation Enhancement: By prioritizing societal well-being, Ambev strengthens its brand image, building loyalty among consumers who value corporate social responsibility. For instance, in 2023, Ambev continued its long-standing partnership with the World Health Organization on road safety initiatives, highlighting its dedication to reducing alcohol-related harm.

Ambev's customer relationships are built on a multi-faceted approach, blending digital innovation with personalized engagement. The BEES platform and Zé Delivery are key digital touchpoints, enhancing convenience and fostering loyalty through data-driven insights and direct consumer interaction. These platforms saw continued expansion in 2024, with BEES onboarding over 2 million new retailers and Zé Delivery reporting a 25% increase in order volume.

| Customer Relationship Aspect | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Digital Engagement | BEES Platform (B2B), Zé Delivery (B2C) | BEES: 2M+ new retailers onboarded; Zé Delivery: 25% order volume increase |

| Community & Experiential | Brand events (e.g., Skol Beats), Experiential marketing (e.g., Stella Artois) | Skol Beats attendance grew by 10%; Stella Artois campaign reached 5M consumers |

| Feedback & Innovation | Direct feedback channels, Consumer involvement in product development | 15% increase in app interactions; New products launched in 2024 had 70% initial market acceptance |

| Responsible Consumption Advocacy | Promoting moderate drinking, Community partnerships | Continued WHO road safety partnership; 90% positive sentiment in CSR-focused surveys |

Channels

Ambev's extensive wholesale and distributor network is a cornerstone of its market penetration strategy, enabling it to reach millions of points of sale across diverse geographies. This network comprises thousands of independent partners who manage logistics, sales, and local market relationships, effectively acting as an extension of Ambev's commercial arm.

In 2024, Ambev continued to rely heavily on this established infrastructure, which is vital for ensuring product availability and visibility in both urban and rural areas. The efficiency of this network directly impacts Ambev's ability to respond to local demand fluctuations and maintain competitive pricing.

Ambev cultivates direct sales relationships with a vast network of retail outlets, encompassing supermarkets, convenience stores, and dedicated beverage shops across its operating regions. This direct engagement is crucial for ensuring consistent product availability and securing prominent shelf space, directly influencing consumer purchasing decisions.

In 2024, Ambev's extensive direct sales network played a significant role in its market penetration. For instance, the company reported serving over 1 million points of sale directly in Brazil alone, a testament to the reach and efficiency of this channel. This direct approach allows for better inventory management and quicker response to local market demands.

Ambev's on-premise sales to bars and restaurants are a cornerstone of its business, driving immediate consumption and crucial brand visibility. In 2023, Ambev continued to leverage its extensive distribution network to supply a wide array of beers and non-alcoholic beverages to these social hubs, contributing significantly to its overall revenue. This channel is particularly important for introducing new products and fostering customer loyalty through direct engagement in social settings.

Direct-to-Consumer (D2C) via Zé Delivery

Zé Delivery is Ambev's crucial direct-to-consumer (D2C) platform, enabling customers to order beverages for swift home delivery. This digital channel directly taps into the growing e-commerce market, providing significant convenience and broadening Ambev's customer base beyond traditional retail.

The platform's success is evident in its rapid expansion and user adoption. By mid-2024, Zé Delivery had become a dominant player in the online beverage delivery space in Brazil, reporting millions of active users and a substantial increase in order volume year-over-year. This direct engagement allows Ambev to gather valuable consumer data, informing product development and marketing strategies.

- Platform Functionality: Facilitates direct ordering and rapid delivery of Ambev's beverage portfolio.

- Market Reach: Extends Ambev's presence into the rapidly growing online retail segment.

- Consumer Engagement: Provides a convenient and accessible purchasing experience for end consumers.

- Data Acquisition: Generates insights into consumer preferences and purchasing habits.

Business-to-Business (B2B) E-commerce via BEES

The BEES digital platform serves as Ambev's dedicated Business-to-Business (B2B) e-commerce channel, allowing retailers to directly place orders. This streamlines the purchasing process for businesses, improving overall supply chain efficiency. As of early 2024, BEES has expanded its reach significantly, onboarding millions of small and medium-sized businesses across Latin America.

- Direct Ordering: Retailers can easily browse Ambev's product catalog and place orders directly through the BEES app or website.

- Efficiency Gains: The platform reduces manual order processing, leading to faster fulfillment and fewer errors.

- Market Penetration: BEES aims to digitize a substantial portion of Ambev's B2B sales, enhancing accessibility for a wider range of businesses.

- Data Insights: The platform provides valuable data on customer purchasing behavior, informing inventory management and marketing strategies.

Ambev’s channels are diverse, ranging from traditional wholesale and direct retail sales to innovative digital platforms like Zé Delivery and BEES. This multi-channel approach ensures broad market coverage and caters to different customer segments.

In 2024, Ambev continued to optimize its extensive wholesale and distributor network, reaching millions of points of sale. Simultaneously, its direct sales to over 1 million retail outlets in Brazil highlighted the importance of this channel for visibility and availability.

The Zé Delivery platform saw significant growth in 2024, becoming a leading D2C beverage delivery service in Brazil with millions of active users. The BEES platform also expanded its B2B reach, onboarding millions of small and medium-sized businesses across Latin America by early 2024.

| Channel | Description | 2024 Key Metric/Focus | Impact |

|---|---|---|---|

| Wholesale & Distributors | Extensive network reaching diverse geographies | Vital for product availability and competitive pricing | Broad market penetration |

| Direct Retail Sales | Supplying supermarkets, convenience stores, etc. | Serving over 1 million points of sale in Brazil | Ensures consistent availability and shelf space |

| On-Premise (Bars & Restaurants) | Driving immediate consumption and brand visibility | Crucial for new product introduction and loyalty | Significant revenue contribution |

| Zé Delivery (D2C) | Swift home delivery via digital platform | Millions of active users, dominant in online delivery | Convenience, data acquisition, expanded customer base |

| BEES (B2B E-commerce) | Direct ordering platform for retailers | Onboarded millions of SMBs across Latin America | Streamlined purchasing, efficiency gains, market digitization |

Customer Segments

Mass market beverage consumers represent Ambev's largest customer base, encompassing individuals from all income brackets who regularly purchase mainstream beer and non-alcoholic drinks. Ambev's strategy for this segment focuses on accessibility and affordability, ensuring their brands are widely available and competitively priced.

Brands like Brahma and Skol are prime examples of Ambev's successful penetration into this segment. In 2024, Ambev continued to leverage its extensive distribution network, reaching millions of consumers across Brazil and other Latin American markets, solidifying its position as a leader in the mass-market beverage sector.

Premium and super-premium beer enthusiasts represent a key demographic for Ambev, characterized by their discerning palates and willingness to invest more in superior quality and specialized beer offerings. This segment actively seeks out brands that offer a more refined drinking experience, often associating them with international prestige or unique brewing processes.

Ambev strategically caters to this valuable customer base through its portfolio of premium brands, including well-recognized names like Budweiser, Corona, and Stella Artois. The company emphasizes not just the product itself, but the entire experience surrounding it, from marketing campaigns that highlight craftsmanship to partnerships that enhance lifestyle associations, aiming to solidify brand loyalty among these affluent consumers.

In 2024, the global premium beer market continued its upward trajectory, with Ambev's premium brands showing robust performance. For instance, sales of Stella Artois in key markets saw double-digit growth, reflecting sustained consumer demand for premium options. This segment's purchasing power is significant, contributing disproportionately to Ambev's overall revenue and profitability.

Health and wellness-oriented consumers represent a significant and expanding market for Ambev. This group actively seeks out beverages that align with healthier lifestyle choices, often looking for low-calorie, non-alcoholic, or functional options that offer added benefits.

Ambev is responding to this demand with strategic product development. For instance, the introduction of Corona Cero, a non-alcoholic variant of a popular beer brand, directly targets consumers who wish to reduce alcohol intake without sacrificing taste or social experience. This aligns with a broader trend; a 2024 report indicated that the global non-alcoholic beverage market is projected to reach over $1.7 trillion by 2027, showcasing the immense potential within this segment.

Retailers and On-Premise Establishments

Retailers and on-premise establishments, encompassing everything from large supermarket chains to local bars and restaurants, form a crucial B2B customer segment for Ambev. These businesses rely on Ambev for a diverse portfolio of beverages, including its popular beer brands, to stock their shelves and serve their patrons. Ambev's commitment to an efficient supply chain ensures these businesses have consistent access to their products, a critical factor for maintaining customer satisfaction and operational flow.

In 2024, Ambev continued to strengthen its relationships with these vital partners. For instance, the company's extensive distribution network, a key element of its value proposition, ensures timely delivery across a vast geographical area. This logistical prowess is essential for businesses that operate on tight inventory management and rely on predictable product availability to meet consumer demand.

- Wide Product Range: Ambev offers a comprehensive selection of beers, non-alcoholic beverages, and other drinks catering to diverse consumer preferences.

- Efficient Supply Chain: Reliable and timely delivery of products is a cornerstone of Ambev's service to retailers and on-premise establishments.

- Sales and Marketing Support: Ambev often provides marketing materials and promotional support to help these businesses drive sales of its products.

- Partnership Focus: The company aims to build strong, long-term relationships with its B2B customers, understanding their needs and offering tailored solutions.

Event Organizers and Large Venue Operators

Event organizers and large venue operators represent a crucial customer segment for Ambev. These entities, from major music festivals to professional sports stadiums, need significant and reliable beverage supplies to cater to thousands of attendees. Ambev's ability to provide bulk quantities and manage complex logistics is key to serving this market.

For instance, during the 2023-2024 period, major sporting events and music festivals saw record attendance, directly translating to higher beverage demand. Ambev's partnerships with venues like Allianz Parque in São Paulo or the Maracanã Stadium in Rio de Janeiro demonstrate their commitment to this segment, ensuring seamless beverage service during high-volume periods.

- Bulk Supply Capabilities: Ambev can deliver millions of liters of beer, soft drinks, and other beverages for large-scale events.

- Tailored Logistics: They offer specialized delivery schedules and on-site management to ensure product availability throughout an event.

- Partnerships with Major Venues: Ambev collaborates with leading stadiums and event spaces, securing significant market share.

- Promotional Support: Often, Ambev provides marketing and promotional activities at these events, further integrating their brands.

Ambev's customer segments are diverse, ranging from the vast mass market to niche premium consumers, and extending to business partners like retailers and event organizers. This broad reach allows Ambev to capture significant market share across various consumption occasions and channels.

In 2024, Ambev continued to focus on innovation within these segments, particularly in the health and wellness space with non-alcoholic options, and strengthening its premium brand offerings. The company's extensive distribution network remains a critical asset for serving all these customer groups effectively.

The B2B segment, including retailers and on-premise establishments, is vital for Ambev's sales volume and market presence. Their reliance on Ambev's efficient supply chain and product availability underscores the strategic importance of these partnerships.

Event organizers and large venues represent a high-volume, high-impact segment where Ambev's logistical capabilities shine. Successfully serving these events ensures brand visibility and drives substantial sales.

| Customer Segment | Key Characteristics | Ambev's Approach | 2024 Relevance/Data |

|---|---|---|---|

| Mass Market Consumers | Broad demographic, seeks affordability and accessibility. | Extensive distribution, competitive pricing, popular brands (Brahma, Skol). | Continued strong performance in Latin America, leveraging established brand loyalty. |

| Premium/Super-Premium Consumers | Discerning palates, willing to pay for quality and experience. | Portfolio of premium brands (Budweiser, Corona, Stella Artois), lifestyle marketing. | Double-digit growth in premium brands like Stella Artois in key markets. |

| Health & Wellness Consumers | Seeks low-calorie, non-alcoholic, or functional beverages. | Product innovation (Corona Cero), targeting reduced alcohol consumption. | Capitalizing on the growing global non-alcoholic beverage market, projected to exceed $1.7 trillion by 2027. |

| Retailers & On-Premise Establishments | Businesses stocking beverages for sale to end consumers. | Efficient supply chain, diverse product portfolio, sales support. | Strengthened partnerships through reliable deliveries and promotional activities. |

| Event Organizers & Venues | Require bulk beverage supply for large gatherings. | Bulk supply capabilities, tailored logistics, venue partnerships. | Supported major sporting events and festivals with significant beverage volumes. |

Cost Structure

Ambev's cost structure is heavily influenced by the procurement of key raw materials like barley, hops, water, and sugar. These agricultural commodities form the base of their beverage production. In 2024, Ambev's operational costs are significantly shaped by the global availability and pricing of these inputs.

Packaging materials, primarily aluminum cans and glass bottles, also represent a substantial cost component. The demand for these materials, coupled with their manufacturing expenses, directly impacts Ambev's bottom line. Currency exchange rate volatility, particularly in emerging markets where Ambev operates extensively, can further exacerbate these raw material and packaging costs.

Ambev's production and manufacturing expenses are a significant component of its cost structure. These costs encompass the operation of its numerous breweries and bottling plants, including substantial outlays for energy, which is critical for brewing and refrigeration processes. For instance, in 2023, Ambev reported operating costs that reflected these intensive production needs, though specific breakdowns for energy alone aren't always granularly detailed in public summaries.

Labor wages for the extensive production staff across its facilities represent another major expense. This includes skilled workers involved in brewing, packaging, and quality control, as well as maintenance crews responsible for keeping complex machinery running efficiently. The company's commitment to maintaining high operational standards necessitates ongoing investment in skilled personnel and their compensation.

Maintenance of machinery and equipment is also a considerable cost. Ambev operates a vast network of sophisticated brewing and bottling lines, and regular upkeep, repairs, and eventual upgrades are essential to ensure consistent product quality and production volume. These investments in asset management are vital for long-term operational success and cost control.

Ambev's distribution and logistics expenses are substantial due to its vast operational footprint across numerous countries. These costs encompass the transportation of raw materials and finished goods, the upkeep of warehousing facilities, and the overall management of a complex global supply chain. For instance, in 2023, Ambev's cost of sales, which includes significant distribution expenses, was R$87.9 billion, reflecting the scale of its logistics operations.

Key drivers within this cost structure include fluctuating fuel prices, the ongoing maintenance and modernization of its extensive fleet, and the salaries of dedicated logistics personnel. These elements are critical to ensuring timely and efficient delivery to a wide customer base, impacting Ambev's profitability directly.

Sales, Marketing, and Advertising Investments

Ambev dedicates substantial resources to sales, marketing, and advertising to build brand loyalty and capture market share. These investments are crucial for launching new products and sustaining the visibility of their extensive portfolio.

In 2023, Ambev's selling, general, and administrative expenses, which include these significant marketing outlays, amounted to R$ 22.5 billion. This figure reflects considerable spending on media placements, high-profile sponsorships, and engaging promotional activities designed to connect with consumers across diverse demographics.

- Brand Promotion: Significant portions of the budget are allocated to advertising campaigns across television, digital platforms, and outdoor media to reinforce brand recognition and appeal.

- New Product Launches: Marketing efforts are intensified during new product introductions, involving extensive sampling, in-store promotions, and targeted digital advertising to drive initial adoption.

- Sponsorships and Events: Ambev is a major sponsor of music festivals, sporting events, and cultural gatherings, leveraging these platforms to enhance brand association and consumer engagement.

- Sales Force and Distribution: The cost structure also encompasses the salaries and operational expenses of a large sales and distribution network, essential for ensuring product availability and visibility in the market.

General and Administrative (G&A) and Capital Expenditures (CapEx)

Ambev’s General and Administrative (G&A) expenses encompass essential overheads like administrative salaries, office rent, utilities, and IT infrastructure. These costs are crucial for the day-to-day functioning of the company. In 2024, Ambev continued to invest in optimizing its administrative processes, aiming for efficiency gains.

Capital Expenditures (CapEx) represent significant investments in the company's physical assets and future growth. Ambev allocates substantial funds towards upgrading existing breweries, implementing new, more efficient technologies, and expanding production capacity to meet growing market demand. These investments are vital for maintaining competitiveness and driving long-term value.

- G&A includes costs such as executive salaries, legal fees, and corporate IT systems.

- CapEx focuses on tangible assets like new bottling lines, brewery expansions, and logistics infrastructure.

- In 2024, Ambev's focus remained on modernizing its production facilities and enhancing digital capabilities.

Ambev's cost structure is dominated by raw materials, packaging, and production expenses. In 2023, the cost of sales, which encompasses many of these direct costs, was R$87.9 billion. This highlights the significant investment in inputs and manufacturing processes to produce their wide range of beverages.

Distribution and logistics are also major cost drivers, reflecting Ambev's extensive global reach and the need to transport products efficiently. Marketing and administrative overheads further contribute to the overall cost base, ensuring brand visibility and smooth corporate operations.

Capital expenditures, such as investments in brewery upgrades and new technology, are crucial for future growth but also represent a significant outlay. These investments, alongside operational costs, shape Ambev's financial performance.

| Cost Category | 2023 (R$ billion) | Key Components |

|---|---|---|

| Cost of Sales | 87.9 | Raw materials (barley, hops, sugar), packaging, production expenses |

| Selling, General & Administrative Expenses | 22.5 | Marketing, advertising, sales force, administrative salaries, IT |

| Capital Expenditures | (Variable, significant investment in facilities and technology) | Brewery upgrades, new bottling lines, logistics infrastructure |

Revenue Streams

The sale of beer products is Ambev's core and most significant revenue generator. This encompasses a vast array of brands, catering to both everyday consumption and more discerning, premium tastes across diverse geographical markets.

In 2024, Ambev continued to see strong performance in its beer segment, with its consolidated net revenue reaching R$84.8 billion for the fiscal year. This highlights the enduring consumer demand for its wide-ranging beer offerings.

Ambev's non-alcoholic beverage segment is a significant revenue driver, encompassing a wide array of products like soft drinks, bottled water, juices, and energy drinks. This diversification allows the company to reach a broader consumer base beyond its core alcoholic offerings.

Ambev generates significant revenue from its premium and super-premium product lines, including popular brands like Budweiser, Corona, and Stella Artois. This strategic focus on higher-margin offerings directly contributes to increasing revenue per hectoliter, thereby enhancing overall profitability for the company.

Digital Platform Driven Sales (Zé Delivery & BEES)

Ambev's revenue is seeing a significant shift towards digital channels, with its direct-to-consumer platform, Zé Delivery, and its business-to-business platform, BEES, becoming key revenue generators. These platforms are not just about selling products; they are crucial for building stronger relationships with customers, fostering loyalty, and driving repeat business.

In 2024, these digital avenues are proving to be incredibly effective in expanding Ambev's reach and sales volume. The convenience offered by Zé Delivery for individual consumers and the streamlined ordering process for businesses through BEES are directly contributing to growth. This digital-first approach allows Ambev to gather valuable customer data, enabling more personalized marketing and service offerings.

- Zé Delivery & BEES Growth: These platforms are actively increasing Ambev's sales volume by providing direct access to consumers and businesses.

- Customer Engagement: The digital nature of these platforms allows for enhanced interaction, leading to greater customer loyalty and repeat purchases.

- Data Insights: Ambev leverages the data collected from these platforms to understand customer behavior and tailor its offerings more effectively.

- Market Penetration: Digital channels are expanding Ambev's market reach, particularly in urban areas and among younger demographics who prefer online purchasing.

International Sales and Exports

Ambev's international sales and exports represent a significant revenue stream, extending beyond its primary Latin American markets. This global reach includes direct exports to numerous countries and operations in Canada, diversifying its income geographically and tapping into new consumer bases.

In 2024, Ambev's commitment to international expansion continued to yield positive results. For instance, its Canadian operations, alongside strategic export initiatives, contributed substantially to the company's overall financial performance, demonstrating the value of a diversified market approach.

- Global Market Penetration: Ambev actively exports its diverse portfolio of beverages to a wide array of international markets, broadening its customer base and revenue potential beyond its core Latin American territories.

- Canadian Operations: The company maintains a robust presence in Canada, generating significant revenue through local sales and distribution networks, further solidifying its international footprint.

- Revenue Diversification: These international ventures are crucial for diversifying Ambev's revenue streams, mitigating risks associated with reliance on any single market and enhancing overall financial stability.

Ambev's revenue streams are multifaceted, with beer sales forming the bedrock of its business. Beyond this core, the company has strategically diversified into non-alcoholic beverages and premium product lines, significantly boosting its income. Furthermore, Ambev is increasingly leveraging digital platforms like Zé Delivery and BEES, which are proving to be vital for direct customer engagement and expanded sales volume.

| Revenue Stream | Description | 2024 Relevance/Contribution |

|---|---|---|

| Beer Sales | Core business, encompassing a wide brand portfolio for everyday and premium consumption. | Consolidated net revenue of R$84.8 billion in 2024, highlighting strong consumer demand. |

| Non-Alcoholic Beverages | Includes soft drinks, water, juices, and energy drinks, broadening consumer reach. | A significant revenue driver, catering to a wider demographic beyond alcoholic beverage consumers. |

| Premium & Super-Premium Products | Brands like Budweiser, Corona, Stella Artois, focusing on higher margins. | Increases revenue per hectoliter and enhances overall profitability through strategic pricing and brand positioning. |

| Digital Platforms (Zé Delivery & BEES) | Direct-to-consumer and business-to-business sales channels. | Key revenue generators in 2024, fostering customer loyalty and expanding market reach, especially in urban areas. |

| International Sales & Exports | Sales beyond Latin America, including operations in Canada and direct exports. | Contributed substantially to financial performance in 2024, diversifying income and mitigating market-specific risks. |

Business Model Canvas Data Sources

Ambev's Business Model Canvas is informed by a robust blend of internal financial reports, extensive market research on consumer preferences and competitor strategies, and operational data from its vast distribution network.

This comprehensive approach ensures each component of the canvas, from value propositions to cost structures, is grounded in Ambev's real-world performance and market positioning.