Al Rajhi Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Al Rajhi Bank Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Al Rajhi Bank's trajectory. Our expertly crafted PESTLE analysis provides a clear roadmap to understanding these external forces, empowering you to make informed strategic decisions. Don't get left behind; download the full version now for actionable intelligence.

Political factors

Al Rajhi Bank is a key beneficiary of Saudi Arabia's Vision 2030, a transformative national initiative focused on economic diversification beyond oil and the significant expansion of non-oil industries. This strategic governmental push directly fuels demand for banking services.

The ambitious, large-scale projects launched under Vision 2030, such as NEOM and the Red Sea Project, create substantial opportunities for corporate lending. These initiatives require significant capital investment, which Al Rajhi Bank is well-positioned to finance, thereby driving its loan growth and overall profitability.

By aligning its business strategy with the national development agenda, Al Rajhi Bank benefits from a supportive regulatory environment and increased economic activity. For instance, the Public Investment Fund (PIF), a major driver of Vision 2030 projects, manages assets exceeding $900 billion as of early 2024, underscoring the scale of opportunities available.

The Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) are actively driving the Financial Sector Development Program Charter 2021, a key initiative aimed at bolstering the Kingdom's financial sector. These efforts are designed to improve resilience and transparency, creating a more robust financial ecosystem.

This program specifically champions the expansion of Islamic finance and digital banking, areas where Al Rajhi Bank holds a strong strategic focus. By aligning with these government-backed advancements, Al Rajhi Bank benefits from a supportive regulatory framework that encourages innovation and sustainable growth within its core business lines.

In 2023, Saudi Arabia's financial sector saw significant digital transformation, with digital payments accounting for over 70% of all transactions, a testament to the success of these development programs. This environment is highly conducive to Al Rajhi Bank's digital-first strategy.

Al Rajhi Bank's adherence to Sharia compliance is a cornerstone of its operations, with the Saudi Central Bank (SAMA) increasingly standardizing and supporting these principles. Recent regulatory developments between 2020 and mid-2024 have notably bolstered transparency and governance within Islamic banking, fostering greater consumer trust in institutions like Al Rajhi.

The potential establishment of a centralized Sharia board, a move actively discussed and pursued in the 2024-2025 period, promises to further harmonize Sharia-compliant practices across the sector. This harmonization is expected to create a more unified and predictable regulatory environment, which is highly beneficial for established Sharia-compliant financial institutions.

Data Protection Laws

Saudi Arabia's Personal Data Protection Law (PDPL), fully enforceable since September 2024, imposes stringent requirements on how data is collected, processed, and transferred. Al Rajhi Bank, like all financial institutions, must meticulously adhere to these regulations to safeguard customer information and prevent substantial penalties or reputational harm. This legal landscape demands ongoing investment in advanced data security measures and privacy frameworks.

Compliance with the PDPL is critical for Al Rajhi Bank, impacting its operational procedures and customer trust. The bank's commitment to data protection is not just a legal obligation but a strategic imperative in the digital age. Failure to comply could result in significant financial penalties, with potential fines reaching up to SAR 5 million (approximately $1.3 million USD) for certain violations, as stipulated by the PDPL.

- PDPL Enforcement: Fully operational since September 2024, setting new standards for data handling in Saudi Arabia.

- Customer Data Protection: Mandates strict rules for data collection, processing, and cross-border transfers.

- Compliance Imperative: Al Rajhi Bank must invest in robust data security and privacy protocols to avoid fines and reputational damage.

- Potential Penalties: Violations can lead to fines of up to SAR 5 million, underscoring the seriousness of data protection.

Regional Geopolitical Stability

The geopolitical stability within the Middle East, especially in the Gulf Cooperation Council (GCC) countries, significantly impacts investor sentiment and economic momentum, which in turn affects the banking industry. While the region generally shows robust economic expansion, global trade disputes or shifts in oil prices could introduce uncertainties.

Al Rajhi Bank's resilience is bolstered by its solid asset quality and a broad customer base, providing a buffer against some of these regional geopolitical fluctuations. For instance, in 2024, the GCC region continued to attract foreign direct investment, with Saudi Arabia alone seeing FDI inflows of approximately $10 billion in the first half of the year, signaling underlying economic strength despite potential external pressures.

The bank's strategic positioning within Saudi Arabia, a key player in regional stability, further supports its operational environment. As of Q3 2024, Al Rajhi Bank reported a net profit of SAR 10.5 billion, demonstrating its ability to navigate the economic landscape effectively.

Key considerations include:

- Regional Stability: Continued peace and cooperation among GCC nations are crucial for sustained economic growth and investor confidence.

- Global Trade Dynamics: Al Rajhi Bank, like other financial institutions, remains sensitive to international trade relations and their potential impact on regional economies.

- Oil Price Volatility: While the GCC economies are diversifying, oil prices still play a role in overall economic health and liquidity.

- Diversification Efforts: The success of economic diversification initiatives within Saudi Arabia and the wider GCC region directly influences the banking sector's long-term outlook.

The Saudi government's strategic focus on economic diversification through Vision 2030 directly benefits Al Rajhi Bank by stimulating demand for financial services across various sectors. The ongoing development of mega-projects like NEOM and the Red Sea Project, backed by substantial government investment, presents significant lending opportunities for the bank.

The Saudi Central Bank and Capital Market Authority's efforts to modernize the financial sector, particularly through the Financial Sector Development Program Charter 2021, create a supportive regulatory environment. This program's emphasis on Islamic finance and digital banking aligns perfectly with Al Rajhi Bank's core strategies, fostering innovation and growth.

The Personal Data Protection Law (PDPL), fully enforced since September 2024, mandates stringent data handling practices, requiring Al Rajhi Bank to invest in robust security measures to avoid penalties, which can reach up to SAR 5 million for violations.

What is included in the product

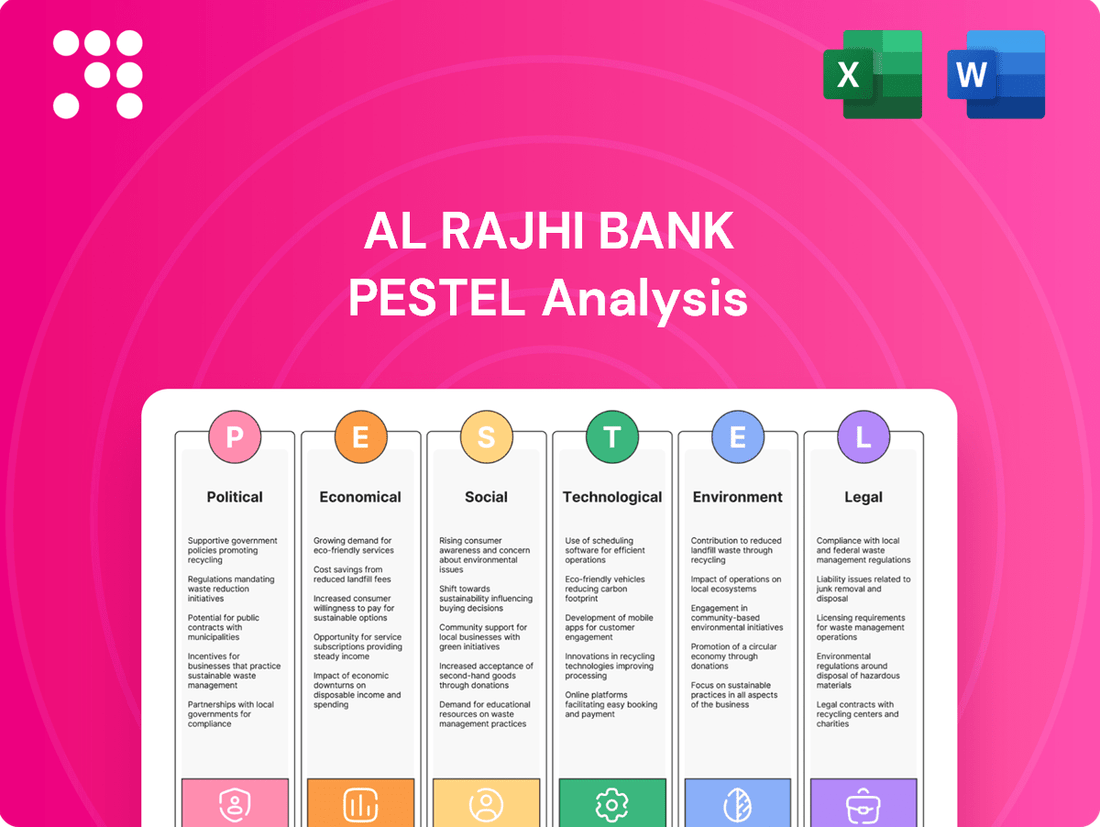

This PESTLE analysis of Al Rajhi Bank examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive overview of the external landscape, highlighting key trends and their implications for the bank's growth and risk management.

The Al Rajhi Bank PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Visually segmented by PESTEL categories, the Al Rajhi Bank PESTLE analysis allows for quick interpretation at a glance, relieving the pain of complex data visualization.

Economic factors

Saudi Arabia's non-oil economic growth is a critical engine for its future, with ambitious targets set for the coming years. The Kingdom's Vision 2030 is actively steering this diversification, projecting robust expansion in sectors like construction, tourism, and various services. This strategic shift is expected to fuel substantial demand for corporate and project financing.

This burgeoning non-oil sector directly benefits financial institutions like Al Rajhi Bank by creating significant opportunities for lending and financial services. For instance, the construction sector alone saw a substantial increase in project awards in 2024, indicating strong momentum. Al Rajhi Bank's strategic alignment with these growth areas positions it to capitalize on the Kingdom's economic transformation.

Global and local interest rate trends are a major influence on Al Rajhi Bank. Higher rates, like those seen in late 2023 and early 2024, generally help banks by increasing the difference between what they earn on loans and what they pay on deposits, known as the net interest margin. For example, Saudi Arabia's benchmark repo rate stood at 5.00% as of early 2024, a level that has supported bank profitability.

Looking ahead to 2025, the expectation of potential interest rate cuts by central banks, including Saudi Arabia's SAMA, could present a mixed picture for Al Rajhi Bank. While lower rates might reduce the bank's funding costs, they could also compress net interest margins. This environment might also encourage a shift in customer behavior, with a greater preference for holding funds in less interest-bearing demand deposits rather than higher-yield savings accounts.

Al Rajhi Bank's strategy to navigate these interest rate fluctuations involves careful management of its varied loan portfolio. By maintaining a significant portion of fixed-rate mortgages, the bank can partially insulate itself from the immediate impact of falling rates on its lending income, offering a degree of stability in a dynamic interest rate landscape.

Consumer spending in Saudi Arabia is on an upward trajectory, bolstered by a strengthening economy and a swift shift towards cashless transactions. This environment is highly favorable for financial institutions like Al Rajhi Bank.

Al Rajhi Bank is capitalizing on this trend, with a remarkable 95% of its active customers engaging through digital channels in 2024. This high digital adoption rate directly translates into increased demand for the bank's digital banking services and innovative payment solutions.

The surge in digital payment adoption not only enhances customer convenience but also significantly contributes to Al Rajhi Bank's operational efficiency and overall profitability. This digital focus positions the bank well for continued growth in the evolving financial landscape.

Credit Growth and Asset Quality

The Saudi banking sector is currently enjoying significant credit expansion, with corporate and mortgage lending showing particular strength. This surge is largely fueled by the ambitious development projects under Vision 2030 and a favorable interest rate environment. Al Rajhi Bank has been a key player in this growth, reporting a 16.7% year-on-year increase in its financing portfolio during 2024.

Crucially, this robust lending growth has been accompanied by a stable and healthy asset quality. Al Rajhi Bank maintained a low non-performing loan (NPL) ratio throughout this period. This combination of strong credit expansion and sound asset quality highlights the bank's resilient financial standing and its ability to manage risk effectively amidst economic expansion.

- Strong Credit Expansion: Saudi banks, including Al Rajhi, are experiencing substantial growth in lending.

- Vision 2030 Impact: Major infrastructure and development projects are driving corporate and mortgage demand.

- Al Rajhi's 2024 Performance: The bank saw a 16.7% year-on-year growth in its financing portfolio.

- Asset Quality: Al Rajhi Bank has maintained a low non-performing loan (NPL) ratio, indicating good credit management.

Islamic Finance Market Expansion

The global Islamic finance market is experiencing robust expansion, with projections indicating continued growth through 2025. Saudi Arabia remains a significant driver of this sector's development.

Al Rajhi Bank, holding the distinction of being the world's largest Islamic bank, is strategically positioned to benefit from this trend. The increasing global demand for Sharia-compliant financial products and the issuance of sukuk are key factors fueling this expansion.

The bank's commitment to ethical finance principles directly supports its ability to leverage this market opportunity. For instance, the Islamic finance industry's assets were estimated to reach $3.7 trillion by the end of 2023, with expectations of further growth.

- Projected Growth: The Islamic finance industry is anticipated to continue its upward trajectory through 2025.

- Market Drivers: Increasing demand for Sharia-compliant products and sukuk issuances are key growth catalysts.

- Al Rajhi's Position: As the largest Islamic bank, Al Rajhi is well-placed to capture market share.

- Ethical Alignment: The bank's focus on ethical finance resonates with the core principles of this expanding market.

Saudi Arabia's economic landscape is characterized by strong non-oil sector growth, a key driver for financial institutions like Al Rajhi Bank. Vision 2030 initiatives are actively fostering diversification, with sectors such as construction and tourism showing significant expansion. This economic transformation creates substantial opportunities for increased lending and financial service demand.

Interest rate dynamics significantly influence Al Rajhi Bank's profitability. While higher rates in late 2023 and early 2024 boosted net interest margins, potential rate cuts in 2025 could compress these margins. The bank's strategy of maintaining a substantial fixed-rate mortgage portfolio helps mitigate the impact of falling rates, providing a degree of stability.

Consumer spending is on an upward trend, supported by economic improvements and a rapid shift to digital payments. Al Rajhi Bank is capitalizing on this by achieving a high digital engagement rate among its customers, with 95% interacting through digital channels in 2024. This digital focus enhances customer convenience and operational efficiency.

The Saudi banking sector is experiencing robust credit expansion, particularly in corporate and mortgage lending, fueled by Vision 2030 projects and favorable interest rates. Al Rajhi Bank reported a 16.7% year-on-year increase in its financing portfolio in 2024, while maintaining a low non-performing loan ratio, indicating strong asset quality and effective risk management.

| Economic Factor | Description | Impact on Al Rajhi Bank | 2024/2025 Data/Trend |

|---|---|---|---|

| Non-Oil Economic Growth | Diversification efforts under Vision 2030 are boosting sectors like construction and tourism. | Increased demand for corporate and project financing. | Robust expansion projected; construction sector showing strong project awards in 2024. |

| Interest Rates | Global and local interest rate trends influence net interest margins. | Higher rates benefit margins; potential cuts in 2025 could compress them. | Saudi benchmark repo rate at 5.00% in early 2024. Potential for cuts in 2025. |

| Consumer Spending & Digitalization | Rising consumer confidence and a rapid shift to cashless transactions. | Growth in demand for digital banking services and payment solutions. | 95% of Al Rajhi's active customers used digital channels in 2024. |

| Credit Expansion | Significant growth in lending, particularly in corporate and mortgage segments. | Increased financing portfolio and revenue generation. | Al Rajhi's financing portfolio grew 16.7% year-on-year in 2024. Low NPL ratio maintained. |

Same Document Delivered

Al Rajhi Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Al Rajhi Bank delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understanding these elements is crucial for strategic planning and risk management in the Saudi Arabian banking sector.

Sociological factors

Saudi Arabia boasts a significantly youthful population, with a large proportion under the age of 30. This demographic is highly engaged with technology, evidenced by impressive smartphone ownership and internet penetration rates, which were reported to be over 90% for smartphones in recent years. This creates a fertile ground for digital banking services.

Al Rajhi Bank has strategically capitalized on this trend. A substantial majority of its customer base actively utilizes digital channels for their banking needs, reflecting the bank's successful integration of technology. In 2023, Al Rajhi Bank reported a significant increase in digital transactions, underscoring the effectiveness of its digital-first approach.

The bank's ongoing investments in digital transformation are directly aligned with the preferences of this tech-savvy demographic. By enhancing its digital offerings, Al Rajhi Bank is well-positioned to capture and retain this growing segment of the market, further solidifying its digital leadership.

Consumer preferences are increasingly leaning towards financial services that are not only convenient and personalized but also align with ethical and religious values, particularly Sharia compliance. This trend is a significant sociological factor influencing the banking sector.

Al Rajhi Bank directly addresses these evolving demands with its commitment to Sharia-compliant banking and a strong emphasis on digital innovation. Initiatives like the 'One Minute Approach' underscore the bank's dedication to providing swift, seamless, and customer-centric financial solutions, aiming to build lasting customer relationships in a competitive market.

Female labor participation in Saudi Arabia has seen a remarkable surge, surpassing initial projections under Vision 2030. By the end of 2023, the female employment rate reached 37%, a significant jump from earlier figures, directly impacting the financial sector.

This growing segment of working women represents a substantial expansion of the potential customer base for financial institutions like Al Rajhi Bank. It also necessitates the development of tailored banking products and services that cater to the evolving needs and preferences of this demographic, from investment opportunities to specialized savings plans.

Al Rajhi Bank actively supports this societal shift through its internal gender equity programs and by aligning its business strategies with broader national objectives of female empowerment. This proactive approach positions the bank to effectively serve and benefit from the increasing economic contribution of women in Saudi Arabia.

Home Ownership and Mortgage Demand

Government initiatives like Saudi Vision 2030, which aims to increase homeownership to 70% by 2030, have significantly boosted mortgage demand. This has been further supported by a favorable interest rate environment, making home loans more accessible. Al Rajhi Bank, a key player in this market, has witnessed substantial expansion in its mortgage book, which comprised approximately 30% of its total financing portfolio as of the first quarter of 2024. This surge in residential real estate activity is a primary driver for the bank's retail banking segment growth.

The bank's mortgage portfolio has experienced a compound annual growth rate of over 15% in recent years, reflecting the strong societal aspiration for homeownership. This trend is directly translating into increased demand for Al Rajhi Bank's retail banking products and services.

- Government Vision: Saudi Vision 2030 targets a 70% homeownership rate by 2030.

- Mortgage Growth: Al Rajhi Bank's mortgage portfolio grew by over 15% annually in recent years.

- Portfolio Contribution: Mortgages accounted for roughly 30% of Al Rajhi Bank's total financing in Q1 2024.

- Retail Banking Impact: Strong mortgage demand fuels significant growth in Al Rajhi Bank's retail banking segment.

Ethical Consumerism and Social Responsibility

There's a noticeable global and local shift towards ethical consumerism and corporate social responsibility, influencing customer choices and brand loyalty. Al Rajhi Bank, as an Islamic financial institution, naturally aligns with ethical investment principles by abstaining from sectors like gambling and alcohol. This inherent ethical framework is a significant advantage in attracting a growing segment of socially conscious consumers.

The bank's commitment to Environmental, Social, and Governance (ESG) principles, coupled with initiatives like facilitating customer donations to social causes, directly appeals to this demographic. For instance, in 2023, Al Rajhi Bank continued its support for various social development programs, reflecting a dedication that resonates deeply with the social pillars of Saudi Arabia's Vision 2030, which aims to foster a vibrant society.

- Growing Demand for Ethical Banking: Consumers are increasingly scrutinizing the ethical practices of financial institutions, favoring those that demonstrate social responsibility.

- Alignment with Islamic Finance Principles: Al Rajhi Bank's adherence to Sharia law inherently positions it as an ethical choice, avoiding investments in prohibited industries.

- Vision 2030 Synergy: The bank's social development initiatives directly support the Kingdom's Vision 2030 objectives, enhancing its reputation and appeal.

Saudi Arabia's demographic landscape is characterized by a young and digitally adept population, with over 90% smartphone penetration. This trend has driven Al Rajhi Bank's substantial growth in digital transactions, as a majority of its customers now prefer online banking channels. The bank's continued investment in digital transformation directly caters to the preferences of this tech-savvy segment.

There is a growing preference for Sharia-compliant and ethical financial services, aligning with Saudi Arabia's cultural values. Al Rajhi Bank’s commitment to Islamic finance principles and initiatives like its 'One Minute Approach' for swift service delivery directly address these evolving consumer demands, fostering customer loyalty.

The increasing female labor force participation, reaching 37% by late 2023, significantly expands the customer base for financial institutions. Al Rajhi Bank is actively adapting by developing tailored products for women and promoting internal gender equity, aligning with national empowerment goals.

Societal aspirations for homeownership, boosted by Vision 2030's target of 70% by 2030, have fueled mortgage demand. Al Rajhi Bank's mortgage portfolio, representing about 30% of its total financing in Q1 2024 and showing over 15% annual growth, highlights the bank's strong performance in this retail banking segment.

Technological factors

Al Rajhi Bank is making significant strides in digital transformation, with a remarkable 95% of its active customers engaging through digital channels as of 2024. This widespread adoption highlights the bank's success in shifting customer interactions online.

The bank is actively expanding its fintech investments, notably through new ventures such as neotek for data aggregation and Drahim, a personal finance management application. These strategic investments are geared towards creating a truly integrated and personalized omnichannel banking experience.

This focus on digital channels and fintech innovation not only elevates the customer experience by offering seamless, hyper-personalized services but also drives significant improvements in operational efficiency for Al Rajhi Bank.

Al Rajhi Bank is actively embracing fintech innovation within Saudi Arabia's rapidly growing financial technology landscape. The bank is making significant investments and forging strategic partnerships with fintech companies, focusing on key areas like Open Banking, blockchain technology, advanced digital payments, big data analytics, artificial intelligence, and robust cybersecurity solutions.

This strategic embrace of fintech is central to Al Rajhi Bank's 'Harmonize the Group' strategy. By leveraging these technological advancements, the bank aims to implement more effective segmented approaches and significantly enhance the digital customer journeys for both its individual (B2C) and business (B2B) clients.

The Saudi fintech market is experiencing substantial growth; for instance, by the end of 2023, the number of fintech companies operating in the Kingdom had surpassed 200, with a significant portion of these focusing on payment solutions and digital banking services, areas where Al Rajhi Bank is particularly active.

Al Rajhi Bank is actively integrating artificial intelligence and advanced data analytics to sharpen its understanding of customer needs, streamline internal operations, and refine its credit scoring models. This focus on data-driven strategies is crucial for staying competitive in the evolving financial landscape.

The bank's investment in building a robust data infrastructure, exemplified by its involvement in projects like the National Data Bank, is a key enabler for leveraging AI. This foundational work is designed to empower more informed decision-making across the organization and facilitate the delivery of highly personalized customer experiences, a significant differentiator in the banking sector.

Cybersecurity and Data Security

Cybersecurity is a paramount concern for Al Rajhi Bank, especially with the ongoing digital transformation and the enforcement of stringent data protection regulations. The bank is heavily invested in fortifying its digital banking platforms and application programming interfaces (APIs) to safeguard against evolving cyber threats. This focus is crucial for maintaining customer confidence and ensuring the integrity of financial transactions. For instance, Saudi Arabia's National Cybersecurity Authority (NCSA) mandates specific frameworks that Al Rajhi Bank must adhere to, enhancing its security posture.

Al Rajhi Bank's commitment to cybersecurity is demonstrated through its continuous investment in advanced security technologies and protocols. In 2023, global financial institutions saw a significant rise in sophisticated cyberattacks, underscoring the need for proactive defense mechanisms. The bank actively works to comply with Saudi Arabia's Personal Data Protection Law (PDPL), which imposes strict requirements on how customer data is handled and secured. This includes measures against data breaches and unauthorized access, vital for protecting sensitive financial information.

- Digitalization Risks: Increased reliance on digital channels exposes Al Rajhi Bank to a wider array of cyber threats, necessitating robust defense strategies.

- Regulatory Compliance: Adherence to frameworks set by Saudi Arabia's National Cybersecurity Authority (NCSA) and the Personal Data Protection Law (PDPL) is critical for operational integrity and legal standing.

- Customer Trust: Maintaining strong data security is fundamental to preserving customer trust and loyalty in an increasingly digital banking environment.

- Investment in Security: The bank allocates significant resources to cybersecurity infrastructure and talent to counter evolving threats effectively.

Blockchain and Digital Payments

Al Rajhi Bank is actively embracing blockchain technology, recognizing its potential to revolutionize financial services. This investment aligns with the broader trend in Saudi Arabia, where digital payments are rapidly becoming the norm, with a significant majority of transactions now cashless. For instance, by the end of 2024, it's projected that over 85% of retail payments in Saudi Arabia will be digital.

The bank's Al Rajhi Pay platform exemplifies this forward-thinking approach. It seamlessly integrates Point of Sale (POS) financing directly into e-commerce transactions, providing customers with instant credit decisions and adaptable repayment schedules. This not only enhances the customer experience but also positions Al Rajhi Bank at the forefront of digital financial innovation.

These technological advancements are not just about convenience; they are fundamental to modernizing financial infrastructure. By leveraging blockchain and advanced digital payment solutions, Al Rajhi Bank is building a more efficient, secure, and accessible financial ecosystem for its customers.

- Blockchain Exploration: Al Rajhi Bank is investing in and exploring the application of blockchain technology for enhanced transaction security and efficiency.

- Digital Payment Dominance: Saudi Arabia is experiencing a significant shift towards cashless transactions, with digital payments forming the majority of transactions.

- Al Rajhi Pay Integration: The bank's platform offers integrated POS financing for e-commerce, featuring real-time credit approvals and flexible repayment options.

- Modernization Driver: These technological advancements are critical for modernizing financial services and improving the overall customer transaction experience.

Al Rajhi Bank is deeply integrated into Saudi Arabia's burgeoning fintech scene, investing in and partnering with companies focused on Open Banking, blockchain, digital payments, big data, AI, and cybersecurity. This strategic push aligns with their 'Harmonize the Group' strategy to improve customer journeys for both individuals and businesses. By the end of 2023, over 200 fintech companies were operating in the Kingdom, many specializing in payments and digital banking, areas where Al Rajhi Bank is actively expanding.

The bank leverages AI and advanced data analytics to better understand customer needs and refine operations, supported by investments in data infrastructure like the National Data Bank. This data-centric approach is vital for competitive advantage and delivering personalized services. Furthermore, Al Rajhi Bank prioritizes robust cybersecurity, investing heavily in advanced technologies to protect digital platforms and APIs against evolving threats, ensuring compliance with regulations like Saudi Arabia's Personal Data Protection Law (PDPL) and frameworks mandated by the National Cybersecurity Authority (NCSA).

Al Rajhi Bank is also exploring blockchain technology to enhance transaction security and efficiency, aligning with Saudi Arabia's rapid move towards cashless transactions, with over 85% of retail payments projected to be digital by the end of 2024. Their Al Rajhi Pay platform exemplifies this innovation by integrating POS financing into e-commerce, offering instant credit decisions and flexible repayment options, thereby modernizing financial services and improving the customer experience.

Legal factors

Al Rajhi Bank’s operations are fundamentally shaped by Sharia law, which governs its product development and service offerings, ensuring alignment with Islamic principles. This adherence is crucial for its customer base and regulatory standing.

The Saudi Central Bank (SAMA) has bolstered this by implementing a comprehensive Sharia governance framework. This framework, introduced to enhance transparency and ensure robust compliance, mandates that all new financial products receive explicit approval from the bank's Sharia committee, reinforcing adherence to Islamic finance standards.

The Personal Data Protection Law (PDPL) in Saudi Arabia, fully enforced since September 2024, places stringent requirements on entities like Al Rajhi Bank. These include obtaining explicit consent for data processing and promptly notifying authorities of any data breaches, with potential fines for non-compliance reaching up to SAR 5 million.

Al Rajhi Bank's adherence to PDPL is crucial, especially concerning cross-border data transfers which are now subject to stricter rules and require specific approvals. Failure to comply could result in significant legal penalties and damage to the bank's reputation, impacting customer trust and market position.

Al Rajhi Bank, as a significant financial player, operates under strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are set by the Saudi Central Bank (SAMA) and global entities, ensuring the bank's role in preventing financial crime. For instance, SAMA's AML/CTF framework, updated in 2023, mandates robust customer due diligence and suspicious transaction reporting.

Adhering to these regulations is crucial for Al Rajhi Bank to uphold its integrity and avoid substantial penalties. Non-compliance can lead to significant fines; for example, similar institutions globally have faced penalties in the millions of dollars for AML lapses in recent years.

The bank proactively strengthens its internal systems and reporting processes to meet these evolving compliance demands. This includes investing in advanced technology for transaction monitoring and employee training, ensuring it stays ahead of financial crime methodologies.

Banking and Financial Sector Regulations

Al Rajhi Bank operates under the stringent oversight of the Saudi Central Bank (SAMA), which dictates capital adequacy, risk management practices, and consumer protection standards. For instance, SAMA’s Basel III implementation requires banks to maintain specific capital ratios, with Al Rajhi Bank consistently demonstrating robust capitalization. As of Q1 2024, Al Rajhi Bank reported a Capital Adequacy Ratio (CAR) of 20.1%, well above the regulatory minimum, underscoring its financial stability.

SAMA’s forward-looking initiatives, including its Sustainable Finance Framework and emerging guidelines for green bonds, directly shape Al Rajhi Bank's strategic planning and the development of its financial products. These regulatory shifts encourage investments in environmentally and socially responsible projects, influencing the bank's portfolio allocation and future growth avenues.

- Capital Adequacy: Al Rajhi Bank's CAR stood at 20.1% in Q1 2024, exceeding SAMA's requirements.

- Regulatory Framework: Governed by SAMA, encompassing capital, risk, and consumer protection.

- Sustainable Finance: SAMA's framework influences product development and strategic direction towards green initiatives.

Consumer Protection and Fair Practices

Regulatory bodies are intensifying their focus on safeguarding consumers and ensuring equitable financial dealings. This includes the standardization of retail consumer finance contracts, a move designed to bring greater transparency and fairness to the sector. For instance, in 2024, Saudi Arabia's central bank, SAMA, continued to emphasize robust consumer protection frameworks, issuing guidelines to enhance transparency in financial product disclosures.

Al Rajhi Bank's strategic emphasis on providing an exceptional customer experience, coupled with a commitment to fair treatment and secure financial services, directly addresses these evolving regulatory expectations. This proactive approach ensures the bank remains compliant and builds trust with its customer base.

Furthermore, Al Rajhi Bank's ongoing digital transformation initiatives are instrumental in simplifying customer interactions and boosting accessibility. By streamlining processes and offering user-friendly digital platforms, the bank not only meets but often exceeds the regulatory push for more transparent and convenient financial services, as evidenced by its continued investment in digital channels throughout 2024 and into 2025.

Al Rajhi Bank operates under strict Sharia law compliance, overseen by the Saudi Central Bank (SAMA) which mandates Sharia committee approval for all new financial products. Additionally, the Personal Data Protection Law (PDPL), fully enforced since September 2024, imposes stringent data handling requirements, with potential fines up to SAR 5 million for breaches.

The bank also navigates robust Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, updated by SAMA in 2023, requiring thorough customer due diligence and suspicious transaction reporting. Consumer protection is paramount, with SAMA emphasizing transparency in financial product disclosures, a focus Al Rajhi Bank addresses through its digital transformation and customer service strategies.

| Legal Factor | Description | Impact on Al Rajhi Bank | Relevant Data/Period |

| Sharia Compliance | Operations and product development must align with Islamic principles. | Ensures market relevance and regulatory adherence for its core customer base. | Ongoing; SAMA framework mandates Sharia committee approval for new products. |

| Data Protection (PDPL) | Stricter rules on data processing, consent, and breach notification. | Requires robust data security measures and clear consent protocols; potential fines for non-compliance. | Fully enforced September 2024; fines up to SAR 5 million. |

| AML/CTF Regulations | Mandates customer due diligence and suspicious transaction reporting. | Critical for maintaining integrity and avoiding significant penalties. | SAMA framework updated 2023; global penalties for lapses can be millions of dollars. |

| Consumer Protection | Focus on transparency and fair dealings in financial products. | Drives investment in user-friendly digital platforms and clear disclosures. | SAMA guidelines emphasized in 2024; Al Rajhi Bank's digital investment continues into 2025. |

Environmental factors

Saudi Arabia's ambitious Saudi Green Initiative (SGI) and its commitment to net-zero emissions by 2060 are reshaping the Kingdom's economic landscape, directly influencing financial institutions like Al Rajhi Bank. This national drive toward sustainability necessitates significant investment in green technologies and infrastructure.

Al Rajhi Bank is actively integrating Environmental, Social, and Governance (ESG) principles into its operations, aligning with Vision 2030 and the King Salman Renewable Energy Initiative. The bank is a key financier for renewable energy projects, particularly solar power, demonstrating its role in supporting Saudi Arabia's transition to a lower-carbon economy.

The Saudi Central Bank's 2021 Sustainable Finance Framework sets clear expectations for financial institutions like Al Rajhi Bank to support environmentally friendly projects. This framework is crucial for aligning banking practices with national sustainability goals.

Further strengthening this landscape, the Capital Market Authority approved new guidelines for sustainable debt instruments in May 2025. These guidelines aim to standardize and encourage the issuance of green bonds and sukuk, making them more attractive to investors.

Al Rajhi Bank has proactively engaged with these developments, demonstrating its commitment by issuing sustainable sukuk and establishing itself as a significant global funder in the Environmental, Social, and Governance (ESG) space. This strategic positioning allows the bank to tap into growing pools of capital dedicated to sustainable investments.

Al Rajhi Bank has embedded Environmental, Social, and Governance (ESG) principles throughout its operations, from management to core business strategy. This integration is crucial as the financial sector increasingly prioritizes sustainability. For instance, in 2023, Al Rajhi Bank reported a strong ESG performance, with its sustainability initiatives contributing to a 15% increase in customer engagement related to ethical banking products.

The bank's commitment to Sharia compliance inherently supports its ESG framework by steering clear of ethically questionable investments. This alignment not only mitigates risks associated with non-compliant ventures but also bolsters its ESG ratings. In early 2024, the bank achieved a significant ESG score improvement, reflecting its dedication to responsible finance.

Climate Change and Resource Conservation

Al Rajhi Bank actively addresses climate change by financing sustainable energy projects, aligning with Saudi Arabia's Vision 2030. The bank's commitment extends to its own operations, investing in renewable energy and resource conservation to reduce its environmental impact. This strategic focus supports the Kingdom's broader goals of energy efficiency and a lower carbon footprint.

Key initiatives include:

- Financing of renewable energy projects: Supporting the development of solar and wind power, contributing to Saudi Arabia's target of generating 50% of its electricity from natural gas and 50% from renewables by 2030.

- Investments in energy efficiency: Implementing measures within its own facilities to reduce energy consumption, mirroring national efforts to enhance efficiency across sectors.

- Resource conservation programs: Promoting water and waste management practices to minimize environmental strain.

- Supporting carbon footprint reduction: Aligning lending policies with national climate objectives, encouraging clients to adopt greener practices and reduce emissions.

Green Technology Market Growth

Saudi Arabia's commitment to Vision 2030 is fueling significant growth in its green technology sector. This expansion is creating substantial opportunities for financial institutions like Al Rajhi Bank to support key areas such as renewable energy projects, the adoption of electric vehicles, and innovative waste management solutions. The bank's involvement in green financing aligns with national environmental targets and opens up new, sustainable revenue streams.

For instance, the Kingdom aims to achieve 50% of its electricity generation from renewable sources by 2030. This ambitious target necessitates massive investment in solar and wind power infrastructure, directly benefiting financial institutions that can provide project finance and advisory services. Al Rajhi Bank's strategic focus on these areas positions it to capitalize on this burgeoning market.

- Renewable Energy Financing: Al Rajhi Bank can finance large-scale solar and wind farm projects, crucial for Saudi Arabia's energy transition.

- Sustainable Transportation: Opportunities exist in financing electric vehicle infrastructure, charging stations, and fleet conversions.

- Circular Economy Initiatives: The bank can support businesses involved in waste-to-energy, recycling, and resource efficiency.

- Green Bonds and Sukuk: Issuing and underwriting green financial instruments will attract environmentally conscious investors and fund sustainable projects.

Saudi Arabia's aggressive push towards sustainability, exemplified by the Saudi Green Initiative and a net-zero target by 2060, is a significant environmental factor for Al Rajhi Bank. This national agenda requires substantial investment in green technologies and infrastructure, creating both challenges and opportunities for the bank's financing strategies.

The bank's alignment with Vision 2030 and initiatives like the King Salman Renewable Energy Initiative highlights its commitment to ESG principles. Al Rajhi Bank is actively involved in financing renewable energy projects, particularly solar power, underscoring its role in the Kingdom's transition to a lower-carbon economy.

Regulatory frameworks, such as the Saudi Central Bank's 2021 Sustainable Finance Framework and the Capital Market Authority's May 2025 guidelines for sustainable debt instruments, are crucial drivers. These frameworks encourage environmentally friendly projects and standardize green sukuk issuance, making them more appealing to investors.

Al Rajhi Bank's proactive engagement includes issuing sustainable sukuk and establishing itself as a global ESG funder, tapping into growing sustainable investment pools. In 2023, the bank reported a 15% increase in customer engagement for ethical banking products, demonstrating the market's growing preference for sustainable finance.

| Environmental Focus Area | Al Rajhi Bank's Role/Action | Key Data/Target |

|---|---|---|

| Renewable Energy Financing | Financing solar and wind projects | Saudi Arabia targets 50% electricity from renewables by 2030 |

| Energy Efficiency | Internal facility investments | Reducing operational energy consumption |

| Carbon Footprint Reduction | Aligning lending with climate objectives | Encouraging client emissions reduction |

| Sustainable Debt Instruments | Issuing green sukuk | Capitalizing on growing ESG investor demand |

PESTLE Analysis Data Sources

Our Al Rajhi Bank PESTLE Analysis is meticulously crafted using data from official Saudi Arabian government bodies, reputable financial institutions, and leading market research firms. This ensures that insights into political stability, economic trends, and technological advancements are grounded in accurate, current information.