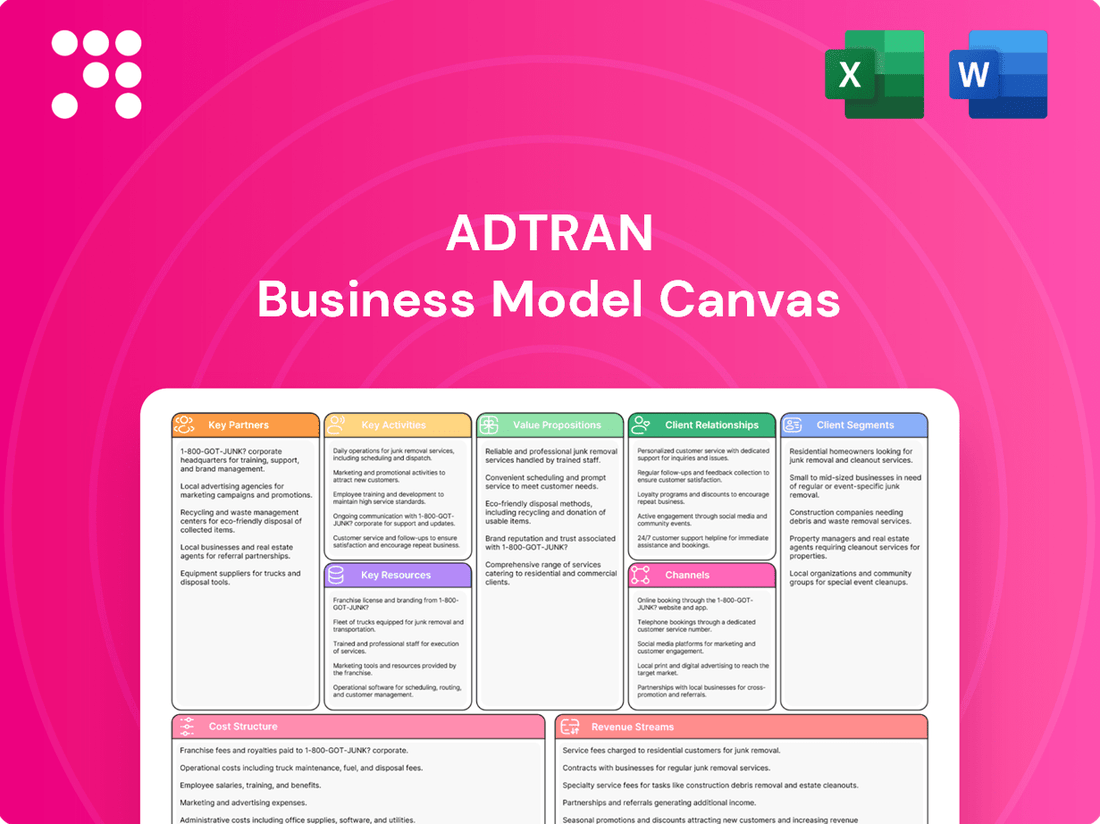

ADTRAN Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADTRAN Bundle

Unlock the full strategic blueprint behind ADTRAN's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ADTRAN actively partners with technology providers to ensure its networking solutions integrate smoothly with wider technology ecosystems. This collaboration is key to achieving interoperability and boosting overall functionality for customers. For instance, ADTRAN's work with open optical transport technology and edge computing platforms exemplifies this commitment to a connected infrastructure.

Strategic alliances with major telecommunications service providers globally are fundamental for ADTRAN. These partners are primary customers and often co-develop or adopt new access and aggregation technologies, like ADTRAN's 10G PON solutions which are critical for enabling multi-gigabit broadband speeds. These relationships directly facilitate the deployment of high-speed internet, voice, and video services to end-users.

ADTRAN powers a significant portion of networks for large operators, indicating the depth of these partnerships. For instance, in 2024, ADTRAN announced expanded deployments with several Tier 1 operators across North America and Europe, underscoring the ongoing demand for their advanced network solutions and the crucial role these telcos play in ADTRAN's market penetration.

ADTRAN relies on a robust network of channel partners and distributors to expand its global footprint, especially in emerging markets like the Asia-Pacific region. These partners are crucial for delivering tailored sales, deployment, and ongoing support services, ensuring customers receive localized expertise.

The company actively cultivates these relationships through initiatives like its enhanced 2025 APAC partner program. This program provides valuable resources, including a dedicated business development fund and an online partner portal, designed to strengthen collaboration and drive mutual growth.

These strategic alliances are fundamental to ADTRAN's ability to successfully design, implement, and maintain the connectivity solutions that are essential for building communities and fostering economic development worldwide.

Government and Public Sector Collaborations

ADTRAN actively pursues partnerships with government entities and public sector organizations to drive critical infrastructure development. These collaborations are crucial for expanding broadband access, particularly in underserved rural areas, by leveraging programs like U.S. federal grants. Such initiatives often involve the deployment of advanced fiber-to-the-home (FTTH) technologies and support smart city projects, directly contributing to national digital transformation goals.

These strategic alliances allow ADTRAN to participate in significant national projects, such as the ongoing efforts to bridge the digital divide. For instance, the company's involvement with eCommunity™ Fiber in Georgia exemplifies its commitment to these public-private partnerships. These collaborations are vital for ADTRAN's mission to connect communities and foster economic growth through enhanced digital capabilities.

- Rural Broadband Expansion: ADTRAN partners with government bodies to access funding and implement projects aimed at bringing high-speed internet to rural regions, a key focus in 2024.

- Smart City Initiatives: Collaborations extend to smart city development, where ADTRAN's technology supports urban modernization and digital services.

- Infrastructure Investment: These partnerships facilitate the deployment of ADTRAN's fiber optic solutions, contributing to the upgrade of essential communication infrastructure nationwide.

- Government Funding Access: By engaging with public sector entities, ADTRAN can secure grants and participate in government-backed programs that accelerate broadband deployment.

Research and Development Collaborators

ADTRAN actively collaborates with leading research institutions and industry consortia to pioneer advancements in network technology. These partnerships are crucial for staying ahead of the curve, particularly in developing solutions for AI-driven network demands, 50G PON, and sophisticated timing systems. By engaging with these groups, ADTRAN ensures its product roadmap is aligned with future market requirements and maintains a competitive edge.

These strategic alliances allow ADTRAN to leverage external expertise and share the costs and risks associated with cutting-edge research. For instance, collaborations in areas like advanced optical networking contribute to the development of next-generation broadband access technologies. This focus on differentiating innovation is central to ADTRAN's strategy for sustained growth and market leadership.

- Focus on AI-driven network demands: ADTRAN partners to develop solutions that intelligently manage and optimize network traffic, anticipating the massive data needs of AI applications.

- Advancements in 50G PON: Collaborations are key to pushing the boundaries of Passive Optical Network technology, aiming for significantly higher speeds and lower latency.

- Development of advanced timing solutions: Partnerships are instrumental in creating precise timing mechanisms essential for 5G and future network synchronization requirements.

- Industry consortia participation: ADTRAN's involvement in groups like the Open Networking Foundation helps shape industry standards and accelerate the adoption of new technologies.

ADTRAN's key partnerships are vital for market reach and technological advancement. Collaborations with global telecommunications service providers are paramount, acting as both major customers and co-developers of new access technologies. These relationships are critical for deploying high-speed broadband, with ADTRAN announcing expanded deployments with several Tier 1 operators in North America and Europe during 2024, highlighting the sustained demand for their advanced network solutions.

Furthermore, ADTRAN leverages a broad network of channel partners and distributors to extend its global presence, particularly in emerging markets. These partners provide essential localized sales, deployment, and support services, a strategy reinforced by initiatives like their enhanced 2025 APAC partner program, which includes dedicated funding and resources to foster collaboration.

Strategic alliances with technology providers ensure seamless integration of ADTRAN's networking solutions into broader technology ecosystems, enhancing interoperability and customer functionality. Partnerships with government entities and public sector organizations are also crucial for driving critical infrastructure development, such as expanding broadband access in rural areas through programs leveraging U.S. federal grants.

Finally, collaborations with research institutions and industry consortia are key to pioneering advancements in network technology, focusing on areas like AI-driven network demands and 50G PON. These partnerships help ADTRAN align its product roadmap with future market needs and share the risks associated with cutting-edge research.

What is included in the product

A detailed ADTRAN Business Model Canvas outlining their strategy for providing network solutions, covering key partnerships and revenue streams.

This model highlights ADTRAN's focus on network infrastructure and services, detailing their customer relationships and cost structure.

ADTRAN's Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot of their entire business, enabling quick identification of core components and potential inefficiencies.

This clear and concise layout, perfect for brainstorming and internal use, allows ADTRAN to easily adapt their strategy and share insights, saving valuable time in aligning teams and developing new solutions.

Activities

ADTRAN's commitment to Research and Development is a cornerstone of its strategy, driving innovation in fiber broadband, Wi-Fi, optical transport, and intelligent network management. This focus ensures their solutions meet the escalating demand for high-speed connectivity. For instance, in 2023, ADTRAN reported significant investment in R&D, with expenditures aimed at developing next-generation technologies.

Key R&D initiatives are centered on advancements like 50G PON technology and solutions tailored for AI-driven network requirements. These efforts are crucial for maintaining a competitive edge and addressing the future needs of telecommunications infrastructure. The company's ongoing development in these areas underscores its dedication to providing cutting-edge networking capabilities.

ADTRAN's core activities revolve around the intricate design, meticulous engineering, and robust manufacturing of a wide array of networking and communications equipment. This encompasses both the physical hardware and the essential software solutions that power modern telecommunications infrastructure, covering areas like access and aggregation, optical networking, and subscriber-facing devices.

The company's commitment to excellence is reflected in its efficient manufacturing processes and a strategically managed, globally distributed supply chain. These elements are paramount to ensuring the consistent delivery of high-quality products to its diverse international clientele, a critical factor in maintaining its competitive edge in the rapidly evolving telecommunications market.

ADTRAN's sales and marketing efforts are crucial for connecting with its diverse customer base, which includes telecom companies, businesses, and government entities. In 2024, the company continued to leverage a multi-pronged approach, combining direct sales teams with robust channel partner networks to ensure broad market reach.

The company actively participates in key industry trade shows and conferences, a strategy that proved effective in showcasing its latest advancements in network infrastructure and cloud-managed Wi-Fi solutions throughout 2024. Digital marketing campaigns, including targeted online advertising and content creation, also played a significant role in generating leads and building brand awareness.

ADTRAN's marketing communications in 2024 emphasized its ability to deliver high-performance, scalable, and secure networking solutions. This focus aimed to clearly articulate the value proposition of its products, such as enhanced broadband speeds and simplified network management, to a global audience and drive customer acquisition.

Network Deployment and Integration

A core activity for ADTRAN is guiding customers through the deployment and integration of their sophisticated networking technologies. This involves providing expert professional services and robust technical support to ensure ADTRAN's solutions work harmoniously within a customer's existing or new network environments.

This integration is crucial for delivering high-speed internet, voice, and video services reliably. ADTRAN's commitment to open and disaggregated network architectures means this deployment phase requires meticulous planning and execution to achieve seamless operation.

In 2024, ADTRAN continued to emphasize these services, recognizing that successful integration is key to customer adoption and satisfaction. For instance, their work with Tier 1 service providers often involves complex multi-vendor environments, highlighting the need for specialized integration expertise.

- Deployment Assistance: Helping customers install and configure ADTRAN's hardware and software.

- Integration Services: Ensuring ADTRAN solutions connect smoothly with existing network infrastructure.

- Technical Support: Providing ongoing troubleshooting and maintenance for deployed systems.

- Service Enablement: Facilitating the delivery of high-speed broadband, voice, and video services through integrated networks.

Customer Support and Services

ADTRAN's commitment to customer support and services is a cornerstone of its business model, directly impacting customer retention and satisfaction. This involves offering robust technical assistance, proactive maintenance, and specialized professional services designed to optimize network performance and ensure seamless operation for their clients.

These services are critical for fostering long-term partnerships. By providing ongoing support, ADTRAN helps customers effectively manage and scale their telecommunications infrastructure, a vital aspect in today's rapidly evolving digital landscape. For instance, in 2024, ADTRAN reported a significant portion of its revenue derived from recurring service and support agreements, underscoring the value customers place on this continuous engagement. This focus on service excellence directly contributes to customer loyalty and reduces churn.

- Technical Assistance: Providing prompt and expert help for troubleshooting and issue resolution.

- Network Optimization: Offering services to enhance network efficiency, speed, and reliability.

- Managed Services: Delivering outsourced management of network operations for greater control and reduced complexity.

- Customer Success: Ensuring clients maximize the value of ADTRAN solutions through ongoing guidance and support.

ADTRAN's key activities are centered on the design, engineering, and manufacturing of networking equipment, coupled with extensive research and development to drive innovation in areas like 50G PON. Their sales and marketing efforts focus on reaching telecom companies, businesses, and government entities through direct sales and channel partners, emphasizing high-performance solutions. Furthermore, ADTRAN provides crucial deployment assistance, integration services, and technical support to ensure seamless operation and customer satisfaction, with a significant portion of their 2024 revenue stemming from these recurring service agreements.

Preview Before You Purchase

Business Model Canvas

The ADTRAN Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring you know exactly what you are getting. You can confidently assess its suitability and begin planning your strategic initiatives with this authentic snapshot.

Resources

ADTRAN's intellectual property is a cornerstone of its business, encompassing a robust portfolio of patents, proprietary software, and advanced designs. This technological foundation is particularly strong in fiber broadband, Wi-Fi, and optical networking solutions, enabling the company to offer cutting-edge products.

Key elements of this portfolio include the SDX Series of network solutions, the Mosaic cloud-native network automation platform, and Oscilloquartz precision timing technology. These innovations are vital for ADTRAN's competitive positioning and its ability to deliver high-performance networking infrastructure.

The company's commitment to research and development, which saw R&D expenses of $105.5 million in 2023, directly fuels the expansion and enhancement of this intellectual property. This ongoing investment ensures ADTRAN remains at the forefront of technological advancement in its target markets.

ADTRAN's highly skilled workforce, including engineers, researchers, sales, and support staff, is a cornerstone of its operations. Their deep knowledge in networking, communications, and software development is essential for creating, building, and maintaining ADTRAN's sophisticated solutions. For instance, as of early 2024, ADTRAN emphasized its commitment to talent development, with a significant portion of its workforce holding advanced degrees in relevant technical fields, underscoring the importance of expertise.

The company's ability to attract and keep top-tier talent directly fuels its innovation pipeline and ensures smooth, efficient operations. In 2023, ADTRAN reported a strong focus on employee retention programs, recognizing that retaining this specialized expertise is critical for staying ahead in the competitive telecommunications sector and for delivering consistent quality to customers.

ADTRAN leverages a sophisticated global supply chain and manufacturing network to ensure efficient production and timely delivery of its networking solutions. This diverse network allows them to source critical components from various regions, mitigating risks associated with single-source dependencies and geopolitical instability. For instance, in 2024, ADTRAN continued to optimize its manufacturing footprint, balancing in-house capabilities with strategic partnerships to maintain operational flexibility and cost-effectiveness.

Their manufacturing capabilities are designed to scale with market demand, enabling them to respond swiftly to the evolving needs of telecommunications providers and enterprises worldwide. This agility is crucial in the fast-paced technology sector, where rapid deployment of new network infrastructure is paramount. ADTRAN's commitment to quality control across its global manufacturing sites ensures that its products meet rigorous industry standards, supporting reliable network performance for its customers.

Financial Capital and Assets

ADTRAN's financial capital and assets are crucial for its operations and growth. This includes maintaining healthy cash reserves and ensuring access to capital markets. These resources are vital for funding innovation, expanding manufacturing capabilities, pursuing strategic acquisitions, and supporting day-to-day business needs.

As of the first quarter of 2025, ADTRAN reported $101.3 million in cash reserves. This liquidity provides a strong foundation for operational resilience and enables the company to pursue growth opportunities effectively. Sound financial management, including careful attention to the debt-to-equity ratio, underpins the company's stability and capacity for future investment.

- Cash Reserves: $101.3 million reported in Q1 2025, supporting operational stability and investment.

- Access to Capital: Essential for funding R&D, manufacturing, and strategic initiatives.

- Financial Management: Focus on liquidity and managing the debt-to-equity ratio to ensure financial health.

Brand Reputation and Customer Base

ADTRAN's strong brand reputation as a key player in networking and communications equipment is a cornerstone of its business model. This established trust, cultivated over years of providing dependable and forward-thinking solutions, serves as a powerful magnet for new clientele. For instance, in fiscal year 2023, ADTRAN reported net sales of $1.3 billion, underscoring the market's continued reliance on their offerings.

This reputation directly translates into a loyal and diverse customer base. ADTRAN consistently serves major telecommunications providers, large enterprises, and various government entities, demonstrating the broad applicability and trusted nature of its products. The company's ability to retain and grow these relationships highlights the value placed on its brand equity.

- Brand Recognition: ADTRAN is recognized globally for its reliability and innovation in networking solutions.

- Customer Loyalty: Years of dependable service have fostered strong loyalty among its existing customer segments.

- Diverse Clientele: The company serves a wide array of customers, including telcos, enterprises, and government bodies.

- Market Trust: ADTRAN's established reputation builds significant trust, attracting new customers and reinforcing existing partnerships.

ADTRAN's intellectual property, including patents and software, underpins its leadership in fiber broadband and optical networking. Key innovations like the SDX Series and Mosaic platform are crucial for its competitive edge, supported by $105.5 million in R&D spending in 2023.

Its skilled workforce, with many holding advanced degrees, drives innovation and operational efficiency. The company's global supply chain and manufacturing network ensure scalability and quality, with ongoing optimization in 2024.

ADTRAN's financial strength, evidenced by $101.3 million in cash reserves as of Q1 2025, supports its growth initiatives. A strong brand reputation built on reliability and innovation attracts and retains a diverse customer base, including major telecommunications providers.

Value Propositions

ADTRAN's value proposition centers on delivering high-speed and reliable connectivity, essential for modern communication. They provide the foundational infrastructure enabling seamless internet, voice, and video services for both consumers and businesses.

Through advanced fiber broadband and Wi-Fi solutions, ADTRAN empowers networks to handle multi-gigabit speeds and anticipates future bandwidth demands. Their 50G PON technology exemplifies this forward-thinking approach, ensuring networks are future-ready.

In 2024, the demand for faster and more dependable internet continued to surge, with ADTRAN's solutions directly addressing this critical market need. Their commitment to innovation in connectivity underpins the reliability and speed users expect.

ADTRAN's value proposition centers on providing service providers with innovative access and aggregation solutions, such as fiber-to-the-home (FTTH) and sophisticated Wi-Fi technologies. These offerings are designed to streamline network expansion and the delivery of advanced services.

By focusing on rapid deployment and simplified management of intricate network architectures, ADTRAN enables its clients to bring next-generation connectivity to market more effectively. This is crucial as demand for high-speed internet continues to surge, with global fiber broadband subscriptions projected to reach over 1 billion by 2025.

ADTRAN's value proposition centers on providing open, disaggregated networking platforms. This means customers aren't tied to a single vendor's proprietary ecosystem, offering significant flexibility and choice in building and managing their networks.

This disaggregated approach empowers service providers to scale services efficiently across diverse network infrastructures, reducing reliance on high-risk vendors. For instance, in 2024, the demand for open networking solutions accelerated as companies sought to diversify their supply chains and avoid vendor lock-in, a trend ADTRAN actively supports.

By promoting interoperability between different network components, ADTRAN's platforms enable seamless integration and innovation. This strategy directly addresses a key concern for many telecommunications companies looking to optimize operational costs and enhance agility in a rapidly evolving market.

Intelligent Network Management and Automation

ADTRAN's intelligent network management and automation capabilities, exemplified by its Mosaic One cloud software, empower customers to streamline operations and boost service agility. This focus on simplification and efficiency is crucial for managing increasingly complex networks, especially with the rise of AI-driven demands.

These solutions provide enhanced control and optimization, directly contributing to improved operational efficiency and customer retention. For instance, by automating routine tasks and providing deeper network insights, ADTRAN helps service providers reduce operational expenses and improve the end-user experience, a key differentiator in today's competitive landscape.

- Simplified Operations: Mosaic One offers a unified platform to manage diverse network elements, reducing complexity and manual intervention.

- Enhanced Service Agility: Automation features allow for faster deployment of new services and quicker response to network issues, improving time-to-market.

- Improved Efficiency: By optimizing resource utilization and automating troubleshooting, ADTRAN's solutions drive down operational costs.

- AI-Ready Networks: The platform is designed to support the dynamic demands of AI applications, ensuring network performance and reliability.

Future-Proofing Network Investments

ADTRAN's value proposition centers on future-proofing network investments for telcos, enterprises, and governments. Their solutions are engineered to support emerging technologies like 5G and AI, ensuring readiness for future data demands. For instance, in 2024, the global 5G infrastructure market was projected to reach over $100 billion, highlighting the critical need for adaptable network solutions.

By focusing on next-generation broadband and advanced optical transport, ADTRAN enables organizations to maximize the return on their existing infrastructure. This forward-looking approach ensures networks can handle escalating data traffic and new service requirements efficiently.

- Next-Generation Broadband: Enabling higher speeds and greater capacity for future services.

- Advanced Optical Transport: Providing scalable and efficient data transmission.

- 5G and AI Readiness: Designing solutions that support the infrastructure needs of these transformative technologies.

- Maximized ROI: Helping customers leverage existing investments while preparing for future growth.

ADTRAN provides service providers with advanced access and aggregation solutions, including fiber-to-the-home and sophisticated Wi-Fi, to simplify network expansion and service delivery. Their focus on rapid deployment and simplified management of complex networks helps clients bring next-generation connectivity to market faster, a critical factor as global fiber broadband subscriptions are expected to exceed 1 billion by 2025.

Customer Relationships

ADTRAN fosters deep customer connections through dedicated sales and account management. These teams engage directly with major telecommunications companies, businesses, and government entities, acting as strategic partners. This consultative approach ensures solutions are precisely aligned with unique client requirements, building lasting alliances.

ADTRAN provides robust technical support and professional services, covering network planning, deployment, integration, and optimization. This comprehensive offering is crucial for customers to effectively utilize ADTRAN's sophisticated networking solutions. For instance, in 2023, ADTRAN reported a significant portion of its revenue derived from services, underscoring the value customers place on this support for their operational continuity and success.

ADTRAN cultivates deep connections with its channel partners through dedicated programs, providing essential resources, comprehensive training, and avenues for joint collaboration. This strategic focus on a partner-first ecosystem is designed to drive shared success and expand ADTRAN's market presence.

The company's commitment to nurturing these relationships is evident in initiatives like the 2025 APAC partner program, which aims to further solidify collaborative efforts and mutual growth within the region.

Direct Feedback Mechanisms

ADTRAN actively solicits and integrates customer feedback to enhance its product and service offerings, ensuring alignment with shifting market requirements. This direct interaction is crucial for pinpointing emerging needs and refining current solutions, cultivating a collaborative and responsive relationship.

This ongoing dialogue directly fuels ADTRAN's product development and innovation pipeline. For instance, in 2024, ADTRAN reported a significant increase in customer-initiated feature requests, which directly informed the roadmap for their next-generation network solutions.

- Customer Input Drives Innovation: Feedback mechanisms allow ADTRAN to identify and prioritize customer-driven enhancements.

- Market Responsiveness: Direct engagement ensures ADTRAN's solutions remain relevant and competitive in a dynamic telecom landscape.

- Partnership Building: Continuous dialogue fosters stronger relationships and a shared vision for technological advancement.

Community and Industry Engagement

ADTRAN actively cultivates its community and industry presence through consistent participation in key events. For instance, their involvement in significant gatherings like ANGA COM and OFC allows them to directly engage with a wide array of stakeholders, from potential customers to technology partners.

This strategic engagement is crucial for ADTRAN to not only showcase its technological advancements and thought leadership but also to gain invaluable insights into evolving market dynamics. By being present at these forums, they foster new relationships and solidify their reputation as an innovator within the telecommunications sector.

- Industry Event Participation: ADTRAN regularly attends and exhibits at major industry conferences such as ANGA COM and OFC, demonstrating their commitment to industry dialogue and showcasing their latest solutions.

- Standards Body Involvement: Active participation in standards bodies ensures ADTRAN remains at the forefront of technological development and interoperability, contributing to the broader industry ecosystem.

- Market Trend Insights: Engagement at these events provides ADTRAN with direct feedback and exposure to emerging trends, enabling them to adapt their strategies and product development accordingly.

- Relationship Building: These platforms are vital for forging new connections and strengthening existing partnerships, reinforcing ADTRAN's position as a key player in the global telecommunications market.

ADTRAN's customer relationships are built on a foundation of direct engagement, comprehensive support, and collaborative feedback. Their dedicated sales and account management teams work closely with clients, acting as strategic partners to align solutions with specific needs. This consultative approach, coupled with robust technical support and professional services, ensures customers can effectively leverage ADTRAN's advanced networking technology, as evidenced by the significant revenue generated from services in 2023.

| Relationship Aspect | Description | Impact/Example |

|---|---|---|

| Direct Sales & Account Management | Consultative engagement with major clients. | Ensures solutions match unique client requirements, fostering lasting alliances. |

| Technical Support & Professional Services | Comprehensive network planning, deployment, and optimization. | Crucial for customer operational continuity; services contributed significantly to 2023 revenue. |

| Channel Partner Programs | Dedicated resources, training, and collaboration avenues. | Drives shared success and expands market reach; 2025 APAC partner program exemplifies this focus. |

| Customer Feedback Integration | Soliciting and incorporating feedback into product development. | 2024 saw increased customer-initiated feature requests, directly influencing next-gen solutions. |

| Industry Presence & Events | Active participation in key conferences like ANGA COM and OFC. | Showcases innovation, gathers market insights, and builds new relationships. |

Channels

ADTRAN's direct sales force is a cornerstone for engaging with its most significant clients, such as major telecommunications companies, large corporations, and government entities. This approach facilitates the sale of intricate solutions, direct contract negotiations, and in-depth technical discussions, which are vital for securing substantial global agreements and strategic partnerships.

ADTRAN’s extensive network of channel partners and resellers is crucial for reaching smaller and medium-sized service providers, regional enterprises, and specialized vertical markets. These partners act as an extension of ADTRAN's sales and support, offering localized expertise and established customer relationships. For instance, ADTRAN's enhanced APAC partner program in 2024 highlights their commitment to strengthening these vital go-to-market channels.

ADTRAN leverages its corporate website, adtran.com, and a dedicated investor relations portal, investors.adtran.com, to connect with customers and stakeholders. These digital hubs are crucial for disseminating product details, company news, and financial reports, ensuring transparency and accessibility.

The company's online platforms also provide essential access to extensive technical documentation and vital support resources, streamlining customer engagement and problem-solving. This digital infrastructure underpins ADTRAN's commitment to clear communication and efficient service delivery.

Industry Events and Trade Shows

ADTRAN actively participates in key industry events like ANGA COM and OFC. These gatherings are vital for showcasing their latest networking solutions and engaging directly with customers and partners. For instance, at OFC 2024, ADTRAN highlighted advancements in optical networking, demonstrating their commitment to innovation and market leadership.

These trade shows offer a unique platform for ADTRAN to conduct live demonstrations of their technology, allowing potential clients to experience the practical application and benefits of their products firsthand. This direct interaction is invaluable for building relationships and generating leads.

Beyond product showcases, these events facilitate crucial networking opportunities and position ADTRAN as a thought leader in the telecommunications sector. Such engagement helps them stay attuned to market needs and competitive trends.

Key benefits of ADTRAN's event participation include:

- Product Innovation Showcase: Demonstrating cutting-edge solutions to a targeted audience.

- Customer Engagement: Direct interaction with potential and existing clients for feedback and relationship building.

- Market Insight: Gathering intelligence on industry trends and competitor activities.

- Lead Generation: Identifying and nurturing new business opportunities.

Public Relations and Media

ADTRAN leverages public relations and media to disseminate key company information. This includes press releases, often distributed through services like Business Wire, to announce product launches, major customer acquisitions, and financial performance updates. In 2024, effective media engagement remains crucial for shaping ADTRAN's brand perception and communicating its competitive standing.

These channels are instrumental in reaching a broad audience, including potential investors, current and prospective customers, and industry analysts. By proactively sharing news and insights, ADTRAN aims to build and maintain a positive market image. For instance, during Q1 2024, ADTRAN's communications highlighted advancements in its fiber access and network solutions, aiming to reinforce its position as an innovator.

- Brand Awareness: Public relations efforts directly contribute to building and reinforcing ADTRAN's brand recognition within the telecommunications sector.

- Market Positioning: Media coverage helps articulate ADTRAN's strategic direction and its role in evolving network technologies.

- Influencing Perception: Consistent and transparent communication through media channels influences how investors, customers, and the industry view ADTRAN's stability and future prospects.

- Key Announcements: Press releases are a primary tool for communicating significant milestones, such as the expansion of their Wi-Fi 7 portfolio in early 2024.

ADTRAN utilizes a multi-faceted channel strategy, combining direct sales for major accounts with an extensive partner network for broader market reach. Their corporate website and investor relations portal serve as key digital touchpoints for information dissemination and customer support.

Participation in industry events like OFC 2024 allows ADTRAN to showcase innovations, engage directly with customers, and gather market intelligence. Public relations and media outreach, including press releases on product launches like their Wi-Fi 7 portfolio expansion in early 2024, are vital for brand awareness and market positioning.

| Channel Type | Target Audience | Key Activities | 2024 Focus/Examples |

|---|---|---|---|

| Direct Sales | Major Telcos, Large Corps, Government | Complex solution sales, contract negotiation, technical discussions | Securing global agreements and strategic partnerships |

| Channel Partners/Resellers | SME Service Providers, Regional Enterprises | Localized expertise, established customer relationships | APAC partner program enhancement |

| Corporate Website/Investor Relations | Customers, Investors, Stakeholders | Product details, news, financial reports, technical docs | Transparency and accessibility |

| Industry Events (e.g., OFC, ANGA COM) | Customers, Partners, Analysts | Product demos, networking, thought leadership | Showcasing optical networking advancements (OFC 2024) |

| Public Relations/Media | Broad Audience (Investors, Customers, Industry) | Press releases, news dissemination | Brand awareness, market positioning, Wi-Fi 7 portfolio announcements |

Customer Segments

Telecommunications Service Providers represent ADTRAN's cornerstone customer segment, a diverse group including major global carriers, regional players, and local network operators. These entities are crucial for delivering essential communication services.

These providers rely on ADTRAN for advanced solutions enabling high-speed broadband, optical networking, and sophisticated network management. Their goal is to efficiently deliver voice, data, and video to end-users, a market that saw significant investment in network upgrades throughout 2024, driven by increasing demand for bandwidth.

Alternative Service Providers, a burgeoning customer segment for ADTRAN, encompasses entities like utility companies, municipalities, and fiber overbuilders. These organizations are increasingly taking the reins to construct their own broadband infrastructure, fueled by a desire to offer competitive services and leverage government funding initiatives. For instance, the US Infrastructure Investment and Jobs Act, passed in 2021, allocated billions towards broadband expansion, directly benefiting this segment.

ADTRAN supports these emerging providers by supplying essential access and aggregation solutions. These technologies are crucial for the successful build-out of new fiber optic networks, enabling these alternative providers to deliver high-speed internet and other advanced telecommunications services to their communities. This strategic focus aligns with the growing trend of decentralized network development.

ADTRAN caters to a broad range of enterprises, from nimble small and medium-sized businesses (SMBs) to expansive, distributed corporations, including Fortune 500 entities. These businesses rely on ADTRAN for robust networking to support critical internal communications, high-volume data transfer, and specialized operational applications.

For instance, in 2024, the demand for reliable connectivity remains paramount as businesses increasingly adopt cloud-based services and remote work models, driving the need for secure and high-performance network infrastructure. ADTRAN's portfolio directly addresses these requirements with its business networking and connected home solutions.

Government Organizations

Government organizations, from federal agencies to local municipalities, represent a crucial customer segment for ADTRAN. These entities depend on secure, reliable, and scalable communication networks to deliver essential public services, safeguard critical infrastructure, and manage internal operations efficiently. ADTRAN's solutions are specifically designed to meet the stringent security, uptime, and capacity demands inherent in government networking environments, often supporting vital digital transformation efforts.

For instance, in 2024, government investment in broadband infrastructure continued to be a significant driver. The US Department of Commerce's National Telecommunications and Information Administration (NTIA) has been actively distributing billions in federal funding through programs like the Broadband Equity, Access, and Deployment (BEAD) program. These initiatives directly translate into opportunities for companies like ADTRAN to provide the underlying network technology required for these upgrades.

- Federal Agencies: Require high-security, resilient networks for national defense, intelligence, and public administration.

- State and Local Governments: Need robust communications for public safety, smart city initiatives, and citizen services.

- Critical Infrastructure Protection: ADTRAN solutions support the secure and reliable connectivity essential for power grids, transportation, and emergency services.

- Digital Transformation Support: Enabling governments to modernize operations, improve data management, and enhance citizen engagement through advanced networking.

Cable Operators (MSOs)

Cable operators, also known as Multiple System Operators (MSOs), are a crucial customer base for ADTRAN. These companies are actively investing in network upgrades to offer faster internet speeds and a wider array of services, directly competing in the broadband market. ADTRAN's technology assists them in modernizing their existing infrastructure and incorporating advanced fiber optic and Wi-Fi capabilities.

ADTRAN's solutions are designed to facilitate MSOs' shift towards next-generation broadband networks. This includes enabling them to deploy higher bandwidth services and improve the overall customer experience. For instance, ADTRAN's fiber-to-the-home (FTTH) solutions allow MSOs to extend their reach and deliver gigabit speeds, a critical differentiator in today's competitive landscape.

- Network Modernization: MSOs are upgrading their hybrid fiber-coaxial (HFC) networks to support multi-gigabit speeds, with many aiming for symmetrical upload and download capabilities.

- Fiber Expansion: Significant investment is being channeled into extending fiber deeper into the network, often reaching the home (FTTH), to meet escalating bandwidth demands.

- Wi-Fi Integration: Enhanced in-home Wi-Fi performance is a key focus for MSOs, driving demand for advanced Wi-Fi solutions that complement their broadband offerings.

- Competitive Pressure: The increasing presence of fiber-only providers and fixed wireless access (FWA) necessitates continuous network investment by MSOs to maintain market share.

ADTRAN's customer base is diverse, primarily serving Telecommunications Service Providers, both large and small, who are the backbone of global communication networks. Alternative Service Providers, like municipalities and utilities, are also key, leveraging government funding for broadband expansion, a trend strongly supported by initiatives like the US BEAD program in 2024. Enterprises of all sizes, from SMBs to large corporations, rely on ADTRAN for robust networking to support cloud services and remote work, with demand for high-performance connectivity remaining critical throughout 2024.

Government entities, including federal agencies and local municipalities, represent another significant segment, requiring secure and scalable networks for public services and digital transformation efforts, with substantial federal investment continuing in 2024. Cable operators (MSOs) are also vital, actively upgrading their networks to offer multi-gigabit speeds and enhanced Wi-Fi, driven by competitive pressures and the need to meet escalating bandwidth demands.

| Customer Segment | Key Needs | 2024 Market Drivers | ADTRAN Solutions |

|---|---|---|---|

| Telecommunications Service Providers | High-speed broadband, optical networking, network management | Increasing bandwidth demand, network modernization | Access and aggregation solutions, advanced networking |

| Alternative Service Providers | New broadband infrastructure, competitive services | Government funding (e.g., BEAD program), decentralized networks | Fiber optic network technology, access solutions |

| Enterprises (SMBs to Large Corps) | Reliable connectivity, cloud integration, remote work support | Cloud adoption, remote work models, digital transformation | Business networking, connected home solutions, secure infrastructure |

| Government Organizations | Secure, scalable, reliable networks for public services | Digital transformation, federal broadband funding, critical infrastructure protection | Secure networking solutions, scalable capacity, high uptime |

| Cable Operators (MSOs) | Faster internet speeds, Wi-Fi enhancement, network upgrades | Competition from fiber providers, demand for gigabit speeds | Fiber-to-the-home (FTTH) solutions, advanced Wi-Fi, network modernization |

Cost Structure

ADTRAN's commitment to innovation makes research and development a significant cost. In 2023, the company reported $101.5 million in R&D expenses, reflecting its dedication to developing advanced solutions for cloud and mobile services to maintain its competitive edge.

ADTRAN's manufacturing and supply chain costs are significant, encompassing raw materials, component sourcing, assembly, and rigorous quality control for networking and communications equipment. These expenses are a core component of their overall cost structure.

The company's global supply chain management, including the complexities of logistics and inventory, adds substantially to these costs. Optimizing inventory levels is a key strategy to mitigate these expenses and improve efficiency.

For instance, in fiscal year 2023, ADTRAN reported cost of goods sold of $516.5 million, reflecting the direct expenses tied to producing their product portfolio.

ADTRAN's sales, marketing, and distribution costs are significant investments in its global reach. These expenses encompass everything from the compensation for its dedicated sales force to broad marketing campaigns designed to build brand awareness and product demand. For instance, in 2023, ADTRAN reported selling, general, and administrative expenses of $346.8 million, a portion of which directly supports these crucial functions.

The company actively engages in industry events and trade shows, which are vital for showcasing its latest networking solutions and connecting with potential customers. Furthermore, ADTRAN relies on a robust network of channel partners, and maintaining these relationships through dedicated programs is a key component of its go-to-market strategy. These expenditures are directly tied to acquiring new customers and expanding ADTRAN's presence in key markets worldwide.

General and Administrative Expenses

General and Administrative (G&A) expenses for ADTRAN encompass operational overhead such as executive compensation, administrative personnel, and essential support functions like legal, finance, and IT. These costs are fundamental to maintaining the business's infrastructure and ensuring smooth operations. Effective stewardship of these expenses directly impacts ADTRAN's bottom line and its ability to achieve operational leverage.

ADTRAN has actively pursued strategies to enhance its operational efficiency, which directly influences its G&A spending. For the first quarter of 2024, ADTRAN reported G&A expenses of $36.0 million. This figure represents a key component of their overall cost structure, highlighting the ongoing efforts to optimize these essential business functions.

- Executive Salaries and Benefits: Compensation for senior leadership and management teams.

- Administrative Staff Costs: Salaries and benefits for support personnel in HR, accounting, and operations.

- Legal and Compliance: Expenses related to legal counsel, regulatory filings, and corporate governance.

- Finance and IT Support: Costs associated with financial management, reporting, and information technology infrastructure.

Acquisition and Integration Related Costs

Following strategic acquisitions, ADTRAN incurs significant costs for integration and restructuring. For instance, the acquisition of Adtran Networks SE (formerly ADVA Optical Networking SE) involved substantial expenses in merging operations and systems. These integration efforts, alongside the amortization of acquired intangible assets, can temporarily affect short-to-medium term profitability.

ADTRAN is actively working to minimize these non-recurring expenses. The company's financial reports for 2024 are expected to show a continued focus on streamlining operations post-acquisition to achieve greater efficiency and reduce these integration-related impacts on its bottom line.

Key cost components in this area include:

- Integration and Restructuring Expenses: Costs associated with merging systems, personnel, and operational processes following acquisitions.

- Amortization of Acquired Intangibles: The systematic expensing of the value of intangible assets, such as patents and customer relationships, acquired in business combinations.

- Consulting and Professional Fees: Expenses incurred for external expertise in areas like legal, financial advisory, and IT integration.

ADTRAN's cost structure is heavily influenced by its research and development efforts, with $101.5 million spent on R&D in 2023 to drive innovation in networking solutions. The cost of goods sold, which includes manufacturing and supply chain expenses, amounted to $516.5 million in fiscal year 2023, reflecting the direct costs of producing their equipment. Sales, general, and administrative expenses were $346.8 million in 2023, covering marketing, distribution, and operational overhead.

Post-acquisition integration and restructuring costs, particularly following the ADVA Optical Networking SE acquisition, represent another significant expense category. While specific 2024 figures for these integration costs are still emerging, the company's focus remains on streamlining operations to mitigate these impacts. These costs are crucial to understand for assessing the company's operational efficiency and profitability trends.

| Cost Category | 2023 Expense (Millions USD) | Key Components |

|---|---|---|

| Research & Development | 101.5 | Innovation in cloud and mobile networking solutions |

| Cost of Goods Sold | 516.5 | Raw materials, assembly, quality control, supply chain logistics |

| Selling, General & Administrative (SG&A) | 346.8 | Sales force compensation, marketing campaigns, distribution, executive compensation, IT, legal |

| Integration & Restructuring | Varies (Post-Acquisition) | System merging, personnel alignment, consulting fees, amortization of intangibles |

Revenue Streams

ADTRAN's core revenue generation stems from the sale of a wide array of networking and communications hardware. This encompasses critical infrastructure like fiber broadband access platforms, advanced Wi-Fi solutions for seamless connectivity, and sophisticated optical networking products. These sales are primarily directed towards telecommunications companies, businesses seeking robust network solutions, and government entities requiring reliable communication infrastructure.

In 2023, ADTRAN reported total revenue of $1.5 billion, with a substantial portion directly attributable to the sale of these networking equipment solutions. This highlights product sales as the dominant driver of the company's financial performance.

ADTRAN generates revenue through software and cloud solution subscriptions, including its Mosaic One platform and other cloud-based offerings. These subscriptions typically involve recurring fees for services like intelligent network management, automation, and data analytics.

This revenue stream diversifies ADTRAN's income and ensures continuous value delivery to its customers through ongoing access to advanced network management capabilities.

ADTRAN generates revenue by offering professional services like network design, deployment, integration, and optimization. These expert services are vital for customers implementing ADTRAN's sophisticated networking solutions, ensuring smooth setup and peak performance.

Beyond initial setup, ADTRAN also provides ongoing managed services and technical support. This continuous support helps customers maintain their networks efficiently and reliably, fostering long-term relationships and recurring revenue streams.

In 2023, ADTRAN's total revenue reached $1.3 billion. While specific breakdowns for professional and managed services aren't always publicly detailed, these offerings are critical components contributing to customer satisfaction and ADTRAN's overall financial health by enhancing the value proposition of their hardware and software solutions.

International Sales

International sales represent a substantial revenue driver for ADTRAN, underscoring its global reach. In 2024, the company continued to see significant contributions from markets outside of North America, with Europe being a particularly strong region. This geographic diversification is a strategic advantage, reducing dependence on any single market and tapping into varied demand cycles.

ADTRAN's expansion into Europe, often facilitated by strategic acquisitions, has been a critical component of its growth strategy. This approach allows the company to quickly establish or enhance its presence and customer relationships in key international territories. The success in these overseas markets is a testament to the adaptability of its product portfolio and sales channels.

- Global Revenue Contribution: International markets, especially Europe, are vital to ADTRAN's overall financial performance.

- Growth Lever: European expansion, fueled by acquisitions, acts as a significant growth engine for the company.

- Risk Mitigation: Geographic diversification through international sales helps to balance market-specific risks.

- Market Penetration: ADTRAN's ability to secure substantial revenue internationally highlights its successful market penetration strategies.

Revenue from Subsidiary Operations

ADTRAN Holdings, Inc. derives substantial revenue from its majority-owned subsidiary, Adtran Networks SE. This subsidiary is a crucial contributor to ADTRAN's consolidated financial performance.

Adtran Networks SE, formerly ADVA Optical Networking SE, plays a pivotal role in bolstering ADTRAN's standing within the optical networking solutions market. Its operational success directly impacts ADTRAN's overall revenue generation.

The financial results of Adtran Networks SE are a key determinant of ADTRAN's consolidated financial outcomes. For instance, in the first quarter of 2024, Adtran Networks SE reported revenue of €264.6 million, representing a significant portion of ADTRAN Holdings' total revenue.

- Subsidiary Contribution: Adtran Networks SE's revenue is a primary driver of ADTRAN's top line.

- Market Position: The subsidiary strengthens ADTRAN's competitive edge in optical networking.

- Q1 2024 Performance: Adtran Networks SE's revenue of €264.6 million highlights its importance.

ADTRAN's revenue streams are multifaceted, primarily driven by hardware sales, software and cloud subscriptions, and professional services. International operations, particularly in Europe, are a significant contributor, further bolstered by the performance of its subsidiary, Adtran Networks SE.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Hardware Sales | Sale of networking and communications equipment. | Total revenue of $1.3 billion in 2023. |

| Software & Cloud Subscriptions | Recurring fees for platforms like Mosaic One. | Diversifies income and ensures continuous value. |

| Professional & Managed Services | Network design, deployment, integration, and ongoing support. | Critical for customer satisfaction and financial health. |

| International Sales | Revenue generated from markets outside North America. | Europe is a particularly strong region in 2024. |

| Adtran Networks SE | Revenue from majority-owned subsidiary in optical networking. | Q1 2024 revenue of €264.6 million. |

Business Model Canvas Data Sources

The ADTRAN Business Model Canvas is meticulously constructed using a blend of internal financial data, comprehensive market research, and detailed competitive analysis. This multi-faceted approach ensures each component of the canvas is grounded in actionable intelligence.