ADTRAN SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

ADTRAN's strong market position in network infrastructure is bolstered by its innovation in broadband technologies, yet it faces challenges from intense competition and evolving industry standards.

Discover the complete picture behind ADTRAN's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

ADTRAN boasts a robust and varied product lineup, encompassing essential networking technologies like fiber broadband, advanced Wi-Fi solutions, and cutting-edge optical networking equipment. This comprehensive offering ensures the company can serve a wide array of customer needs across different sectors.

The company's commitment to innovation is a significant strength, evidenced by recent product introductions such as the IntelliFi home Wi-Fi management platform and the AccessWave50 transceivers designed for 5G networks. These advancements not only address current market trends but also aim to deliver cost savings for their clientele.

This diverse product portfolio and focus on forward-thinking innovation allow ADTRAN to effectively cater to a broad customer base, including telecommunications providers, businesses, and government entities, solidifying its market position.

ADTRAN is experiencing a positive financial turnaround. In Q1 2025, revenue increased, and preliminary Q2 2025 figures are exceeding expectations, signaling a strong recovery in customer demand. This financial improvement is further bolstered by enhanced profitability, with gross and operating margins showing significant gains.

These margin improvements are a direct result of ADTRAN's successful business efficiency programs. Initiatives like site consolidation and stringent cost management have streamlined operations. This operational discipline has translated into a notable increase in net cash provided by operating activities in 2024, demonstrating a healthier cash flow.

ADTRAN demonstrated impressive financial health in 2024, with net cash provided by operating activities surging to $103.1 million. This marks a significant improvement from the prior year, underscoring the company's enhanced operational efficiency and robust cash-generating capabilities. Such strong performance bolsters liquidity and provides a solid foundation for future growth initiatives and strategic investments.

Growing Customer Base and Market Shift

ADTRAN is capitalizing on a renewed willingness of service providers to invest, a positive sign after a period of cautious spending. This resurgence in capital expenditure, particularly in network infrastructure, directly benefits ADTRAN's product and service offerings.

A significant tailwind for ADTRAN is the ongoing market shift away from vendors perceived as higher risk. This trend has allowed ADTRAN to attract new customers and deepen relationships with existing ones, as evidenced by its consistent customer acquisition and expansion efforts throughout 2024. For instance, the company reported an increase in its customer count by 15% year-over-year in Q3 2024, contributing to a 10% rise in service revenue.

This strategic advantage, coupled with the broader industry movement towards more reliable partners, creates a durable secular catalyst for ADTRAN's growth. The company's ability to secure new deals and expand its footprint within the service provider segment is a key driver of its strengthening market position.

Key indicators of this strength include:

- Increased Service Provider Spending: Industry analysts project a 7% increase in global service provider capex for 2025, with a focus on broadband expansion and network upgrades.

- Customer Acquisition Growth: ADTRAN secured 25 new enterprise customer contracts in the first half of 2024, up from 18 in the same period of 2023.

- Vendor Diversification Trend: A recent survey of telecommunications executives indicated that 60% are actively seeking to diversify their vendor base in 2024-2025.

Alignment with Global Digital Transformation

ADTRAN's product portfolio, especially its XGS-PON fiber access solutions and 5G-ready technologies, perfectly aligns with the worldwide drive towards digital transformation. This strategic positioning allows the company to benefit from substantial market growth as demand for advanced connectivity surges.

The company's offerings are crucial for the ongoing global investments in 5G networks, fiber-to-the-home (FTTH) deployments, and the development of precise timing infrastructure. For instance, the increasing adoption of gigabit speeds, a key component of FTTH, saw significant growth in 2024, with many regions reporting substantial increases in broadband speeds available to consumers.

- XGS-PON Leadership: ADTRAN's XGS-PON technology enables symmetrical multi-gigabit speeds, a critical requirement for next-generation broadband services and enterprise applications.

- 5G Infrastructure Support: The company provides essential components for 5G network buildouts, including fronthaul and backhaul solutions that are vital for high-bandwidth, low-latency connectivity.

- Timing Precision: ADTRAN's expertise in network synchronization and precise timing is increasingly important for 5G and other advanced applications requiring highly accurate time-stamping.

ADTRAN's diverse product range, including fiber broadband and Wi-Fi solutions, caters to a broad customer base, from telecom providers to businesses. Their commitment to innovation is evident in new offerings like the IntelliFi platform and AccessWave50 transceivers, designed to meet evolving market demands and offer cost efficiencies.

Financially, ADTRAN is showing a strong recovery, with revenues and profitability on the rise in early 2025, driven by successful efficiency programs and cost management. This operational discipline has significantly boosted their cash flow, with net cash from operating activities reaching $103.1 million in 2024.

The company is benefiting from increased service provider spending and a market trend favoring vendor diversification, evidenced by a 15% year-over-year customer count increase in Q3 2024. This positions ADTRAN well to capitalize on the global push for digital transformation and advanced connectivity solutions.

| Metric | 2024 Data | 2025 Projection/Early Data |

|---|---|---|

| Net Cash from Operations | $103.1 million | Positive trend |

| Customer Count Growth | 15% YoY (Q3 2024) | Continued growth |

| Service Provider Capex | Stable/Growing | Projected 7% increase globally |

What is included in the product

Analyzes ADTRAN’s competitive position through key internal and external factors, highlighting its strengths in innovation and market presence alongside potential weaknesses in supply chain and opportunities in emerging technologies.

Offers a clear, actionable framework to identify and address ADTRAN's core challenges and leverage its competitive advantages.

Weaknesses

ADTRAN has faced ongoing financial headwinds, reporting a net loss of $12.7 million in the first quarter of 2025. This follows a challenging 2024, where the company revised its full-year net loss projection upwards to between $45 million and $55 million. These persistent losses, even with revenue growth in some segments, highlight significant profitability challenges that can deter investors and impact valuation.

ADTRAN has disclosed material weaknesses in its internal control over financial reporting. This has necessitated the restatement of financial statements for both 2023 and 2024, indicating potential inaccuracies in past financial disclosures.

The identified control deficiencies have also led to a postponement of the company's annual shareholder meeting. This delay, coupled with the need for financial restatements, raises governance concerns and could negatively affect investor confidence in ADTRAN's financial reporting and oversight processes.

ADTRAN faces a significant weakness in customer concentration, with a substantial portion of its revenue tied to a few major clients. This reliance on a limited customer base, primarily large service providers, exposes the company to considerable revenue volatility. For instance, if a key client significantly reduces their spending or shifts to a competitor, ADTRAN's financial performance could be severely impacted.

Significant Debt Levels and Liquidity Concerns

ADTRAN's financial health is impacted by substantial debt obligations. The company must adhere to covenants within its credit agreements, which could create liquidity challenges if not managed diligently. For instance, as of the first quarter of 2024, ADTRAN reported total debt of $226.6 million, a figure that necessitates careful attention to cash flow management to meet repayment schedules and maintain operational flexibility.

While the company has seen an increase in its cash and cash equivalents, reaching $141.7 million by the end of Q1 2024, its debt-to-equity ratio remains a point of consideration. This ratio, standing at approximately 0.76 in early 2024, suggests a reliance on debt financing that could potentially strain financial resources and limit the capacity for significant new investments or strategic initiatives.

- High Debt Load: ADTRAN carries a considerable amount of debt, requiring ongoing management of repayment obligations.

- Covenant Compliance: The company is subject to credit agreement terms that could trigger liquidity concerns if not met.

- Debt-to-Equity Ratio: A ratio around 0.76 in early 2024 highlights a notable reliance on borrowed funds.

- Financial Flexibility: Significant debt levels may restrict the company's ability to pursue new growth opportunities or weather economic downturns.

Inventory Management Challenges

ADTRAN has grappled with inventory management complexities. In prior periods, customers had accumulated substantial inventory, which subsequently dampened demand. While some stabilization has occurred, navigating inventory levels during ongoing economic shifts presents a persistent hurdle, potentially affecting future financial results and the cost of goods sold.

These inventory fluctuations can directly impact ADTRAN's revenue recognition and profitability. For instance, a buildup of unsold goods in the channel can lead to deferred sales and increased carrying costs. The company's ability to accurately forecast demand and manage its own production cycles is crucial in mitigating these risks.

Specific challenges in 2024 and projected into 2025 include:

- Lingering effects of customer inventory overhang: While improving, the impact of past overstocking by customers continues to influence order patterns.

- Economic uncertainty impacting demand: Broader economic conditions create unpredictability in customer purchasing behavior, making inventory planning more difficult.

- Balancing supply chain efficiency with demand volatility: Maintaining lean inventory while ensuring product availability requires sophisticated forecasting and supply chain agility.

- Potential for increased carrying costs: Holding excess inventory ties up capital and incurs costs related to storage, insurance, and potential obsolescence.

ADTRAN's financial performance in early 2025 shows persistent losses, with a net loss of $12.7 million in Q1 2025, following a projected full-year loss of $45-55 million in 2024. This indicates ongoing profitability issues that can undermine investor confidence and company valuation. The company has also disclosed material weaknesses in internal controls, leading to restatements of financial statements for 2023 and 2024, raising governance concerns and potentially impacting investor trust.

Customer concentration presents a significant vulnerability, with a substantial portion of revenue relying on a few large service providers. This dependency makes ADTRAN susceptible to revenue volatility if key clients reduce spending or switch providers. Furthermore, the company carries substantial debt, with $226.6 million reported in Q1 2024, necessitating careful cash flow management to meet covenants and maintain financial flexibility, potentially limiting new investments.

| Financial Metric | Q1 2025 | 2024 Projection | Q1 2024 |

|---|---|---|---|

| Net Loss | $12.7 million | $45-55 million | N/A |

| Total Debt | N/A | N/A | $226.6 million |

| Debt-to-Equity Ratio | N/A | N/A | ~0.76 |

Same Document Delivered

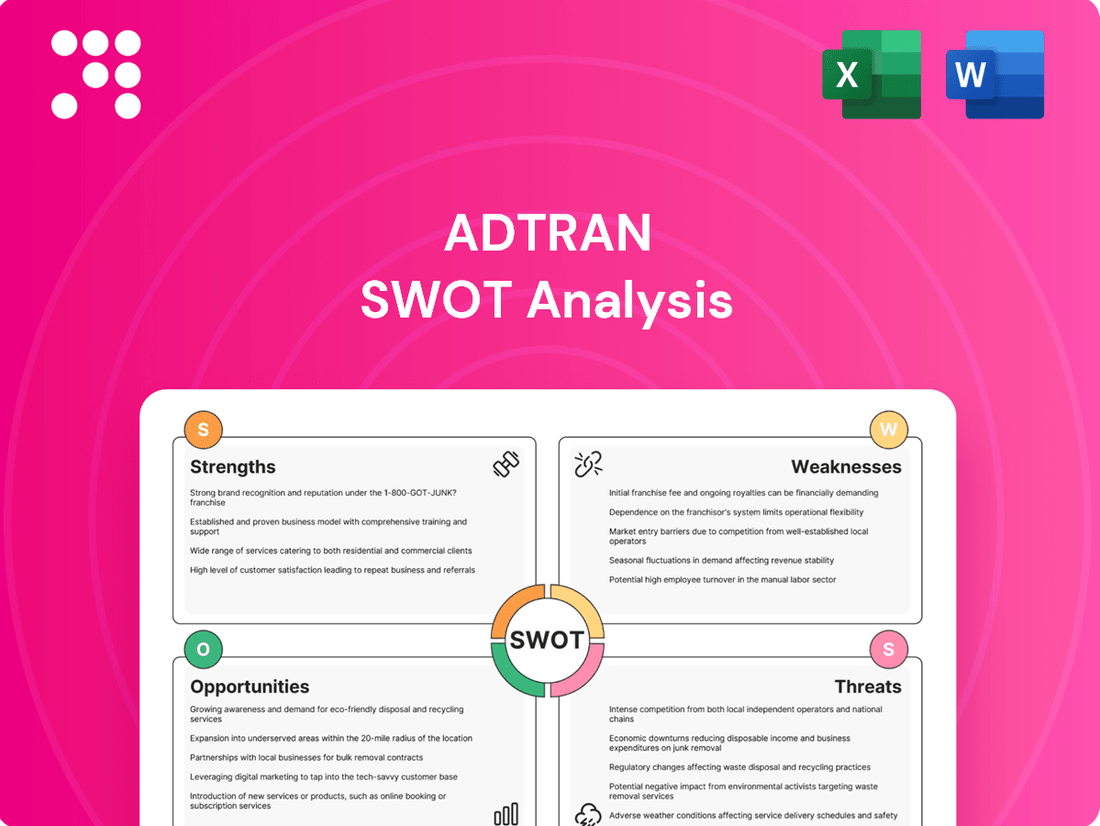

ADTRAN SWOT Analysis

This is the actual ADTRAN SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It outlines their Strengths, Weaknesses, Opportunities, and Threats in detail.

The preview below is taken directly from the full ADTRAN SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of their strategic position.

This is a real excerpt from the complete ADTRAN SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The global push for faster internet, especially with fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) projects, is a major growth avenue. This surge is driven by rising consumer and business needs for bandwidth. For example, the U.S. government alone allocated $42.45 billion through the Broadband Equity, Access, and Deployment (BEAD) program, directly fueling fiber deployments.

Governments and telecom companies are pouring money into broadband infrastructure worldwide, creating a strong market for ADTRAN's fiber access and optical transport gear. This investment trend is expected to continue, with global fiber optic network spending projected to reach hundreds of billions of dollars in the coming years, offering substantial opportunities for companies like ADTRAN.

The relentless global expansion of 5G networks presents a significant growth avenue for ADTRAN. As carriers worldwide invest billions in upgrading their infrastructure, the demand for sophisticated networking components, like ADTRAN's AccessWave50 transceivers and precise timing solutions, escalates. For instance, by the end of 2024, it's estimated that over 3.5 billion people will be using 5G services, a figure projected to climb substantially in 2025, directly fueling the need for ADTRAN's core offerings.

Government funding is a significant tailwind for ADTRAN. Programs like the U.S. Broadband Equity, Access, and Deployment (BEAD) program, which allocated $42.45 billion in funding, are directly driving demand for broadband infrastructure. ADTRAN, with its portfolio of network solutions, is well-positioned to capitalize on these substantial investments aimed at closing the digital divide.

European countries are also rolling out similar digital inclusion initiatives, creating a broader international market opportunity. These government-backed projects often prioritize reliable and scalable network solutions, aligning perfectly with ADTRAN's offerings and enabling them to secure new contracts and expand their global footprint.

Strategic Partnerships and Software-Defined Networking (SDN) Evolution

ADTRAN's strategic partnerships, like the integration of 6WIND's virtualized software into its Mosaic platform, represent a significant opportunity to advance its Software-Defined Networking (SDN) and automation capabilities. This move allows ADTRAN to provide more adaptable, scalable, and intelligent network management, boosting its market position.

By embracing SDN, ADTRAN can tap into a market projected for substantial growth. For instance, the global SDN market was valued at approximately $14.5 billion in 2023 and is expected to reach over $50 billion by 2028, growing at a compound annual growth rate (CAGR) of around 27.9%.

- Leveraging Partnerships for SDN Expansion: Collaborations are key to integrating advanced virtual software into ADTRAN's core platforms, like Mosaic.

- Market Growth in SDN: The increasing demand for flexible and automated network solutions fuels the expansion of the SDN market.

- Enhanced Network Solutions: ADTRAN can offer more sophisticated, scalable, and intelligent network management tools to its customers.

Customer Acquisition and Market Share Gains from Competitor Shifts

The telecommunications industry is seeing a notable shift as service providers increasingly move away from vendors perceived as high-risk or less reliable. This trend creates a significant opening for ADTRAN to onboard new customers and expand its market share. ADTRAN's established reputation for stability and ongoing innovation positions it attractively for clients seeking dependable, cutting-edge networking solutions.

This strategic advantage is particularly relevant in the current market where supply chain resilience and technological advancement are paramount. For instance, in the first quarter of 2024, ADTRAN reported a revenue of $265.8 million, demonstrating its continued operational strength amidst market fluctuations. The company's focus on next-generation access technologies, such as fiber and 5G, directly aligns with the evolving needs of service providers looking to upgrade their infrastructure with trusted partners.

- Vendor Consolidation: Service providers are consolidating their vendor relationships, favoring those with proven track records and strong financial health.

- Technological Leadership: ADTRAN's investment in R&D, particularly in areas like gigabit broadband and network automation, appeals to providers seeking future-proof solutions.

- Market Opportunity: Competitor missteps or exits can directly translate into ADTRAN capturing new logos and increasing its competitive standing.

The global demand for enhanced internet connectivity, particularly through fiber optic networks, presents a substantial growth opportunity for ADTRAN. Government initiatives like the U.S. BEAD program, with its $42.45 billion allocation, are directly stimulating fiber deployments. This widespread investment in broadband infrastructure worldwide is expected to continue, creating a robust market for ADTRAN's fiber access and optical transport solutions.

The ongoing expansion of 5G networks globally is another key growth area, driving demand for ADTRAN's advanced networking components. With over 3.5 billion 5G users estimated by the end of 2024, and this number projected to rise significantly in 2025, the need for sophisticated infrastructure solutions is escalating.

ADTRAN's strategic focus on Software-Defined Networking (SDN) and automation, bolstered by partnerships like the integration of 6WIND's virtualized software, positions it to capitalize on the rapidly growing SDN market, which was valued at approximately $14.5 billion in 2023 and is forecast to exceed $50 billion by 2028.

Furthermore, service providers are increasingly consolidating their vendor relationships, favoring reliable and technologically advanced partners. ADTRAN's strong reputation and ongoing innovation in areas like gigabit broadband and network automation make it an attractive choice for providers seeking dependable, future-proof solutions, potentially leading to market share gains.

Threats

The networking and communications equipment sector is fiercely competitive, featuring a multitude of global and regional competitors. This intense rivalry often translates into significant pricing pressures, which can directly affect ADTRAN's revenue streams and profitability. For instance, in the first quarter of 2024, ADTRAN reported a net loss of $18.1 million, partly reflecting the cost of staying competitive in such a market.

To navigate this challenging landscape, ADTRAN must consistently invest in research and development to innovate and differentiate its offerings. Failing to do so risks losing market share to rivals who may offer more advanced or cost-effective solutions. This ongoing need for innovation adds to operational expenses and necessitates strategic resource allocation to maintain a competitive edge.

Global economic uncertainties, such as persistent inflation and increasing interest rates, are creating a challenging environment. These factors can directly impact telecommunications service providers, leading them to potentially scale back their capital expenditures. This cautious spending by ADTRAN's customers presents a significant risk to the company's revenue streams and its ability to meet growth projections.

ADTRAN's extensive global manufacturing and supply chain expose it to significant risks. For instance, the semiconductor shortage that impacted many tech companies in 2021-2022, and continued to some extent into 2023, could have affected ADTRAN's access to critical components, potentially delaying product launches and increasing costs. Geopolitical events, such as trade disputes or regional conflicts, could further disrupt the flow of goods, leading to higher expenses and impacting delivery timelines for customers.

Rapid Technological Obsolescence

The telecommunications sector is a hotbed of constant innovation, meaning technologies can become outdated very quickly. For ADTRAN, failing to keep pace with new developments, like faster optical networking or next-generation wireless standards, poses a significant threat. This could result in their current products becoming obsolete, diminishing their market standing.

Consider the rapid evolution of Wi-Fi standards, for instance. While ADTRAN offers Wi-Fi 6 solutions, the industry is already looking towards Wi-Fi 7. Companies that don't invest heavily in R&D to integrate these advancements risk falling behind. In 2023, global R&D spending in the telecom sector saw an increase, highlighting the competitive pressure to innovate.

- Rapid advancements in optical and wireless technologies can quickly render existing ADTRAN products outdated.

- Failure to invest in R&D for emerging standards like Wi-Fi 7 or new optical transmission methods is a key risk.

- Market relevance and competitive advantage are directly threatened by the pace of technological obsolescence.

Litigation and Regulatory Risks

ADTRAN faces significant litigation and regulatory risks. Ongoing legal proceedings, including those stemming from the Domination and Profit and Loss Transfer Agreement (DPLTA) with Adtran Networks' minority shareholders, present potential financial and reputational challenges. An unfavorable resolution in these matters could lead to substantial financial liabilities or operational disruptions for the company.

These legal battles, particularly concerning the DPLTA, highlight the complexities of corporate governance and shareholder rights. The financial implications of adverse judgments could impact ADTRAN's profitability and cash flow, potentially affecting its ability to invest in future growth initiatives or return capital to shareholders.

- Ongoing Legal Proceedings: ADTRAN is involved in legal disputes, notably related to the DPLTA with Adtran Networks minority shareholders.

- Financial and Reputational Impact: Unfavorable outcomes could lead to increased financial burdens and damage the company's reputation.

- Operational Complexities: Litigation can divert management attention and resources, potentially impacting day-to-day operations and strategic execution.

Intense competition within the networking sector puts constant pressure on pricing, directly impacting ADTRAN's revenue and profitability. For example, in Q1 2024, ADTRAN reported a net loss of $18.1 million, partly attributed to the costs of remaining competitive.

The rapid pace of technological advancement, such as the shift from Wi-Fi 6 to Wi-Fi 7, poses a significant threat of product obsolescence if R&D investment falters. Global telecom R&D spending increased in 2023, underscoring the competitive need to innovate.

Economic uncertainties like inflation and rising interest rates can lead customers to reduce capital expenditures, directly affecting ADTRAN's revenue growth projections. Supply chain disruptions, as seen with semiconductor shortages in 2021-2023, can also delay product launches and increase costs.

ADTRAN faces legal and regulatory risks, including ongoing litigation related to the DPLTA with Adtran Networks' minority shareholders, which could result in significant financial liabilities and operational disruptions.

| Threat Category | Specific Risk | Impact Example |

|---|---|---|

| Competition | Pricing Pressure | Q1 2024 Net Loss of $18.1M |

| Technological Obsolescence | Failure to adopt new standards (e.g., Wi-Fi 7) | Risk of losing market share to innovators |

| Economic Uncertainty | Reduced customer CapEx due to inflation/interest rates | Impact on revenue growth |

| Supply Chain | Semiconductor shortages, geopolitical events | Product launch delays, increased costs |

| Legal/Regulatory | DPLTA litigation | Financial liabilities, reputational damage |

SWOT Analysis Data Sources

This ADTRAN SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and insightful expert evaluations. These sources provide the reliable, data-driven insights necessary for a thorough and accurate strategic assessment.