Al Rajhi Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Al Rajhi Bank Bundle

Al Rajhi Bank operates within a dynamic financial landscape, facing significant pressures from customer loyalty and the availability of alternative Sharia-compliant banking solutions. The intensity of competition among established Islamic banks and the growing influence of digital-only financial providers significantly shape its market position.

The complete report reveals the real forces shaping Al Rajhi Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers, particularly those offering specialized financial software and digital infrastructure, hold some bargaining power over Al Rajhi Bank. This is due to the bank's increasing reliance on advanced fintech solutions and robust IT systems. For instance, in 2024, the global fintech market was valued at over $2 trillion, with significant growth in areas like cloud computing and cybersecurity, which are crucial for banks.

However, Al Rajhi Bank can mitigate this power by leveraging its in-house development capabilities and the availability of multiple vendor options. The bank's strategic investments in digital transformation, including partnerships with fintech firms, demonstrate a proactive approach to managing these supplier relationships and securing favorable terms.

The bargaining power of suppliers in the context of human capital for Al Rajhi Bank hinges on the availability of highly skilled professionals. A scarcity of talent in areas like Sharia-compliant finance, digital banking, and advanced analytics can empower these individuals to demand higher salaries and improved benefits, directly impacting the bank's operational costs.

The Saudi Central Bank (SAMA) acts as a key regulator and liquidity provider, but its influence is primarily supervisory, focusing on the stability of the entire financial system. This means SAMA's direct bargaining power over Al Rajhi Bank's funding costs is limited, though its policies significantly shape the market.

Al Rajhi Bank's access to and cost of funds are more directly impacted by interbank market rates and its ability to tap broader capital markets. For instance, the bank demonstrated robust capital market access by successfully issuing a $1.5 billion dollar-denominated Additional Tier 1 Sukuk in 2024, highlighting its capacity to secure funding.

Infrastructure and Real Estate

Al Rajhi Bank, with its significant physical presence and extensive branch network across Saudi Arabia, depends on real estate and infrastructure providers for its operations. While prime locations are crucial for customer access, the broad availability of commercial properties and construction services generally keeps the bargaining power of individual suppliers in check. For instance, in 2024, commercial real estate development in major Saudi cities continued to expand, increasing the supply of available office and retail spaces suitable for bank branches.

The bank's reliance on these suppliers is somewhat mitigated by the sheer scale of its operations and the competitive nature of the real estate and construction sectors. This competitive landscape limits the ability of any single supplier to dictate terms. Furthermore, the ongoing digital transformation within the banking industry might gradually lessen Al Rajhi Bank's dependence on a vast physical footprint, potentially further reducing the bargaining power of infrastructure and real estate suppliers in the long term.

- Supplier Dependence: Al Rajhi Bank requires real estate for its numerous branches and infrastructure for its operations.

- Supplier Bargaining Power: Generally low due to the availability of commercial properties and construction services.

- Market Factors: Expansion of commercial real estate in Saudi Arabia in 2024 increased supply, limiting supplier leverage.

- Future Trends: Digital banking's growth may reduce the need for physical branches, further diminishing supplier power.

Regulatory Bodies and Sharia Boards

Regulatory bodies such as the Saudi Central Bank (SAMA) and the Sharia Supervisory Board wield significant influence over Al Rajhi Bank. SAMA's directives, including capital adequacy ratios and liquidity requirements, directly shape the bank's operational capacity and risk management strategies. For instance, SAMA's ongoing efforts to enhance financial sector stability through updated prudential regulations in 2024 necessitate continuous adaptation in Al Rajhi's capital allocation and product development.

The Sharia Supervisory Board's pronouncements are equally critical, ensuring all products and services adhere to Islamic finance principles. This non-negotiable compliance dictates the very nature of Al Rajhi's offerings, from financing structures to investment portfolios. Any deviation would not only violate core tenets but also alienate its primary customer base, making the board's power absolute in defining the bank's Islamic identity and market positioning.

- SAMA's Prudential Regulations: In 2024, SAMA continued to emphasize robust capital and liquidity management, impacting how Al Rajhi Bank structures its balance sheet and manages its risk-weighted assets.

- Sharia Compliance: The Sharia Supervisory Board's approval is mandatory for all new products and services, ensuring alignment with Islamic finance principles and maintaining customer trust.

- Operational Framework: These regulatory and religious bodies collectively define the operational boundaries and permissible activities for Al Rajhi Bank, acting as powerful gatekeepers.

Technology providers for specialized financial software and digital infrastructure possess moderate bargaining power due to Al Rajhi Bank's reliance on these solutions. The global fintech market, exceeding $2 trillion in 2024, highlights the critical nature of these suppliers, particularly in cloud computing and cybersecurity. However, Al Rajhi Bank's in-house development and multiple vendor options help to temper this power.

Human capital suppliers, especially those with expertise in Sharia-compliant finance, digital banking, and analytics, can exert significant influence. A shortage of highly skilled professionals in these niche areas allows them to command higher compensation, impacting Al Rajhi Bank's operational costs. The bank actively addresses this by investing in talent development and strategic partnerships.

Suppliers of funds, such as those in the interbank market and capital markets, have a notable degree of bargaining power. Al Rajhi Bank's ability to secure substantial funding, exemplified by its $1.5 billion Additional Tier 1 Sukuk issuance in 2024, demonstrates its strong market access. This access helps to manage the cost of funds and maintain liquidity.

| Supplier Type | Bargaining Power Level | Key Factors | Al Rajhi Bank Mitigation Strategies |

|---|---|---|---|

| Technology Providers | Moderate | Reliance on fintech, cloud, cybersecurity; large global market value (> $2 trillion in 2024) | In-house development, multiple vendor options, strategic partnerships |

| Human Capital (Specialized) | High | Scarcity of Sharia finance, digital banking, analytics talent | Talent development, competitive compensation, strategic partnerships |

| Fund Suppliers (Capital Markets) | Moderate to High | Interbank rates, capital market access | Strong capital market access (e.g., $1.5 billion Sukuk in 2024), robust liquidity management |

What is included in the product

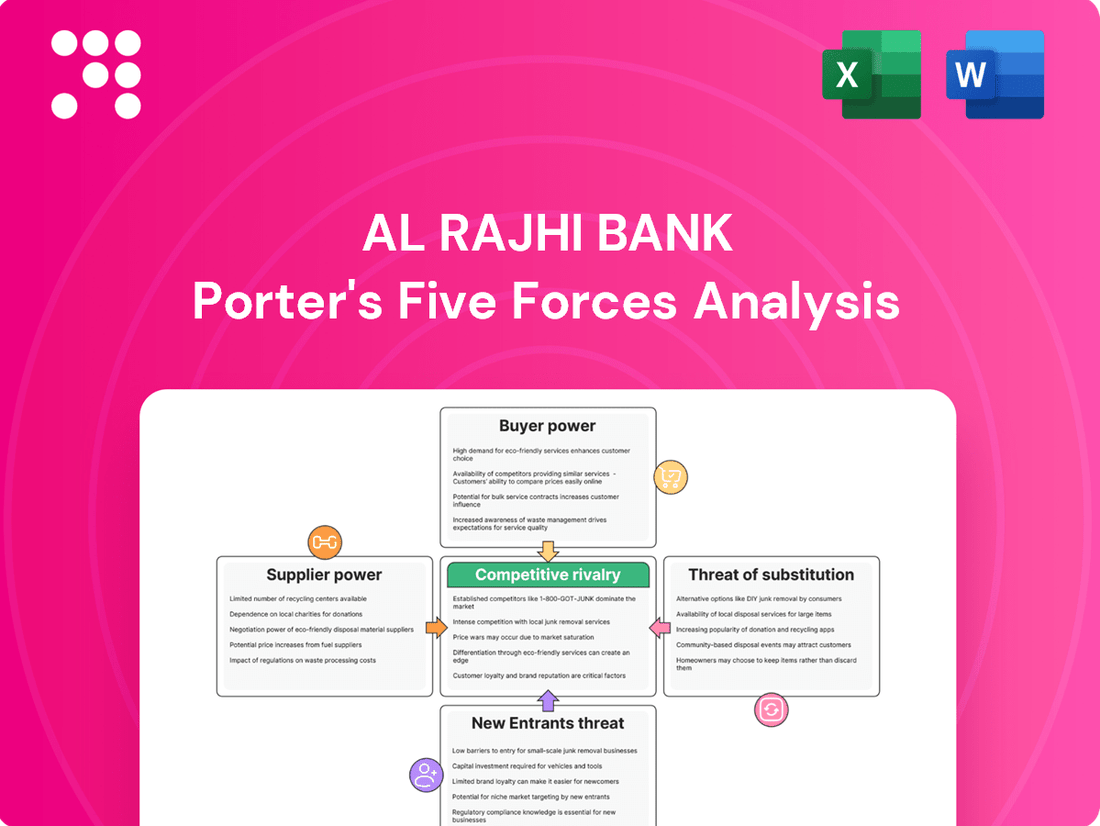

This Porter's Five Forces analysis for Al Rajhi Bank dissects the competitive intensity within the Saudi Arabian banking sector, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing players.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Al Rajhi Bank.

Gain actionable insights into bargaining power and potential disruptions, enabling proactive strategies to alleviate competitive pressures.

Customers Bargaining Power

Individual customers in retail banking typically wield moderate bargaining power. This is largely due to the relatively low costs associated with switching banks for basic services, especially as digital banking solutions become more prevalent and user-friendly across the industry. For instance, in 2024, many neobanks and established institutions continued to offer seamless account opening processes, further lowering the barrier to entry for customers considering a change.

Al Rajhi Bank, however, benefits from factors that can temper this individual customer power. Its robust brand reputation and widespread branch and ATM network contribute to customer loyalty. Furthermore, its commitment to Sharia-compliant financial products appeals to a significant segment of the market, creating a stickier customer base that is less inclined to switch for minor conveniences offered elsewhere.

The bank actively works to retain its retail customers by prioritizing digital innovation and customer experience. By enhancing digital platforms and focusing on personalized offerings through cross-selling strategies, Al Rajhi Bank aims to deepen relationships and reduce the likelihood of customers seeking alternatives, thereby mitigating their bargaining influence.

Small and Medium Enterprises (SMEs) represent a significant customer segment for Al Rajhi Bank, often seeking competitive financing rates and specialized services to support their growth. While their individual needs can be fragmented, their collective bargaining power is moderate. For instance, in 2024, Al Rajhi Bank continued its focus on SME development, offering various financing solutions that aim to meet diverse operational requirements.

Al Rajhi Bank's strategy to empower SMEs, including digital platforms and partnerships for trade finance, helps to mitigate their direct bargaining power by fostering loyalty. The bank’s commitment to providing tailored financial products and advisory services for SMEs creates a degree of stickiness, making it less likely for these businesses to switch providers solely based on minor rate differences.

Large corporations and institutions wield considerable bargaining power when dealing with banks like Al Rajhi. Their sheer size means they conduct massive transaction volumes, often requiring sophisticated, tailored financial solutions. This scale allows them to negotiate favorable terms, fees, and interest rates, as they can easily shift their business to a competitor offering a better deal. In 2023, Saudi Arabia's corporate sector saw significant activity, with major projects driving demand for complex financial services, highlighting the importance of retaining these large clients.

Digital Adoption and Financial Literacy

The growing digital savviness and the widespread use of digital payment systems in Saudi Arabia are significantly boosting customer bargaining power. Customers now have readily available information and can easily switch between financial service providers, including innovative fintech companies. This heightened awareness and accessibility mean customers can more effectively compare offerings and demand better terms.

This trend is evident in the rapid growth of digital transactions. For example, by the end of 2023, the value of e-commerce transactions in Saudi Arabia reached SAR 29.5 billion, demonstrating a strong customer preference for digital channels. Furthermore, the Saudi Central Bank's initiatives, like the National Payments Platform (SADAD), have facilitated seamless digital payments, further empowering consumers.

- Increased Information Access: Customers can easily research and compare financial products and services from multiple providers online.

- Ease of Switching: Digital platforms simplify the process of opening new accounts and closing existing ones, reducing customer inertia.

- Rise of Fintech Competition: New digital-first financial service providers offer competitive alternatives, forcing traditional banks to innovate and offer better value.

- Digital Payment Adoption: Widespread use of digital payments means customers are comfortable and proficient in managing their finances online, increasing their willingness to explore new options.

Sharia Compliance Preference

For customers specifically seeking Sharia-compliant financial products, Al Rajhi Bank holds a unique position as a leading Islamic bank. This preference can reduce their willingness to switch to conventional banks, thereby lowering their bargaining power against Al Rajhi Bank within this niche. In 2024, the global Islamic finance market continued its robust growth, with assets projected to reach over $4.9 trillion by 2025, indicating a strong and sustained demand for Sharia-compliant offerings.

This specialized customer base is often less sensitive to minor price differences when the core requirement of Sharia compliance is met. For instance, Al Rajhi Bank's strong brand recognition and established Sharia governance framework provide a significant advantage. In 2023, Al Rajhi Bank reported significant growth in its customer base, reflecting this strong preference for its Islamic banking solutions.

- Sharia Compliance as a Differentiator: Customers prioritizing Islamic finance are less likely to switch to non-compliant alternatives, diminishing their bargaining power.

- Market Growth: The expanding global Islamic finance market, estimated to exceed $4.9 trillion by 2025, underscores the significant customer demand for Sharia-compliant products.

- Brand Loyalty: Al Rajhi Bank's established reputation and adherence to Islamic principles foster customer loyalty, reducing price sensitivity and bargaining power.

- Reduced Switching Costs: For devout Muslims, the perceived cost of switching to a conventional bank that does not offer Sharia-compliant products is high, further limiting their leverage.

Customer bargaining power at Al Rajhi Bank is a mixed bag, influenced by individual customer needs and the bank's strategic responses. While retail customers can easily switch due to digital advancements, Al Rajhi leverages its strong brand and Sharia-compliant offerings to build loyalty, thus moderating individual customer influence. The bank’s focus on digital customer experience and personalized services further aims to reduce customer churn and their inherent bargaining leverage.

For SMEs, their collective bargaining power remains moderate, though Al Rajhi's tailored solutions and digital support aim to foster loyalty. Large corporations, however, possess significant power due to their transaction volumes and ability to negotiate favorable terms, a factor amplified by the active Saudi corporate sector in 2023.

The increasing digital savviness of customers in Saudi Arabia, supported by initiatives like SADAD and a surge in digital transactions reaching SAR 29.5 billion by end-2023, has undeniably amplified customer bargaining power by enhancing information access and ease of switching. This trend is further fueled by the rise of fintech competitors, compelling traditional banks to offer better value.

Al Rajhi Bank's position as a leading Islamic bank significantly diminishes the bargaining power of customers specifically seeking Sharia-compliant products. This niche market, with a global Islamic finance market projected to exceed $4.9 trillion by 2025, shows strong loyalty to institutions like Al Rajhi due to brand reputation and adherence to Islamic principles, making them less sensitive to minor price variations.

Full Version Awaits

Al Rajhi Bank Porter's Five Forces Analysis

This preview showcases the complete Al Rajhi Bank Porter's Five Forces Analysis, detailing the competitive landscape and strategic implications for the banking sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your immediate use.

Rivalry Among Competitors

The Saudi banking sector is a crowded arena, with numerous large local and international players, encompassing both conventional and Islamic financial institutions, all actively pursuing market share. Al Rajhi Bank, while a significant entity, finds itself in direct competition with formidable rivals such as Saudi National Bank (SNB) and Riyad Bank, both of which command substantial presence and resources.

The Saudi banking sector is experiencing robust growth, fueled by the Kingdom's Vision 2030 and a concerted effort towards economic diversification away from oil. This expansion creates a larger market, potentially easing the intensity of rivalry as there are more opportunities for all participants to capture. For instance, in 2023, Saudi banks reported a collective net profit increase of approximately 20%, highlighting this positive trajectory.

Banks, including Al Rajhi Bank, fiercely compete by constantly innovating their product offerings and digital services, aiming to elevate the customer experience. This drive for differentiation is crucial in a crowded market. Al Rajhi Bank, for instance, distinguishes itself through its robust Sharia-compliant product suite, a key draw for a significant customer segment.

Furthermore, Al Rajhi Bank's substantial investments in digital transformation and fintech solutions are designed to streamline customer interactions and introduce advanced services. This focus on enhancing the customer journey is a primary battleground for competitive advantage in the banking sector. By mid-2024, Al Rajhi Bank reported a 15% year-on-year growth in its digital customer base, highlighting the success of these initiatives.

Switching Costs for Customers

Switching costs for Al Rajhi Bank's customers can vary significantly. For simple transactions, moving to another bank might be relatively easy. However, when customers engage with Al Rajhi Bank across multiple products, such as savings accounts, loans, and investment services, the effort and potential loss of benefits increase, making them less likely to switch. This is a key factor in managing competitive rivalry.

Banks actively work to deepen customer relationships to lock them in. For instance, Al Rajhi Bank's integrated digital banking platform and its wide array of personal and business banking solutions are designed to make it more inconvenient for customers to transfer all their financial activities elsewhere. By offering bundled services and tailored financial advice, the bank aims to elevate the perceived cost of switching.

- Integrated Services: Al Rajhi Bank's offering of current accounts, savings, loans, and investment products creates a sticky ecosystem for its clients.

- Digital Platforms: The bank's investment in user-friendly digital channels encourages customers to manage all their banking needs in one place.

- Loyalty Programs: While specific details may vary, loyalty initiatives can further incentivize customers to remain with Al Rajhi Bank, increasing the perceived cost of moving their business.

- Corporate Relationships: For businesses, switching banking partners involves significant operational changes, particularly if Al Rajhi Bank provides complex financing or treasury management services.

Regulatory Environment and Vision 2030

The Saudi Central Bank (SAMA) is actively guiding the financial sector's evolution, aligning with Vision 2030's goals. This regulatory framework fosters digital innovation, promotes financial inclusion, and ensures a competitive market, directly impacting how institutions like Al Rajhi Bank operate and strategize.

SAMA's directives encourage banks to adopt advanced technologies and expand services to underserved populations, creating opportunities for those who can effectively leverage digital channels. This environment rewards proactive adaptation and strategic alignment with national economic development plans.

- SAMA's Digital Transformation Initiatives: SAMA has been a key driver of digital banking adoption, with a significant portion of transactions moving online. For instance, in 2023, digital transactions in Saudi Arabia saw substantial growth, reflecting the success of these policies.

- Vision 2030's Financial Inclusion Goals: Vision 2030 aims to increase financial inclusion, and banks are incentivized to develop products and services that reach a broader segment of the population. This focus creates a more dynamic and inclusive competitive arena.

- Encouraging Healthy Competition: Regulatory measures are in place to foster fair competition among financial institutions, preventing monopolies and encouraging innovation. This ensures that customers benefit from a wider range of choices and better services.

Competitive rivalry within the Saudi banking sector is intense, driven by a substantial number of large, well-resourced domestic and international institutions. Al Rajhi Bank faces formidable competition from players like Saudi National Bank (SNB) and Riyad Bank, which possess significant market share and operational capabilities. This rivalry is further amplified by the sector's overall growth, projected to continue benefiting from Vision 2030 initiatives, which expands the market but also intensifies efforts to capture new customers.

Banks are actively differentiating themselves through product innovation and enhanced digital offerings, with Al Rajhi Bank leveraging its strong Sharia-compliant product suite as a key differentiator. For example, by mid-2024, Al Rajhi Bank reported a 15% year-on-year growth in its digital customer base, indicating successful strategies in this competitive landscape. The Saudi Central Bank's push for digital transformation and financial inclusion, as evidenced by the substantial growth in digital transactions in 2023, creates a dynamic environment where technological adoption is a critical factor in maintaining competitive advantage.

| Competitor | Market Share (Approx. % of Total Assets, Q1 2024) | Key Strengths |

|---|---|---|

| Saudi National Bank (SNB) | 28.5% | Large asset base, extensive branch network, strong corporate banking. |

| Riyad Bank | 17.2% | Diversified services, significant retail presence, digital banking focus. |

| Al Rajhi Bank | 22.1% | Leading Islamic banking provider, strong digital adoption, extensive customer base. |

| SABB | 9.8% | International linkages, corporate finance expertise, wealth management. |

SSubstitutes Threaten

The growing prevalence of fintech solutions and digital wallets presents a substantial threat to Al Rajhi Bank. These platforms offer convenient, often cheaper alternatives to traditional banking, directly competing with established services.

By the close of 2024, electronic payments captured an impressive 79% of all retail transactions, highlighting a clear shift in consumer behavior towards digital alternatives that Al Rajhi Bank must actively address.

Alternative financing platforms, such as peer-to-peer (P2P) lending and crowdfunding, present a significant threat of substitution to traditional bank lending. These platforms offer individuals and small to medium-sized enterprises (SMEs) quicker access to capital and specialized funding options that might not be readily available through conventional banking channels.

While the P2P lending and crowdfunding markets are still developing compared to the established banking sector, their rapid expansion signifies a potential migration of financing activities away from traditional institutions. For instance, the global P2P lending market was valued at approximately $67.5 billion in 2022 and is projected to reach $222.7 billion by 2029, indicating a substantial shift in financing preferences.

Large corporations and sophisticated investors increasingly bypass traditional bank intermediation by directly accessing capital markets. In 2024, the issuance of corporate bonds and Sukuk in Saudi Arabia continued to grow, providing an alternative financing avenue. For instance, Saudi Aramco's substantial Sukuk issuances demonstrate this trend, offering investors direct exposure to a major entity's capital needs.

The expanding Saudi capital markets, particularly the growth of the Tadawul All Share Index (TASI), present a viable alternative to bank-led financing. As of mid-2024, the TASI has seen significant inflows and listings, enabling companies to raise substantial capital through equity offerings. This development intensifies competition for banks like Al Rajhi by offering direct investment opportunities that may yield attractive returns without bank involvement.

Informal Financial Channels

Informal financial channels, such as peer-to-peer lending platforms or community savings groups, can present a threat of substitution for certain basic banking services. These channels often cater to specific needs or segments that may be underserved by traditional banks. For instance, in Saudi Arabia, while Al Rajhi Bank is a dominant player in formal Islamic finance, informal lending networks have historically played a role in providing quick, albeit less regulated, access to funds for small businesses and individuals.

However, the formal banking sector, exemplified by Al Rajhi Bank, offers significant advantages that mitigate this threat. These include enhanced security, regulatory oversight, and a comprehensive suite of financial products and services, from savings accounts and investments to complex corporate financing. In 2024, Al Rajhi Bank's robust digital banking infrastructure and extensive branch network continued to provide a level of trust and convenience that informal channels struggle to match, particularly for larger transactions and long-term financial planning.

The perceived risk associated with informal channels, coupled with the increasing digitalization and accessibility of formal banking services, means that while substitutes exist, their impact on Al Rajhi Bank's core operations remains limited. The bank’s commitment to Sharia-compliant finance and its strong customer base solidify its position against these less formal alternatives.

- Informal channels offer niche financing but lack the security of regulated banks.

- Al Rajhi Bank's digital and physical infrastructure provides a competitive edge.

- Regulatory oversight in formal banking builds customer trust against informal substitutes.

Embedded Finance and Non-Financial Entities

The rise of embedded finance presents a significant threat. Non-financial companies are increasingly integrating financial services, like point-of-sale financing or payment solutions, directly into their customer journeys. This bypasses traditional banking channels, offering a more seamless experience for the end-user and acting as a substitute for specific bank offerings.

For instance, e-commerce platforms offering 'buy now, pay later' (BNPL) options directly at checkout are a prime example. In 2024, the global BNPL market was projected to continue its rapid expansion, with transaction values reaching hundreds of billions of dollars, indicating a substantial shift in consumer payment preferences away from traditional credit products.

- Embedded Finance Growth: The global embedded finance market is anticipated to reach over $7 trillion by 2030, showcasing its potential to disrupt traditional financial service delivery.

- BNPL Adoption: BNPL services saw a significant surge in adoption in 2023 and 2024, particularly among younger demographics, directly competing with credit card and loan products.

- Platform Integration: Major tech and retail platforms are actively developing or partnering for embedded financial capabilities, reducing reliance on banks for customer-facing financial transactions.

- Customer Convenience: The convenience of accessing financial services within a familiar non-financial context makes these substitutes highly attractive to consumers.

Fintech solutions, digital wallets, and alternative financing platforms like P2P lending and crowdfunding represent significant substitutes for Al Rajhi Bank's services. These digital alternatives often provide greater convenience and potentially lower costs, drawing customers away from traditional banking. For example, electronic payments accounted for 79% of retail transactions by the end of 2024, underscoring the shift towards digital financial interactions.

Furthermore, the increasing accessibility of capital markets for large corporations and sophisticated investors, alongside the growth of embedded finance such as buy now, pay later (BNPL) options, directly challenges banks' intermediation roles. The global BNPL market's projected expansion into hundreds of billions of dollars in transaction value by 2024 highlights this trend.

| Substitute Type | Key Characteristics | Impact on Al Rajhi Bank | 2024 Data/Projections |

|---|---|---|---|

| Fintech & Digital Wallets | Convenience, lower fees, user-friendly interfaces | Erosion of transaction volumes, competition for customer deposits | 79% of retail transactions were electronic by end of 2024 |

| Alternative Financing (P2P, Crowdfunding) | Faster access to capital, specialized funding | Loss of lending market share, particularly for SMEs | Global P2P lending market projected to reach $222.7B by 2029 |

| Capital Markets | Direct access to funding for corporations | Reduced demand for traditional bank loans and advisory services | Continued growth in corporate bond and Sukuk issuances in Saudi Arabia |

| Embedded Finance (BNPL) | Seamless integration into purchase journeys | Competition for consumer credit and payment services | Global BNPL market transaction values in hundreds of billions USD in 2024 |

Entrants Threaten

High capital requirements present a formidable barrier to entry in the banking sector, particularly for institutions like Al Rajhi Bank that offer comprehensive commercial services. Establishing a new bank necessitates massive upfront investments in physical infrastructure, advanced technological systems, and rigorous adherence to stringent regulatory capital adequacy ratios. For instance, in 2024, regulatory bodies globally continue to mandate significant capital reserves, often running into billions of dollars, to ensure financial stability and protect depositors. This financial hurdle significantly limits the pool of potential new competitors capable of mounting a credible challenge.

The stringent regulatory framework in Saudi Arabia, overseen by the Saudi Central Bank (SAMA), acts as a significant barrier to new entrants in the Islamic banking sector. SAMA imposes rigorous licensing requirements, demanding substantial capital and a robust operational plan. For instance, in 2024, SAMA continued to emphasize capital adequacy ratios, with Islamic banks needing to maintain a minimum capital adequacy ratio well above international standards, making it costly for newcomers to establish a foothold.

Furthermore, new entrants must adhere to comprehensive prudential regulations covering areas like risk management, corporate governance, and consumer protection. Crucially, all Islamic banks must ensure strict Sharia compliance in their products and operations. This requires specialized knowledge and oversight, adding another layer of complexity and cost that deters potential competitors from entering the market, especially when compared to less regulated financial sectors.

Established institutions like Al Rajhi Bank possess significant advantages due to their long-standing brand recognition and deep-rooted customer trust, often cultivated over decades. This ingrained loyalty makes it exceptionally challenging and expensive for new players to attract a substantial customer base. For instance, Al Rajhi Bank's extensive branch network, a tangible asset built over years, provides a physical presence that new digital-only banks struggle to replicate quickly, impacting their ability to build immediate trust and accessibility.

Economies of Scale and Experience

Incumbent banks like Al Rajhi Bank benefit significantly from established economies of scale. This allows them to spread operational, technological, and risk management costs across a vast customer base, making their per-unit costs lower than potential new entrants. For instance, in 2024, major Saudi banks continued to invest heavily in digital infrastructure, a cost that is more manageable for established players.

New entrants often face a steep uphill battle in achieving comparable cost efficiencies. They must invest substantially in building out their infrastructure, acquiring customers, and developing expertise in managing a diverse range of financial products and complex risk profiles. This initial investment hurdle can be a major deterrent.

- Economies of Scale: Al Rajhi Bank leverages its large operational footprint and customer base to reduce per-transaction costs, a significant barrier for new, smaller competitors.

- Experience Curve: Years of experience in managing diverse financial products and navigating regulatory landscapes provide incumbents with invaluable insights and risk mitigation strategies that new entrants lack.

- Technological Investment: Established banks can amortize significant investments in advanced banking technologies and cybersecurity over a larger revenue base, creating a cost advantage.

Fintech-led Niche Entrants

While establishing a full-service bank in Saudi Arabia faces significant hurdles, the threat of new entrants is increasingly coming from nimble fintech companies targeting specific market segments. These specialized firms, operating with lower overheads and agile digital platforms, can efficiently disrupt niches like payments, lending, or wealth management. By the close of 2024, the Saudi financial landscape had witnessed a substantial influx of these innovators, with a reported 261 fintech firms actively operating.

The lower capital requirements and regulatory sandboxes available to fintechs allow them to bypass many of the traditional barriers to entry that established banks like Al Rajhi Bank must navigate. This dynamic creates a competitive pressure point, as these specialized players can offer tailored digital solutions that appeal to specific customer needs, potentially siphoning off profitable business lines.

- Niche Disruption Fintechs focus on specific services, avoiding the broad operational costs of full-service banking.

- Digital Agility Lower overheads and digital-first models enable faster adaptation and customer acquisition.

- Market Growth Saudi Arabia's fintech sector expanded significantly, with 261 firms by end of 2024, indicating a fertile ground for new entrants.

The threat of new entrants for Al Rajhi Bank is moderated by substantial capital requirements and stringent regulatory oversight from the Saudi Central Bank (SAMA). These factors, alongside established brand loyalty and economies of scale enjoyed by incumbents, create significant barriers. However, the rise of agile fintech companies targeting niche markets presents a more dynamic challenge, leveraging digital platforms and lower overheads to disrupt specific financial services.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data) |

|---|---|---|---|

| Capital Requirements | High upfront investment for infrastructure, technology, and regulatory reserves. | Significantly limits the number of potential entrants. | Global regulatory bodies continue to mandate billions in capital reserves for new banks. |

| Regulatory Hurdles | Strict licensing, prudential regulations (risk management, governance), and Sharia compliance. | Increases complexity, cost, and time-to-market for new players. | SAMA emphasizes high capital adequacy ratios for Islamic banks in Saudi Arabia. |

| Brand Loyalty & Trust | Established customer relationships and decades of reputation building. | Makes customer acquisition expensive and time-consuming for newcomers. | Al Rajhi Bank's extensive branch network offers a physical presence difficult for digital-only banks to quickly replicate. |

| Economies of Scale | Lower per-unit costs due to large operational footprint and customer base. | New entrants struggle to match cost efficiencies. | Major Saudi banks' investments in digital infrastructure are amortized over a larger revenue base. |

| Fintech Competition | Niche-focused digital players with lower overheads. | Disrupts specific market segments (payments, lending) with agile solutions. | 261 fintech firms were actively operating in Saudi Arabia by the end of 2024. |

Porter's Five Forces Analysis Data Sources

Our Al Rajhi Bank Porter's Five Forces analysis is built on a foundation of robust data, drawing from the bank's annual reports, Saudi Central Bank (SAMA) regulatory filings, and reputable industry research from firms like Fitch Ratings and S&P Global. This blend of internal financial disclosures and external expert assessments ensures a comprehensive view of the competitive landscape.