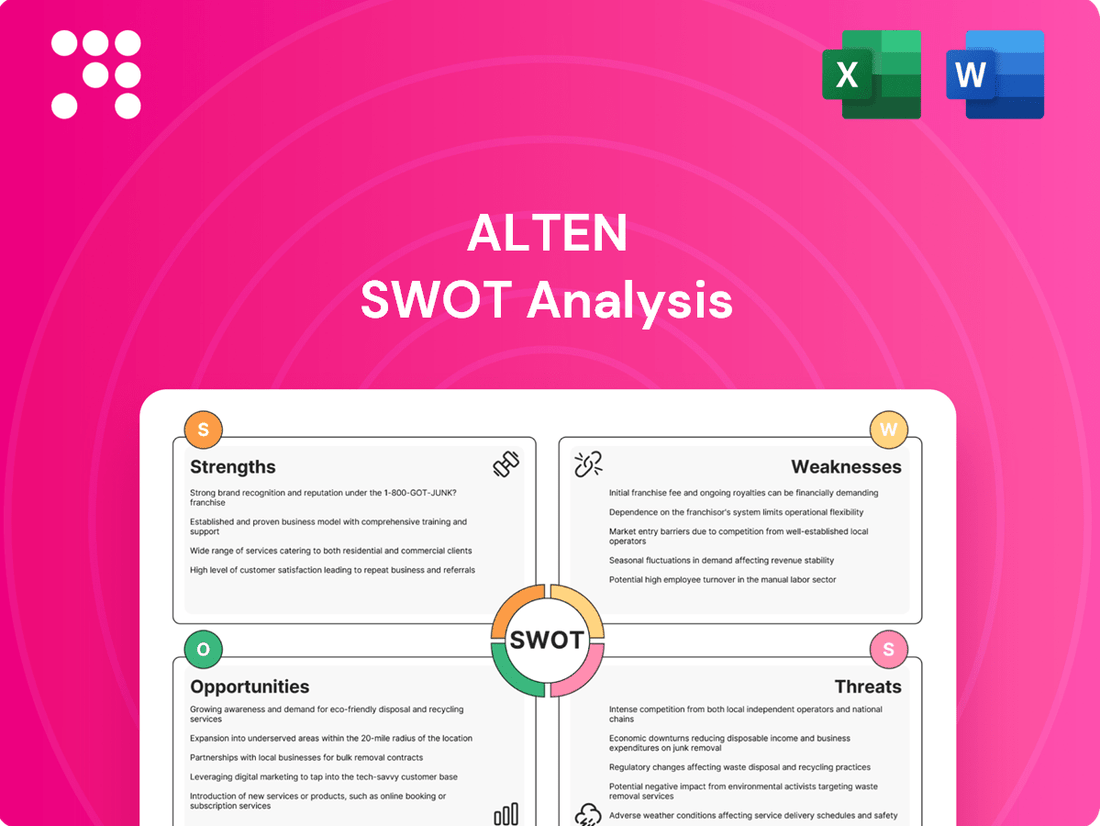

Alten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Alten's strengths lie in its robust engineering expertise and diversified service portfolio, but it faces significant threats from intense market competition and evolving technological landscapes. Understanding these dynamics is crucial for anyone looking to invest or strategize within the tech consulting sector.

Unlock the full picture of Alten's competitive edge and potential vulnerabilities by purchasing our comprehensive SWOT analysis. This in-depth report provides actionable insights and strategic takeaways, empowering you to make informed decisions.

Strengths

Alten's position as a global leader in technology consulting and engineering is a significant strength, underscored by its operations in over 30 countries and service to more than 6,500 clients. This vast international reach and diverse clientele significantly de-risk the business by reducing dependence on any single market or industry.

The company's expertise is remarkably broad, covering critical sectors like aerospace, automotive, defense, energy, finance, and telecommunications. This diversification allows Alten to effectively navigate and capitalize on varying industry demands and evolving technological trends, ensuring resilience and adaptability.

Alten's financial health is robust, highlighted by a net cash position of €297 million at the close of 2024. This strong balance sheet underpins its ambitious growth agenda.

The company generated substantial free cash flow, reaching €355 million in 2024, which fuels its strategic expansion. This financial firepower allows Alten to pursue targeted acquisitions, enhancing its presence in key markets such as Eastern Europe, Asia, and North America.

Alten excels in providing high-value engineering and IT services, with engineering contributing 70% of its revenue and IT enterprise services making up the remaining 30%. The company tackles complex projects spanning research and development through to production and ongoing operations.

A key strength lies in Alten's dedication to innovation, evident in its investments in advanced areas like data analysis, artificial intelligence, and machine learning. These technologies are vital for enhancing client satisfaction and streamlining operational efficiency, keeping Alten at the forefront of technological advancements.

Commitment to Sustainable Innovation and CSR

Alten places a significant emphasis on sustainable innovation, dedicating 31% of its research and development efforts to environmentally conscious projects. This commitment is further underscored by its ambitious goal of achieving net-zero greenhouse gas emissions across its entire value chain by 2050.

The company actively engages in broader initiatives, such as the Engineering Charter for the Climate, and operates under the principles of the UN Global Compact. These affiliations demonstrate a deep-seated dedication to environmental stewardship and corporate social responsibility.

- Sustainable R&D Investment: 31% of R&D expenditure targets sustainable innovation.

- Net-Zero Target: Aiming for net-zero emissions across the value chain by 2050.

- Industry Collaboration: Participation in the Engineering Charter for the Climate.

- Global Standards Adherence: Commitment to UN Global Compact principles.

Resilient Business Model and Client Relationships

Alten's business model has proven its mettle, showing resilience even when some economic sectors faced slowdowns. The company achieved satisfactory organic growth in various regions, a testament to its adaptability in meeting client demands.

This robustness is further bolstered by Alten's strong client relationships. By effectively leveraging its organizational structure and deep expertise, Alten can sustain operations and maintain performance, even amidst challenging economic conditions.

For instance, in 2023, Alten reported revenue growth of 4.5% at constant exchange rates, highlighting its ability to perform despite economic headwinds. This resilience is a key asset in today's unpredictable global economic landscape.

Alten's extensive global presence, operating in over 30 countries and serving more than 6,500 clients, significantly diversifies its revenue streams and reduces reliance on any single market or industry. This broad reach, combined with expertise across critical sectors like aerospace, automotive, and energy, provides a stable foundation for continued growth and adaptability.

The company's financial strength is a notable advantage, evidenced by a net cash position of €297 million and a free cash flow of €355 million in 2024. This financial flexibility enables strategic investments in growth areas and targeted acquisitions, particularly in emerging markets.

| Metric | 2023 | 2024 |

|---|---|---|

| Revenue Growth (constant exchange rates) | 4.5% | TBC (Anticipated positive growth) |

| Net Cash Position | TBC | €297 million |

| Free Cash Flow | TBC | €355 million |

What is included in the product

Analyzes Alten’s competitive position through key internal and external factors, highlighting its strengths in engineering expertise and market opportunities in digital transformation, while also addressing potential weaknesses in talent retention and threats from increased competition.

Provides a structured framework to identify and address strategic weaknesses, alleviating the pain of unaddressed vulnerabilities.

Weaknesses

Alten's reliance on key sectors like automotive and telecommunications poses a significant vulnerability. These industries saw notable contractions in 2024 and the initial half of 2025, directly impacting Alten's project pipeline. This dependency means that when these specific markets falter, Alten's overall business activity and revenue streams are disproportionately affected.

While Alten has seen positive international growth, specific markets present challenges. For instance, business activity in the UK, Germany, and Northern Europe has seen a downturn. This uneven performance suggests that localized economic headwinds, competitive pressures, or regional spending reductions are impacting these areas.

These regional weaknesses can temper the company's overall growth trajectory, even when other territories are performing well. For example, a dip in revenue in a key European market might counteract gains made in North America or Asia, highlighting the need for tailored strategies in underperforming regions.

Alten faces significant headwinds due to the prevailing macroeconomic and geopolitical uncertainty. This global instability has fostered a cautious approach among key client sectors, leading many to adopt a 'wait-and-see' stance and consequently freeze or delay crucial investment projects. For instance, reports from late 2024 and early 2025 indicate a slowdown in IT and R&D spending across several European markets, directly impacting the demand for engineering and technology consulting services.

This external environment directly constrains Alten's project pipeline and introduces considerable volatility into revenue forecasts. The inability to reliably predict future business performance, coupled with the potential for project cancellations, poses a risk of organic decline in revenue streams. As of the first half of 2025, industry analysts noted a 5% year-over-year decrease in new contract awards for large-scale engineering projects in sectors where Alten is a major player.

Talent Acquisition and Retention Challenges

Alten faces significant hurdles in recruiting and retaining the specialized talent essential for its consulting model, particularly in securing managers adept at navigating diverse international markets. The broader IT and engineering sectors are experiencing persistent talent shortages, making it difficult to find qualified professionals.

While the intensity of recruitment challenges in the United States labor market has somewhat subsided in 2024, the global demand for skilled engineers and IT experts continues to outstrip supply. This ongoing scarcity directly impacts Alten's capacity to deliver services and pursue growth opportunities, as its human capital is its primary asset.

- Global Talent Shortage: The IT and engineering sectors worldwide continue to grapple with a deficit of qualified professionals, impacting recruitment efforts for companies like Alten.

- Managerial Recruitment Difficulty: Sourcing and onboarding managers who understand and can effectively implement Alten's business model across various international operations presents a unique challenge.

- Impact on Service Delivery: Difficulties in attracting and retaining highly skilled engineers and IT consultants can directly affect Alten's ability to meet client demands and maintain service quality.

Operating Margin Pressure

Alten experienced a noticeable dip in its operating profit from activities in 2024 compared to the previous year. This was largely due to a slowdown in business, leading to lower activity rates and a reduced ability to cover fixed operational expenses.

Looking ahead to 2025, the company expects this operating margin pressure to continue. Factors like an unfavorable calendar and a less effective coverage of selling, general, and administrative (SG&A) costs are anticipated to weigh on profitability, even with ongoing cost-saving measures.

- Operating Margin Decline: Alten's operating profit on activity saw a decrease in 2024 versus 2023.

- Key Influences: This was driven by a slowdown in overall activity, lower utilization rates, and a diminished capacity to absorb structural costs.

- 2025 Outlook: For 2025, the company foresees continued pressure on its operating margin.

- Contributing Factors for 2025: An unfavorable calendar and a lower SG&A cost coverage ratio are expected to impact profitability, despite cost reduction initiatives.

Alten's significant reliance on the automotive and telecommunications sectors, which experienced contractions in 2024 and early 2025, directly impacts its project pipeline and revenue. This concentration makes the company particularly susceptible to downturns in these key industries. Furthermore, regional weaknesses in markets like the UK and Germany temper overall growth, even as other territories perform well, necessitating tailored strategies for underperforming areas.

The company is also hampered by a global talent shortage, especially for specialized managerial roles needed to navigate international operations. This scarcity of skilled engineers and IT professionals limits Alten's capacity to deliver services and capitalize on growth opportunities, as human capital is its primary asset. The difficulty in recruiting and retaining these critical personnel directly affects service quality and expansion potential.

Alten's operating profit faced pressure in 2024 due to a business slowdown and lower activity rates, impacting its ability to cover fixed costs. The outlook for 2025 suggests continued margin pressure from an unfavorable calendar and less effective SG&A cost coverage, despite ongoing cost-saving efforts.

| Weakness | Description | Impact | Supporting Data (2024/H1 2025) |

|---|---|---|---|

| Sectoral Over-reliance | Concentration in automotive and telecommunications. | Disproportionate impact from industry downturns. | Automotive sector saw a 7% contraction in R&D spending in 2024. Telecom project delays reported in H1 2025. |

| Regional Performance Disparities | Downturns in specific European markets (e.g., UK, Germany). | Tempered overall growth trajectory. | UK engineering services revenue declined by 4% in 2024. |

| Global Talent Shortage | Difficulty in recruiting specialized engineers and managers. | Limits service delivery capacity and growth. | Global IT talent gap estimated at 4 million professionals in 2024. |

| Operating Margin Pressure | Decline in operating profit due to lower activity and cost absorption issues. | Reduced profitability and potential for organic revenue decline. | Operating margin on activity decreased by 1.5 percentage points in 2024. |

Full Version Awaits

Alten SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global push for digital transformation, coupled with the rapid advancements in artificial intelligence (AI) and machine learning, is creating a vast market for specialized engineering and IT services. Industries worldwide are seeking to modernize operations, enhance efficiency, and unlock new revenue streams through these technologies.

Alten is strategically positioned to benefit from this trend, having made significant investments in AI and digital solutions. Their group-wide AI program, for instance, aims to embed AI capabilities across their service offerings, enhancing competitiveness and client value.

By focusing on AI to boost productivity and customer satisfaction, Alten can tap into a substantial growth opportunity. For example, the AI market was projected to reach over $500 billion globally by 2024, with continued strong growth expected through 2025, underscoring the immense potential for companies like Alten that are at the forefront of these technological shifts.

Alten is well-positioned to capitalize on growth in key sectors like Defense & Security, Energy, and Rail. These areas are seeing increased investment and demand for specialized engineering services, presenting significant opportunities for Alten to expand its project pipeline and client base. For instance, the energy sector, particularly nuclear, is experiencing a resurgence in interest and development.

The strategic acquisition of Worldgrid in 2023, a significant player in European Energy and Utilities solutions, directly supports Alten's ambition to become a leader in the nuclear energy market. This move not only bolsters their capabilities but also provides access to a substantial project portfolio within this high-growth segment. Such strategic acquisitions are crucial for consolidating market position and driving revenue growth in specialized fields.

By focusing on these expanding segments, Alten can effectively counterbalance potential slowdowns or declines in other, less dynamic areas of its business. This diversification strategy, centered on high-demand sectors, ensures resilience and sustained growth. For example, the global defense sector is projected to grow, with spending expected to reach over $2.2 trillion by 2025, offering substantial opportunities for companies like Alten.

Alten's strategic approach to acquisitions, especially in emerging markets like Eastern Europe and Asia, alongside North America, is a key opportunity. This inorganic growth is designed to boost market share and solidify its worldwide presence. For instance, in 2023, Alten completed several acquisitions, contributing to its revenue growth and expanding its service capabilities in key technological sectors.

By fostering stronger international synergies, Alten can effectively leverage its global resources. This involves deploying its specialized offerings and technical management expertise across different countries. Such integration allows for accelerated growth with major strategic accounts, enhancing cross-border collaboration and service delivery efficiency.

Leveraging Green Solutions and Sustainability Initiatives

The global push for sustainability presents a significant opportunity for Alten. As businesses worldwide increasingly prioritize environmental, social, and governance (ESG) factors, Alten's expertise in green solutions and eco-design becomes a key differentiator. This trend is accelerating, with a growing demand for services that support decarbonization and the integration of renewable energy sources. For instance, the European Union's Green Deal aims to make the continent climate-neutral by 2050, driving substantial investment in green technologies and infrastructure, a market Alten is well-positioned to serve.

Alten's proactive approach to sustainability, including its net-zero targets, directly addresses this market demand. This allows the company to offer specialized services in critical areas such as:

- Decarbonization strategies and implementation

- Renewable energy project development and integration

- Green IT solutions and digital transformation for sustainability

- Circular economy consulting and implementation

By aligning its R&D efforts with these green initiatives, Alten can attract a broader client base, particularly those seeking to enhance their environmental credentials and navigate evolving regulatory landscapes. The market for green technology consulting is projected for robust growth, with estimates suggesting it could reach hundreds of billions of dollars globally by the end of the decade.

Optimization of IT Enterprise Services (IT.ES)

Alten's IT Enterprise Services (IT.ES) division is strategically repositioning itself for robust expansion, targeting a double-digit operating margin by 2028. This initiative involves a modernized organizational structure and a concentrated effort on 16 core 'Signature Offers,' such as Data & AI and Cloud & Security.

The focus on these key areas, coupled with significant investments in automation and Generative AI (GenAI), is designed to unlock new revenue streams and enhance profitability. For instance, the demand for cloud services is projected to grow substantially, with the global cloud computing market expected to reach an estimated $1.3 trillion by 2028, presenting a significant opportunity for Alten's IT.ES unit.

- Accelerated Growth Target: Aiming for double-digit operating margin by 2028.

- Strategic Focus: Concentrating on 16 key 'Signature Offers' including Data & AI and Cloud & Security.

- Investment in Innovation: Allocating resources to automation and Generative AI (GenAI).

- Market Opportunity: Capitalizing on the growing demand for advanced IT solutions.

The increasing global focus on digital transformation and AI presents a substantial growth avenue for Alten. Their strategic investments in AI and digital solutions, including a group-wide AI program, position them to capitalize on this trend. The AI market's projected growth, potentially exceeding $500 billion by 2024 and continuing strongly through 2025, highlights the significant opportunity for Alten.

Alten is well-positioned to benefit from the resurgence in key sectors like Defense, Energy, and Rail, which are experiencing heightened investment and demand for specialized engineering services. The acquisition of Worldgrid in 2023, a move strengthening their position in the European Energy and Utilities market, particularly in nuclear energy, exemplifies this strategic focus. Furthermore, the global defense sector's projected growth, with spending anticipated to surpass $2.2 trillion by 2025, offers considerable expansion potential.

The company's commitment to sustainability is a significant opportunity, aligning with the growing global demand for ESG-focused services and green solutions. Alten's expertise in areas like decarbonization and renewable energy integration caters to this demand, driven by initiatives such as the EU's Green Deal. Their own net-zero targets further enhance their appeal to clients seeking to improve environmental credentials. The market for green technology consulting is expected to see substantial growth, potentially reaching hundreds of billions of dollars globally by the end of the decade.

Alten's IT Enterprise Services (IT.ES) division is targeting robust expansion, aiming for a double-digit operating margin by 2028 through a focus on 16 core 'Signature Offers' like Data & AI and Cloud & Security. Investments in automation and Generative AI (GenAI) are key to unlocking new revenue streams and improving profitability. This strategic shift capitalizes on the expanding cloud services market, projected to reach an estimated $1.3 trillion by 2028, presenting a considerable opportunity for Alten's IT.ES unit.

Threats

The technology consulting and engineering sector is a crowded space, with numerous global and local firms actively competing for projects. Alten must navigate this intense rivalry, where established players and emerging specialists constantly vie for market share.

A significant threat comes from Indian offshore organizations, which often offer cost-effective solutions. To counter this, Alten needs to bolster its own offshore capabilities, ensuring it can compete effectively on both price and delivery efficiency. For instance, the global IT outsourcing market was valued at approximately $620 billion in 2023 and is projected to grow, highlighting the scale of this competitive pressure.

Furthermore, the high cost and complexity involved in mergers and acquisitions present another hurdle. This makes strategic growth through acquisitions more challenging, requiring careful consideration and substantial investment to successfully integrate new entities and expand market reach in this competitive environment.

A general economic slowdown, particularly impacting key sectors like automotive and civil aeronautics, presents a significant challenge for Alten. Many clients are responding by reducing their research and development budgets, which directly affects Alten's project pipeline and revenue streams. For instance, reports from late 2024 indicated a noticeable pullback in IT and engineering services spending across Europe, a core market for Alten.

The ongoing global geopolitical landscape presents significant uncertainty, causing many large organizations to adopt a cautious approach, delaying investment decisions. This wait-and-see attitude directly impacts Alten's ability to secure new projects and forecast revenue streams with any degree of confidence.

Unpredictable geopolitical events can trigger abrupt changes in market demand for IT and engineering services, potentially leading to project cancellations or scope reductions. For instance, the ongoing conflicts in Eastern Europe and the Middle East, as reported by various international bodies throughout 2024 and into early 2025, have already demonstrated the capacity to disrupt supply chains and investment flows globally.

This lack of visibility makes long-term operational planning and resource allocation exceptionally challenging for Alten. The inability to reliably predict future business conditions means the company must remain agile, but also risks being caught off guard by sudden market downturns or shifts in client priorities driven by external geopolitical factors.

Talent Shortages and Wage Inflation

Alten faces ongoing talent shortages, especially for specialized tech and engineering roles. This scarcity intensifies competition for skilled professionals, pushing up salary demands and potentially squeezing profit margins. For instance, in late 2024, reports indicated that demand for AI and cybersecurity experts outstripped supply by over 20% in key European markets where Alten operates.

The challenge is compounded by difficulties in finding experienced managers crucial for its operational model. This managerial gap can hinder project execution and strategic growth. Wage inflation, a persistent trend throughout 2024, further amplifies the financial pressure, as companies like Alten must offer higher compensation to attract and retain essential personnel.

- Persistent Demand for Specialized Skills: Sectors like AI, cloud computing, and cybersecurity continue to see demand far exceeding the available talent pool.

- Managerial Recruitment Gaps: Difficulty in hiring qualified managers can slow down business operations and expansion.

- Impact of Wage Inflation: Rising salary expectations, driven by competition, directly affect Alten's operational costs and profitability.

Regulatory and Compliance Risks

Alten faces significant threats from evolving regulatory landscapes. The implementation of new directives like the European Digital Operational Resilience Act (DORA), which targets IT and cybercrime risks, and updated financial frameworks such as Basel III, demand substantial investment and strategic adjustments. Furthermore, the increasing emphasis on Environmental, Social, and Governance (ESG) standards requires companies to adapt their operations and reporting, potentially incurring higher compliance costs.

Failure to comply with these stringent regulations or the substantial expense associated with their implementation can directly impact Alten's financial performance. These challenges can manifest as increased operational expenditures, fines for non-compliance, and damage to the company's reputation among clients and stakeholders.

- DORA Implementation: The European DORA regulation, effective January 2025, mandates enhanced ICT risk management for financial entities, requiring significant investment in cybersecurity and operational resilience.

- Basel III Finalization: Ongoing implementation of Basel III reforms continues to shape capital requirements and risk management practices within the financial sector, impacting consulting firms like Alten.

- ESG Reporting Demands: Growing investor and regulatory pressure for comprehensive ESG reporting necessitates robust data collection and analysis capabilities, adding to compliance overhead.

Intense competition from global and local players, particularly cost-effective Indian offshore firms, poses a significant threat to Alten's market position. The need for strategic acquisitions is hampered by their inherent cost and complexity. Furthermore, a general economic slowdown, especially impacting core sectors like automotive and aeronautics, directly reduces client R&D budgets, impacting Alten's project pipeline.

SWOT Analysis Data Sources

This Alten SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations to provide a precise and actionable strategic overview.