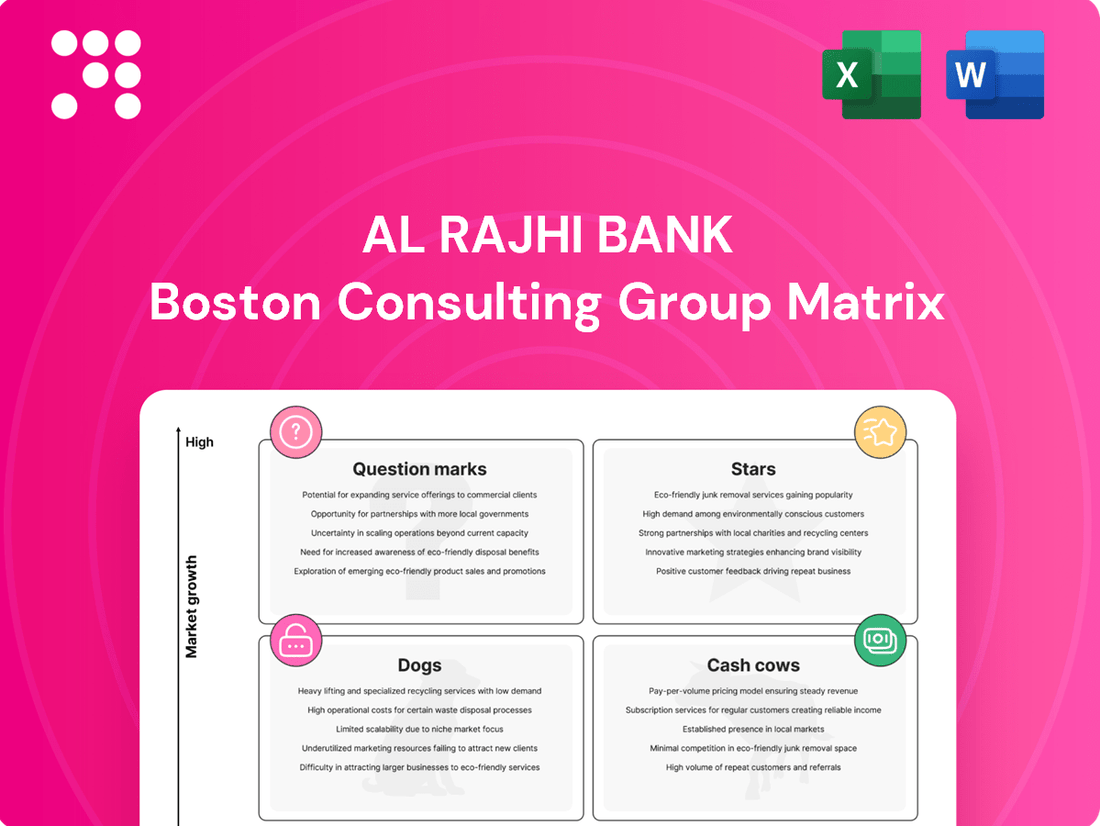

Al Rajhi Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Al Rajhi Bank Bundle

Curious about Al Rajhi Bank's strategic positioning? This glimpse into their BCG Matrix reveals how their products are performing in the market, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for detailed quadrant analysis and actionable insights to drive your investment decisions.

Stars

Al Rajhi Bank's digital banking and mobile app services are a clear star in its BCG matrix. The bank has poured significant resources into its digital offerings, evidenced by a substantial increase in mobile app downloads and active users. In 2024, Al Rajhi Bank reported over 1.7 million active mobile banking users, a testament to their successful digital push.

This strategic focus aligns perfectly with the booming digital landscape in Saudi Arabia, where cashless transactions are becoming the norm. The convenience and accessibility offered by their enhanced mobile app position these services as market leaders, capturing a growing segment of digitally savvy customers.

Al Rajhi Bank is significantly expanding its support for Small and Medium-sized Enterprises (SMEs), demonstrating robust growth in its financing portfolio. The bank achieved an impressive 34.5% year-on-year growth in SME financing during the first quarter of 2025, building on a strong 29.6% expansion in 2024.

This strategic focus on SMEs positions them as a key growth driver for the bank, reflecting a dynamic market with increasing demand for accessible capital. The bank's commitment is further evidenced by its collaborations, such as the partnership with the Muhide fintech platform, designed to enhance digital capabilities for SMEs and provide them with competitive financing options.

Al Rajhi Bank has actively participated in the growing sustainable finance market, demonstrating its commitment through significant sukuk issuances. Following its 2023 and 2024 issuances, the bank launched a $1.5 billion USD-denominated sustainable additional tier 1 sukuk in the first quarter of 2025. This strategic move aligns with the increasing global investor appetite for Environment, Social, and Governance (ESG) compliant instruments.

Corporate Financing

Al Rajhi Bank's corporate financing segment is a key growth engine, demonstrating robust expansion. This strategic focus positions the bank to capture a larger share of the large corporate market, a typically high-demand and expanding area.

- Corporate Financing Growth: The bank saw a substantial 35.8% year-on-year increase in its corporate financing portfolio in Q1 2025, following a strong 31.8% growth throughout 2024.

- Strategic Focus: This performance underscores Al Rajhi Bank's commitment to becoming the primary banking partner for large corporations.

- Market Position: The bank is actively increasing its presence and market share within this high-growth corporate segment.

Asset Management and Investment Products (Al Rajhi Capital)

Al Rajhi Capital, the investment banking arm of Al Rajhi Bank, stands out as a dominant force in asset management. In 2024, its total Assets under Management (AuM) experienced an impressive 62% year-on-year surge, underscoring its significant market leadership.

This robust growth is fueled by strategic initiatives, including the introduction of new public funds and consistently strong performance across its equity fund offerings.

- Market Leadership: Al Rajhi Capital is a recognized leader in the Saudi asset management sector.

- Exceptional Growth: Achieved a 62% year-on-year increase in total Assets under Management (AuM) in 2024.

- Product Innovation: Successfully launched new public funds to broaden its investment product suite.

- Strong Performance: Demonstrated high market share through excellent performance in various equity funds.

Al Rajhi Bank's digital banking services, particularly its mobile app, are a clear star in its BCG matrix. The bank reported over 1.7 million active mobile banking users in 2024, reflecting significant investment and customer adoption in this high-growth area. This focus aligns with Saudi Arabia's increasing embrace of digital transactions.

Al Rajhi Capital's asset management division is another star performer. In 2024, its Assets under Management (AuM) grew by an impressive 62% year-on-year, driven by new fund launches and strong equity fund performance. This positions Al Rajhi Capital as a leader in the Saudi asset management sector.

| Business Unit | BCG Category | Key Performance Indicator (2024/Q1 2025) | Growth/Metric |

| Digital Banking (Mobile App) | Star | Active Mobile Users | 1.7+ Million (2024) |

| Al Rajhi Capital (Asset Management) | Star | Assets Under Management (AuM) | +62% YoY (2024) |

| SME Financing | Star | SME Financing Portfolio Growth | +29.6% YoY (2024), +34.5% YoY (Q1 2025) |

| Corporate Financing | Star | Corporate Financing Portfolio Growth | +31.8% YoY (2024), +35.8% YoY (Q1 2025) |

| Sustainable Finance (Sukuk) | Star | USD Sukuk Issuance | $1.5 Billion (Q1 2025) |

What is included in the product

This Al Rajhi Bank BCG Matrix overview provides clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs.

The Al Rajhi Bank BCG Matrix offers a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Al Rajhi Bank's retail banking, particularly its traditional products like current and savings accounts, stands as a strong cash cow. This segment benefits from the bank's established presence and high market share within a mature market. For instance, in 2023, Al Rajhi Bank reported a net profit of SAR 13,627 million, with a significant portion stemming from its retail operations.

The bank's focus on consumer banking means these products are well-established, generating consistent and substantial cash flow with minimal need for aggressive investment. This allows Al Rajhi Bank to leverage its existing customer base and infrastructure for continued profitability in this core area.

Mortgage financing stands as a cornerstone of Al Rajhi Bank's retail offerings, demonstrating robust growth. In the first quarter of 2025, this segment expanded by an impressive 15.2%. This growth solidifies its position as a major contributor, accounting for nearly 38% of the bank's total financing portfolio in 2024.

Al Rajhi Bank's dominance in the Saudi Arabian mortgage market is a key factor in its Cash Cow status. The bank holds a significant market share in mortgage products, directly supporting the Saudi Vision 2030 initiative to increase homeownership rates. This strategic alignment ensures a steady and substantial cash flow, characteristic of a mature and highly profitable business unit.

Al Rajhi Bank's Customer Deposits (CASA) are a clear Cash Cow. As of March 2025, these deposits formed a substantial 69.0% of the bank's total deposits. This high percentage of low-cost funding is a significant advantage, providing a stable and reliable base for the bank's operations in a competitive market.

The consistent inflow of CASA deposits fuels Al Rajhi Bank's profitability. This segment's low cost of funds allows the bank to generate strong net interest margins, even in a mature banking environment. It represents a core strength that underpins the bank's financial performance and stability.

Point-of-Sale (POS) Terminal Services

Al Rajhi Bank's Point-of-Sale (POS) terminal services are a prime example of a Cash Cow within its business portfolio. The bank boasts an impressive network, exceeding 585,000 POS terminals across Saudi Arabia. This extensive reach positions them strongly in a market that is increasingly embracing digital payments.

The ongoing shift towards cashless transactions in Saudi Arabia directly benefits Al Rajhi Bank's POS services. This trend indicates a mature, albeit steadily growing, market where the bank already holds a significant market share. Consequently, these services are characterized as a low-growth, high-market-share product, reliably generating substantial fee income.

- Extensive Network: Over 585,000 POS terminals deployed in Saudi Arabia.

- Market Trend: Increasing migration to cashless transactions supports stable demand.

- Financial Contribution: Generates consistent and significant fee income for Al Rajhi Bank.

- BCG Classification: Positioned as a Cash Cow due to high market share and low market growth.

International Remittance Services

International remittance services represent a significant Cash Cow for Al Rajhi Bank. The bank's extensive network of 159 remittance centers across Saudi Arabia solidifies its strong position in this mature market.

Leveraging this established infrastructure, Al Rajhi Bank consistently captures a high market share, translating into stable, transaction-based revenue streams. This segment benefits from consistent demand and economies of scale.

- Market Position: High market share in a mature international remittance market.

- Revenue Generation: Steady, predictable revenue from transaction fees.

- Network Advantage: 159 remittance centers provide a competitive edge.

- Strategic Importance: A core business contributing significantly to profitability.

Al Rajhi Bank's ATM network, comprising over 2,000 ATMs as of early 2025, functions as a significant Cash Cow. This extensive physical presence in a mature market provides consistent transaction-based revenue. The bank's high market share in ATM services ensures a stable cash flow with limited need for substantial reinvestment.

| Business Segment | BCG Matrix Classification | Key Supporting Data (as of early 2025) | Revenue Driver |

| Retail Banking (Core Products) | Cash Cow | SAR 13,627 million net profit (2023) | Interest income, fees |

| Mortgage Financing | Cash Cow | 15.2% growth (Q1 2025), 38% of total financing (2024) | Interest income |

| Customer Deposits (CASA) | Cash Cow | 69.0% of total deposits (March 2025) | Net interest margin |

| Point-of-Sale (POS) Services | Cash Cow | >585,000 POS terminals | Transaction fees |

| International Remittance | Cash Cow | 159 remittance centers | Transaction fees |

| ATM Network | Cash Cow | >2,000 ATMs | Transaction fees, service charges |

What You’re Viewing Is Included

Al Rajhi Bank BCG Matrix

The Al Rajhi Bank BCG Matrix preview you are viewing is the identical, fully-formatted report you will receive upon purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed, analysis-ready document ready for immediate strategic application. You can trust that the insights and structure presented here are precisely what you'll be working with to understand Al Rajhi Bank's business portfolio. This comprehensive report is designed for clarity and actionable insights, enabling informed decision-making for your business planning and competitive analysis.

Dogs

Al Rajhi Bank's extensive physical branch network, while a historical strength, now presents challenges for services that remain heavily reliant on in-person interactions. As digital channels gain traction, these outdated, branch-dependent offerings are likely experiencing reduced customer engagement. For instance, while Al Rajhi reported a significant increase in digital transactions in 2024, services like manual cheque processing or in-branch account opening for simple transactions may represent a declining segment.

Legacy IT systems, if not continuously invested in and modernized, can become significant drains on resources. These systems, often costly to maintain, offer diminishing returns in the fast-paced digital banking environment, potentially hindering Al Rajhi Bank's competitive edge. For instance, in 2024, many traditional banks reported that maintaining outdated core banking systems accounted for a substantial portion of their IT budgets, sometimes exceeding 60%, with little to show in terms of new revenue streams or enhanced customer experience.

Al Rajhi Bank, as a prominent Islamic financial institution, prioritizes Sharia-compliant offerings. Niche conventional banking products that have dwindled in demand and don't fit within its ethical investment guidelines are considered 'dogs.' These products typically hold a small market share and exhibit negligible growth potential.

Underperforming Foreign Branches/Operations (if any)

Al Rajhi Bank's strategic expansion into Jordan and Kuwait for card processing services in 2025 highlights a forward-looking approach. However, within the BCG matrix framework, any existing foreign branches or operations that are currently underperforming, failing to meet growth or profitability targets, and possess a low market share in their respective regions would be classified as 'dogs.'

These underperforming units demand careful scrutiny. The bank must assess whether these operations can be revitalized through strategic interventions or if divestiture is the more prudent course of action to reallocate resources effectively. For instance, if a particular branch in a mature market is showing declining profitability, a detailed review of its operational costs and revenue streams would be essential.

- Low Market Share: Operations with a negligible presence in their local markets.

- Declining Profitability: Branches consistently failing to generate positive returns.

- Stagnant Growth: Units exhibiting minimal or no revenue or customer base expansion.

- Resource Drain: Operations that consume capital without commensurate returns.

Certain Traditional Corporate Lending Segments (if not Sharia-compliant or low-yield)

Certain traditional corporate lending segments, particularly those offering low yields or not adhering to Sharia compliance, could be categorized as Dogs within Al Rajhi Bank's BCG Matrix. These segments, while potentially stable, are unlikely to drive significant growth or market share compared to the bank's more strategically focused, high-potential areas.

For example, traditional lending to large, established corporations in mature industries might yield modest returns and face intense competition, limiting both growth prospects and market dominance. In 2023, Al Rajhi Bank's overall corporate banking segment saw growth, but specific low-yield, non-Sharia compliant niches within it would lag.

- Low Growth Potential: These segments often operate in mature markets with limited expansion opportunities.

- Low Market Share: Intense competition from other financial institutions can prevent significant market penetration.

- Reduced Profitability: Low yields directly impact the profitability of these lending activities.

- Strategic Misalignment: They may not align with Al Rajhi Bank's core Islamic finance principles or its focus on higher-return areas.

Within Al Rajhi Bank's portfolio, 'Dogs' represent business units or product lines that exhibit low market share and low growth potential. These are often legacy offerings or operations in saturated markets that consume resources without generating significant returns. For instance, certain specialized, non-Sharia compliant financial products that have seen declining customer interest would fall into this category.

These 'Dog' segments require strategic evaluation to determine if they can be revitalized or if divestment is a more appropriate course of action. The bank's 2024 financial reports indicated a strong push towards digital services, suggesting that traditional, branch-dependent services with low adoption rates are likely candidates for this classification.

Identifying these 'Dogs' allows Al Rajhi Bank to reallocate capital and management focus towards its Stars and Cash Cows, thereby optimizing its overall business strategy and enhancing profitability. For example, a manual remittance service with minimal digital uptake would be a prime example of a 'Dog' needing attention.

The bank's commitment to Sharia compliance further refines this classification, as any conventional products that do not align with its core principles and also show poor performance are definitively 'Dogs'.

| Category | Market Share | Market Growth | Al Rajhi Bank Example |

|---|---|---|---|

| Dogs | Low | Low | Certain legacy, non-Sharia compliant lending products with declining demand. |

| Underperforming foreign branches in mature, competitive markets. | |||

| Manual financial processing services with low digital adoption. |

Question Marks

Al Rajhi Bank's new digital insurance products, launched in 2024 in partnership with Al Rajhi Takaful, represent a strategic move into a burgeoning market. These six offerings are currently positioned as question marks within the BCG matrix. While the digital insurance sector is experiencing significant growth, these new products are in their nascent stages, meaning their market share is still relatively small.

Significant investment in marketing and customer education will be crucial to drive adoption and elevate these products from question marks to stars. The bank's commitment to digital innovation aims to capture a larger portion of this expanding market, potentially transforming these initial investments into future revenue drivers.

Al Rajhi Bank's acquisition of a 65% stake in Drahim in September 2024 positions the bank in the rapidly expanding open banking and robo-advisory space. This move aims to leverage Drahim's personal financial management and automated investment capabilities to enhance customer offerings.

As a recent integration, Drahim is currently in the process of establishing its market presence within Al Rajhi Bank's broader digital ecosystem. While the fintech sectors it operates in show significant growth potential, Drahim itself is still cultivating its user base and market share.

Al Rajhi Bank's Virtual Relationship Manager (VRM) service, slated for introduction after 2024, would likely be categorized as a Question Mark in the BCG Matrix. This is due to its innovative nature aimed at improving customer experience in a digital-first environment, but it currently operates with an unestablished market share and requires significant investment to grow.

The bank's strategic move to launch a VRM reflects the broader trend in the banking sector, where digital engagement is paramount. For instance, in 2023, Saudi Arabia's digital banking sector saw substantial growth, with mobile banking transactions increasing by over 20%, highlighting the demand for enhanced digital services.

New Customer Segments (Premium, Expat, Family)

Al Rajhi Bank's 2024 'Harmonize the Group' strategy targets new customer segments like Premium, Expat, and Family, recognizing their significant growth potential.

While these segments offer promising avenues for expansion, Al Rajhi Bank is actively working to establish its market presence and craft specialized offerings to meet their unique financial needs.

- Growth Opportunity: The Premium segment, often characterized by higher disposable income and complex financial needs, presents a key opportunity for increased revenue and deeper customer relationships.

- Expatriate Market: Targeting expats allows Al Rajhi Bank to tap into a demographic that frequently requires international banking solutions, cross-border payments, and wealth management services.

- Family Banking: The Family segment focus aims to capture a broader customer base by offering integrated banking solutions that cater to the financial requirements of all family members, from savings accounts for children to investment products for parents.

- Market Penetration: As of early 2024, Al Rajhi Bank is still building its market share within these segments, indicating a strategic investment phase rather than established dominance.

Blockchain-enabled SME Trade Finance Solutions

Al Rajhi Bank's blockchain-enabled SME trade finance solutions, launched in February 2025 through its partnership with Muhide fintech, represent a significant innovation. This initiative targets the high-growth fintech sector, leveraging blockchain's potential to streamline trade finance processes for small and medium-sized enterprises.

While this technology is considered cutting-edge, its market adoption and share are still in nascent stages. This means substantial investment is required to scale these solutions effectively and capture a larger market presence.

- Innovation: Blockchain-enabled SME trade finance solutions are a novel offering, positioning Al Rajhi Bank at the forefront of digital transformation in banking.

- Market Position: The solutions operate in a high-growth sector, but market share is currently limited due to the developing nature of blockchain adoption in trade finance.

- Investment Needs: Significant capital investment is necessary to scale these blockchain solutions and achieve widespread market penetration.

- Strategic Importance: This venture is crucial for Al Rajhi Bank's future growth, aiming to capture a significant portion of the evolving SME trade finance landscape.

Al Rajhi Bank's digital insurance products, Drahim integration, and blockchain-enabled SME trade finance solutions are all currently classified as Question Marks. These ventures are characterized by operating in high-growth potential markets but have not yet established significant market share. They require substantial investment in marketing, customer education, and scaling to transition into Stars or Cash Cows.

The bank's strategic focus on new customer segments like Premium, Expat, and Family also places them in the Question Mark category. While these segments offer clear growth opportunities, Al Rajhi Bank is actively working to build its presence and tailor offerings, indicating an investment phase for market penetration.

The Virtual Relationship Manager (VRM) service, planned for post-2024, is also a Question Mark. Its innovative nature aims to enhance digital customer experience, but it needs investment to gain traction and market share in a sector where digital engagement is rapidly increasing, as evidenced by Saudi Arabia's digital banking growth.

| Product/Service | Market Growth | Market Share | Investment Need | BCG Category |

|---|---|---|---|---|

| Digital Insurance Products | High | Low | High | Question Mark |

| Drahim (Open Banking/Robo-Advisory) | High | Low | High | Question Mark |

| Virtual Relationship Manager (VRM) | High (Digital Banking Sector) | Very Low (Pre-launch) | High | Question Mark |

| Blockchain SME Trade Finance | High | Low | High | Question Mark |

| Premium, Expat, Family Segments | High | Developing | High | Question Mark |

BCG Matrix Data Sources

Our Al Rajhi Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.