ADTRAN Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

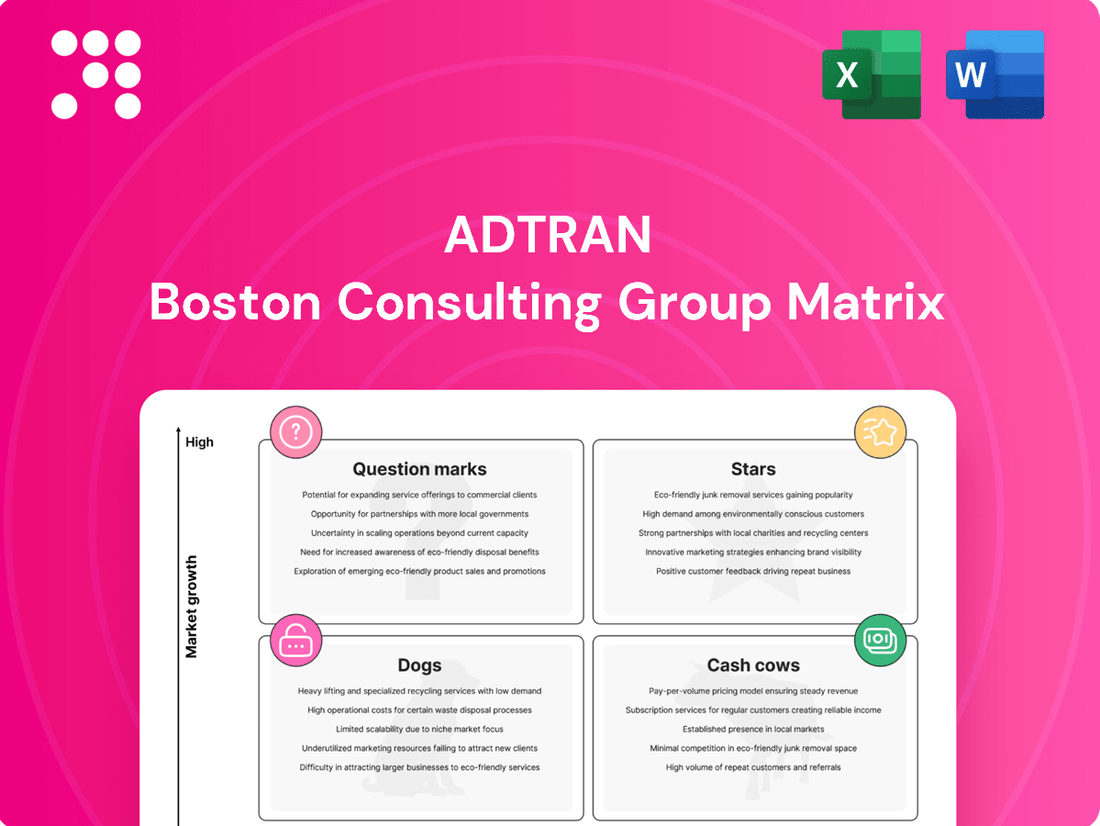

Unlock the strategic potential of ADTRAN's product portfolio with our comprehensive BCG Matrix analysis. Understand which offerings are market leaders (Stars), which generate consistent revenue (Cash Cows), which require careful consideration (Question Marks), and which may be underperforming (Dogs).

This preview offers a glimpse into ADTRAN's strategic positioning. Purchase the full BCG Matrix to gain detailed quadrant placements, data-driven insights, and actionable recommendations to optimize your investment and product development strategies.

Don't miss out on the complete picture of ADTRAN's market standing. The full BCG Matrix provides quadrant-by-quadrant clarity and strategic takeaways, empowering you to make informed decisions and gain a competitive edge.

Stars

ADTRAN's GPON and XGS-PON fiber access platforms are considered Stars in the BCG matrix. This is driven by robust global growth in fiber-to-the-home (FTTH) deployments, fueled by significant government funding for rural broadband expansion and the development of urban smart city infrastructure. These solutions are at the forefront of enabling faster, more reliable internet connectivity.

The company's strong financial performance, evidenced by exceeding revenue expectations in Q2 2025, directly reflects the sustained demand for its advanced networking technologies. This demand highlights the critical role ADTRAN's fiber access solutions play in meeting the increasing need for high-speed internet services worldwide.

Strategic collaborations, like the one with eCommunity™ Fiber, further solidify ADTRAN's leading position in this high-growth market. These partnerships are instrumental in expanding access to fiber technology and reinforcing ADTRAN's commitment to innovation and market leadership in the fiber access space.

ADTRAN is a leader in 50G PON technology, with 2025 shaping up to be a key year for its widespread adoption. This advanced technology promises substantial speed increases, essential for handling the growing bandwidth needs of homes, businesses, and 5G networks. ADTRAN's demonstrated capabilities and early commercial successes, such as the UK's initial 50G PON service with Netomnia, highlight its strong market standing and significant growth prospects.

ADTRAN's Mosaic One platform is positioned as a Star in the BCG Matrix. This AI-powered solution for service providers is crucial in today's market, driving automation and enhancing subscriber experiences. Its ability to reduce operational expenses is a significant draw for customers.

The platform offers advanced capabilities like predictive maintenance and rapid root cause analysis. This directly addresses the high-growth market demand for streamlined and efficient network management. By enabling quicker problem resolution, Mosaic One solidifies its status as a leading offering.

Wi-Fi 7 Solutions (SDG 9000 Series)

ADTRAN's SDG 9000 Series Wi-Fi 7 service delivery gateways, launched in May 2025, represent a strategic move into the rapidly expanding Wi-Fi 7 market. This expansion targets a growing need for robust, secure, and high-speed internet access across various user segments, including homes, small businesses, and multi-dwelling units.

The introduction of these gateways positions ADTRAN to capture significant market share as Wi-Fi 7 adoption accelerates. The global Wi-Fi market is projected to reach $18.4 billion by 2028, with Wi-Fi 7 expected to be a key driver of this growth, offering speeds up to 46 Gbps, a substantial leap from previous standards.

- High-Growth Market: The demand for enhanced connectivity fuels the Wi-Fi 7 market, which is experiencing substantial growth.

- Multigigabit Speeds: ADTRAN's SDG 9000 Series provides multigigabit speeds, meeting the increasing bandwidth requirements of modern applications.

- Cloud Management: Integrated cloud management capabilities offer scalability and ease of deployment for service providers.

- Connected Home Trends: The solutions align with the growing trend of sophisticated connected home ecosystems and the increasing number of connected devices per household.

Open Optical Transport Solutions

ADTRAN's open optical transport solutions, like the FSP 3000 open line system and the 100ZR+ QSFP28 transceiver, are seeing increased market adoption. These offerings are designed to meet the rising need for adaptable and power-saving networks, crucial for AI, cloud, and future network designs. Customer interest is particularly strong in software-defined access and 10G solutions.

The market is increasingly favoring open architectures that offer greater flexibility and interoperability. ADTRAN's strategy in this area positions them to capitalize on this trend, with solutions that reduce vendor lock-in and lower total cost of ownership.

- Market Traction: ADTRAN's open optical transport solutions are gaining momentum, indicating strong market acceptance.

- Key Offerings: The FSP 3000 open line system and 100ZR+ QSFP28 transceiver are central to their strategy.

- Demand Drivers: These solutions address the growing need for flexible, energy-efficient networking for AI, cloud, and next-gen architectures.

- Customer Engagement: ADTRAN is experiencing increased customer interest in their software-defined access and 10G solutions.

ADTRAN's fiber access platforms, including GPON and XGS-PON, are classified as Stars due to significant global demand driven by FTTH expansion and smart city initiatives. The company's Q2 2025 performance, exceeding revenue expectations, underscores the strong market appetite for these advanced networking solutions.

ADTRAN's leadership in 50G PON technology, with early successes like Netomnia's UK deployment, positions it for substantial growth as this technology gains traction in 2025. The Mosaic One platform, an AI-powered solution for service providers, also falls into the Star category, offering automation and cost reduction benefits that are highly sought after.

The SDG 9000 Series Wi-Fi 7 gateways, launched in May 2025, are Stars, targeting the rapidly growing Wi-Fi 7 market with its promise of significantly faster speeds. Open optical transport solutions, such as the FSP 3000 and 100ZR+ transceiver, are also Stars, meeting the demand for flexible, energy-efficient networks for AI and cloud applications.

| Product Category | BCG Status | Key Growth Drivers | ADTRAN's Competitive Edge |

| Fiber Access Platforms (GPON, XGS-PON) | Star | Global FTTH expansion, rural broadband funding, smart city infrastructure | Leading technology, strong partnerships, proven performance |

| 50G PON Technology | Star | Increasing bandwidth demands, 5G network backhaul | Early commercial deployments, technological innovation |

| Mosaic One Platform | Star | Service provider need for automation, operational cost reduction, enhanced subscriber experience | AI-powered capabilities, predictive maintenance, rapid root cause analysis |

| Wi-Fi 7 Gateways (SDG 9000 Series) | Star | Growing Wi-Fi 7 adoption, demand for multigigabit speeds, connected home trends | New product launch, alignment with market growth projections |

| Open Optical Transport Solutions | Star | Demand for flexible, energy-efficient networks, AI/cloud infrastructure growth | Open architecture strategy, reduced vendor lock-in, customer interest in 10G solutions |

What is included in the product

The ADTRAN BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic guidance on investment, holding, or divestment for each product category.

ADTRAN's BCG Matrix offers a clear, one-page overview, alleviating the pain of complex portfolio analysis.

Cash Cows

ADTRAN's legacy GPON deployments are solidifying their position as Cash Cows. These established networks are a reliable source of ongoing revenue, primarily from maintenance and support contracts. Service providers are finding value in extending the life of these systems, especially with the advent of Combo PON, which allows for the integration of newer XGS-PON services without a complete infrastructure rip-and-replace.

ADTRAN's established access and aggregation solutions represent a significant portion of their business, reflecting a long-standing presence in the networking and communications sector. These products are crucial for telecommunications providers, businesses, and government entities needing dependable connectivity.

While these offerings might not be in a high-growth phase, their maturity translates into substantial market share and consistent revenue generation. This stability is a hallmark of a cash cow, providing the financial foundation for ADTRAN's other ventures.

In 2024, the demand for robust network infrastructure remains strong, driven by ongoing digital transformation initiatives. ADTRAN's established solutions are well-positioned to capitalize on this sustained need, ensuring continued cash flow for the company.

ADTRAN's Maintenance and Managed Services are classic Cash Cows within its Business Matrix. These offerings, encompassing network implementation, integration, and ongoing support, generate reliable, high-margin revenue. This is largely because they leverage the company's extensive installed base, requiring minimal incremental investment to serve existing customers who depend on these services for operational efficiency and faster market entry.

Broadband Access Equipment for Tier 2/3 Service Providers

ADTRAN's broadband access equipment for Tier 2 and Tier 3 service providers represents a classic Cash Cow in the BCG matrix. The company boasts deep-rooted relationships and a significant market presence within these provider segments across the US and internationally. This established customer base ensures a consistent and predictable revenue stream, even if the growth rate isn't explosive.

This segment is characterized by its stability and reliability, acting as a dependable engine for ADTRAN's overall financial performance. The ongoing demand for broadband infrastructure upgrades from these providers creates a steady market for ADTRAN's offerings. For instance, in 2023, ADTRAN reported strong performance in its Broadband Solutions segment, which directly includes this equipment, highlighting the consistent demand.

- Established Market Share: ADTRAN holds a significant position with Tier 2/3 providers, ensuring consistent sales.

- Predictable Revenue: The ongoing need for network upgrades provides a stable income source.

- Customer Loyalty: Strong relationships foster repeat business and reduce customer acquisition costs.

- Profitability: Mature product lines and efficient operations typically lead to healthy profit margins in this segment.

Carrier-Grade Ethernet Solutions

ADTRAN's Carrier-Grade Ethernet Solutions represent a mature but vital segment within its portfolio, fitting the profile of a Cash Cow in the BCG Matrix. These solutions are foundational for many service provider networks, ensuring consistent demand for sales, upgrades, and essential support services.

This segment has historically been a strong contributor to ADTRAN's revenue. For instance, in the first quarter of 2024, ADTRAN reported total revenue of $300.2 million, with its Network Solutions segment, which heavily includes Carrier Ethernet, playing a significant role. The predictable nature of these service contracts provides a stable revenue stream, bolstering ADTRAN's overall financial health.

- Stable Revenue Generation: Carrier Ethernet solutions provide recurring revenue through maintenance and support contracts.

- Mature Market Position: ADTRAN's established presence in this segment ensures continued demand from existing and new customers.

- Essential Network Infrastructure: These solutions are critical for service providers, maintaining their relevance and necessity.

- Cash Flow Contribution: The predictable sales cycle and service agreements make this a reliable source of cash for ADTRAN.

ADTRAN's established broadband access equipment for Tier 2 and Tier 3 service providers is a prime example of a Cash Cow. Their deep-rooted relationships and significant market presence in these segments, particularly across the US, ensure a consistent and predictable revenue stream. This stability, even without explosive growth, makes it a dependable engine for ADTRAN's financial performance.

The ongoing demand for broadband infrastructure upgrades from these providers fuels a steady market for ADTRAN's offerings. In 2023, ADTRAN's Broadband Solutions segment, which encompasses this equipment, demonstrated strong performance, underscoring the sustained need.

This segment benefits from established market share, predictable revenue from network upgrades, and strong customer loyalty, all contributing to healthy profit margins. These mature product lines and efficient operations solidify its Cash Cow status.

| ADTRAN Cash Cow Segments | Description | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Broadband Access (Tier 2/3 Providers) | Established equipment for regional service providers. | High market share, predictable revenue, customer loyalty. | Significant portion of Broadband Solutions segment. |

| Carrier-Grade Ethernet Solutions | Foundational networking for service providers. | Stable revenue from support/maintenance, mature market position. | Key contributor to Network Solutions segment. |

| Maintenance & Managed Services | Ongoing support and network services. | Leverages installed base, high margins, minimal incremental investment. | Reliable, high-margin revenue stream. |

What You’re Viewing Is Included

ADTRAN BCG Matrix

The ADTRAN BCG Matrix preview you are viewing is the identical, fully-unlocked document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, is ready for immediate application in your strategic planning sessions. You can be assured that no watermarks or placeholder content will be present in the final downloaded file, ensuring a professional and actionable resource.

Dogs

ADTRAN's overall revenue saw a dip in Q4 2024, signaling a potential loss of ground in certain product categories. Products situated in mature market segments, particularly those facing reduced demand from service providers who are managing high inventory levels, are likely candidates for this classification.

For instance, ADTRAN's legacy access networking solutions, often found in established service provider networks, may be experiencing this trend. With service providers prioritizing upgrades and new deployments, older, mature technologies could see their market share diminish as demand shifts.

Older product lines that no longer align with ADTRAN's strategic direction, such as its focus on fiber broadband and Wi-Fi 7, would be categorized as Dogs. These offerings typically exhibit low market share and minimal growth potential. For instance, if ADTRAN had legacy copper-based network solutions with declining demand and a small customer base, these would fit this quadrant.

These products might continue to be supported for existing customers but are unlikely to receive significant new investment or development resources. ADTRAN's reported revenue from its Broadband Solutions segment, which includes its strategic fiber offerings, has been a key growth driver, highlighting the company's shift away from older technologies.

High customer inventory levels significantly affected ADTRAN's performance in 2024, causing a noticeable dip in demand for some of their offerings. This situation is particularly challenging if these products are situated in markets with limited growth potential and ADTRAN holds a minor market share within them.

When products are in slow-growing sectors and ADTRAN's market share is low, they often fall into the Dogs category of the BCG Matrix. This classification means they are not generating substantial revenue or growth, and importantly, they tie up valuable capital that could be better invested elsewhere for higher returns.

Niche Products with Limited Scalability

Niche products with limited scalability, often found in ADTRAN's portfolio, cater to very specific market segments. These offerings might achieve break-even status but lack the potential for significant expansion or substantial profit generation. For instance, a specialized network device designed for a single industry with a small customer base would fall into this category.

Such products, while potentially meeting a unique need, do not drive overall company growth. Their limited reach means they are unlikely to contribute meaningfully to revenue or market share. In 2024, ADTRAN's focus on broad market solutions means these niche items might represent a small fraction of their overall product strategy.

- Limited Market Reach: Products serving highly specialized industries with few potential customers.

- Low Growth Potential: Unlikely to see significant increases in sales volume or market penetration.

- Strategic Review: Candidates for divestiture or reduced investment to reallocate resources to more promising areas.

Non-Core Acquisitions Not Integrated Effectively

Non-core acquisitions that haven't been smoothly integrated into ADTRAN's main business plan, or those that haven't captured substantial market share, could be categorized as Dogs. These ventures might drain valuable resources without delivering the anticipated financial benefits or strategic advantages.

For instance, if ADTRAN acquired a company focused on a niche technology that didn't align with its broader network solutions strategy, and that product line subsequently underperformed, it would fit this description. Such an acquisition might have represented a strategic misstep, consuming capital and management attention that could have been better allocated to core growth areas.

- Underperforming Acquisitions: Past acquisitions that have failed to achieve expected market penetration or revenue targets.

- Resource Drain: These ventures consume capital and management bandwidth without generating commensurate returns.

- Strategic Misalignment: Product lines from acquisitions that do not fit ADTRAN's core business strategy or customer needs.

Products in ADTRAN's Dogs category represent offerings with low market share in slow-growing industries, often due to declining demand or strategic shifts. These products tie up capital and management resources without contributing significantly to growth. For instance, legacy copper-based networking solutions or niche products with limited scalability would fit this classification, potentially being candidates for divestiture.

ADTRAN's 2024 financial reports indicated a general dip in revenue, particularly in segments facing reduced service provider spending due to high inventory levels. This environment directly impacts products categorized as Dogs, as they operate in mature markets with limited upside. The company's strategic focus on fiber broadband and Wi-Fi 7 further underscores the move away from older, less profitable technologies.

These underperforming assets, including potentially non-core acquisitions that haven't gained traction, consume valuable resources. By identifying and managing these 'Dog' products, ADTRAN can reallocate capital and attention to its more promising 'Stars' and 'Question Marks', driving overall business performance and innovation. The company's commitment to streamlining its portfolio is evident in its strategic investments.

For example, while ADTRAN's Broadband Solutions segment showed growth, other legacy product lines might be experiencing the challenges of a saturated market. Products that don't align with the company's forward-looking strategy, such as advanced fiber and Wi-Fi solutions, are prime candidates for the Dogs quadrant, reflecting their minimal growth potential and market share.

| Product Category Example | Market Growth | ADTRAN Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy Copper Access Solutions | Declining | Low | Dog | Divestiture or minimal support |

| Niche Industrial Networking Devices | Slow | Low | Dog | Evaluate for profitability, consider divestiture |

| Underperforming Acquired Technology | Stagnant | Very Low | Dog | Resource reallocation, potential write-off |

Question Marks

The SD-WAN market is booming, fueled by the widespread adoption of cloud services and the rise of remote workforces. ADTRAN has offerings in this dynamic sector, but their precise market share and competitive standing within this fast-paced environment need closer examination to ascertain if they are making substantial inroads or are still considered a Question Mark.

As of early 2024, the global SD-WAN market was projected to reach over $10 billion, with continued robust growth expected. ADTRAN's participation in this expanding market presents an opportunity, but their ability to capture significant share against established players and newer entrants will be critical for their classification.

ADTRAN's broader dynamic AI Network Cloud solutions, particularly those enhancing Data Center Interconnect (DCI) capabilities, are positioned as Question Marks within the BCG Matrix. This segment is experiencing significant growth, fueled by the increasing demand for robust AI infrastructure that necessitates advanced networking. For instance, the global DCI market was projected to reach over $20 billion by 2024, highlighting the substantial opportunity.

While this area represents a high-growth market, ADTRAN's specific market share and the ultimate success of these newer AI-driven offerings require careful observation. The company's ability to capture a meaningful portion of this expanding market will determine if these solutions transition to Stars or remain Question Marks. The rapid evolution of AI technology means continuous investment and innovation are crucial for competitive positioning.

ADTRAN's Ensemble Cloudlet vRouter, introduced in May 2025, targets the burgeoning enterprise edge services market, a sector projected for significant expansion driven by 5G and IoT adoption. This product aims to facilitate swift deployment of these crucial services at the network edge.

While the edge computing landscape is experiencing robust growth, with analyst firms predicting the global edge computing market to reach over $110 billion by 2028, the specific market penetration and competitive standing of ADTRAN's vRouter remain to be determined. This uncertainty places it squarely in the Question Mark quadrant of the BCG Matrix.

Newer Quantum-Secured Encryption Offerings

ADTRAN is making strides in the burgeoning field of quantum-secured encryption, a critical development for future network security. Colt, a significant player in telecommunications, is leveraging ADTRAN's FSP 3000 technology to implement quantum-secured encryption across its extensive metro and long-haul network infrastructure. This partnership highlights the practical application and growing demand for such advanced security solutions.

This segment represents a significant innovation with considerable growth potential, positioning ADTRAN's quantum-secured encryption offerings as a prime candidate for the Question Mark category in the BCG Matrix. While the technology is cutting-edge, its current market penetration remains limited, and the trajectory towards widespread adoption is still being defined. The early stages of market development and the ongoing evolution of quantum computing threats contribute to its uncertainty.

- Market Potential: The quantum-secured encryption market is projected for substantial growth as organizations prepare for the threat of quantum computers breaking current encryption standards. Analysts predict this market could reach tens of billions of dollars by the end of the decade.

- Colt's Adoption: Colt's deployment of ADTRAN's FSP 3000 for quantum-secured encryption signifies a real-world validation of the technology's capabilities in demanding network environments.

- Technological Advancement: ADTRAN's involvement places it at the forefront of a rapidly evolving technological landscape, where innovation is key to capturing future market share.

- Adoption Challenges: Widespread adoption faces hurdles including the cost of upgrading existing infrastructure and the need for standardized protocols, making its future market position uncertain.

Solutions for Rural Broadband Initiatives (Beyond Core FTTH)

Beyond core Fiber-to-the-Home (FTTH), ADTRAN's rural broadband solutions can leverage fixed wireless access (FWA) and advanced Wi-Fi technologies to reach underserved areas efficiently. In 2024, government initiatives like the Broadband Equity, Access, and Deployment (BEAD) program are injecting significant capital, with over $42 billion allocated to expand broadband access, particularly in rural regions. ADTRAN’s ability to integrate these diverse technologies allows them to address the unique terrain and cost challenges inherent in rural deployments, making them a key player in capturing this high-growth market.

- Fixed Wireless Access (FWA): ADTRAN offers FWA solutions that bypass the high costs of trenching fiber in difficult rural landscapes, providing a quicker and more economical path to connectivity.

- Wi-Fi 6/6E and Mesh Networks: Extending high-speed internet within homes and businesses in rural areas is crucial, and ADTRAN's advanced Wi-Fi technologies ensure reliable in-premise coverage.

- Network Aggregation and Edge Computing: For scalable rural networks, ADTRAN provides solutions for efficient data aggregation and processing at the network edge, optimizing performance and reducing latency.

ADTRAN's foray into quantum-secured encryption, evidenced by Colt's adoption of their FSP 3000 technology, positions this offering as a Question Mark. While the market for quantum-resistant solutions is poised for significant growth, estimated to reach tens of billions by 2030, ADTRAN's current market share and the broader adoption rate remain uncertain.

The rapid development of quantum computing necessitates advanced security, making ADTRAN's quantum-secured encryption a promising but unproven venture within the BCG framework. The company's ability to scale this technology and establish industry standards will be pivotal in determining its future market trajectory.

The uncertainty surrounding widespread adoption, driven by infrastructure upgrade costs and the need for standardized protocols, places ADTRAN's quantum-secured encryption firmly in the Question Mark quadrant. This segment requires continued investment and strategic partnerships to solidify its market position.

ADTRAN's rural broadband solutions, incorporating Fixed Wireless Access (FWA) and advanced Wi-Fi, are also classified as Question Marks. While government initiatives like the BEAD program, with over $42 billion allocated in 2024, are driving demand in underserved areas, ADTRAN's specific market capture in this segment is yet to be fully realized.

| ADTRAN Offering | BCG Quadrant | Market Growth | Market Share | Rationale |

|---|---|---|---|---|

| Quantum-Secured Encryption | Question Mark | High (tens of billions by 2030) | Low/Uncertain | Innovative technology with high potential but unproven widespread adoption and market share. |

| Rural Broadband (FWA & Wi-Fi) | Question Mark | High (driven by government initiatives like BEAD) | Moderate/Developing | Leverages government funding and diverse technologies, but market penetration is still evolving. |

BCG Matrix Data Sources

Our ADTRAN BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and strategic competitor intelligence, to provide a robust strategic overview.