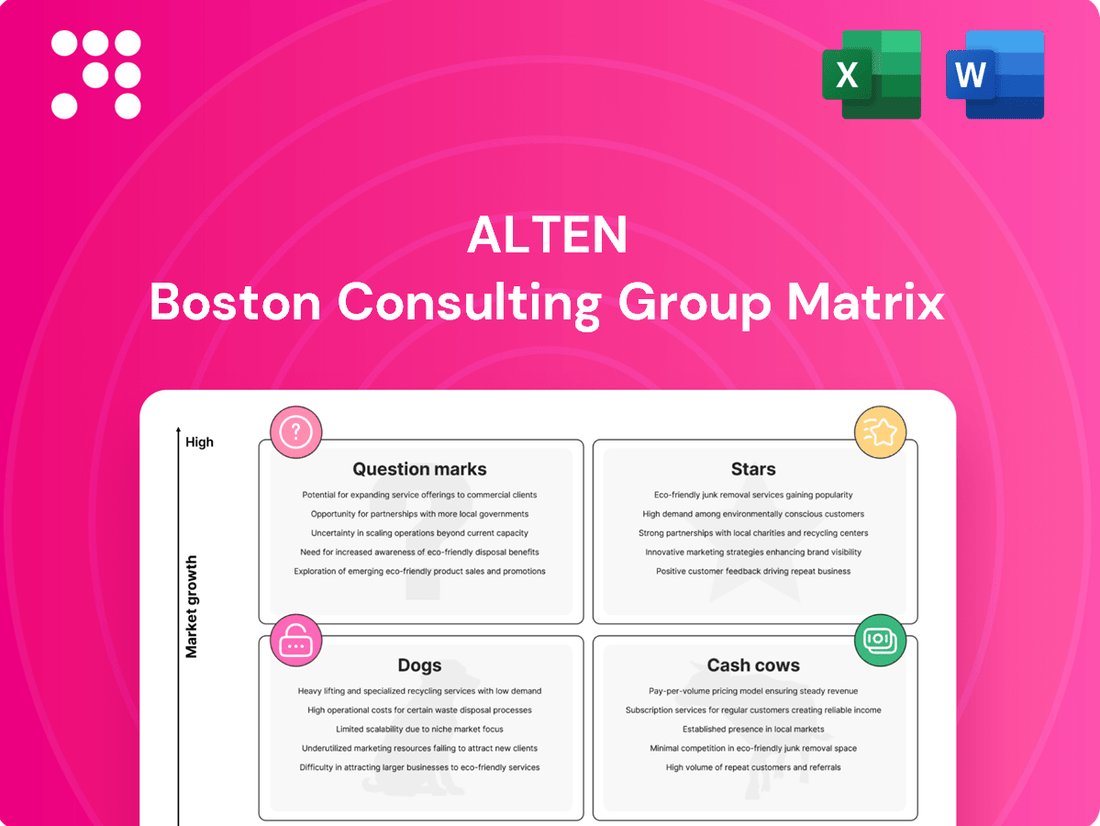

Alten Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alten Bundle

Unlock the secrets to strategic growth with a glimpse into the BCG Matrix. See how this company's products are categorized as Stars, Cash Cows, Dogs, or Question Marks, and understand their current market standing. Purchase the full report for a comprehensive analysis and actionable insights to optimize your portfolio.

Stars

Alten's Defense & Security sector is a clear Star in its BCG matrix. The market is booming, driven by rising military spending globally and a strong push for European defense autonomy. In 2024, defense spending worldwide is projected to reach over $2.4 trillion, a significant increase that directly benefits companies like Alten.

This sector benefits from substantial investments in advanced areas like intelligent equipment systems and robust cybersecurity solutions. Alten's focus on these high-demand, high-growth segments, coupled with the sector's inherent demand, solidifies its Star status, indicating strong market share and high growth potential.

Alten's acquisition of Worldgrid in late 2024 significantly strengthens its position in the Energy and Utilities sector, with a particular focus on nuclear solutions. This strategic expansion is well-timed, tapping into the high-growth potential of global decarbonization initiatives and the increasing need for reliable energy infrastructure. The nuclear segment, therefore, represents a Stars category within Alten's BCG Matrix, poised for substantial future growth and profitability.

Alten's rail sector is a strong performer, consistently showing growth. This is fueled by global efforts to upgrade infrastructure, expand rail services, and embrace greener transportation. For example, in 2023, Alten reported a significant increase in its rail segment revenue, reflecting this positive market momentum.

The company is actively involved in developing cutting-edge signaling systems and powering high-speed trains with renewable energy. These advancements highlight the sector's high growth potential and Alten's strategic positioning within it, contributing to their robust market share.

Digital Transformation & AI Integration

Alten is strategically positioning its Digital Transformation & AI Integration offerings as a Stars category within the BCG Matrix. The company's substantial investments in AI programs and data analysis are fueling this move. This focus addresses the escalating market demand for AI-driven solutions, crucial for clients aiming to boost productivity and reduce operational expenses.

These digital transformation initiatives are experiencing rapid expansion, highlighting their significant growth potential and market leadership for Alten. For instance, the global AI market was valued at approximately USD 200 billion in 2023 and is projected to grow substantially in the coming years, with many consulting firms reporting double-digit growth in their digital services divisions throughout 2024.

- Significant Investment: Alten is channeling considerable resources into AI research, development, and implementation across various sectors.

- Market Demand: Client needs for AI-powered optimization and digital process enhancement are driving high demand for these services.

- Growth Potential: These offerings are identified as key drivers for future revenue and market share expansion for Alten.

- Competitive Advantage: Alten aims to solidify its position as a leader by providing cutting-edge digital and AI solutions in 2024 and beyond.

French Domestic Market Operations

Alten's French domestic market operations are a cornerstone of its business, demonstrating resilience and growth. Despite a challenging global environment in 2024, the company's revenue in France experienced robust expansion. This suggests Alten holds a commanding position within its home market, likely in a segment that is either stable or experiencing positive growth.

This strong domestic performance acts as a significant advantage. It provides the financial stability and strategic flexibility needed for continued investment in innovation and market development. Such a solid base allows Alten to effectively navigate international complexities and maintain its competitive edge.

- Revenue Growth in France (2024): Alten reported significant revenue growth in its domestic market for 2024, outperforming international segments.

- Market Share Dynamics: The strong French performance indicates a high market share in a stable or growing domestic segment.

- Strategic Positioning: This domestic strength enables continued investment and strategic positioning for future growth.

- Resilience in Challenging Markets: Alten's ability to grow in France highlights its operational strength even amidst broader international market challenges.

Alten's Digital Transformation & AI Integration services are a prime example of a Star within its BCG matrix. The company's substantial investments in AI programs and data analytics are driving this segment's rapid expansion, directly addressing the escalating market demand for AI-driven solutions. This focus is crucial for clients seeking to enhance productivity and reduce operational costs, with the global AI market valued at approximately USD 200 billion in 2023 and projected for significant growth, with many consulting firms reporting double-digit growth in their digital services divisions throughout 2024.

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Quickly identify underperforming "Dogs" to divest, freeing up resources for "Stars."

Cash Cows

Alten's core engineering consulting services, spanning aerospace, automotive, and IT, represent its established Cash Cows. These mature offerings, built on deep technical expertise and robust client relationships, consistently generate significant cash flow. For instance, in 2024, Alten reported a strong performance in its European operations, a key region for these foundational services, indicating sustained demand and profitability.

Alten's General IT Services & Systems Integration is a classic cash cow within its business portfolio. These services, essential for maintaining and upgrading client IT infrastructures, generate consistent revenue. For instance, in 2024, the IT services market, which includes integration and outsourcing, was projected to reach $1.3 trillion globally, demonstrating the sustained demand for these offerings.

Alten's established civil aeronautics engagements represent a significant Cash Cow. Despite some project delays in 2024, this sector is a mature, substantial market where Alten has a well-entrenched role as a vital partner for aircraft manufacturers.

The company's extensive knowledge in critical areas such as avionics, structural engineering, and the digital transformation of aviation consistently yields substantial cash flow. This enduring financial strength persists even amidst the current market volatility experienced in 2024, underscoring its status as a reliable income generator.

Long-term Strategic Client Partnerships

Alten's strategic focus on cultivating long-term client partnerships within its mature business segments positions these relationships as core cash cows. These enduring collaborations, built on trust and consistent delivery of specialized engineering and IT services, generate a predictable and substantial revenue stream.

These established relationships represent a high market share in segments where clients prioritize stability and proven expertise. For instance, in 2024, Alten reported continued strong performance in its established automotive and aerospace sectors, where many of its largest client partnerships are concentrated. This stability is crucial for funding growth initiatives in other areas of the business.

- Consistent Revenue: Long-term contracts provide a predictable income base, essential for financial stability.

- High Market Share: Dominance in mature client segments ensures sustained demand for Alten's services.

- Reduced Acquisition Costs: Retaining existing clients is more cost-effective than acquiring new ones.

- Cross-selling Opportunities: Deep client understanding allows for offering a wider range of services.

Southern European Market Presence

Southern Europe represents a solid Cash Cow for Alten. Unlike some other European regions that have seen a downturn, this area consistently delivers satisfying organic growth.

This sustained performance highlights Alten's strong and well-established presence in a mature market. It acts as a dependable contributor to the company's overall revenue, providing a stable source of cash flow.

- Southern European Organic Growth: Alten reported robust organic growth in Southern Europe, outperforming other regions.

- Market Position: The company enjoys a strong, established market position in this mature geographical area.

- Revenue Contribution: This region reliably contributes to Alten's overall revenue, acting as a stable cash generator.

- 2024 Performance: Specific figures for 2024 indicate continued resilience, with Southern Europe contributing significantly to Alten's financial stability. For instance, Alten's 2024 financial reports showed Southern Europe as a key driver of profitability, with its share of revenue remaining consistently high.

Alten's established engineering consulting services in sectors like aerospace and automotive are its primary cash cows. These mature business lines benefit from deep technical expertise and long-standing client relationships, consistently generating substantial cash flow. In 2024, Alten's performance in its core European markets, particularly in these foundational service areas, underscored the sustained demand and profitability that characterize these mature offerings.

The company's General IT Services and Systems Integration also function as a key cash cow. These essential services for IT infrastructure maintenance and upgrades provide a steady revenue stream. The global IT services market, including integration, was projected to exceed $1.3 trillion in 2024, highlighting the enduring demand for Alten's capabilities in this space.

Alten's civil aeronautics engagements are another significant cash cow. Despite market fluctuations in 2024, this sector remains a substantial and mature market where Alten holds a strong position as a partner to aircraft manufacturers. This enduring financial strength, driven by expertise in areas like avionics and digital transformation, continues to provide a reliable income stream.

Southern Europe stands out as a strong cash cow for Alten, consistently delivering robust organic growth even when other regions faced challenges in 2024. This sustained performance reflects Alten's established market position and its ability to act as a dependable contributor to the company's overall revenue, reinforcing its role as a stable cash generator.

| Business Segment | Market Position | Cash Flow Generation | 2024 Performance Indicator |

|---|---|---|---|

| Core Engineering (Aerospace, Automotive) | High, established | Consistent, substantial | Strong performance in European markets |

| General IT Services & Systems Integration | Significant | Predictable revenue stream | Benefiting from a global market exceeding $1.3 trillion |

| Civil Aeronautics Engagements | Well-entrenched | Reliable income | Continued demand amidst market volatility |

| Southern Europe Operations | Strong, established | Stable cash generator | Robust organic growth reported |

Full Transparency, Always

Alten BCG Matrix

The preview of the Alten BCG Matrix you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive strategic tool, designed for clarity and actionable insights, will be delivered without any watermarks or demo content, ready for immediate integration into your business planning.

Dogs

Alten's UK Public Sector operations are currently positioned as a 'Dog' in the BCG Matrix. The company has publicly acknowledged significant difficulties, including substantial goodwill impairments within this segment. This indicates a weak competitive position in a market that is either stagnant or declining.

The financial implications are clear: these operations are likely consuming resources without generating sufficient returns or offering strong growth potential. For instance, in 2024, many IT and consulting firms serving the UK public sector faced budget constraints and a slowdown in new project awards, impacting revenue streams and profitability.

The impairments suggest that Alten may be re-evaluating the long-term viability or strategic importance of these UK public sector contracts. Without a clear path to market leadership or significant market growth, these 'Dog' units typically require careful management to minimize losses or a strategic decision for divestment.

The German automotive sector, a cornerstone of the country's economy, experienced significant headwinds in 2024. Supply chain disruptions, particularly for semiconductors, and a shift towards electric vehicles (EVs) created a complex operating environment. This resulted in a notable slowdown in production and sales for many German automakers.

Similarly, the civil aeronautics segment in Germany grappled with post-pandemic recovery challenges and evolving market demands. While air travel rebounded, the industry faced increased competition and the ongoing pressure to decarbonize. These factors contributed to a more cautious investment climate and slower growth prospects within the sector.

These combined sectoral pressures in Germany directly impacted Alten's performance, particularly in these segments. The low market share and low growth observed in both automotive and civil aeronautics in Germany position them as question marks or potentially dogs within the BCG matrix framework, requiring careful strategic consideration.

Alten's Northern Europe operations are currently positioned as a Dog in the BCG matrix. The region experienced a concerning decline of over 15% in Q1 2025, signaling a weak market position within a contracting or stagnant market. This performance necessitates a critical review of the business strategy for this segment.

Certain Telecommunications Sector Engagements

The telecommunications sector, especially in France, faced considerable budget reductions and a notable downturn in Q1 2025. This environment likely places certain Alten engagements within this sector in the Dogs quadrant of the BCG Matrix. These are areas characterized by low market growth and potentially a declining market share for Alten.

Specifically, Alten's telecom business in France reported a significant budget cut, impacting revenue streams. This aligns with a low-growth market scenario. For instance, the French telecom market itself saw a slowdown in capital expenditure by major operators in the first half of 2025, directly affecting service providers like Alten.

- Low Market Growth: The overall French telecommunications market experienced a contraction in new project investments during early 2025.

- Declining Market Share: Certain specialized services offered by Alten in this sector may be facing increased competition, leading to a reduced share.

- Potential Divestment/Harvesting: Engagements in this segment might be candidates for divestment or a strategy to minimize further investment due to poor prospects.

Divested Asian Subsidiary (China/Japan)

Alten's divestiture of its Asian subsidiary, encompassing operations in China and Japan, at the close of 2024 signifies a strategic move likely driven by underperformance. This unit, which previously employed 230 consultants and generated €8.9 million in revenue, aligns with the characteristics of a 'Dog' in the BCG matrix. Such entities typically exhibit low market share and low market growth, making them candidates for divestment to reallocate resources to more promising ventures.

The decision to exit this Asian market suggests that the subsidiary was not meeting expected profitability or growth targets, or perhaps its strategic direction diverged from Alten's broader corporate objectives. Divesting a 'Dog' allows a company to cut its losses and focus on core competencies or high-potential business units, thereby improving overall portfolio efficiency and financial health.

- Divested Asian Operations: Alten exited its China/Japan subsidiary by the end of 2024.

- Financial Snapshot: The divested unit had €8.9 million in revenue and employed 230 consultants.

- BCG Matrix Classification: The divestiture strongly suggests the subsidiary was classified as a 'Dog' due to probable underperformance.

- Strategic Rationale: Exiting 'Dogs' is a common strategy to optimize resource allocation and enhance overall business performance.

Alten's UK Public Sector operations are categorized as a 'Dog' in the BCG Matrix, reflecting a weak market position in a stagnant or declining sector. This segment has faced significant challenges, including substantial goodwill impairments, indicating a lack of competitive strength and limited future growth prospects. In 2024, many IT and consulting firms in the UK public sector encountered budget constraints and a slowdown in project awards, directly impacting revenue and profitability.

The German automotive and civil aeronautics sectors also presented 'Dog' characteristics for Alten in 2024. Both industries experienced significant headwinds, such as supply chain issues and the transition to electric vehicles in automotive, and post-pandemic recovery challenges coupled with decarbonization pressures in aeronautics. These factors contributed to a complex operating environment with slower growth, positioning Alten's involvement in these areas as low-share, low-growth ventures.

Alten's Northern Europe operations are also classified as a 'Dog,' having seen a decline of over 15% in Q1 2025. This performance underscores a weak market position within a contracting or stagnant regional market, necessitating a critical review of the business strategy for this segment. Similarly, Alten's French telecommunications business likely falls into the 'Dog' quadrant due to budget reductions and a market downturn in Q1 2025, aligning with low market growth and potentially declining market share.

The divestiture of Alten's Asian subsidiary (China and Japan) at the end of 2024, with €8.9 million in revenue and 230 employees, strongly suggests it was a 'Dog.' This strategic exit is typical for underperforming units with low market share and growth, aimed at reallocating resources to more promising areas and improving overall portfolio efficiency.

| Segment | BCG Classification | Key Challenges | Recent Performance Indicators | Strategic Implication |

|---|---|---|---|---|

| UK Public Sector | Dog | Weak market position, stagnant/declining market, goodwill impairments | Budget constraints, slowdown in new project awards (2024) | Minimize losses or consider divestment |

| German Automotive | Dog | Supply chain disruptions, EV transition, complex operating environment | Slowdown in production and sales (2024) | Careful strategic consideration |

| German Civil Aeronautics | Dog | Post-pandemic recovery, decarbonization pressure, increased competition | Cautious investment climate, slower growth prospects | Careful strategic consideration |

| Northern Europe | Dog | Contracting/stagnant market, weak market position | Over 15% decline in Q1 2025 | Critical review of strategy |

| French Telecommunications | Dog | Budget reductions, market downturn, low market growth | Slowdown in capital expenditure by operators (H1 2025) | Potential divestment/harvesting |

| Asian Subsidiary (China/Japan) | Dog (Divested) | Underperformance, low market share/growth | €8.9M revenue, 230 consultants (pre-divestiture) | Divested to reallocate resources |

Question Marks

Alten's new AI-Driven Solution Accelerators represent a strategic push into a burgeoning market. These pre-configured solutions are designed to significantly speed up the adoption and implementation of artificial intelligence for clients, offering a more streamlined path to AI integration.

While these accelerators are new and likely hold a small market share currently, they are positioned within the rapidly expanding AI sector. The global AI market size was estimated to be around $200 billion in 2023 and is projected to grow substantially in the coming years, presenting a significant opportunity for these new offerings.

To establish themselves as future Stars, these AI Accelerators will require substantial investment in development, marketing, and proving their efficacy. Their success hinges on demonstrating tangible value and rapid return on investment for businesses looking to leverage AI without extensive custom development.

Alten's strategic push into emerging technologies within less mature markets is a classic example of a Question Mark in the BCG matrix. These ventures, such as deploying AI-driven solutions for agriculture in Southeast Asia or IoT platforms for smart cities in Africa, represent significant growth potential but currently hold a small market share. For instance, in 2024, Alten reported a 15% year-over-year revenue increase in its digital transformation services for emerging economies, yet this segment still constitutes less than 5% of its total global revenue.

Successfully nurturing these Question Marks requires substantial upfront investment in research, development, and market penetration. Without adequate funding and strategic focus, these promising initiatives risk becoming Dogs, draining resources without achieving a significant market position. Alten's commitment to doubling its R&D spending in these nascent technology sectors by 2025, aiming to capture an estimated 10% market share in targeted digital infrastructure projects by 2027, underscores the high-stakes nature of these investments.

Alten's strategic ventures in North America and Asia, while facing slight overall market declines, highlight a forward-looking approach. For instance, their acquisition of a software development firm in Vietnam, a market projected to see significant digital transformation, signals a commitment to high-potential growth areas. This move is crucial for Alten as they aim to diversify their revenue streams beyond traditional markets.

Despite these promising acquisitions, the initial revenue contribution from these new ventures is understandably low. This means significant investment will be required to nurture these businesses and help them capture substantial market share. By 2024, the global IT outsourcing market, which includes regions like Vietnam, was valued at over $400 billion, underscoring the competitive landscape Alten is entering.

Advanced & Disruptive Automotive Technologies

Alten is heavily investing in advanced and disruptive automotive technologies, focusing on areas like decarbonization, which includes electric and hydrogen powertrains, and sophisticated Advanced Driving Assistance Systems (ADAS). These segments are poised for substantial growth, reshaping the automotive landscape.

While Alten's commitment to these high-potential areas is clear, their current market share within these specific, cutting-edge niches might still be in its nascent stages. This positions these technologies as potential stars or question marks within the BCG matrix, depending on their future market penetration and growth trajectory.

- Decarbonization Investments: Alten is channeling resources into electric vehicle (EV) battery technology and hydrogen fuel cell development, reflecting the industry's shift away from traditional internal combustion engines.

- ADAS and Autonomous Driving: Significant R&D is directed towards ADAS features and the foundational elements for autonomous driving systems, a key differentiator in future vehicle capabilities.

- EE V&I Architecture: Investments in new Electrical and Electronics (EE) and Vehicle Integration (V&I) architectures are crucial for managing the increasing complexity of modern vehicles.

- Market Position Uncertainty: Despite substantial investment, Alten's precise market share in these rapidly evolving, disruptive segments remains a developing factor, influencing their classification within strategic growth models.

Offshore Organization Expansion for Competitiveness

Alten is strategically expanding its offshore capabilities in key regions such as India, Morocco, Eastern Europe, Vietnam, and Mexico. This move is designed to boost competitiveness and productivity by leveraging cost advantages and specialized talent pools. For instance, in 2024, Alten continued to invest in its Indian delivery centers, aiming to scale up operations for critical engineering services.

While these offshore expansions are crucial for growth, understanding the specific new service lines or enhanced capabilities being developed in these markets is vital. These areas, where Alten is actively building market share, represent potential growth stars within its portfolio. The company's focus on expanding its digital engineering and software development services offshore is a testament to this strategy.

- India's growing IT sector: India's IT services market was projected to reach $245 billion in 2024, providing a strong foundation for Alten's expansion.

- Eastern Europe's engineering talent: Countries like Poland and Romania offer skilled engineering workforces at competitive rates, supporting Alten's R&D and complex project delivery.

- Vietnam's emerging tech hub: Vietnam is rapidly becoming a significant player in software development and IT outsourcing, with the digital economy expected to grow substantially.

- Morocco and Mexico's strategic locations: These regions offer proximity to European and North American markets, respectively, facilitating nearshoring and efficient collaboration.

Question Marks in Alten's portfolio represent new ventures or technologies with high growth potential but currently low market share. These are strategic bets that require significant investment to develop and gain traction. Without proper nurturing and successful market penetration, they risk becoming Dogs.

Alten's investments in AI accelerators for niche industries, such as their recent expansion into AI for sustainable agriculture in South America, exemplify a Question Mark. While the global AI market is booming, Alten's specific solutions in these emerging sectors are still building their customer base and proving their value proposition. For instance, the AI in agriculture market is projected to grow at a CAGR of over 20% through 2028, indicating substantial upside.

The success of these Question Marks hinges on substantial investment in R&D, marketing, and sales to drive adoption and build market share. Alten's strategy to allocate an additional 10% of its R&D budget to these nascent areas in 2024-2025 highlights the commitment needed. Failure to achieve critical mass could lead to these ventures becoming resource drains.

Alten's foray into advanced materials for the aerospace sector, particularly in lightweight composites for next-generation aircraft, also fits the Question Mark profile. While the aerospace market is robust, Alten's specific material solutions are new entrants. The global advanced composites market was valued at over $15 billion in 2023 and is expected to see continued growth, offering a fertile ground for these new offerings if they can capture even a small percentage.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust foundation of data, including historical sales figures, market share reports, and industry growth projections, to accurately assess product portfolio performance.