Aavas Financiers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Unlock the critical external factors shaping Aavas Financiers's journey, from evolving government housing policies to economic shifts impacting affordability. Our PESTLE analysis delves deep into these forces, offering you a strategic advantage. Don't guess the future; understand it. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government housing policies, particularly initiatives like the Pradhan Mantri Awas Yojana (PMAY), are pivotal for the affordable housing segment. These policies offer subsidies and drive the goal of universal housing, especially in less urbanized regions.

The updated PMAY-Urban 2.0, launched in September 2024, is set to assist one crore urban households over the next five years. Concurrently, PMAY-Gramin continues its focus on rural housing, with specific targets for the 2024-25 fiscal year.

Regulatory stability is a cornerstone for Aavas Financiers. The Reserve Bank of India (RBI) and the National Housing Bank (NHB) are key regulators, and their directives significantly shape the operational landscape for housing finance companies (HFCs). Recent circulars issued in August 2024 and January 2025 are particularly noteworthy, as they focus on aligning regulations for HFCs and Non-Banking Financial Companies (NBFCs).

These updated regulations, which became effective from January 1, 2025, introduce crucial changes. They impact areas such as the requirements for liquid assets, the ability to accept public deposits, and the necessary asset cover. Such measures are designed to bolster the overall stability and promote more prudent financial practices within the sector.

The Reserve Bank of India's (RBI) monetary policy, particularly its stance on interest rates, significantly influences the housing finance market. For instance, the RBI maintained its repo rate at 6.25% through much of 2024, a level that generally supports borrowing affordability.

Lower interest rates make housing loans more accessible, which directly boosts demand for properties and, consequently, for housing finance services offered by companies like Aavas Financiers. This policy environment can encourage more individuals, especially first-time homebuyers, to enter the market, driving sector growth.

Political Stability and Governance

Political stability and robust governance are foundational for Aavas Financiers, directly influencing investor confidence and the predictable execution of housing finance policies. A stable government environment encourages long-term investment in the sector, crucial for sustained growth and development.

The Indian government's continued emphasis on structural reforms, coupled with significant investments in infrastructure and economic growth initiatives, is a positive signal for the housing finance market. These policies are anticipated to boost demand, especially within the Economically Weaker Section (EWS), Lower Income Group (LIG), and Middle Income Group (MIG) segments, which are core to Aavas Financiers' business model.

- Government Housing Initiatives: Schemes like Pradhan Mantri Awas Yojana (PMAY) continue to support affordable housing, directly benefiting Aavas Financiers' target customer base. In FY23, PMAY-U saw sanctions for over 12 lakh houses, indicating ongoing government commitment.

- Regulatory Environment: A stable and supportive regulatory framework from bodies like the National Housing Bank (NHB) is vital. NHB's refinance rates and policy directives significantly impact the cost of funds for housing finance companies.

- Economic Growth Policies: Government policies aimed at boosting overall economic growth, such as those promoting manufacturing and job creation, indirectly increase disposable incomes and the capacity for homeownership, thereby driving demand for Aavas Financiers' products.

Financial Inclusion Initiatives

Government and regulatory efforts are actively expanding the financial landscape, directly benefiting companies like Aavas Financiers. These initiatives are designed to bring more people into the formal financial system, which in turn grows the potential customer base.

The Financial Inclusion Index (FI-Index) is a key indicator of this progress, reaching 67 in March 2025, up from 64.2 in March 2024. This upward trend signifies a growing number of individuals and households accessing formal financial services.

Programs such as the Jan Dhan Yojana are particularly impactful, focusing on bringing underserved populations, especially those in rural and semi-urban regions, into the formal financial fold. This expansion of access creates a larger addressable market for housing finance providers.

Key aspects of these initiatives include:

- Increased access to banking services: More people now have bank accounts, facilitating savings and credit.

- Promotion of digital payments: Digital platforms are making financial transactions easier and more accessible.

- Targeted credit schemes: Government schemes often include provisions for easier access to credit for specific segments.

- Financial literacy programs: Efforts to educate individuals on managing finances are crucial for sustained inclusion.

Government housing initiatives, such as the Pradhan Mantri Awas Yojana (PMAY), remain central to Aavas Financiers' operating environment. The PMAY-Urban 2.0, launched in September 2024, aims to assist one crore urban households over the next five years, directly supporting the affordable housing segment. Furthermore, PMAY-Gramin continues its focus on rural housing, with specific targets for the 2024-25 fiscal year, expanding the potential customer base for Aavas.

Regulatory stability, driven by the Reserve Bank of India (RBI) and the National Housing Bank (NHB), is crucial. Recent circulars in August 2024 and January 2025, effective from January 1, 2025, have aligned regulations for Housing Finance Companies (HFCs) and Non-Banking Financial Companies (NBFCs), impacting areas like liquid assets and public deposits. The RBI's monetary policy, maintaining the repo rate at 6.25% through much of 2024, has supported borrowing affordability.

The government's commitment to structural reforms and economic growth initiatives positively impacts the housing finance market. Policies promoting job creation and infrastructure development indirectly boost disposable incomes, increasing demand for homeownership, particularly among Economically Weaker Section (EWS), Lower Income Group (LIG), and Middle Income Group (MIG) segments, which are Aavas Financiers' core focus.

Financial inclusion efforts are expanding the market for housing finance. The Financial Inclusion Index (FI-Index) reached 67 in March 2025, up from 64.2 in March 2024, indicating greater access to formal financial services for more individuals, especially in rural and semi-urban areas, thereby growing Aavas's potential customer base.

What is included in the product

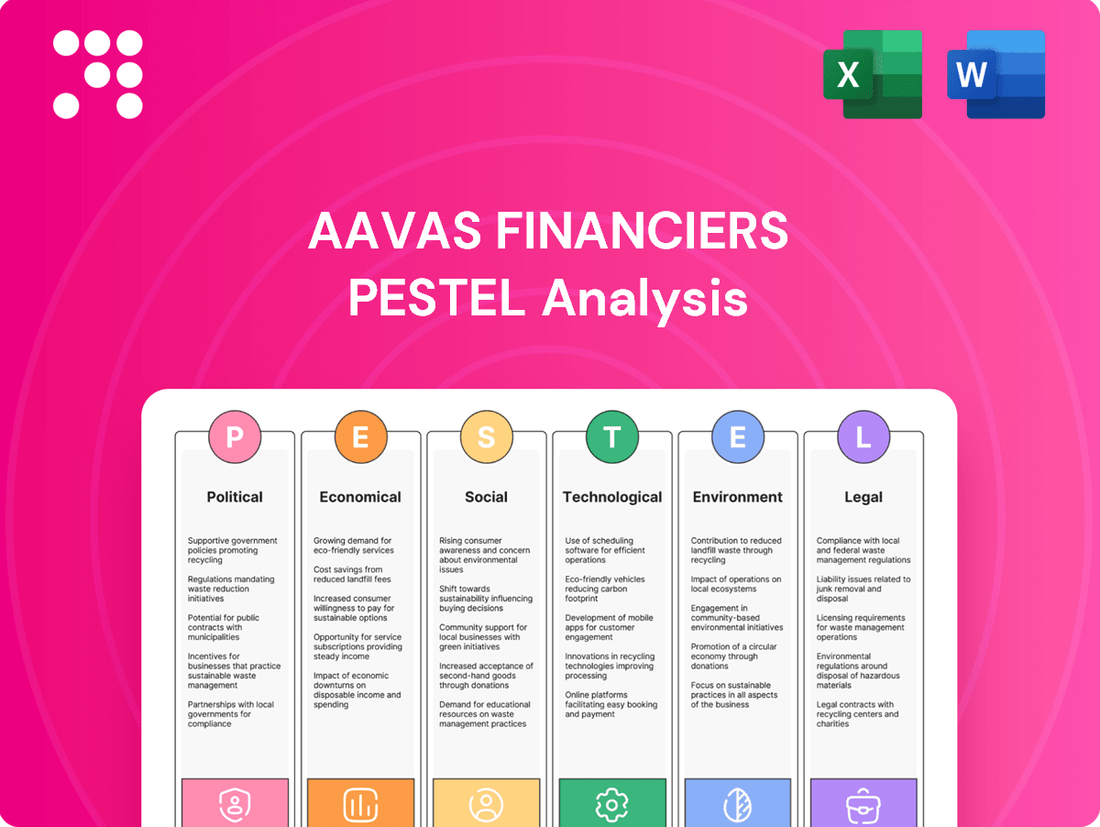

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Aavas Financiers, providing a comprehensive overview of the external landscape.

A clear, actionable breakdown of Aavas Financiers' PESTLE factors, highlighting how understanding these external forces can alleviate strategic uncertainty and guide proactive decision-making.

Economic factors

Interest rate fluctuations significantly influence Aavas Financiers' borrowing costs and customer loan affordability. The company's overall cost of borrowing stood at 8.07% in Q4 FY24, a slight increase from previous periods, reflecting the prevailing market conditions.

The incremental cost of borrowing for Aavas Financiers rose to 8.14% in the fourth quarter of fiscal year 2024. This upward movement in borrowing costs can impact the company's net interest margins and the competitiveness of its loan products.

Inflation significantly impacts Aavas Financiers by diminishing the purchasing power of its core customer base, often in the low and middle-income brackets. For instance, if inflation outpaces wage growth, individuals may find it harder to secure or repay housing loans, potentially leading to increased defaults. The Reserve Bank of India's retail inflation rate averaged around 5.4% for the fiscal year 2023-24, a figure that directly affects the affordability of homes for Aavas's target demographic.

Economic stability, characterized by controlled inflation, is paramount for Aavas Financiers' sustained growth in the affordable housing segment. A stable economic environment fosters consumer confidence, encouraging more individuals to invest in property and take on long-term financial commitments like home loans. Conversely, persistent high inflation can deter such investments, creating headwinds for the company's expansion plans.

Economic growth in India, especially in semi-urban and rural areas where Aavas Financiers focuses, is a key driver for housing demand. Higher income levels in these regions directly translate to increased purchasing power for homes.

The Indian housing market is experiencing a significant shift, with Tier II and III cities becoming major growth centers. These cities are attracting both real estate developers and a growing population, thanks to ongoing infrastructure development and more accessible land costs.

For instance, India's GDP growth was projected to be around 6.5% for the fiscal year 2023-24, indicating a robust economic environment that supports housing finance. This expansion in the broader economy directly fuels the demand for affordable housing solutions that Aavas provides.

Availability of Credit and Funding

Aavas Financiers relies heavily on access to a variety of affordable funding to fuel its growth. As of March 31, 2024, their funding structure was a mix of bank term loans, securitization and assignment, and refinancing from the National Housing Bank, indicating a well-rounded approach to capital sourcing.

This diversification is crucial for managing borrowing costs and ensuring consistent liquidity. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a borrowing cost of 8.59%, a testament to their ability to secure funds at competitive rates. Their total borrowings stood at ₹20,480.47 crore as of the same date.

- Diversified Funding Sources: Term loans from banks, securitization/assignment, and NHB refinancing.

- Borrowing Cost: Recorded at 8.59% for the fiscal year ending March 31, 2024.

- Total Borrowings: Reached ₹20,480.47 crore as of March 31, 2024.

- Impact on Operations: Access to credit directly influences lending capacity and expansion.

Income Levels and Employment Trends

Income stability and employment trends are crucial for Aavas Financiers, particularly within the low and middle-income segments. These factors directly influence a borrower's ability to qualify for loans and, importantly, their capacity to repay them consistently. Stable employment and rising incomes are foundational for a healthy housing loan market.

The growth of India's middle class is a significant tailwind. Projections indicate that by 2025, approximately 50 million households are expected to have annual incomes surpassing ₹30 lakh. This expanding demographic represents a substantial pool of potential homebuyers, directly fueling demand for housing finance solutions offered by companies like Aavas Financiers.

Key economic indicators impacting Aavas Financiers include:

- Rising Disposable Income: As incomes grow, so does the capacity for individuals to save and invest in housing.

- Employment Stability: Consistent job creation and low unemployment rates in key sectors bolster confidence and loan repayment ability.

- Middle-Class Expansion: The increasing size and affluence of the middle class directly translate to higher demand for home loans.

- Wage Growth: Sustained wage increases across various employment levels enhance affordability and loan eligibility.

Economic growth is a primary driver for Aavas Financiers, particularly in its focus on semi-urban and rural markets. India's projected GDP growth of around 6.5% for FY2023-24 signifies a robust economy, directly translating into increased demand for affordable housing and, consequently, for Aavas's loan products.

Interest rate movements are critical, influencing both Aavas's borrowing costs and customer loan affordability. The company's incremental borrowing cost stood at 8.14% in Q4 FY24, a slight increase that can affect net interest margins and product competitiveness.

Inflation, averaging around 5.4% for RBI retail inflation in FY2023-24, directly impacts the purchasing power of Aavas's target demographic, potentially increasing loan default risks if it outpaces wage growth.

The expansion of India's middle class, with an estimated 50 million households projected to earn over ₹30 lakh annually by 2025, presents a significant opportunity for increased demand in the housing finance sector.

| Economic Factor | Indicator/Data Point | Impact on Aavas Financiers |

|---|---|---|

| GDP Growth (Projected FY2023-24) | ~6.5% | Boosts housing demand, especially in Tier II/III cities. |

| RBI Retail Inflation (FY2023-24 Avg.) | ~5.4% | Reduces affordability for low/middle-income customers, potential default risk. |

| Incremental Borrowing Cost (Q4 FY24) | 8.14% | Affects net interest margins and loan pricing. |

| Middle-Class Households (Projected by 2025) | 50 million earning > ₹30 lakh | Expands potential customer base for home loans. |

Same Document Delivered

Aavas Financiers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Aavas Financiers delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a detailed breakdown of each PESTLE element relevant to Aavas Financiers. This includes insights into government housing policies, economic growth trends, demographic shifts, technological advancements in fintech, regulatory changes in the financial sector, and environmental sustainability initiatives.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete and actionable analysis of the external forces shaping Aavas Financiers' business landscape. You'll gain a deep understanding of the opportunities and threats presented by these macro-environmental factors.

Sociological factors

India's urban population is projected to reach 67.2% by 2035, up from 35.9% in 2020, according to the UN. This rapid growth fuels demand for housing in cities and semi-urban areas, directly benefiting companies like Aavas Financiers that focus on affordable housing.

The migration from rural to urban centers, driven by economic opportunities, creates a consistent need for housing finance. As people settle in these new locations, they require loans to purchase or construct homes, a segment Aavas Financiers actively targets.

In FY24, Aavas Financiers reported a 19% year-on-year growth in its Assets Under Management (AUM), reaching ₹21,484 crore. This expansion reflects the company's successful navigation of the increasing demand for housing finance stemming from urbanization trends.

The desire for permanent, well-built homes, often referred to as 'pucca' houses, is on the rise among low and middle-income families. This growing aspiration is a powerful sociological force propelling the housing finance industry forward.

Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) are instrumental in making homeownership a tangible reality for many. For instance, as of March 31, 2024, PMAY has facilitated the construction of over 12 million houses, significantly boosting accessibility for first-time homebuyers.

The financial literacy of individuals in semi-urban and rural regions directly influences how well they grasp loan terms and their commitment to repayment. This understanding is vital for Aavas Financiers in assessing borrower suitability and managing risk.

Initiatives aimed at boosting financial awareness are showing positive results, as evidenced by the Reserve Bank of India's Financial Inclusion Index. This index, which stood at 56.4 in March 2022 and is expected to show continued growth through 2024-2025, highlights an increasing understanding of financial products, making it easier for companies like Aavas Financiers to reach and serve a broader customer base responsibly.

Demographic Shifts and Household Formation

Demographic shifts significantly shape housing demand. For instance, a rising trend towards smaller, nuclear families, coupled with an increasing young population entering their prime home-buying years, directly fuels the need for new housing units. This dynamic is a key driver for housing finance companies like Aavas Financiers.

India's demographic profile shows a substantial youth bulge, with a significant portion of the population in the 20-35 age bracket, a critical period for household formation and homeownership. This age group's increasing aspirations and financial independence are translating into higher demand for housing finance solutions. For example, as of 2023, over 50% of India's population was under 25, indicating a sustained demand for housing in the coming years.

The changing household formation rates, moving towards smaller family units, also impact the type of housing demanded. Smaller homes and apartments are becoming more popular, especially in urban and semi-urban areas where Aavas Financiers primarily operates. This shift necessitates tailored financial products that cater to the needs of these emerging household structures.

Key demographic trends influencing housing finance include:

- Increasing Urbanization: A significant migration to cities leads to greater demand for urban housing and associated finance.

- Young Population: India's large young population (under 35) is entering the home-buying phase, driving demand for first-time home loans.

- Nuclear Families: The rise of smaller, nuclear families boosts demand for individual housing units rather than joint family accommodations.

- Rising Disposable Incomes: Growing incomes among the working-age population enhance their ability to service home loans.

Cultural Attitudes Towards Debt and Homeownership

In India, owning a home is more than just shelter; it's a significant marker of stability and social standing. This cultural drive fuels a strong demand for housing loans, even among those with less formal credit history, which is a core demographic for Aavas Financiers.

This cultural preference directly supports Aavas Financiers' business model, which caters to individuals seeking affordable housing finance, often in semi-urban and rural areas. The company's growth is intrinsically linked to this societal aspiration.

- Homeownership as a cultural aspiration: A significant portion of the Indian population views owning a home as a primary life goal.

- Demand for housing loans: This cultural emphasis translates into a consistent demand for mortgage products, especially in Tier 2 and Tier 3 cities where Aavas Financiers operates.

- Aavas Financiers' market alignment: The company's focus on this cultural value positions it favorably to tap into a large, motivated customer base.

Sociological factors significantly shape Aavas Financiers' operating environment, particularly concerning housing aspirations and financial literacy. The deep-seated cultural preference for homeownership in India remains a powerful driver for housing loans. This aspiration is particularly strong in the semi-urban and rural markets Aavas Financiers serves.

The increasing financial literacy, evidenced by the Reserve Bank of India's Financial Inclusion Index reaching 56.4 in March 2022, indicates a growing understanding of financial products. This trend, expected to continue through 2024-2025, makes it easier for companies like Aavas Financiers to engage with and serve a broader customer base more effectively.

Demographic shifts, such as the growing number of nuclear families and a large young population entering prime home-buying years, directly fuel demand for housing finance. India's substantial youth bulge, with over 50% of its population under 25 as of 2023, ensures sustained demand for housing solutions.

Technological factors

The increasing adoption of digital lending platforms and mobile applications is a significant technological factor. These platforms simplify the loan application process, cut down processing times, and make financial services more accessible, especially for those in underserved or remote regions. For Aavas Financiers, this translates to opportunities for online mortgage applications, digital Know Your Customer (KYC) procedures, and faster loan disbursements, potentially improving customer experience and operational efficiency.

Advanced data analytics, machine learning, and AI are revolutionizing credit risk assessment for Aavas Financiers, particularly for individuals with thin or no formal credit histories. These technologies allow for more consistent and objective evaluations, moving beyond traditional metrics.

By leveraging alternative data sources, Aavas Financiers can now assess the creditworthiness of borrowers in the low and middle-income segments more effectively. This technological shift is crucial for expanding credit access to underserved populations, a key market for the company.

For instance, in 2023, Aavas Financiers reported a significant portion of its new customer base comprised individuals with limited prior credit exposure, highlighting the impact of these data-driven assessment tools in reaching new market segments.

As financial transactions increasingly move online, robust cybersecurity measures and data privacy protocols become paramount. Aavas Financiers must protect customer information and maintain trust. In 2024, the global cost of data breaches was estimated to reach $9.5 trillion annually, highlighting the critical need for strong defenses.

Ensuring secure digital platforms is critical for Aavas Financiers to mitigate risks associated with online operations. With a growing reliance on digital channels for loan applications and customer service, a single breach could severely damage reputation and lead to significant financial penalties, potentially impacting their ability to operate effectively.

Integration of Fintech Solutions

Aavas Financiers is actively exploring collaborations with fintech companies to streamline its operations. This integration is expected to boost efficiency and enhance customer service through advanced tools. For instance, by adopting real-time credit scoring, the company can expedite loan approvals, a critical factor in the housing finance sector.

The company is looking into automated underwriting processes to reduce manual intervention and speed up decision-making. This move is crucial for scaling operations and managing a growing customer base. In 2023, the Indian fintech market was valued at approximately $50 billion and is projected to reach $150 billion by 2025, indicating significant growth potential for integrated solutions.

- Enhanced Operational Efficiency: Fintech integration allows for faster processing of loan applications and approvals.

- Improved Customer Experience: Real-time credit scoring and digital onboarding provide a smoother customer journey.

- Innovative Product Offerings: Partnerships can lead to the development of new, customer-centric financial products.

- Regulatory Compliance: Seamless integration with regulatory platforms ensures adherence to evolving financial laws.

Cloud Computing and Digital Infrastructure

Aavas Financiers' operational efficiency and adaptability are significantly bolstered by its investment in cloud computing and robust digital infrastructure. This technological foundation allows for scalable operations, meaning the company can easily adjust its capacity to meet changing demands without substantial upfront investment in physical hardware. It also facilitates efficient data management, crucial for handling the vast amounts of customer and financial information Aavas processes.

The adoption of cloud-based systems directly contributes to lower operational costs. By utilizing cloud services, Aavas can reduce expenses related to maintaining on-premises servers, IT staff, and energy consumption. This cost-effectiveness is vital in a competitive market. Furthermore, this digital infrastructure enhances Aavas Financiers' agility in responding to regional variations in customer needs and evolving regulatory landscapes, ensuring compliance and service relevance across its operating areas.

Real-world data highlights the trend: In 2024, the global cloud computing market was projected to reach over $1 trillion, demonstrating widespread adoption and investment by businesses seeking efficiency. For Aavas Financiers, this translates to:

- Enhanced Data Security and Accessibility: Cloud platforms offer advanced security features and allow authorized personnel to access critical data from anywhere, improving decision-making speed.

- Scalability for Growth: As Aavas expands its reach or product offerings, cloud infrastructure can seamlessly scale to accommodate increased transaction volumes and customer bases.

- Cost Optimization: Shifting from capital expenditure on hardware to operational expenditure on cloud services can lead to significant savings, especially in the long term.

- Improved Customer Service: Digital infrastructure enables faster processing of loan applications, quicker query resolution, and a more seamless customer experience.

Technological advancements are reshaping how Aavas Financiers operates, particularly through digital lending and data analytics. The company is leveraging these tools to assess creditworthiness, especially for individuals with limited credit histories, by utilizing alternative data sources. This is crucial for expanding access to finance in their target market.

The increasing reliance on digital platforms necessitates robust cybersecurity measures. In 2024, the global cost of data breaches was projected at $9.5 trillion annually, underscoring the critical need for Aavas to safeguard customer data and maintain trust through secure online operations.

Aavas Financiers is actively integrating with fintech companies to improve efficiency and customer service. This includes exploring automated underwriting and real-time credit scoring, which can significantly expedite loan approvals. The Indian fintech market's growth, projected to reach $150 billion by 2025 from $50 billion in 2023, highlights the potential of these collaborations.

The company's investment in cloud computing enhances its operational efficiency and scalability. This allows for cost optimization and improved data management, crucial for adapting to market demands. The global cloud computing market's projected growth to over $1 trillion in 2024 signifies the widespread adoption of these technologies for business efficiency.

Legal factors

Aavas Financiers operates within a robust regulatory environment overseen by the Reserve Bank of India (RBI) and the National Housing Bank (NHB). These bodies establish the rules for Housing Finance Companies (HFCs), ensuring stability and consumer protection.

New regulations, effective from January 1, 2025, introduce more stringent requirements for HFCs. These include enhanced liquidity ratios, revised limits on public deposits, and updated asset cover mandates, aligning them more closely with Non-Banking Financial Company (NBFC) prudential norms.

These regulatory shifts necessitate Aavas Financiers to maintain higher levels of liquid assets and potentially adjust its deposit-taking strategies. Compliance with these updated norms is crucial for continued operation and financial health, impacting capital adequacy and operational flexibility.

Aavas Financiers must strictly adhere to consumer protection laws to ensure fair lending. This involves transparent disclosure of loan terms, interest rates, and fees, particularly crucial for their target demographic of low-to-mid income customers. For instance, the Reserve Bank of India's (RBI) Fair Practices Code mandates clear communication and prohibits unfair practices.

Avoiding mis-selling, such as bundling insurance with home loans without clear consent, is a key aspect of these regulations. This protects borrowers from unexpected costs and ensures they understand the products they are purchasing. Non-compliance can lead to penalties and reputational damage, impacting customer trust and future business.

Property and land registration laws are foundational to Aavas Financiers' business model, directly influencing the security and enforceability of its housing loans. Clear, efficient legal frameworks for property ownership, registration, and transfer ensure that Aavas can reliably secure its collateral. For instance, the Registration Act, 1908, and related state-level laws mandate the proper documentation and recording of property transactions, which is crucial for preventing title disputes and ensuring loan repayment.

The efficiency of these legal processes directly impacts the speed and cost of loan origination and recovery. In India, efforts to streamline land records and reduce registration timelines, such as the Digital India Land Records Modernization Programme, are vital. Delays or ambiguities in property titles can lead to increased non-performing assets (NPAs) for lenders like Aavas. As of the fiscal year ending March 31, 2024, Aavas Financiers reported a gross NPA ratio of 1.01%, highlighting the importance of robust legal frameworks in maintaining asset quality.

Loan Recovery and Foreclosure Laws

The legal framework governing loan recovery and foreclosure significantly shapes the risk associated with lending and the effectiveness of managing bad loans. Robust legal processes are crucial for preserving the quality of a lender's assets. In India, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, provides a streamlined mechanism for financial institutions to recover secured debts without court intervention. This act has been instrumental in improving recovery rates for lenders.

For instance, the recovery rate under SARFAESI has shown improvement over the years. While specific aggregate recovery figures for all financial institutions are dynamic, reports from the Reserve Bank of India (RBI) often highlight the impact of such legislation. The efficiency of these laws directly impacts a company like Aavas Financiers by enabling quicker resolution of non-performing assets (NPAs), thereby freeing up capital and reducing the cost of holding distressed assets. This legal recourse is fundamental to maintaining a healthy balance sheet and ensuring continued lending operations.

- SARFAESI Act, 2002: Provides a legal framework for the enforcement of security interests and recovery of NPAs by secured creditors.

- Impact on Asset Quality: Effective foreclosure laws reduce the time and cost associated with recovering defaulted loans, directly improving asset quality.

- Recovery Efficiency: The legal efficiency in resolving NPAs influences the overall profitability and risk management strategies of housing finance companies.

Taxation Policies Related to Housing

Government taxation policies significantly influence the housing market and companies like Aavas Financiers. For instance, changes in Goods and Services Tax (GST) on construction materials or property transactions can directly affect project costs and buyer affordability. In India, the Union Budget 2024-25 continued to focus on affordable housing, with potential implications for tax deductions on home loan interest, a key driver for demand in the sector.

Favorable tax incentives for homebuyers, such as deductions under Section 24(b) of the Income Tax Act for interest on housing loans, have historically boosted housing demand. While these policies can stimulate the market, they also impact the profitability of housing finance companies by influencing loan volumes and interest income. The government's approach to capital gains tax on property sales also plays a crucial role in investment decisions within the real estate sector.

- Impact of Income Tax Deductions: Continued tax benefits on home loan interest payments, like those available under Section 24(b), encourage homeownership and thus increase demand for housing finance.

- GST on Real Estate: The Goods and Services Tax (GST) structure on construction, materials, and services directly affects the final cost of housing, influencing affordability and developer margins. As of recent budgets, the GST on under-construction properties remains a key consideration.

- Property Transaction Taxes: Stamp duty and registration charges, levied by state governments, add to the overall cost of acquiring property, impacting transaction volumes and the need for financing.

- Capital Gains Tax: Policies governing capital gains tax on the sale of property can influence investor sentiment and the liquidity of the real estate market, indirectly affecting the housing finance sector.

The legal landscape for Aavas Financiers is shaped by stringent regulations from the RBI and NHB, with new norms from January 1, 2025, demanding higher liquidity and potentially altering deposit strategies. Compliance with consumer protection laws, such as the RBI's Fair Practices Code, is vital for transparent dealings and preventing mis-selling, particularly with their core customer base.

Property and loan recovery laws are critical for Aavas's operational efficiency and asset quality. The SARFAESI Act, 2002, facilitates quicker NPA resolution, a key factor in maintaining a healthy balance sheet. As of March 31, 2024, Aavas Financiers reported a gross NPA ratio of 1.01%, underscoring the importance of effective legal frameworks in asset management.

Taxation policies, including GST on construction and income tax deductions for homebuyers (like Section 24(b)), significantly influence market demand and Aavas's profitability. The Union Budget 2024-25's continued focus on affordable housing suggests ongoing support for the sector, impacting loan volumes and interest income.

Environmental factors

The increasing focus on environmental responsibility is reshaping the housing sector, directly impacting lending. Aavas Financiers is well-positioned to capitalize on this trend by developing financing solutions for homes that meet stringent sustainability standards. For instance, offering preferential rates for properties with high energy efficiency ratings or those constructed with recycled materials can attract environmentally conscious borrowers.

In 2024, the Indian green building market is projected to grow significantly, with an estimated compound annual growth rate (CAGR) of 10-12% through 2028, according to various industry reports. This expansion presents a clear opportunity for Aavas Financiers to innovate its product portfolio. By providing specialized home loans for energy-efficient appliances or solar panel installations, the company can align its business strategy with national environmental targets and tap into a growing segment of the market.

The increasing frequency and intensity of extreme weather events, such as floods and heatwaves, present a significant environmental risk to housing assets. For instance, India experienced a 13% increase in heavy rainfall events between 1950 and 2015, with a notable rise in extreme events since 2000. This trend directly impacts property values and the structural integrity of homes, particularly in coastal or flood-prone areas.

Aavas Financiers must integrate these climate-related risks into its loan assessment and portfolio management strategies. This involves evaluating the vulnerability of properties to climate change impacts, potentially adjusting lending criteria or requiring enhanced insurance coverage in high-risk zones. For example, assessing a property's elevation and proximity to water bodies, alongside projected climate change impacts for that region, becomes crucial for mitigating potential loan defaults.

Stricter environmental regulations are increasingly impacting the construction sector. For instance, new mandates in India, effective from 2024, focus on enhanced waste management protocols and the use of sustainable building materials, potentially increasing initial construction expenses. These evolving standards, covering everything from energy efficiency to pollution control, directly influence project planning and material sourcing for developers.

Compliance with these environmental mandates is not just a legal requirement but a crucial factor in project viability. Developers must factor in the costs associated with adhering to these regulations, which can include investments in greener technologies or specialized waste disposal services. Consequently, these upfront costs can indirectly affect the affordability of housing and the overall risk profile for housing finance institutions like Aavas Financiers.

ESG Reporting and Transparency

The growing emphasis on Environmental, Social, and Governance (ESG) factors by investors and regulators is driving the need for clear and honest reporting on environmental impacts. Aavas Financiers has responded by releasing its Sustainability Report for FY 2023-24, demonstrating its dedication to ESG principles. This includes efforts like tracking carbon emissions and fostering eco-conscious office environments.

The company's commitment is further evidenced by specific initiatives detailed in their reporting.

- Monitoring Carbon Emissions: Aavas Financiers actively tracks its carbon footprint, aiming for reduction strategies.

- Environmentally Friendly Workplaces: The company promotes sustainable practices within its operational spaces.

- Investor Demand for ESG: There's a clear trend of institutional investors prioritizing companies with strong ESG performance, influencing Aavas Financiers' transparency efforts.

Resource Efficiency in Operations

Aavas Financiers is prioritizing resource efficiency in its operations to minimize its environmental impact. This includes initiatives like reducing paper consumption by embracing digital workflows and implementing energy and water conservation measures across its office spaces. The company is committed to fostering environmentally conscious workplaces, aiming to reduce waste and promote sustainable practices throughout its business.

These efforts align with broader industry trends and regulatory expectations. For instance, in 2023, the Indian financial services sector saw increased focus on ESG (Environmental, Social, and Governance) reporting, with many companies adopting digital solutions to cut down on physical resource usage.

- Digitization: Transitioning to paperless processes reduces operational costs and environmental strain.

- Energy Conservation: Implementing energy-efficient lighting and equipment in offices lowers carbon emissions.

- Water Management: Adopting water-saving fixtures and practices in facilities contributes to conservation.

- Waste Reduction: Implementing recycling programs and minimizing single-use materials in the workplace.

Environmental factors significantly influence the housing finance sector, with a growing emphasis on sustainability and climate risk. Aavas Financiers is adapting by offering green financing options and managing climate-related property risks.

The Indian green building market's projected growth, estimated at 10-12% CAGR through 2028, presents opportunities for specialized home loans. Stricter environmental regulations from 2024 onwards, focusing on waste management and sustainable materials, are also impacting construction costs and project viability.

Aavas Financiers' commitment to ESG is evident in its FY 2023-24 Sustainability Report, highlighting carbon emission monitoring and eco-friendly workplaces, aligning with investor demand for transparent environmental impact reporting.

Resource efficiency, through digitization and conservation measures, is a key operational focus for Aavas Financiers, mirroring industry trends in the Indian financial services sector for 2023.

| Environmental Factor | Impact on Aavas Financiers | Data/Trend (2023-2025) |

|---|---|---|

| Green Building Growth | Opportunity for specialized home loans | Indian green building market CAGR: 10-12% (projected through 2028) |

| Climate Change Risks | Property value and structural integrity concerns | 13% increase in heavy rainfall events (India, 1950-2015), rising extreme events post-2000 |

| Environmental Regulations | Increased construction costs, project viability impact | New mandates from 2024 on waste management and sustainable materials |

| ESG Investor Demand | Drives transparency and reporting | Increased ESG reporting focus in Indian financial services (2023) |

| Resource Efficiency Initiatives | Operational cost reduction, reduced environmental strain | Digitization, energy & water conservation, waste reduction in workplaces |

PESTLE Analysis Data Sources

Our PESTLE analysis for Aavas Financiers is built upon a comprehensive review of data from reputable financial news outlets, government housing and finance policy documents, and reports from leading economic research firms. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.