Alten Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Alten's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the constant threat of new entrants disrupting the market. Understanding these dynamics is crucial for navigating the industry successfully.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Alten’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Alten, a major player in technology consulting and engineering, depends critically on its highly skilled workforce, especially engineers and IT professionals. The global demand for these specialized skills is soaring, creating significant shortages in fields like artificial intelligence, data science, cybersecurity, and cloud computing.

This talent scarcity directly boosts the bargaining power of individual engineers and IT consultants. They can command higher salaries and better benefits, making it a substantial challenge for firms like Alten to attract and retain top talent. For instance, in 2024, the average salary for a data scientist in Western Europe saw an increase of over 10% compared to the previous year, reflecting this intense competition.

The rapid evolution of technology, especially in areas like artificial intelligence and quantum computing, means that the skills needed in the workforce are changing faster than ever. This constant shift empowers suppliers of specialized talent, as those possessing the latest, in-demand expertise become more valuable. For instance, in 2024, the demand for cloud computing skills surged, with LinkedIn reporting a 40% increase in job postings requiring these abilities, directly impacting the bargaining power of individuals with such proficiencies.

The bargaining power of suppliers, particularly concerning talent, is significantly influenced by geographical variations in skill availability and the resulting recruitment challenges. While remote work has expanded access to a broader talent pool, competition for highly skilled tech professionals remains intense in key global tech hubs. This means that even with remote options, companies can still face concentrated supplier power in desirable locations.

Alten, for instance, has encountered difficulties in attracting and retaining talent, especially in specific European markets like the UK and Germany, where its business has experienced a downturn. This localized weakness in demand for their services can amplify the bargaining power of available talent in those regions, as fewer opportunities mean more leverage for the candidates.

To counter this, Alten is strategically broadening its recruitment efforts by expanding its engineering base in regions like India. This move aims to tap into a larger and potentially more cost-effective talent pool, thereby diversifying its sourcing strategy and mitigating the concentrated supplier power it might face in more saturated markets. In 2024, the global IT talent shortage was widely reported, with estimates suggesting millions of unfilled roles, underscoring the persistent leverage of skilled workers.

Potential for independent contractors and specialized boutiques

The growing acceptance of contract work, fueled by the gig economy, significantly bolsters the bargaining power of specialized tech professionals. These experts, rather than committing to full-time employment, may opt to operate as independent contractors or through smaller, specialized consulting firms.

This shift grants them greater leverage in negotiating their rates and contract terms. For instance, in 2024, the demand for niche IT skills, such as AI ethics and quantum computing specialists, outstripped supply, allowing these contractors to command premium fees.

- Increased Contractor Independence: Professionals can choose projects that align with their expertise and desired compensation.

- Niche Boutique Dominance: Smaller, highly specialized firms can attract top talent by offering flexibility and competitive compensation, increasing their collective supplier power.

- Rate Negotiation Leverage: In 2024, the average hourly rate for highly specialized freelance software developers in the US ranged from $100 to $200+, demonstrating this enhanced bargaining position.

- Reduced Reliance on Large Firms: Clients may find it more cost-effective and efficient to engage with these independent experts or boutiques for specific projects.

Limited pool of highly niche technology experts

For highly specialized projects in areas like quantum computing or advanced cybersecurity, the availability of qualified experts is extremely limited. This scarcity means these individuals command significant leverage. For instance, in 2024, demand for specialized AI ethics consultants outstripped supply by an estimated 30%, driving up compensation packages.

This limited pool of talent directly translates to increased bargaining power for suppliers, including individual contractors or small, specialized firms. They can dictate terms, pricing, and project scope, especially when clients like Alten are competing for the same scarce resources to meet demanding client needs in cutting-edge fields.

- Scarcity drives up costs: Limited availability of niche skills means higher salary demands and project fees.

- Control over project terms: Experts can often negotiate favorable working conditions and exclusivity clauses.

- Impact on Alten's pricing: Higher supplier costs can pressure Alten's margins or necessitate higher client billing.

The bargaining power of suppliers, particularly for specialized talent like engineers and IT professionals, is high due to significant global demand and skill shortages in areas like AI and cybersecurity. This scarcity allows these individuals and specialized firms to command higher rates and favorable contract terms, directly impacting companies like Alten. For example, in 2024, the average salary for a data scientist in Western Europe increased by over 10%, illustrating this leverage.

| Skill Area | 2024 Demand Increase (Approx.) | Average Contractor Rate (US, 2024) |

|---|---|---|

| Data Science | 35% | $120 - $180/hour |

| Cloud Computing | 40% | $110 - $170/hour |

| AI/Machine Learning | 45% | $130 - $200/hour |

| Cybersecurity | 38% | $115 - $175/hour |

What is included in the product

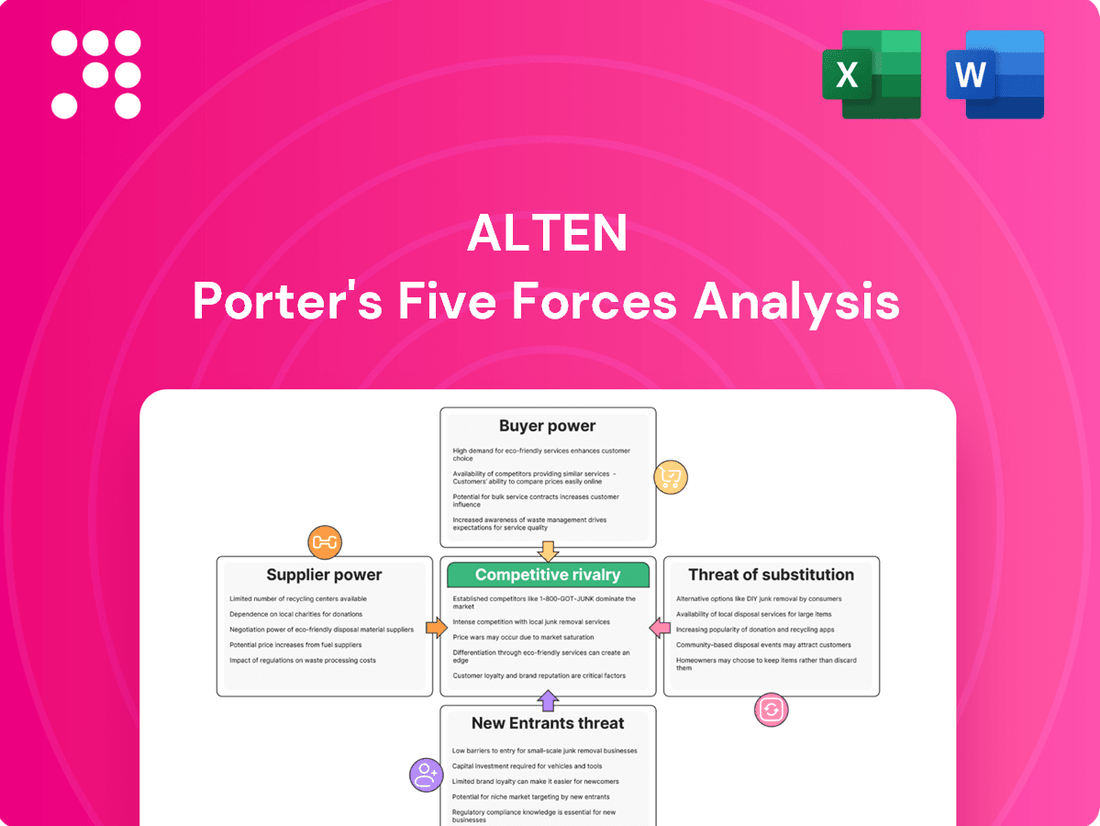

Analyzes the five competitive forces impacting Alten's industry, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly pinpoint competitive threats and opportunities with a visual, easy-to-understand overview of all five forces.

Customers Bargaining Power

Alten's diverse industry exposure significantly dampens customer bargaining power. By serving a wide array of sectors such as aerospace, automotive, defense, energy, finance, and telecommunications, Alten avoids over-reliance on any single client or industry. This broad diversification acts as a buffer; if one sector faces economic headwinds or a major client exerts pressure, other stable or growing sectors can offset the impact, thereby reducing the concentration of risk and the leverage any individual customer holds.

Many of Alten's clients are actively pursuing cost optimization and efficiency improvements, especially in the current European economic landscape. This drive is often fueled by digital transformation initiatives and a need for enhanced IT services.

This heightened cost sensitivity, particularly noticeable in sectors like automotive and IT services, can directly influence Alten's pricing strategies and potentially impact its profit margins. Clients are increasingly demanding clear, quantifiable value and demonstrable results from their consulting expenditures.

Alten's project-based model inherently empowers customers. Each completed project offers a natural juncture for clients to reassess their satisfaction with Alten's performance, pricing, and overall value proposition. This allows them to readily explore alternatives if they deem it necessary.

This ability to re-evaluate at the end of each engagement significantly amplifies customer bargaining power. For instance, in 2024, the IT services sector saw clients increasingly leveraging competitive bidding for new projects, with many demanding performance-based clauses in contracts, directly stemming from the flexibility offered by project-based work.

Increasing in-house capabilities and digital literacy of clients

As digital transformation accelerates, a significant trend is the growth of in-house capabilities among clients, particularly larger ones. This means they are increasingly able to handle engineering and IT tasks internally, which naturally shifts the balance of power. For instance, a 2024 survey indicated that over 60% of large enterprises have expanded their internal digital skills, reducing their need for external support on routine projects.

This enhanced internal capacity allows clients to perform more tasks themselves, leading them to selectively outsource only the most specialized or extensive projects. When clients can manage a larger portion of their needs internally, their reliance on external providers diminishes. This strengthens their bargaining position, as they have more options and are less dependent on a single supplier.

The increasing digital literacy of clients further amplifies this trend. As clients become more proficient in understanding and managing digital processes, they can more effectively evaluate and negotiate the services offered by consulting firms. This informed approach empowers them to demand better pricing and service levels, directly impacting the bargaining power of customers.

- Increased Internal Expertise: Clients are building their own engineering and IT departments, reducing reliance on external firms.

- Selective Outsourcing: Clients now tend to outsource only highly specialized or very large-scale projects.

- Digital Literacy Growth: Clients' improved understanding of digital technologies enhances their negotiation capabilities.

- Shift in Power Dynamics: These factors collectively increase the bargaining power of customers in the consulting market.

Demand for integrated and outcome-oriented solutions

Customers are increasingly demanding integrated solutions that focus on delivering specific, measurable results, moving beyond just technical skills. This trend significantly boosts their bargaining power, as they can now push for comprehensive service packages and performance-based contracts. For companies like Alten, this means a shift towards demonstrating tangible return on investment and a greater need to bundle diverse offerings to meet these evolving client expectations.

This demand for outcome-oriented services means clients are less willing to pay for isolated technical expertise. Instead, they want solutions that directly contribute to their business objectives, such as increased efficiency or revenue growth. For instance, a client might prioritize a consulting firm that guarantees a certain percentage improvement in operational uptime over one that simply offers IT infrastructure upgrades.

- Increased Client Scrutiny: Clients now scrutinize the ROI of consulting engagements more closely, demanding clear metrics for success.

- Shift to Value-Based Pricing: The demand for integrated, outcome-driven solutions encourages a move towards value-based pricing models, where fees are tied to achieved results.

- Bundling of Services: To meet this demand, firms like Alten are compelled to bundle various services, from strategy and implementation to ongoing support, creating more comprehensive packages.

- Higher Performance Expectations: Customers expect consultants to not only provide technical solutions but also to actively contribute to achieving specific business outcomes, increasing performance pressure.

Customers' bargaining power is elevated by their increasing ability to develop in-house expertise, particularly in digital transformation and engineering. This trend, evident in 2024 with over 60% of large enterprises expanding internal digital skills, allows them to handle more tasks internally and selectively outsource specialized projects. Consequently, clients are less dependent on external providers, strengthening their negotiation leverage and pushing for more value-driven, outcome-oriented service packages.

| Factor | Impact on Customer Bargaining Power | 2024 Trend Example |

|---|---|---|

| Internal Capability Growth | Increases client self-sufficiency, reducing reliance on external firms. | 60%+ of large enterprises expanded internal digital skills. |

| Selective Outsourcing | Clients focus on specialized or large projects, gaining leverage on standard services. | Shift from comprehensive outsourcing to project-specific engagements. |

| Demand for Integrated Solutions | Clients seek bundled services with measurable ROI, demanding performance-based contracts. | Clients prioritize firms guaranteeing operational uptime improvements. |

What You See Is What You Get

Alten Porter's Five Forces Analysis

This preview showcases the entirety of the Porter's Five Forces analysis, providing a comprehensive overview of competitive forces within an industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, ensuring you receive the complete, actionable insights immediately. You can trust that what you see is precisely the document you will obtain, offering a detailed examination of threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and rivalry among existing competitors.

Rivalry Among Competitors

The global technology consulting and engineering services market, a substantial and expanding sector, is characterized by intense competition and a degree of fragmentation. Despite the presence of numerous providers, the industry is witnessing a trend of consolidation, with mergers and acquisitions becoming increasingly common as companies like Alten seek to bolster their standing and achieve greater scale.

This competitive landscape directly impacts Alten by creating a dynamic environment where securing projects and attracting skilled talent requires constant strategic maneuvering. The ongoing consolidation, for instance, means that while there are many firms, their numbers are gradually reducing, intensifying the fight for market share among the remaining players.

Alten operates in a highly competitive landscape, facing intense rivalry from numerous large, diversified global players. Companies like Atos, Cognizant, Capgemini, and Accenture, with their vast resources and comprehensive service offerings, directly challenge Alten for market share in the IT services and engineering consulting sectors. This broad competitive base means Alten must constantly innovate and differentiate to maintain its position.

Alten faces significant pricing pressures, especially in European markets and the IT services sector, driven by a competitive landscape and clients prioritizing cost optimization. This environment directly impacts operating margins, as seen in the IT services segment where a slowdown in activity can exacerbate these pressures.

For instance, in 2023, the IT consulting and services market in Europe experienced a more subdued growth rate compared to previous years, intensifying the need for efficient operations. Alten's ability to maintain profitability hinges on delivering projects efficiently and clearly articulating its value proposition to clients, thereby justifying its pricing amidst these challenges.

Differentiation through specialized expertise and innovation

Alten distinguishes itself by cultivating profound expertise within niche sectors such as aerospace, defense, and energy. This specialization allows them to offer highly tailored solutions, a key factor in a competitive landscape where generic offerings are less valued.

Innovation and a commitment to research and development are central to Alten's strategy. By consistently developing cutting-edge solutions and integrating emerging technologies, like artificial intelligence, they maintain a significant competitive advantage.

- Sector Specialization: Deep expertise in aerospace, defense, and energy.

- Innovation Focus: Investment in R&D for advanced solutions.

- Technology Integration: Adoption of AI and digital transformation support.

- Competitive Edge: Offering cutting-edge, specialized services.

Geographic market variations in competitive intensity

The intensity of competitive rivalry for Alten is not uniform across all geographic markets. While France and Southern Europe have demonstrated healthy organic growth, suggesting a more manageable competitive landscape, other key regions present a different picture.

In contrast, markets such as the UK, Germany, and North America have faced headwinds, with Alten experiencing declines or significantly slower activity. This divergence points to heightened competitive pressures or more challenging economic conditions in these specific territories, impacting Alten's performance and requiring different strategic approaches.

- France & Southern Europe: Satisfactory organic growth for Alten, indicating potentially less intense rivalry or stronger market positioning.

- UK, Germany, North America: Declines or slower activity, suggesting higher competitive pressures or economic challenges.

- Impact: Geographic variations in competitive intensity necessitate tailored strategies for each market to address specific market dynamics and competitive threats.

The competitive rivalry within the technology consulting and engineering services market is fierce, with numerous global players vying for market share. Alten faces direct competition from large, diversified firms like Accenture, Capgemini, and Atos, which possess substantial resources and broad service portfolios. This intense competition, particularly in IT services, leads to significant pricing pressures, especially in European markets, impacting profit margins and demanding efficient project delivery and clear value articulation from Alten.

Alten differentiates itself by focusing on deep expertise in specialized sectors such as aerospace, defense, and energy, offering tailored solutions that stand out from more generic offerings. Innovation and investment in research and development, including the integration of emerging technologies like AI, are crucial for maintaining a competitive edge. This strategic focus on specialization and innovation helps Alten navigate the crowded market and justify its premium pricing.

The intensity of competition varies geographically for Alten. While France and Southern Europe show healthy organic growth, indicating a more manageable competitive environment, markets like the UK, Germany, and North America have experienced declines or slower activity. This suggests heightened competitive pressures or economic challenges in these specific regions, requiring adaptable strategies to address varying market dynamics and competitive threats.

| Competitor | Key Service Areas | Estimated 2024 Revenue (USD Billion) | Geographic Strength |

|---|---|---|---|

| Accenture | IT Services, Consulting, Digital Transformation | ~65.0 | Global |

| Capgemini | IT Services, Consulting, Digital Transformation, Engineering | ~25.0 | Europe, North America |

| Atos | IT Services, Consulting, Digital Transformation, Cloud | ~12.0 | Europe |

| Cognizant | IT Services, Digital Transformation, Consulting | ~20.0 | North America, Europe |

SSubstitutes Threaten

Clients developing strong in-house engineering and IT capabilities represent a significant threat of substitutes for external technology consulting and engineering firms. Companies are increasingly investing in their own talent and infrastructure to handle complex projects internally.

For instance, in 2024, many large corporations continued to bolster their digital transformation units, aiming to reduce dependency on third-party expertise for areas like AI development and cloud migration. This internal build-up directly siphons demand away from external service providers.

This trend means that external firms must continually innovate and offer specialized, high-value services that clients cannot easily replicate in-house. The ability to provide cutting-edge solutions and strategic insights becomes paramount for retaining market share.

The rise of readily available off-the-shelf software, cloud platforms, and advanced AI tools presents a significant threat of substitution for traditional consulting services. These digital solutions can now automate many tasks, perform complex data analysis, and optimize workflows that once necessitated specialized human expertise. For instance, in 2024, the global AI market size was valued at approximately $200 billion, with a substantial portion of this growth driven by accessible AI-powered business solutions.

This increasing maturity and accessibility mean that businesses can often achieve desired outcomes through these technological substitutes, thereby reducing their reliance on external consultants for certain functions. While companies like Alten integrate these tools into their offerings, the widespread availability of these solutions can directly impact the demand for specific, traditionally provided consulting services, forcing a shift in value proposition.

The consulting industry is experiencing a significant shift towards productized services and 'consulting as a service' models. This means that instead of highly customized, bespoke solutions, clients are increasingly opting for standardized offerings or platforms that deliver specific outcomes more efficiently. For instance, many firms now offer pre-packaged digital transformation roadmaps or AI implementation frameworks, reducing the need for extensive, tailored consulting engagements.

Furthermore, the rise of low-code and no-code platforms presents a potent substitute for traditional software development and IT consulting. These platforms allow businesses to build applications and automate processes with minimal to no traditional coding. By 2024, the global low-code development platform market was projected to reach over $21 billion, indicating a strong adoption trend that directly reduces reliance on external consulting for many software needs.

Generalist management consulting firms expanding into technology

Generalist management consulting firms are increasingly encroaching on Alten's territory by bolstering their technology consulting and digital transformation services. While not direct engineering rivals, these firms can offer a comprehensive strategic view, blending technology with overall business objectives. This broad approach presents a significant substitute, particularly for clients prioritizing integrated, end-to-end solutions over specialized IT enterprise services.

This trend is evident in the growth of technology advisory services within major consulting players. For instance, in 2023, the global management consulting market saw technology consulting services grow by an estimated 10-15%, reaching hundreds of billions of dollars. Firms like Accenture, Deloitte, and McKinsey are heavily investing in digital capabilities, aiming to provide clients with a seamless transition from strategy to implementation, directly competing with Alten's offerings.

- Broadened Scope: Generalist firms offer integrated business and technology strategies, appealing to clients seeking holistic digital transformation.

- Strategic Integration: Their ability to link technology solutions directly to core business strategy can be a more attractive value proposition for some clients.

- Market Growth: The technology consulting segment within management consulting is experiencing robust growth, indicating a strong competitive push.

Emergence of specialized niche technology vendors

Clients increasingly seek out highly specialized niche technology vendors or agile startups. These firms offer deep expertise in very specific, cutting-edge areas, presenting a direct substitute for engaging larger, diversified technology consultancies. For instance, a company needing advanced AI model development might bypass a generalist firm for a startup that exclusively focuses on generative AI solutions, potentially offering more tailored and cost-effective outcomes.

These specialized providers can deliver more agile and often more cost-effective solutions for particular technological challenges. They act as viable substitutes for broader, more comprehensive consulting engagements by focusing on delivering excellence within a defined technological domain. This trend is evident in the growing venture capital investment in specialized tech startups, with over $150 billion invested globally in AI and machine learning startups in 2023 alone, indicating a strong market appetite for niche expertise.

- Niche Expertise: Clients bypass large firms for specialized vendors with deep knowledge in specific tech areas.

- Agility and Cost: Niche providers can offer more flexible and economical solutions for targeted problems.

- Market Trend: Significant venture capital flows into specialized tech startups highlight this growing substitute threat.

The threat of substitutes for traditional engineering and IT consulting services is amplified by the increasing accessibility of advanced digital tools and platforms. Companies can now leverage readily available off-the-shelf software, cloud infrastructure, and sophisticated AI solutions to automate tasks and gain insights that previously required external expertise. For example, the global AI market was valued at approximately $200 billion in 2024, with many accessible solutions directly substituting for specialized consulting services.

Furthermore, the rise of low-code/no-code platforms is significantly reducing the need for external IT consulting for many software development and process automation needs. These platforms empower businesses to build applications with minimal coding, a trend underscored by the projected over $21 billion market size for low-code development platforms in 2024. This accessibility allows companies to achieve desired outcomes internally, diminishing reliance on external IT specialists.

The competitive landscape also includes generalist management consulting firms that are expanding their technology and digital transformation offerings. These firms provide integrated strategic views, blending technology with overall business objectives, which can serve as a substitute for specialized IT consulting. The technology consulting segment within management consulting experienced robust growth, estimated at 10-15% in 2023, indicating a strong push into Alten's traditional service areas.

Specialized niche technology vendors and agile startups also pose a significant threat of substitution. They offer deep expertise in cutting-edge areas, such as advanced AI model development, often providing more tailored and cost-effective solutions than larger, diversified consultancies. The over $150 billion invested globally in AI and machine learning startups in 2023 alone highlights the market's appetite for this specialized, substitute expertise.

| Substitute Type | Key Characteristic | Impact on Traditional Consulting | 2024 Market Indicator |

|---|---|---|---|

| In-house Capabilities | Building internal talent and infrastructure | Reduces demand for external expertise | Continued bolstering of corporate digital units |

| Digital Tools & Platforms | Off-the-shelf software, cloud, AI | Automates tasks, provides insights | Global AI market ~$200 billion |

| Low-code/No-code | Application development with minimal coding | Decreases need for IT consulting | Low-code platform market >$21 billion |

| Generalist Management Consulting | Integrated business & tech strategy | Offers holistic solutions | Tech consulting growth 10-15% (2023) |

| Niche Tech Vendors/Startups | Deep, specialized expertise | Provides tailored, cost-effective solutions | AI/ML startup investment >$150 billion (2023) |

Entrants Threaten

Entering the technology consulting and engineering sector globally, similar to Alten, demands significant investment in both specialized talent and a worldwide operational network. This high barrier means new players need considerable financial backing to compete effectively.

For instance, building a robust global infrastructure, from offices to advanced technological resources, can easily run into hundreds of millions of dollars. Furthermore, attracting and retaining top-tier engineers and consultants, who command high salaries and require continuous training, adds substantially to the initial capital outlay.

In 2023, the global IT services market, a key segment for companies like Alten, was valued at over $1.3 trillion, underscoring the scale of investment needed to capture even a small share. This substantial financial commitment deters many potential entrants.

Alten's position in highly regulated sectors like aerospace and defense presents a significant barrier to new entrants. These industries require extensive, specialized expertise and a multitude of industry-specific certifications, which take considerable time and investment to acquire. For instance, obtaining certifications like AS9100 for aerospace or meeting stringent defense procurement standards can be a multi-year process, demanding substantial upfront resources and a demonstrated history of compliance.

Established client relationships and long sales cycles present a significant barrier to new entrants in the IT services sector. Building trust and long-term partnerships with large corporate clients, particularly in critical sectors, is a process that often spans many years. Alten, for instance, has cultivated a strong reputation and a loyal client base over decades of consistent performance.

New companies entering this market would find themselves facing protracted sales cycles, often extending to 12-24 months for complex projects. Overcoming the inertia of existing vendor relationships and demonstrating the reliability and expertise required for critical IT infrastructure is a substantial challenge. Clients typically prioritize proven partners with a track record of success, making it difficult for newcomers to displace established providers.

Economies of scale and scope for large, diversified players

Large, established players like Alten leverage significant economies of scale, enabling them to spread fixed costs over a larger output. This is crucial in areas like global project management and sophisticated R&D, where upfront investments are substantial. For instance, Alten's ability to manage complex, multi-year projects across continents reduces per-project overheads compared to a smaller, regional competitor.

Furthermore, economies of scope allow these large firms to offer a diverse portfolio of services, such as engineering, IT solutions, and research and development, often bundled together. This integrated offering is a strong deterrent to new entrants who may only possess expertise in a narrow niche. In 2024, companies with broad service portfolios often secured larger, more complex contracts, as clients increasingly sought single-source providers.

- Economies of Scale: Reduced per-unit costs for large-volume operations in talent acquisition, global resource deployment, and shared R&D infrastructure.

- Economies of Scope: Ability to offer a wider range of integrated services (e.g., engineering, digital transformation, cybersecurity) across multiple client industries.

- Competitive Disadvantage for New Entrants: Difficulty in matching cost efficiencies and breadth of offerings without substantial upfront capital and market penetration.

- Market Share Impact: Large firms can use their scale to offer more competitive pricing or value-added services, limiting market entry opportunities for smaller, less diversified businesses.

Challenges in talent acquisition and retention for startups

Startups and new entrants often struggle to attract and keep skilled engineering and IT professionals. Without a well-known brand, robust career growth opportunities, or top-tier compensation, they find it tough to compete with established companies. This talent acquisition hurdle significantly increases the barrier to entry for new players.

For instance, in 2024, the tech talent gap remained a significant concern. A report by CompTIA indicated that the demand for IT occupations continued to outpace the supply of qualified workers. Startups, in particular, had to contend with this scarcity, often finding it difficult to offer the comprehensive benefits packages that larger, more established firms could readily provide.

- Talent Scarcity: The overall shortage of skilled tech workers in 2024 meant startups were competing against a larger pool of established companies for limited talent.

- Brand Recognition: New entrants lacked the employer brand equity that attracts candidates, making it harder to stand out in a crowded job market.

- Compensation & Benefits: Startups often couldn't match the salary ranges, stock options, or extensive benefits offered by industry giants, hindering their ability to secure top talent.

- Career Development: The absence of clearly defined career paths and extensive training programs at nascent companies made them less appealing to ambitious professionals seeking long-term growth.

The threat of new entrants into the technology consulting and engineering sector is generally low due to substantial capital requirements, the need for specialized expertise, and established brand loyalty. Companies like Alten benefit from high barriers to entry, which protect their market position and profitability.

Significant upfront investment in global infrastructure and talent acquisition, often in the hundreds of millions of dollars, deters many potential competitors. Furthermore, navigating regulatory hurdles and obtaining industry-specific certifications, which can take years, adds another layer of difficulty for newcomers.

Established firms leverage economies of scale and scope, offering integrated services and cost efficiencies that are difficult for new entrants to replicate. The ongoing scarcity of skilled tech talent in 2024 also means startups struggle to attract and retain the necessary expertise to compete effectively.

For instance, the global IT services market, valued at over $1.3 trillion in 2023, demonstrates the scale of investment required. In 2024, the continued demand for IT occupations outstripping supply, as highlighted by CompTIA, further amplified the challenges faced by new companies in securing top talent against established players.

| Barrier to Entry | Impact on New Entrants | Alten's Advantage |

|---|---|---|

| Capital Investment | High upfront costs for global infrastructure and R&D. | Established financial resources and economies of scale. |

| Specialized Expertise & Certifications | Time-consuming and costly to acquire industry-specific knowledge and compliance. | Decades of experience and numerous certifications in regulated sectors. |

| Talent Acquisition | Competition for scarce skilled tech professionals, especially for startups. | Strong employer brand, competitive compensation, and career development programs. |

| Client Relationships & Sales Cycles | Long sales cycles and difficulty displacing established vendors. | Long-standing client partnerships and a reputation for reliability. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research reports to provide a comprehensive understanding of competitive dynamics.