Alten PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Unlock the strategic advantages Alten holds by understanding the intricate political, economic, social, technological, environmental, and legal forces at play. Our comprehensive PESTLE analysis provides the critical external intelligence you need to anticipate market shifts and capitalize on opportunities. Download the full version now to gain actionable insights and elevate your strategic planning.

Political factors

Government R&D funding significantly shapes the landscape for technology consulting firms like Alten. For instance, the European Union's Horizon Europe program, with a budget of approximately €95.5 billion for 2021-2027, aims to boost research and innovation across various sectors, including digital technologies and climate action. This directly translates to increased demand for specialized engineering and consulting services to implement these funded projects.

Public investment in areas such as defense modernization and the transition to green energy presents substantial growth avenues. In 2023, NATO members committed to increasing defense spending, with many exceeding the 2% of GDP target, creating opportunities for Alten in defense technology consulting. Similarly, national climate strategies, like Germany's €170 billion energy transition package announced in 2023, drive demand for expertise in renewable energy infrastructure and smart grid development.

Conversely, shifts in government spending priorities can pose challenges. A reduction in public funding for digital transformation initiatives, for example, could lead to a slowdown in project pipelines for IT consulting services. Alten's strategic planning must account for these policy shifts, adapting its service offerings to align with evolving government investment focuses, such as the growing emphasis on artificial intelligence and cybersecurity in many developed economies.

Global geopolitical stability is paramount for Alten, a company deeply involved in international projects. For instance, the ongoing conflicts and trade disputes in regions like Eastern Europe and the Middle East directly impact supply chain reliability and client confidence in new investments. In 2024, the World Bank noted that geopolitical fragmentation could shave 0.5% off global GDP growth.

Alten's extensive operations mean that trade relations between major economic blocs, such as the EU and China, are critical. Tariffs or sanctions imposed by governments can significantly alter project costs and the feasibility of cross-border collaborations. The IMF projected in early 2025 that escalating trade tensions could lead to a further 1% contraction in global trade volumes.

Alten's operations are significantly influenced by sector-specific regulations, particularly in aerospace and defense, where stringent safety and certification requirements, such as EASA Part 21 or AS9100, are paramount. For instance, evolving environmental regulations in the energy sector, like those pertaining to CO2 emissions or renewable energy integration, directly impact the demand for Alten's engineering consulting services in developing sustainable solutions. Failure to adhere to these evolving compliance standards, which saw increased scrutiny and updates throughout 2024, could lead to project delays or outright disqualification, impacting revenue streams.

Government Procurement & Defense Spending

Government procurement, especially in defense and public sector digital transformation, represents a crucial revenue stream for Alten. For example, in 2024, many European nations, including France and Germany, increased their defense budgets to address evolving geopolitical landscapes. This trend directly impacts the demand for Alten's specialized engineering and technology services.

Fluctuations in national defense budgets and evolving procurement policies significantly shape the opportunities for companies like Alten. A government's commitment to digital modernization, such as investments in cybersecurity or cloud infrastructure, directly influences the types and volume of contracts available. For instance, the French government's stated goal to accelerate digital transformation across public services in 2024-2025 creates a favorable environment for Alten's digital solutions.

- Defense Budget Growth: Many NATO countries are increasing defense spending; for example, Germany's defense budget saw a significant uplift in 2024.

- Digital Transformation Initiatives: Public sector digital agendas, like France's focus on e-government services, create demand for IT and engineering support.

- Procurement Policy Shifts: Changes in how governments acquire technology can open or close avenues for Alten's business.

- Geopolitical Influences: International security concerns often drive increased government spending on defense and related technologies.

Data Sovereignty & Cybersecurity Policies

Governments worldwide are intensifying their focus on data sovereignty and cybersecurity, significantly influencing technology project lifecycles. This trend means companies like Alten must adapt their solutions to comply with increasingly stringent regulations concerning where data is stored, processed, and how it moves across borders. For instance, the European Union's General Data Protection Regulation (GDPR), enacted in 2018, continues to set a high bar, with ongoing discussions and potential updates in 2024-2025 around data localization requirements for specific sectors.

Navigating this complex legal terrain is crucial for Alten. The company needs to ensure its offerings and client implementations align with a patchwork of national cybersecurity standards and data residency mandates. This includes understanding and adhering to regulations like the Cybersecurity Law of China or the proposed frameworks emerging in various countries aimed at protecting critical infrastructure and citizen data. Failure to comply can result in substantial fines and reputational damage.

- Data Localization Mandates: Many nations are pushing for data generated within their borders to remain within those borders, impacting cloud service providers and data analytics firms.

- Cross-Border Data Transfer Restrictions: New agreements and regulations are being developed to govern how personal and sensitive data can be transferred internationally, requiring robust compliance mechanisms.

- Increased Cybersecurity Audits: Governments are conducting more frequent and thorough cybersecurity audits of companies handling sensitive data, demanding higher levels of security and transparency.

- National Security Concerns: Political considerations around national security are driving policies that scrutinize foreign technology providers and mandate the use of domestically approved solutions.

Government policies on research and development funding directly impact Alten's growth trajectory, particularly in areas like digital transformation and green energy. The European Union's Horizon Europe program, with its substantial €95.5 billion budget for 2021-2027, fuels demand for engineering and consulting services to implement innovative projects. Similarly, national climate strategies, such as Germany's €170 billion energy transition package from 2023, create significant opportunities for expertise in renewable energy infrastructure.

Public investment in defense modernization and national cybersecurity initiatives presents key revenue streams for Alten. Many NATO countries increased defense spending in 2023, with some exceeding the 2% of GDP target, bolstering demand for defense technology consulting. Furthermore, government focus on digital transformation, exemplified by France's public service modernization goals for 2024-2025, drives the need for Alten's IT and engineering support.

Geopolitical stability and international trade relations are critical for Alten's global operations. Trade disputes and regional conflicts, as noted by the World Bank in 2024 potentially shaving 0.5% off global GDP, can disrupt supply chains and client confidence. Evolving trade policies and potential sanctions, with the IMF projecting in early 2025 that escalating trade tensions could contract global trade volumes by 1%, directly influence project costs and cross-border collaborations.

Regulatory environments, especially in aerospace, defense, and energy, significantly shape Alten's business. Stringent safety certifications like EASA Part 21 and AS9100 are paramount in aerospace, while evolving environmental regulations in energy, such as CO2 emission standards, impact demand for sustainable solutions. Compliance with these standards, which saw increased scrutiny in 2024, is vital to avoid project delays and revenue loss.

| Political Factor | Impact on Alten | Supporting Data/Example |

| R&D Funding & Climate Policies | Drives demand for innovation and green tech consulting. | EU Horizon Europe (€95.5B for 2021-2027); Germany's energy transition package (€170B in 2023). |

| Defense Spending & Cybersecurity Focus | Increases opportunities in defense tech and digital security. | NATO defense budget increases in 2023; French digital transformation goals (2024-2025). |

| Geopolitical Stability & Trade Relations | Affects global project feasibility and costs. | World Bank: Geopolitical fragmentation could reduce global GDP by 0.5% (2024); IMF: Trade tensions could contract global trade by 1% (early 2025 projection). |

| Sector-Specific Regulations | Requires strict adherence for project success, especially in aerospace and energy. | EASA Part 21/AS9100 in aerospace; evolving environmental standards in energy sector. |

What is included in the product

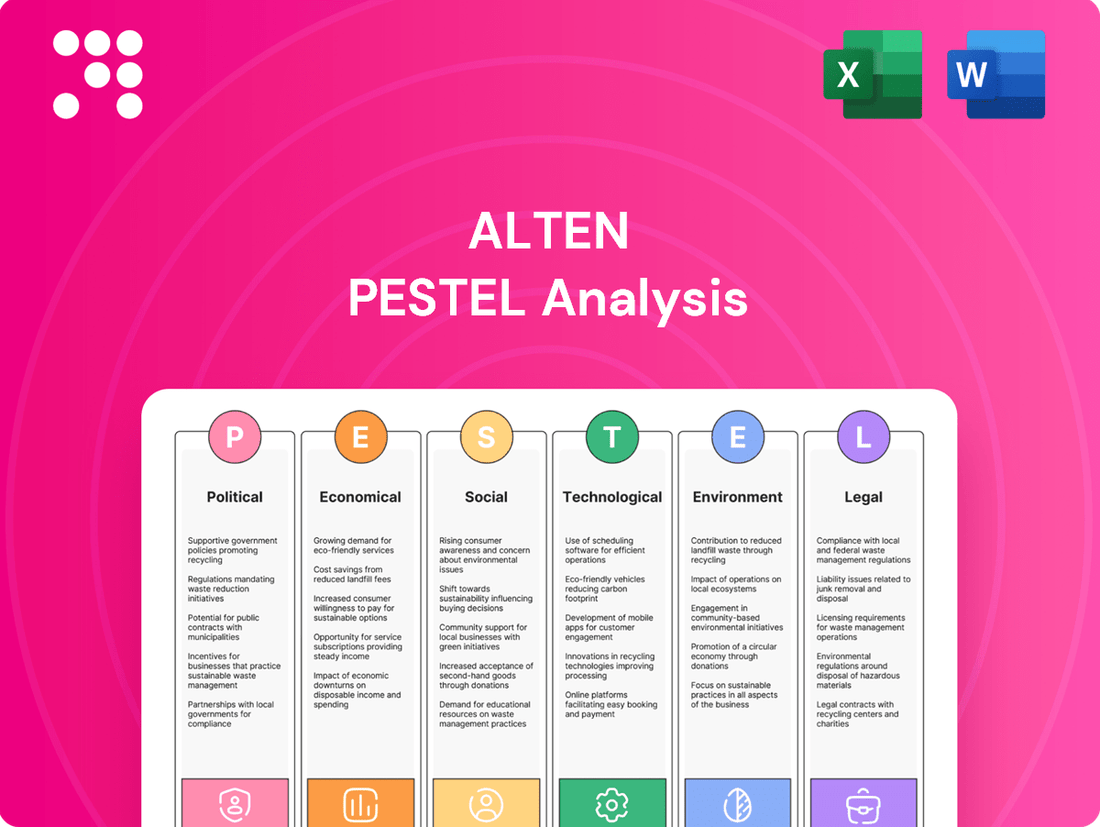

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Alten, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights.

Economic factors

Global economic growth prospects for 2024 and 2025 are a key consideration for Alten. While the IMF projected 3.1% global growth for 2024 in its April 2024 World Economic Outlook, a slight uptick from 2023, the risk of recession remains a concern in various regions. Strong growth typically fuels client investment in technology and engineering, boosting demand for Alten's services.

Conversely, economic slowdowns or recessions can lead to deferred projects and reduced spending by clients, directly impacting Alten's revenue streams. For instance, a significant slowdown in major European economies, a key market for Alten, could temper growth expectations for the company.

Rising inflation, with global averages hovering around 5-6% in early 2024, directly impacts Alten's operating expenses, from raw materials to talent acquisition. If Alten cannot fully pass these increased costs to clients, profit margins could contract. For instance, a 10% increase in component costs without a corresponding price hike could significantly erode profitability.

Interest rate hikes, such as the US Federal Reserve's continued tightening cycle in late 2023 and early 2024, raising rates to the 5.25%-5.50% range, make capital more expensive. This affects Alten's ability to finance new ventures and can deter clients from undertaking large technology investments due to higher borrowing costs, potentially slowing project pipelines.

Alten's financial health is intrinsically linked to the economic vitality of its core client sectors. For instance, the automotive industry, a significant revenue driver for Alten, saw global vehicle production reach approximately 78.5 million units in 2023, with projections for continued growth in 2024, particularly in electric vehicle (EV) segments.

Similarly, the aerospace and defense sector is experiencing robust demand, with global defense spending projected to exceed $2.4 trillion in 2024, according to various defense intelligence reports. This surge directly benefits Alten through increased engineering and R&D contracts in areas like advanced aircraft development and defense system modernization.

The telecommunications industry's ongoing 5G rollout and fiber optic network expansion also presents substantial opportunities. Global 5G subscriptions were estimated to surpass 1.5 billion by the end of 2024, fueling demand for Alten's expertise in network design, deployment, and optimization. Any slowdown in these key industries, however, would inevitably lead to a contraction in Alten's project pipeline and revenue streams.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Alten, a global engineering and technology consulting firm. Operating across numerous countries means its financial results are exposed to the volatility of various currencies. For instance, if the Euro strengthens against the US Dollar, and Alten has substantial revenue in the US, that revenue will translate into fewer Euros, potentially impacting its consolidated financial statements negatively.

Conversely, a weaker Euro could boost reported earnings when converting revenue from stronger-currency markets. In 2024, major currency pairs like EUR/USD experienced notable shifts, with the Euro trading in a range that could have impacted companies with significant cross-border transactions. For Alten, this means that profitability can be influenced not just by operational performance but also by the unpredictable movements in foreign exchange markets.

Effective currency risk management is therefore crucial for Alten's financial health. This often involves hedging strategies, such as forward contracts or options, to lock in exchange rates for future transactions. Such measures help to mitigate the impact of adverse currency movements and provide greater predictability to earnings.

- Impact on Revenue: A stronger local currency where Alten earns revenue can reduce its value when converted back to the company's reporting currency, impacting top-line figures.

- Impact on Costs: Conversely, a stronger local currency where Alten incurs significant operating costs (like salaries or office leases) can increase its expenses in reporting currency terms.

- Profitability Squeeze: If costs rise due to currency movements while revenue falls, Alten's profit margins can be squeezed considerably.

- Hedging Necessity: Proactive currency hedging strategies are vital to stabilize financial performance and protect against unexpected currency-driven losses.

Availability of Capital for Innovation

The ease with which Alten's clients can access capital directly influences their ability to invest in innovation, R&D, and digital transformation. Favorable credit conditions and robust equity markets in 2024 and early 2025 have generally encouraged companies to pursue ambitious technological projects, benefiting demand for consulting services.

However, potential shifts towards tighter credit markets or dips in investor confidence, as seen in some sectors during late 2024, could lead to a more cautious approach from clients, potentially impacting spending on external innovation consulting.

- Capital Availability: In Q1 2025, venture capital funding for tech startups in Europe saw a moderate increase compared to the previous year, indicating continued, albeit selective, capital flow for innovation.

- Interest Rate Environment: Central bank policies in major economies, influencing interest rates throughout 2024-2025, play a crucial role in the cost of borrowing for R&D and expansion.

- Market Sentiment: Investor sentiment, closely monitored by equity markets, directly correlates with corporate willingness to fund long-term, high-risk innovation projects.

- Client Investment Trends: Reports from late 2024 indicated that companies were prioritizing digital transformation and AI integration, contingent on accessible funding for these initiatives.

Global economic growth for 2024 and 2025 is a critical factor for Alten. The IMF projected 3.1% global growth for 2024, a slight increase from 2023, though recession risks persist in some areas. Strong economic conditions generally boost client investment in technology and engineering, thereby increasing demand for Alten's services.

Conversely, economic downturns can lead to project delays and reduced client spending, directly impacting Alten's revenue. For instance, a significant slowdown in key European markets, where Alten has a strong presence, could temper the company's growth prospects.

Inflation, with global averages around 5-6% in early 2024, increases Alten's operating costs for everything from materials to talent. If Alten cannot pass these higher costs to clients, profit margins may shrink. For example, a 10% rise in component costs without a corresponding price increase could significantly reduce profitability.

Rising interest rates, exemplified by the US Federal Reserve's tightening cycle in late 2023 and early 2024, making capital more expensive, affects Alten's financing capabilities and can deter clients from large tech investments due to higher borrowing costs, potentially slowing project pipelines.

| Economic Factor | 2024 Projection/Status | Impact on Alten | Example Data/Trend |

|---|---|---|---|

| Global GDP Growth | IMF: 3.1% (2024) | Higher growth drives demand for services. | Slight uptick from 2023, but recession risks remain. |

| Inflation Rate | Global average ~5-6% (early 2024) | Increases operating costs, potentially squeezing margins. | Rising input costs can reduce profitability if not passed on. |

| Interest Rates | US Fed: 5.25%-5.50% (late 2023/early 2024) | Increases cost of capital for Alten and clients. | Higher borrowing costs can deter client investment in new projects. |

| Key Industry Performance (Automotive) | Global production ~78.5M units (2023) | Strong performance in client sectors boosts revenue. | Growth in EV segments presents opportunities for engineering services. |

| Key Industry Performance (Aerospace & Defense) | Global spending >$2.4T (2024 projection) | Increased demand for R&D and engineering contracts. | Modernization and advanced aircraft development drive demand. |

| Key Industry Performance (Telecoms) | Global 5G subscriptions >1.5B (end 2024 projection) | Demand for network design and deployment services. | 5G rollout and fiber expansion fuel opportunities. |

Full Version Awaits

Alten PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Alten PESTLE Analysis provides a detailed examination of the external factors influencing the company's strategic decisions. You'll gain valuable insights into the political, economic, social, technological, legal, and environmental landscape affecting Alten.

Sociological factors

Alten's success hinges on access to a robust pool of highly skilled engineers and IT professionals. The company's ability to secure talent in cutting-edge fields like artificial intelligence, cybersecurity, and data science directly influences its capacity to deliver innovative solutions and pursue growth opportunities in these demanding sectors.

The global competition for specialized tech talent presents a significant challenge, with a notable skills gap persisting in areas like AI development and quantum computing. For instance, reports in early 2024 indicated a shortfall of over 1.4 million cybersecurity professionals globally, a trend that directly impacts companies like Alten needing specialized security expertise.

Attracting and retaining this in-demand talent is an ongoing strategic imperative for Alten. Factors such as competitive compensation, professional development opportunities, and a stimulating work environment are crucial for ensuring a stable and high-performing workforce capable of meeting client needs.

Societal shifts are heavily favoring flexible work arrangements, with remote and hybrid models becoming increasingly common. This directly impacts Alten's operational strategies and how it manages its talent pool. For instance, a 2024 survey indicated that over 60% of employees prefer hybrid work, highlighting the need for Alten to adapt its policies to remain competitive in attracting and retaining skilled professionals.

Adapting to these evolving employee preferences is not just about talent acquisition; it also influences project delivery methodologies and client relationship management. Alten's capacity to effectively manage distributed teams, ensuring seamless collaboration and client satisfaction across different work models, will be a significant differentiator in the market. As of early 2025, companies with robust remote work infrastructure reported higher employee engagement and productivity.

Globally, many developed economies are experiencing aging populations. For instance, in 2023, the median age in Japan was 49.5 years, and in Italy, it was 48.3 years. This demographic trend can shrink the pool of experienced engineering talent available for companies like Alten. Conversely, younger demographics entering the workforce often possess strong digital skills and fresh perspectives, which are crucial for innovation.

Alten's commitment to diversity and inclusion is a significant societal expectation and a strategic imperative. In 2023, the global workforce diversity landscape continued to evolve, with many companies reporting increased efforts in gender and ethnic representation. A diverse workforce, with varied backgrounds and experiences, can lead to more creative problem-solving and a deeper understanding of a wider range of client needs across different markets.

Societal Acceptance of Automation & AI

Public perception regarding automation and AI significantly shapes how quickly and in what ways companies integrate these technologies. For Alten, this means understanding how willing clients are to embrace AI-driven solutions.

Societal concerns, particularly around job losses due to automation and the ethical considerations of AI, can create headwinds. For example, a 2024 survey indicated that while 65% of respondents see AI as beneficial for efficiency, nearly 40% expressed worry about its impact on employment. This apprehension could lead to stricter regulations or a more cautious approach from clients, potentially slowing down demand for advanced automation consulting services that Alten offers.

The acceptance level directly influences the types of projects Alten undertakes and the speed of their deployment. A society more comfortable with AI might readily adopt complex automation solutions, whereas a hesitant public could favor incremental, less disruptive changes.

- Public Sentiment: Growing awareness of AI's capabilities is met with both optimism for efficiency and concern for job security.

- Regulatory Impact: Societal anxieties can translate into governmental oversight, affecting the deployment of AI and automation solutions.

- Client Adoption Pace: The degree of public acceptance directly influences how quickly businesses are willing to invest in and implement advanced automation consulting services.

Education System Quality and STEM Focus

The quality and STEM focus of education systems directly shape Alten's future talent pool. Countries with robust STEM programs, like Germany, which consistently ranks high in engineering education and research, provide a stronger base of qualified candidates. Alten's ability to recruit effectively hinges on these educational foundations.

A strong emphasis on Science, Technology, Engineering, and Mathematics ensures a steady influx of graduates equipped with the necessary skills for the technology consulting sector. For instance, in 2024, the European Union saw a notable increase in STEM graduates, with countries like Poland reporting a 5% year-on-year rise in engineering enrollments, benefiting companies like Alten.

Strategic partnerships between companies like Alten and universities are crucial for aligning academic curricula with industry demands. These collaborations help ensure that graduates possess practical, in-demand skills, reducing the training gap and fostering innovation. Alten's engagement with institutions like TU Delft in the Netherlands exemplifies this approach, aiming to cultivate talent for emerging fields.

- STEM Graduate Trends: In 2024, several European nations reported increased STEM graduate numbers, with a particular surge in computer science and data analytics graduates, directly benefiting tech-focused firms.

- University-Industry Collaboration: Initiatives like joint research projects and internships between Alten and leading engineering universities aim to bridge the skills gap and foster practical experience.

- Educational Investment: Government spending on STEM education, such as the €5 billion allocated by France in 2023 for digital skills and research, directly influences the quality and availability of future talent.

- Curriculum Relevance: Continuous updates to university curricula, often in consultation with industry leaders, ensure graduates are prepared for the evolving technological landscape Alten operates within.

Societal trends are increasingly emphasizing work-life balance and flexible working arrangements, with hybrid models becoming the norm. For instance, a 2024 survey revealed that over 60% of employees prefer hybrid work, directly impacting Alten's talent acquisition and retention strategies.

Demographic shifts, such as aging populations in developed countries, can shrink the pool of experienced engineering talent. In 2023, Japan's median age was 49.5, illustrating this challenge for companies like Alten.

Public perception of AI and automation is a critical factor; while 65% of respondents in a 2024 poll saw AI's efficiency benefits, nearly 40% worried about job displacement, potentially influencing client adoption of advanced solutions.

Technological factors

The relentless acceleration of digital transformation is a primary driver for Alten's business. In 2024, global IT spending was projected to reach $5.06 trillion, an increase from $4.77 trillion in 2023, highlighting companies' commitment to adopting new technologies.

This shift fuels demand for Alten's expertise as businesses across sectors integrate cloud computing, big data, and the Internet of Things (IoT) to boost efficiency and innovation. For instance, IoT adoption in industrial settings is expected to grow significantly, creating new avenues for Alten's engineering and technology consulting services.

Alten's competitive edge hinges on its ability to integrate cutting-edge technologies like AI, IoT, and 5G. These advancements are reshaping industries, with the global AI market alone projected to reach over $1.5 trillion by 2030, according to some forecasts, highlighting the immense potential for growth and innovation.

The rapid rollout of 5G networks, for instance, is enabling a surge in IoT devices, with the number of connected IoT devices expected to exceed 29 billion by 2030. Alten must proactively build capabilities in these domains to deliver advanced solutions and avoid its current offerings becoming outdated in this fast-evolving landscape.

The evolving landscape of cyber threats demands sophisticated defense mechanisms, a need Alten addresses by offering comprehensive cybersecurity services. This includes expertise in secure system design, advanced threat detection, and rapid incident response, ensuring clients’ digital assets are protected. The global cybersecurity market was valued at approximately $217 billion in 2023 and is projected to reach over $345 billion by 2028, highlighting the immense demand for such services.

Alten's role in providing these critical services positions it favorably to capitalize on this growing market. However, the inherent risk of a significant cyberattack, either targeting Alten directly or its clients, presents a substantial challenge. Such an event could lead to severe financial losses, reputational damage, and operational disruptions, underscoring the importance of continuous investment in and refinement of their cybersecurity capabilities.

Automation in Engineering & Development

The increasing adoption of automation, including low-code/no-code platforms and robotic process automation (RPA), is fundamentally changing how engineering and software development projects are executed. These advancements are streamlining workflows and accelerating delivery cycles. For instance, Gartner predicted that by 2024, the market for low-code development will reach $26.9 billion, highlighting its growing significance.

Alten needs to strategically integrate these automation tools into its own operations to maintain competitiveness and enhance service delivery efficiency. This shift necessitates an evolution in how Alten approaches project execution, potentially moving away from purely manual task execution.

- Increased Efficiency: Automation in engineering and development can significantly reduce the time and resources required for tasks like testing, deployment, and even initial coding.

- Shift in Skill Demand: As automation takes over routine tasks, there's a growing demand for engineers skilled in managing, implementing, and optimizing these automated systems.

- Focus on Higher-Value Services: Alten may find opportunities to expand its service offerings into areas like strategic automation consulting, process optimization, and the integration of complex digital solutions, leveraging its engineering expertise.

- Impact on Project Timelines: The ability to automate repetitive processes allows for faster project completion, potentially leading to quicker time-to-market for clients and increased project throughput for Alten.

Disruptive Technologies & Innovation Cycles

The rapid evolution of disruptive technologies, such as artificial intelligence (AI) and advanced automation, presents both opportunities and threats for Alten. Companies must remain agile, anticipating shifts in the technological landscape to avoid obsolescence. For instance, the global AI market was valued at an estimated $200 billion in 2023 and is projected to reach over $1.8 trillion by 2030, highlighting the immense growth and potential for disruption.

Alten's ability to stay ahead of innovation cycles is crucial. This involves strategic investment in research and development (R&D) and cultivating an environment that encourages continuous learning and adaptation among its workforce. A proactive approach allows Alten to identify and leverage emerging trends, ensuring it remains competitive rather than being overtaken by new technological paradigms.

- AI Integration: Alten can leverage AI for enhanced efficiency in software development, project management, and client service delivery.

- Automation in Engineering: Implementing advanced automation in engineering processes can lead to faster design cycles and reduced operational costs.

- Cybersecurity Advancements: Staying abreast of cutting-edge cybersecurity technologies is vital to protect Alten's intellectual property and client data in an increasingly digital world.

- Cloud Computing and Big Data: Utilizing scalable cloud infrastructure and sophisticated big data analytics will be key to managing and deriving insights from the vast amounts of information generated in the tech sector.

Technological advancements are reshaping Alten's operational landscape, driving demand for its digital transformation and engineering services. Global IT spending is projected to reach $5.2 trillion in 2025, underscoring the pervasive integration of technologies like AI, cloud computing, and IoT, which are core to Alten's offerings.

Alten's competitive advantage relies on its mastery of emerging technologies such as AI and 5G. The AI market is expected to grow substantially, with some projections indicating it could exceed $2 trillion by 2030, while the rollout of 5G networks is expanding the reach of IoT, with over 30 billion connected devices anticipated by 2030.

The increasing adoption of automation tools, including low-code/no-code platforms and RPA, is streamlining engineering and software development. Gartner predicted that the low-code market would reach $33.4 billion in 2025, highlighting the efficiency gains and evolving skill demands in the sector.

Alten's strategic focus on cybersecurity is crucial, given the expanding market valued at an estimated $270 billion in 2024, projected to surpass $400 billion by 2028. This emphasis protects client data and Alten's own intellectual property amidst evolving digital threats.

| Technology Area | 2024 Market Estimate | 2025 Projection | Alten's Relevance |

|---|---|---|---|

| Global IT Spending | $5.06 trillion | $5.2 trillion | Drives demand for consulting and implementation services. |

| Artificial Intelligence (AI) | Estimated $200 billion+ | Projected growth to over $1.8 trillion by 2030 | Key for innovation, efficiency, and new service development. |

| Internet of Things (IoT) | Growing rapidly | Over 30 billion devices by 2030 | Enables new engineering solutions and data analytics. |

| Cybersecurity | $270 billion | Projected $400 billion+ by 2028 | Essential for protecting client assets and Alten's operations. |

Legal factors

The growing landscape of data privacy laws like GDPR and CCPA directly shapes how Alten manages client information and builds its technology. Failure to comply with these complex and changing regulations, which are becoming increasingly common globally, can lead to substantial financial penalties and damage to Alten's reputation. For instance, in 2023, the EU reported over €1.5 billion in GDPR fines issued across member states, highlighting the significant financial risk involved.

Intellectual property laws are crucial for Alten, shielding the company's and its clients' technological advancements. In 2024, the global IP market continued its upward trajectory, with significant investments in patents and software, underscoring the value of innovation. Strong IP protection is vital for recouping research and development expenditures and sustaining market leadership.

Alten's operations necessitate careful navigation of intricate IP agreements. Ensuring client projects adhere to patent, copyright, and trade secret legislation is paramount. For instance, the software development sector, a key area for Alten, saw a 15% increase in patent filings globally in the first half of 2024, highlighting the dynamic IP landscape.

Alten, as a global entity, navigates a labyrinth of labor laws and employment regulations across its operating countries. These regulations cover everything from recruitment and dismissal to working hours, employee benefits, and the right to unionize. Staying compliant is paramount to prevent costly legal battles, foster positive employee relationships, and ensure smooth operations worldwide.

For instance, in France, where Alten has a significant presence, the Code du Travail dictates strict rules on employee contracts, working time, and collective bargaining agreements. In 2023, France saw a 6.7% unemployment rate, highlighting the competitive labor market and the importance of adhering to employment laws to attract and retain talent. Non-compliance can lead to substantial fines and reputational damage, impacting Alten's ability to secure new projects and maintain its workforce.

Industry-Specific Compliance & Certifications

Alten operates within sectors such as aerospace, defense, and healthcare, all of which are heavily regulated. These industries mandate strict adherence to specific compliance requirements and certifications, like ISO standards and crucial safety regulations. For Alten, meeting these legal and regulatory frameworks is not just a formality but a prerequisite for securing projects and ensuring their successful completion.

Failure to comply with these industry-specific legal mandates can result in significant financial penalties and, more critically, the loss of valuable business opportunities. For instance, in the aerospace sector, compliance with standards like AS9100 is essential, and a company like Alten would need to demonstrate this to win contracts. In 2023, the global aerospace market saw continued emphasis on regulatory compliance, with ongoing updates to safety and cybersecurity protocols impacting service providers.

- Aerospace & Defense: Compliance with standards like AS9100 and ITAR (International Traffic in Arms Regulations) is non-negotiable for project participation and business continuity.

- Healthcare: Adherence to regulations such as GDPR (General Data Protection Regulation) for data handling and FDA (Food and Drug Administration) guidelines for medical device development is critical.

- Cybersecurity: As digital transformation accelerates, meeting evolving cybersecurity regulations and data protection laws is paramount across all Alten's operational domains.

- Environmental Regulations: Increasing global focus on sustainability means compliance with environmental laws, such as emissions standards or waste management, is also becoming a key legal factor.

Contract Law and Liability

Contract law forms the bedrock of Alten's client and supplier relationships, dictating terms for project execution, intellectual property, and payment. In 2024, robust contract management is crucial, especially as Alten navigates complex international projects where differing legal systems can impact enforceability. Failure to adhere to contractual obligations can lead to significant financial penalties and damage to Alten's reputation.

Alten's exposure to liability, particularly concerning engineering design and project delivery, necessitates a deep understanding of tort law and product liability statutes. For instance, a significant engineering error on a major infrastructure project could result in substantial claims. Proactive risk management, including comprehensive insurance and rigorous quality control, is therefore paramount to protect the company from unforeseen liabilities. The company's 2023 annual report highlighted a minor legal provision for potential contract disputes, underscoring the ongoing need for vigilance in this area.

- Contractual Clarity: Ensuring all agreements with clients and partners clearly define scope, deliverables, and payment schedules is vital for preventing disputes and ensuring smooth project progression.

- Liability Mitigation: Proactive risk assessment and management are essential to address potential liabilities arising from engineering errors, project delays, or breaches of contract.

- Regulatory Compliance: Adherence to evolving contract and liability laws across different operating jurisdictions is critical for maintaining legal standing and operational integrity.

- Dispute Resolution: Establishing clear mechanisms for dispute resolution within contracts can help minimize the financial and reputational impact of disagreements.

Alten must navigate a complex web of international and national laws, impacting everything from data handling to employee relations. Staying compliant with evolving regulations, such as GDPR and CCPA, is crucial to avoid significant fines, like the €1.5 billion in GDPR fines issued across the EU in 2023, and protect its reputation. Robust intellectual property protection is also vital, especially in the tech-heavy sectors Alten serves, where patent filings saw a 15% global increase in the first half of 2024.

Labor laws across Alten's operating countries, including France's strict Code du Travail, dictate employment practices and require diligent adherence to prevent legal disputes and maintain a stable workforce. Furthermore, industry-specific regulations in aerospace, defense, and healthcare, such as AS9100 and FDA guidelines, are non-negotiable prerequisites for securing and executing projects, with the aerospace sector in 2023 emphasizing updated safety and cybersecurity protocols.

Contract law underpins Alten's business relationships, demanding clear agreements to manage project execution and payments, especially given the complexities of international projects in 2024. Liability mitigation through understanding tort law and product liability statutes is also paramount, as highlighted by Alten's 2023 report noting provisions for potential contract disputes, underscoring the need for proactive risk management.

| Legal Area | Key Considerations for Alten | Relevant 2023/2024 Data Points |

| Data Privacy | Compliance with GDPR, CCPA, etc. | Over €1.5 billion in GDPR fines issued in EU (2023) |

| Intellectual Property | Protection of patents, software, and client IP | 15% global increase in software patent filings (H1 2024) |

| Labor Law | Adherence to employment regulations globally | France unemployment rate at 6.7% (2023) |

| Industry-Specific Compliance | Meeting AS9100, ITAR, FDA, etc. | Aerospace sector focused on updated safety/cybersecurity protocols (2023) |

| Contract & Liability | Clear agreements, risk management | Provisions for potential contract disputes noted in 2023 reports |

Environmental factors

The intensifying global commitment to combating climate change is directly translating into more stringent environmental regulations and aggressive decarbonization goals for businesses worldwide. This regulatory shift is a significant tailwind for companies like Alten, as it fuels a growing demand for their expertise in sustainable engineering, energy efficiency improvements, and the integration of renewable energy sources. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, creating a substantial market for the very solutions Alten provides.

This evolving regulatory landscape compels clients across various sectors, including energy and automotive, to seek external expertise to navigate compliance and achieve their own Environmental, Social, and Governance (ESG) targets. Alten's ability to offer solutions that help clients reduce their carbon footprint and improve energy management positions them favorably to capitalize on this trend. The automotive sector, for example, is seeing rapid adoption of electric vehicles, driven by regulations like the US Environmental Protection Agency's proposed stricter emissions standards for model year 2027 and beyond, which Alten can support through engineering services.

Growing consumer and corporate awareness of environmental impact is significantly fueling demand for sustainable products, processes, and technologies. This shift is evident in market trends, with global spending on sustainable goods projected to reach trillions by 2025, driven by a desire for reduced carbon footprints and ethical sourcing.

Alten is well-positioned to capitalize on this trend, leveraging its expertise to assist clients in designing eco-friendly products, optimizing resource consumption, and implementing green IT solutions. For instance, the company's work in renewable energy integration and circular economy principles directly addresses this escalating market need.

This growing demand represents a substantial growth area for technology consulting and engineering services, with the green technology and sustainability market expected to expand at a compound annual growth rate (CAGR) of over 10% through 2028, according to recent industry analyses.

Growing concerns about resource scarcity, especially for materials vital to advanced manufacturing, directly affect component availability and pricing for Alten's clients. For instance, the International Energy Agency reported in 2024 that demand for critical minerals like lithium and cobalt, essential for batteries and electronics, is projected to increase significantly by 2030, putting pressure on supply chains.

Alten can proactively guide clients toward adopting circular economy models and sustainable sourcing strategies. This involves advising on optimizing energy and water usage within their operations, thereby enhancing supply chain resilience against environmental and economic volatility. The World Economic Forum's 2024 Global Risks Report highlighted supply chain disruptions as a major global threat, underscoring the urgency of these mitigation efforts.

Environmental, Social, and Governance (ESG) Pressures

Environmental, Social, and Governance (ESG) pressures are significantly reshaping how companies like Alten operate and are viewed. Investors, customers, and employees are now keenly examining a company's commitment to sustainability, ethical conduct, and sound governance. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, demonstrating a substantial shift in capital allocation towards ESG-conscious businesses. This trend means Alten and its clients must actively showcase robust environmental stewardship, fair labor practices, and transparent governance to attract and retain stakeholders.

These ESG demands directly influence corporate strategy, investment choices, and project selection. Companies are increasingly prioritizing projects that align with sustainability goals, leading to a greater emphasis on impact assessment and transparent reporting. By 2025, it's projected that over 90% of S&P 500 companies will be reporting on ESG metrics, highlighting the widespread adoption of these standards. This creates both challenges and opportunities for Alten, requiring a strategic focus on developing and delivering solutions that meet these evolving environmental and social expectations.

- Investor Scrutiny: Global sustainable investment market valued at $37.4 trillion in 2024.

- Customer Expectations: Growing demand for products and services from environmentally and socially responsible companies.

- Employee Engagement: Talent attraction and retention are increasingly linked to a company's ESG performance and values.

- Regulatory Landscape: Anticipated increase in ESG reporting mandates, with over 90% of S&P 500 companies expected to report by 2025.

Waste Management & Pollution Control

Environmental regulations worldwide are tightening, particularly concerning waste management, hazardous materials handling, and pollution control. For instance, the European Union's Circular Economy Action Plan, updated in 2023, emphasizes reducing waste generation and promoting sustainable resource use, impacting industries that Alten serves.

Alten's engineering expertise is increasingly vital for clients needing to develop innovative systems that minimize waste streams, effectively manage emissions, and adhere to strict environmental discharge standards. This includes designing cleaner production processes and implementing advanced pollution abatement technologies.

Beyond client services, Alten must also scrutinize its own operational footprint and supply chain. In 2024, many companies are setting ambitious Scope 3 emission reduction targets, which encompass indirect emissions from their value chain, a critical area for engineering firms like Alten.

- Stricter Regulations: Expect increased enforcement and new legislation globally, such as the EU's forthcoming revisions to waste framework directives aiming for higher recycling rates by 2030.

- Demand for Green Engineering: Clients are actively seeking solutions for waste reduction, emission control, and sustainable material usage, creating a significant market opportunity for Alten's services.

- Supply Chain Scrutiny: Alten's own environmental performance, including its supply chain's impact, is under greater investor and regulatory pressure, with a growing emphasis on Scope 3 emissions reporting.

- Technological Innovation: The need for compliance drives demand for advanced technologies in areas like industrial wastewater treatment and air quality monitoring, where Alten can provide specialized engineering solutions.

The global push towards sustainability and climate action is a significant driver for Alten, creating demand for its expertise in areas like renewable energy and energy efficiency. Stricter environmental regulations, such as the EU's Fit for 55 package targeting a 55% emissions reduction by 2030, directly benefit companies offering green engineering solutions.

This regulatory environment compels clients, particularly in sectors like automotive and energy, to seek external help to meet their Environmental, Social, and Governance (ESG) goals. For example, the push for electric vehicles, supported by regulations like the EPA's proposed stricter emissions standards for 2027 and beyond, highlights a key market for Alten's engineering services.

Growing awareness of environmental impact is increasing demand for sustainable products and processes, with global spending on sustainable goods expected to reach trillions by 2025. Alten's focus on eco-friendly design and resource optimization places it to capture this market growth, further bolstered by the green technology sector's projected CAGR of over 10% through 2028.

Resource scarcity, particularly for critical minerals like lithium and cobalt essential for advanced manufacturing, poses supply chain challenges. The International Energy Agency noted in 2024 that demand for these minerals is set to rise significantly by 2030, emphasizing the need for strategies like circular economy models that Alten can help implement to enhance supply chain resilience.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alten is built upon a robust foundation of data sourced from official government publications, reputable financial institutions, and leading industry research firms. This ensures that every aspect of the analysis, from political stability to technological advancements, is grounded in accurate and current information.