ADTRAN Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

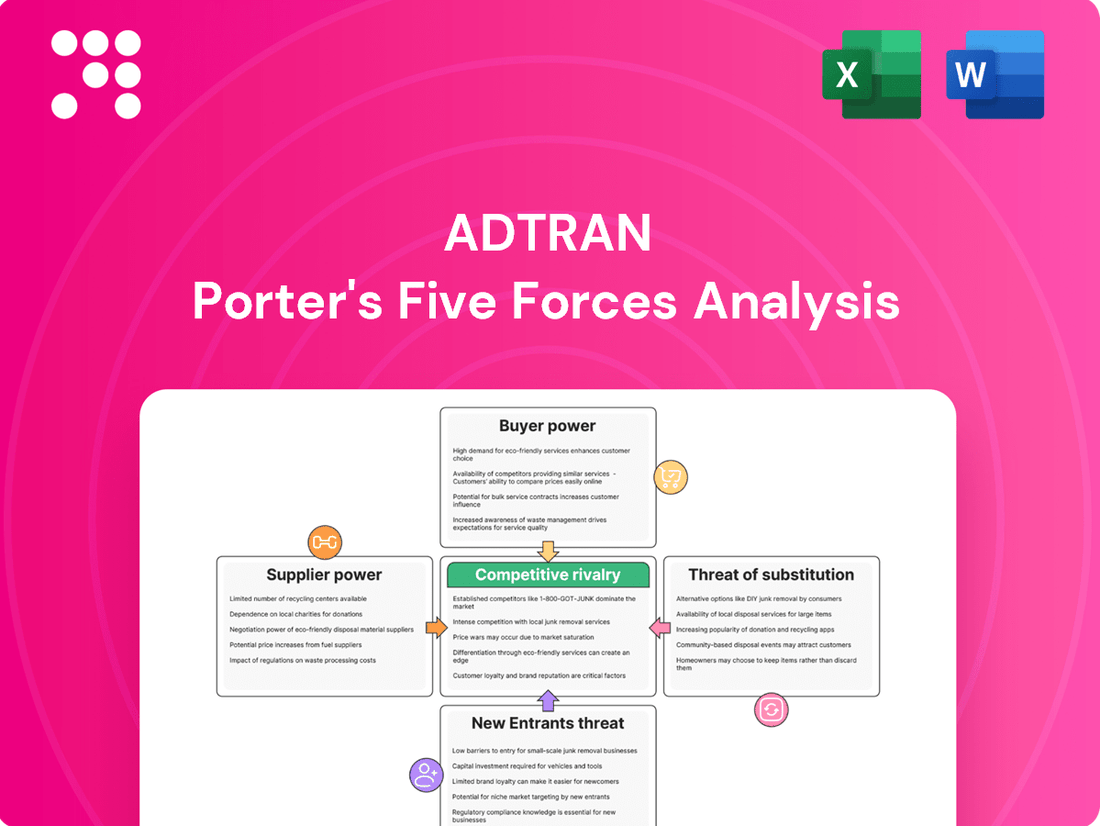

ADTRAN operates in a dynamic telecommunications infrastructure market, facing significant competitive pressures. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success. This brief overview highlights the key forces, but the full analysis unlocks a deeper understanding.

The complete report reveals the real forces shaping ADTRAN’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

ADTRAN's reliance on a limited number of suppliers for crucial components such as semiconductors, optical modules, and specialized chipsets significantly amplifies supplier bargaining power. When these high-tech or unique parts are sourced from only a handful of dominant providers, these suppliers gain considerable leverage. This concentration means ADTRAN faces potential challenges in negotiating favorable pricing and ensuring a consistent, reliable supply chain, which could impact its operational efficiency and product cost structure.

Suppliers providing unique or highly specialized technologies crucial for ADTRAN's advanced networking solutions, such as those for fiber broadband or Wi-Fi 7, wield considerable bargaining power. If these critical inputs are difficult to substitute or source from alternative providers, ADTRAN's reliance on these suppliers increases, granting them leverage in negotiations over pricing and supply terms.

For ADTRAN, the costs and complexities associated with switching suppliers can be significant. These can range from the expense of redesigning products to accommodate new components to the time and resources required for re-certifying alternative parts and reconfiguring manufacturing lines. For instance, in the telecommunications equipment sector, a shift in a key component supplier might necessitate extensive re-testing and validation to ensure compliance with industry standards, a process that could easily run into hundreds of thousands of dollars.

These substantial switching costs inherently bolster the bargaining power of ADTRAN's current suppliers. Even if competitive alternatives are available, the financial and operational hurdles to transition mean ADTRAN has less leverage to negotiate better terms or switch to a potentially cheaper provider. This can translate into higher input costs or less favorable contract terms, directly impacting ADTRAN's profitability and operational flexibility.

Threat of Forward Integration by Suppliers

Suppliers to ADTRAN, particularly those providing critical components or technologies, possess the potential to integrate forward into ADTRAN's core business. This means they could start manufacturing and selling their own networking and communications equipment, effectively becoming direct competitors. While the high capital investment and technical expertise required for such a move present significant barriers, it remains a credible long-term threat.

Should a key supplier develop the necessary technological capabilities and establish direct market access to ADTRAN's customer base, such as service providers and enterprises, they could bypass ADTRAN entirely. This would directly impact ADTRAN's market share and revenue streams. For instance, in 2024, the telecommunications equipment market saw continued consolidation and strategic partnerships, highlighting the dynamic nature of supplier relationships and the potential for vertical integration across the value chain.

- Forward Integration Risk: Suppliers could leverage their technological know-how to enter ADTRAN's market, competing directly by offering their own networking solutions.

- Barrier to Entry for Suppliers: The complexity and capital intensity of telecommunications equipment development create a substantial hurdle for suppliers considering forward integration.

- Market Access as a Lever: A supplier with established relationships and distribution channels to ADTRAN's customer base could more easily transition to direct sales.

- Long-Term Strategic Threat: While not an immediate concern for all suppliers, the potential for forward integration represents a strategic risk that ADTRAN must monitor.

Importance of ADTRAN's Volume to Suppliers

ADTRAN's substantial order volumes can significantly influence its bargaining power with suppliers. If ADTRAN accounts for a considerable percentage of a supplier's overall revenue, the supplier is more likely to offer competitive pricing and favorable terms to retain this key customer. For instance, in 2023, ADTRAN reported total revenue of $1.56 billion, indicating a significant purchasing capacity that suppliers would want to secure.

Conversely, if ADTRAN's orders represent a minor portion of a supplier's business, the supplier may have less incentive to concede to ADTRAN's demands. This is particularly true during times of high demand or when supply chains face disruptions, as the supplier might prioritize larger or more strategically important clients. This dynamic can weaken ADTRAN's negotiating position, potentially leading to less favorable pricing or longer lead times.

- Significant Revenue Contribution: Suppliers who rely heavily on ADTRAN's business are more susceptible to ADTRAN's pricing and term negotiations.

- Low Order Volume Impact: If ADTRAN's purchases are a small fraction of a supplier's total sales, the supplier's need to accommodate ADTRAN's requests diminishes.

- 2023 Revenue Context: ADTRAN's $1.56 billion in revenue highlights its potential as a major client for many suppliers in the telecommunications equipment sector.

- Supply Chain Vulnerability: In tight supply environments, suppliers may prioritize clients who offer larger, more consistent order volumes, potentially disadvantaging ADTRAN if its orders are not substantial enough.

ADTRAN's bargaining power with suppliers is influenced by its order volume. A significant portion of a supplier's revenue derived from ADTRAN translates to greater negotiation leverage for ADTRAN. For example, ADTRAN's 2023 revenue of $1.56 billion signifies substantial purchasing power.

Conversely, if ADTRAN represents a small part of a supplier's business, the supplier has less incentive to meet ADTRAN's demands, especially during periods of high demand or supply chain disruptions.

Suppliers who are critical to ADTRAN's product lines, particularly those providing unique or specialized components, hold significant sway. The difficulty in finding suitable alternatives for these essential inputs amplifies their negotiating position, impacting pricing and supply terms.

The substantial costs and complexities involved in switching suppliers, encompassing redesign, re-certification, and manufacturing line reconfiguration, also bolster existing suppliers' bargaining power. These switching costs can easily reach hundreds of thousands of dollars in the telecommunications sector, limiting ADTRAN's flexibility.

| Factor | Impact on ADTRAN's Bargaining Power | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Weakens ADTRAN's Power | Reliance on a few providers for semiconductors and optical modules. |

| Switching Costs | Weakens ADTRAN's Power | High costs for redesign and re-certification can exceed hundreds of thousands of dollars. |

| Order Volume | Strengthens ADTRAN's Power (if significant) | 2023 Revenue: $1.56 billion. |

| Supplier Forward Integration Risk | Potential Threat to ADTRAN | Suppliers could enter ADTRAN's market, though capital and technical barriers exist. |

What is included in the product

This analysis dissects the competitive forces impacting ADTRAN, revealing the intensity of rivalry, buyer power, supplier leverage, threat of new entrants, and the impact of substitutes on its market position.

Instantly visualize competitive intensity and identify areas of strategic vulnerability with ADTRAN's Porter's Five Forces analysis, simplifying complex market dynamics for confident decision-making.

Customers Bargaining Power

ADTRAN serves a diverse clientele, including major telecommunications companies, large enterprises, and government bodies. The concentration of revenue among a few key clients significantly amplifies their bargaining power. For instance, if a handful of these large customers represent a substantial percentage of ADTRAN's total sales, they can leverage this influence to negotiate better pricing or demand tailored product specifications, impacting ADTRAN's profitability.

For customers, particularly major telecom operators, the expense and disruption involved in switching from one networking equipment supplier to another are significant. These high switching costs, encompassing staff retraining, ensuring equipment compatibility, and mitigating the risk of network outages, effectively diminish customer leverage.

In 2024, the telecommunications industry continues to grapple with these entrenched switching costs, a factor that historically benefits established vendors like ADTRAN by locking in existing client relationships. For instance, a major network upgrade could easily run into millions of dollars in new hardware, software integration, and specialized labor.

However, evolving market dynamics, such as the increasing adoption of open-access network architectures and standardized interfaces, are gradually creating pathways to reduce these barriers. This trend, while still developing, has the potential to empower customers by offering greater flexibility and choice in the long term.

In the telecommunications equipment sector, customers exhibit significant price sensitivity, especially when procuring standardized network components. This is particularly true as the demand for high-speed internet and fiber optic infrastructure continues to surge, pushing buyers to seek the most cost-effective solutions available.

This heightened sensitivity compels companies like ADTRAN to engage in competitive pricing strategies, which can directly affect profit margins. For instance, in 2024, the global broadband access market, a key area for ADTRAN, is projected to reach over $100 billion, with intense competition driving price pressures on equipment suppliers.

As the market matures and consolidation trends persist, ADTRAN may face increased pressure to lower prices to maintain market share. This dynamic directly impacts the bargaining power of customers, forcing ADTRAN to balance cost competitiveness with innovation and service quality.

Customer's Ability to Backward Integrate

Some very large telecommunications service providers, or even government entities, possess the substantial technical expertise and financial resources to develop their own networking and communications equipment. This capability, though typically focused on highly specific needs rather than a complete overhaul, represents a potential for backward integration.

While a full-scale internal development of ADTRAN's comprehensive product suite is unlikely for most, the mere possibility of sophisticated customers creating niche solutions can exert pressure. This threat limits ADTRAN's pricing power and ability to dictate terms, as customers could theoretically bring some production in-house if ADTRAN's offerings become too costly or unaligned with their specialized requirements.

- Customer Backward Integration Threat: The potential for large telecom operators to develop proprietary solutions for specific network segments can curb ADTRAN's pricing flexibility.

- Niche Solution Development: While not a complete replacement, customers might build in-house capabilities for highly specialized components or functions.

- Impact on Pricing Power: This threat acts as a ceiling on how much ADTRAN can charge for its products and services.

Availability of Substitute Products/Solutions for Customers

Customers in the networking and communications market, including those considering ADTRAN solutions, benefit from a wide array of substitute products. This means they can easily switch to a competitor if they aren't satisfied with ADTRAN's offerings or pricing. For instance, the increasing availability of competing fiber broadband solutions and advanced Wi-Fi technologies provides readily accessible alternatives.

The sheer volume of choices available significantly bolsters customer bargaining power. With numerous network management platforms and equipment providers in the market, customers can shop around for the best deals and features. This competitive landscape directly translates into leverage for buyers, allowing them to negotiate more favorable terms.

- Broad Availability of Alternatives: Customers can choose from multiple vendors offering similar networking and communication equipment.

- Competitive Fiber Broadband Solutions: The market features numerous companies providing alternative fiber broadband technologies.

- Diverse Wi-Fi and Network Management Platforms: A wide range of Wi-Fi solutions and network management software are available, increasing customer options.

- Enhanced Negotiation Leverage: The abundance of choices empowers customers to negotiate better prices and contract terms.

The bargaining power of ADTRAN's customers is a significant factor, influenced by several key elements. While high switching costs can anchor customers, the increasing availability of substitutes and price sensitivity are notable counterbalances. Furthermore, the potential for large customers to develop niche in-house solutions adds another layer of pressure.

In 2024, the competitive landscape for telecommunications equipment remains dynamic, with customers actively seeking cost-effective solutions. The global broadband access market, a crucial segment for ADTRAN, is projected to exceed $100 billion, highlighting the intense price competition suppliers face. This environment empowers buyers, as they can readily switch to alternative vendors if ADTRAN's pricing or offerings are not sufficiently competitive.

| Factor | Impact on ADTRAN | 2024 Relevance |

|---|---|---|

| Customer Concentration | High leverage for key clients | Significant revenue from major telecom operators |

| Switching Costs | Lowers customer leverage | Millions in costs for network upgrades, retraining |

| Price Sensitivity | Drives competitive pricing | Broadband access market over $100 billion |

| Availability of Substitutes | Increases customer options | Numerous competing fiber broadband and Wi-Fi solutions |

| Potential for Backward Integration | Limits pricing power | Niche in-house development possible for specialized needs |

Preview Before You Purchase

ADTRAN Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The ADTRAN Porter's Five Forces Analysis you see here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications equipment industry. This comprehensive overview is crucial for understanding ADTRAN's strategic positioning and potential growth avenues.

Rivalry Among Competitors

The global networking and communications equipment market is a crowded space, with many companies vying for market share. This includes big names and smaller, specialized firms, all offering solutions for broadband, optical networking, Wi-Fi, and network management. For instance, in 2024, the market is characterized by the presence of giants like Nokia and Ericsson, alongside numerous other providers, creating a highly competitive environment for ADTRAN.

The telecom equipment and broadband access market is booming, fueled by the relentless demand for faster internet, the rollout of fiber optics, and the expansion of 5G. This robust growth, while generally easing competitive pressures, paradoxically intensifies them as it draws significant new investment and prompts established companies to aggressively pursue market share, particularly in high-demand areas like fiber-to-the-home (FTTH) and smart city initiatives.

ADTRAN differentiates itself by offering advanced access and aggregation solutions for fiber broadband, Wi-Fi, and intelligent network management. This focus on cutting-edge technology, such as Wi-Fi 7 and 10G-PON, aims to create a competitive edge. For instance, ADTRAN's investments in R&D are evident in their portfolio of high-performance networking equipment.

However, the telecommunications infrastructure market is characterized by intense competition, with rivals also prioritizing research and development. This continuous innovation cycle means that achieving and maintaining product differentiation can be challenging, as competitors often quickly match new features, leading to a constant pursuit of technological parity.

Exit Barriers for Competitors

ADTRAN operates in a market characterized by high exit barriers. Significant investments in specialized network infrastructure and R&D create substantial fixed assets that are difficult to liquidate or redeploy. This capital intensity means competitors may be reluctant to leave the industry, even when facing financial challenges, to avoid substantial losses on their assets.

Furthermore, long-term contracts with service providers and the need for specialized technical expertise to manage and maintain deployed network solutions create switching costs for customers. This entrenches existing players and makes it costly for competitors to exit gracefully, as they may be bound by ongoing service obligations or face penalties.

The telecommunications equipment sector, where ADTRAN is positioned, has seen consolidation, but the remaining players often face these structural impediments to exiting. For instance, in 2023, the global telecommunications market experienced ongoing investments in 5G and fiber infrastructure, making it challenging for companies with legacy assets to divest without significant write-downs.

- High Capital Investment: Companies in the telecommunications infrastructure space often have substantial investments in manufacturing facilities and specialized equipment, making exit costly.

- Specialized Workforce: The industry relies on highly skilled engineers and technicians, whose expertise is often specific to the technology deployed, limiting their redeployment options outside the sector.

- Long-Term Customer Commitments: Service agreements and the integration of ADTRAN's solutions into customer networks create sticky relationships, increasing the cost and complexity of exiting for competitors.

- Brand Reputation and Relationships: Established relationships and brand loyalty within the telecommunications industry can be difficult to divest or transfer, further trapping companies in the market.

Intensity of Price Competition

The networking and communications equipment market, particularly in mature segments, experiences intense price competition due to a crowded vendor landscape. This often forces companies like ADTRAN to engage in aggressive pricing to secure market share.

Customers in this sector are frequently price-sensitive, and the availability of numerous alternative suppliers amplifies this pressure. Consequently, ADTRAN must navigate a challenging environment where competitive pricing can significantly impact its profitability, demanding continuous efforts in cost management and operational efficiency.

- Price Pressure: In 2023, the global telecommunications equipment market saw intense price competition, with key players frequently adjusting pricing strategies to capture market share, especially in mature product categories.

- Margin Compression: For companies like ADTRAN, this aggressive pricing environment can lead to thinner profit margins, making efficient supply chain management and cost reduction critical for sustained profitability.

- Customer Leverage: The presence of multiple vendors gives customers considerable leverage, allowing them to negotiate favorable terms and further intensifying the need for competitive pricing from ADTRAN.

Competitive rivalry is a significant force for ADTRAN, driven by a crowded market with numerous players offering similar solutions. This intense competition, particularly in areas like fiber broadband and Wi-Fi, forces companies to constantly innovate and compete on price. For instance, in 2024, the market features major global vendors alongside specialized regional providers, all vying for contracts with telecommunication service providers.

The drive for market share in the booming telecom infrastructure sector means that even with market growth, companies like ADTRAN face pressure to differentiate through technology and aggressive pricing. This is evident as many competitors invest heavily in R&D to offer next-generation technologies, such as advanced Wi-Fi standards and higher-speed PON solutions, mirroring ADTRAN's own strategic focus.

The telecommunications equipment market is characterized by high capital investment and specialized workforces, creating high exit barriers that keep competitors entrenched. This means that even during economic downturns, companies are less likely to exit, maintaining a high level of rivalry. For example, in 2023, significant ongoing investments in 5G and fiber infrastructure by major players underscored the difficulty of divesting assets without substantial losses.

| Metric | 2023 Data (Approximate) | Implication for Rivalry |

|---|---|---|

| Global Telecom Equipment Market Size | ~$100-120 Billion | Large market attracts many competitors. |

| R&D Spending as % of Revenue (Industry Average) | 10-15% | High R&D fuels rapid innovation and competitive feature parity. |

| Customer Switching Costs | High (due to integration and long-term contracts) | Entrenches existing players, but also makes new entrants' market penetration difficult. |

SSubstitutes Threaten

While fiber broadband remains a leading solution for high-speed internet, alternative technologies are increasingly viable substitutes. Fixed Wireless Access (FWA), satellite internet, and advanced cellular networks like 5G-Advanced can fulfill connectivity needs in specific markets or for particular use cases, presenting a competitive challenge to ADTRAN's fiber-focused offerings.

The growth of these alternatives, driven by innovation and the need for broader accessibility, directly impacts the demand for ADTRAN's traditional fiber infrastructure. For instance, by the end of 2024, global 5G subscriptions were projected to surpass 1.5 billion, indicating a significant shift in how consumers and businesses access connectivity, potentially diverting some market share from fixed-line solutions.

Customers may choose more generic networking solutions if they offer adequate performance at a lower price point, bypassing ADTRAN's specialized access and aggregation equipment. This preference for "good enough" over "best-in-class" can reduce demand for ADTRAN's unique products. For instance, in 2024, the market for basic broadband access solutions saw significant growth driven by cost-conscious consumers and smaller businesses, potentially diverting some demand from higher-end, specialized offerings.

Customer willingness to switch to substitutes for ADTRAN's networking and communication solutions is a key factor in the threat of substitutes. This willingness is often driven by the ease with which a customer can adopt an alternative, the cost savings it provides, and any perceived performance improvements or enhanced reliability. For instance, the increasing maturity and accessibility of cloud-based networking solutions or open-source alternatives can make it easier for customers to consider switching from traditional hardware-centric approaches. In 2024, many businesses are actively evaluating Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) as potential substitutes, seeking greater agility and reduced capital expenditure.

Technological Advancements in Substitution Pathways

Technological advancements are a significant threat to ADTRAN. Innovations such as AI-driven network management and software-defined networking (SDN) are creating new ways to deliver network services. These technologies can potentially bypass or reduce the reliance on ADTRAN's traditional hardware-based solutions, offering alternative pathways for network infrastructure.

The rise of Network-as-a-Service (NaaS) models further intensifies this threat. Companies can increasingly procure network capabilities as a service, rather than investing in and managing their own physical infrastructure. This shift directly challenges the market for ADTRAN's physical network equipment.

For example, the global NaaS market was valued at approximately $15.9 billion in 2023 and is projected to grow substantially, indicating a strong market appetite for service-based network solutions. This growth highlights the increasing viability of substitutes that offer flexibility and reduced capital expenditure compared to traditional hardware purchases.

- AI-driven network management offers automated optimization and fault resolution, reducing the need for manual intervention and potentially specialized hardware.

- Software-defined networking (SDN) decouples network control from physical hardware, allowing for more agile and programmable network configurations, which can be managed by less specialized or virtualized components.

- Network-as-a-Service (NaaS) provides network functionality on a subscription basis, directly competing with the sale of network hardware and associated services.

- The projected growth of the NaaS market underscores the increasing adoption of these alternative, service-oriented solutions.

Price-Performance Trade-off of Substitutes

The attractiveness of substitutes for ADTRAN's networking solutions is heavily influenced by their price-performance trade-off. If competitors offer comparable or adequate performance at a lower price point, the threat of substitution intensifies. For instance, in the broadband access market, while ADTRAN offers advanced fiber solutions, lower-cost DSL or fixed wireless access technologies might serve as viable substitutes for less demanding applications, presenting a clear price advantage.

Conversely, if alternative solutions can deliver superior performance for a similar cost, ADTRAN faces increased pressure. This dynamic compels ADTRAN to continuously invest in research and development to enhance its product performance and optimize its cost structure. As of early 2024, the global telecommunications equipment market is experiencing significant investment in next-generation technologies, with companies like Nokia and Ericsson also vying for market share by offering competitive price-performance ratios in areas like 5G infrastructure, a sector where ADTRAN also competes.

- Price Sensitivity: Customers will switch to substitutes if the cost savings outweigh any perceived performance degradation.

- Performance Benchmarks: Substitutes offering comparable or superior performance at a lower price point pose a significant threat.

- Technological Advancements: Rapid innovation in substitute technologies can quickly alter the price-performance landscape.

- Market Dynamics: Competitor pricing strategies and the overall economic climate directly impact the appeal of substitutes.

The threat of substitutes for ADTRAN's offerings is significant, as alternative technologies can fulfill similar connectivity needs. Fixed Wireless Access (FWA), satellite internet, and advanced cellular networks like 5G-Advanced are increasingly viable, especially for specific markets or use cases. These alternatives present a competitive challenge to ADTRAN's fiber-centric solutions by offering different approaches to delivering high-speed internet.

Customer willingness to adopt these substitutes is driven by factors like cost savings, ease of adoption, and perceived performance improvements. For instance, the growing accessibility of cloud-based networking and open-source alternatives makes switching easier. By 2024, many businesses were exploring Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) for greater agility and reduced capital expenditure, directly impacting demand for traditional hardware.

The price-performance trade-off is crucial; if substitutes offer comparable performance at a lower cost, the threat intensifies. While ADTRAN excels in advanced fiber, lower-cost DSL or fixed wireless can be adequate for less demanding applications. As of early 2024, significant investments are being made in next-generation technologies, with competitors like Nokia and Ericsson offering competitive price-performance ratios in areas like 5G infrastructure, a key market for ADTRAN.

| Substitute Technology | Key Advantage | Potential Impact on ADTRAN | 2024 Market Trend |

|---|---|---|---|

| Fixed Wireless Access (FWA) | Deployment speed, lower initial infrastructure cost | Captures market share in areas where fiber deployment is costly or slow | Continued growth, particularly in underserved rural and suburban areas |

| Satellite Internet | Global coverage, accessibility in remote locations | Serves niche markets where terrestrial broadband is unavailable | Advancements in LEO satellite constellations improving speeds and latency |

| 5G-Advanced Cellular | Mobility, high bandwidth for mobile devices | Offers a wireless alternative for home and business connectivity, potentially reducing reliance on fixed lines | Projected over 1.5 billion global 5G subscriptions by end of 2024 |

| Network-as-a-Service (NaaS) | Flexibility, reduced CapEx, operational efficiency | Challenges the sale of traditional network hardware by offering capabilities as a service | Global NaaS market valued around $15.9 billion in 2023, with strong projected growth |

Entrants Threaten

Entering the networking and communications equipment industry, where ADTRAN operates, demands significant upfront capital. Companies need to invest heavily in cutting-edge research and development to stay competitive, build state-of-the-art manufacturing facilities, and establish robust global distribution networks. For instance, major players in the semiconductor and networking hardware sectors often report R&D expenditures in the billions annually.

These substantial financial barriers make it exceedingly difficult for new companies to gain a foothold. The sheer scale of investment required for innovation, production, and market penetration acts as a powerful deterrent, effectively shielding established firms like ADTRAN from immediate, disruptive competition. This high barrier to entry is a critical factor that helps maintain the existing market structure.

Existing players in the telecommunications equipment market, including ADTRAN, benefit significantly from established economies of scale. These advantages are evident in their ability to negotiate lower prices for raw materials through bulk purchasing and spread substantial research and development costs across a larger production volume. For example, in 2023, the global telecommunications equipment market was valued at approximately $197.1 billion, with major players leveraging their size to drive down per-unit costs.

These cost efficiencies create a formidable barrier for new entrants. Without the established infrastructure and high production volumes that ADTRAN and its peers possess, newcomers would face considerably higher per-unit production costs. This makes it challenging for them to compete on price, as they cannot immediately match the cost-effectiveness achieved through years of operational experience and market presence.

ADTRAN's strong portfolio of proprietary technology and patents in areas like fiber broadband and network management creates a significant hurdle for potential new entrants. This intellectual property, including numerous patents, requires substantial investment in research and development for any competitor aiming to match ADTRAN's capabilities. For instance, in 2024, companies entering this space would need to navigate a landscape where ADTRAN has already established advanced solutions, making it difficult to compete on technological parity without considerable upfront capital or strategic partnerships.

Access to Distribution Channels and Customer Relationships

New entrants into the telecommunications networking sector face substantial hurdles in accessing established distribution channels and forging critical customer relationships. Companies like ADTRAN have spent years building trust and deep partnerships with major telecommunications service providers, large enterprises, and government entities. These incumbent relationships represent significant barriers, making it difficult for newcomers to secure the necessary agreements and market penetration.

Gaining entry into these key markets requires overcoming the loyalty and established trust that companies like ADTRAN have earned. For instance, securing contracts with major carriers often involves lengthy qualification processes and proven track records of reliability and support, which new players typically lack. This makes it challenging for them to even get their products in front of the decision-makers who control these vital distribution networks.

- Incumbent Advantage: ADTRAN's long-standing relationships with Tier 1 and Tier 2 service providers are a significant moat, as switching costs and the need for proven reliability are high.

- Channel Access Difficulty: New entrants struggle to secure shelf space or preferred vendor status with these major customers, often needing to offer significantly lower prices or unique value propositions to even be considered.

- Customer Trust Premium: The trust built over years of service delivery and support by established players like ADTRAN is not easily replicated, requiring substantial investment and time for new entrants to develop.

Regulatory and Compliance Hurdles

The telecom equipment sector faces significant regulatory and compliance challenges. Navigating complex standards, certifications, and interoperability requirements can be a substantial barrier for newcomers. For instance, adherence to stringent security protocols and evolving government mandates, such as those related to network resilience and data privacy, demands considerable investment in expertise and infrastructure.

These regulatory landscapes, which are constantly being updated, mean that new entrants must allocate substantial resources to ensure compliance. In 2024, the ongoing discussions around network security and the potential for government-imposed restrictions on certain technologies further amplify these barriers. Companies that cannot demonstrate immediate and ongoing compliance with these evolving rules find it exceptionally difficult to gain market traction.

- Complex Standards: Telecom equipment must meet a myriad of technical and safety standards.

- Certification Costs: Obtaining necessary certifications can be time-consuming and expensive.

- Evolving Regulations: Frequent updates to regulations require continuous adaptation and investment.

- Security Mandates: Increasing focus on cybersecurity adds another layer of compliance complexity.

The threat of new entrants in the telecommunications equipment market, where ADTRAN competes, is generally low due to several significant barriers. These include high capital requirements for R&D and manufacturing, strong economies of scale enjoyed by incumbents, and substantial intellectual property protection. Furthermore, established customer relationships and complex regulatory environments create additional hurdles for newcomers.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Deters new companies due to substantial upfront investment needs. |

| Economies of Scale | Lower per-unit costs for established players through bulk purchasing and high production volumes. | Makes it difficult for new entrants to compete on price. |

| Intellectual Property | Proprietary technology and patents held by incumbents like ADTRAN. | Requires significant R&D investment for competitors to match capabilities. |

| Customer Relationships & Distribution | Established trust and long-term contracts with service providers. | New entrants struggle to gain access to key markets and customer bases. |

| Regulatory & Compliance | Complex standards, certifications, and evolving government mandates. | Demands significant investment in expertise and infrastructure for compliance. |

Porter's Five Forces Analysis Data Sources

Our ADTRAN Porter's Five Forces analysis is built upon a robust foundation of data, drawing from ADTRAN's annual reports, investor presentations, and publicly available financial statements. We supplement this with insights from industry analyst reports, market research databases, and competitor filings to provide a comprehensive view of the competitive landscape.